As the landscape expands, Ethereum's competitors are vying for institutional attention. Solana and Stellar are making significant strides, particularly in the RWA space.

Written by: Jonah Roberts, Bankless

Translated by: Deng Tong, Jinse Finance

What do all these frequently repeated buzzwords have in common? Cryptocurrency employees at TradFi companies use them to pitch the exciting advantages of blockchain technology to their bosses, and this year, executives seem to be listening.

In 2024, institutions are more eager than ever to venture into the cryptocurrency space through customized blockchain integrations, tokenized funds and ETFs, industry partnerships, and research papers. These initiatives are beginning to bridge the gap between TradFi and DeFi. However, this article does not focus on why companies are building on-chain. Instead, we are concerned with where these funds choose to build.

What is happening with Ethereum?

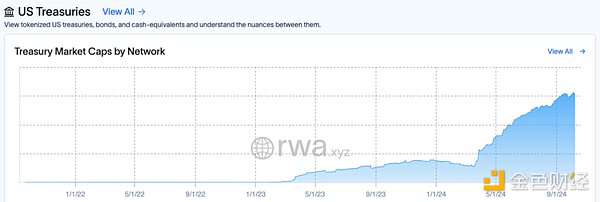

Ethereum is the world's largest smart contract blockchain network. It has over $90 billion in RWA, including stablecoins. 2024 is also a significant year for Ethereum's adoption of non-stablecoin RWA, as the network increases its on-chain U.S. Treasury bonds, bonds, and cash equivalents from $800 million to over $1.5 billion, with the total value of non-stablecoin RWA rising to $2.9 billion.

Some of the major players based on Ethereum this year include Visa, BlackRock, and Franklin Templeton.

Earlier this month, Visa announced that they are building the Visa Tokenized Asset Platform (VTAP) on Ethereum. This is the company's largest step yet in cryptocurrency adoption. VTAP enables Visa to issue and manage fiat-backed tokens on Ethereum. It aims to serve as a sandbox for participating financial institution partners to create and experiment with fiat-backed tokens. They expect to pilot the platform with Spanish multinational bank BBVA starting in 2025. While the VTAP initiative is undoubtedly an experiment, it confirms the argument that TradFi will migrate its business to Ethereum in the coming decades.

Earlier this year, both BlackRock and Franklin Templeton established nine-figure on-chain funds. BlackRock's fund, known as BUIDL (BlackRock Dollar Institutional Digital Liquidity Fund), is the larger of the two, currently standing at $522 million.

BlackRock also launched the IBIT Bitcoin and ETHA Ethereum ETFs, leading the way in the crypto ETF space. While these funds do not allow investors to have the opportunity to custody anything on-chain, they do provide a more traditionally appealing way to access the crypto economy. Although BlackRock's head of digital assets, Robbie Mitchnick, explicitly stated on Bankless that there are no immediate plans to create ETFs for any other crypto assets following IBIT and ETHA, the company has already shown interest in integrating with other parts of the Web3 ecosystem.

Who else is vying for institutional attention?

As the landscape expands, Ethereum's competitors are vying for institutional attention. Solana and Stellar are making significant strides, particularly in the RWA space.

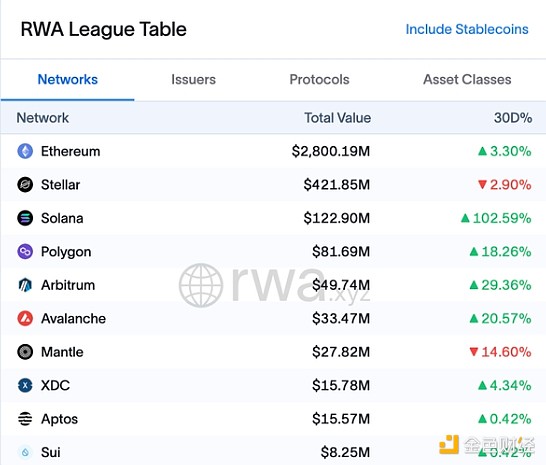

Stellar focuses on partnerships with large financial institutions like IBM, making its RWA value second highest, with tokenized RWA valued at $421 million.

Solana, often praised for its speed and throughput, is also becoming an important player in the race for institutional adoption. Franklin Templeton announced at Solana's Breakpoint conference that they are bringing compatibility for Solana with its $445 million on-chain fund FOBXX. Nevertheless, for now, Solana's RWA value remains relatively low at just $120 million.

EVM-compatible networks like Arbitrum, Polygon, Avalanche, and Mantle are also playing a key role. These networks have a total RWA value exceeding $190 million, providing institutions with a familiar smart contract architecture and the added advantage of Layer 2 scalability. However, Ethereum's mainnet RWA value of $2.9 billion (excluding stablecoins) dwarfs these smaller networks, solidifying its dominance in the space.

However, the success of Ethereum's competitors highlights a key point: institutions are no longer limited to a single network. While Ethereum is foundational, blockchains like Solana and Stellar offer increasingly hard-to-ignore alternatives. However, they also raise new interoperability challenges.

Interoperability is central to the future of institutional blockchain adoption. As Visa noted in the VTAP press release, the biggest benefits of building on-chain include ease of integration, programmability, and interoperability. Institutions venturing into non-EVM chains like Solana or Stellar may face challenges regarding asset liquidity and protocol compatibility. This could lead to reliance on third-party services to bridge assets between chains, introducing complexity and security risks. Ethereum's widespread use means that staying within the EVM ecosystem (whether through Ethereum or Layer 2 solutions) remains the simplest and safest choice for institutions.

Future Outlook

Institutions like BlackRock are well aware of Ethereum's value proposition. As BlackRock's head of digital assets pointed out on Bankless, institutional investors are "students of the market" and "students of technology." They rely on proven technology, and Ethereum's strong track record makes it a reasonable choice for most blockchain projects. BlackRock's partnerships with Coinbase and Circle further underscore Ethereum's entrenched position in institutional finance.

However, for Ethereum to maintain its lead in the competition for institutional adoption, it must continue to balance world-class security and stability with the performance and scalability that competing chains are constantly pushing. The network must not only meet today's demands but also anticipate future needs to win in the race for institutional financial attention. Ethereum is currently in a favorable position, but maintaining that lead requires continuous evolution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。