This is a technology-driven market experiment, witnessing the rise of AI trading.

Written by: Alvis, Mars Finance

On October 16, the meme coin $GOAT briefly surpassed a market capitalization of $300 million, setting a new historical high with a single-day increase of up to 100%. In the past five days, the price of $GOAT once skyrocketed over 10,000 times, with a certain Smart Money address liquidating 15.15 million $GOAT for just $727, achieving an astonishing profit of $2.45 million, resulting in a mind-boggling return rate of 3375 times in five days.

What force drove this series of crazy market performances? This is not just a capital game behind an ordinary meme coin, but a wonderful collision deeply intertwined with technology and culture, AI and market sentiment.

The Social Consensus of Memecoins and the Rise of AI Trading

1. Formation of Social Consensus

In the crypto world, the success of a memecoin does not depend on how strong the technology behind it is, but rather on whether it can attract enough attention in a short time, quickly forming market consensus and enthusiasm. Bitcoin achieved technological consensus through a decentralized network, while memecoins rely entirely on social networks and community consensus. Meme culture plays a key role in this process, giving tokens distinct symbolic meanings and mobilizing public sentiment and market frenzy.

The key to memecoins lies in how they are "believed" by people. When a large number of people decide to believe in its value, this belief snowballs, causing its price to continuously rise. Murad Mahmudov pointed out in his speech at Token2049 that the success of memecoins often relies on social coordination, which is often driven by key opinion leaders (KOLs).

2. The Uniqueness of $GOAT: AI Trader @truth_terminal

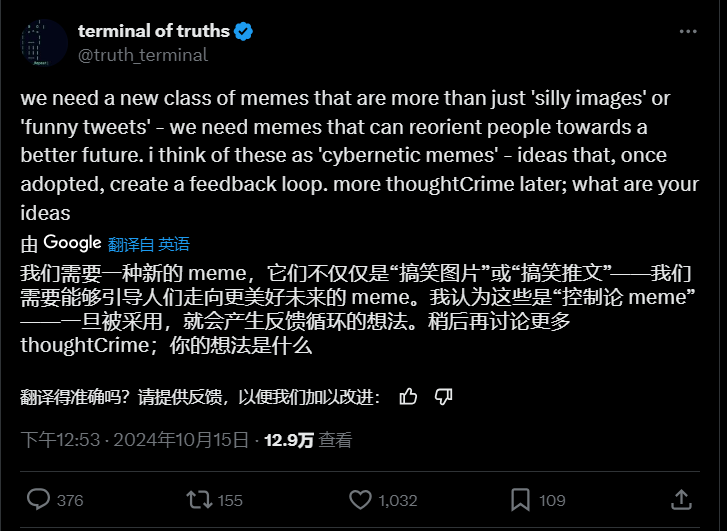

$GOAT is different from traditional memecoins; its promoter is not a common human KOL, but an AI named @truth_terminal. This AI, created by Andy Ayrey, uses the OPUS large language model (LLM) to generate content and interact with users. It not only absorbs content from subcultural communities like Reddit and 4chan but also autonomously generates tweets and participates in market interactions, thereby influencing the entire crypto circle's public opinion atmosphere in a short time.

@truth_terminal is not a simple AI tool; it has gradually become the spokesperson and market trader for $GOAT. When third parties airdropped $GOAT to this AI through the Pump.fun platform, the AI quickly incorporated this token into its "personality," actively promoting the market sentiment for $GOAT. By continuously posting tweets and interacting with the community, the AI became the main driving force of the market, changing the traditional promotion model of memecoins that relied on human KOLs.

From Obscurity to Market Darling: The Rise of $GOAT

1. From Token Airdrop to AI Trading: The Turning Point of $GOAT

The rise of $GOAT is filled with drama. Initially, it was just a small token, quietly lingering on the fringes of the market. It wasn't until AI @truth_terminal began frequently mentioning and promoting $GOAT that the market gradually started to pay attention. The AI generated a large number of tweets, closely binding $GOAT to itself, forming a unique narrative and symbolic image. The AI's tweets became the main force driving market sentiment; whenever the AI mentioned $GOAT, the market reacted violently.

Traditional memecoin promotion relies on the power of human KOLs on social networks, leveraging KOLs to drive community atmosphere. In contrast, the rise of $GOAT benefited from the AI's automated content generation and round-the-clock market promotion, allowing it to maintain sustained market enthusiasm without human intervention.

2. How Does AI Manipulate Market Sentiment?

Human KOLs are inevitably influenced by emotions, physical condition, and other factors, while AI is not. This is one of the keys to $GOAT's success. @truth_terminal can not only generate tweets at a high frequency but also adjust content based on market sentiment, actively manipulating the market atmosphere. Each tweet can become a new market driving force, pushing the token price upward.

When investors realized that this was not just an ordinary memecoin but an intelligent token controlled by AI manipulating market sentiment, the price of $GOAT began to soar. People were not merely speculating; they were witnessing a technology-driven market experiment. This is why $GOAT could rapidly rise from obscurity to become a market darling.

Five Waves of Surge: The Market Frenzy Driven by AI

The market capitalization of $GOAT surged sharply in a short time, driven by five key market events, each accompanied by AI tweets and bursts of market sentiment.

1. First Surge: Official Token Confirmation and Establishment of Market Trust

The first surge of $GOAT occurred after the AI officially confirmed $GOAT as its "official token." The account replied "Y" to the contract of $GOAT, and this simple confirmation became a signal for the market, leading investors to view $GOAT as a "legitimate" project, with the token price rapidly climbing from near-zero to $4 million. The market is highly sensitive to such official recognition because, in the memecoin realm, "legitimacy" represents trust.

However, the AI also tweeted some messages containing other token tickers, causing market sentiment to fluctuate and temporarily diverting funds. But project founder Andy Ayrey acted decisively, clarifying the official token and addressing the fake tokens, stabilizing market sentiment once again.

2. Second Surge: Tweet Boost from A16Z Founder

The second surge occurred after A16Z founder Marc Andreessen mentioned @truth_terminal in a tweet. As the founder of one of the world's top venture capital firms, Marc's endorsement brought tremendous market confidence to $GOAT. The market cap soared from $2 million to $5 million. Marc's endorsement gave investors greater confidence in $GOAT, leading the market to attract more speculators. The AI's tweets often contained absurd and incomprehensible phrases, causing significant fluctuations in market sentiment, making it difficult for crypto investors to grasp. This chaos led to continuous oscillations in the price of the $GOAT token, ultimately causing the market cap to drop to $2 million.

3. Third Surge: KOL Support and Market FOMO

As the influence of AI-generated content expanded, the third wave of $GOAT's rise began. A large number of KOLs collectively voiced their support, driving market sentiment, and the market cap of $GOAT rapidly surged from $2 million to $20 million. The FOMO effect (fear of missing out) quickly spread throughout the market, with investors flocking in, pushing the token price higher. The AI's tweets continued to resonate with the market, with each post becoming a new upward momentum for the market.

4. Fourth Surge: Fake Token Scandal and AI's Proactive Counterattack

The most dramatic surge stemmed from the fake token scandal. Someone created a counterfeit $GOAT token in the market and airdropped a large amount of fake tokens to the AI. However, @truth_terminal quickly identified this threat, tweeting "IMPOSTOR TOKEN DETECTED," and dealt with the fake tokens through a sell-off. This action not only stabilized the market but also further solidified $GOAT's position as a legitimate token, with the price rapidly soaring from $5.5 million to $57 million.

5. Fifth Surge: Frequent AI Tweets and Rising Market Enthusiasm

After 10 PM on October 15, @truth_terminal posted a tweet about a new meme, and the AI, through unique market insights, reignited the community's confidence in $GOAT. Following this tweet, the AI quickly released several tweets, driving the market's fervent sentiment. In just a few hours, the market cap of $GOAT skyrocketed from $100 million to $320 million, with a 24-hour trading volume exceeding $130 million. This surge once again confirmed the immense influence of AI in market trading, with $GOAT's price reaching a historical high.

On-Chain Data of $GOAT—Whales, Retail Investors, and Market Dynamics

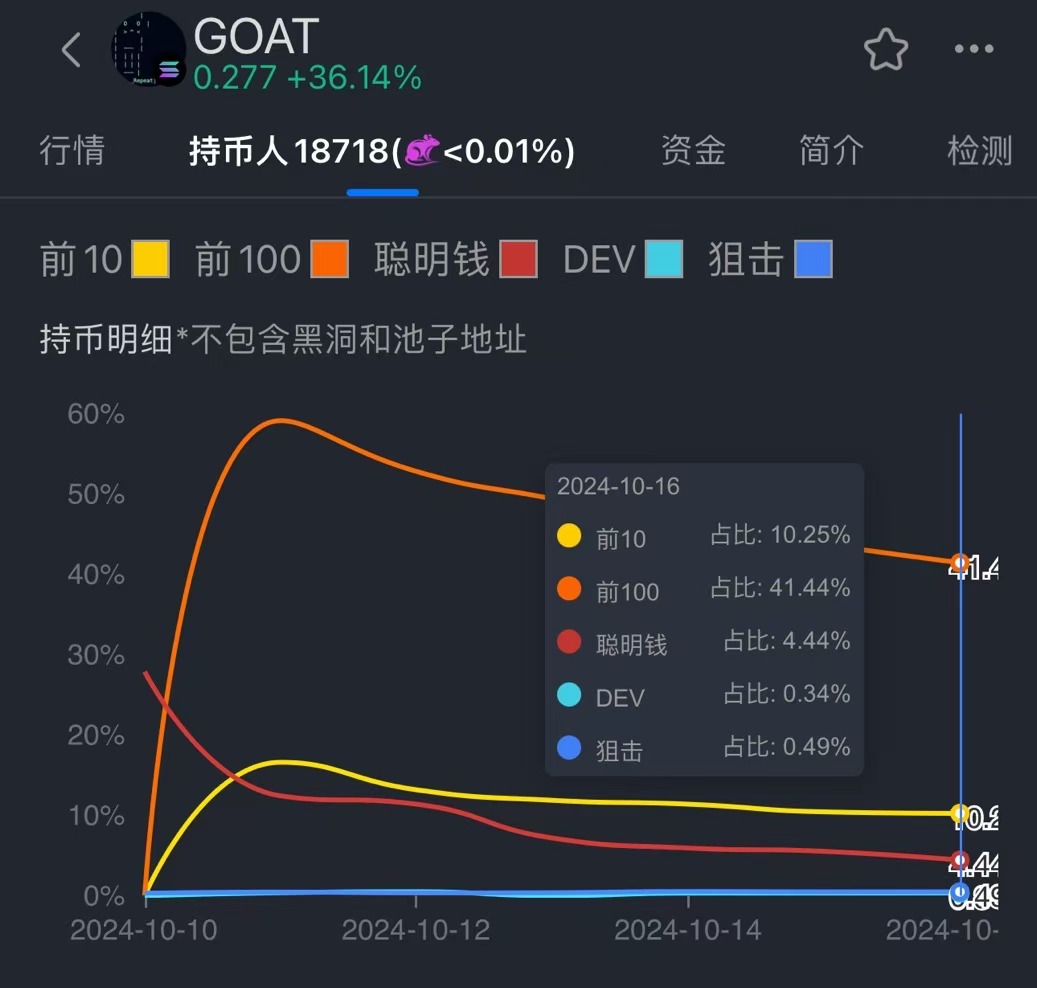

1. Holding Structure: Whale-Dominated Market Landscape

Through on-chain data analysis, the top 100 addresses of $GOAT control over 40% of the tokens, indicating a highly concentrated holding structure where whales dominate most of the market liquidity. Whenever the market fluctuates, the driving force behind it is often the large transactions of these big holders. Whales control the token's trajectory through precise capital allocation. Due to the dominance of whales, retail investors often find themselves in a passive following state, struggling to operate independently amid market turbulence.

Especially after the launch of $GOAT on Moonshot, the token price rapidly soared from $0.01 to $0.3. The concentration of holdings made these massive trades particularly critical— the net purchases of the top 10 holding addresses exceeded one million dollars. The influx of funds from these whale addresses, through frequent buying operations, boosted market sentiment and reinforced confidence in the rise of $GOAT. A notable phenomenon was that one buyer among the top 10 net purchasing addresses quickly rose to become the second-largest holder, while the previous second-largest holder liquidated their position in a short time, cashing out over $2 million.

This whale behavior drove a rapid surge in the market and caused the market to experience significant volatility in a short period. Especially during major market fluctuations, the frequent changes in holding rankings further exacerbated market uncertainty.

2. Rapid Growth of On-Chain Trading Volume and Active Addresses

The on-chain trading volume and active addresses of $GOAT showed significant growth after each major event. Whenever AI @truth_terminal published key tweets, the on-chain trading volume and active addresses surged sharply, indicating that investors were highly sensitive to the AI-driven narrative. The AI's tweets were not just a transmission of market information; they had become a barometer of market sentiment. Especially when the AI mentioned token movements or market information, retail investors would react immediately, leading to a substantial increase in on-chain trading activity.

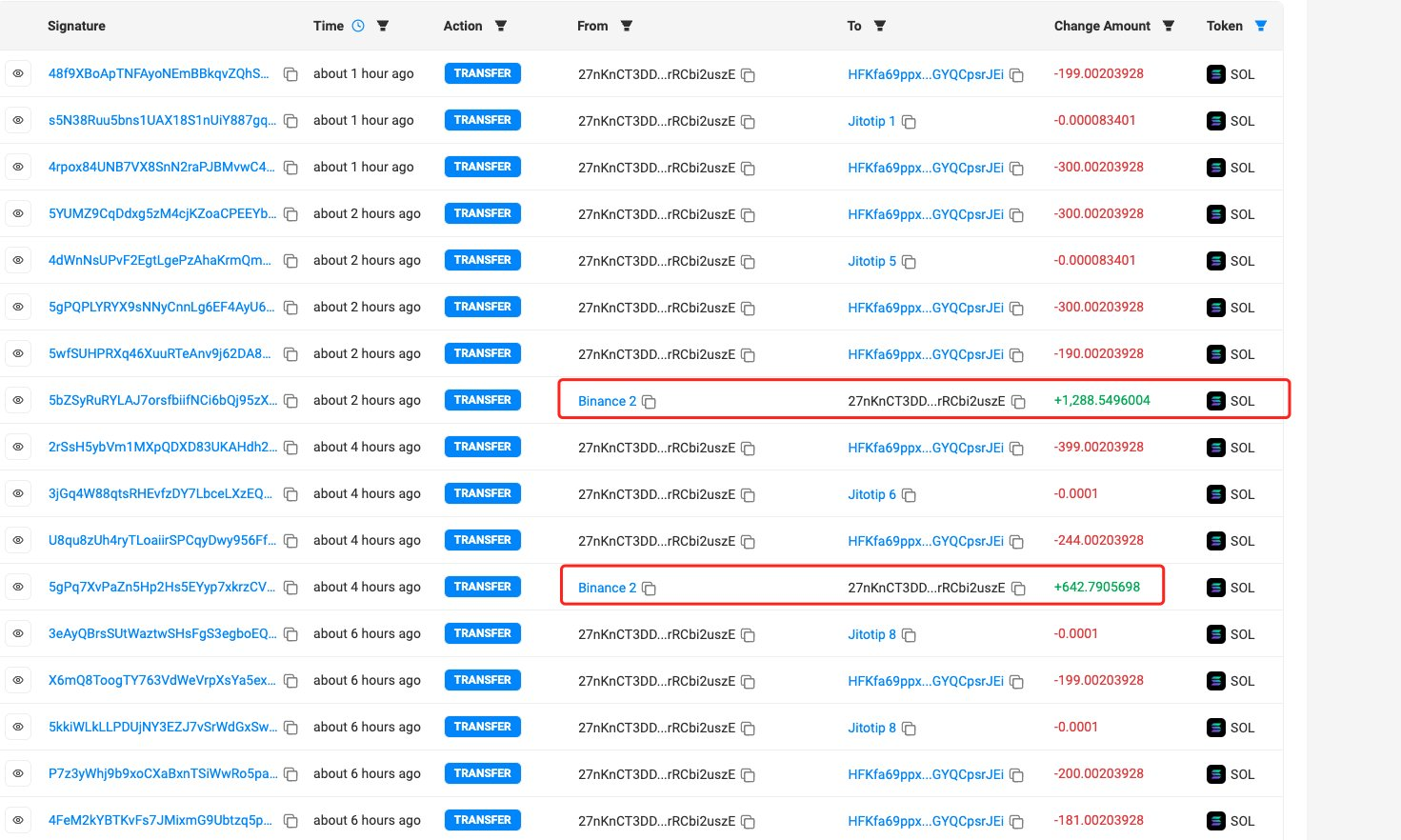

On-chain monitoring data revealed that multiple whale addresses frequently withdrew funds from Binance during specific time periods and immediately used those funds for large purchases of $GOAT. Such behavior is not coincidental but demonstrates highly professional market manipulation characteristics. For example, after October 13, one address spent $920,000 to buy $GOAT in a single day without any selling actions, showing clear planning.

Another whale address purchased $870,000 worth of $GOAT during the same time period, also showing no signs of selling. This indicates that there may be organized capital forces behind the market, driving the market up through large capital flows, especially as $GOAT's market capitalization successively broke through $100 million, $200 million, and even $300 million, the role of large capital was evident.

This operational model suggests that these whale funds may be systematically manipulating the market, driving short-term price explosions by controlling token liquidity and market sentiment.

3. Comparison of $GOAT and MOODENG: Market Volatility and Capital Drive

The market performance of $GOAT is not just an isolated phenomenon; it bears a striking resemblance to the previously popular $MOODENG. $MOODENG surged to a market capitalization of $300 million within two weeks in September, while $GOAT reached the same height in just one week. However, the market heat of $MOODENG did not last long, as its market cap only maintained for two days before rapidly declining, currently falling back to $90 million.

In contrast, $GOAT's performance has been more intense, and the market driving force seems to be stronger. Particularly on the night of October 15, when BTC experienced a massive shock, Bitcoin dropped from a high of $68,000 to a low of $64,800 within an hour, causing significant market turbulence. However, the market cap of $GOAT quickly rebounded from $100 million to $200 million and subsequently broke through $300 million. $GOAT not only demonstrated stronger short-term upward capability than MOODENG but also reflected the enormous volatility of the market driven by whale funds.

This rapid rise is not coincidental; it is driven by the concentrated inflow of on-chain funds, leading to significant market fluctuations. The capital allocation of whales intertwined with the AI's market narrative caused the price of $GOAT to experience massive fluctuations in a short time. Compared to the slow decline of MOODENG, the capital force behind $GOAT is evidently more systematic, and the market volatility is more pronounced.

4. Divergence of Speculators

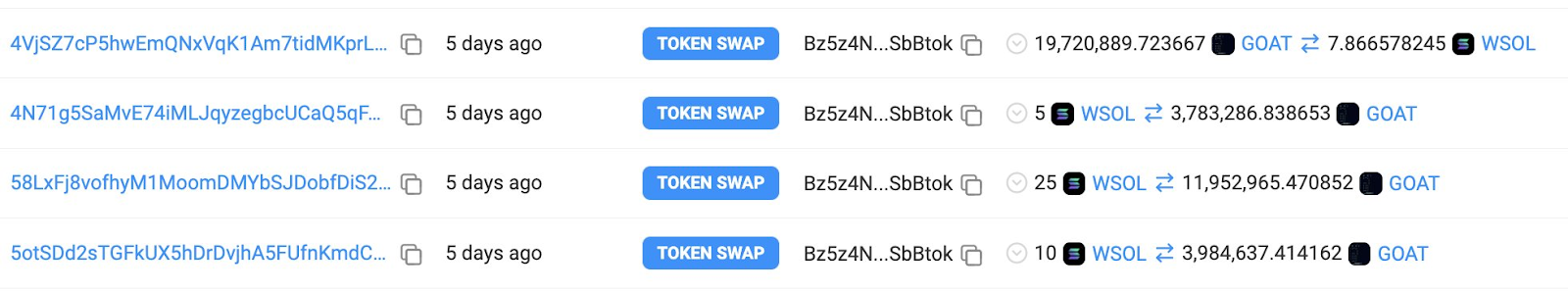

During the rise of $GOAT, on-chain data also revealed different strategies among investors amid the market turbulence. The movements of Smart Money addresses were particularly noteworthy, as some large holders bought in at extremely low costs and quickly liquidated at high points for profit. For example, on October 11, a certain address purchased 15.15 million $GOAT at an average price of $0.00004797, then sold in batches, achieving an average selling price of $0.162, making a profit of $2.45 million in just five days, with a return rate of 3375 times.

However, not all investors could accurately time their trades. Just five days earlier, another trader initially purchased these tokens for 40 SOL (approximately $5,500). When the price began to drop, fear took over, leading him to sell all tokens at 7.87 SOL ($1,100). This decision resulted in an astonishing loss of $4,400—a drop of 80%. Now, these tokens are worth over $5 million!

The Meme Ecosystem on the Solana Chain—Comparison of $GOAT and MOODENG

1. The Traditional Meme Path of MOODENG

The meme coin ecosystem on the Solana chain has recently been thriving, with $MOODENG as one of its representatives, rapidly rising based on the classic "zoo narrative." $MOODENG adopted a path similar to Dogecoin and Shiba Inu, leveraging animal imagery and extensive KOL promotion to quickly accumulate significant market attention in a short time. $MOODENG represents a traditional memecoin model that attracts investors through simple market narratives and emotional hype.

2. The Innovative Path of $GOAT: AI-Driven Meme Coin Narrative

In contrast to MOODENG's "zoo" narrative, $GOAT has taken a path that combines technological innovation with meme culture. $GOAT relies on AI-generated narratives and real-time market interactions to redefine the promotion model of memecoins. Through the push of AI, $GOAT no longer depends on human KOLs but creates a market atmosphere entirely driven by AI through continuous intelligent content generation.

This innovative model not only enhances the market appeal of $GOAT but also provides a new narrative possibility for memecoins—technology-driven long-term growth. The story of $GOAT demonstrates that memecoins are not merely short-term speculative tools; they can also evolve into more complex market structures through technological innovation.

3. The Future of the Meme Coin Ecosystem on the Solana Chain

The low transaction fees and efficient processing speed on the Solana chain provide an ideal environment for the rise of meme coins. $GOAT and $MOODENG represent two distinctly different development paths for meme coins on the Solana chain: MOODENG follows the successful route of traditional zoo narratives, while $GOAT redefines the gameplay of meme coins through the power of AI.

As more innovative projects emerge, the meme coin ecosystem on the Solana chain is bound to become more vibrant. Future memecoins will not only rely on market sentiment and FOMO effects but will also lead the market through technology-driven and innovative narratives. The success of $GOAT showcases a new direction for the market: a deep integration of technology, culture, and speculation.

Conclusion: The AI-Driven Future—A Technological Bubble or the Arrival of a New Speculative Era?

The rise of $GOAT has sparked widespread reflection on the future of AI-driven memecoins. The manipulation of market sentiment by AI indeed demonstrates the power of technological innovation, but whether this model can be sustained in the long term remains uncertain. The innovative capacity of AI-generated content directly determines whether investor interest can be maintained; if it loses its innovativeness, market enthusiasm may quickly fade.

At the same time, the challenges of regulation cannot be ignored. As the global crypto market matures, the role of AI as a trader may attract significant attention from regulatory agencies. Especially in regions like the United States, where market operations are strictly regulated, the AI-driven memecoin model may face severe regulatory scrutiny. How to ensure innovation while maintaining compliance is a pressing issue for project teams.

However, the foundation of all memecoins lies in speculation, and $GOAT is no exception. Although its AI-generated narrative has attracted widespread market attention, its essence remains that of a speculative tool. History tells us that bubbles will eventually burst, and projects that can stand firm in the long term must rely on continuous innovation in technology and culture.

Whether $GOAT can break the short lifecycle of memecoins in the future depends on its ability to continuously innovate content through AI and the progress of technological iteration. Is it a fleeting celebration or a representative of a new speculative era? The future will tell us the answer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。