Author: flowie, ChainCatcher

Editor: Nianqing, ChainCatcher

Last week, after founder Michael Saylor announced that Microstrategy (NASDAQ:MSTR) aims to become the leading "Bitcoin bank," MSTR surged nearly 16% last Friday, breaking through $212 (temporarily falling back to $194), with its market capitalization skyrocketing to $43 billion, setting a new historical high.

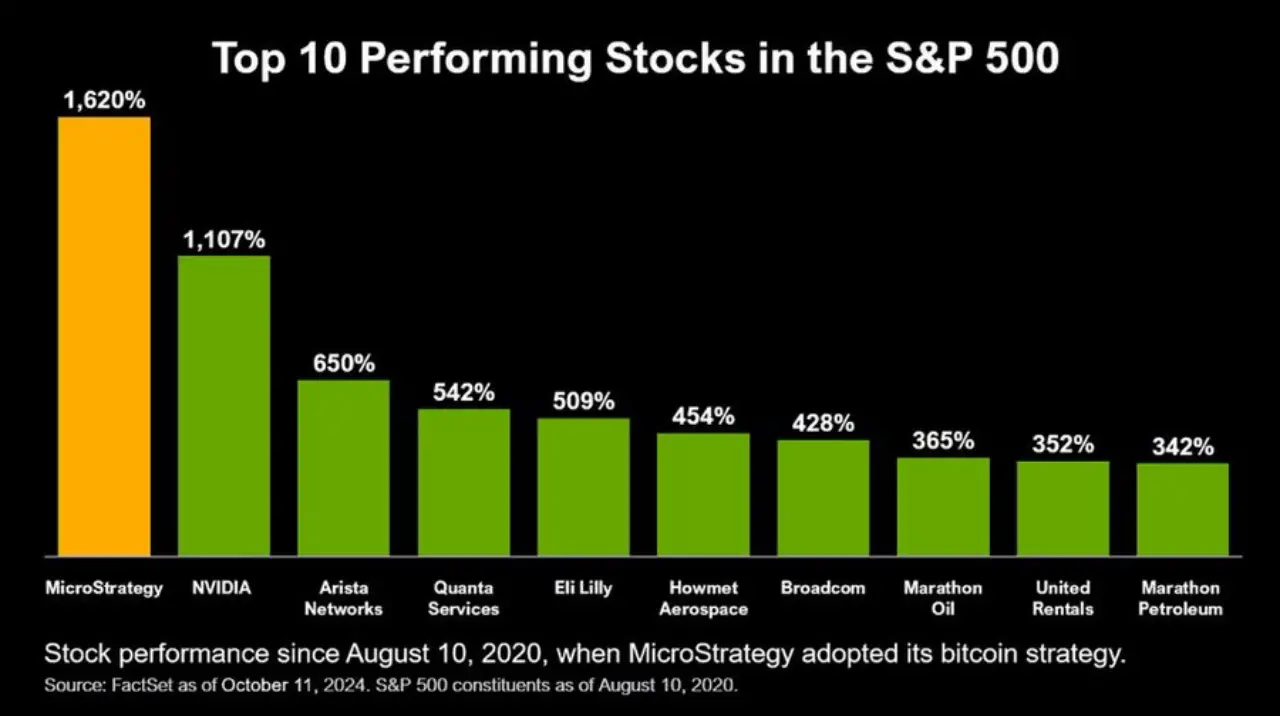

Since Microstrategy launched its Bitcoin investment strategy in August 2020, MSTR has increased by over 1600%, outperforming BTC and major S&P 500 tech stocks like Nvidia.

This year, MSTR's outperformance over BTC has been even more pronounced. According to market data:

- Year-to-date, BTC has risen by 52%, while MSTR has increased by 180%.

- In the past 30 days, BTC has risen by about 7.41%, while MSTR has surged by 44%.

MicroStrategy's "easy profit" model has also attracted more imitators. The Japanese listed company Metaplanet has seen its stock price rise by 480% since it began its Bitcoin investment strategy in April. Recently, the German listed company Samara Asset Group announced it would issue €30 million in bonds, part of which will be used to purchase Bitcoin.

Why can a listed company "win" simply by holding a large amount of BTC? Are there any risks associated with the MicroStrategy model?

Borrowing to Buy Bitcoin: MicroStrategy's "Easy Profit" Model

MicroStrategy's original main business was enterprise-level AI software, contributing about $100 million in revenue each quarter. For a U.S. listed company, this part of the business is quite mediocre.

It wasn't until August 2020, when MicroStrategy began its Bitcoin investment strategy and aggressively bought Bitcoin, that the company's stock price started its explosive rise. MicroStrategy's market capitalization grew from $600 million to over $40 billion.

As a result, many, especially in the crypto community, view MicroStrategy as merely a listed company that continuously increases its Bitcoin holdings. Investing in MicroStrategy is indirectly equivalent to investing in BTC.

However, MicroStrategy co-founder Michael Saylor believes there is a misunderstanding about the company; most people actually do not know what they are doing.

Last week, in a conversation with Bernstein analysts, Michael Saylor revealed the logical thinking behind MicroStrategy's Bitcoin strategy. He clearly defined MicroStrategy's model and positioning, as well as why it can outperform BTC and beat major tech stocks in the S&P 500, including Nvidia.

In simple terms, MicroStrategy's Bitcoin investment strategy is not just about buying and holding Bitcoin, but about borrowing money to buy Bitcoin through bond issuance, creating a leverage effect.

Michael Saylor stated that MicroStrategy is currently borrowing money to buy Bitcoin at almost zero interest (with the last two issuances at 0.625% interest) or issuing stock at a 60% or 100% premium to buy back Bitcoin.

For example, in September this year, MicroStrategy completed a $1.01 billion convertible note issuance with a 0.625% coupon rate and a 40% conversion premium.

The cost of debt is relatively fixed, while the value of Bitcoin assets has increased. MicroStrategy has invested in digital capital with returns many times higher than its capital costs, arbitraging between the legal capital market and the digital capital market. This is why MicroStrategy's performance has surpassed all 500 companies in the S&P index and outperformed Bitcoin.

This arbitrage model has also led to net profit growth, enhancing stock value. According to MicroStrategy's Q2 financial report, the company introduced a new accounting standard, using BTC yield to describe MSTR's investment value. This year, MicroStrategy's BTC yield has reached 17.8%, meaning that an investment of 1 BTC through MicroStrategy has effectively become 1.178 BTC. This is also why MSTR's stock price increase has outperformed Bitcoin.

Michael Saylor stated that MicroStrategy has now developed into a Bitcoin securitization company.

In addition to MicroStrategy's stock providing 1.5 times the volatility exposure of Bitcoin, the company also has various derivatives, such as MSTX and MSTU, which can provide 3 times leverage, as well as MSTR options markets that can offer 10 or 20 times leverage.

In the future, MicroStrategy will also explore the fixed income market and consider issuing preferred stock. To some extent, MicroStrategy is encroaching on the stock market, options market, convertible note market, and fixed income market.

A Rising Perpetual Motion Machine or U.S. Stock "Luna"?

MicroStrategy's model seems quite simple. However, for a listed company, holding BTC and clever mathematical calculations can lead to a faster stock price increase than selling software, data, AI, and other tech products without needing to maintain a large team. This raises questions about potential loopholes and risks, which have become a focal point of debate in the crypto community.

Overseas KOL Glenn Hodl believes MicroStrategy has found a "perpetual motion machine" model for rising stock prices.

Glenn stated that even if Bitcoin prices no longer increase, MicroStrategy can leverage the market's differing valuation models for commodities and companies to create a sustainable "perpetual motion machine" that pushes its market value higher, ultimately making MicroStrategy the largest company by market capitalization in the world. Recommended reading: “How Microstrategy Became a Rising ‘Perpetual Motion Machine’?”

Crypto KOL @CryptoPainter_X also believes that MicroStrategy's current model can indeed be described as an "infinite funding loophole." "If MSTR's market capitalization could increase tenfold, then theoretically, its stock price could be raised infinitely high in sync with BTC's price… If its stock market value is very high, every time it raises funds through stock expansion, it will gain a lot of money, achieving a true perpetual motion machine."

But can MicroStrategy really borrow infinitely to have unlimited ammunition to buy Bitcoin? Is there a risk of liquidation if Bitcoin prices drop?

Michael Saylor stated that MicroStrategy has no restrictions and can borrow infinitely, refinancing $100 billion, $200 billion, or even a trillion dollars is not a problem.

As for whether MicroStrategy has enough cash to pay interest and repay debts to prevent liquidation risks in a cooling capital market, Michael Saylor is also very optimistic.

On one hand, based on confidence in Bitcoin, Michael Saylor believes that the MicroStrategy model will only fail if Bitcoin's yield is permanently 0 and volatility must also be 0.

On the other hand, MicroStrategy's current interest expenses are minimal, and the company can continuously deleverage by establishing permanent Bitcoin capital. Michael Saylor stated, "We are not doing this overnight; we are gradually deleveraging back and forth."

According to MicroStrategy's Q2 financial report, the company holds 226,500 BTC, valued at about $15 billion, while its debt is around $1.45 billion, resulting in a debt ratio of 10%.

Michael Saylor has also mentioned that MSTR's liquidation line is when BTC falls below $700. Currently, the probability of such a situation occurring is low.

Crypto analyst @Phyrex_Ni also believes that the borrowing ratio is relatively low, with not much financial leverage, and that MSTR's BTC does not face liquidation risks. "Even if it falls below $700, MSTR has many ways to repay these loans without liquidating."

However, crypto KOL @lindazhengzheng is skeptical. She believes MicroStrategy is similar to the LUNA model and could fall into a death spiral. "If BTC prices experience a significant drop, the value of the collateral for MSTR decreases. Then MSTR's stock price and bond prices will fall; in extreme cases, when old bonds mature, buyers may no longer purchase new bonds, leading to a lack of new liquidity; and the company may not have enough money to pay off old debts, causing the stock price to drop further."

@CryptoPainter_X also believes that there is no true "spiral ascent" or "stepping on both feet." "If you Google the Enron financial fraud incident, you will find that Ponzi schemes eventually come to an end."

It is worth mentioning that MicroStrategy was also fined $8.5 million by the SEC in 2000 for financial fraud, causing its stock price to plummet by 62%, and Saylor personally lost $6 billion in wealth in a single day.

Moreover, even without liquidation risks, MicroStrategy provides 1.5 times the volatility exposure to Bitcoin. When BTC rises, MSTR increases more than BTC, but when BTC falls, MSTR also declines more. Holding MSTR still carries risks.

Clone "MicroStrategy" Enters in Bulk, What is the Impact?

MicroStrategy's strategy has no barriers to entry. Michael Saylor has also stated that any listed company can replicate this strategy—first buy Bitcoin, then issue stock at a premium to Bitcoin, and finally issue bonds secured by Bitcoin.

Michael Saylor believes that "buying Bitcoin will ultimately become a fundamental strategy for all other companies."

In fact, this year, the skyrocketing stock price of MicroStrategy has indeed caused listed companies to FOMO and imitate. Japanese listed company Metaplanet, U.S. listed medical company Semler Scientific, and German listed company Samara Asset Group, among others, have all adopted the "MicroStrategy" Bitcoin investment model.

Additionally, according to Blockworks, the frequency of corporate Bitcoin purchases has significantly increased this year, reaching 32 times as of September 30, far exceeding last year's total of 9 times; MicroStrategy, Block, Metaplanet, Semler Scientific, OneMedNet, and the British football club Real Bedford FC have collectively purchased nearly 50,000 Bitcoins.

The clone "MicroStrategy" entering the market to buy BTC in bulk should, in the short term, boost the price of BTC. Crypto KOL @lindazhengzheng believes that "if too many listed companies use the MicroStrategy model this time, it will bring the second wave of new highs for BTC earlier and higher, but it will also rise more sharply and fall more severely."

As mentioned earlier, the MicroStrategy model still carries risks, and dangers may also be accelerating on the way. Although the MicroStrategy model seems to have no barriers, the cost of BTC purchases for latecomer listed companies is much higher than that of MicroStrategy, and they may also lack the risk management capabilities for this model.

@lindazhengzheng analyzed that the terrifying scenario is a chain reaction of listed companies collapsing, making it difficult for Bitcoin prices to sustain, leading to a Lehman moment of a bull-to-bear transition.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。