As we look back at the year 2023 so far, the GameFi-related projects that have received significant funding and performed well (currently, GambleFi is also classified within the GameFi sector) have primarily focused on infrastructure development in areas such as gaming platforms and game Layer 3. The most notable among them is the pump.fun casino, which has attracted countless participants since the beginning of the year, along with the explosive growth of Not and the Telegram mini-game ecosystem. This article will analyze the defensive investment logic behind such investment phenomena and our attitude towards this investment logic.

1. GameFi Market Financing Overview

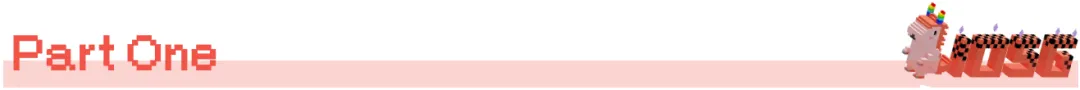

Source: InvestGame Weekly News Digest #35: Web3 Gaming Investments in 2020-2024

Looking at the investment volume and number of projects in the GameFi sector from 2020 to 2024, even though Bitcoin has surpassed its previous high from 2021 this year, the data from the past year appears relatively sluggish and conservative in both total volume and number of projects. In comparison, during Q4 of 2021, there were as many as 83 total investment projects with a total amount of $1,591M, averaging $19.2M per project. In contrast, this year, during the first quarter when it broke the previous high, there were a cumulative 48 projects with a total investment of $221M, averaging $4.6M per project, representing a 76% year-on-year decline. In terms of amount, overall investment behavior shows a conservative defensive posture.

2. Analyzing Three Market Phenomena from the Past Year: Underlying Logic, Changes, and Doubts

2.1 Phenomenon 1: Gaming Platforms Evolving from Pure Platforms to User Acquisition Channels

"The evolution of gaming infrastructure into user acquisition channels, aside from strong survival capabilities and long lifecycles, is why they are favored by VCs."

Among the 34 GameFi-related projects that received over $10M from June 2023 to August 2024, 9 were gaming platforms and 4 were game Layer 3 projects. From BSC to Solana, from Base to Polygon, and even self-built Layer 2 and Layer 3, gaming platforms are flourishing everywhere. Even with a significant decline in total funding amounts, 38% of high-investment projects are still concentrated in gaming infrastructure, which has strong survival capabilities and long lifecycles. Platforms are narratives that cannot be disproven by trends and are a low-risk defensive investment choice to remain in the market.

Source: PANTERA

In addition, for leading gaming ecosystems, there are multiple funds like Pantera that heavily invest in top gaming platforms - the Ton ecosystem token is one such example, and Ronin is also a secondary choice for several VCs. The reason Ton and Ronin ecosystems are favored by VCs may be attributed to the gradual evolution of platform roles. With nearly a billion users on Telegram, games like Not, Catizen, and Hamster attract new users to Web3 (Not has 30M users, Catizen has 20M users with 1M paying users, and Hamster has 0.3B users). The traffic from the Ton ecosystem, after listing on exchanges, brings in new user groups, injecting new blood into the entire crypto world. Since March of this year, Ton announced over $100M in ecosystem incentives and multiple league prize pools, but later on-chain data shows that Ton's TVL does not seem to have significantly increased with the explosion of mini-games. More users are primarily converted directly into exchanges through pre-recharge activities. On Telegram, the CPC (Cost-Per-Click) is as low as $0.015, while the average customer acquisition cost for a new account on exchanges is between $5-10, and the cost for each paying user can exceed $200, averaging $350. The customer acquisition and conversion costs on Ton are far lower than those of the exchanges themselves. This indirectly confirms why exchanges are rushing to list various Ton mini-game tokens and memecoins.

Moreover, Ronin's existing user base provides many more customer acquisition opportunities for individual games. The migration of high-quality games like Lumiterra and Tatsumeeko to the Ronin chain further illustrates this. The user increment and acquisition capabilities that gaming platforms can bring seem to have become a new angle of favor.

2.2 Phenomenon 2: Short-Term Projects Dominating the Market Become New Favorites, but User Retention Capabilities Are Questionable

"In a secondary market with poor liquidity, many games' flywheel and profit-making effects are directly curtailed, turning perpetual games into one-time games. In the current unfavorable macro environment, these short-term projects are more aligned with VCs' risk aversion as a defensive investment choice, but we still question whether users' long-term retention capabilities match VCs' expectations."

Let's take a look at Not (a short-term project) and its economic model.

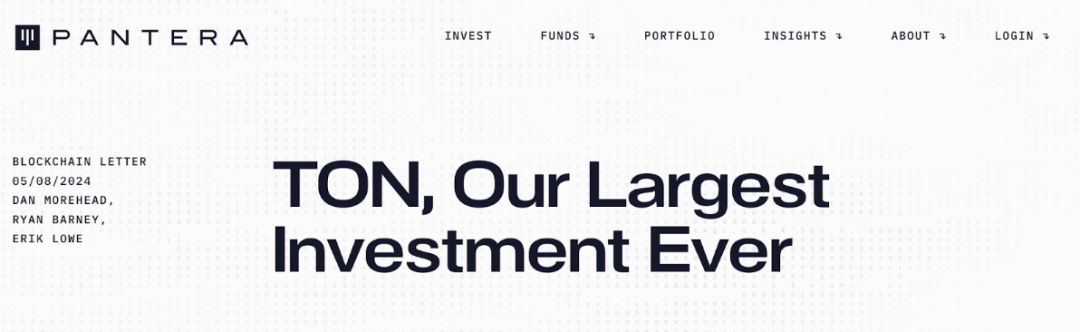

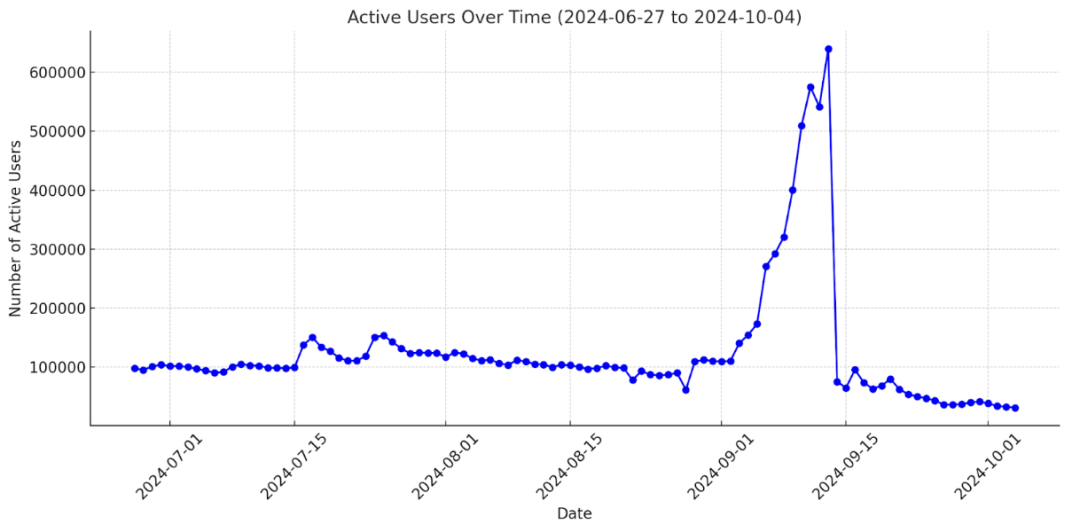

Source: CryptoQuant

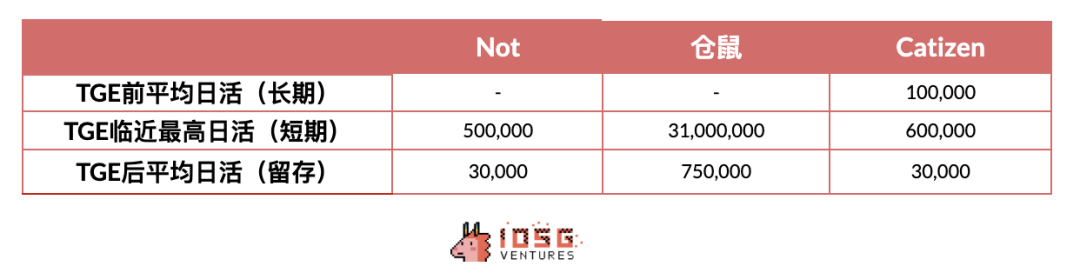

Not's active users have been declining since the token launch, dropping from an initial 500,000 to 200,000 five days after TGE, and stabilizing at around 30,000. The user decline reached 94%. If we refer to user data, Not is indeed a short-term project. Recently launched projects on Binance like Dogs, Hamster Kombat, and Catizen, which are fully circulating short-term projects, have garnered significant attention from the market and VCs.

Source: Starli

From the previous P2E (Play-To-Earn) model of earning money through gaming, with simple game level setups, auto-chess modes, and Pixel's farming and logging for coins, to Not's explosive click-to-earn model, these projects branded as GameFi are gradually simplifying or even shedding the gaming layer. When the market eagerly accepts this, is it because people's acceptance is increasing, or are they becoming impatient and restless? Accepting that the essence of most GameFi projects is merely a replacement of mining machines with interactions to mine, why bother with those cumbersome game steps and modeling costs? It would be better to use the costs originally needed for game development as the initial cake for this Ponzi mining factory, benefiting both parties.

The economic model of Not differs from the previous GameFi flywheel model, with fully circulating one-time unlocks and no upfront cost investment. Users can exit as soon as they receive airdropped tokens, and VCs no longer have to endure the pain of locking up funds for two to three years. The model has shifted from a sustainable mining game to a more short-term version similar to memecoins. Additionally, similar to the value added by platforms in user acquisition, the simple monetization game mechanics attract new Web2 users to participate in Web3, with new users cashing out their airdrops and moving to exchanges. The user traffic brought to ecosystems and exchanges may also be another reason VCs are optimistic about such projects.

The essence of the flywheel cycle and why short-term projects align better with the current market, while mid-to-late stage investment returns are questionable.

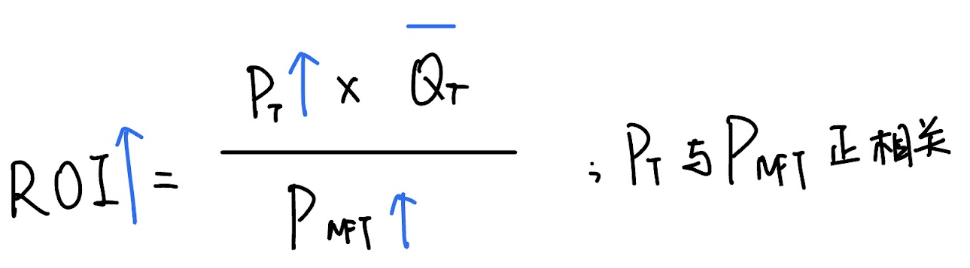

Previously, P2E games had a complete economic cycle, and whether this economic cycle's flywheel can run depends on whether players can calculate an acceptable ROI (Return on Investment). In P2E games, ROI = Net Profit / Net Spend translates to the future expected returns (value of mined tokens) / NFT costs (cost of mining machines). Therefore, in P2E games, the formula for participants' earnings is:

ROI = Value of Future Rewards / Acquisition Cost of NFT

Ignoring wear and electricity costs for now, the larger the calculated ROI, the stronger the incentives for players. How can we maximize ROI? Let's break down the formula.

Source: Starli, IOSG Ventures

- Path 1: Increase the Value of Future Rewards

Value of Future Rewards = Quantity of Future Rewards * Price of Future Rewards

V = P * Q

When the value of future rewards increases, either the quantity of rewards increases (i.e., token rewards increase), or the price of rewards rises (i.e., token prices increase).

In the context of the Web3 economy, the output settings for almost all tokens exhibit a converging trend, similar to Bitcoin's halving cycle. As time progresses, token output decreases while mining difficulty increases. Perhaps more expensive mining machines or rarer NFTs yield higher rewards, but they also incur additional costs. Therefore, without changing the quality of mining machines, increasing the quantity of rewards does not make sense.

The most likely way to achieve an increase in ROI is through the appreciation of the token price of the rewards, meaning that the value of the tokens players mine continues to grow steadily. In a secondary market with ample buying volume, there won't be a situation of oversupply; buying pressure will absorb all selling pressure while still showing an upward trend. This, in turn, increases the numerator in the ROI calculation.

- Path 2: Lowering NFT Costs

When the denominator in the ROI calculation decreases, the ROI naturally increases, which means that the acquisition cost of NFTs as mining machines becomes lower. If the price of NFTs traded with project tokens decreases, it could be due to either a decrease in demand for those NFTs and an increase in supply, or a decline in the price of the token as a medium of exchange and standard of measure, leading to a decrease in NFT prices from external factors.

A decrease in demand is naturally because the profit-making attributes of the game weaken, prompting players to seek opportunities in other games with higher ROIs. When settled in other fiat currencies like Ethereum or Solana, the market influences will cause mainstream coin prices to drop, and altcoins will not fare any better. Thus, NFT prices and token prices are bound to show a positive correlation. Therefore, the increase in the numerator and the decrease in the denominator cannot coexist; their changes are synchronous and may even have a certain proportional interaction.

This implies that the most likely method to achieve an increase in ROI is through the anticipated appreciation of the token price, with NFTs rising in sync but at a rate less than or equal to the token price increase. In this case, ROI can stabilize or slowly rise, continuously incentivizing players. In such a scenario, new funds entering the Ponzi scheme act as an amplifier, and only in a bull market, when token prices rise, can the P2E game's flywheel start to spin. When ROI stabilizes or gradually increases, players will reinvest their earnings, creating a snowball effect where injections exceed withdrawals. Axie is the most successful example of this flywheel cycle.

Source: Starli, IOSG Ventures

Source: Starli, IOSG Ventures

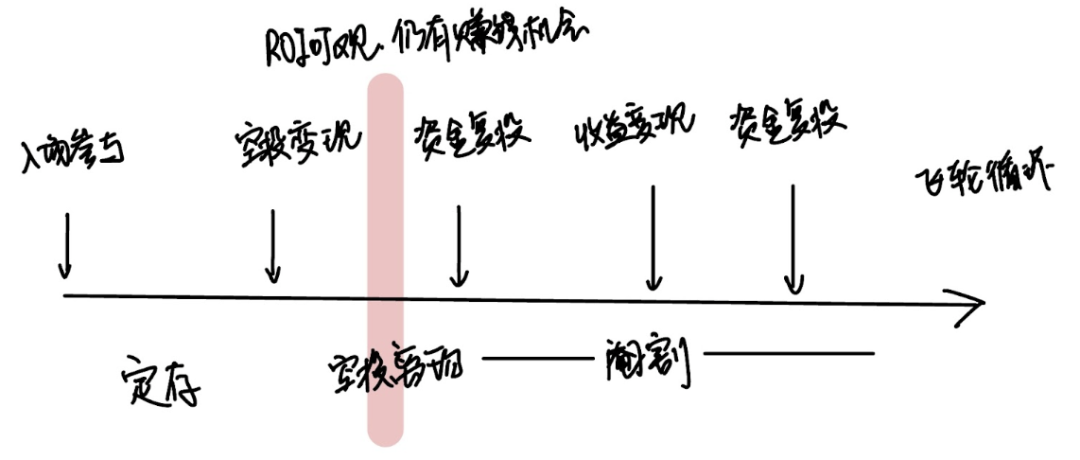

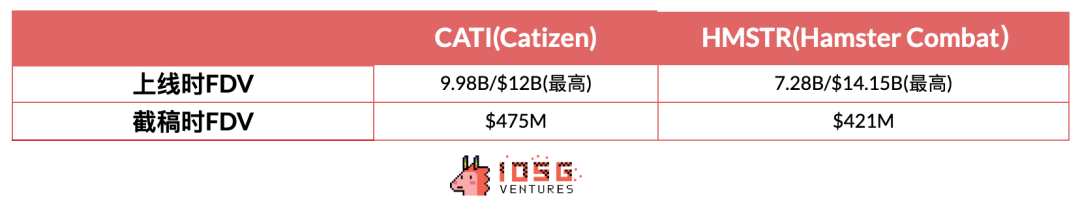

Looking back at the games in this cycle, it seems that most experienced a brief FOMO before launch, only to plummet overnight after the FG, with all airdrop-unlocked tokens becoming selling pressure. After cashing out, players move on to find the next opportunity. Without subsequent ROI, reinvestment of funds, and the flywheel cycle, it becomes a burden for diamond hands to bear all the short-term risks. P2E has become less talked about, while P2A has quietly gained traction; "play to airdrop" is a frightening concept, as this title seems to label the game as a one-time event. The goal of extracting value is merely to sell the airdrop upon listing and cash out, rather than continuously seeking earning opportunities within the game ecosystem. Despite the changing times, the act of selling tokens remains consistent, but in the current weak secondary market, where altcoins are struggling, the secondary token prices cannot sustain the flywheel. Without strong market makers to support the price, many games' flywheels and profit-making effects are directly curtailed, shifting from a loop to a short-term focus, turning perpetual games into one-time events. From this perspective, examining the performance of Catizen and Hamster after their TGE also indirectly supports the notion that their economic models were designed for the short term, negating the need to run the subsequent flywheel. For such projects, whether mid-to-late stage Token Funding represents a lucrative deal remains questionable.

The flywheel cycle requires a more sophisticated economic model and cost investment, while the short term only needs the expectation of airdrops, as the task is accomplished once the tokens are listed, and the subsequent economic model can be curtailed. The expectation of airdrops is merely about profiting from the liquidity spread between the primary and secondary markets. We can understand these short-term projects as a form of fixed deposit until reinvestment into the economic system, where players invest the costs of NFTs or pass cards as principal, allowing for a time cost of capital retention until they earn airdrop profits upon token listing.

Such projects do not require cross-cycle operating time and uncertain economic cycles, nor do they rely heavily on market conditions and FOMO emotions. Their brief yet brilliant lifecycles, along with fully circulating unlock models, relieve VCs of the hassle of locked funds, allowing for quicker exit times. In the current unfavorable macro environment, these short-term projects align more closely with VCs' risk-averse defensive investment choices.

User Long-Term Retention Capabilities Are Questionable

Whether it's Not, Catizen, Hamster, or Dogs, they have brought a significant wave of new user growth to exchanges like Binance. However, how many of these new users actually remain in the ecosystem or on the exchanges in the long term? Does the value of these new users match VCs' expectations and investments?

Source: IOSG Ventures

Let's take a look at Catizen, one of the hottest mini-games on the Ton ecosystem. It saw its active users drop from 640,000 before the token launch to just 70,000 in a single day, with subsequent user retention data appearing even more dismal. From a long-term user perspective, even if the game content remains unchanged, once the expectation of airdrops disappears, over 90% of users immediately withdraw, leaving only around 30,000 users retained. Does this level of user retention meet investors' expectations and achieve the goal of user acquisition? Even if users who received airdrops turn to exchanges for a wave of immediate user growth, after cashing out their airdrops, will these users abandon Catizen as well? When the product itself transforms into a viral campaign aimed at user acquisition, even if it brings a wave of incremental growth to the ecosystem in the short term, can the truly retained users meet the expectations of the ecosystem and exchanges, justifying this investment? We remain skeptical.

2.3 Phenomenon 3: Top VCs Investing in Casinos for Revenue, but Lacking Token Issuance Expectations and Value Capture

"Infrastructure projects and secondary trading are closely related to the macro market. When the market is strong, funds are more willing to stay in the market to capitalize on various hot trends. In an environment where there is no strong buying or selling desire in the secondary market, relying on casinos and pump.fun's PVP to earn revenue and kill rates has become a more stable and conservative defensive choice for VCs. But where does the customer acquisition come from? Platforms and tools lack token issuance expectations, and the revenue from these casinos may underperform compared to GameFi project investments."

Several casino projects have begun to emerge, accounting for 15% of the high financing in GameFi related to 2024. In this fast-paced crypto world, since memes and pump.fun can be reasonably accepted, games of chance no longer need to disguise themselves under the GameFi label, appearing openly before everyone.

On February 12 of this year, Monkey Tilt, led by Polychain Capital with follow-on investments from Hack VC, Folius Ventures, and others, provided a betting website and online casino backed by large funds. Myprize, which announced on March 24 that it was led by Dragonfly Capital with participation from major VCs like a16z, raised a total of $13 million for an online casino, taking a bolder approach with its homepage featuring sexy dealers and live options.

Source: Myprize

Pump.fun: The Logic of Earning Revenue and Cash Flow from Casino Platforms

When the market cools and remains uncertain, with the election undecided and the U.S. interest rate cuts dragging on and consuming market expectations, during this garbage time, coupled with the emergence of tokens like BOME (Book of MEME) and others that have seen hundredfold or thousandfold increases, people's gambling instincts are greatly stimulated, leading more money to flow onto the chain and into pump.fun in search of the next "golden dog." The timing of pump.fun's emergence coincided with a period of sustained volatility after Solana's rise.

What is the largest casino in Web3? Many may already have an answer in mind. Binance, OKX, and other top exchanges offer perpetual futures contracts with leverage of up to 125X, while smaller exchanges may offer 200X or even 300X leverage. In contrast, the maximum fluctuation in A-shares is 10% daily, and 20% for the ChiNext. Tokens, which have no price limits and are T+0, combined with 100X leverage, mean that less than a 1% price fluctuation can wipe out all your principal.

Both rising and falling token prices can be participated in through long or short positions. Essentially, ultra-short contracts are betting on the size of the market during the entry and exit periods, with odds ranging from 5X to 300X. Exchanges profit handsomely from transaction fees, holding costs, and forced liquidation fees. The logic is similar for casinos, which typically earn revenue from the house edge or the kill rate when acting as the dealer.

If infrastructure projects and secondary trading are closely tied to the macro market environment, when the overall environment is clear and the market is rising, funds are more willing to stay in the market to capitalize on significant gains from various hot trends, yielding considerable returns with lower risk. However, in the current uncertain market, funds seem to be flowing into casinos and PVP, leveraging high margins to bet on returns that cannot be reached in the present. High leverage amplifies gains, but it also magnifies losses. In a market that oscillates back and forth, the revenue generated from exchanges and platform fees may be more objective than during a one-sided market.

In a market characterized by uncertainty and increased gambling instincts, funds and interest seem to be flowing into casinos and PVP. The revenue generated from casinos and tool-based products has become a stable income source with demand and growth, aligning with the defensive investment logic of earning revenue. However, the revenue from casinos or platform-based operations also presents certain issues.

Lack of Token Issuance Expectations and Value Capture

For platform projects like pump, even if they become phenomenally successful and generate substantial trading volume, they still lack token issuance expectations. Whether considering the necessity and utility of the token within the ecosystem or from a regulatory perspective, as long as no tokens are issued, there is no risk of being flagged by the SEC for securities violations. Similar casinos or platforms also lack genuine token issuance expectations.

On the other hand, in the absence of token issuance expectations, the logic of earning revenue and casinos is more applicable during sideways market fluctuations and cannot predict future hot trends. Revenue generation relies on the popularity and activity of on-chain memes or gambling, serving as an intermediary tool that meets demand rather than being the demand itself, lacking genuine value capture based on its own merits. The recent actions of pump.fun in liquidating a large amount of Solana (as of September 29, it has sold approximately $60 million worth of Solana tokens, accounting for about half of its total revenue) illustrate this; without token issuance expectations and value capture, pump.fun, while benefiting from the prosperity of $SOL, also exerts significant selling pressure on the market.

Although pump.fun will undoubtedly bring many positive effects to the entire Solana ecosystem, such as increased trading activity, attracting new users to the Solana ecosystem during the meme summer, stable demand and buying pressure for $SOL, and the purchasing power of those who buy in after seeing the price rise, the issue remains. It takes from the people and sells back to the people, charging $SOL as fees while dumping these sell orders into the market. The closer the total sales approach the total revenue, the more neutral pump.fun's impact on Solana's price becomes, resembling a stabilizer, and there may even be negative premiums (only sell orders without buy orders). During the growth phase, pump.fun has a very strong positive impact on the Solana ecosystem, potentially exhibiting geometric growth; however, once it matures and reaches a plateau, the relatively fixed selling pressure (as revenue from transaction fees) minus the diminishing positive impact may result in greater selling pressure.

In summary, similar gambling platforms are likely to underperform compared to GameFi projects that have genuine value capture.

Furthermore, most VC investment returns come from revenue sharing, and in a scenario where equity exits are unrealistic and there is a lack of token issuance expectations, they can only wait for the next round of mergers or acquisitions to exit, which is a long and arduous process.

3. Conclusion: Casinos and platforms may underperform GameFi, short-term project retention declines, and a cautious attitude towards past defensive investments

Whether it is attracting retained users to new games or converting the user base into new Web3 user growth, one of the main roles and value directions of gaming platforms seems to have evolved into a channel for user acquisition. However, for projects relying on such platforms to convert users through short-term projects as genuine value, the long-term retention rate of users has yet to be proven by time and data. In the absence of token issuance expectations and value capture, gambling platforms seem to underperform compared to GameFi projects that genuinely capture value and achieve product-market fit during a bull market.

We remain cautious about past defensive investments in the market and are eager to find products and high-quality games that have yet to form a consensus and have fewer investors at this stage. Such games can convert future willing buyers into higher retention rates, increased in-game spending, and on-chain activity due to their quality. Ultimately, this will translate into a higher value for the tokens.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。