According to reports, cryptocurrency venture capital firms invested $2.4 billion in the third quarter of 2024, a decrease of 20% compared to the third quarter.

Current State of Cryptocurrency Venture Capital

According to a new report from cryptocurrency investment firm Galaxy Digital, venture capital for cryptocurrency startups amounted to $2.4 billion (a quarter-over-quarter decrease of 20%), involving 478 transactions (a quarter-over-quarter decrease of 17%).

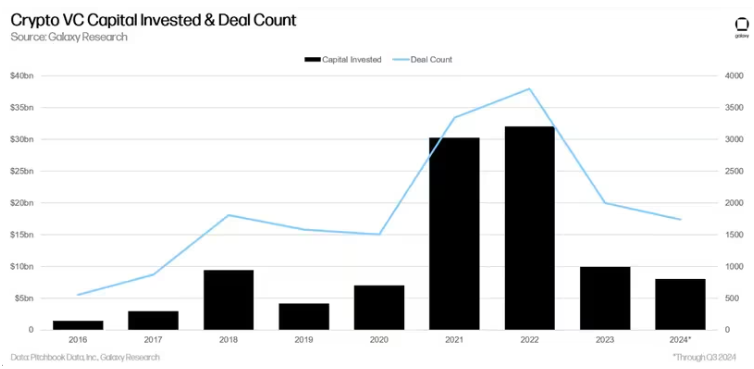

In the first three quarters, the industry's investment reached $8 billion, and financing in 2024 is expected to be only slightly higher than in 2023. These figures are a stark contrast to the trading conditions in the cryptocurrency industry in 2021 and 2022, when over $30 billion was transacted annually across 3,000 deals.

So what is the reason for the lack of interest in cryptocurrency venture capital? Thorn stated that high interest rates have reduced the attractiveness of venture funds, while spot Bitcoin (BTC) and Ether (ETH) exchange-traded funds (ETFs) provide new avenues for gaining exposure to cryptocurrencies.

Capital Allocation

Most of the funds flowed into early-stage companies—those still developing their products and business models. They received 85% of the capital investment, while later-stage companies, which typically already have well-known products and brands, only received 15% of the capital.

Image source: Internet

Although the valuations of cryptocurrency companies plummeted in 2023, they rebounded in the second quarter of 2024, with a median pre-investment valuation of $23 million and an average deal size of $3.5 million. While this data conveys market confidence in the industry's recovery, that confidence is not evenly distributed across the entire cryptocurrency ecosystem.

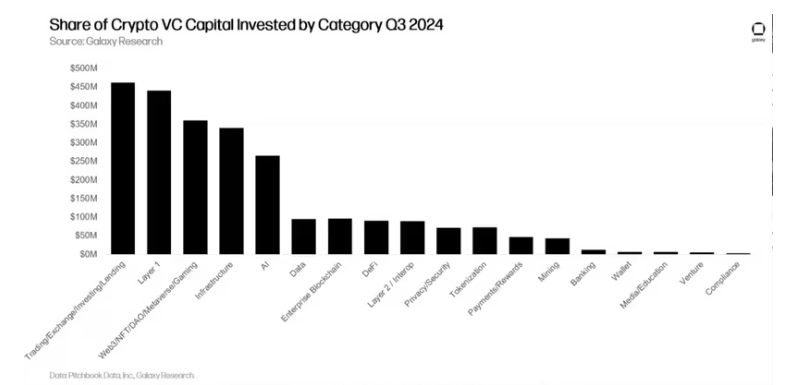

Certain sectors, such as cryptocurrency exchanges, lending, investment, and trading platforms, collectively raised 18% of venture capital, totaling over $460 million. These sectors have become the focus of capital pursuit due to their direct ties to market trading.

Image source: Internet

Additionally, reports indicate that raising funds for cryptocurrency venture capital is challenging, with eight new funds raising only $140 million. "On an annualized basis, 2024 is set to be the worst year for cryptocurrency venture capital fundraising since 2020, with only 39 new funds raising $1.95 billion, far below the boom periods of 2021-2022."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。