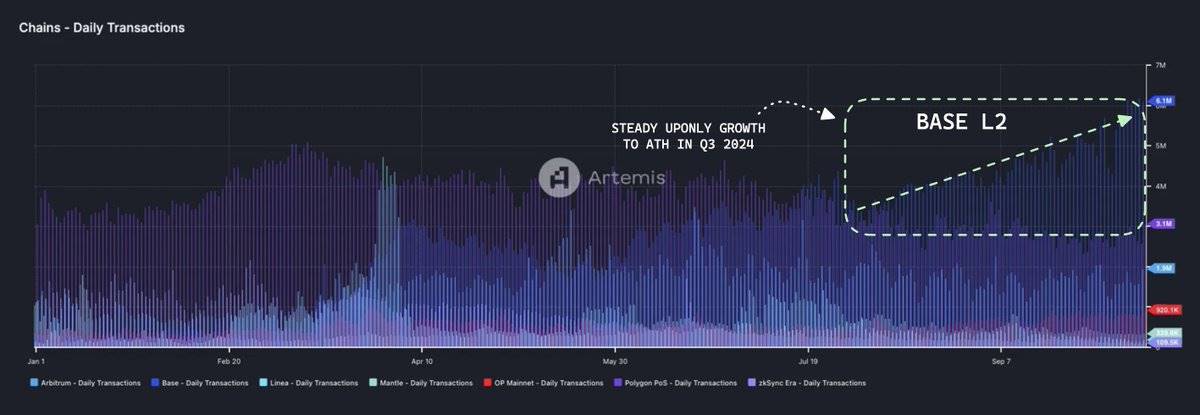

Base has achieved the largest growth in average daily trading volume this year, reaching a historic high of 6.1 million transactions.

Author: Cheeezzyyyy

Compiled by: Deep Tide TechFlow

If you think that @base Memecoin summer was the peak of its on-chain activity, you are mistaken.

Things have just begun.

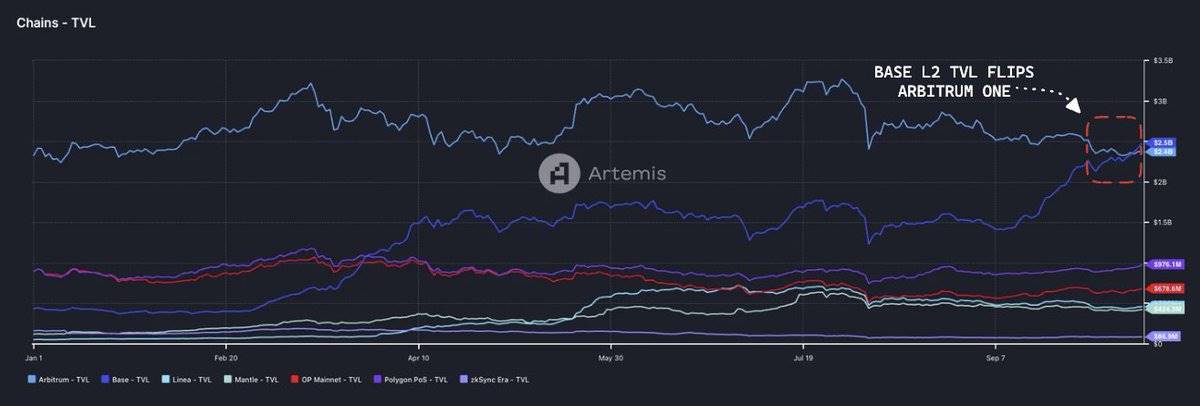

There have been significant changes in the L2 space, with Base briefly becoming the largest L2, surpassing @arbitrum for the first time.

Here are key insights from @artemis__xyz:

First, a major turning point—@base ($2.5 billion) has for the first time surpassed @arbitrum ($2.4 billion) in TVL (Total Value Locked).

So far this year, only three L2s have seen significant growth in TVL:

@0xMantle network: from $121 million to $424 million (+350%)

Base L2: from $445 million to $2.5 billion (+562%)

@LineaBuild L2: from $53 million to $460 million (+868%)

@base has achieved the largest growth in average daily trading volume this year, reaching a historic high of 6.1 million transactions.

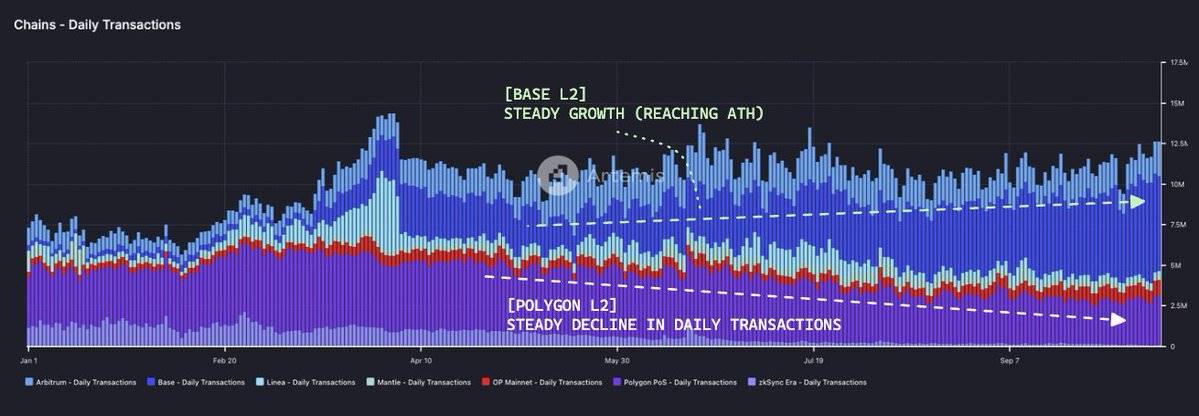

This growth has surpassed the leading position of @0xPolygon PoS and is three times that of @arbitrum.

Undoubtedly, the increase in trading volume aligns with the average historical DEX trading volume described next.

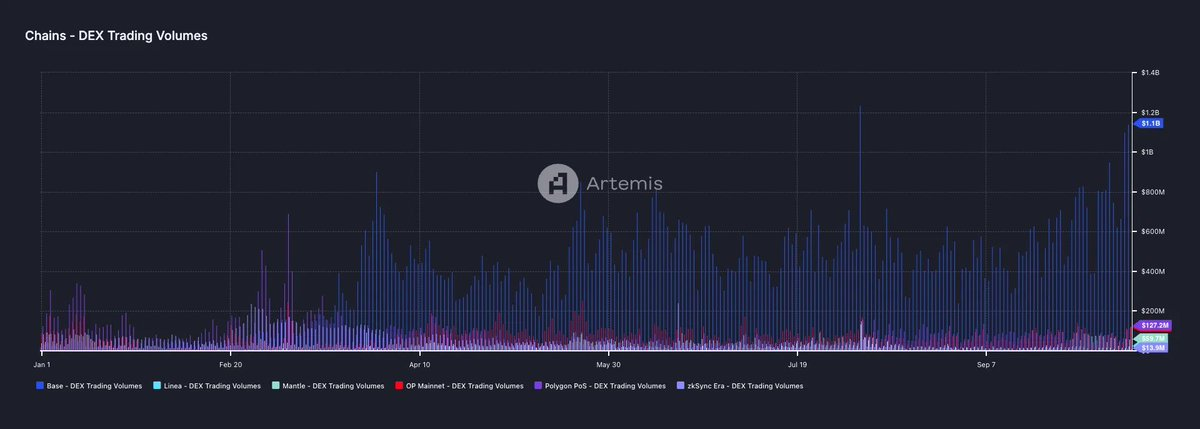

Specifically, since the beginning of 2024, decentralized exchange (DEX) trading volume on @base has increased by more than 15 times.

This is the largest growth indicator so far, primarily driven by the outstanding trading volume growth of @AerodromeFi.

For other L2s, average trading volume seems to have changed little.

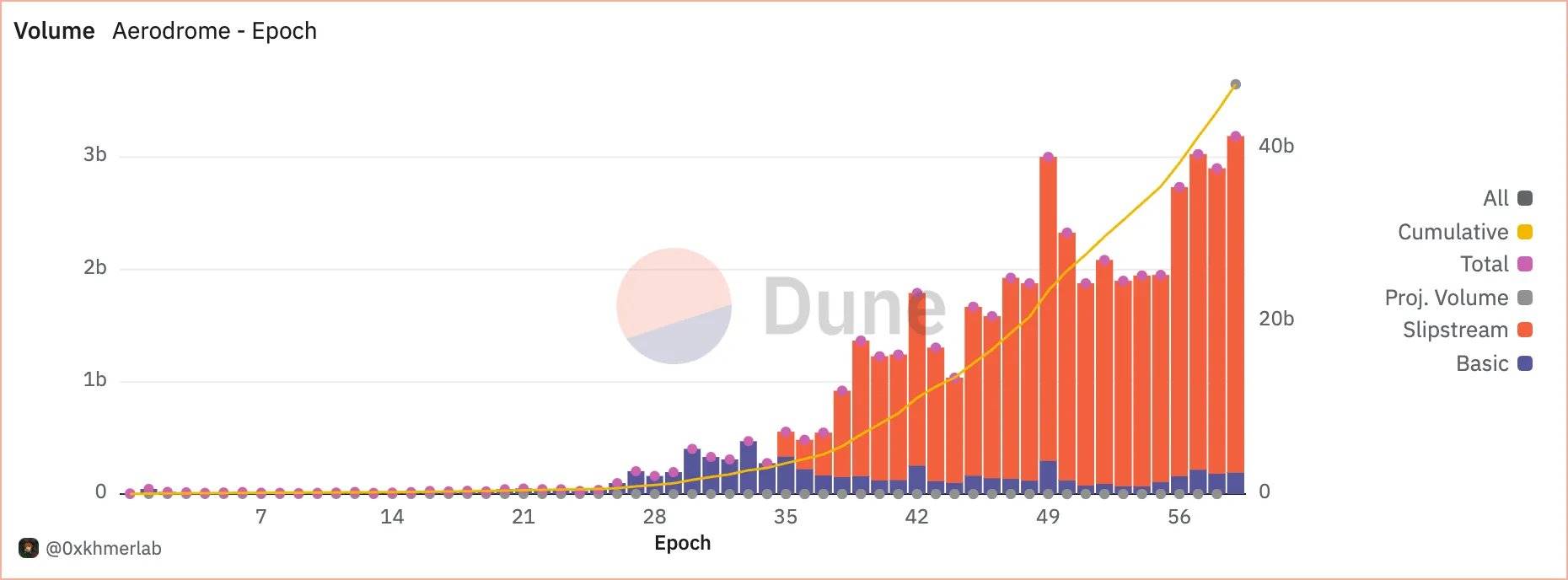

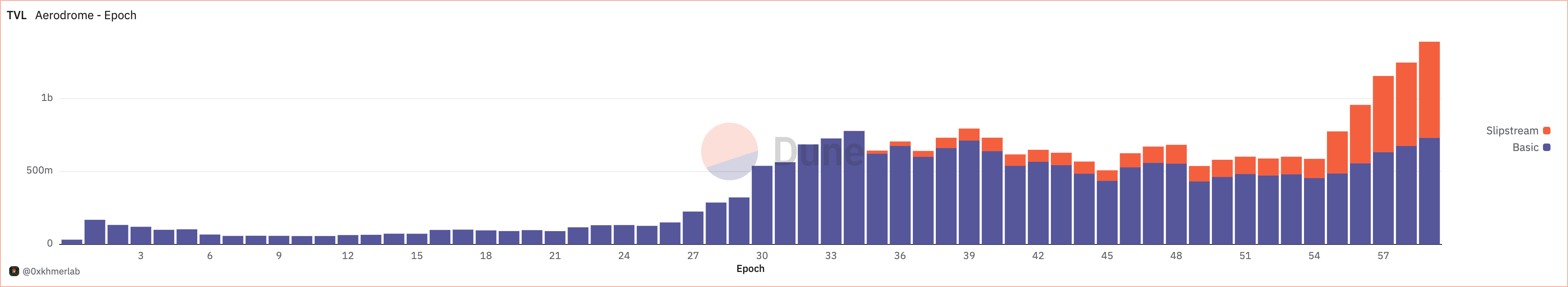

Unsurprisingly, @AerodromeFi is experiencing:

Weekly trading volume reaching a historic high (approximately $3.5 billion)

Total Value Locked (TVL) breaking the $1 billion mark (approximately $1.4 billion)

The concentrated liquidity mechanism introduced by Slipstream further enhances capital efficiency and user trading experience. For more information, please visit here.

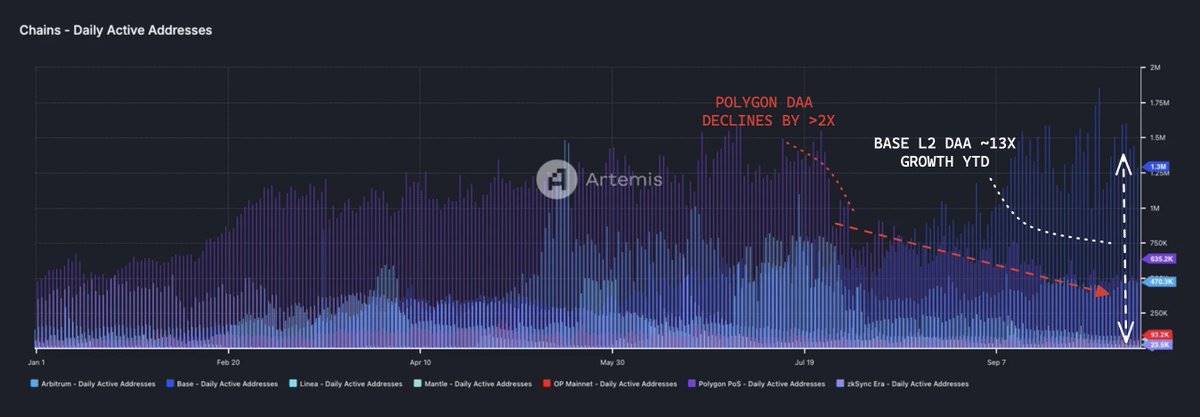

Even in terms of Daily Active Addresses (DAA), @base is performing exceptionally well.

DAA reflects the breadth of the user base, growing 13 times year-to-date, validating all the trends mentioned earlier.

Notably, since the third quarter of 2024, DAA for @0xPolygon L2 has significantly declined, while Arbitrum has remained stable.

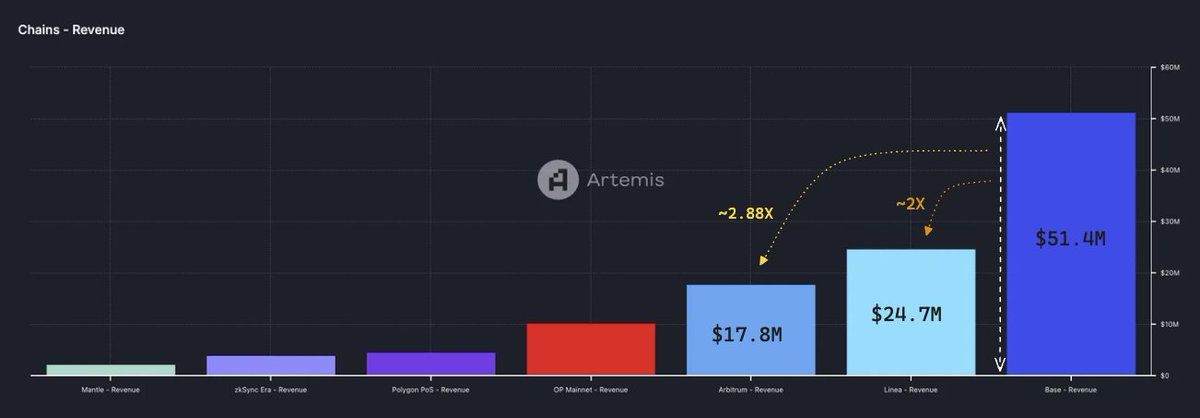

Finally, the most striking metric is L2 revenue.

@base has been known for its high yields from sequencers, generating $51.4 million so far this year.

From the data, this is equivalent to:

Twice the $24.7 million of @LineaBuild

2.88 times the $17.8 million of @arbitrum

It is expected to reach around $60 million by the end of the year.

This is not only a huge victory for @coinbase but also for @Optimism.

Because @base is an Optimium (L2) built on the OP Stack, with a profit-sharing protocol.

This not only promotes the growth of the Superchain ecosystem but also expands more sources of revenue.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。