Is Unichain a bearish or bullish factor for Ethereum?

Written by: Mu Mu

Recently, Uniswap Labs officially announced the launch of the Ethereum Layer2 network Unichain based on OP Stack and has launched the testnet. As a pillar of the Ethereum ecosystem and the DeFi field, the crypto community has paid significant attention to this important development event of Uniswap. Various KOLs, including Vitalik, have expressed differing opinions, but perhaps the most concerned are those old Ethereum FUDers, who have begun to analyze the "death countdown" of ETH following the "defection" of Ethereum's largest DApp…

Is Unichain really a "defection" route for Uniswap?

According to official information, the main purpose of launching Unichain is to address some challenges in DeFi, such as: cost, efficiency, and the seamless cross-chain swap demand due to liquidity fragmentation. In simple terms, the Uniswap team will continue to improve user experience and the competitiveness of its products by customizing a unique Layer2 network.

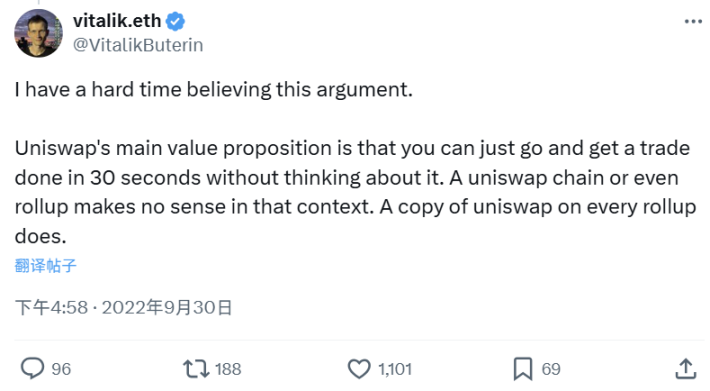

In response, comments from various KOLs have been mixed; aside from relatively positive views, the most eye-catching may be the opposition from Vitalik and others. In fact, as early as 2022, Vitalik commented on social media opposing the concept of Unichain, stating: "The main value proposition of Uniswap is that you can complete a transaction in 30 seconds without much thought. In this case, Uniswap chain or even Rollup is meaningless; it only makes sense if there is a Uniswap copy on each Rollup."

Overall, the main argument from Vitalik and other opponents is that Uniswap should focus on successful application areas, as the most successful DeFi application deployed on the mainnet and every Layer2, rather than diverting attention to develop (reinventing the wheel) a new chain. Of course, the context two years ago was that Layer2 solutions had not yet been implemented; if UniChain had been proposed at that time, it would have certainly been an independent application chain rather than a Layer2 chain, which is why the opposition from Vitalik and other Ethereum crypto community KOLs was quite strong back then.

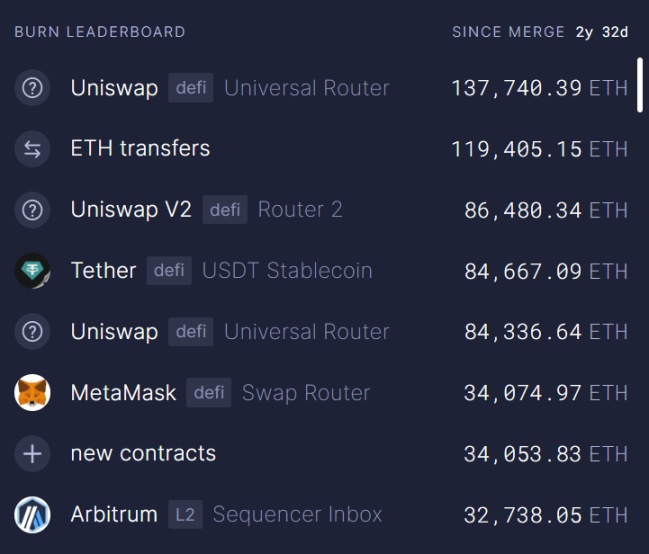

Compared to the internal opposition within the community, some individuals outside the Ethereum community, who have long been skeptical of Ethereum and frequently publish ETH FUD analyses, seem to have found a new strong "argument" here. They further analyzed that UniChain would be Uniswap's "defection" from Ethereum, believing that this DApp, which contributes the most to gas burning on Ethereum, is about to take away Ethereum's last revenue, leading to a decline in Ethereum's gas fee income and ultimately approaching "death."

Burning ranking since Ethereum's merge Source: Ultrasound money

Clearly, the launch of UniChain two years later has sparked widespread discussion not only within the Ethereum community but is also seen as a slap in the face to Vitalik. However, compared to the internal discussions from Vitalik and others, these external FUD voices may stem from the fact that Ethereum has "made too many enemies" over the years. The previously underestimated Layer2 route has attracted increasing attention from major companies and institutions, and the success of Layer2 has blocked many cross-chain tracks and some high-performance public chains. Only if Ethereum's development stagnates can they gain more market space, which is one of the fundamental reasons why ETH FUD is rampant.

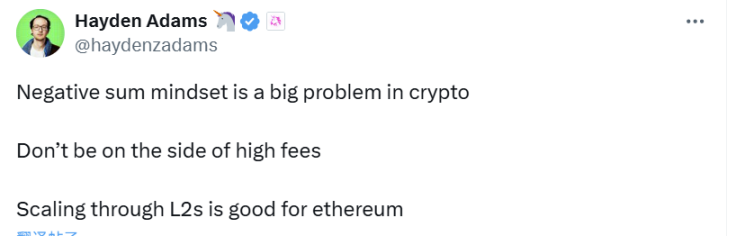

Uniswap founder Hayden Adams recently responded to the controversy, stating: "Zero-sum bias is a big problem in the crypto community; do not stand on the side of high fees. Scaling through L2 is beneficial for Ethereum."

That said, the analysis that Unichain is Uniswap's "defection" is a misinterpretation. Although on the surface it seems that developing Layer2 has created a new chain, unlike the "relocation" style of joining the Cosmos ecosystem as seen with dydx, UniChain not only remains within the Ethereum ecosystem but also considers the Ethereum mainnet as Uniswap's primary "battlefield." Most of the DeFi funds in the entire crypto ecosystem are on Ethereum, and large holders tend to pursue "security and stability," which is one reason why Ethereum serves as an irreplaceable "city wall." The high frequency and timeliness of interaction needs between Uniswap users and dydx users differ; early deployment on the Ethereum network and rooting in the secure and stable Ethereum ecosystem is one of Uniswap's greatest advantages as an important infrastructure in DeFi.

In the foreseeable future, Uniswap on the Ethereum mainnet will still gather more liquidity to meet the large secure swaps of big holders, while some small high-frequency trades will need to cross to Layer2 like UniChain.

To give a simple example, if Ethereum is a huge agricultural market, Uniswap is the most popular vendor in a prominent location with the highest foot traffic. As business grows, it rents an independent storefront with a warehouse at the entrance of the market, providing a more spacious and comfortable shopping experience for customers, thus meeting different customer needs.

Therefore, the "defection" theory does not hold water; leaving is not an option, and Uniswap still wants to be the most attractive player in the Ethereum ecosystem.

Why is it necessary to create UniChain?

It seems that since someone proposed UniChain two years ago, Uniswap has made a difficult decision. From the perspective of Vitalik and some people in the Ethereum community, Uniswap is already very successful and does not need to take unnecessary actions. However, from the perspective of the Uniswap community and development team, this may not be the case; at least it has the following sufficient reasons to launch UniChain:

1) Optimizing expansion to meet challenges and competition

Although Uniswap has been very successful, it is actually facing many challenges and competition in the future of multi-chain (including multiple Layer2). Aside from the advantages of the Ethereum mainnet, in some Layer2 and high-performance EVM chains, for various reasons, many public chains have "local" new DEX brands occupying the top positions in the DEX track, such as Pancakswap, QuickSwap, etc. At the same time, the existing challenges of liquidity fragmentation in Layer2 have left Uniswap, as an upper-layer application, with limited options.

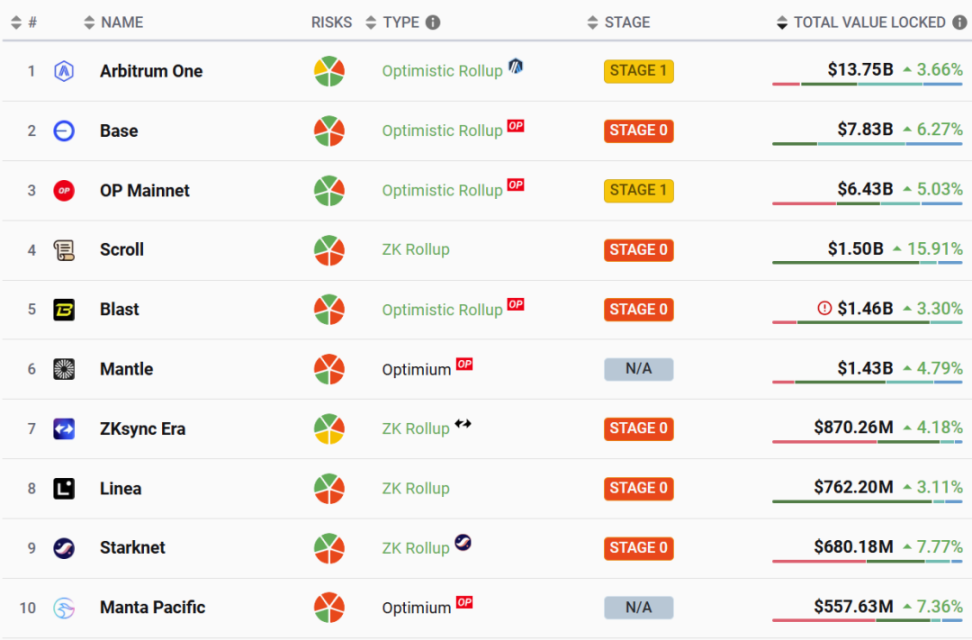

Unichain's choice of OP Stack as part of the Optimism Superchain should be a well-considered decision. Among the top Rollups in Layer2 TVL rankings, besides OP Mainnet, there are also Base and Blast, which have gathered over ten billion dollars in liquidity. Coupled with deployments from many crypto-native teams like SNX, Mantle, and external giants like Sony, the Superchain is indeed rich in funds and talent. As a "homogeneous" chain, it shares a consistent development path and technology, making it easier to solve interoperability issues. Currently, Uniswap Labs has stated that it is working with OP Labs to achieve native cross-chain interoperability, addressing the liquidity fragmentation issue between Layer2 and providing a seamless cross-chain swap experience.

Source: L2beat

In simple terms, by deploying a Layer2 through OP Stack at a lower cost, Uniswap has joined this Layer2 development community, shared technological achievements, and accelerated the resolution of interoperability between Layer2, addressing the significant issue of liquidity fragmentation. Of course, issues like MEV can also be addressed through customized underlying solutions, which were beyond Uniswap's control when it was merely a DApp.

2) An inevitable choice after DApp grows stronger

DApps deployed on public chain platforms will inevitably consider their future development roadmap as they grow. In addition to the previously mentioned optimization and expansion, there are also more internal community demands and pressures from token empowerment, which is why the announcement of UniChain led to a rise in UNI. In fact, as every DApp grows from a small circle to a large community, even if the project team does not want to take action, the community will push the project team forward. At the same time, high-quality projects have ample income and talent reserves, making it a natural progression to break through bottlenecks and even cross tracks, leading to the idea of "growing bigger and stronger."

For example, many offline or online shopping malls host a large number of brand merchants, such as Uniqlo, Starbucks, KFC, etc. After these brands occupy a certain market share in their respective tracks, they often establish their own official independent channels, such as independent official stores or official mini-programs, etc. Unlike the form of being hosted, having all user-generated data ownership and flexibility through official independent channels allows for personalized marketing activities and the collection and satisfaction of more personalized user needs.

In the future, UniChain may open up differentiated advantages to share the liquidity of the Uniswap protocol, attracting more DeFi applications to settle in, creating a unique ecosystem, which is a beautiful vision.

3) Uniswap: This is my freedom

In the values of crypto openness and freedom, no underlying infrastructure should lock any users and funds like centralized traditional finance, and of course, the development team should not be locked either. The multi-chain interoperable ecosystem remains the future. The decentralized Ethereum community will not and cannot forcibly lock these users and funds; they will maintain free flow, with a flourishing application ecosystem where the fittest survive, and products brought by developers will compete freely in the open market.

Unichain, whether it is a major strategy of Uniswap or just a "trial run," is the freedom of Uniswap Labs and the Uniswap community, all for the common benefit of the community.

Is it good or bad for Ethereum?

From the erroneous interpretation of ETH FUD, it seems that Unichain will accelerate Ethereum's demise. However, the opposite is true; the launch of Unichain is not a bad thing. It can not only promote the resolution of cross-chain liquidity issues in the Ethereum ecosystem's Layer2, leading to ecological prosperity, but also support the adoption of Layer2 solutions, with more major companies like Sony on the way.

From another perspective, the launch of Unichain is inevitable. Although it has brought about opinions from Vitalik and others that it is "unnecessary and not recommended," it has directly validated the correctness of Ethereum's Layer2 route from years ago and the foresight of many development teams in the Ethereum community. Imagine if there were not so many successful and open Layer2 solutions today; these DApps might have grown to a point where they could no longer tolerate Ethereum's high fees and low efficiency, deeming it unpromising and directly transitioning to independent chains to solve scalability issues. That would truly mean leaving the Ethereum ecosystem and even being forced to become "Ethereum killers."

The current outcome is a process of self-innovation and transformation within the Ethereum ecosystem. We are no longer in an era of expensive and slow transactions. Applications deployed in the vast ecosystem of Ethereum now have more and better internal options while maintaining their original intentions, thus not needing to compromise with centralization for scalability and performance.

Conclusion

Regardless, we respect the choice of the Uniswap community and hope that UniChain continues to create a different future in the DeFi space, bringing more new possibilities.

ETH FUD often clings to the issue of Layer2 reducing and "siphoning" Ethereum platform gas fees. In reality, one only needs to understand this question: Is the value of Ethereum solely for collecting gas fees? Client wallets and other infrastructure, scaling solutions, application implementation, and user experience, all flourishing while continuously leading crypto innovation, is where Ethereum's value lies.

When Ethereum gas fees are high, they say it is bearish; when Layer2 is proposed, they say this route will fail; when Layer2 scaling succeeds and gas fees drop, they say it is siphoning Ethereum, and they still say it is bearish… As Uniswap's founder said, the crypto community is filled with zero-sum bias, and some bears have not even truly understood Ethereum, purely standing on different positions. Therefore, it is essential to DYOR to avoid being easily misled.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。