Recently, U.S. federal prosecutors have filed market manipulation and fraud charges against four cryptocurrency market makers and their employees, with one of the accused, Gotbit, becoming a focal point of public opinion due to its close ties with multiple projects such as Bonk and Neiro. On October 16, Gotbit officially confirmed on social media that its CEO, Alexey Andryunin, has been arrested in Portugal, further entangling the company in legal troubles.

The Rise and Operating Methods of Gotbit

Gotbit is a cryptocurrency market maker established in 2017, at which time its founder, Alexey Andryunin, was a newly enrolled university student. Gotbit's business is primarily divided into two major segments: market making and venture capital, managing $1.3 billion in assets and having over 400 institutional clients.

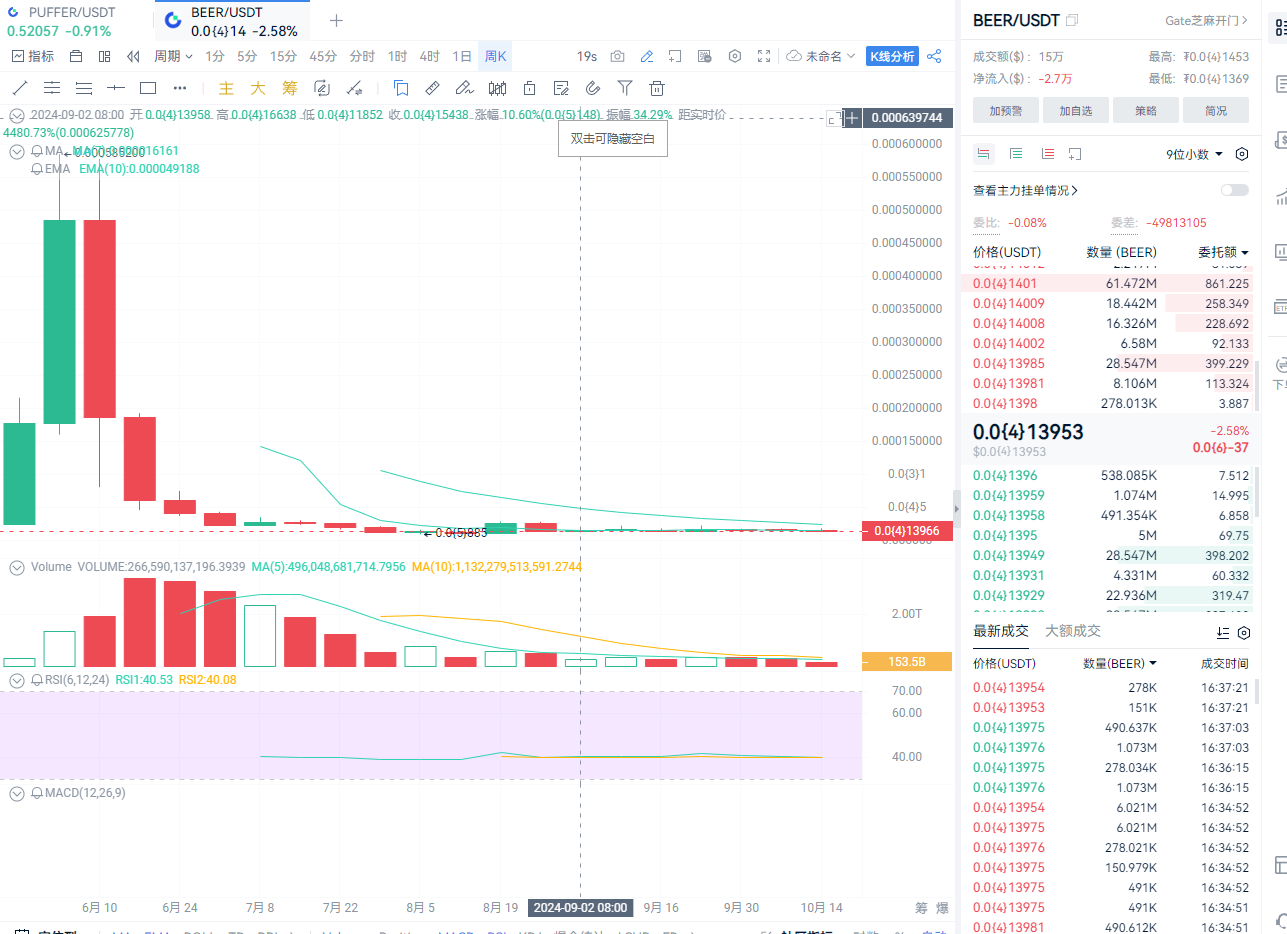

On-chain detective ZachXBT revealed that Gotbit would inflate token prices up to 10 times within the first few minutes of the price discovery phase to create FOMO (Fear Of Missing Out) and attract as much buying power as possible, subsequently selling large amounts of tokens during the ensuing price surge. This tactic was not only applied in the BONK project but also used in several other projects, such as NEIRO and BEER.

According to data from Gotbit's official X platform, this year it has provided market-making services for about 50 projects, including Neiro and Hamster Kombat, most of which are meme projects.

Data Source: Internet

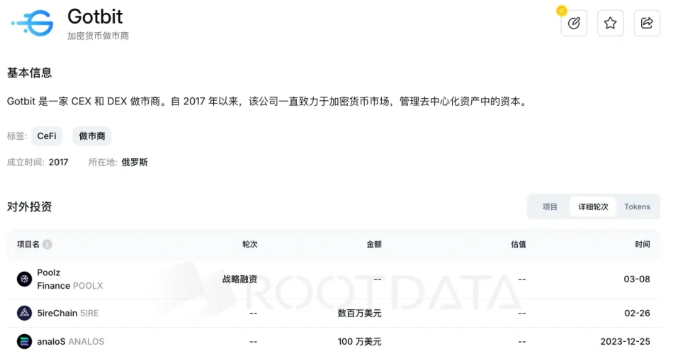

Gotbit's impact on the market is not limited to its market-making services; it has also invested in decentralized cross-chain IDO platform Poolz Finance and the meme project analoS on Solana. The Layer 1 blockchain 5ireChain also received a million-dollar investment from Gotbit Hedge Fund. These investments further expanded Gotbit's influence in the cryptocurrency market.

Exposed for Falsifying Trading Activities, Heading into Legal Turmoil

As early as 2019, Gotbit was exposed by CoinDesk for writing programs that allowed bots to trade tokens back and forth, creating a false appearance of an active market to help clients list on unknown exchanges and achieve listings on CoinMarketCap. This manipulation helped clients list on at least two unknown exchanges.

Gotbit did not slow down due to market regulation; instead, it intensified its activities. At the end of 2022, the first meme coin on the Solana chain, Bonk, was launched, with Gotbit emerging as the market maker behind it. The surge in Bonk's market capitalization brought Gotbit back into the spotlight, and by the end of 2023, the ANALOS market-made by Gotbit created a wealth myth of 3,700 times within a week.

On October 9 of this year, U.S. federal prosecutors filed market manipulation and fraud charges against Gotbit and three other market makers. Gotbit's CEO, Aleksei Andriunin, was arrested in Portugal, and two employees from Russia were also indicted. Investigation documents provided by the FBI indicate that Gotbit induced purchases by exaggerating trading volumes and manipulating trading prices to inflate cryptocurrency prices and sell at a profit.

Gotbit is not the only company facing charges. Following Gotbit, the SEC charged a well-established market maker, Cumberland, founded in 2014, claiming it operated as an unregistered securities dealer. This series of legal actions indicates that cryptocurrency market makers may become a focus of U.S. regulatory scrutiny.

Risks and Opportunities of Meme Projects

As the Gotbit incident unfolds, the risks associated with meme projects in the cryptocurrency market have also been amplified. Beer-themed MEME tokens like BEER and WATER experienced significant market fluctuations with Gotbit's involvement. The BEER token surged 30 times shortly after its launch but then plummeted 90%, with its market cap falling back to $50 million. Meanwhile, the WATER token briefly surged 10 times after its launch, surpassing a market cap of $1 billion, but then significantly dropped within hours.

Image Source: AICoin

Despite this, there are still voices in the market suggesting that regulatory intervention could be a positive signal. CryptoQuant founder KiYoung Ju stated that regulation would help eliminate the gambling stigma associated with cryptocurrencies. Crypto KOL @WazzCrypt believes this is a bearish signal for memes, as Gotbit's actions have made promoting meme coins more difficult.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。