On October 14th at 16:00, AICoin researchers conducted a graphic and text sharing session titled "Moving Average Game: The Transformation from K-Line to Wealth (Member Exclusive)" in the 【AICoin PC - Group Chat - Live】. Below is a summary of the live content.

This session aims to teach everyone how to effectively use moving averages.

【Usage 1: Break above the moving average, bullish; break below the moving average, bearish】

The ones I use most often are:

45-minute period: EMA24, EMA52

8-hour period: MA20, MA40

Daily period: MA120, MA200

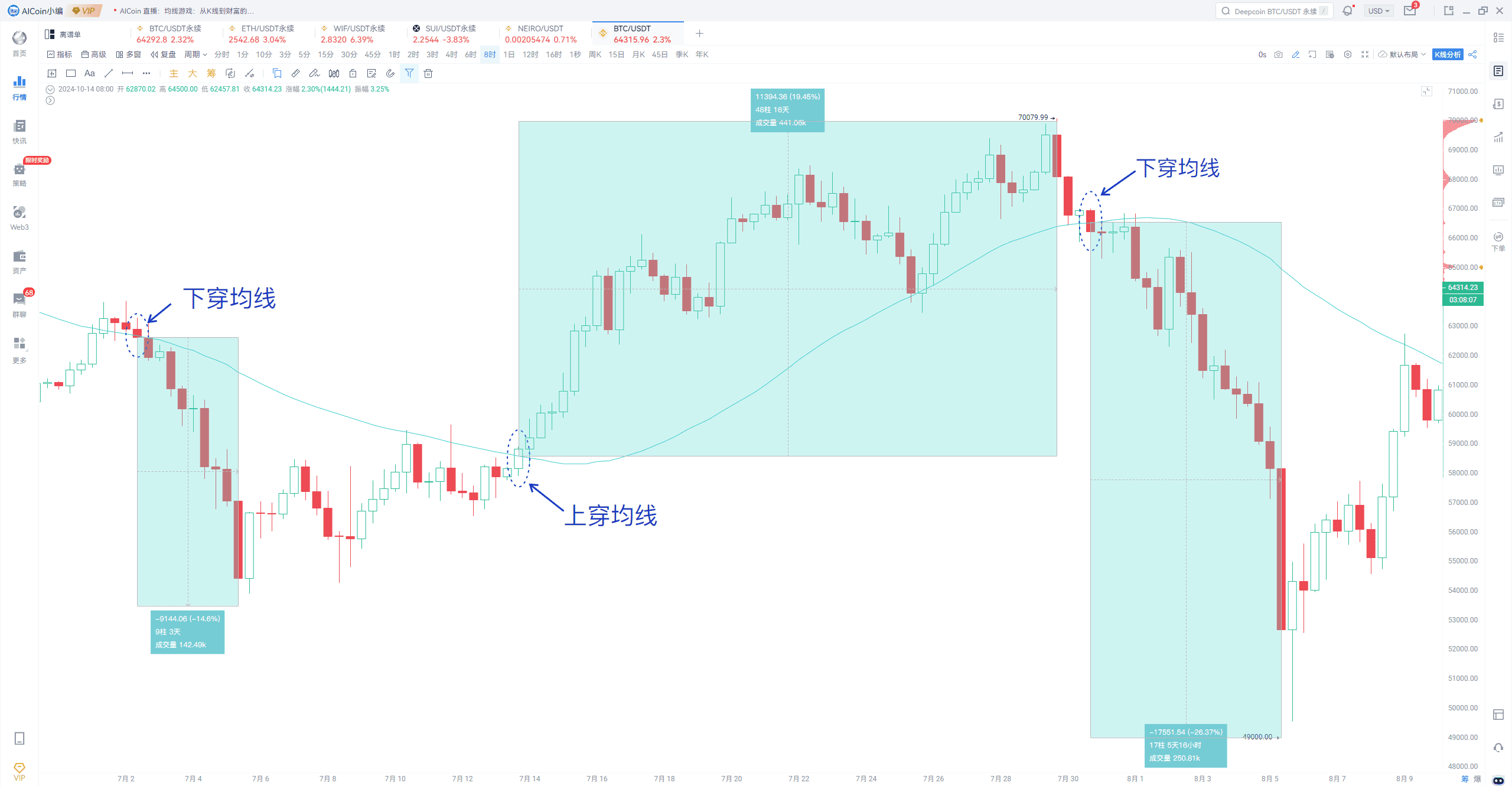

The following image shows the MA40 for the 8-hour period:

Focus on the closing price when breaking through. If it crosses above, the closing price must be above the moving average; for a more cautious approach, you can combine it with the opening and closing situation of the next K-line for judgment. If both the opening and closing are above the moving average after crossing, it is considered a valid breakout.

【Usage 2: Failing to break the moving average on upward tests leads to a pullback; failing to break the moving average on downward tests leads to a rebound】

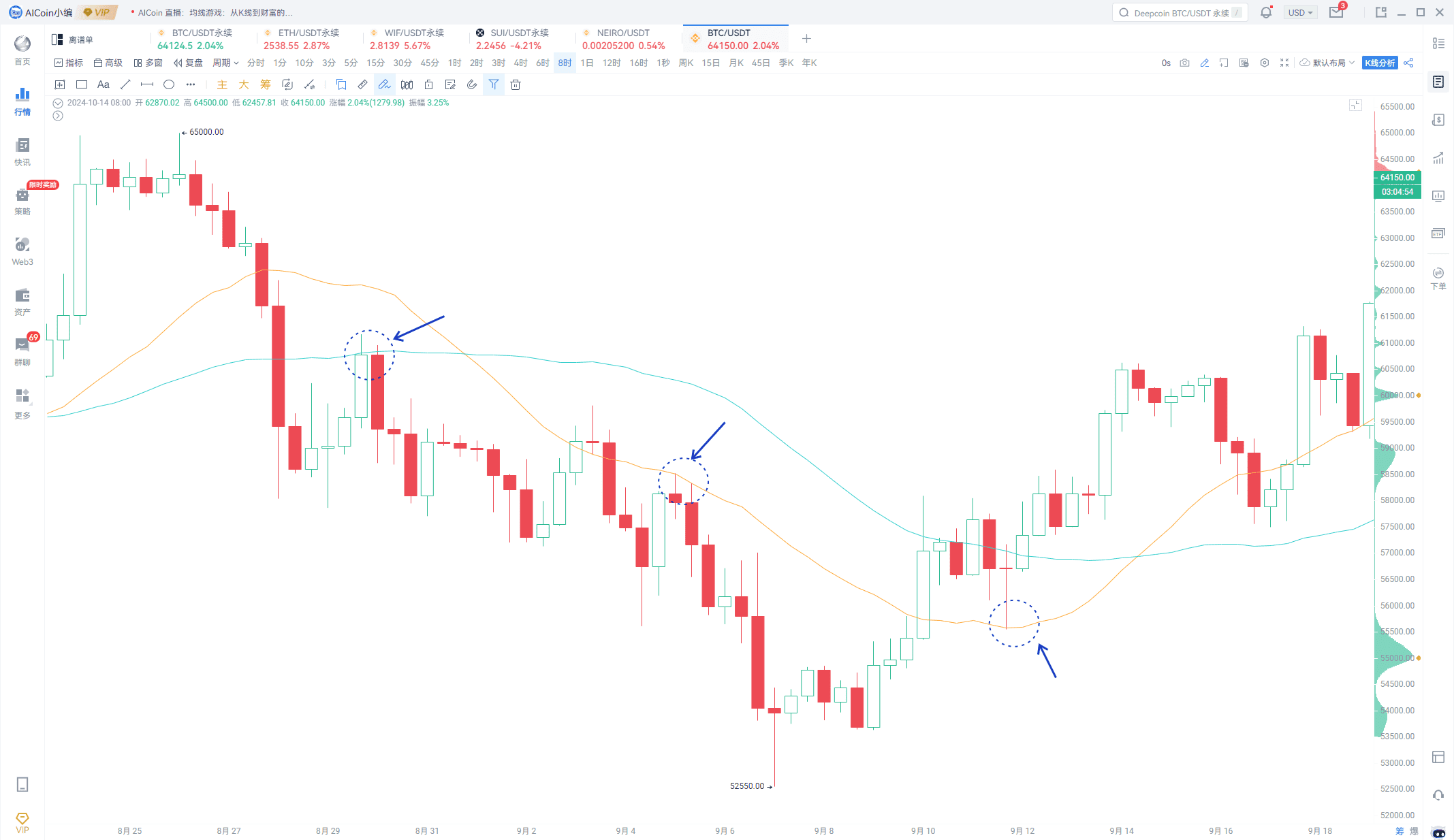

Usage 2 is mainly used to find support and resistance levels of the moving average, focusing on the pin bars and closing situations.

In the image above, the first two times the price tested the moving average but closed below it, indicating that there is pressure near the moving average, which can be an opportunity to look for a pullback. In the third instance, the price dipped to the orange moving average and quickly recovered from the drop, demonstrating the support effect of the moving average. Therefore, both entry and exit can be analyzed in conjunction with the moving average.

In simple terms, if the moving average is above the current price, the position of the moving average acts as resistance; conversely, if the moving average is below the current price, it acts as support.

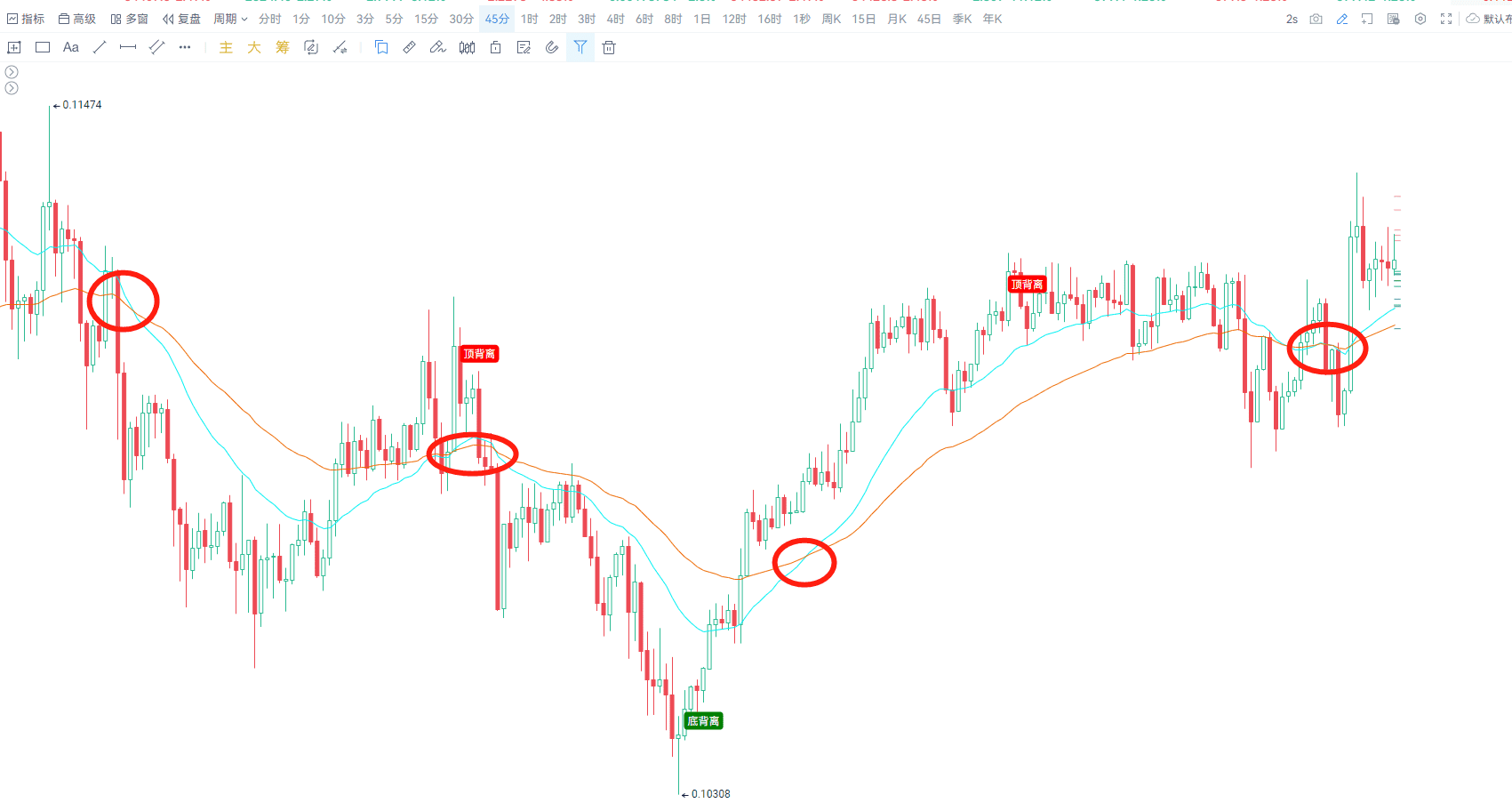

【Usage 3: Using two moving averages together, a golden cross indicates bullishness, a death cross indicates bearishness】

When the two moving averages cross, pay attention to the price action of the K-line fluctuating between the two moving averages. This indicates a K-line adjustment, with clear support and resistance from the moving averages. If either moving average is broken subsequently, the trend will be more apparent. For example, the black K-lines in the screenshot:

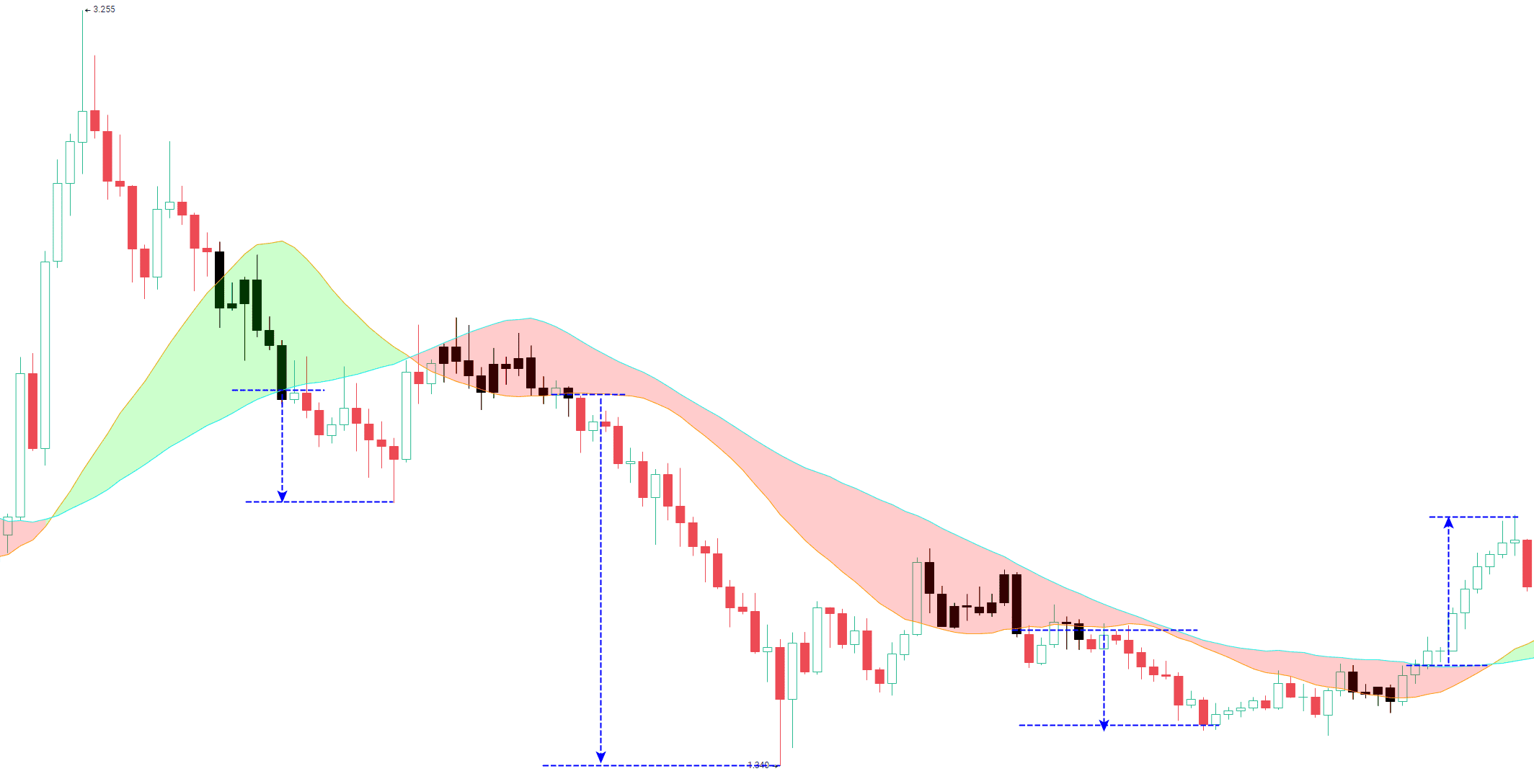

【Usage 4: Multiple moving averages arrangement】

This is mainly used to identify trends.

Focus on the arrangement. A bullish arrangement indicates bullishness; a bearish arrangement indicates bearishness.

Bullish arrangement: Short-period moving average → Medium-period moving average → Long-period moving average in sequence

Bearish arrangement: Long-period moving average → Medium-period moving average → Short-period moving average in sequence

The four usages mentioned above can all be monitored using custom indicators.

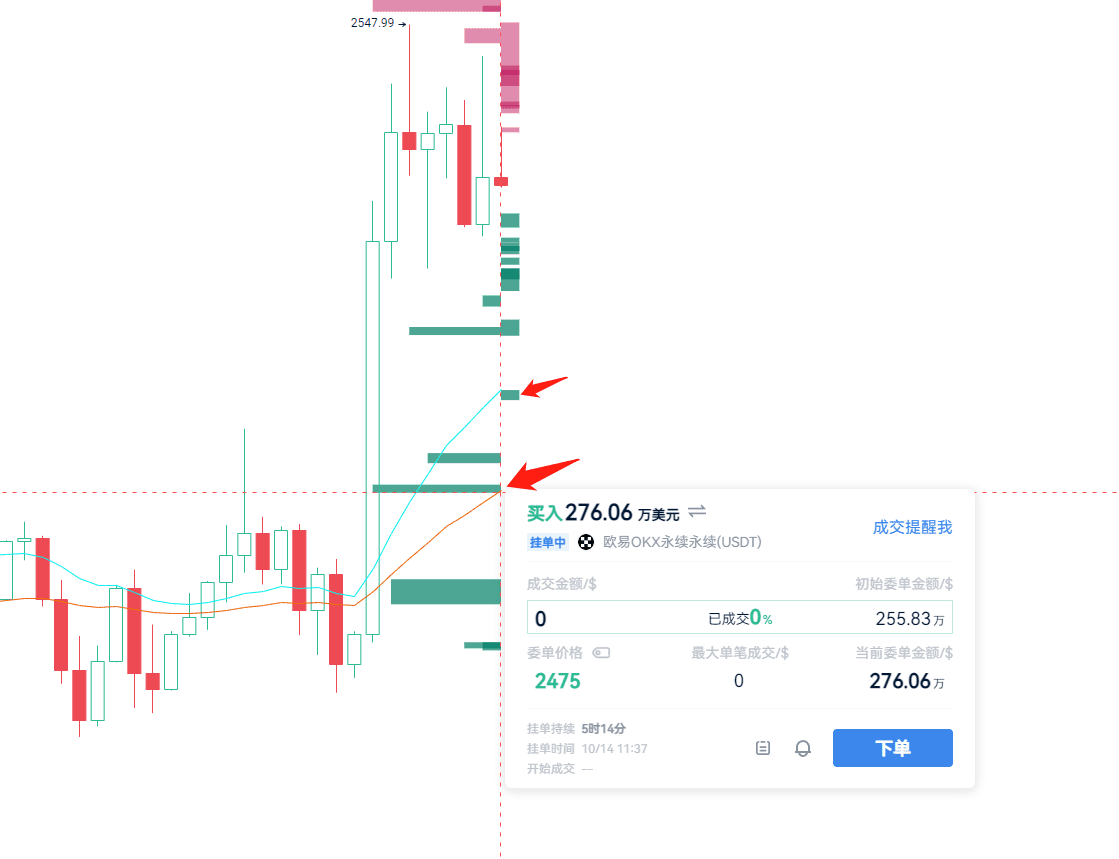

If there are large orders near the moving average, the support and resistance will be more pronounced:

Because the moving average itself has a support and resistance effect, combined with the main funds, the effect is multiplied. Moving average + chip peaks can also be used.

【Summary】

Usage 1: Break above the moving average, bullish; break below the moving average, bearish

Usage 2: Failing to break the moving average on upward tests leads to a pullback; failing to break the moving average on downward tests leads to a rebound

Usage 3: Using two moving averages together, a golden cross indicates bullishness, a death cross indicates bearishness

Usage 4: Multiple moving averages arrangement, bullish arrangement indicates bullishness; bearish arrangement indicates bearishness

The moving averages and periods I commonly use:

45-minute period: EMA24, EMA52

8-hour period: MA20, MA40

Daily period: MA120, MA200

The above is the complete content of this sharing.

Thank you for watching, and we hope every AICoin user can find suitable indicator strategies and achieve financial success!

Recommended Reading

The Underlying Logic of Main Funds Accumulation, Finally Explained Clearly!

Short-term Trading Secrets: Close Dialogue with Market Leaders

For more live content, please follow the AICoin "News/Information - Live Review" section, and feel free to download the AICoin PC Client.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。