The data in this report indicates that a paradigm shift has begun, and the Polkadot DAO is preparing for a long-term sustainable budget.

Written by: Alice und Bob, Jeeper

Alice und Bob released the Polkadot Treasury Report for Q3 2024. The data in this report shows that a paradigm shift has begun, and the Polkadot DAO is preparing for a long-term sustainable budget.

The Polkadot Treasury is a multi-asset, multi-chain system. It manages over $150 million in funds through a trustless mechanism, distributed across 7 different blockchains. The governance structure of Polkadot is continuously expanding, as evidenced by the increase in the number of executing entities funded by the treasury and the ongoing deployment of funds across 4 different DeFi chains within the Polkadot ecosystem. Additionally, the treasury has completed its first proactive asset swap operation, exchanging 1 million DOT for an equivalent amount of MYTH tokens, which is part of the Mythical game chain's integration into the Polkadot ecosystem.

The report includes a balance sheet and income statement, managing millions of dollars in assets using traditional accounting methods. The balance sheet will provide a comprehensive overview of all active accounts managed by the treasury, as well as the distribution of assets across various operations. The income statement will detail the various categories of treasury expenditures.

Furthermore, the report concludes with a discussion on long-term trends, including the overall development of the treasury, the progress of decentralized budgeting implementation, and how upcoming inflation changes may impact the treasury.

This report was produced by OpenGov.Watch and funded by the Web3 Foundation. Data sources include dotreasury.com developed by the OpenSquare team and additional data provided by the Parity data team.

Key Insights

Balance Sheet

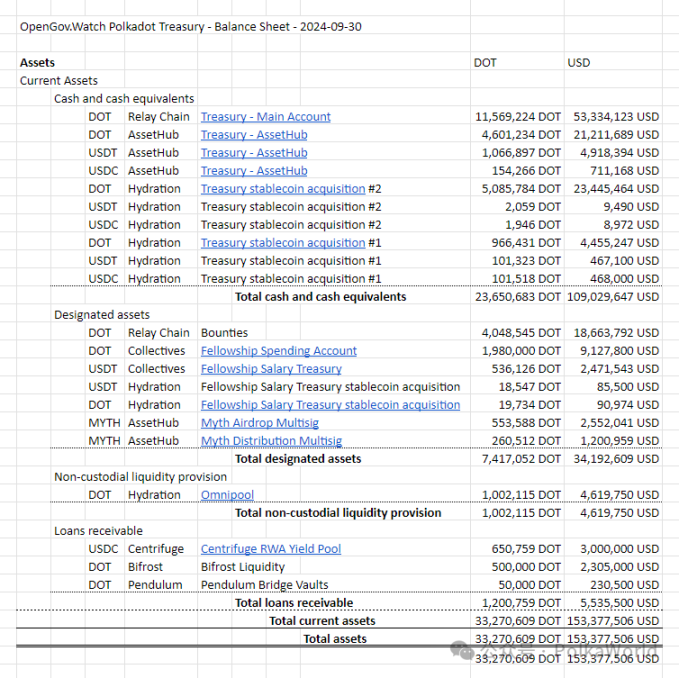

- The balance sheet shows $153 million (33.3 million DOT), of which $109 million (23.7 million DOT) is available for use.

- Cash reserves include $6.6 million in stablecoins, with an additional 6 million DOT ($28 million) allocated for automated stablecoin purchases.

Expenditures

- The treasury expenditure for Q3 2024 was $27.3 million (5.1 million DOT).

- 15% of expenditures were made through executing entities (bounty programs and collectives).

- $34 million (7.4 million DOT) was allocated to various executing entities of Polkadot for strategic projects such as marketing, DeFi tools, gaming, business development, etc.

Market Operations

- Polkadot provided assets worth $10 million (2.2 million DOT) as liquidity for 4 different DeFi chains.

The Polkadot DAO is responding to past expenditure increases by reducing spending. Additionally, the anticipated decrease in inflation may also bring more stable income to the treasury. For more information, please read the discussion section at the end of the report.

Balance Sheet

Assets

The balance is 33.3 million DOT / $153 million. After accounting for liabilities, the remaining balance is 32.4 million DOT / $149 million.

Before diving into specific categories, we first analyze some general statistics.

General Statistics

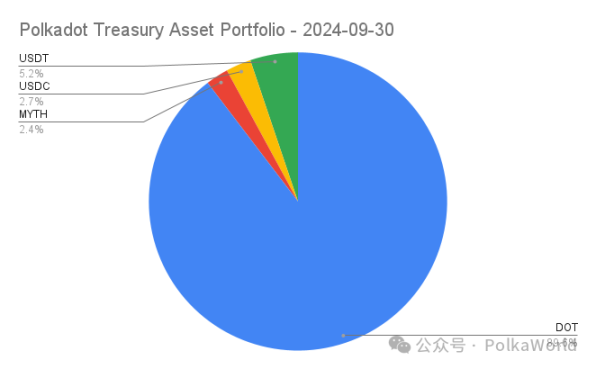

Polkadot Treasury Asset Portfolio

Most assets are held in DOT (approximately 90%), with 5.2% in USDT, 2.7% in USDC, and 2.4% in MYTH. At the time of the snapshot, the Polkadot treasury's stablecoin holdings amounted to $12.2 million, including $8 million in USDT and $4.2 million in USDC. The total amount of DOT tokens held across various accounts by the treasury is 30 million DOT ($137 million).

To provide a true value of the treasury's assets, we do not include memecoins. Although their nominal value may be high, the treasury cannot actually sell these tokens at nominal value due to low liquidity. We estimate the total value of these tokens to be less than $100,000.

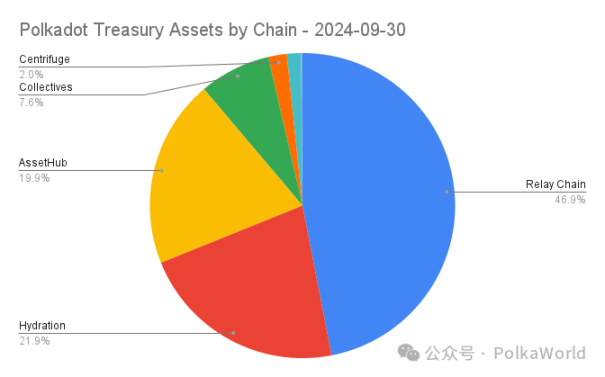

Asset Distribution of the Polkadot Treasury Across Different Chains

Parachains have become an important component of the treasury economy, with over 25% of the treasury's own assets deployed across various DeFi chains, such as Hydration ($33.7 million), Centrifuge ($3 million), Bifrost ($2.3 million), and Pendulum ($230,000). Polkadot's governance mechanism ensures that all blockchains connected under Polkadot's security (including parachains) can make decisions without relying on trusted intermediaries.

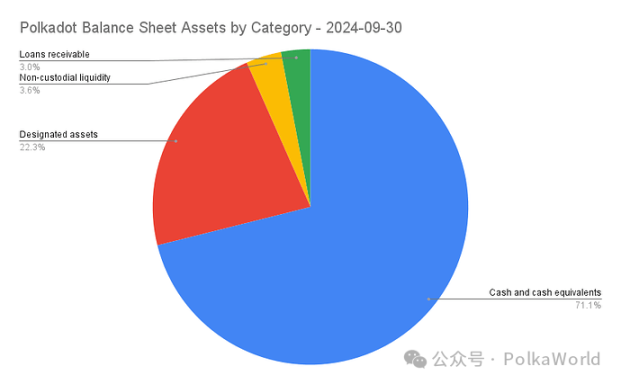

Asset Classification

In the balance sheet, we classify assets as follows:

- Cash and cash equivalents: 24 million DOT / $109 million

- Designated assets: 7.4 million DOT / $34 million

- Unmanaged liquidity provision: 1 million DOT / $4.6 million

- Receivable loans: 1.2 million DOT / $5.5 million

1. Cash and Cash Equivalents (24 million DOT / $109 million)

This category includes DOT, USDT, and USDC, which can be made available to the treasury immediately or very quickly. The treasury keeps its discretionary cash reserves on the relay chain and AssetHub system chain.

- Relay Chain: 11.6 million DOT ($53 million)

- AssetHub:

- 4.6 million DOT ($21 million)

- 4.9 million USDT (1 million DOT)

- 710,000 USDC (154,000 DOT)

Additionally, there are currently two trustless and fully automated stablecoin purchase activities running through the Hydration DeFi chain.

- Stablecoin Purchase Activity #1: By Q1 2025, approximately 1 million DOT ($4.5 million) is pending exchange (https://polkadot.subsquare.io/referenda/457)

- Stablecoin Purchase Activity #2: By Q3 2025, approximately 5 million DOT ($23 million) is pending exchange (https://polkadot.subsquare.io/referenda/1104)

2. Designated Assets (7.4 million DOT / $34 million)

Designated assets are those controlled by OpenGov but allocated for specific tasks, primarily to fund its executing bounties (bounty programs and collectives). Additionally, Polkadot holds $3.7 million in MYTH, which will be distributed to DOT holders through an airdrop.

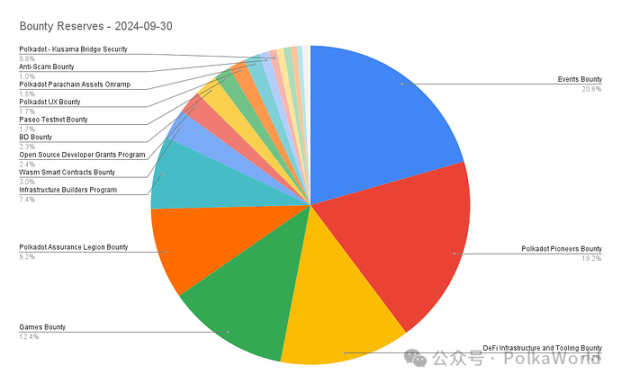

Bounties

Polkadot holds $18.7 million (4 million DOT) in the bounty pool, ready to be allocated to teams providing value-added services to the ecosystem. https://polkadot.subsquare.io/treasury/bounties

Strictly speaking, publishing the following infographic is not very meaningful, as this data changes every month. The bounty reserves are dynamic, and as DOT is allocated to teams and individuals, the bounty pool will continue to be replenished. However, it is still included in this report to showcase the excellent teams currently working in the Polkadot governance execution department:

Technical Fellowship

The Polkadot Technical Fellowship is the core maintainer of the Polkadot runtime, funded by the treasury. They have two accounts:

- Salary Account: 2.5 million USDT (equivalent to 540,000 DOT) (https://assethub-polkadot.subscan.io/account/13w7NdvSR1Af8xsQTArDtZmVvjE8XhWNdL4yed3iFHrUNCnS?tab=transfer)

- Expenditure Account: 2 million DOT ($9.1 million) (https://assethub-polkadot.subscan.io/account/16VcQSRcMFy6ZHVjBvosKmo7FKqTb8ZATChDYo8ibutzLnos)

Additionally, they are trustlessly acquiring USDT through the Hydration chain, with approximately 38,000 DOT ($180,000) expected to be exchanged by October 2024.

MYTH Airdrop

As part of the strategic partnership between Polkadot and Mythical, Polkadot exchanged 1 million DOT for an equivalent amount of MYTH tokens (https://polkadot.subsquare.io/referenda/643). Shortly after our balance sheet date of September 30, 2024, MYTH tokens worth approximately $2.5 million were distributed to DOT holders. The remaining MYTH, equivalent to $1.2 million, is still held in the MYTH distribution account (https://assethub-polkadot.subscan.io/account/13gYFscwJFJFqFMNnttzuTtMrApUEmcUARtgFubbChU9g6mh) for future use.

3. Unmanaged Liquidity Provision (1 million DOT / $4.6 million)

These are portions of idle funds that the treasury has deployed into the Polkadot economy.

Currently, 1 million DOT ($4.6 million) is held as a DOT liquidity provider (LP) in the Hydration Omnipool. https://app.hydration.net/liquidity/my-liquidity?account=7KQx4f7yU3hqZHfvDVnSfe6mpgAT8Pxyr67LXHV6nsbZo3Tm&id=5

4. Receivable Loans (1.2 million DOT / $5.5 million)

These portions correspond to the counterparty of managed liquidity provision.

- At the time of the snapshot, the treasury had deployed 3 million USDT into the Centrifuge RWA yield pool. (Shortly after the snapshot, 1.5 million USDT was returned for immediate expenditures) https://polkadot.subsquare.io/referenda/1122

- Bifrost has deployed 500,000 DOT into its liquid staking DOT product. https://polkadot.subsquare.io/referenda/432

- Pendulum borrowed 50,000 DOT for its stablecoin bridging treasury. https://polkadot.subsquare.io/referenda/748

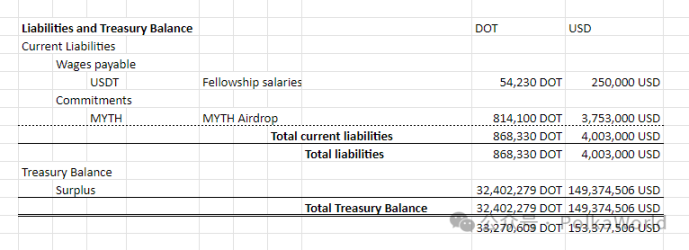

Liabilities and Treasury Balance

In Polkadot, liabilities are relatively straightforward.

- The Fellowship's payable salaries are up to $250,000 every 28-day cycle.

- The MYTH token plan is to distribute all tokens to DOT holders. Shortly after the balance sheet was recorded, $2.5 million worth of MYTH was distributed, with the remaining portion to be distributed in the future.

After accounting for liabilities, the Polkadot treasury has a surplus of 32.4 million DOT ($149 million).

Income Statement

When writing financial statements in the crypto space, there is always a question: which unit of measurement should be used? Is it DOT, as it is the native currency of the network? Or USD, as it is easier for the average observer to understand?

For the income statement, we use DOT as the primary unit of measurement because the treasury's main source of income—inflation—is based on DOT. For the expenditure section, we will also provide a table priced in USD, as understanding stable expenditure amounts is important for analyzing the income statement.

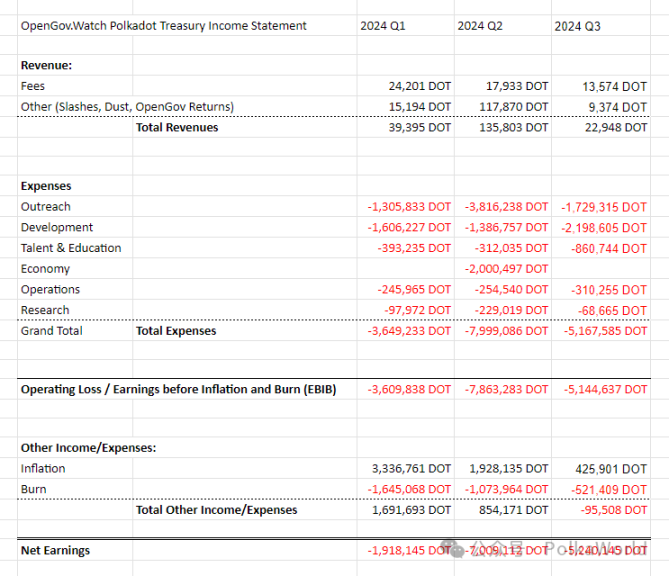

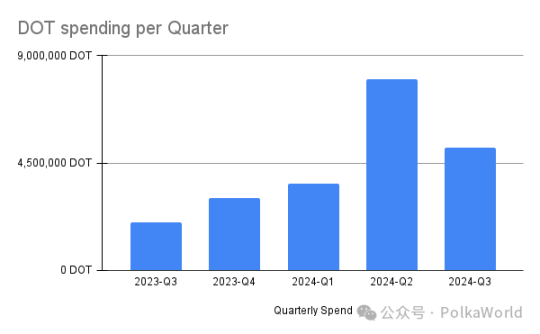

Polkadot's expenditures decreased from 7.9 million DOT in Q2 to 5.1 million DOT in Q3. The amount destroyed this quarter exceeded inflation. Relay chain fees have decreased, and as more functionalities are transferred to the system chain, these fees are expected to continue to decline, which is part of Polkadot's large JAM strategy. In the future, the main metric for measuring Polkadot's value accumulation may be the DOT destroyed through core sales (as well as potential fees from the Plaza superchain project).

Expenditures

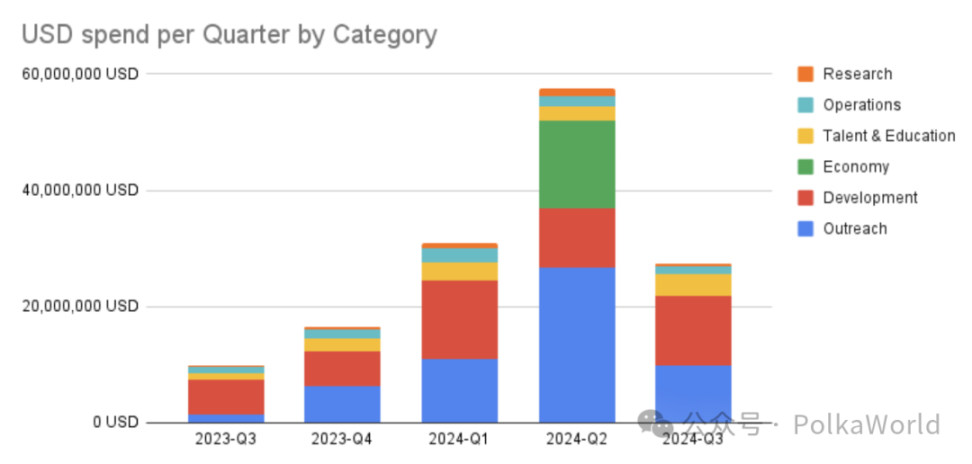

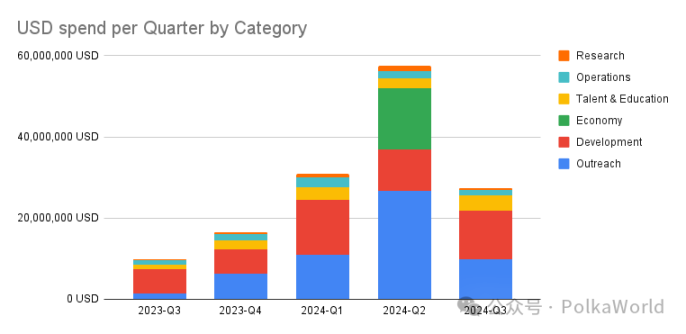

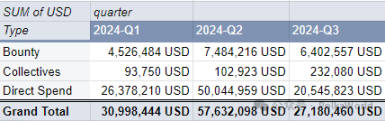

In Q3, Polkadot's expenditures significantly decreased to $27 million (5.2 million DOT), which is half of Q2's expenditures. Let's take a look at the expenditures in the first three quarters of this year, calculated in both DOT and equivalent USD.

Before diving into detailed analysis, let's first look at the main expenditure categories of Polkadot funds.

Categories

The expenditure categories described in this chapter have been gradually formed over the past year through the writing of multiple budget reports. These categories have been further refined through discussion posts on the Polkadot forum. Suggestions for improvements are welcome in the discussion posts for future reports. https://forum.polkadot.network/t/polkadot-spending-reporting-standards/7141

1. Research: Protocol research, reports and analysis, user experience (UX) and developer experience (DX), anti-fraud, audits (security, quality assurance)

2. Development: Software development that directly impacts the relay chain and system chain (future hardware development may also be included), or software that can be used with these chains: wallets, bridges, Substrate clients, light clients, multi-signature support, privacy, indexing tools, protocol subsidies (public welfare chains), protocol and software incubation, development toolkits (such as wrappers from Web3 to Web2), smart contract technology, zero-knowledge technology (ZK), Polkadot protocol (technical fellowship compensation)

3. Operations: Software, hardware, and service costs incurred while running the network:

- Network: RPCs, archive nodes

- Auxiliary services: blockchain explorers, indexers

- Legal costs (foundation)

4. Outreach (marketing, business development, community development):

- Marketing: media production, public relations, advertising

- Business development: consulting, solution architecture

- Community development: hosting conferences, attending events, local promotion, activities, community building, ambassador programs

5. Talent and Education: Education, hackathons, recruitment, talent incubation (e.g., PBA)

6. Economy: Stimulating economic development through liquidity incentives

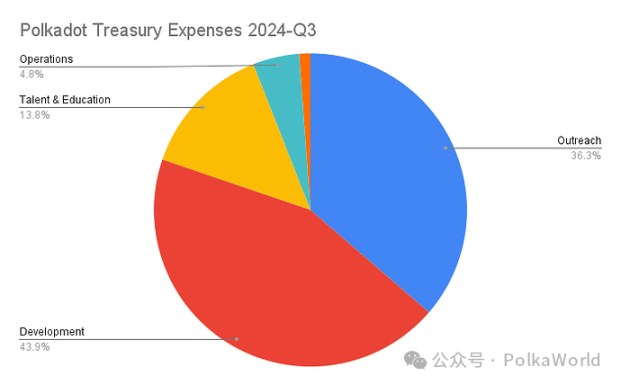

Q3 expenditures amounted to $27 million (5.2 million DOT), which is half of Q2's expenditures ($58 million → $27 million), and expenditures measured in DOT also saw a significant decline (8 million DOT → 5.2 million DOT).

- Outreach expenditures saw the most significant decrease, dropping from $27 million to $9.9 million.

- Development expenditures remained relatively stable ($10 million → $11.9 million).

- Operational costs also maintained previous levels ($1.7 million → $1.4 million).

- Talent and education expenditures saw an increase ($2.3 million → $3.8 million).

- Research expenditures are at a low point this year ($1.5 million → $310,000).

- No economic stimulus proposals were approved this quarter.

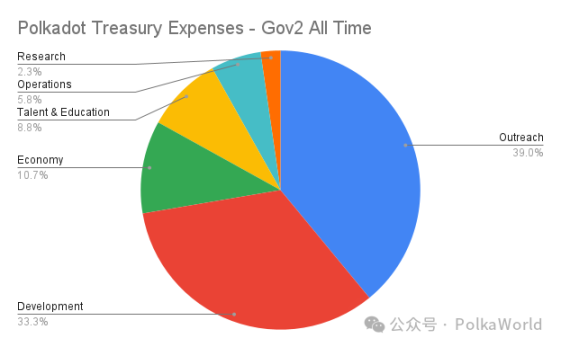

Comparing the historical distribution (above) with this quarter's distribution (below), it is evident that the two are very similar. The "Economy" category only had allocations in Q2 2024. Overall, outreach has maintained its historical proportion, while development and talent & education have seen increases.

Now let's take a deeper look at each category!

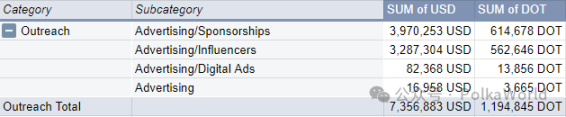

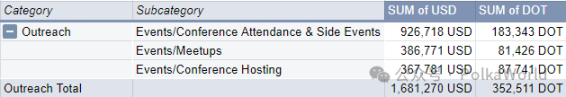

Outreach

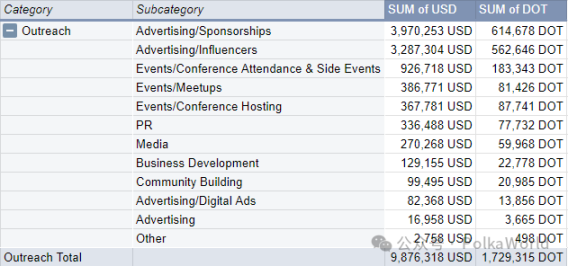

This quarter, $9.9 million was spent on outreach (a significant decrease from $26.8 million in Q2), covering activities such as marketing, business development, and community building, all aimed at attracting new users, developers, and businesses to the ecosystem.

The subcategories of advertising and events show significant differences, so we will further break them down into smaller subcategories.

Advertising ($7.4 million) constituted the main part of this quarter's outreach efforts. This was primarily used to supplement sponsorship contracts ($4 million), including collaborations with Inter Miami ($3.9 million) and HEROIC ($84,000). Additionally, KOL marketing ($3.3 million) was carried out through agencies such as Pineta Digital ($2.2 million), EVOX ($650,000), Pink Brains ($330,000), and Lunar Strategy ($50,000).

Event expenditures amounted to $1.7 million. Polkadot participated in events such as Token2049 ($370,000), the 2024 Asia Blockchain Summit ($105,000), the 2024 Korea Blockchain Week ($103,000), and 10 other conferences and related activities, totaling $930,000. The expenditures for dozens of smaller gatherings ($387,000) were roughly equivalent to the hosting costs for the Sub0 Developer Conference ($368,000).

Other subcategories of outreach include: public relations ($336,000), provided by Chainwire ($319,000) and MarketAcross ($17,000) for the ecosystem. Media ($270,000) was primarily spent on the Spanish bounty ($192,000), the "Behind the Code" interview series ($44,000), the "Meme Frenzy" in The Dots magazine ($37,000), and the Spanish editorial office ($35,000). Business development ($129,000) and community building ($99,000) made up the remaining subcategories.

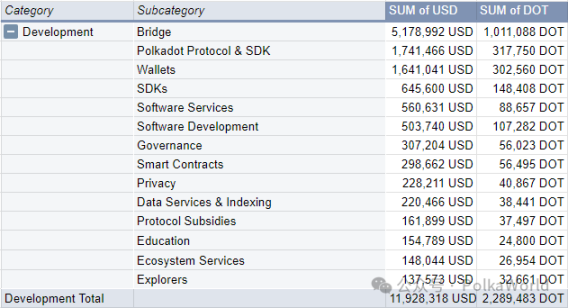

Development

Expenditures in development amounted to $11.9 million (compared to $10 million in Q2). The largest expenditure was for the Polkadot-Ethereum bridging project ($5.2 million), which recently went live. Wallet development ($1.6 million) funded Subwallet ($810,000) and three new projects: New Kampela ($640,000), Polkasafe multi-signature ($160,000), and PlutoWallet ($35,000).

To develop the Polkadot protocol and SDK ($1.7 million), the C++ implementation KAGOME project received $820,000 in funding. OpenZeppelin received $250,000 for developing new templates, while the total salary for the technical fellowship was $232,000. The SDK ($645,000) portion includes PAPI ($560,000) and Reactive DOT ($88,000). Software services ($560,000) were third-party services funded by Polkadot.

Software development ($504,000) is a general category that includes all uncategorized development costs. AssetPortal ($145,000) and Kheopswap ($59,000) are both DEX user interfaces built for the native decentralized exchange (DEX) functionality of AssetHub. dAppForge ($79,000) is an AI plugin provided for Polkadot developers. Polkadot also funded the RegionX Coretime market ($54,000) to enhance its new on-chain block space market.

Governance ($307,000) funded OpenGov tools, including Bounty UI ($170,000) and Subsquare Collectives support ($138,000). Smart contracts ($299,000) funded the Phink - ink! fuzz testing tool ($192,000) and three other projects. In the privacy ($228,000) category, there was a fully homomorphic encryption project developed for WASM ($195,000) and the privacy sidechain Incognitee ($33,000). On the other hand, in the data services and indexing ($220,000) category, the main project this quarter was the user segmentation and conversion project for Ink!, Pallets, and XCM ($215,000).

Other subcategories include protocol subsidies ($162,000), education ($155,000), ecosystem services ($148,000), and blockchain explorers ($138,000).

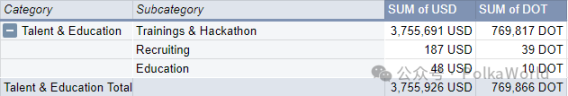

Talent and Education

Expenditures in the talent and education category amounted to $3.8 million (compared to $2.3 million in Q2). The main subcategory is training and hackathons ($3.8 million), with $2.2 million allocated to the Polkadot Blockchain Academy, and the remaining amount for various hackathon activities. The subcategories for recruitment ($187) and education ($48) may seem a bit unusual this time, but they reflect that the treasury also provides small rewards to participants in the ecosystem for value-added work, such as creating standardized interviews or writing guides, and requests modest small rewards.

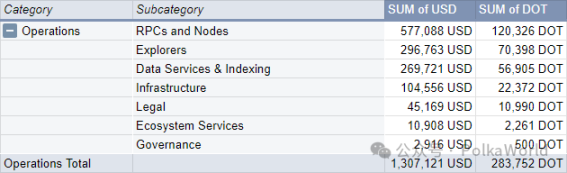

Operations

Operational expenditures in Q3 amounted to $1.4 million (compared to $1.7 million in Q2). RPC and nodes ($577,000) were used to maintain network operations, with $462,000 allocated to infrastructure bounty projects, $74,000 for public RPC bounties for the relay chain and system chain, and $40,000 for validator bounties for system parachains. This means that all expenditures in this subcategory were completed in the form of bounties!

Blockchain explorers ($297,000) covered 9 months of Subscan fees ($259,000) and some other licensing fees ($38,000). Data services and indexing ($270,000) were paid to Subsquid ($234,000) and Polkawatch ($35,000). Infrastructure ($104,000) was specifically allocated for Paseo testnet bounties. Polkadot spent $45,000 acquiring intellectual property through the Polkadot Community Foundation. Minor expenditures included ecosystem services ($11,000) and governance ($3,000).

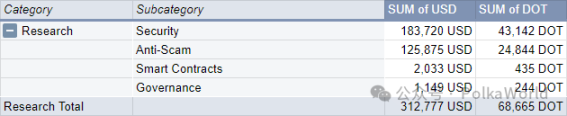

Research

Research expenditures amounted to $313,000 (compared to $1.5 million in Q2). Security ($183,000) was primarily used for auditing the ink! 5.0 codebase. Anti-fraud bounties cost $125,000. Smaller expenditures included research costs for smart contracts ($2,000) and governance ($1,000).

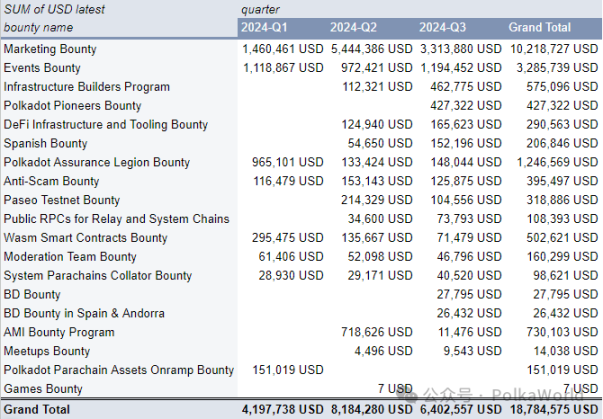

Bounties

Let’s take a look at bounty and collective expenditures. They are two types of execution mechanisms that simplify the OpenGov process by reducing the voting volume on the regular voting track and allocating funds to expert institutions to decide on expenditures. From the table above, it can be seen that bounty expenditures are more stable than direct expenditures, while collective expenditures are on the rise. Please note that these costs have already been reflected in previous chapters; this is just a different perspective to present them.

We start our analysis with bounties.

So far this year, a total of $18.8 million has flowed through the bounty channel, with $6.4 million in Q3. Among them, marketing bounties ($3.3 million) still dominate, although the community temporarily paused this bounty to replan and consider new strategies. Event bounties ($1.2 million) also showed consistency and are known for establishing good internal operations.

Overall, we can observe that the number of bounties in operation is greater than before, and best practices are beginning to be gradually established.

Fellowship

The salary claims for the technical fellowship are on the rise. Here are the amounts disbursed in the first half of its operation:

- April 2024: $16,670

- May 2024: $35,000

- June 2024: $51,253

- July 2024: $67,080

- August 2024: $71,670

- September 2024: $93,330

Discussion

On the treasury's burn rate

Our previous report sparked considerable controversy, claiming that the treasury has about 2 years of funding reserves (while also acknowledging that due to the volatility of crypto assets, it is difficult to make accurate predictions). This argument is based on the fact that the treasury has 32 million DOT (approximately $200 million) in liquid assets, with an expected annual net loss of 17 million DOT ($108 million). At this rate, the treasury could be depleted in 2 years. Now, with an additional 3 months of data, we can reassess this situation.

Inflation

The strongest argument against the notion that "the treasury's funds are about to run out" is that the treasury cannot run out of funds because the inflation mechanism will continuously replenish the treasury. Technically, this point is correct, but it overlooks the fact that the inflation rate cannot be arbitrarily increased. Because inflation effectively acts as a tax on those who do not stake tokens, it needs to be managed carefully. Furthermore, the current reserves of the Polkadot treasury already exceed one year of inflation income, which can be viewed as the treasury's "reserve fund." However, at the current expenditure rate, the treasury's reserves may be depleted. While this situation aligns with the current strategy, it is important to face and acknowledge this reality honestly in discussions.

Recently, DOT holders voted through wish for change https://polkadot.subsquare.io/referenda/1139 to reduce inflation, while providing more income for the Polkadot treasury and lowering the high annual interest rates for stakers to a more reasonable level. By 2025, the treasury is expected to generate approximately 18 million DOT (about $83 million) in income. This means a quarterly budget of about 4.5 million DOT without tapping into the treasury reserves.

Looking back at the expenditure situation, we find that its growth rate exceeds the expected quarterly inflation income of 4.5 million DOT (3.6 million DOT in Q1, 7.9 million DOT in Q2, 5.1 million DOT in Q3), as marked by the line in the chart below.

Current Treasury Consumption Situation

The surplus of the Polkadot treasury decreased from 38.2 million DOT in Q2 to 32.4 million DOT in Q3, consuming 5.8 million DOT per quarter, with an annual consumption rate of about 23.2 million DOT. Based on the total expenditure of the first three quarters (16.8 million DOT), the estimated annual expenditure is similar, around 22.4 million DOT.

When comparing this annual expenditure with the expected annual inflation income (18 million DOT per year), the treasury incurs a net loss of about 5 million DOT each year. However, the current treasury balance of 32.4 million DOT is 6.5 times this net loss. Even considering only cash and cash equivalents of 23.6 million DOT, this is still 4.7 times the net loss.

Therefore, compared to the previously mentioned "less than two years of funding reserves" situation, the treasury has received timely replenishment through additional income.

In the long term, the DAO still needs to develop a strategy for sustainable fund usage. While it is good to look forward to favorable market conditions in the future, having a comprehensive plan would be even better.

Budget

Community members have expressed a desire to develop a budget, and this desire has persisted for over a year. However, for a decentralized autonomous organization (DAO) like Polkadot, which has a complex structure and involves many stakeholders, how to effectively implement budgeting is a challenging question. To address this issue, we are releasing a proposal here, based on a bottom-up principle, combined with the legislative process that Polkadot is developing.

- Proposal link: https://forum.polkadot.network/t/budgeting-via-subdaos-wfc-draft/10448

View the full report link: https://forum.polkadot.network/t/2024-q3-polkadot-treasury-report/10450

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。