As expectations rise for a rate cut at the November FOMC meeting, traders have entered a risk-on mode, pushing the crypto market higher.

The CME FedWatch Tool shows a 94% probability of a 25 basis point rate cut on November 7, up from 80% last week. At the close of the U.S. stock market, the S&P 500, Dow Jones, and Nasdaq indices all rose, increasing by 0.47%, 0.79%, and 0.28%, respectively.

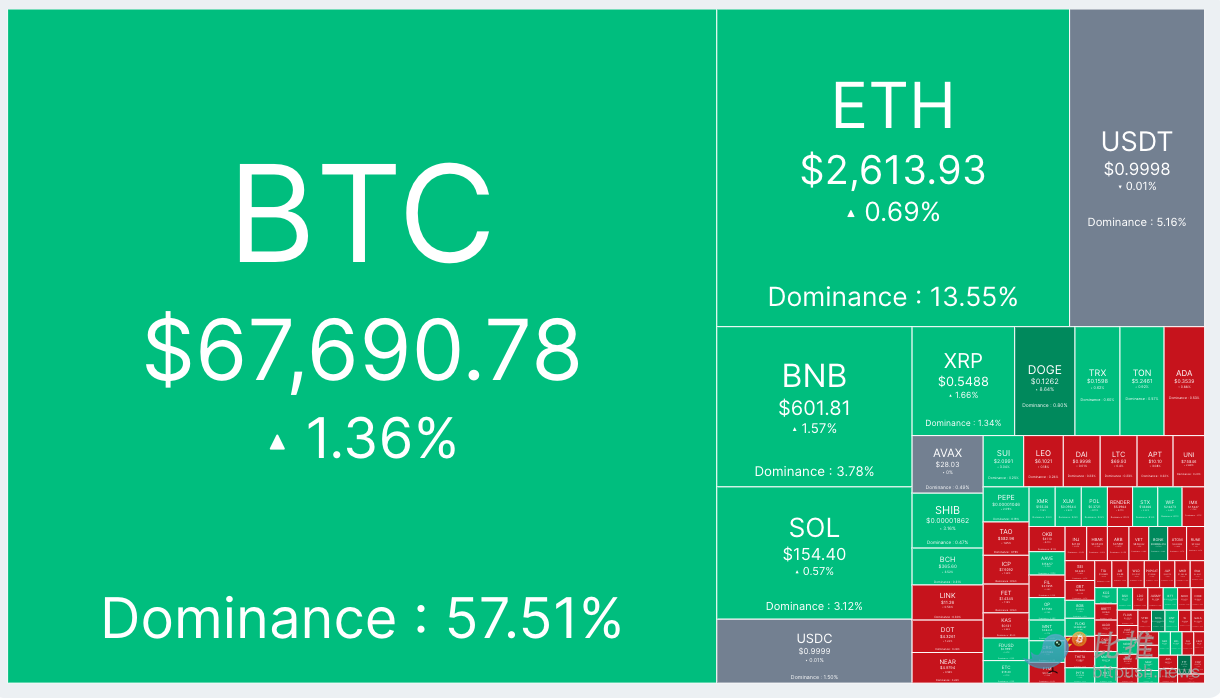

According to Bitpush data, Bitcoin bulls surged to a monthly high of $68,400 on the same day. As of the time of writing, Bitcoin's trading price has retreated to $67,690, with a 24-hour increase of 1.36%.

The altcoin market showed mixed results, with FTX Token (FTT) performing the best among the top 200 tokens by market capitalization, rising by 14.4%, followed by Dogecoin (DOGE) and Scroll (SCR), which increased by 10.8% and 8.1%, respectively. BinaryX (BNX) fell by 12%, leading the decline, while Popcat (POPCAT) dropped by 9.1%, and Memecoin (MEME) decreased by 9%.

The overall market capitalization of cryptocurrencies is currently $2.32 trillion, with Bitcoin's market share at 57.7%.

Warning Signals of Potential Correction

Some experts believe the market may experience a correction in the short term as retail investors begin to exhibit FOMO.

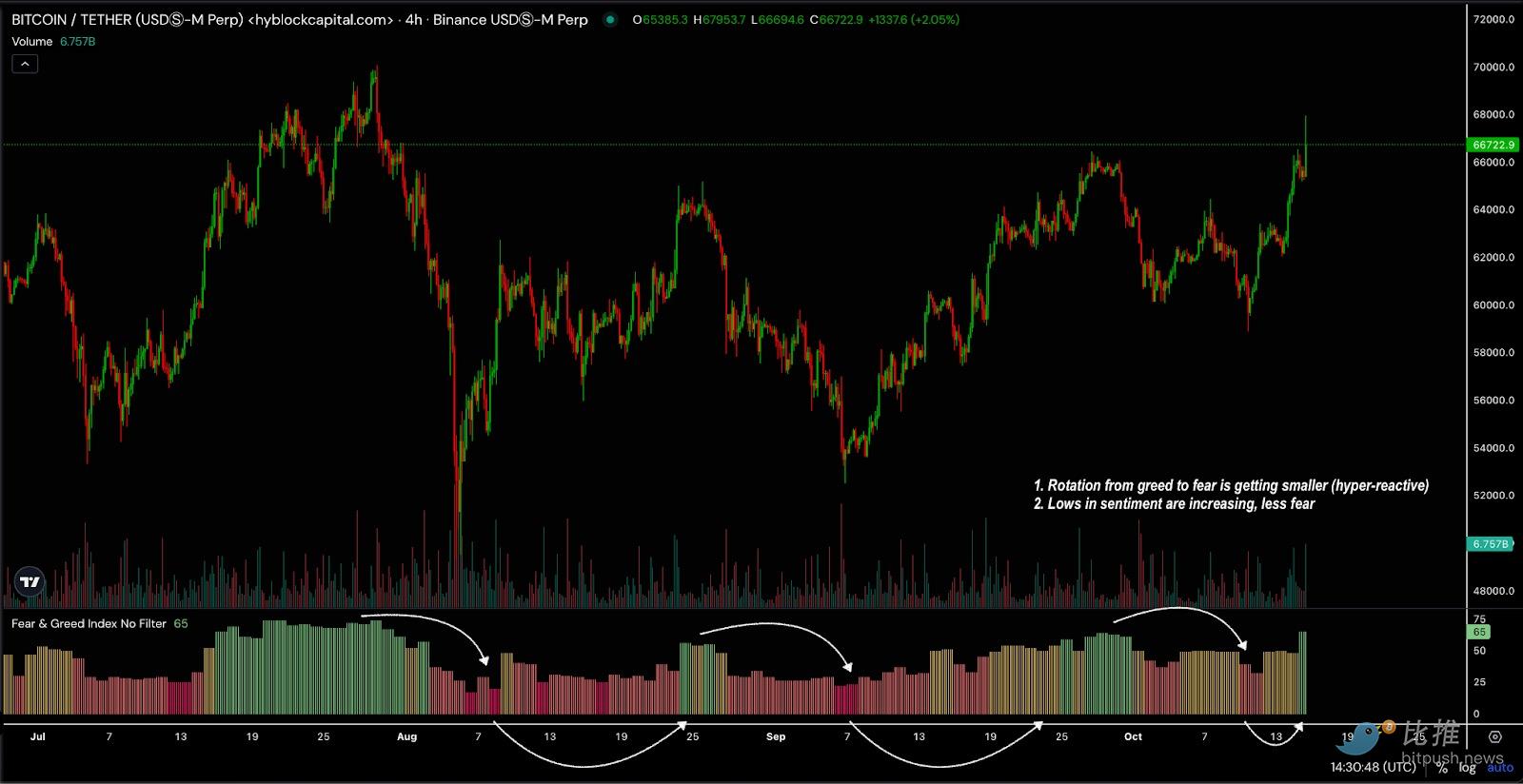

Shubh Varma, co-founder and CEO of Hyblock Capital, stated, "As the Fear and Greed Index shows, the current market sentiment is sending key signals that cannot be ignored. Firstly, the fluctuations between fear and greed are becoming more frequent, with shorter intervals. This narrowing indicates that uncertainty remains high, and the market is highly sensitive to even the smallest triggering factors."

Additionally, Varma noted, "On the retail side, the proportion of retail bulls is now close to a low level, with less than 40% of Binance BTC accounts in long positions. This indicator fluctuates between 0 and 100 but typically remains within a narrower range, making the current low reading even more significant."

He explained, "When the participation of retail investors in long positions reaches such low levels, the likelihood of a reversal increases. Historically, when this indicator reverses from low to high, it indicates that retail traders are entering long positions en masse—this is often a bearish signal. Retail investors tend to be on the wrong side of the market, and their shift from short to long often marks a local top. When they enter long positions in large numbers, the market tends to reverse downward. If this trend follows its usual pattern, we will soon see a correction aimed at catching retail investors off guard again."

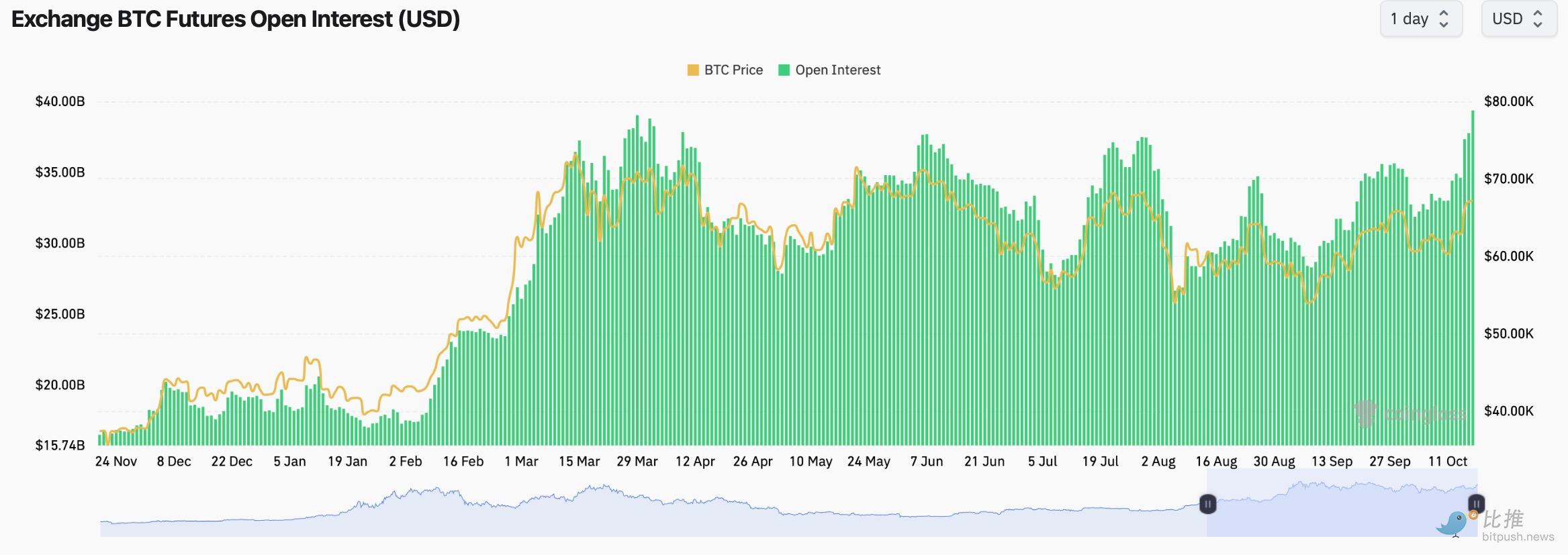

According to CoinGlass data, on October 16, Bitcoin's open interest (OI) reached $39.36 billion, setting a new high for the year and surpassing the peak of $38.8 billion set on April 1, 2024.

Varma emphasized that Bitcoin's open interest (OI) (the total number of outstanding derivative contracts that have not been settled) has reached "historical resistance levels, and a corrective move may be imminent to clear long positions." He stated, "A price drop followed by a decrease in OI could confirm this correction."

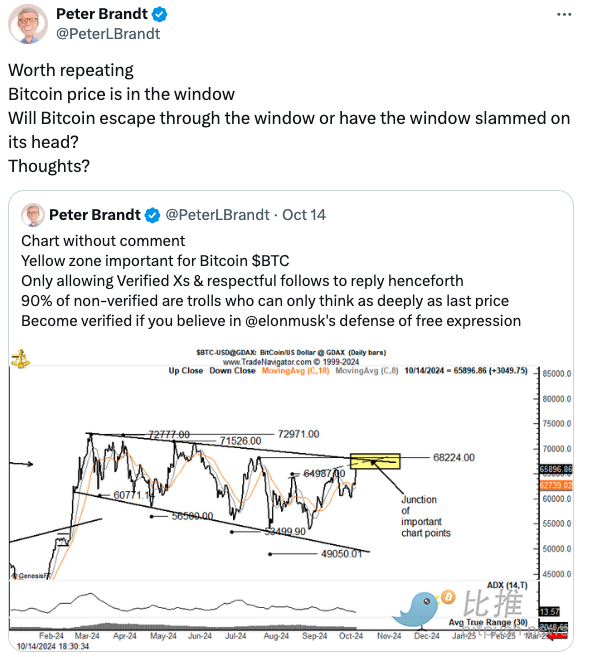

Veteran trader Peter Brandt indicated that Bitcoin's price may experience two-way fluctuations. He stated on the X platform, "Bitcoin's price is in a window period; will Bitcoin break upward or face downward pressure?"

Meanwhile, independent trader BitQuant believes that after breaking through $70,000, Bitcoin may enter a long-term consolidation between $95,000 and $75,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。