Since the inception of Bitcoin, its holders have gradually diversified, including publicly listed companies, private enterprises, and government agencies, among others. In January 2024, the United States approved a Bitcoin spot ETF, making it easier for investors to participate in this market. So who exactly is holding Bitcoin and Bitcoin ETFs?

Written by: Dingqian Wang, Chen Li

Corresponding Author: Youbi Research Team

TL;DR

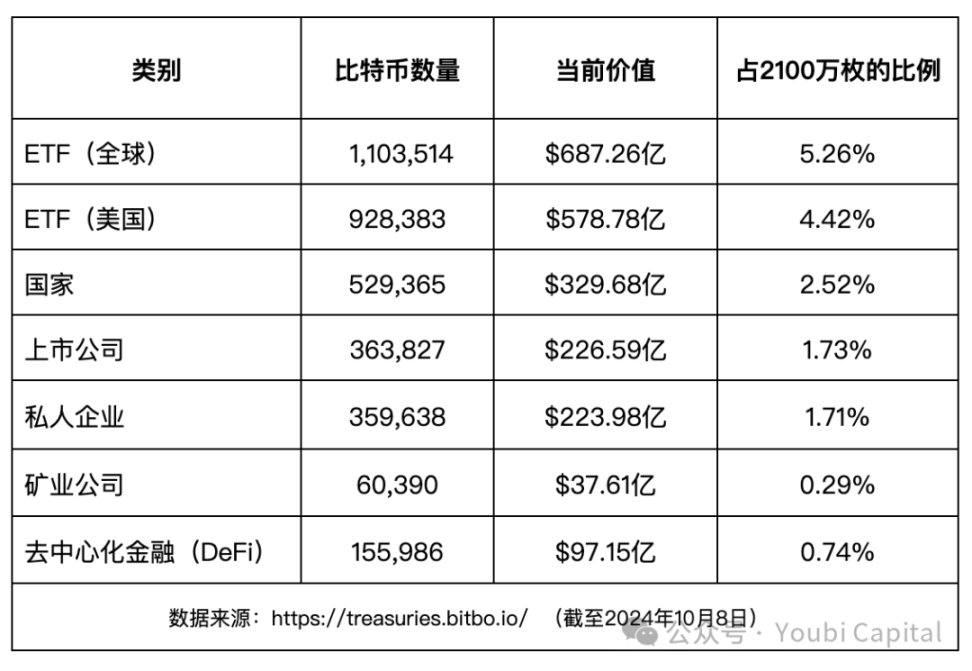

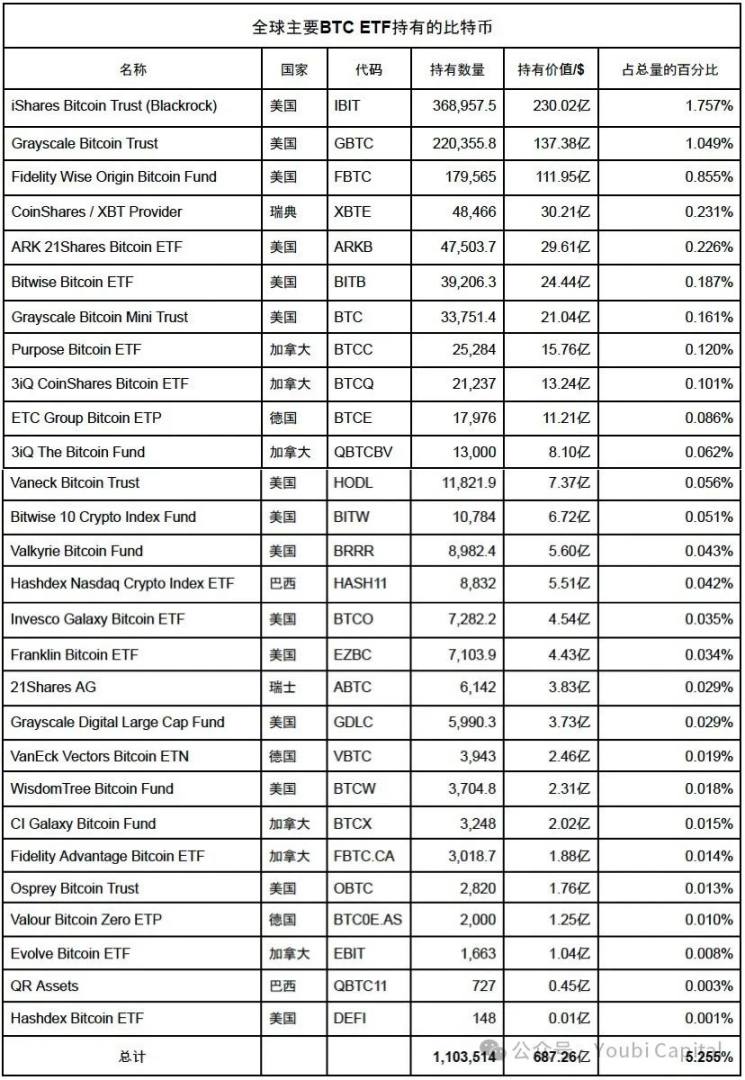

Whether as a reserve asset or part of innovative investments, Bitcoin's holders have diversified since its inception, with publicly listed companies, private enterprises, and some government agencies joining the ranks of Bitcoin holders. In January 2024, the U.S. approved the Bitcoin spot ETF, providing investors with a more convenient way to invest, quickly making ETFs the largest group of holders. As of October 8, 2024, global BTC ETFs held over 1.1 million BTC (approximately $68.73 billion), accounting for 5.26% of the total supply; among them, U.S. BTC ETFs held about 928,000 BTC (approximately $57.79 billion), representing 84.13% of the total global BTC ETF holdings.

The SEC's (U.S. Securities and Exchange Commission) 13F filings reveal which U.S. institutions are buying BTC ETFs. The conclusions can be summarized in three points:

Many different types of professional institutions hold Bitcoin ETFs, including hedge funds, investment advisors, quant funds, banks, and even state government investment funds.

Bitcoin ETFs have attracted unprecedented interest from professional investors. Comparing BTC ETFs with the institutional holdings of the ten fastest-growing new ETFs in history, BTC ETFs surpassed other ETFs in both the number of holders and assets under management (AUM) just two quarters after their launch.

When comparing Bitcoin spot ETFs with other investments, non-reporting entities are over-investing in Bitcoin spot ETFs. Compared to major securities and other ETFs, 76.8% of spot BTC ETF holders are retail or non-reporting entities, significantly higher than other investment targets.

Although most Bitcoin ETF investments in Q1 and Q2 of 2024 still came from retail or non-reporting entities, the participation of professional investors may be increasing, as they often make small personal allocations before allocating on behalf of clients, wanting to test the waters before going public with their investments.

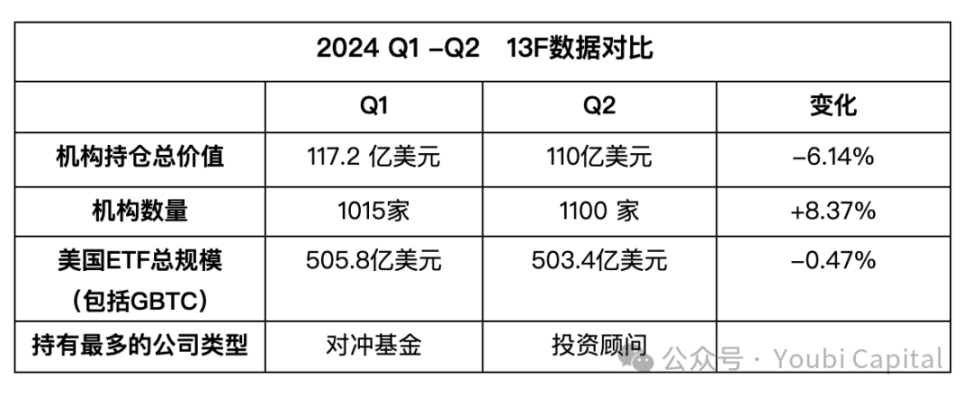

In the first quarter of 2024, nearly 1,015 institutions held approximately $11.72 billion in Bitcoin spot ETFs. This accounted for about 23.2% of the total U.S. BTC ETF market (including GBTC), with 76.8% of holders being unidentified (non-reporting entities, such as those with assets under $100 million or retail investors). A significant portion of the BTC ETF assets held by institutions represents only a small part of their total asset management scale.

Despite a 12% drop in Bitcoin prices in the second quarter of 2024, institutional investors continued to buy Bitcoin ETFs, with a total of 1,100 institutions holding $11 billion (although the value of holdings decreased from $11.73 billion in Q1, it actually represents an increase in holdings since BTC dropped over 12% in Q2). The number of institutions grew by 8.37% compared to Q1 (1,015 institutions). In Q2 2024, there were a total of 6,794 institutions with a total market value of over $48.66 trillion, meaning nearly 1/6 of the 13F fund institutions held spot Bitcoin ETFs.

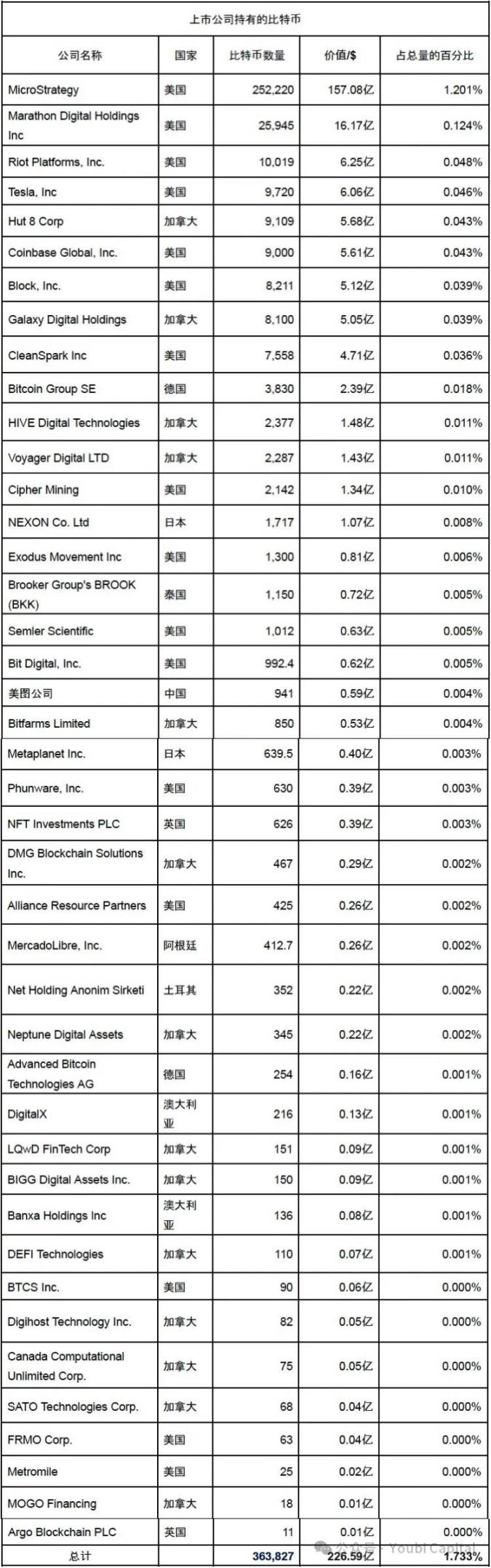

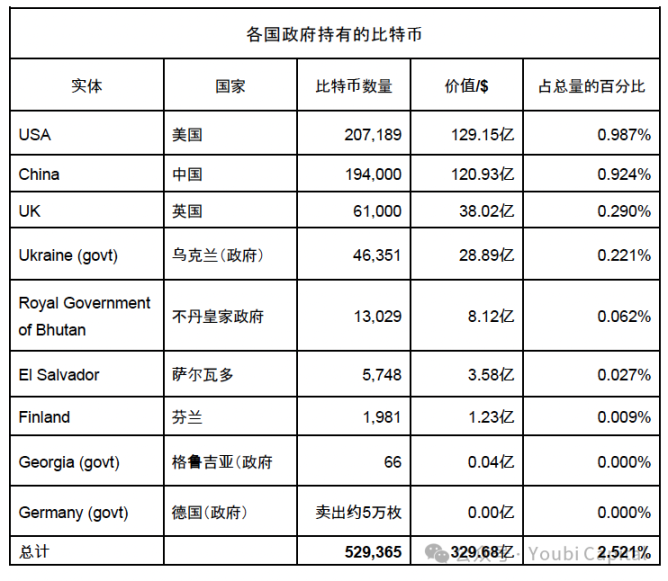

As of October 8, 2024, governments around the world held approximately 529,365 BTC, valued at $3.2968 billion, accounting for 2.52% of the total. 42 publicly listed companies held 363,827 BTC, valued at $2.2659 billion, accounting for 1.73% of the total supply. 12 private companies held approximately 359,638 BTC, valued at $2.2398 billion, accounting for 1.71% of the total.

01 Introduction

The total supply of Bitcoin is 21 million. Whether as a reserve asset or part of innovative investments, its holders have diversified since its inception, with publicly listed companies, private enterprises, and some government agencies joining the ranks of Bitcoin holders. In January 2024, the U.S. approved the Bitcoin spot ETF, providing investors with a more convenient way to invest, quickly making ETFs the largest group of holders. As of October 8, 2024, global BTC ETFs held over 1.1 million BTC (approximately $68.73 billion), accounting for 5.26% of the total supply; among them, U.S. BTC ETFs held about 928,000 BTC (approximately $57.79 billion), representing 84.13% of the total global BTC ETF holdings.

Table 1: Distribution of ETF Holders

So, who exactly is buying the spot Bitcoin ETFs? The answer can be found in the SEC's (U.S. Securities and Exchange Commission) 13F filings, which reveal the movements of these investors.

02 What is 13F?

The SEC's 13F report (Form 13F) is a quarterly report that requires institutional investors managing over $100 million in assets (such as hedge funds, asset management companies, etc.) to disclose their holdings of U.S. equities, including common stocks, exchange-traded funds (ETFs), convertible bonds, etc., to the U.S. Securities and Exchange Commission (SEC). The submission deadline is within 45 days after the end of each quarter. The primary purpose of 13F is to provide market transparency, allowing investors and regulators to understand the holdings of large institutional investors.

1 Data Overview

Table 2: Comparison of 2024 Q1-Q2 13F Data

2024 Q1 13F

According to the 13F reports submitted to the SEC for the first quarter of 2024, nearly 1,015 institutions held approximately $11.72 billion in Bitcoin spot ETFs. This accounted for about 23.2% of the total U.S. BTC ETF market (including GBTC), with 76.8% of holders being unidentified (non-reporting entities, such as those with assets under $100 million or retail investors).

In the first quarter of 2024, there were 18 institutions holding BTC-related assets exceeding $100 million, 106 institutions holding over $10 million, and 382 institutions holding over $1 million in BTC. A significant portion of the BTC ETF assets held by institutions represents only a small part of their total asset management scale.

Note: In the first quarter of 2024 (as of March 31), Grayscale's GBTC saw outflows of approximately $14.767 billion, while BTC ETFs from BlackRock, Fidelity, Bitwise, etc., had net inflows of approximately $12.132 billion. In total, the ETFs approved in January saw inflows of $26.899 billion. As of the end of the first quarter of 2024, the asset scale of U.S. spot BTC ETFs (including GBTC, excluding ETFs from other countries) reached $50.58 billion.

If we consider the inflow amounts of the several spot BTC ETFs approved in 2024 (from BlackRock, Fidelity, Bitwise, etc.), the proportion of these 1,000 institutions holding will increase, as many institutions are converting GBTC into lower-fee ETFs like IBIT and FBTC.

The nearly 1,015 institutions holding ETFs do not include those with a holding value of 0; some institutions show a holding value of 0, indicating they sold after holding.

2024 Q1 13F

Despite a 12% drop in Bitcoin prices in the second quarter of 2024, institutional investors continued to buy Bitcoin ETFs. According to Bitwise data, a total of 1,100 institutions held $11 billion (although the value of holdings decreased from $11.73 billion in Q1, it actually represents an increase in holdings since BTC dropped over 12% in Q2). The number of institutions grew by 8.37% compared to Q1 (1,015 institutions). In Q2 2024, there were a total of 6,794 institutions with a total market value exceeding $48.66 trillion, meaning nearly 1/6 of the 13F fund institutions held spot Bitcoin ETFs.

Note: In the second quarter of 2024 (as of June 30), Grayscale's GBTC saw outflows of approximately $18.515 billion, while BTC ETFs from BlackRock, Fidelity, Bitwise, etc., had net inflows of approximately $14.522 billion. In total, the ETFs approved in January saw inflows of $33.037 billion. As of the end of the second quarter of 2024, the asset scale of U.S. spot BTC ETFs (including GBTC, excluding ETFs from other countries) reached $50.34 billion.

(The first quarter was $50.58 billion, and the holding scale needs to consider the 12% drop in Bitcoin prices, so the overall is an increase in holdings.)

2 Types of Investors

Many different types of professional institutions hold Bitcoin ETFs, including hedge funds, investment advisors, quant funds, banks, and even state government investment funds. Among the disclosed institutions, hedge funds and investment advisors are the largest holding groups, with investment advisory firms being the most numerous. In the first quarter, over 700 firms held BTC ETFs valued at approximately $3.8 billion, while hedge funds, though only 107 in number, were more concentrated, holding about $4.7 billion. In the second quarter, investment advisors surpassed hedge funds to become the largest holding group.

Bitcoin ETFs have attracted unprecedented interest from professional investors. Bloomberg ETF analyst Eric Balchunas stated that such large-scale investor participation is remarkable for a new ETF. Historically, even the most successful ETFs, such as the gold ETF launched in 2004, raised over $1 billion in just five days, but only 95 professional firms invested in that product at its first 13F filing. In contrast, from the perspective of widespread investor participation, Bitcoin ETFs have achieved historic success.

Eric Balchunas also compiled the institutional holdings of the ten fastest-growing new ETFs in history. Just two quarters after its launch, the Bitcoin ETF has far surpassed other ETFs in both the number of holders and assets under management (AUM).

The only ETF that can be somewhat compared is the Nasdaq-100 QQQs, although this comparison may not be entirely appropriate, as the QQQ ETF was launched in March 1999, but Eric Balchunas only found historical 13F data for Q1 2001 for comparison (which means the data is lagged by nine quarters). Even so, the number of institutional holders of the Bitcoin ETF is still three times that of QQQ.

Table 3: Institutional Holdings Two Quarters After ETF Launch

When comparing Bitcoin spot ETFs with other investments, non-reporting entities are over-investing in Bitcoin spot ETFs. According to NYDIG data, for U.S. stocks like AAPL, the proportion of non-reporting investments is 40.0%, NVDA is 30.0%, and MSFT is 28.7%. Other ETFs, such as SPY at 43.5%, QQQ at 61.8%, GLD at 62.5%, and IAU at 42.2%. Compared to major securities and ETFs, 76.8% of spot BTC ETF holders are retail or non-reporting entities, significantly higher than other investment targets.

Although most Bitcoin ETF investments in Q1 and Q2 of 2024 still came from retail or non-reporting entities, the participation of professional investors may be increasing. This is because professional investors often make small personal allocations before allocating on behalf of clients, wanting to test the waters before going public with their investments. Data shows that the median investor holding Bitcoin ETFs in the second quarter allocated only 0.47% of their portfolio to Bitcoin.

Bitwise has helped professional investors enter the cryptocurrency space over the past seven years and found that most investors follow a fixed pattern when investing in cryptocurrencies: from due diligence and personal testing to widespread allocation among their client base.

The number of professional investors is continuously increasing, as reflected in the number of institutions in Q2: For example, Goldman Sachs did not hold BTC ETFs in its Q1 2024 13F, but its Q2 13F shows it holds $418 million worth of Bitcoin ETFs. Additionally, the Wisconsin Investment Board invested approximately $163 million in Bitcoin ETFs in Q1, followed by the Michigan Retirement System purchasing $6.6 million worth of Bitcoin ETFs in Q2.

03 Changes in 13F Holders

The 13F reports for the first and second quarters of 2024 disclosed nearly a thousand institutions. For brevity, this article only compares the changes among major holders. Detailed information on other institutions can be accessed through the query link on the SEC's official website below.

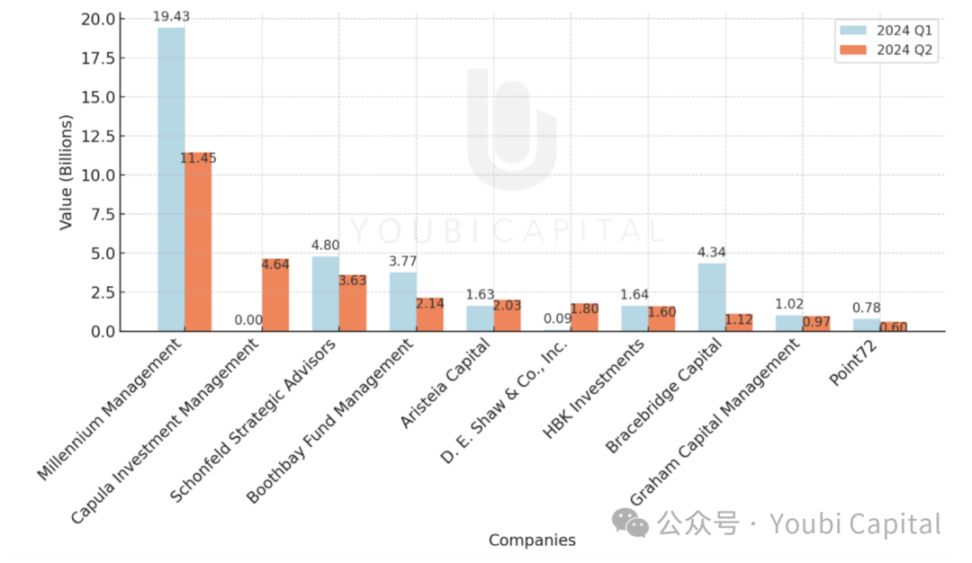

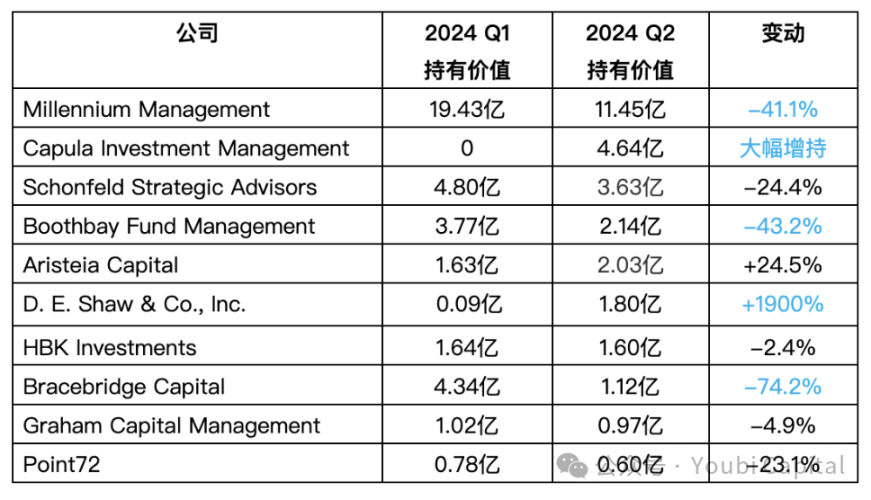

1 Hedge Funds

The largest category of holders in Bitcoin spot ETFs in Q1 2024 was hedge funds, with 107 hedge funds reporting their spot holdings in Bitcoin ETFs, accounting for 9.3% of the total ETF volume, approximately $4.7 billion. Although hedge funds are the largest holding group, these positions may primarily be used for hedging trading strategies rather than complete long investments. For example, these positions may be part of market-making or arbitrage activities. Additionally, hedge fund holdings can change rapidly, and the current level of holdings may have significantly changed since the report was published. In Q2, hedge funds were the second-largest holder group after investment advisors.

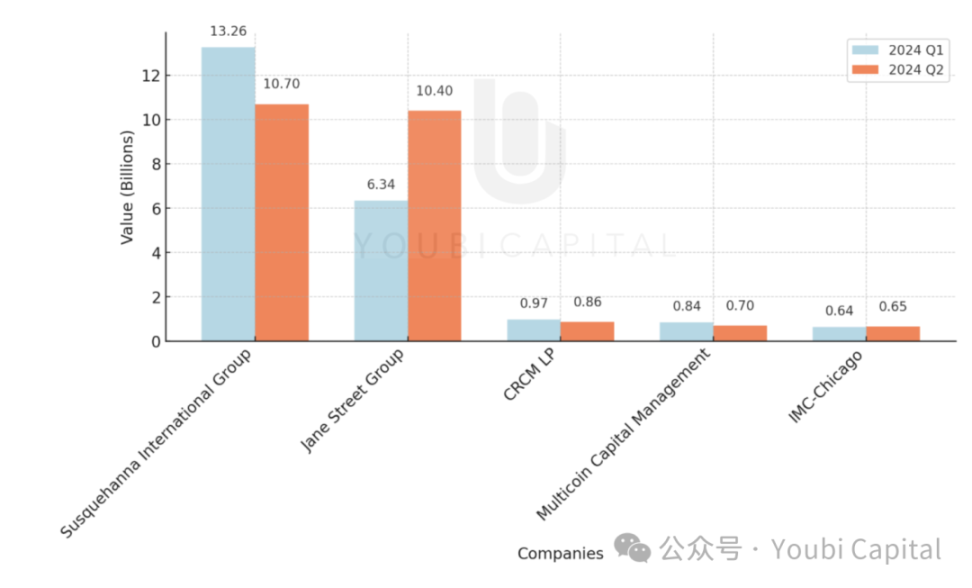

Changes in the Value of Some Hedge Fund Holdings from Q1 to Q2 2024

According to River's statistics, 60% of the 25 largest hedge funds in the U.S. hold Bitcoin ETFs. In the second quarter, most funds continued to increase their holdings. Millennium Management significantly reduced its BTC ETF holdings in Q2, but it remains the largest holder of BTC ETFs.

Note: While the holding value of firms like HBK Investments has changed, the number of BTC ETFs held has not changed; the change in holding value comes from market price fluctuations (BTC dropped 12% in Q2 compared to Q1). The more significant changes in holdings are due to active rebalancing and some from market price fluctuations. For example, Schonfeld Strategic Advisors held 3,735,534 shares of FBTC worth approximately $232 million in Q1. In Q2, it held 3,901,786 shares of FBTC worth approximately $205 million, increasing its holdings by 166,000 shares, but the holding value decreased by $27 million.

Figure 1: Changes in the Value of Some Hedge Fund Holdings

Table 4: Changes in the Value of Some Hedge Fund Holdings

1)Millennium Management (approximately $1.145 billion)

Millennium Management is a global multi-strategy hedge fund based in New York, founded in 1989. It was established by Israeli-American financier Israel Englander and is currently one of the largest hedge funds in the world.

In Q1 2024, the firm held five Bitcoin ETFs with a total value of approximately $1.94 billion, accounting for about 3% of the hedge fund's assets under management. In Q2 2024, it held approximately $1.145 billion in BTC ETFs.

2)Capula Investment Management ($464 million)

Capula Investment Management, the fourth-largest hedge fund in Europe, disclosed that as of June 30, it held $464 million in BlackRock and Fidelity Bitcoin spot ETFs in Q2.

3)Schonfeld Strategic Advisors (approximately $363 million)

Schonfeld Strategic Advisors is a global hedge fund company founded in 1988 and based in New York. The company was initially established by Steven Schonfeld as a proprietary trading firm focused on stock trading and later evolved into a multi-strategy hedge fund management company.

In Q1 2024, Schonfeld held a total of $479 million in BTC ETFs, including $248 million in IBIT and $231.8 million in FBTC. In Q2 2024, it held $363 million.

4)Boothbay Fund Management ($214 million)

Boothbay Fund Management is a hedge fund management company based in New York, founded in 2011 by Ari Glass.

In Q1 2024, the firm invested a total of $377 million in Bitcoin spot ETFs. In Q2 2024, it held $214 million.

5)Aristeia Capital ($203 million)

Aristeia Capital is a hedge fund company based in New York, founded in 1997 by Robert Henry Lynch and Anthony Michael Frascella.

In Q1 2024, it held $163 million in IBIT investments. In Q2 2024, it held $203 million.

6)D. E. Shaw & Co., Inc. ($180 million)

D. E. Shaw & Co., Inc. is a leading global hedge fund and investment management company founded in 1988. It is known for its investment strategies that heavily rely on mathematics, computer science, and quantitative analysis.

In Q1 2024, it held $8.987 million in Bitcoin spot ETFs. In Q2 2024, it held $180 million.

7)HBK Investments ($160 million)

HBK Investments is a hedge fund company based in Dallas, Texas, founded in 1991.

In Q1 2024, it held $164 million in Bitcoin spot ETFs. In Q2 2024, it held $160 million.

8)Bracebridge Capital ($112 million)

Bracebridge Capital is a hedge fund company based in Boston, Massachusetts, founded in 1994 by Nancy Zimmerman and Gabrielle Sulzberger. Bracebridge Capital manages billions of dollars in assets, with clients primarily including university endowments, foundations, family offices, and other institutional investors.

In Q1 2024, it held approximately $434 million in Bitcoin spot ETFs. In Q2 2024, it held $112 million.

9)Graham Capital Management ($97 million)

Graham Capital Management is a hedge fund company focused on global macro and quantitative investment strategies, founded in 1994 and based in Rowayton, Connecticut. The company was founded by Kenneth G. Tropin, a veteran in the hedge fund industry.

In Q1 2024, it held $98.8 million in IBIT investments and $3.8 million in FBTC investments. In Q2 2024, it held $97 million.

10)Point72 ($60 million)

Point72, a hedge fund with $34 billion under the management of billionaire and New York Mets owner Steven Cohen, held $77.58 million worth of Bitcoin spot ETFs as of the end of Q1. In Q2 2024, it held $60 million.

2 Financial Services Companies

Financial services companies are the most diverse group, with most of the reporting entities coming from this sector, including investment consulting, wealth management, and investment banking.

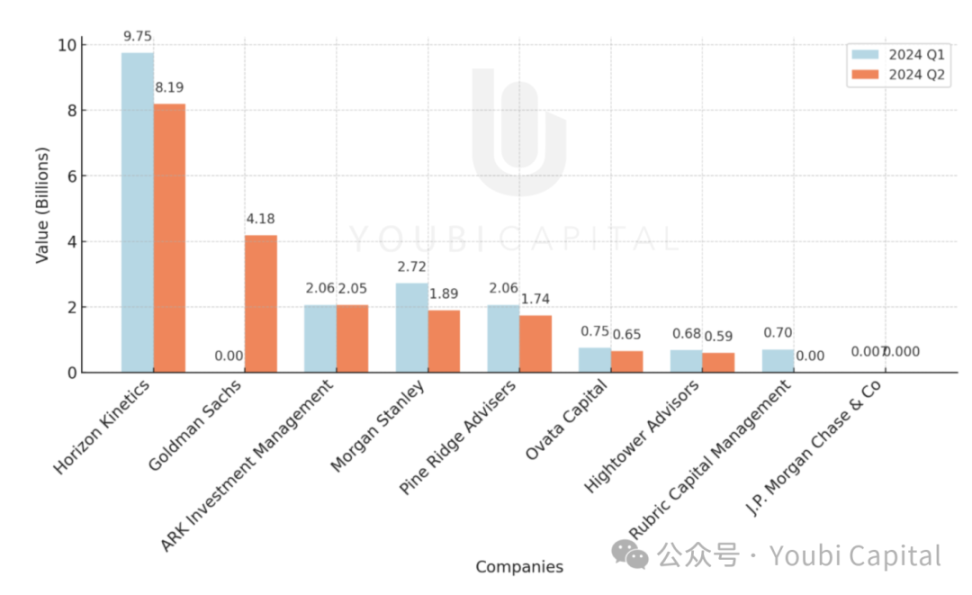

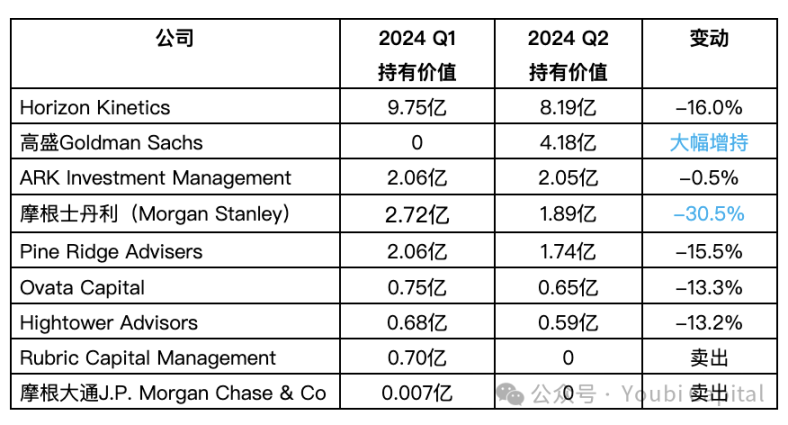

Changes in the Value of Some Financial Services Companies' Holdings from Q1 to Q2 2024

According to River's statistics, 13 of the 25 largest Registered Investment Advisors (RIAs) have ventured into Bitcoin and are gradually increasing their allocation. Many financial services companies have added holdings; for example, Goldman Sachs did not disclose holding BTC ETFs in Q1 2024, but its Q2 13F shows it holds $418 million in Bitcoin spot ETFs, making Goldman Sachs the third-largest holder of IBIT, following hedge fund Millennium Management and the fourth-largest hedge fund in Europe, Capula Investment Management.

Additionally, taking Horizon Kinetics as an example, it held 14,974,187 shares of GBTC worth $946 million in Q1. In Q2, it still held 14,917,448 shares of GBTC worth $794 million. It reduced its GBTC holdings by 0.38%, but the holding value decreased by 16.07%. Most of this was due to market price fluctuations rather than a significant reduction in holdings.

Figure 2: Changes in the Value of Some Financial Services Companies' Holdings

Table 5: Changes in the Value of Some Financial Services Companies' Holdings

1)Horizon Kinetics ($819 million)

Horizon Kinetics is an independent investment advisory firm founded in 1994 and based in New York. The company focuses on long-term, contrarian, and fundamental value investment philosophies, seeking undervalued investment opportunities in non-traditional and inefficient markets. It manages approximately $7 billion in assets.

In Q1 2024, it held a total of $946 million in Grayscale's GBTC, making it the second-largest holder of GBTC (the first being Susquehanna International Group mentioned below). Additionally, it held $29.01 million in IBTC. Horizon Kinetics' holdings in GBTC accounted for 33% of its internet fund assets, indicating a strong belief in Bitcoin's long-term prospects and gaining spot exposure to Bitcoin through GBTC. In Q2 2024, it held $819 million.

2)Pine Ridge Advisers ($174 million)

Pine Ridge Advisers LLC is a financial consulting firm based in New York, founded in 2018. The firm manages approximately $863 million in assets, primarily providing investment consulting and financial planning services to high-net-worth individuals and small businesses.

In Q1 2024, it held $205.8 million in Bitcoin spot ETFs. In Q2 2024, it held $174 million.

3)ARK Investment Management ($205 million)

ARK Invest is an American asset management company founded in 2014 by "Cathie Wood." ARK Invest primarily invests in companies utilizing revolutionary technologies, such as artificial intelligence, genomics, robotics, fintech, blockchain, and 3D printing.

In Q1 2024, it held $206 million in the ARK 21 Shares Bitcoin ETF, one of the first 11 Bitcoin spot ETFs launched. In Q2 2024, it held $205 million.

4)Morgan Stanley ($189 million)

Morgan Stanley is an international financial services company founded in 1935 and headquartered in New York, USA. It offers a variety of financial services, including investment banking, wealth management, asset management, and securities trading.

In Q1 2024, it held $272 million in Bitcoin ETF investments, all invested in Grayscale's GBTC, making it the third-largest holder of GBTC. In Q2 2024, it held $189 million.

5)Ovata Capital Management ($65 million)

Ovata Capital is an asset management company based in Hong Kong, founded in 2017.

In Q1 2024, it held Bitcoin ETFs worth over $75 million. In Q2 2024, it held $65 million.

6)Hightower Advisors ($59 million)

Hightower Advisors is a company providing wealth management and investment advisory services, headquartered in Chicago, USA.

In Q1 2024, it held over $68.34 million in U.S. Bitcoin spot ETFs, while the company manages a total of $122 billion in assets. In Q2 2024, it held $59 million.

7)Rubric Capital Management ($0)

Rubric Capital Management is an investment management company based in the U.S., founded in 2008.

In Q1 2024, it held over $69.709 million in BlackRock's Bitcoin spot ETF. In Q2 2024, it sold off this BTC ETF.

8)J.P. Morgan Chase & Co. ($0)

J.P. Morgan is a financial services company headquartered in New York, founded in 2000, offering a variety of financial services, including investment banking, commercial banking, asset management, and securities trading.

In Q1 2024, it held $731,000 in Bitcoin spot ETFs. In Q2 2024, it sold off this BTC ETF.

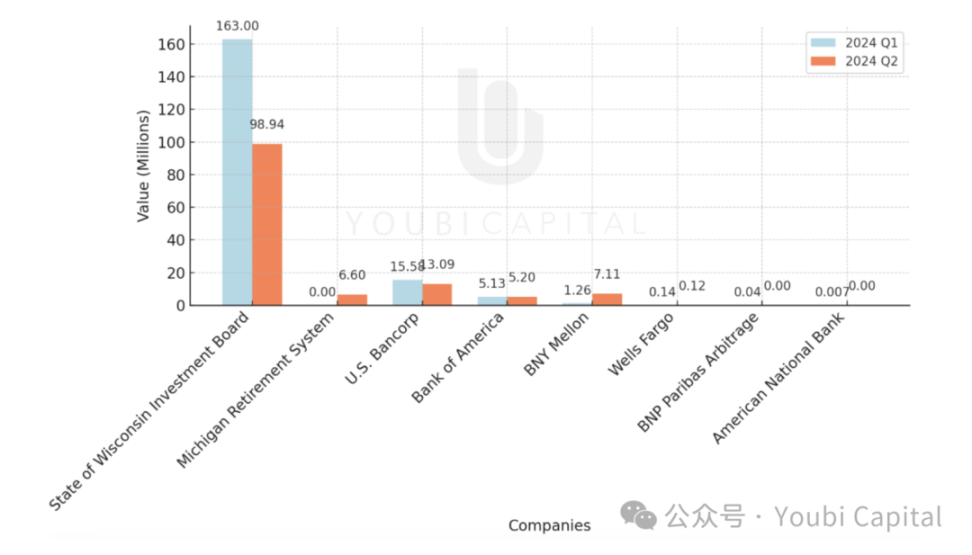

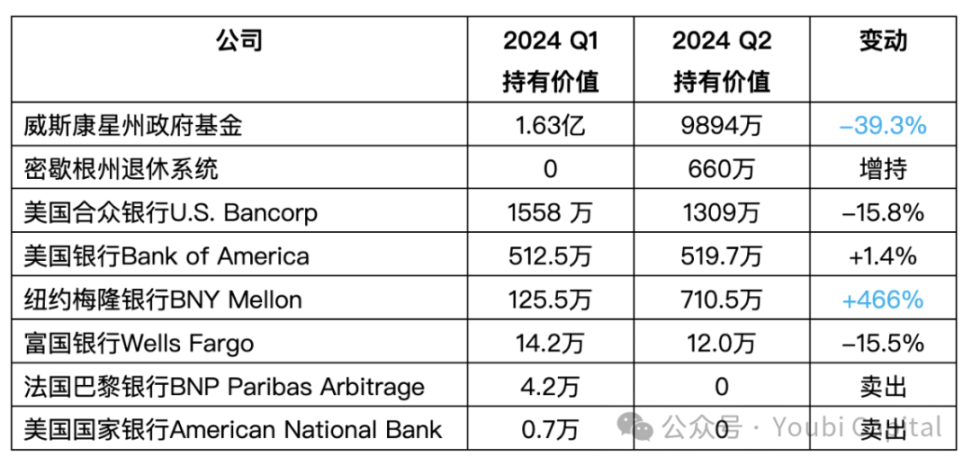

3 State Government Investment Funds, Banks, etc.

In the 13F disclosures, the proportion of BTC ETFs held by banks, such as Bank of America and U.S. Bancorp, is relatively low. Although these institutions manage trillions of dollars in assets, their current participation in this field is almost negligible. However, this also means they have significant growth potential in the future.

The listed holders of BTC ETFs do not necessarily mean they are currently providing trading services to clients. Some are custodians, such as BNY Mellon; others hold only a small portion, like National Bank and BNP PARIBAS, which may be early testing.

Some private banks have begun to offer BTC trading services to clients. For example, in August 2024, Morgan Stanley advisors started offering clients Bitcoin spot ETFs (IBIT and FBTC). According to sources, Wells Fargo may follow Morgan Stanley in providing Bitcoin ETFs to clients. Merrill, a subsidiary of Bank of America Corp., has also begun offering direct investment in Bitcoin ETFs.

On September 4, 2024, Zurich Cantonal Bank, Switzerland's largest state bank and the fourth-largest bank, announced the launch of cryptocurrency services for its retail clients and third-party banks.

Changes in the Value of State Government Investment Funds and Some Banks from Q1 to Q2 2024

Figure 3: Changes in the Value of State Government Investment Funds and Some Banks' Holdings

Table 6: Changes in the Value of State Government Investment Funds and Some Banks' Holdings

1)State of Wisconsin Investment Board ($98.94 million)

The first state government fund in the U.S. to purchase Bitcoin spot ETFs, established in 1951, currently manages over $156 billion in assets according to its website. Its primary responsibility is to manage Wisconsin's retirement systems (such as the Wisconsin Retirement System, WRS) and other state government portfolios.

In Q1 2024, Wisconsin purchased nearly $100 million in BlackRock iShares Bitcoin Trust (IBIT) and $64 million in Grayscale Bitcoin Trust (GBTC).

In Q1 2024, it held a total value of approximately $163 million in Bitcoin spot ETFs.

In Q2 2024, it held a total value of approximately $98.94 million in Bitcoin spot ETFs. Additionally, the Wisconsin Investment Board also holds over 98,000 shares of Coinbase stock worth nearly $21.9 million and 115,000 shares of Marathon Digital stock worth approximately $2.3 million.

2)Michigan Retirement System ($6.6 million)

After the Wisconsin Investment Board invested in Bitcoin ETFs in Q1, the Michigan Retirement System purchased $6.6 million worth of Bitcoin ETFs in Q2.

3)U.S. Bancorp DE ($13.09 million)

U.S. Bancorp is a large commercial bank in the U.S. and one of the top five banks, with over 3,000 branches primarily located in the western and midwestern U.S. Its parent company is U.S. Bancorp, headquartered in Minneapolis, Minnesota.

U.S. Bancorp launched its cryptocurrency custody service in 2021 and previously invested in the security tokenization infrastructure company Ownera. U.S. Bancorp Fund Services, LLC, U.S. Bank N.A., and U.S. Bank Global Fund Services are involved with the ETFs from Valkyrie and Hashdex.

In Q1 2024, it held approximately $15.58 million in Bitcoin spot ETFs. In Q2 2024, it held $13.09 million.

4)BNY Mellon ($7.105 million)

BNY Mellon was established in 2007 through the merger of one of America's oldest banks, The Bank of New York, and Mellon Financial Corporation. Headquartered in New York City, BNY Mellon is one of the largest custodial banks and asset management companies in the world.

BNY Mellon has long been involved in cryptocurrency and digital asset services and has received approval from New York regulators to provide cryptocurrency custody services. BNY Mellon serves as the ETF manager, transfer agent, and cash custodian for ARK 21Shares, Bitwise, Grayscale, Invesco/Galaxy, BlackRock, and Franklin Templeton. Additionally, BNY Mellon is an authorized dealer for Hashdex and can participate in purchasing shares.

According to the 13F filings, in Q1 2024, it held nearly $1.255 million in Bitcoin spot ETFs. In Q2 2024, it held $7.105 million.

5)Bank of America ($5.197 million)

In Q1 2024, it held $5.125 million in Bitcoin spot ETFs. In Q2 2024, it held $5.197 million.

6)Wells Fargo & Co ($1.2 million)

Wells Fargo, the fourth-largest bank in the U.S. (with total assets of approximately $1.88 trillion), held $142,000 in Bitcoin spot ETFs in Q1 2024. In Q2 2024, it held $120,000.

7)BNP Paribas Arbitrage, SA ($0)

BNP Paribas Arbitrage, SA is a subsidiary of BNP Paribas, specializing in arbitrage trading and market-neutral strategies. In Q1 2024, it held approximately 1,000 shares of IBIT (worth about $42,000). In Q2 2024, it sold off this ETF.

8)American National Bank ($0)

American National Bank has approximately $637 million in assets under management. In Q1 2024, it held 100 shares of ARKB (worth about $7,000), and in Q2 2024, it sold off this ETF.

4 Other Countries' Private Banks

Standard Chartered's virtual banking subsidiary Mox announced in August 2024 the launch of cryptocurrency ETF services, becoming the first bank of its kind to offer direct trading of spot Bitcoin and Ethereum ETFs on its platform. The bank also plans to expand its cryptocurrency products, including future direct purchases and trading of crypto assets in collaboration with licensed exchanges.

Julius Baer Group has been providing digital asset services since 2020 and expanded its crypto business to Dubai in 2023.

Itaú Unibanco, Brazil's largest private bank, launched cryptocurrency trading services in December 2023.

BBVA, a Swiss private bank, announced in November 2023 the expansion of its partnership with digital asset custody and tokenization provider Metaco. BBVA Switzerland became the first major bank in the Eurozone to offer cryptocurrency custody and trading services to individual clients.

Santander International Private Banking is part of the Spanish financial services giant Banco Santander. In November 2023, it began offering trading and investment services for major cryptocurrencies Bitcoin and Ethereum to high-net-worth clients in Switzerland.

Banco Galicia, Argentina's largest private bank, began offering Bitcoin and Ethereum trading to clients in May 2022. According to the Central Bank of Argentina, one reason for the popularity of cryptocurrencies in Argentina is that the country has one of the highest inflation rates in the world.

DBS Group, Southeast Asia's largest bank, announced in May 2021 that its private banking division offers crypto trust services. This means high-net-worth clients can store Bitcoin (BTC) and Ethereum (ETH) at the bank. DBS Private Bank claims this is the first bank-supported trust service in Asia.

Bordier & Cie, a Swiss private bank, partnered with digital asset bank Sygnum in February 2021 to provide cryptocurrency trading services to clients. Bordier & Cie is a private bank based in Geneva, founded in 1884 and owned and managed by the Bordier family for five generations.

Maerki Baumann, a Swiss private bank, announced in June 2020 that it would begin offering cryptocurrency trading and custody services to its clients after receiving approval from the Swiss Financial Market Supervisory Authority (FINMA). Maerki Baumann, headquartered in Zurich, is the second bank in Switzerland to accept cryptocurrency assets.

Banco Sella, an Italian bank, launched its own Bitcoin trading service in March 2020, allowing its clients to buy, sell, and store Bitcoin through the Hype platform.

5 Other Types (Quantitative, Market Making, etc.)

Changes in the Value of Holdings of Some Other Types of Companies from Q1 to Q2 2024

Multicoin Capital Management held 1,321,808 shares of GBTC worth $84 million in Q1 2024. In Q2 2024, it still held 1,321,808 shares of GBTC, valued at $70 million. This was also due to market price fluctuations, resulting in a 16.67% decrease in holding value despite the number of shares remaining unchanged.

Figure 4: Changes in the Value of Holdings of Some Other Types

Table 7: Changes in the Value of Holdings of Some Other Types

1)Susquehanna International Group ($1.07 billion)

The parent company of Susquehanna International Group is SIG Holdings, LLC, abbreviated as SIG, which translates to Susquehanna International Group. Susquehanna International Group, LLP (SIG) was founded in 1987 and is headquartered in Bala Cynwyd, Pennsylvania, focusing primarily on quantitative trading and market making.

In Q1 2024, it held nine Bitcoin spot ETFs worth approximately $1.326 billion. The largest holding was Grayscale's GBTC, with a total purchase of 17.27 million shares valued at up to $1.09 billion, making it the largest holder of Grayscale GBTC. The company's total investment scale is approximately $57.59 billion, so Bitcoin ETFs are just a small part of it. In Q2 2024, it held $1.07 billion.

2)Jane Street Group ($1.04 billion)

Jane Street Group is a leading global quantitative trading firm headquartered in New York, USA, founded in 2000.

In Q1 2024, it held approximately $634 million in Bitcoin spot ETFs. In Q2 2024, it held $1.04 billion.

3)CRCM LP ($86 million)

CRCM LP is a company focused on venture capital, primarily investing in startups and early-stage growth companies. In Q1 2024, it held approximately $96.67 million in Bitcoin spot ETFs. In Q2 2024, it held $86 million.

4)Multicoin Capital Management ($70 million)

Multicoin Capital Management is an investment firm focused on the blockchain and cryptocurrency sectors. Founded in 2017 and headquartered in Austin, Texas, USA.

In Q1 2024, it held approximately $83.5 million in Bitcoin spot ETFs. In Q2 2024, it held $70 million.

5)IMC-Chicago ($65 million)

IMC-Chicago is a quantitative trading firm that focuses on algorithmic trading and market making. In Q1 2024, it held approximately $64.14 million in Bitcoin spot ETFs. In Q2 2024, it held $65 million.

6 Family Offices

The number of family offices optimistic about cryptocurrencies is also on the rise. According to Citibank's "2024 Global Family Office Survey," the number of family offices optimistic about cryptocurrencies doubled this year from 8% last year to 17%.

The report indicates that regardless of the size of assets under management, family offices have a similar level of interest in digital assets, with direct cryptocurrency investments and cryptocurrency-related investment funds being their top priorities. Large family offices show greater interest in tokenized real-world assets (RWA), with 11% holding cryptocurrency exposure, while the proportion for small family offices is 3%.

The Asia-Pacific region is leading in digital asset adoption, with 37% of family offices investing in or interested in investing in digital assets. Family offices in Latin America show the least interest, with 83% not prioritizing allocations to digital assets.

……… etc., the details of each company's holdings can be checked on the SEC's official website as mentioned in the last chapter.

04 Global BTC Holding Distribution

1 Global BTC ETF Fund Data

As of October 8, 2024, 28 Bitcoin ETF funds hold over 1.1 million Bitcoins, valued at approximately $68.7 billion.

Table 8: Global BTC ETF Distribution

2 Global Distribution of BTC Holdings by Companies, Governments, etc.

According to Bitcointreasuries data, as of October 8, 2024, 42 publicly traded companies hold 363,827 Bitcoins (accounting for 1.73% of the total supply), valued at $22.659 billion. Compared to $7.2 billion a year ago, the value of these Bitcoin holdings has increased by nearly 214%.

Governments hold approximately 529,365 Bitcoins (accounting for 2.52% of the total supply), valued at $32.968 billion. Private companies hold approximately 359,638 Bitcoins (accounting for 1.7% of the total supply), valued at $22.398 billion.

Note: Publicly traded companies typically disclose the number of Bitcoins they hold in their annual reports (10-K forms) or quarterly reports (10-Q forms), as this may impact the company's financial condition. In these reports, companies disclose information such as their balance sheets and cash flow statements, which may include the number and value of held cryptocurrencies.

Table 9: Publicly Traded Companies Holding BTC

Table 10: Governments Holding BTC

Table 11: Private Companies Holding BTC

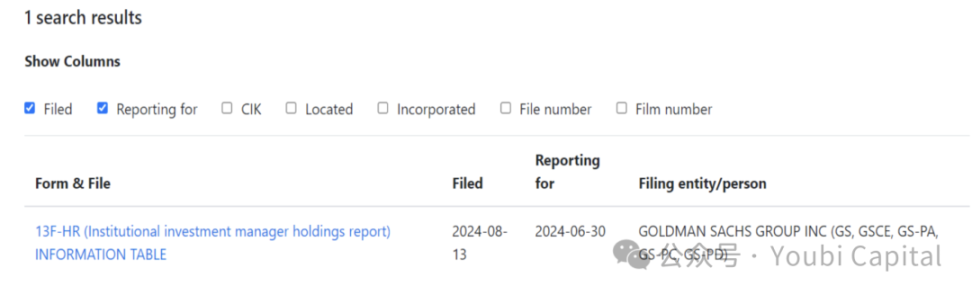

05 Query Process for Company 13F Filings

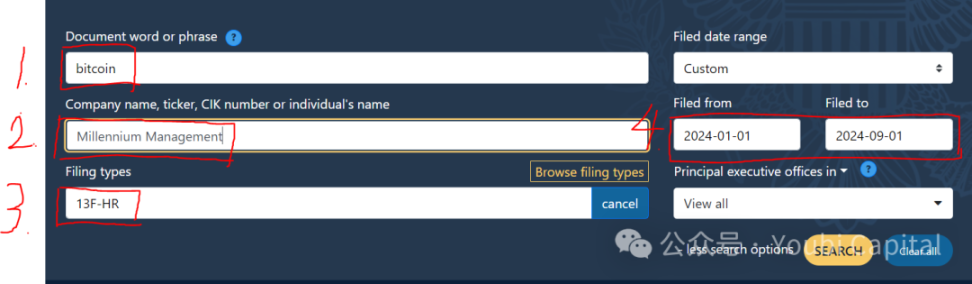

If you need to find out whether a company has disclosed its holdings and how much BTC ETF it holds in its 13F filings, you can follow these steps:

Open the SEC 13F website:

https://www.sec.gov/edgar/search/?utmsource=flows.heyapollo.com&utmmedium=referral&utm_campaign=fidelity-s-firehose-hong-kong-etfs-next-week#/q=bitcoin&dateRange=custom&category=custom&startdt=2024-01-01&enddt=2024-09-01&forms=13F-HR

1. Enter the keyword: Bitcoin

2. Enter the company name: For example, Millennium Management

3. Select the file type: 13F-HR

4. Select the date: From 2024-01-01 to 2024-09-01**

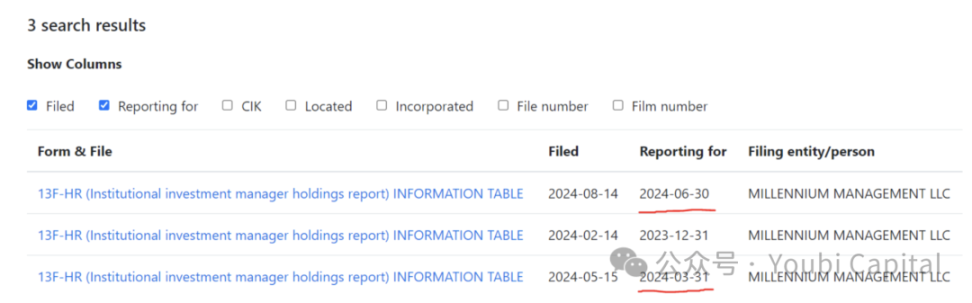

5. Click search: Taking Millennium Management's Q2 13F as an example, the search results are as follows, with a total of 3. The report for 2024-06-30 is the 13F for Q2 2024, while the Q1 2024 13F is for 2024-03-31.

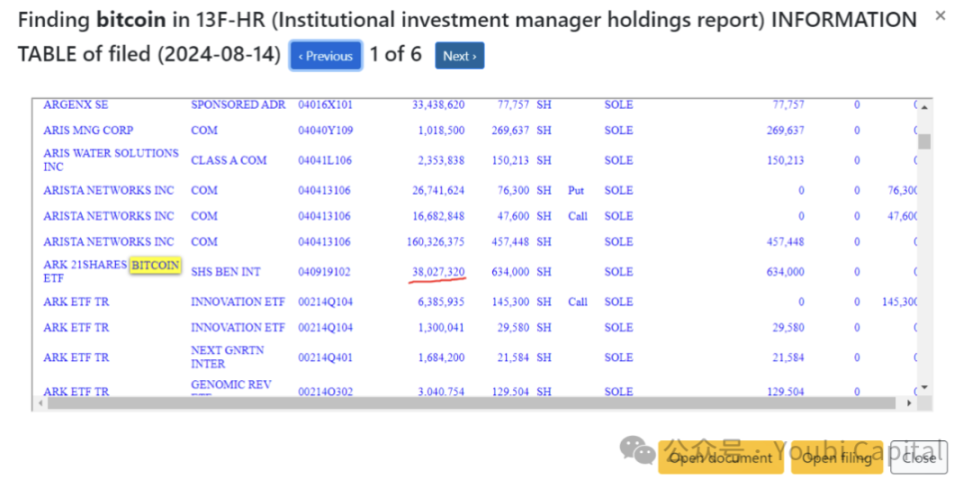

6. Click on the first file to see the following interface: The first occurrence of the keyword Bitcoin indicates that Millennium Management holds ARK's BTC ETF, valued at approximately $38 million.

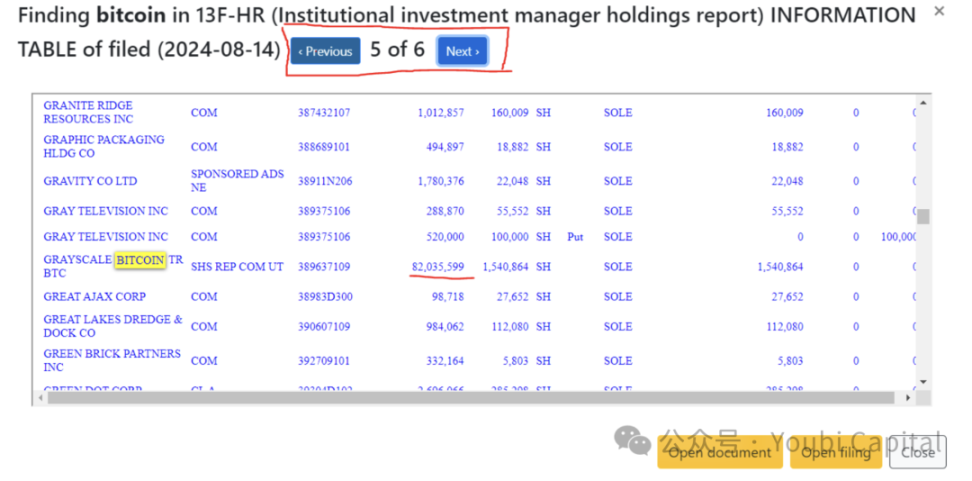

7. The file contains a total of 6 occurrences of the keyword Bitcoin, and by clicking Next, you can see that it also holds ETFs issued by BITWISE, FIDELITY, etc. Overall, in Q2 2024, Millennium Management held BTC ETFs valued at approximately $1.145 billion.

8. Similarly, you can check the first quarter or other companies' 13F disclosures regarding BTC ETF holdings.

For example, you can see that in Q1 2024, Millennium Management held BTC ETFs worth a total of $1.942 billion, while in Q2 it held $1.145 billion, representing a reduction of about 41.1%. You can replace the company name with Goldman Sachs, which did not hold BTC in its Q1 2024 13F, but in the Q2 13F (as of June 30), it held Bitcoin ETFs worth $418 million.

References

Bitcoin ETF Investors: Full List of Institutional BTC Fund Holders in 13F Filings

https://www.ccn.com/news/crypto/bitcoin-etf-holders-list-btc-investors-sec-13f-filing/

Bitcoin Treasuries

https://treasuries.bitbo.io/

Research Weekly - Answering the ETF Ownership Question

https://nydig.com/research/answering-the-etf-ownership-question

Who’s Buying Bitcoin ETFs (According to 13F Filings)

https://experts.bitwiseinvestments.com/cio-memos/whos-buying-bitcoin-etfs-according-to-13f-filings

Bitwise: Bitcoin ETFs Are Achieving Institutional Adoption Faster Than Any ETF in History

https://x.com/Matt_Hougan/status/1826258117115740605

River: The holding status of BTC ETFs by top hedge funds and RIAs (Registered Investment Advisors).

https://x.com/macromule/status/1825564790489579902

Q2 13F Filings Reveal Continued Institutional Demand for Bitcoin ETFs

https://www.21shares.com/en-us/blog/institutional-interest-reaches-high-q2-13f-filings-demand-bitcoin-etfs

Global BTC ETF Holdings https://x.com/HODL15Capital/status/1825202502679085102

Number of Institutions in 13F

https://global.finance.sina.com.cn/clues/13f/

Global Bitcoin ETF Holdings Exceed 1 Million, What Are the Major Holding Institutions?

https://www.panewslab.com/zh/articledetails/coa4n5sq4sva.html

Complete List of 1,000 Bitcoin Spot ETF Buyers: Total Investment Exceeds $11.5 Billion, Hedge Funds Dominate

https://www.chaincatcher.com/article/2129025

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。