The rapid growth of Ethena and its flagship product, the USDe stablecoin, is one of the most notable events in the DeFi space recently. Influenced by its collaboration with BlackRock and various other factors, the TVL of USDe has surpassed $3 billion in just a few months, a growth rate that is rare in the history of stablecoins. Ethena initially focused on creating a secure and reliable high-quality stablecoin, maintaining stable operations even after experiencing severe market fluctuations. Now, Ethena's goal seems to be aimed directly at the heavyweight of the crypto market—Tether. Tether's market share of over $160 billion is also facing challenges.

In this article, the author will analyze Ethena's business model, the yield mechanism of USDe, and compare the advantages and disadvantages of Ethena and Tether, followed by a discussion on the future development trends of the stablecoin market and the positions of stablecoins like Ethena and Tether in the future competitive landscape.

Potential Challenger to Tether's Dominance

It all starts with Ethena's strategy. Ethena, originally a purely DeFi-native stablecoin project, aims to transform into a comprehensive stablecoin competitor with a higher value proposition and improved distribution channels. This includes the recent announcement of the launch of USTb, collaborations with traditional financial giants like BlackRock, and the global trend of declining interest rates, all of which provide a favorable external environment for Ethena. It seems that Ethena has the opportunity to establish USDe as the dominant stablecoin in the cryptocurrency space. However, the challenges remain significant—can Ethena succeed? The outcome depends on many factors.

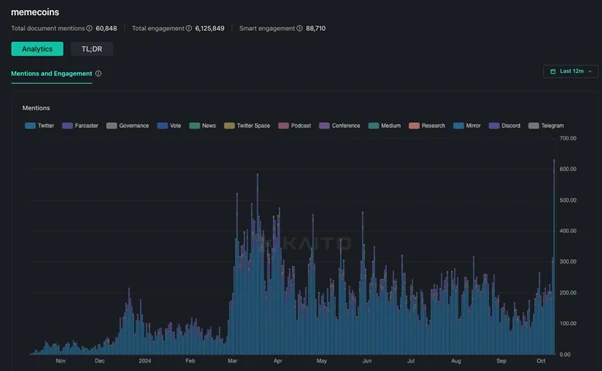

From the current market environment, meme coins are prevalent, and speculative behavior has become dominant… Investors are keen on chasing short-term gains, disregarding the long-term value and fundamentals of projects. This phenomenon has been referred to by some as "financial nihilism," which is the pure pursuit of narrative while being indifferent or even contemptuous of fundamentals. Although this strategy has brought considerable, even massive returns to some investors during the recent bear market phase, its sustainability is questionable.

However, the basic laws of the market still exist: successful speculative behavior is often based on certain realities. The prosperity of meme coins is mainly due to the behavior dominated by retail investors in the market. This type of user often overlooks that, in the long run, the parabolic growth exhibited by the best-performing high-liquidity assets is often built on solid fundamentals. Only when the fundamentals are supported can a consensus be formed among all participants (including retail investors, hedge funds, proprietary trading, and long-only funds).

The rapid growth of $SOL at the beginning of 2023 is a good example. At that time, its growth was based on continuous developer participation and ecological prosperity. Similar examples include Axie Infinity and Terra Luna, both of which experienced brief surges but ultimately exposed inherent issues.

Despite "financial nihilism" being the mainstream trend in the current market, projects with strong product-market fit still have the potential to change market consensus.

Ethena may be a potential contender.

Investment Prospects of High-Yield Stablecoin USDe and $ENA Token

After analyzing market trends, let's look at where Ethena's potential lies. Currently, it is evident that the project has two main trump cards: value proposition and distribution channels.

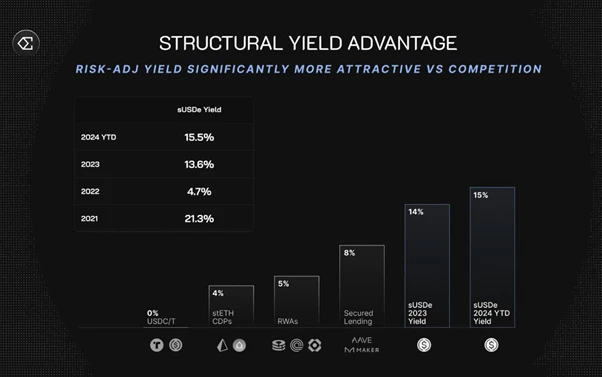

The value proposition of USDe has already been very clear. Users can deposit $1 to obtain a delta-neutral position allocated between collateralized ETH and ETH short positions, while also earning yields. In a normal interest rate environment, the sustainable yield provided by sUSDe (annualized yield of 10-13%) ranks among the best in all stablecoins. This strong value proposition has propelled Ethena to become one of the fastest-growing stablecoins in history, reaching a peak TVL of $3.7 billion within 7 months and stabilizing around $2.5 billion after interest rates declined. USDe's yields are significantly higher than those of other DeFi products. However, Tether still dominates, primarily due to its greater access to channels and extremely high liquidity.

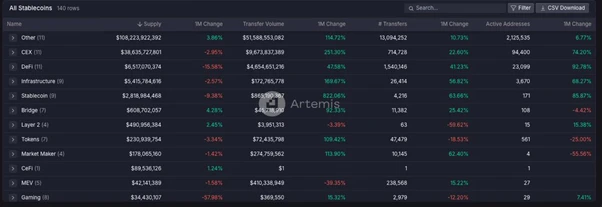

Now, let's discuss the channel issue. Distribution channels are crucial for the success of any new stablecoin. The reason USDT can dominate the market is that it serves as a benchmark currency in almost all centralized exchanges. This is a significant competitive advantage that new stablecoins need years to achieve. However, Ethena has successfully pushed USDe to the market through collaborations with major centralized exchanges like Bybit and has integrated automatic yield features within the platform, lowering the user entry barrier. Currently, this is something that other decentralized stablecoins find difficult to replicate.

Centralized exchanges currently hold about $38.6 billion in stablecoins, which is 15 times the current supply of USDe. Let's calculate: if 20% of these stablecoins shift to USDe, the available market for USDe would grow nearly fourfold. If all major CEXs adopt USDe as a margin asset, the impact would be significant.

Ethena faces two main catalysts: one is the structural decline in interest rates, and the other is the launch of USTb.

Since Ethena's establishment, the yield premium of sUSDe has consistently been 5-8% higher than the Federal Reserve's federal funds rate. This structural advantage has attracted billions of dollars in capital inflow. However, the Federal Reserve's interest rate cuts may impact USDe's yield. Although the rate cuts themselves are unrelated to Ethena's sources of income, they may have an indirect effect on funding rates.

The supply of USDe is very sensitive to the yield spread relative to government bonds. Historical data shows that when the yield premium is high, the demand for USDe also increases correspondingly, and vice versa. Therefore, a return of the yield premium in the future may once again drive the growth of USDe.

The launch of USTb is considered a game-changing factor. USTb is a stablecoin fully backed by BlackRock and Securitize's tokenized fund BUIDL. It can integrate with USDe to provide treasury yields to sUSDe holders. This, to some extent, alleviates market concerns about the stability of Ethena's yields.

Finally, let's analyze the economic model of the $ENA token. The $ENA token faces a common issue among many VC tokens: the unlocking of tokens for early investors and the team can lead to increased market selling pressure. Since its peak, the price of $ENA has dropped by about 80%. However, the inflation rate of $ENA will significantly decrease in the next six months, which may alleviate selling pressure. Currently, the price of $ENA has bottomed out and rebounded.

Future Competitive Landscape of Stablecoins

Ethena now positions its long-term goal as expanding the scale of USDe to hundreds of billions or even trillions of dollars. Given the growing demand for stablecoins in international cross-border payments, a trillion-dollar market cap is not entirely impossible. If Ethena can achieve this goal, the value of the $ENA token will also increase significantly.

However, the author believes this is still a journey full of challenges and uncertainties. Whether Ethena can compete with Tether in the stablecoin arena remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。