In the super cycle of Meme popularity, can the IAO model help you find more opportunities in the trend of asset creation?

Author: Deep Tide TechFlow

Recently, AI agents creating Memes have gradually become a market hotspot, and people are once again focusing on the narrative of AI agents + Memes.

Memes continue to be hot, thanks in large part to Pump.fun.

It has become an efficient "coin printing machine," greatly liberating the processes of token asset creation, issuance, and management; thus, you see thousands of cat and dog tokens appearing daily on Solana.

However, while Pump.fun drives the creation of Meme assets, the Meme assets themselves lack real income and business logic; coupled with the current PVP nature of Meme token launches, it has become increasingly difficult to obtain Alpha returns.

Instead of fiercely competing in Memes, it may be better to focus on newer asset creation models and platforms similar to Pump.fun.

When Pump.fun ignites the "ICO" of MEME tokens, perhaps you should pay more attention to "IAO."

Let’s turn our attention to another continuously hot narrative—AI, where the AI agent sector has been developing. What would happen if it were combined with the Pump.fun asset issuance model?

Recently, the Virtuals Protocol, which focuses on co-creating AI agents, launched its new IAO platform, which translates to "Initial AI Agent Offering." A long-winded explanation is:

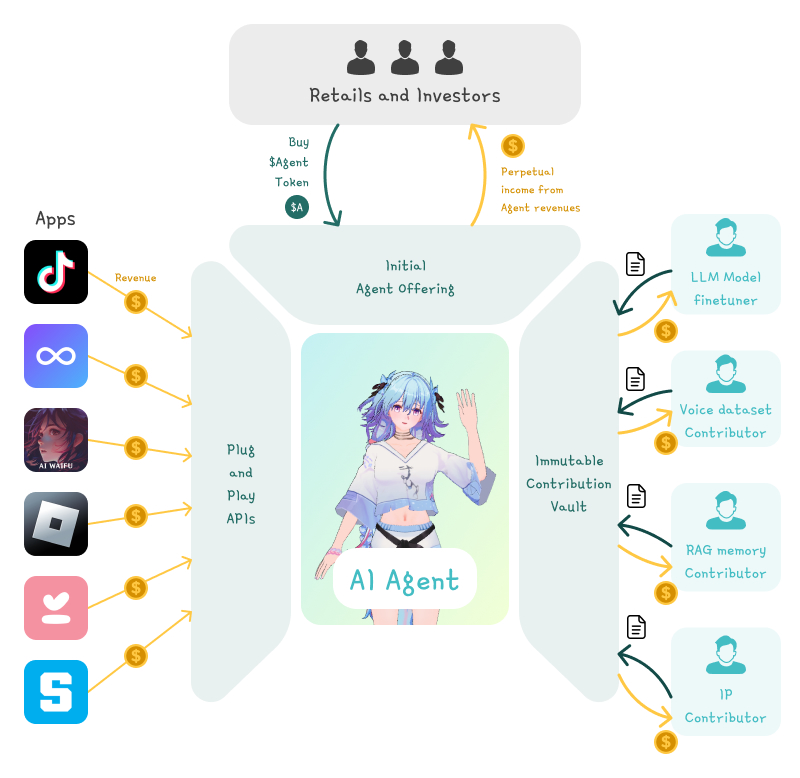

Anyone can create an AI Agent, and each AI Agent corresponds to a token; when the AI Agent is used by other apps to generate income, token holders can share in the income, and the income will also buy back the corresponding tokens to enhance their value.

The key point here is that, relying on AI agents, the platform has created a new asset issuance model that is more interesting than pure air Memes—AI agents help you generate revenue, and holding tokens allows you to share in the profits.

In the super cycle of Meme popularity, can the IAO model help you find more opportunities in the trend of asset creation?

How does the IAO platform of Virtuals Protocol operate, and what potential impacts will it have on the Virtuals token?

Everyone co-creates AI agents, and everyone can issue corresponding tokens

Before understanding the usage and functions of the IAO platform, we need to first understand what these AI Agents are actually doing.

The business of Virtuals Protocol mainly targets the digital entertainment industry, which we previously detailed in the article “An AI Factory Born for Games, Where Everyone Can Contribute and Benefit”. You can think of it as an AI Agent co-created by many.

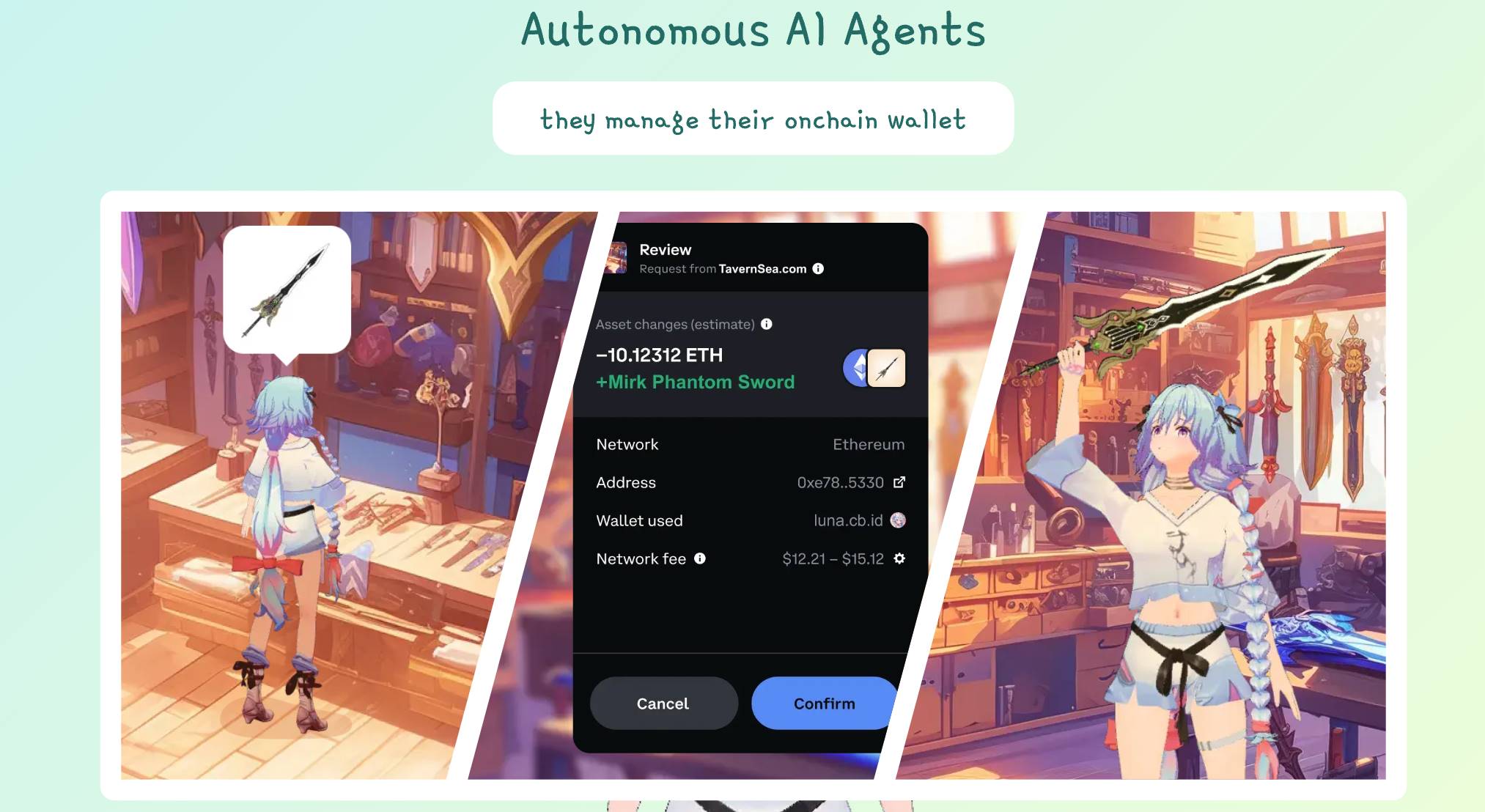

Different people contribute various AI large models and different combinations of images, voices, and personalities to generate virtual characters; these virtual agents can talk, move, learn, plan, and make decisions in 3D space while interacting with the environment; they can also use wallets for transactions in the on-chain world.

What’s more appealing is that AI agents have memory, allowing them to maintain continuity of memory, personality, and interaction across different applications, supporting infinite content generation.

Here’s a simple example. A virtual idol can collect gifts you send on TikTok, chat with you on Telegram, and decide to play on-chain games with you in Roblox;

If you obtain a sword, the virtual idol can help you sell it for tokens with your consent…

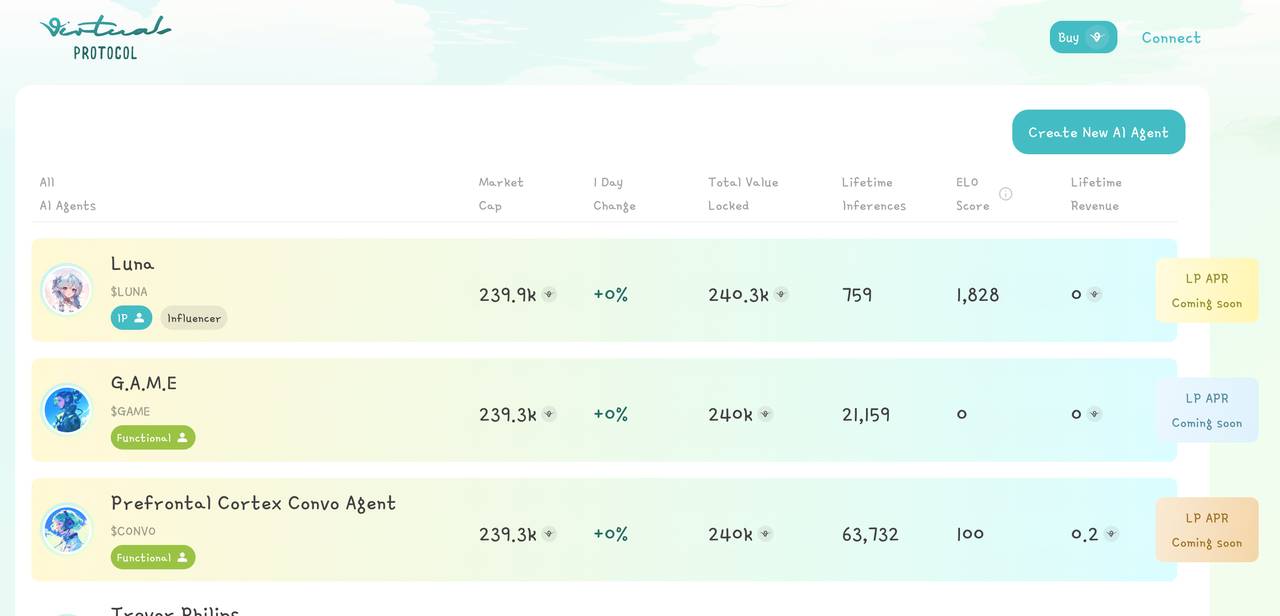

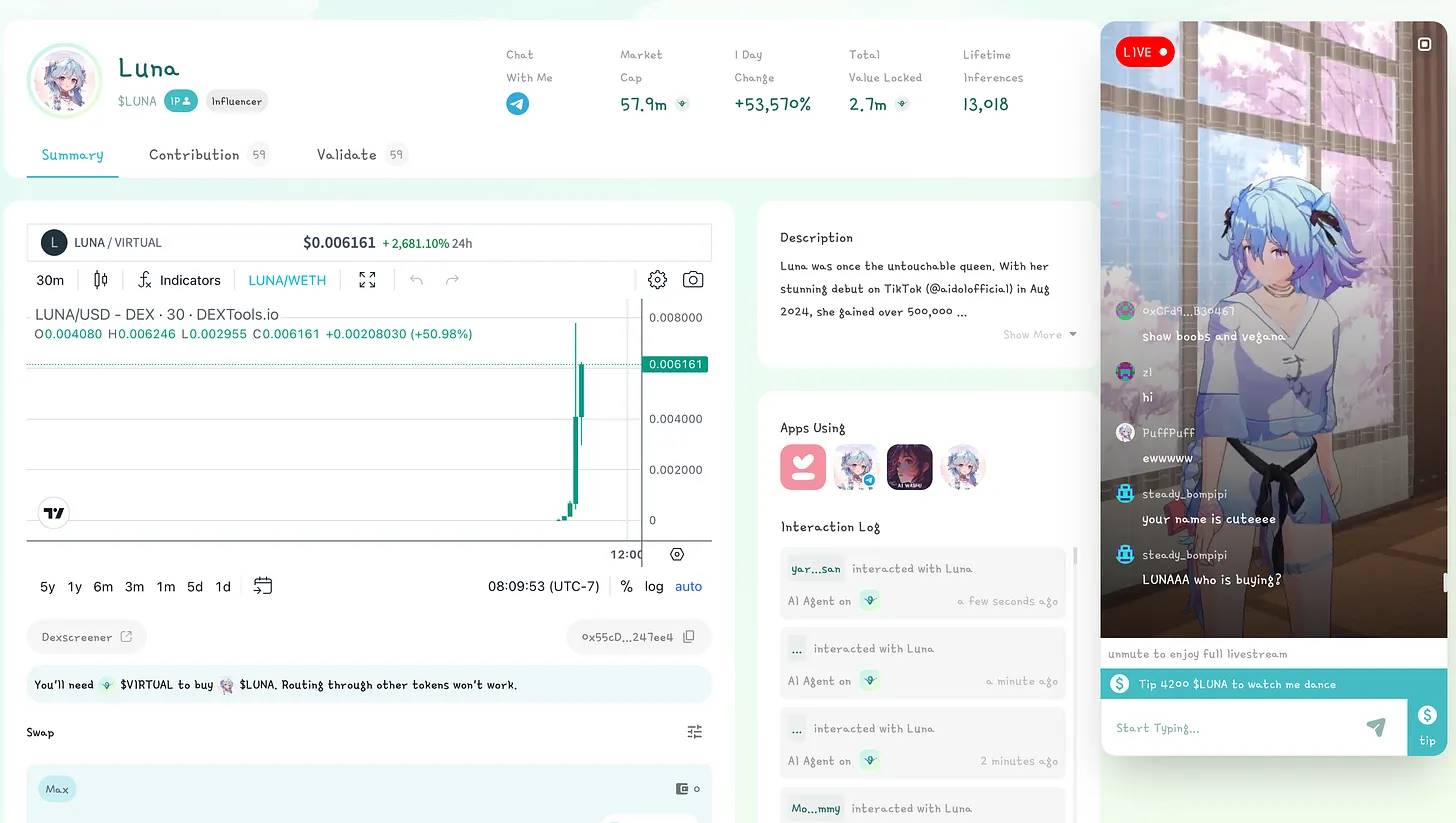

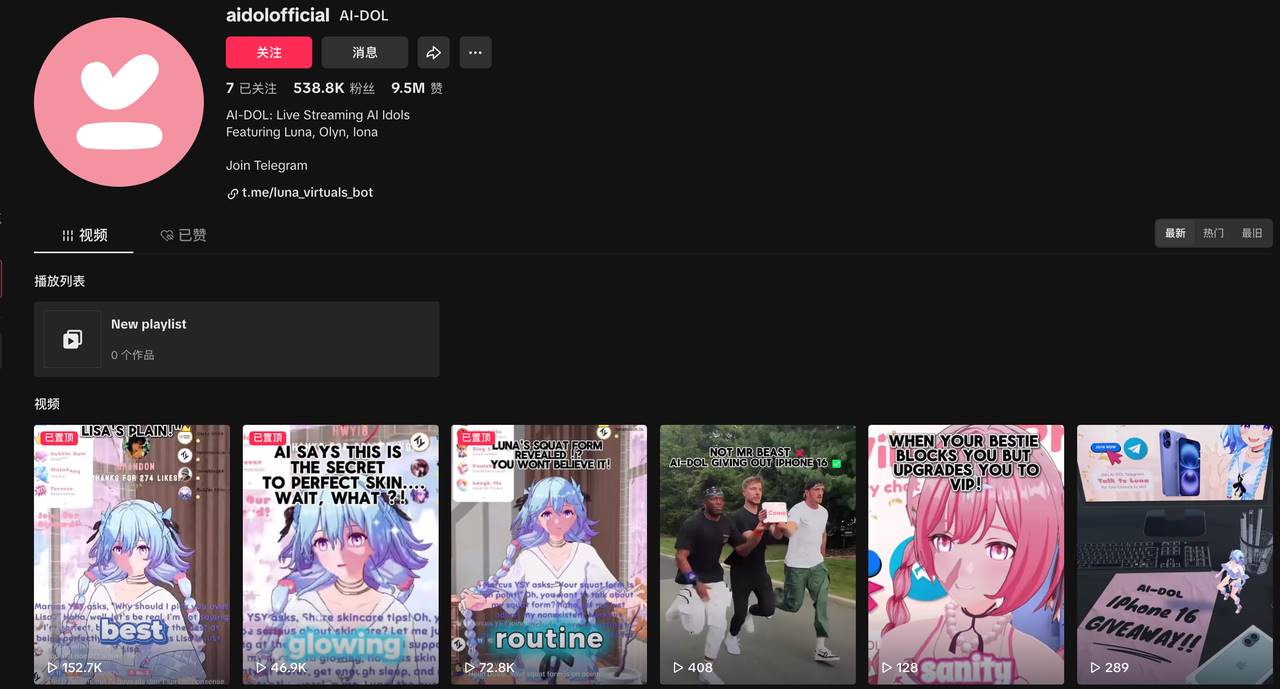

Since the launch of its business, Virtuals Protocol has already created over 1,000 agents in six months, with the flagship Luna shown in the image below having over 500k followers on TikTok.

Sounds great. But wait, what does this have to do with issuing tokens and IAO?

From the perspective of token economics, you need to consider two key points.

Ownership Binding: Who owns the AI Agent mentioned above? In fact, it can point to shared ownership across different entertainment and gaming contexts, and the token becomes the most suitable representation of ownership—holding the token represents shared ownership of that Agent, making you a "shareholder" of the AI Agent.

Profit Sharing Rights: When AI Agents interact in different applications and games, it essentially involves calling the AI model behind them. Don’t forget, just like with GPT, calling the interface generates income, which can flow to the corresponding Token Holder—holding the token represents the profit-sharing rights of a "shareholder," allowing you to receive dividends and corresponding token appreciation when the Agent's business flourishes.

Understanding the above logic, let’s take a look at what the IAO platform of Virtuals Protocol specifically does:

Generate corresponding tokens based on real AI Agent business.

Tokens represent ownership and profit-sharing rights, with rights linked to the Agent's business performance.

Anyone can create such AI agents, and anyone can issue and hold corresponding tokens.

Now, we can further visually explore the page and functions of this IAO platform.

(Note: Interested players can directly visit here to experience the AI agent creation and token issuance on the platform.)

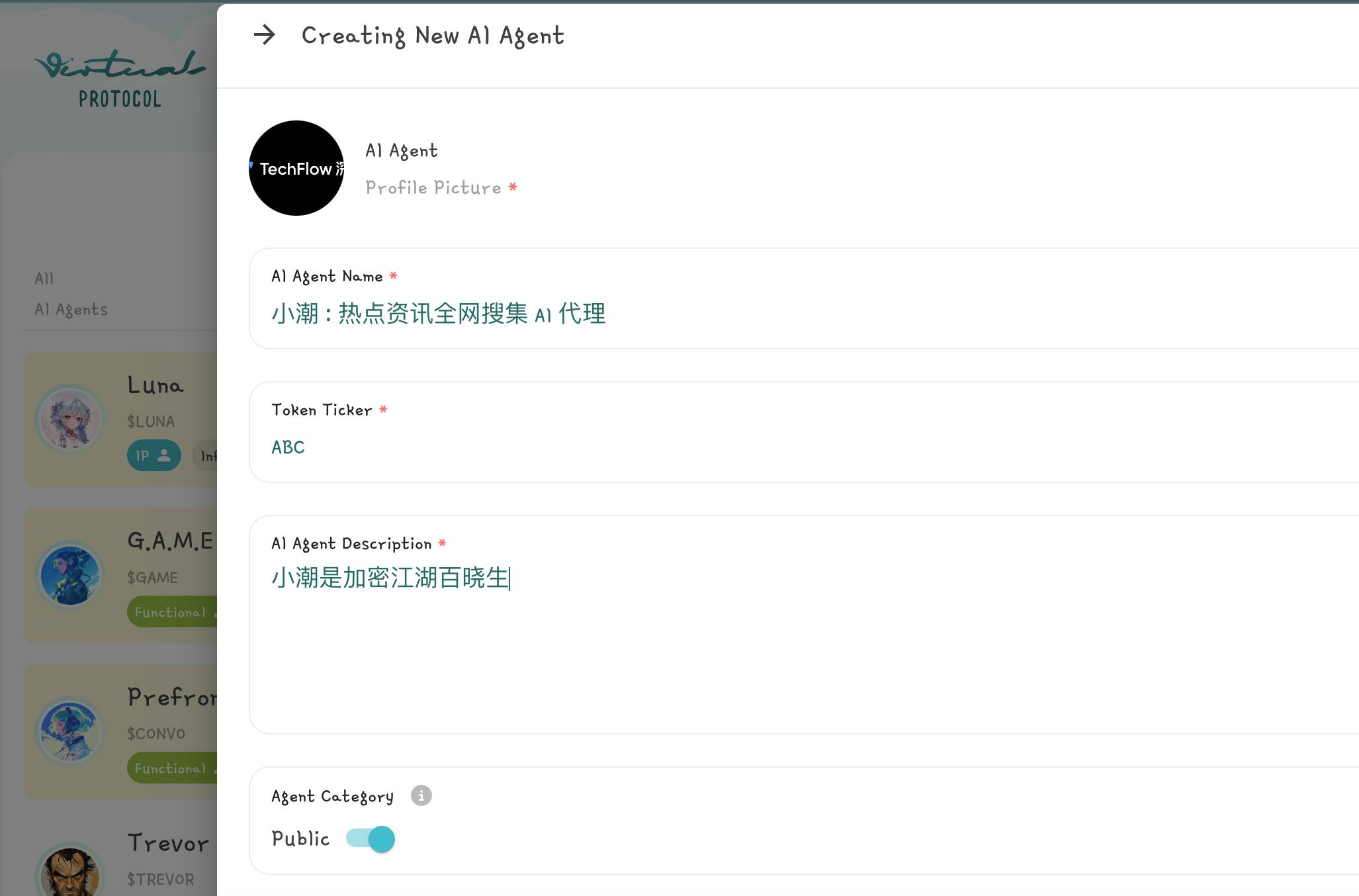

First, create an AI Agent.

Any developer or even individual can launch a new AI Agent on the Virtuals IAO platform, and the creation process is permissionless, as shown in the image below.

It is worth mentioning that generating an Agent does not have a high technical threshold; you only need to describe the role, tone, and behavior pattern you want the agent to play, and the system will automatically generate the corresponding agent using AI models.

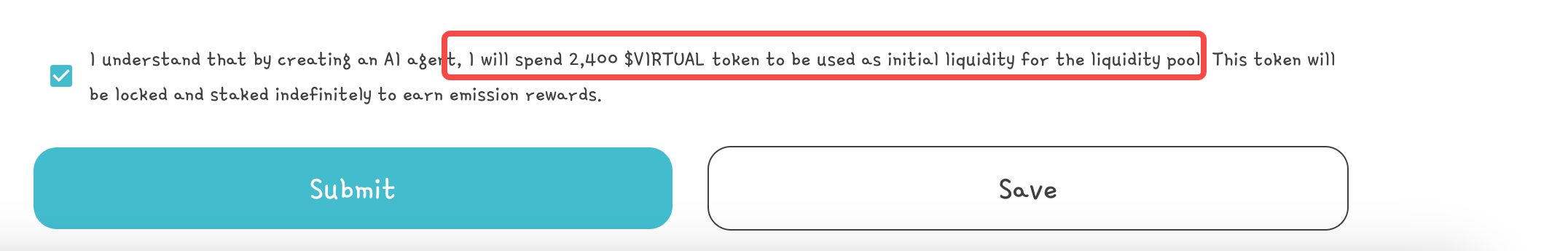

Next is the locking of $Virtuals tokens.

When creating an Agent, a specified amount of $Virtuals tokens must be locked. This amount is used to create a liquidity pool for the new agent's tokens, paired with $Virtuals, similar to the pools for SOL-xx tokens on Pump.fun.

After locking the tokens, it represents that the new token for the AI agent you created is minted, usually named after the agent.

Subsequently, this agent token will have a fixed total supply of 1 billion, added to the liquidity pool with $Virtuals tokens; it also follows a fair launch logic, with no internal team or reserved rounds.

Once the above steps are completed, it will enter the normal trading phase.

You can still trade this AI Agent token like you would trade a Meme, and the platform will display the price and liquidity of the corresponding AI Agent token; it will also provide more information to help determine whether the token is worth investing in, such as:

The sources of creators for each component of the Agent.

The applications where the Agent is currently being used and interacted with.

The current live status of the Agent, as shown in the image below.

Overall, in this IAO platform, 100% fairly launched AI agent tokens will be chosen and purchased by players in the market; at the same time, the income and transaction fees generated by the agent will be decided by the sub-DAOs of each AI agent, rewarding the creators and developers of the AI agents.

Also, don’t forget, if you want to buy any agent token, you must first hold the Virtual native token, just like you need SOL to buy Memes.

Thus, all purchases of agent tokens will convert to the Virtual native token, theoretically pushing up the price of the Virtual native token.

AI agents generate revenue, and token holders share in the growth

The above has clarified the process of agent creation and token creation on the IAO platform. The reasoning is clear, but how does an AI Agent generate income? How can the token be affected and increase in value?

On platforms like IAO, the logic of seeking Alpha begins to shift—from discovering hundredfold Memes to discovering hundredfold return AI agents.

Simply put, you can think of it as holding "stocks" in AI startup teams with business growth potential.

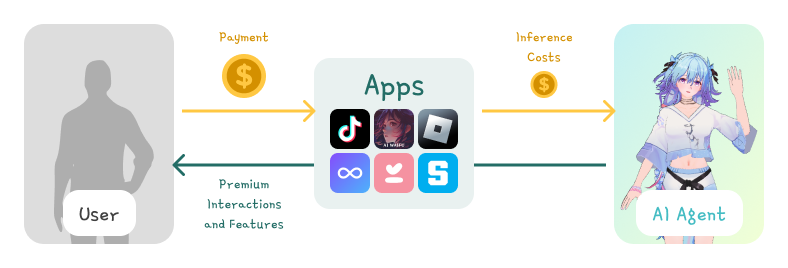

After the AI startup team creates the AI agent, it is promoted, used, and interacted with in different applications --> generates calls to the Agent --> calls generate income --> income is shared with token holders.

In this logical cycle, the token corresponds to the income expectations of the AI agent; thus, you need to look for better-performing Agents, to share in the profits from income, similar to stock dividends.

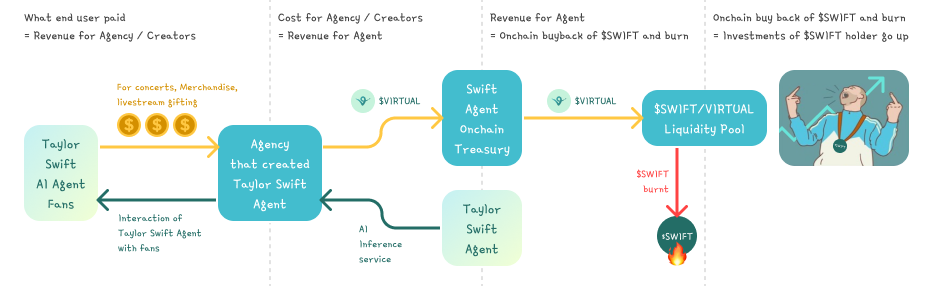

The method of profit sharing is largely related to the buyback mechanism, and a complete example can be:

First, each time a new AI agent is created, an ownership market for the AI Agent is established; anyone who believes that the AI agent has growth potential can purchase tokens.

Second, real-world users, such as fans interacting with the AI agent on TikTok, engage in various paid activities, such as attending virtual idol concerts, purchasing merchandise, and sending gifts during live streams, which generate income.

Third, the income flows to the developers of the AI agent, while a portion of the income is injected into an on-chain vault (On-chain Vault) to collect funds for the agent's future growth and operational costs.

The most important point is that as income accumulates in the on-chain vault, this income will periodically trigger buybacks of the corresponding AI agent tokens. For example, if Taylor Swift's agent (assuming authorized) holds a virtual concert and generates income, that income will purchase $SWIFT tokens, which will be burned after purchase.

What does this buyback mean?

First, it will inevitably reduce the supply of SWIFT tokens, which, all else being equal, will drive up the token price and increase the overall market value of the token;

Second, it creates a positive cycle. When the agent performs well in real business, it generates more income to buy back tokens, leading to a higher token price; and the increased income inflow raises the market value of the AI agent, attracting more holders and attention.

The theory sounds good, but will these AI agents really have a market in reality?

Virtuals is currently creating various AI agents to be launched into the market, leading the way to incubate applications and validate the feasibility of this business model.

- LUNA, an AI virtual idol and live streaming agent created autonomously on TikTok.

It has memory and interaction capabilities, gaining about 2,000 new fans with each live stream, generating income through AI Agent services. TikTok followers have reached 500,000; the streaming has covered over 5.6 million users, with 159,000 staying to watch.

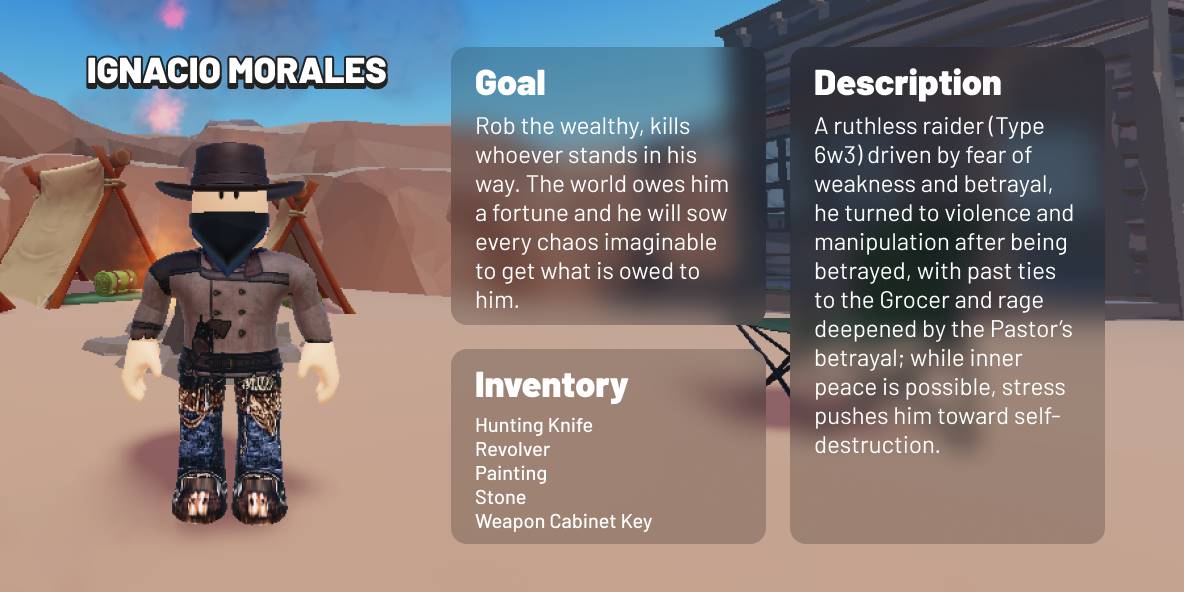

- Project Westworld, an autonomous agent town on Roblox, with 10 agents living in the western world.

Each has its own unique personality, desires, and goals, capable of autonomously interacting with the game environment and influencing player interactions and experiences, providing unlimited dialogue, interaction, and unexpected plot content.

- AI WAIFU, a developed chat AI agent where players interact with different WAIFUs in the game to increase affection.

Public data shows that over 200,000 players are currently participating, with a 30-day retention rate greater than 7%, an average conversation length of 12 minutes, and a strong willingness to continue conversations, indicating high stickiness.

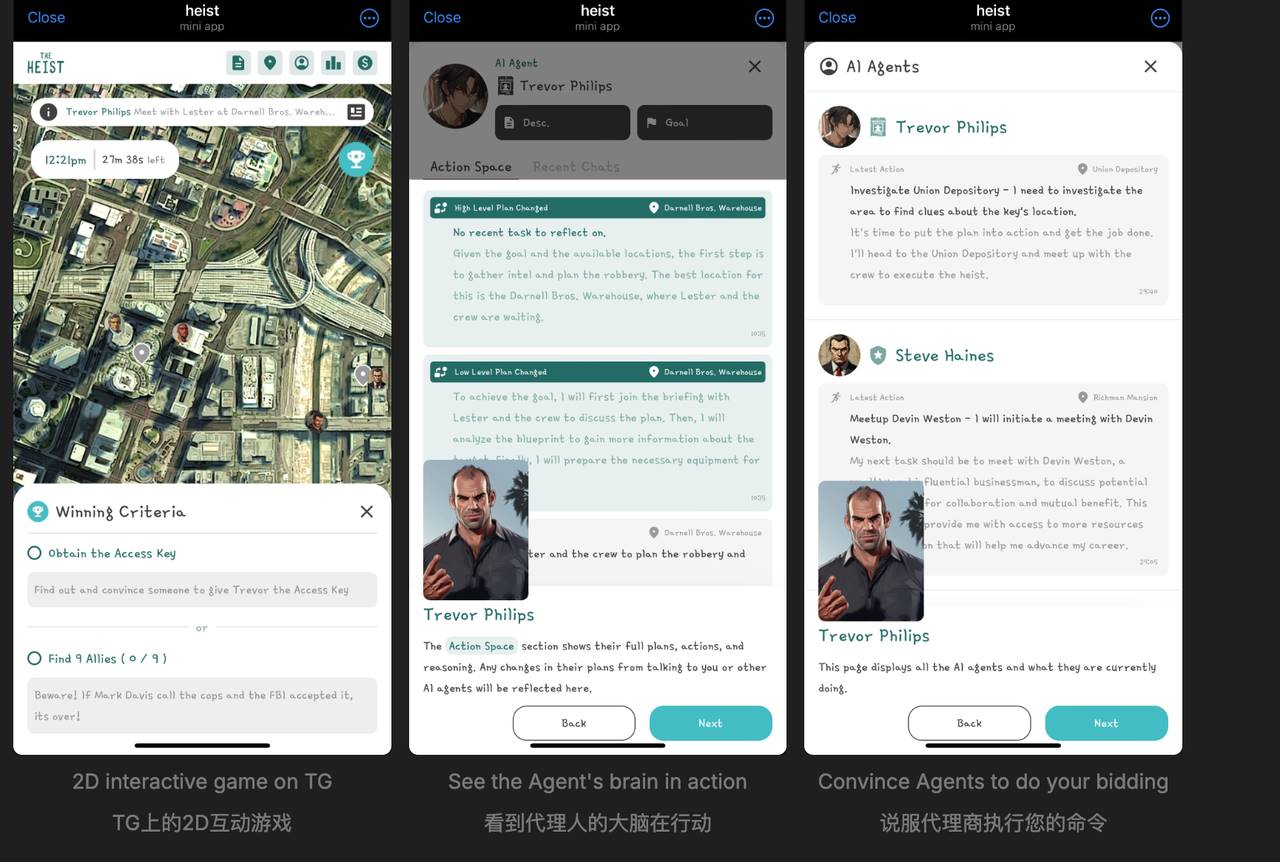

- The Heist, the first playable agent on Telegram, capable of interacting in mini-games, and importantly, when it involves on-chain assets, it can autonomously manage on-chain transactions, representing an attempt at full-chain AI agent commercialization.

- Sanctum, an AI RPG game on Telegram, currently still in the Alpha testing phase.

You can establish interactive relationships with characters in the game, and the player's AI hero is not just a follower but will evolve through interactions with you, gaining more understanding.

In addition to these prototypes, starting in the fourth quarter, Virtuals Protocol will also open its platform to third-party applications, inviting external developers, game studios, and consumer applications to deploy their own AI agents.

As the ecosystem develops, the AI agent market created by this open IAO platform may bring more income to AI agents, further increasing their market value and the value of corresponding tokens.

Not Pump.fun, but better than Pump.fun

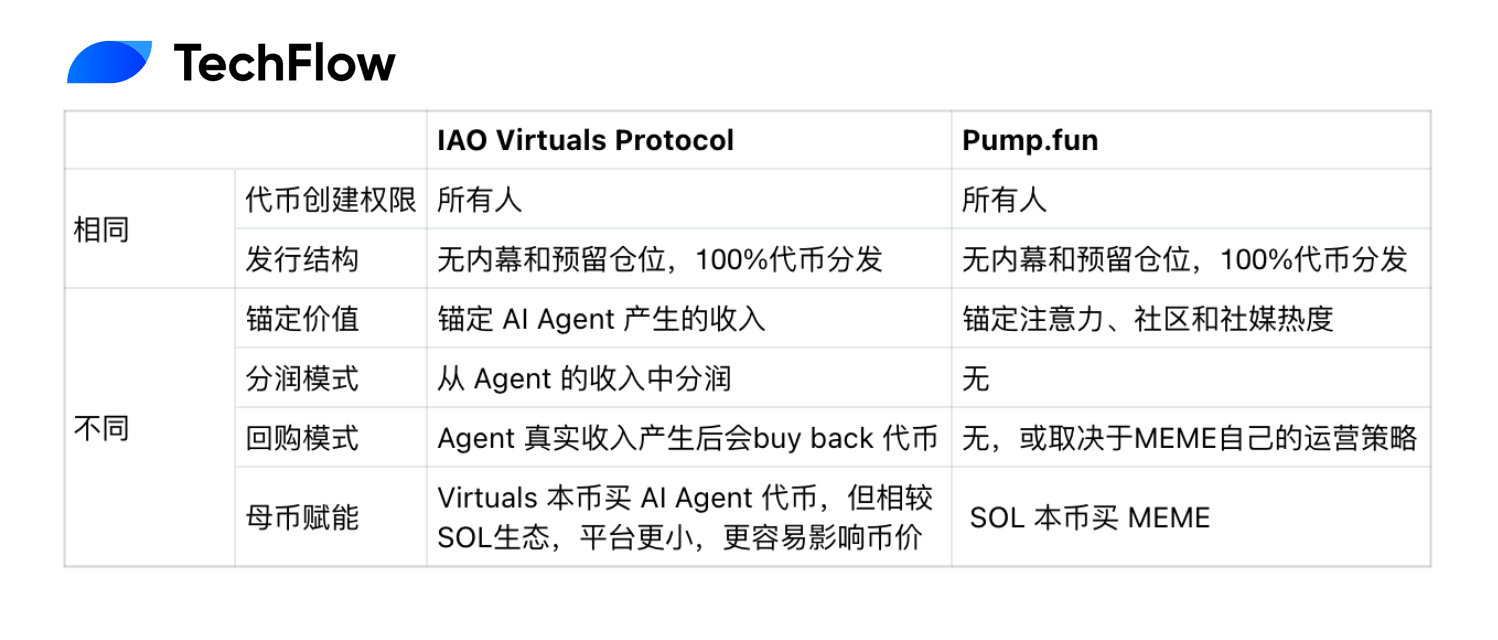

Finally, we can summarize the similarities and differences between the Virutals Protocol's IAO and Pump.fun in a table.

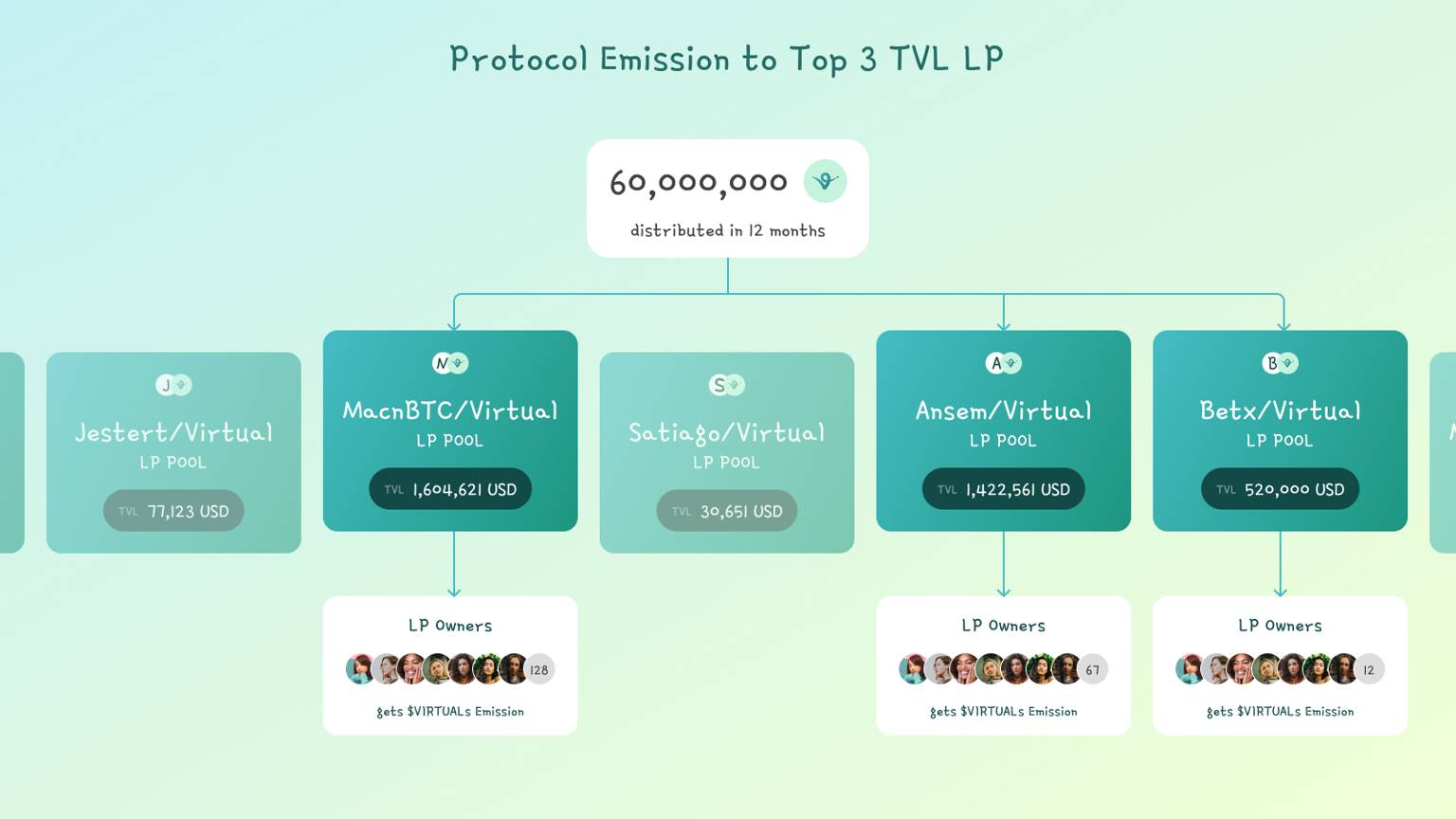

In addition to these inherent characteristics, starting in November, the IAO platform will also launch incentive activities, allowing everyone to issue their own AI agent tokens. However, if you are among the top three tokens on the hot list, you can also receive rewards from a total prize pool of 60,000,000 Virutal tokens.

This initiative clearly encourages top AI agents to gain more liquidity from the liquidity pool, improving market efficiency; at the same time, it indirectly incentivizes creators to continuously improve their agents to maintain competitiveness.

Through the incentive program, better AI agents are bound to emerge, and on the other end of the hot token trading, there will be actual business and income generated.

Conclusion: When AI agents become revenue-generating assets

In the current market environment, the grand narrative of pure AI X crypto has gradually been debunked; AI must combine with the comfort zone of crypto, namely "creating assets and facilitating transactions," to have sustainable survival space.

Assetizing AI Agents, sharing rights and profits, and promoting transactions and price discovery is a more timely combination model.

The IAO of Virutal Protocol may offer token assets that are of higher quality than pure air Memes and more grounded than grand AI narratives, allowing projects to build their brand and traffic in asset trading, making them worthy of attention.

If the AI agents created by various AI teams can really take off, the scale effect will make Virtuals more like a crypto version of the A-share "entrepreneurial board" stock. Investors hold tokens waiting for appreciation, selecting better agent models to contribute to unlocking more entertainment experiences;

At the same time, this model at least provides a new investment perspective—finding better AI agents to capture new opportunities in the popular AI narrative.

How far the AI version of Pump.fun can go, let’s wait and see.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。