Cryptocurrency will change the world in its unique way.

Authors: Shlok Khemani & michaellwy

Compiled by: Deep Tide TechFlow

Today's article provides entrepreneurs with a framework for thinking, helping them understand the role of blockchain and its best applications in solving problems and creating value. If you are a startup founder developing a business that can uniquely benefit from crypto technology, we look forward to connecting with you.

Hello!

Last week, the stunning images of Mechazilla successfully capturing a booster rocket amazed the world. This event occurred in an era where artificial intelligence has deeply penetrated society. NVIDIA's stock performance in recent months reminds us of the 2021 frenzy when companies rushed to add blockchain to their names. However, this time, there is indeed substantial content behind the hype. As an industry, AI is attracting significant attention, capital, and talent.

In contrast, the blockchain (or cryptocurrency) industry seems lost in a chaotic mix of jargon, interspersed with some "meme" assets. It's hard not to feel that continuing to work in this field is a waste of time. Of course, there are occasional bull markets, and prices (or the market) are a significant motivator for people to keep working in this industry. We may be at the forefront of the future development of the internet, or we might be undergoing a massive psychological experiment to see what happens when individuals can turn anything into a market.

Perhaps both are true.

Today's article, co-authored with Monad and Michael, explores a key question: Why is blockchain important? As an innovative system, is it as significant as space exploration or artificial intelligence? Are we wasting our time? To find the answer, we look back at history, particularly the history of the automotive industry.

From Ford to Toyota

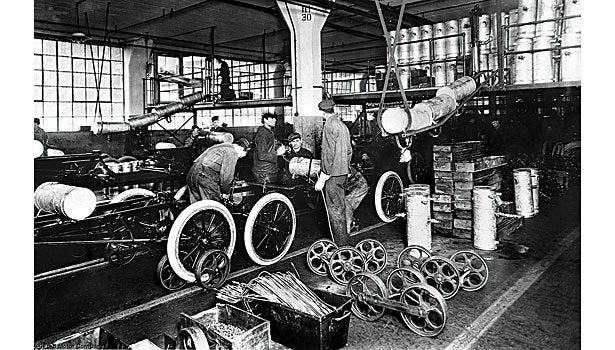

Before Henry Ford founded the Ford Motor Company in 1903, automobiles were a luxury that only the wealthy could afford. Cars were typically handmade, leading to low production efficiency and a scarcity of skilled workers. Ford's innovation was the introduction of the moving assembly line, where each worker performed a specific task as the car passed by. By breaking down work into simple, repeatable actions, Ford was able to hire less skilled workers to perform many tasks. This greatly increased production efficiency, reduced costs, and made cars affordable for the middle class.

Ford's assembly line (Source)

The mass adoption of automobiles changed society in multiple ways. The horse-drawn carriage, once the primary mode of transportation, was quickly phased out. People could travel farther for work and leisure. Countless new job opportunities emerged, not only in the automotive industry but also in related sectors such as rubber, steel, and oil. Highways transformed the geographical landscape, and modified Ford cars were used as tractors, significantly boosting agricultural productivity.

Ford's rise became a significant turning point in human history.

About 50 years later, after World War II, the Japanese automaker Toyota was on the brink of bankruptcy. The government refused to provide a bailout, 1,600 workers were laid off, and founder Kiichiro Toyoda resigned. The company barely survived on vehicle orders from the U.S. military for the Korean War. During this time, Eiji Toyoda (the founder's cousin) and Taiichi Ohno began reimagining the operation of the automotive assembly line. They drew inspiration from American supermarkets and introduced systems such as just-in-time, lean manufacturing, and kanban.

In Toyota's factory, an Andon (problem display board) lights up to alert workers to abnormalities (Source)

These improvements made Toyota's manufacturing process more efficient and cost-effective while enhancing the quality of cars. Once on the verge of bankruptcy, Toyota has now grown to become one of the largest automakers in the world, renowned for its reliability.

Over time, the "Toyota Way" has become the operational standard in the automotive industry and beyond—ranging from healthcare and retail to chip manufacturing and software development. Although Toyota's rise was not as rapid or dramatic as Ford's, it changed the world in a subtle, gradual, and profound way.

Innovation takes many forms.

The Schumpeterian perspective, derived from the works of economist Joseph Schumpeter, views innovation as the primary driver of economic growth. Schumpeter introduced the concept of "creative destruction," describing how new technologies and innovations disrupt and replace outdated ones, thereby driving economic progress.

In simple terms, these breakthroughs significantly enhance human productivity and unleash vast potential economic value. This includes Henry Ford's assembly line, the printing press, microprocessors, the internet, and artificial intelligence.

In contrast, the Coasian perspective, based on the theories of economist Ronald Coase, emphasizes transaction costs and the role of institutions in reducing these costs to facilitate economic activity. Coase argued that the existence of economic systems and institutions primarily serves to reduce transaction and coordination costs between individuals and organizations.

Coase's perspective highlights those less conspicuous yet equally important infrastructures that are crucial for enhancing economic efficiency. While the economic benefits of improving these institutional frameworks may not be immediately apparent, they can be significant in the long run. Decentralized Autonomous Organizations (DAOs) are a typical example of Coasian innovation.

Toyota's manufacturing innovations initially changed the company's fate, then altered the economic landscape of the automotive industry, and ultimately impacted various sectors. However, this transformation was gradual, and its effects became apparent only in hindsight, rather than being immediately visible during the transition.

Other examples, such as double-entry bookkeeping, stock exchanges, open-source software, and reusable rocket boosters, are instances of technological advancement driven in the Coasian sense. While these innovations may not have the dramatic flair of Schumpeterian breakthroughs, they are equally important in enhancing economic efficiency and advancing human society.

So, what about cryptocurrency?

Consider the areas where cryptocurrency has found or is about to find market fit.

First is Bitcoin, which has evolved into an asset with a market capitalization of a trillion dollars and established itself as a legitimate, institutionalized store of value. Bitcoin possesses most of the characteristics of gold—scarcity, durability, portability, divisibility, and inertness. Time will tell whether it can surpass gold and become the de facto store of value. If it can, it is because it achieves these characteristics more efficiently. Bitcoin also has its own ETF, and at least Wall Street considers it an asset worth paying attention to.

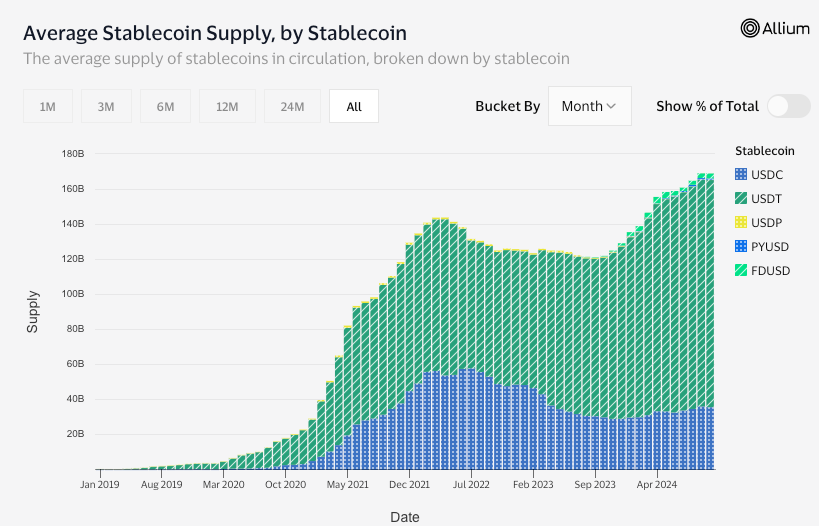

Next are stablecoins, which provide a cheaper and faster way to make cross-border payments than traditional methods. The demand for stablecoins is incredibly strong, as evidenced by the total supply of stablecoins growing from $500 million to $168 billion.

It is worth exploring why this is happening. Cross-border fiat currency transfers typically involve multiple intermediaries, such as banks, governments, and services like Western Union. Each intermediary exists to provide trust services and thus charges fees (whether in money or time). Blockchain, as a highly secure, transparent, and decentralized ledger, significantly reduces trust costs. Stablecoins are cheaper and faster because the trustworthiness of the Ethereum blockchain can rival, and even exceed, that of the institutional mix traditional fiat currencies rely on.

This situation also applies to areas like Decentralized Finance (DeFi) and digital art (NFTs). In DeFi, interacting with smart contracts is more efficient than trading through intermediaries like banks, brokerages, and exchanges. Before the advent of NFTs, auction houses served as trust bridges between collectors and artists. Unknown artists found it difficult to sell their works at high prices without the endorsement of an auction house. Ethereum provides the same (or even better) trust assurance, and it is faster and more economical.

Recently, we have witnessed the rise of various types of DePIN networks. Are these networks creating entirely new services? Not really. Mobile data, electricity, GPUs, satellite data, and digital maps do not inherently depend on the existence of blockchain. However, their monetization and distribution methods are either inefficient or reliant on centralized institutions. DePIN networks are attempting to achieve more efficient coordination.

Fundamentally, cryptocurrency is a Coasian technology. While cryptocurrencies have indeed brought many groundbreaking changes from a financial perspective, from a broader viewpoint, finance is actually a means to facilitate human coordination and productivity, and finance itself possesses Coasian characteristics.

Cryptocurrency will not fundamentally change the world like AI or rockets; it was never intended to do so. Instead, cryptocurrency plays a different role. It will help us collect data to train large language models (LLMs) and provide a means for value transfer between AI agents. It will accelerate the formation of new networks and may even help the next Elon Musk move from a third-world country to the United States. However, cryptocurrency alone may not disrupt social structures as we expect. It is more like paint rather than a canvas; what kind of picture will be painted with it remains to be seen.

As technology continues to advance along an exponential trajectory, cryptocurrency will lubricate the wheels of development, pave the way for innovation, and strengthen the bridges of connection.

Cryptocurrency will change the world in its unique way.

Enjoy the debate between Ethereum and Solana on CT,

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。