The TVL of Aptos DeFi is growing rapidly, with new projects emerging one after another, currently still a relatively low-competition blue ocean.

Written by: Alex Liu, Foresight News

I wrote an article in June this year titled "Gold Mining Manual | Aptos Ecosystem Airdrop, How to Layout for Multiple Gains?" because "as a public chain with a total financing of $350 million, 4 out of the top 5 protocols in Aptos ecosystem TVL have not yet issued tokens."

A quarter has passed, and the total locked value (TVL) of DeFi on the Aptos chain has experienced rapid growth, while several potential protocols have been launched. Currently, Sui is highly popular, overshadowing other public chains, but Aptos, as one of the Move twins, has also been active recently in terms of token price and ecosystem, deserving more attention. Lurking in the current blue ocean of the Aptos ecosystem, where competition is low, may yield unexpected rewards.

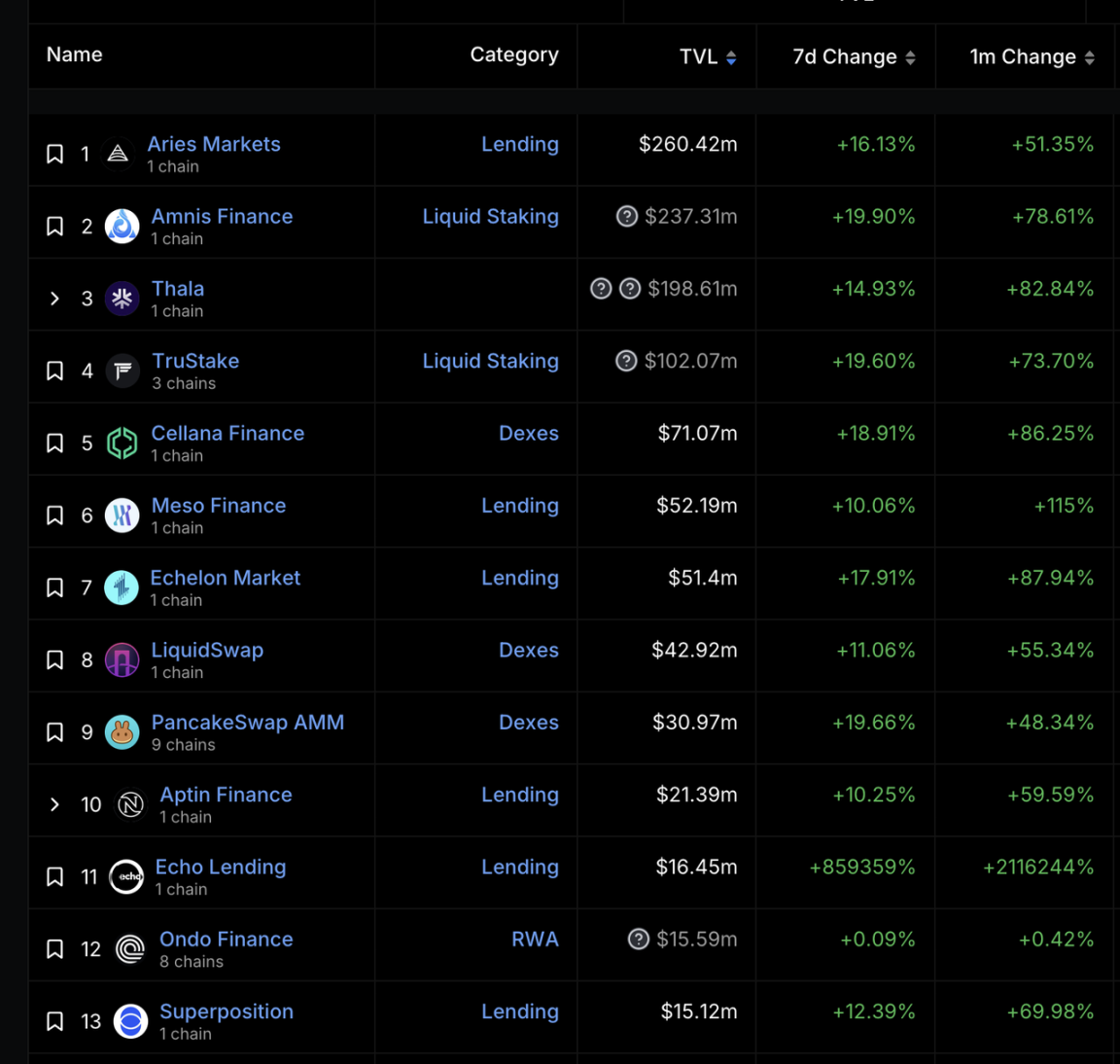

Aptos Ecosystem Protocol TVL Ranking, Data: DeFiLlama

The above image shows the potential protocols with high TVL in the Aptos ecosystem, among which Aries Markets, Amnis Finance, Cellana Finance, Echelon Market, and LiquidSwap were mentioned in the June article. This article mainly focuses on interaction opportunities with new protocols.

Meso & TruStake & Panora

Meso Finance achieved over 100% TVL growth last month, becoming the second-largest lending protocol by TVL on Aptos.

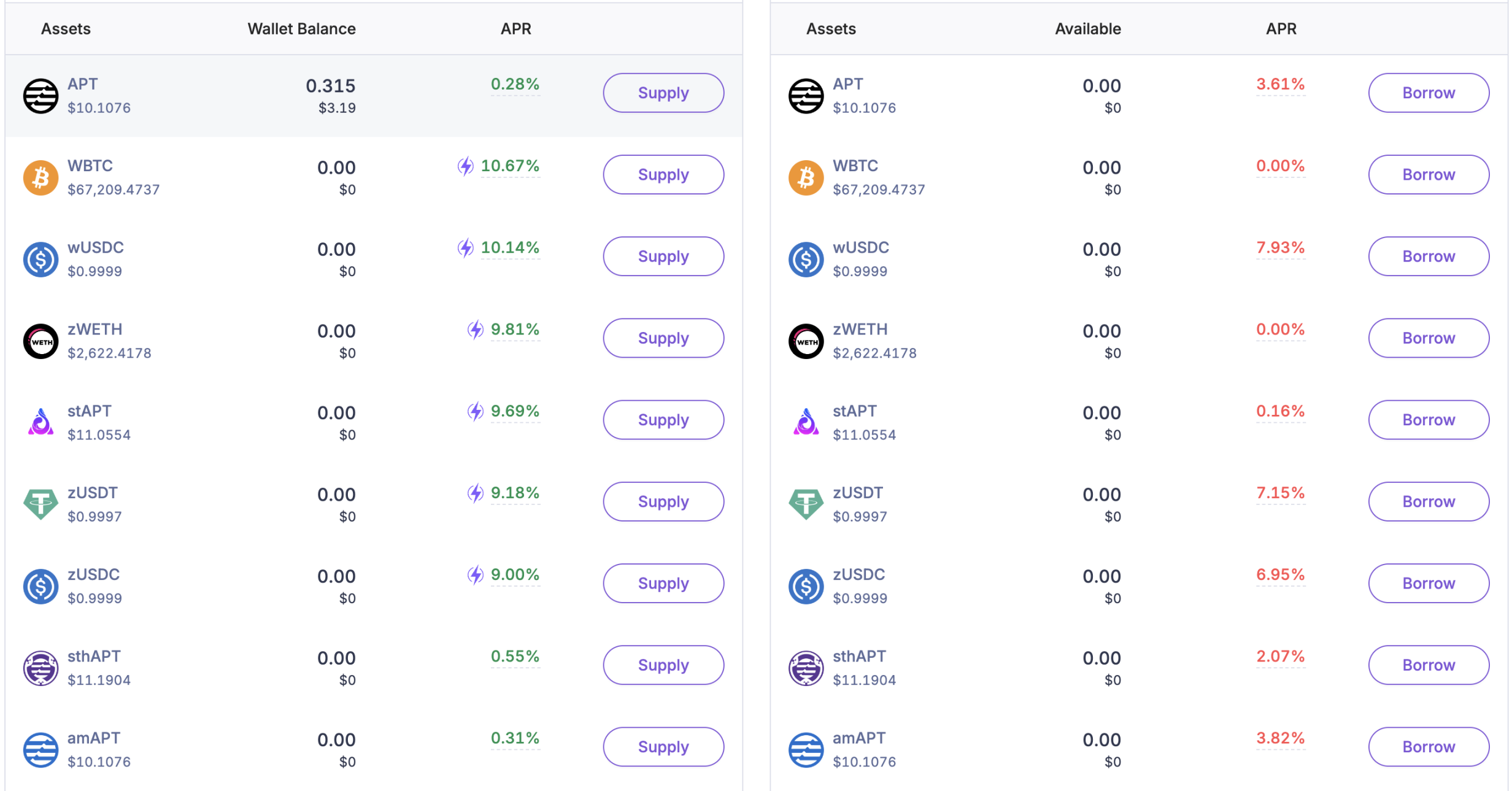

The protocol has received subsidies from the Aptos Foundation, and depositing specific tokens can earn APT token incentives, with overall annualized returns being quite good.

Currently, there is a points system where every $1 asset deposited earns 1 point per day, and every $1 asset borrowed earns 3 points per day (stAPT, which is Amnis's liquid staking token, has a 1.2x points multiplier for both deposits and loans).

It is noted that Meso Finance can also deposit TruAPT (the only lending protocol currently supporting this asset), allowing for multiple gains while interacting with TruStake, a protocol that has jumped into the top five in Aptos TVL but remains relatively unknown.

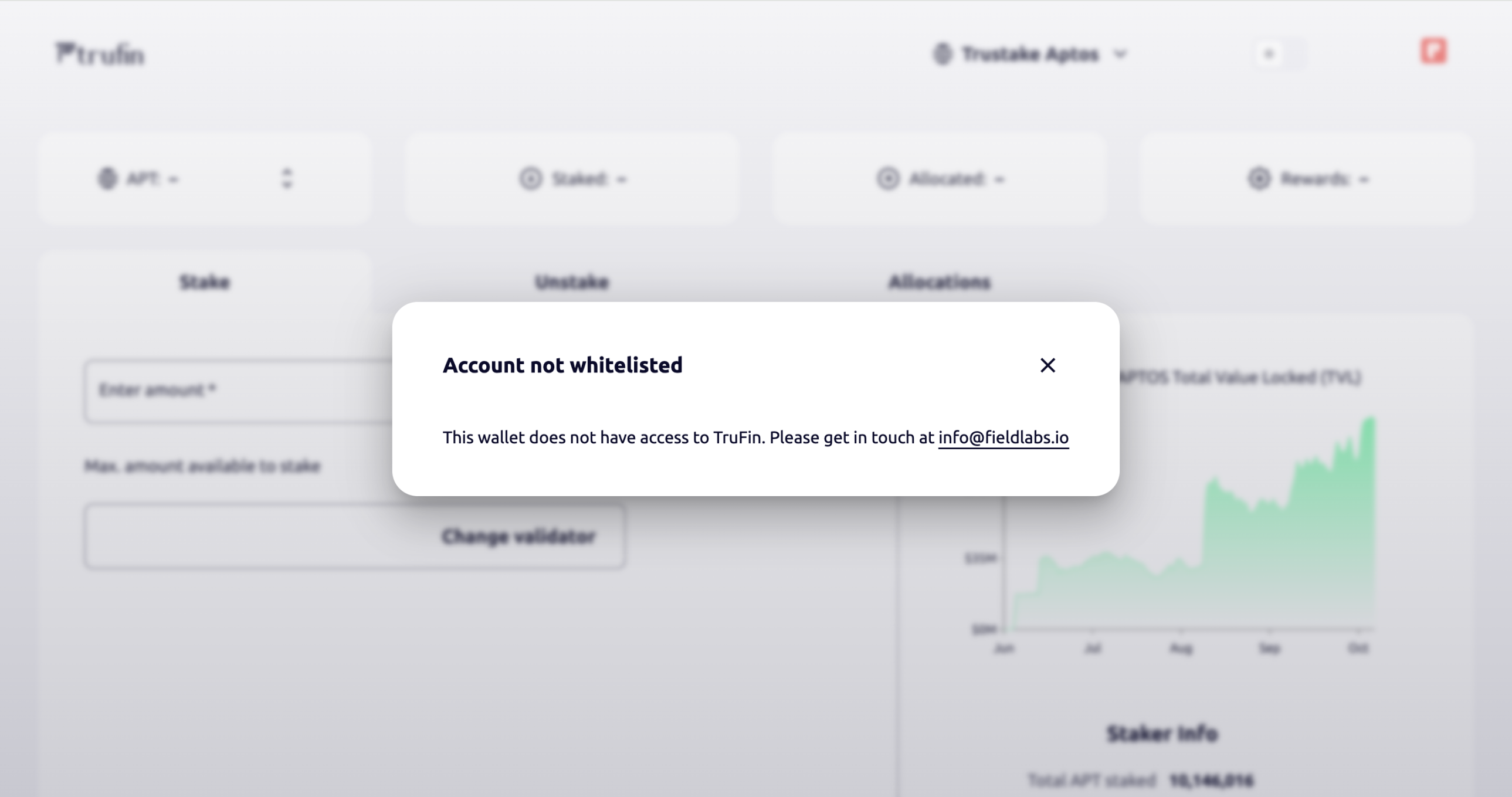

However, TruStake mainly serves institutional clients, and regular accounts are not whitelisted and cannot be used.

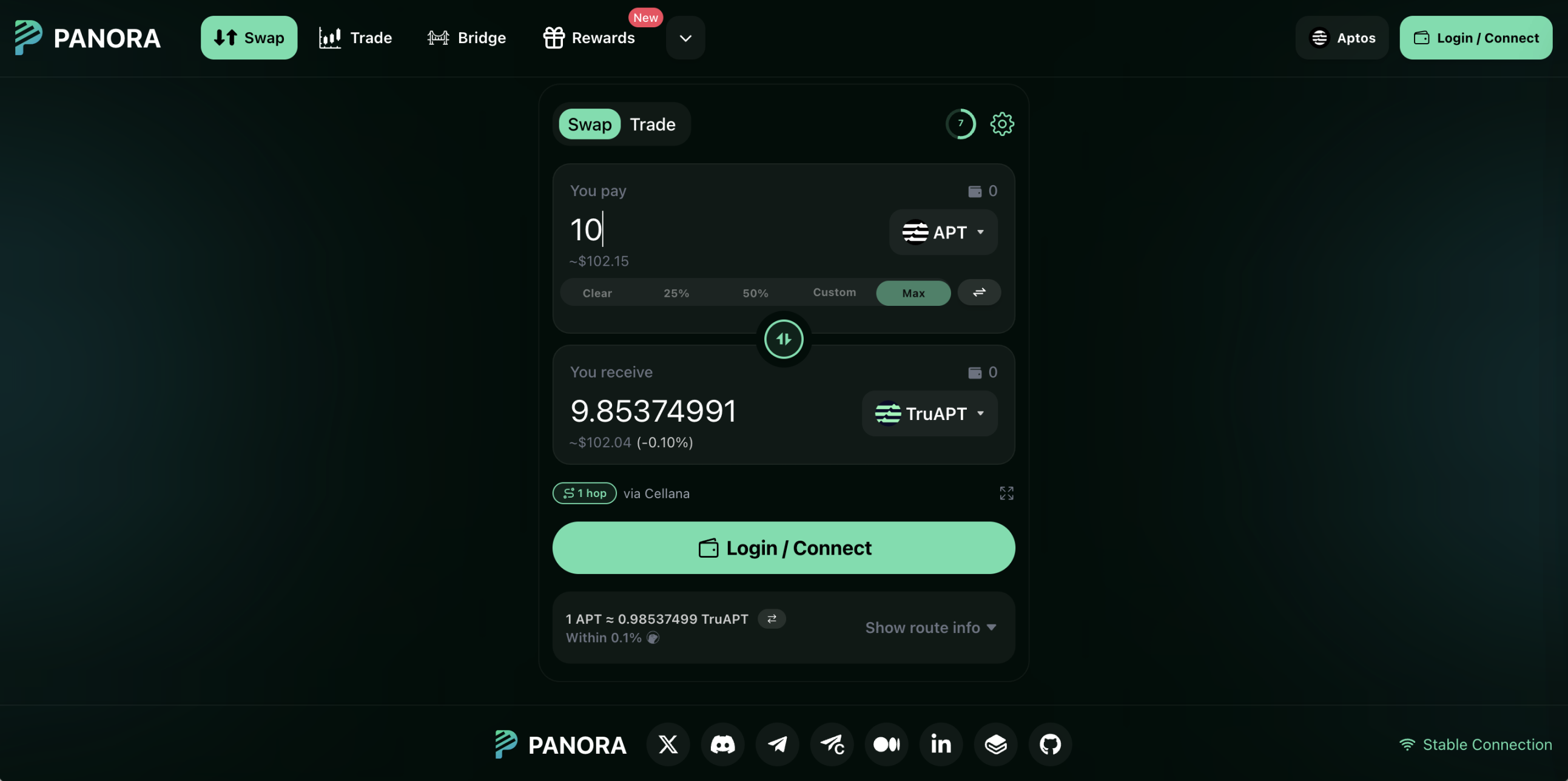

So what can we do? We can use the aggregator Panora to directly obtain TruAPT through Swap. Panora itself is not a DEX, so it does not appear in the TVL rankings, but it has become the most commonly used Swap aggregator in the Aptos ecosystem and has good airdrop expectations, making it worth interacting with.

It is noted that Meso also offers around 10% returns for mainstream assets like BTC and ETH (mainly composed of APT token incentives), which may be a good place to idle those assets. And the BTC earning opportunities on Aptos are not limited to this.

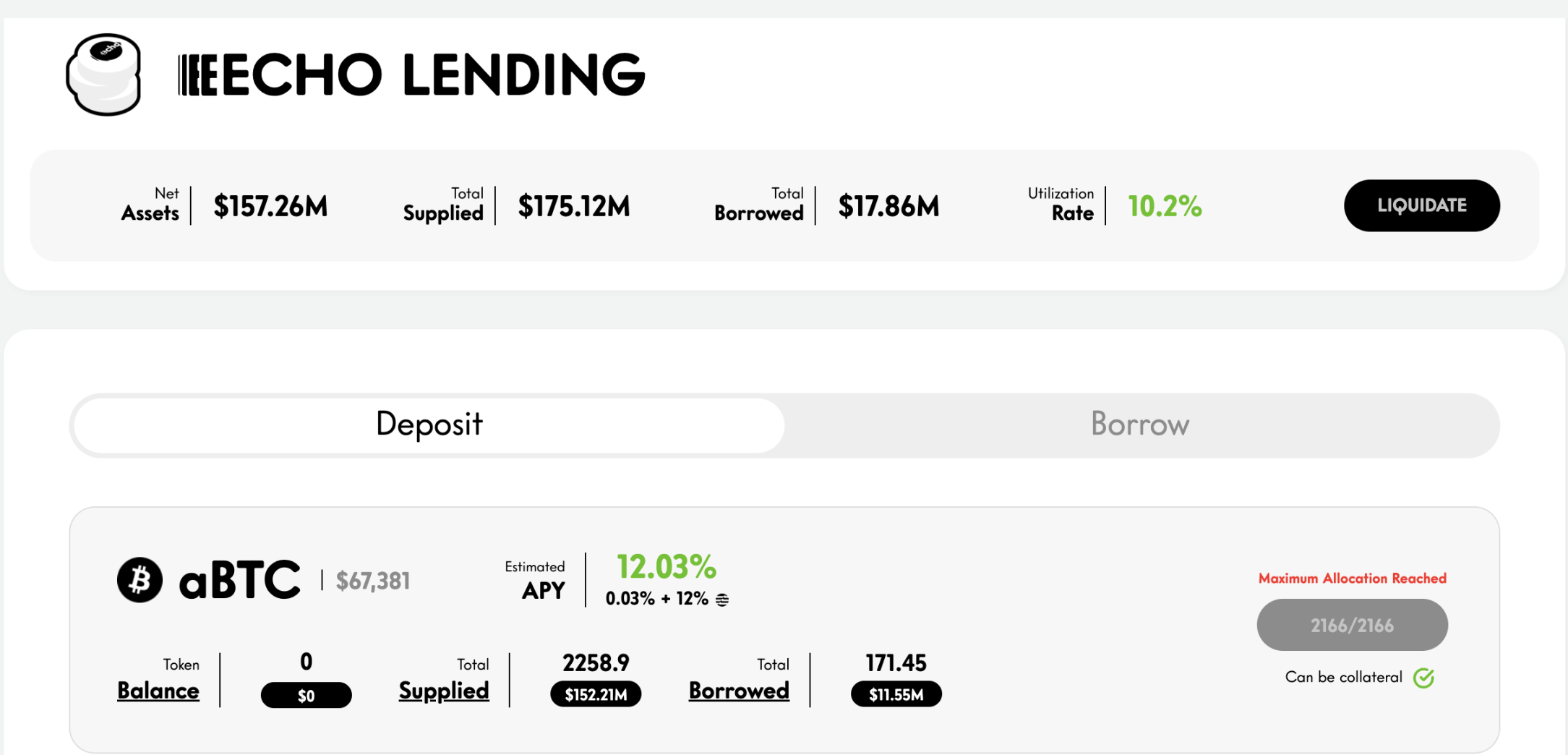

Echo Lending

Although Echo's TVL shows over $16 million on DeFiLlama, according to its website, the amount of Bitcoin deposited in Echo has reached 2,166 BTC, with a TVL of $157 million.

The project has received endorsement from the Aptos official and has established a partnership with the Aptos Foundation, allowing deposits of BTC to earn 12% annualized APT token returns (currently fully subscribed). The project also plans to launch products like eAPT and APT re-staking.

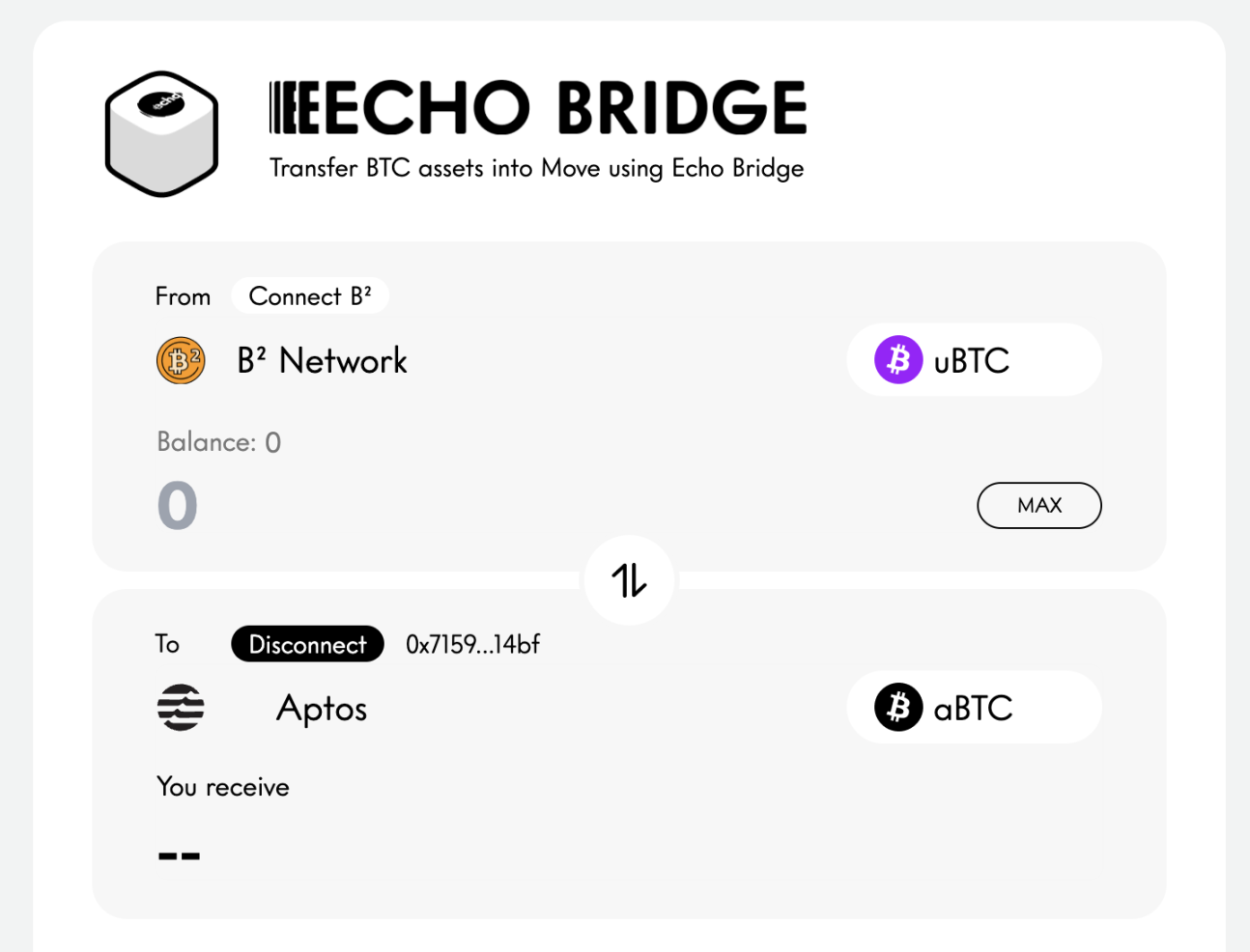

To obtain aBTC supported by Echo on Aptos, you need to cross-chain uBTC from B Square. Depositing BTC in Echo can also generate points for B Square.

Superposition

Superposition is also a new dark horse lending protocol on Aptos. With so many lending protocols, what advantages does Superposition have?

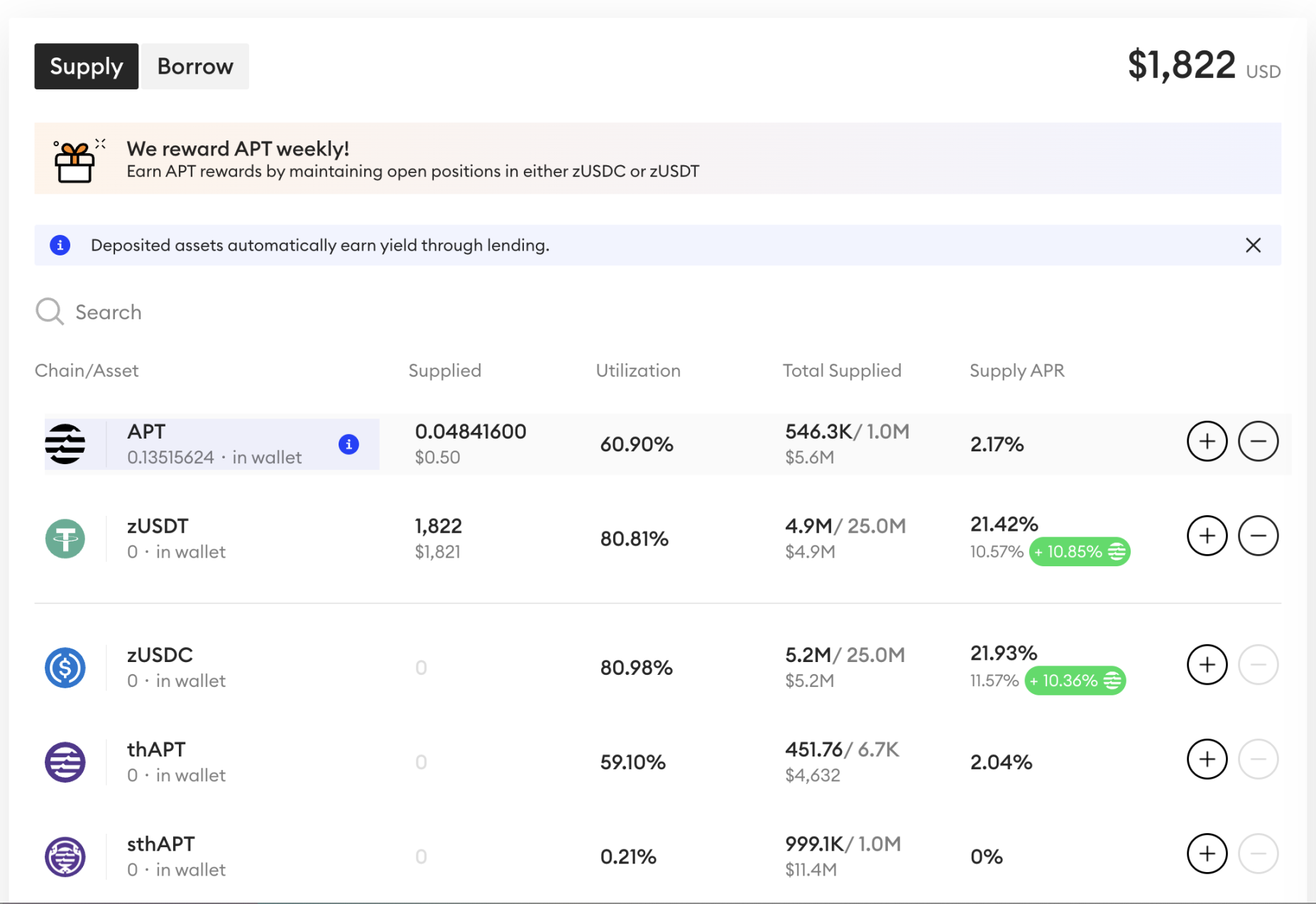

Superposition offers the highest annualized returns on stablecoins!

Currently, zUSDC and zUSDT (USDC and USDT bridged via LayerZero) have annualized returns exceeding 20%! (composed of interest and APT incentives). APT token incentives are distributed weekly, directly deposited into your lending position.

Superposition also has a points activity, where every $1 asset deposited earns 1 point per day, and every $1 asset borrowed earns 2 points per day.

Tip: You can deposit zUSDT in Meso and borrow zUSDC (or deposit zUSDC and borrow zUSDT) to deposit in Superposition, gaining higher returns through circular lending while earning points from both projects, and the number of points earned from borrowing is higher.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。