In the cryptocurrency market, Bitcoin (BTC) has always been regarded as an important barometer. On the evening of the 15th, Bitcoin's price suddenly plummeted significantly, but shortly after, it quickly underwent a price adjustment. Media reports indicated that major funds engaged in protective actions for Bitcoin's price, exceeding $100 million.

Image source: AICoin

On the evening of the 15th, Bitcoin's price dropped rapidly within an hour, falling by as much as 6.5%, resulting in a market value evaporation of hundreds of billions of dollars in just a few hours. Is there a "butterfly effect" hidden behind this, related to U.S. economic policies?

Who is protecting Bitcoin? Who is most affected by the drop in Bitcoin's price?

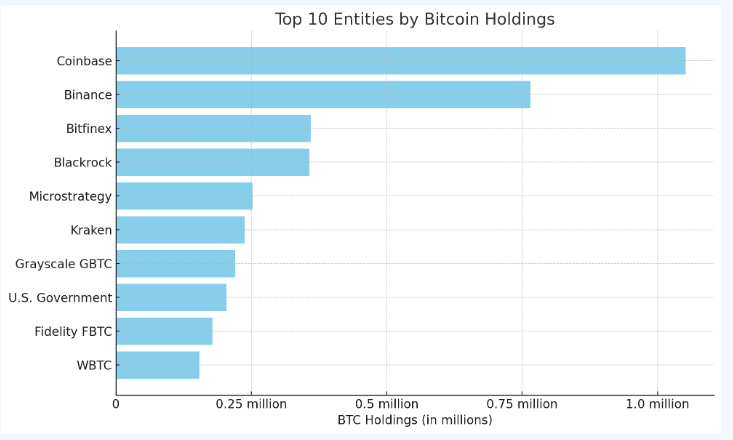

Institutions Holding the Most Bitcoin

In the United States, institutions are the organizations holding the most Bitcoin. Regardless of whether Bitcoin's price rises or falls, institutions are the most affected.

Data shows that as of September 22, 2024, Coinbase is the largest entity holding the most BTC, with Timechainindex.com emphasizing that the centralized exchange Coinbase holds 1,051,650.41 BTC, valued at $6.64 billion, stored in 145,491 addresses. The centralized exchange Binance is the second-largest entity holding the most BTC, with 765,072.92 BTC. Bitfinex is the third-largest holder, entering the top three centralized exchanges, holding 359,687.52 BTC distributed across 2,161 wallets. Blackrock is the fourth-largest BTC holder, with 357,550.21 BTC distributed across 760 addresses. Notably, Blackrock's BTC is custodied by Coinbase.

Image source: Internet

On the evening of October 16, news emerged that BlackRock officially updated its holdings data for the spot Bitcoin exchange-traded fund iShares Bitcoin Trust ETF (IBIT). As of October 15, IBIT's holdings exceeded 375,000 BTC, with a market value surpassing $25 billion, reaching $25.064 billion.

Motivation Behind Major Funds Protecting Bitcoin

With the U.S. elections approaching, candidate Trump has stated that if elected, he would embrace the Bitcoin market and relax regulatory oversight of the trading environment, aiming to make the U.S. the world's leading Bitcoin-holding country. This is a significant positive for Bitcoin investors, and Bitcoin, as a well-known risk reserve asset in the U.S., is favored by many investors due to its speculative nature, recently breaking the $68,000 mark.

Institutional investors, as the group holding the most Bitcoin, would see their Bitcoin assets devalue if the price continues to plummet due to market factors. More importantly, the protective actions of institutional investors enhance market confidence in Bitcoin, stabilize investor sentiment, and promote a virtuous cycle in the cryptocurrency market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。