Subsequently, please look forward to the value discovery of liquid tokens.

Written by: Kyle

Translated by: Luffy, Foresight News

The argument for liquid tokens is simple: I believe there is a huge opportunity (alpha) in the liquid token investment space, while the VC token investment space is already oversaturated.

Many great companies are building in the cryptocurrency space, and they all have their own tokens, but the pricing is not reasonable.

The main driver of valuations in 2021 was the depiction of dreams. I believe that valuations after 2024 will come from the realization of those dreams.

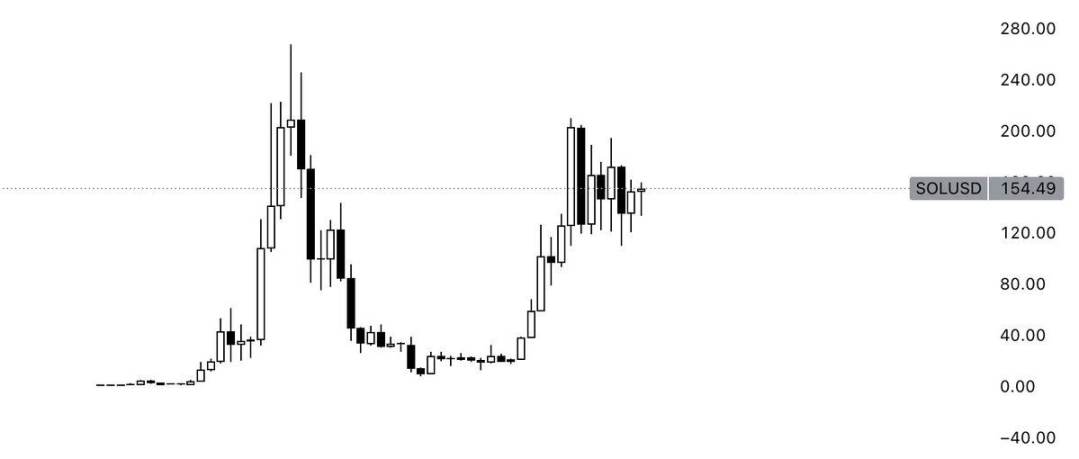

MONTHLY CHART OF SOL

Solana is a typical example of this shift, as people realized three years later that "maybe it's not all talk."

If you are a fund company, your opportunity lies in: working hard to figure out who is building truly cool products. You might think, "Shouldn't we be repricing now?" — no.

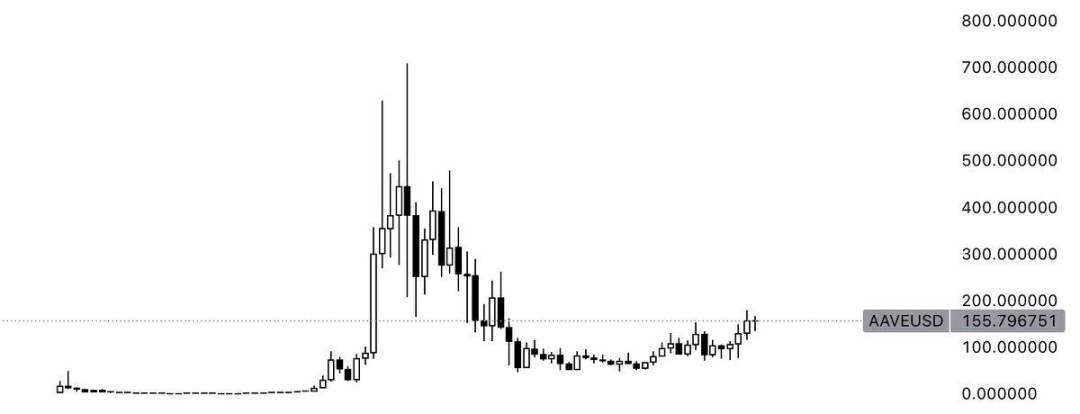

MONTHLY CHART OF AAVE

Arthur stated in his latest article about the DeFi revival that DeFi is severely undervalued and will continue to grow in the coming years. Facts speak louder than words. In the cryptocurrency space, some very legitimate companies have been overlooked, even those currently valued in the billions.

However, the theory of liquid markets does not only apply to old tokens. It is widely believed that there are many opportunities in the liquid token space, with companies that are truly building currently presenting asymmetric returns. A clear example is the Banana Gun mentioned in Theia Research article.

Banana Gun ranks 6th in revenue among all on-chain protocols, but its market cap ranks 284th. This indicates that some companies that are genuinely building are undervalued.

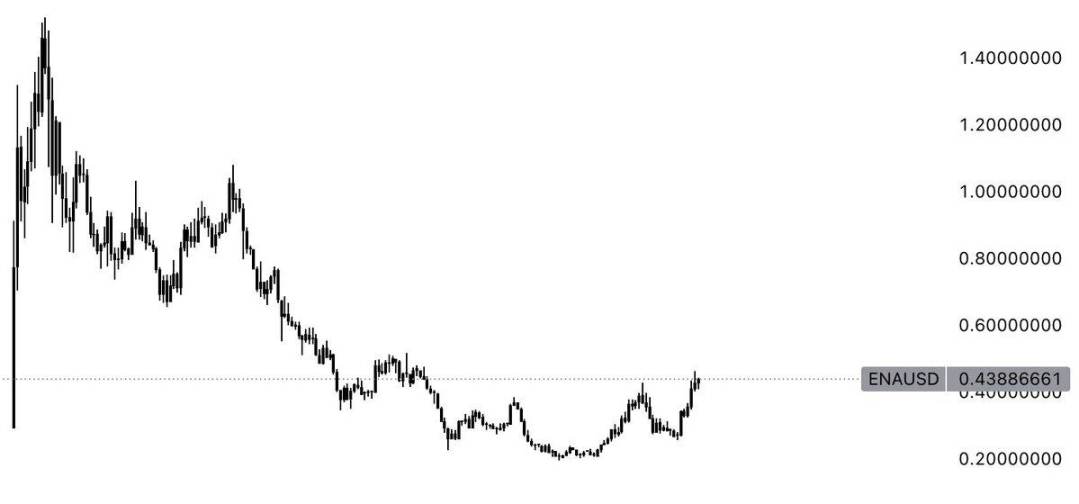

A more recent example is Ethena. You may disagree with this argument, but I hope to clarify my point here. If you know where to look, there are incredible opportunities in the liquid token market.

This is not just about "oh, this is an AI token, go long on it," or "this is something new, so the price will go up." The core idea here is:

- Some companies with issued tokens are severely undervalued.

- The market will pay more attention to fundamentals.

Below, I explain the opportunities in liquid tokens with four questions.

Question 1: Aren't scams the most profitable?

Yes. After all, it is still cryptocurrency, and there is a "hype" factor. Things can quickly become overvalued, and I have no doubt we will still see false scams pushed to sky-high prices (TRB is an example).

But if you look towards 2024, you will find that asset selection is becoming more important than ever, as people have learned how the "selling dreams" game works, and no one will fall into the traps of "putting the world on the blockchain" or "yield mining second tokens" again.

In 2021, you could go long on anything and make money; in 2024, you can go long on hot trends and make money. But in the coming years, you will gradually reduce your preference for false scams and choose more legitimate projects.

Question 2: When will the market pay attention?

I don't know. I aim to go where the puck is going to be, not where it is now. But sometimes it takes a while for the puck to get there. However, we can see that the market has already begun to pay attention, and asset selection will become crucial in 2024.

Many seem to forget that our ultimate goal is to introduce Tradfi currency. Tradfi always needs a reason: the reason they like Bitcoin is that it is becoming "digital gold." While you may have different thoughts, the fact is that fundamentals are the factors that connect things.

Anyone with enough power to drive the market needs fundamentals and wants to see actual numbers.

But at the same time, another issue with this argument is that it requires bullish conditions (i.e., BTC price rising), which we have not encountered in the past five months. This is also why Memecoins have performed so well, as Memecoins tend to be very resilient to market fluctuations and are in a completely different competitive environment (on-chain).

Question 3: Why not buy Memecoins? Dude, just buy Memecoins.

I agree with this viewpoint. Many people reading this article may think that Memecoins are the pinnacle of false advertising. They are not; I believe false advertising is the disconnect between promises and delivery. But for Memecoins, the promise and delivery are consistent: they promise nothing and deliver nothing. What do you expect from Popcat? Or from Doge?

From this perspective, you can build a "fundamental" framework for Memecoins: clearly, it won't be based on how much money it makes each year, but on other factors. Does it have community worship? Does it have memes that unite people? And so on.

When there are 1000 different memes for the same animal, it becomes hard to distinguish good from bad. This is not much different from having 100 different L1s or 100 different GameFi projects.

The most powerful speculation is built on the core of truth, and for Memecoins, the core of truth is "a strong community." This is completely different from false projects that sell you dreams.

Memecoins and liquid tokens are two sides of the same coin, just at opposite ends of the spectrum. Similarly, some false projects are valued absurdly high without any actual results, yet they promise the world. At least Memecoins promise nothing; what you see is what you get.

You may disagree with this viewpoint. I admit, I am not betting on Memecoins. But if I had to choose between Memecoins and scams, I would unhesitatingly choose the former.

Regardless of your views on the Memecoin supercycle, it is clear that this has become a reality.

Therefore, the Memecoin + liquid token barbell strategy makes sense: choose the memes with the strongest cult and the tokens with the best products.

Question 4: What do fundamentals represent?

All the examples I provided above share a common viewpoint: "It makes a lot of money, but the trading price is X, and it should be higher." But I believe not all fundamental arguments need to be stated this way. The essence of fundamentals means "there is a logical argument to explain why it should be valued higher," and valuation is one way to express that.

Besides valuation, there are many ways to express this, but the core element is that the argument is rooted in reasonable logic, not just "this is a new token, dude."

Conclusion

TLDR: Some liquid tokens are doing very cool things but have not been truly discovered yet. Find them!

I divide the past year into three phases:

- Phase 1 (January to March): Excitement. The bull market is really back! At this time, we still see false advertising, but much less than in 2021; more focus on some projects that are genuinely doing things.

- Phase 2 (April - now): Memes! Memes! Memes! No one cares about altcoins anymore. As the old saying goes: buy when no one is watching, sell when everyone is talking.

- Phase 3 (coming soon): Alternatives to Memecoins are emerging.

I look forward to discovering more unpolished gems: companies with good fundamentals that are severely undervalued.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。