In June 2024, the number of monthly active mobile cryptocurrency wallet users reached a historic high of 29 million.

Written by: Daren Matsuoka, Robert Hackett, Eddy Lazzarin

Translated by: 1912212.eth, Foresight News

7 Key Points:

- Cryptocurrency activity and usage reached an all-time high

- Cryptocurrency has become an important political issue ahead of the U.S. elections

- Stablecoins have found product-market fit (PMF)

- Infrastructure improvements have increased throughput and significantly reduced transaction costs

- DeFi remains popular and continues to grow

- Cryptocurrency is expected to address some of AI's most pressing challenges

- More scalable infrastructure unlocks new on-chain applications

Cryptocurrency Activity and Usage Reached an All-Time High

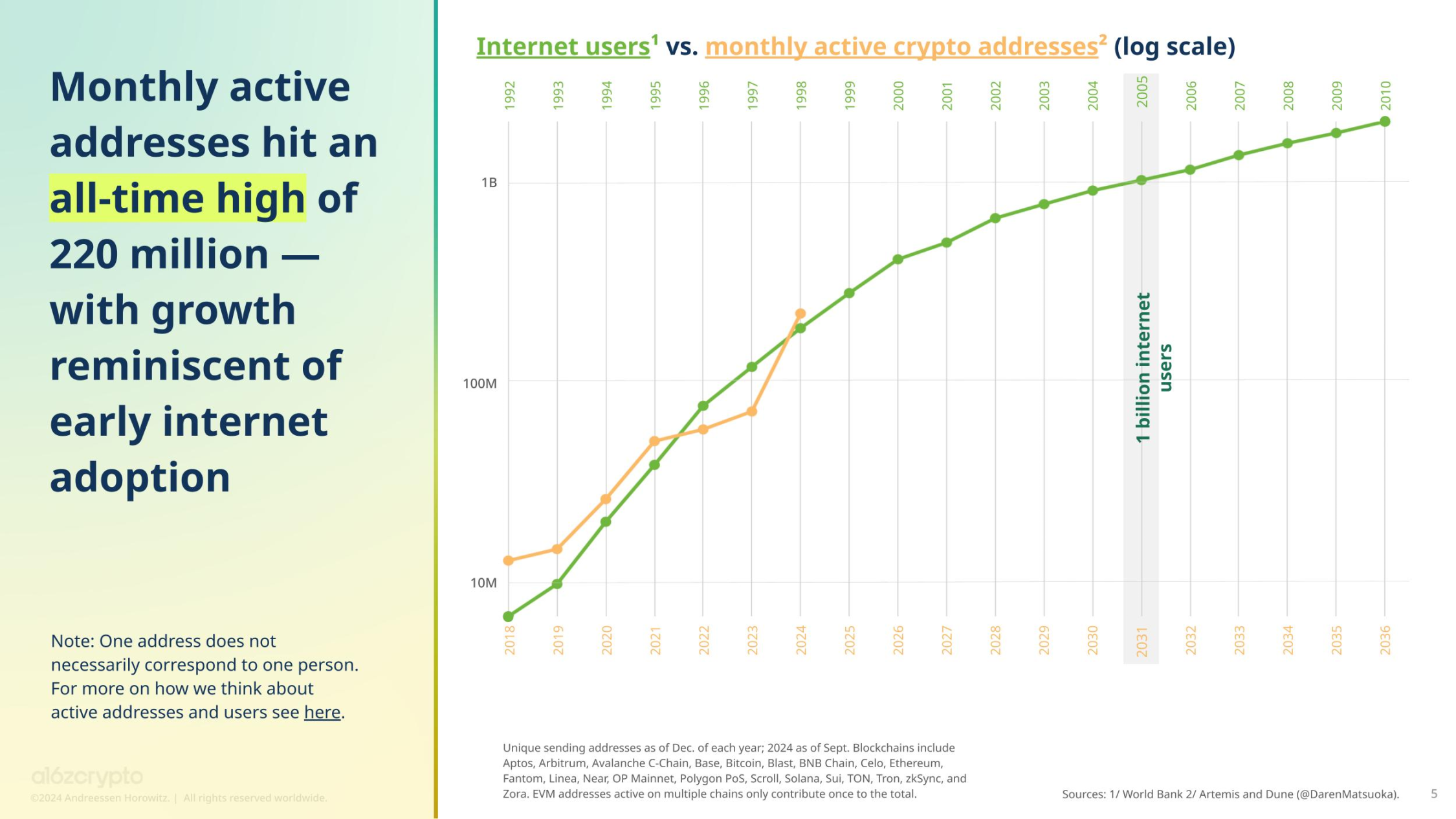

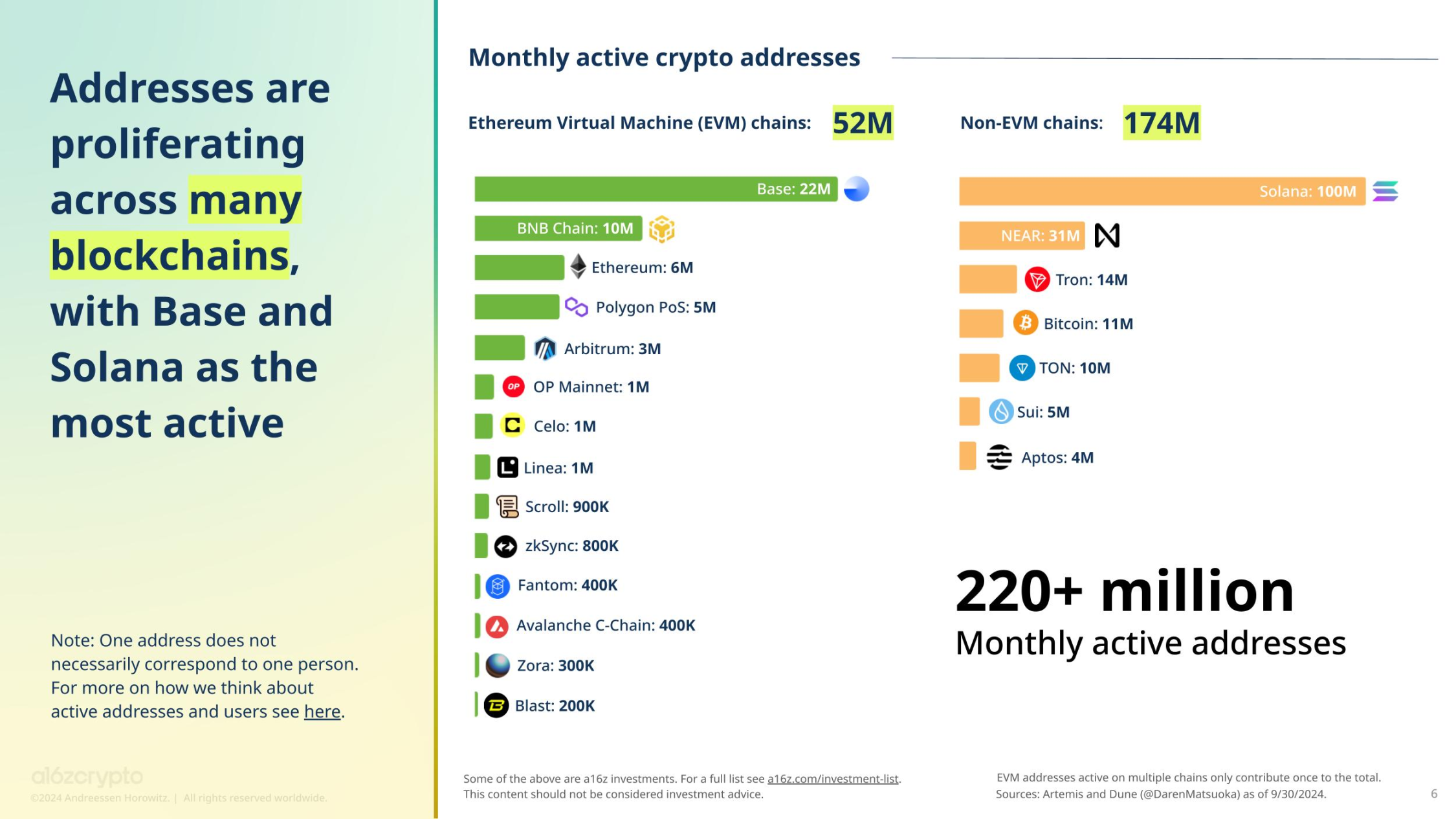

Never before have there been so many monthly active cryptocurrency addresses. In September 2024, there were 220 million addresses that interacted with the chain at least once, more than tripling since the end of 2023. (As a metric, active addresses are less susceptible to manipulation than other measures.)

The surge in activity is primarily attributed to Solana, which has about 100 million active addresses. Following Solana are NEAR (31 million active addresses), Coinbase's Layer 2 network Base (22 million), Tron (14 million), and Bitcoin (11 million). Among Ethereum Virtual Machine (EVM) chains, the most active chain after Base is Binance's BNB Chain (10 million), followed by Ethereum (6 million). (Note: To calculate the total of 220 million, active addresses on EVM chains are deduplicated by public key.)

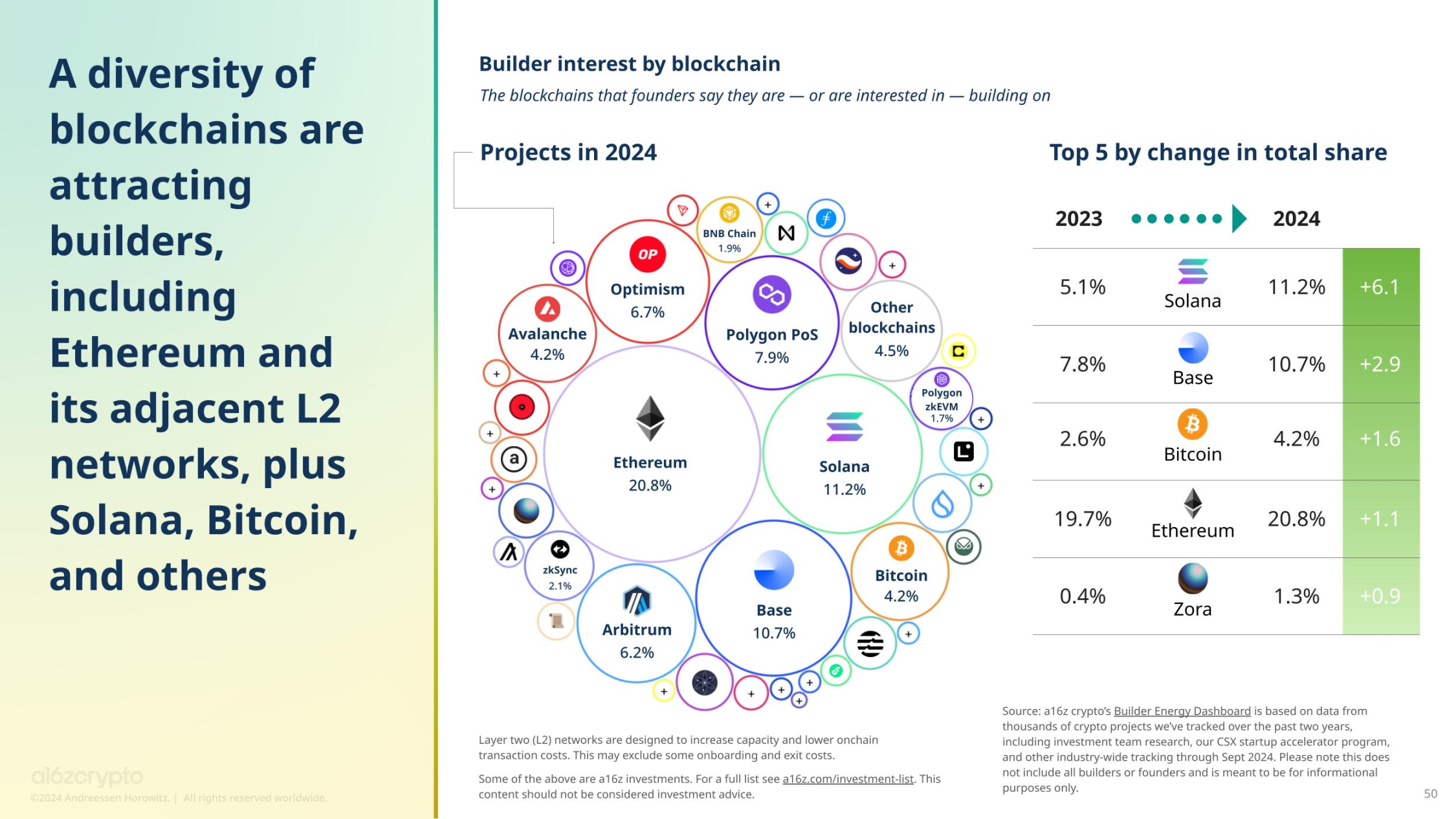

These trends are also reflected in our developer activity dashboard. The largest change in the total share of developer interest is seen in Solana. Specifically, the data shows that the total share of founders currently building or interested in building on Solana increased from 5.1% last year to 11.2% this year. Base follows closely, with its share rising from 7.8% last year to 10.7%, while Bitcoin increased from 2.6% last year to 4.2%.

In absolute terms, Ethereum still attracts the most developer interest, with a total share of 20.8%, followed by Solana and Base. Next are Polygon (7.9%), Optimism (6.7%), Arbitrum (6.2%), Avalanche (4.2%), and Bitcoin (4.2%).

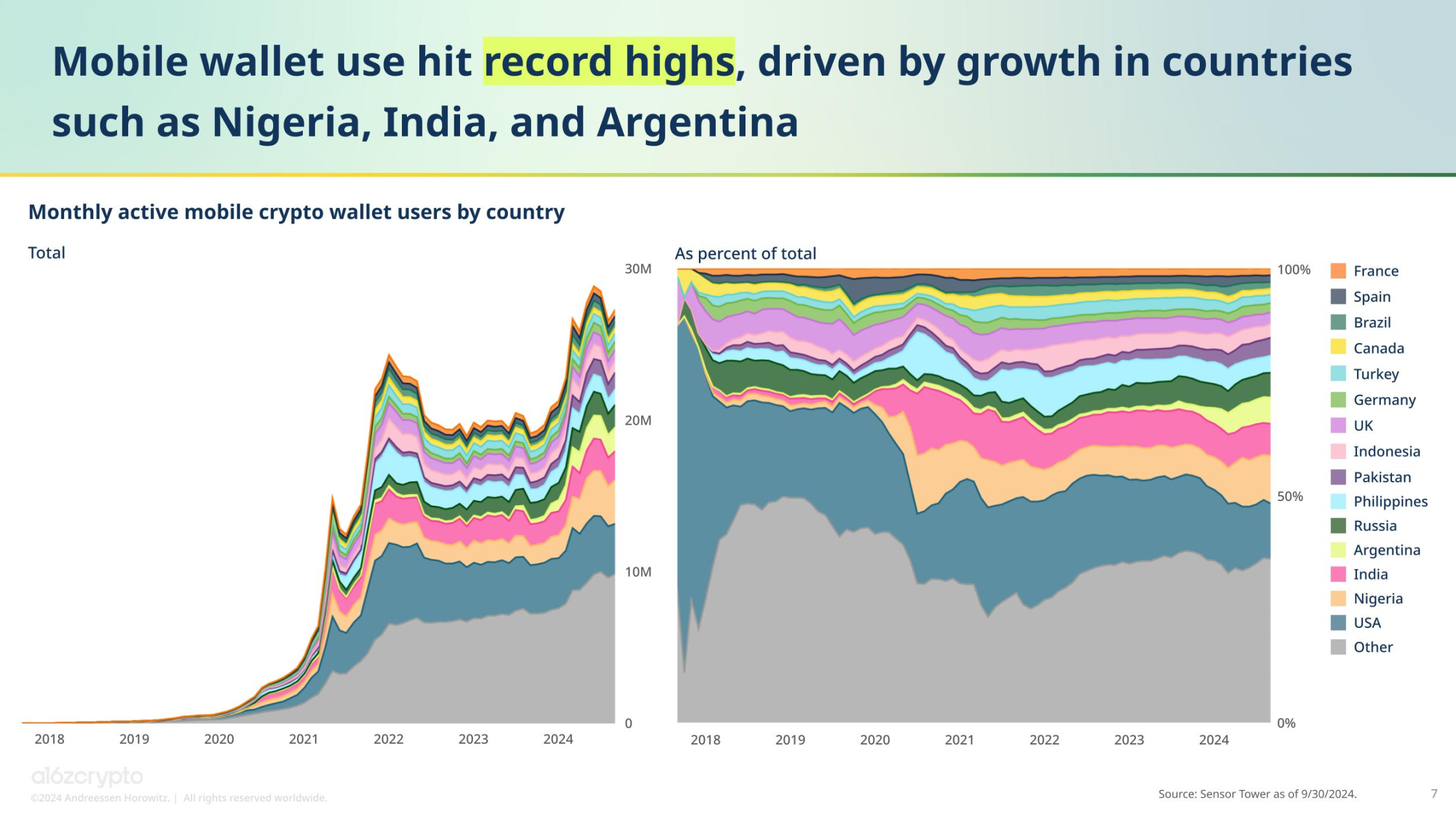

Meanwhile, in June 2024, the number of monthly active mobile cryptocurrency wallet users reached a historic high of 29 million. While the U.S. accounted for the largest share of monthly active mobile wallet users (12%), the share of the U.S. in the total user base has declined in recent years due to the global adoption of cryptocurrency and an increasing number of projects avoiding U.S. regulations through geographic blocking.

The influence of cryptocurrency continues to expand globally. After the U.S., countries with significant shares of mobile wallet users include Nigeria (which has provided regulatory clarity through measures such as regulatory incubation projects and has seen significant growth in consumer use cases like bill payments and retail purchases), India (with a booming population and high mobile phone penetration), and Argentina (where many residents have turned to cryptocurrency, especially stablecoins, due to currency devaluation).

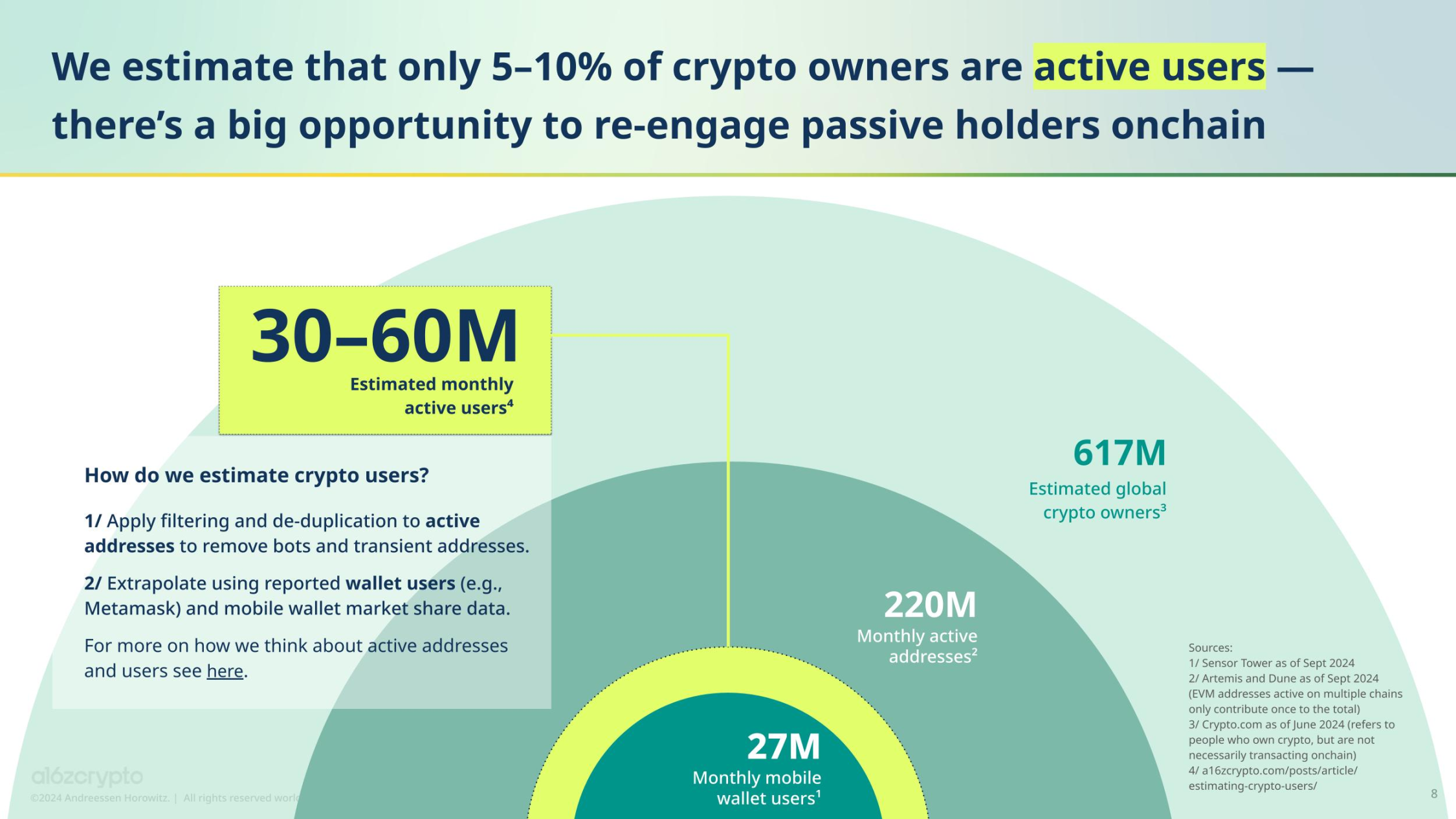

While it is easy to measure active addresses and monthly active mobile wallet users, the actual number of active cryptocurrency users is more challenging to quantify. However, through various methods, we estimate that the number of globally monthly active cryptocurrency users is between 30 million and 60 million, which only accounts for 5%-10% of the estimated 617 million global cryptocurrency holders as of June 2024 according to Crypto.com.

This discrepancy highlights the significant opportunity to reactivate passive cryptocurrency holders. With major infrastructure improvements enabling new, engaging applications and user experiences, more dormant cryptocurrency holders may become active users on-chain again.

Cryptocurrency Has Become an Important Political Issue Ahead of the U.S. Elections

Cryptocurrency has entered the core of national discussions during this election cycle.

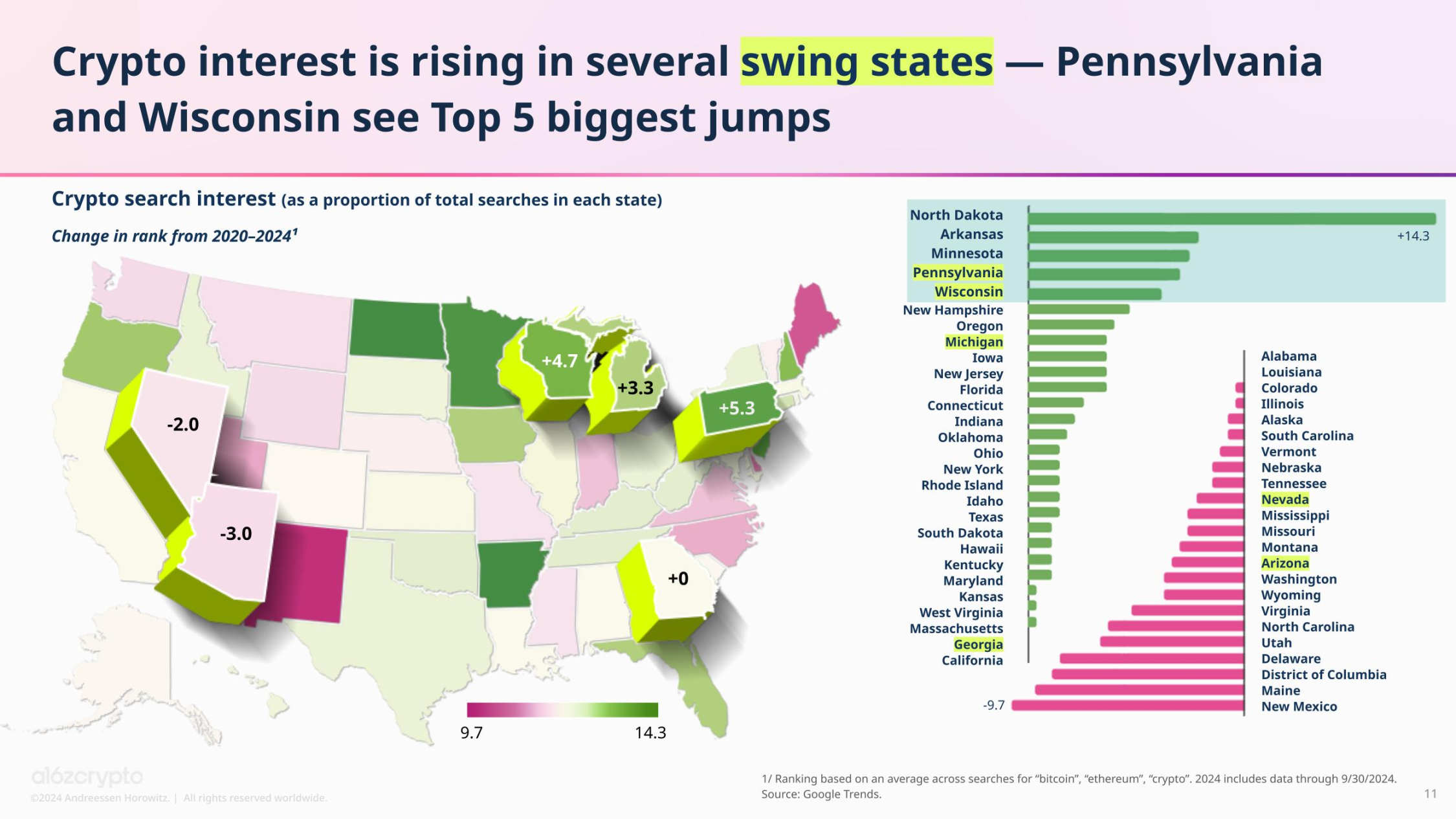

As such, we measured the relative interest levels in cryptocurrency in swing states. The two battleground states expected to be most fiercely contested in November—Pennsylvania and Wisconsin—saw their cryptocurrency search interest rise to fourth and fifth place, respectively, as a proportion of total search volume since the last election in 2020. Michigan ranked eighth, while Georgia remained unchanged. Meanwhile, interest in Arizona and Nevada has slightly declined since 2020.

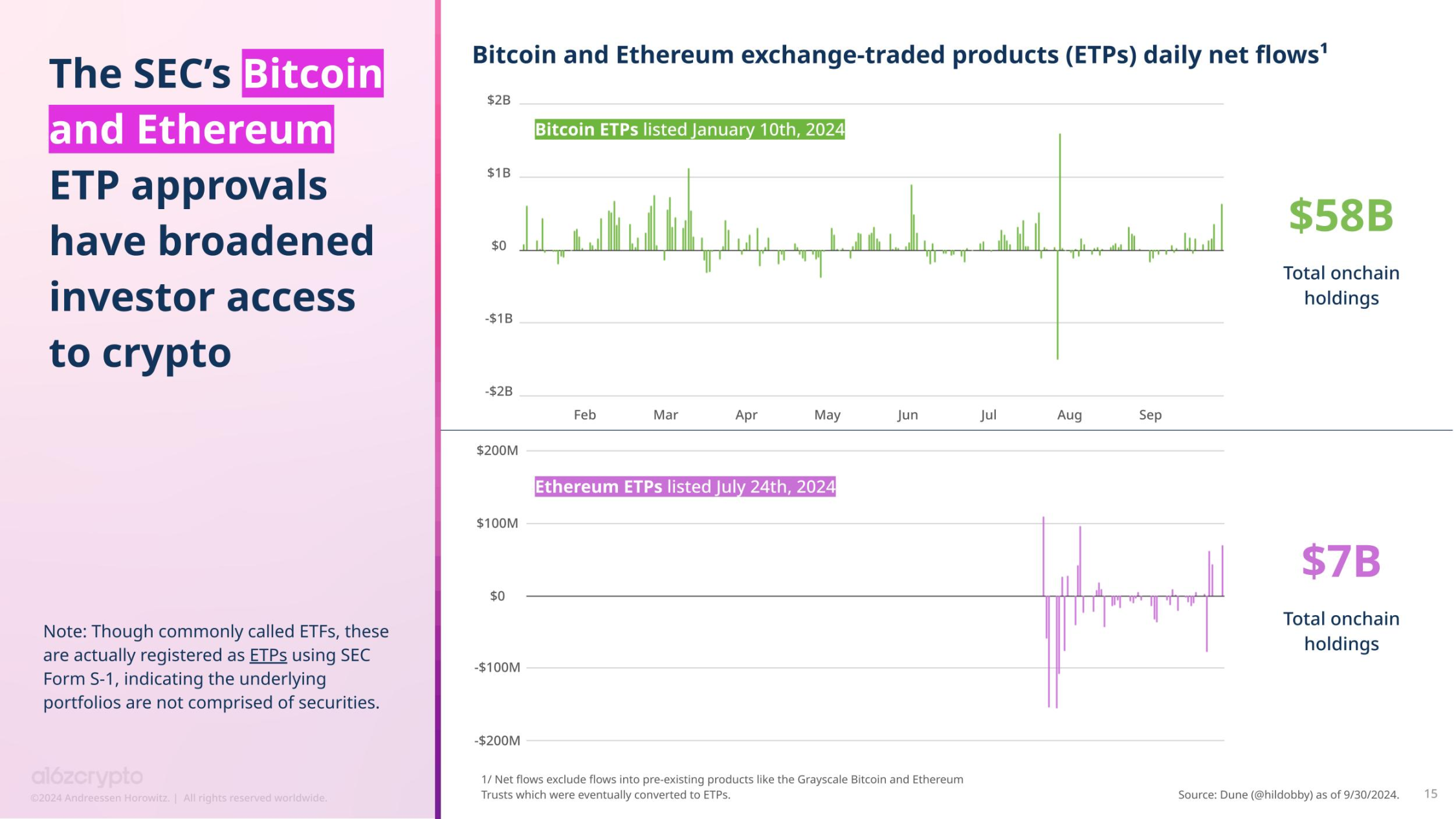

One factor that may spark interest in cryptocurrency this year is the listing of Bitcoin and Ethereum exchange-traded products (ETPs). These ETPs have broadened access for investors, and the number of people in the U.S. holding cryptocurrency is expected to grow. Bitcoin and Ethereum ETPs have included $65 billion in on-chain holdings. (Note: Although these products are often referred to as ETFs, they are actually ETPs registered through the SEC's S-1 form, indicating that their underlying portfolios do not include securities.)

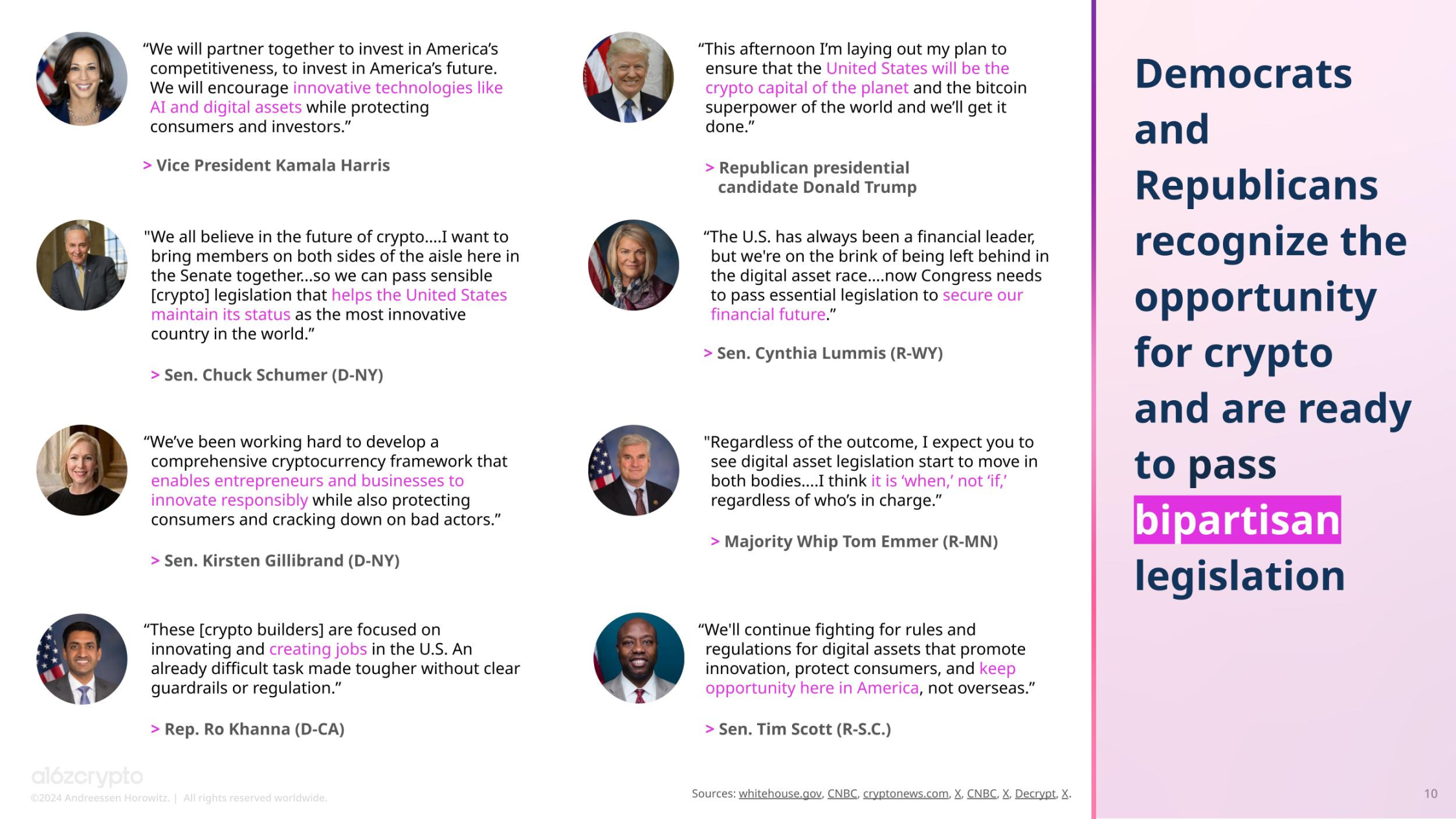

The SEC's approval of ETPs represents a significant milestone in cryptocurrency policy. Regardless of which party wins in November, many politicians expect that policy momentum will further strengthen as both parties push for cryptocurrency legislation. An increasing number of policymakers and politicians from both camps hold a positive attitude toward cryptocurrency.

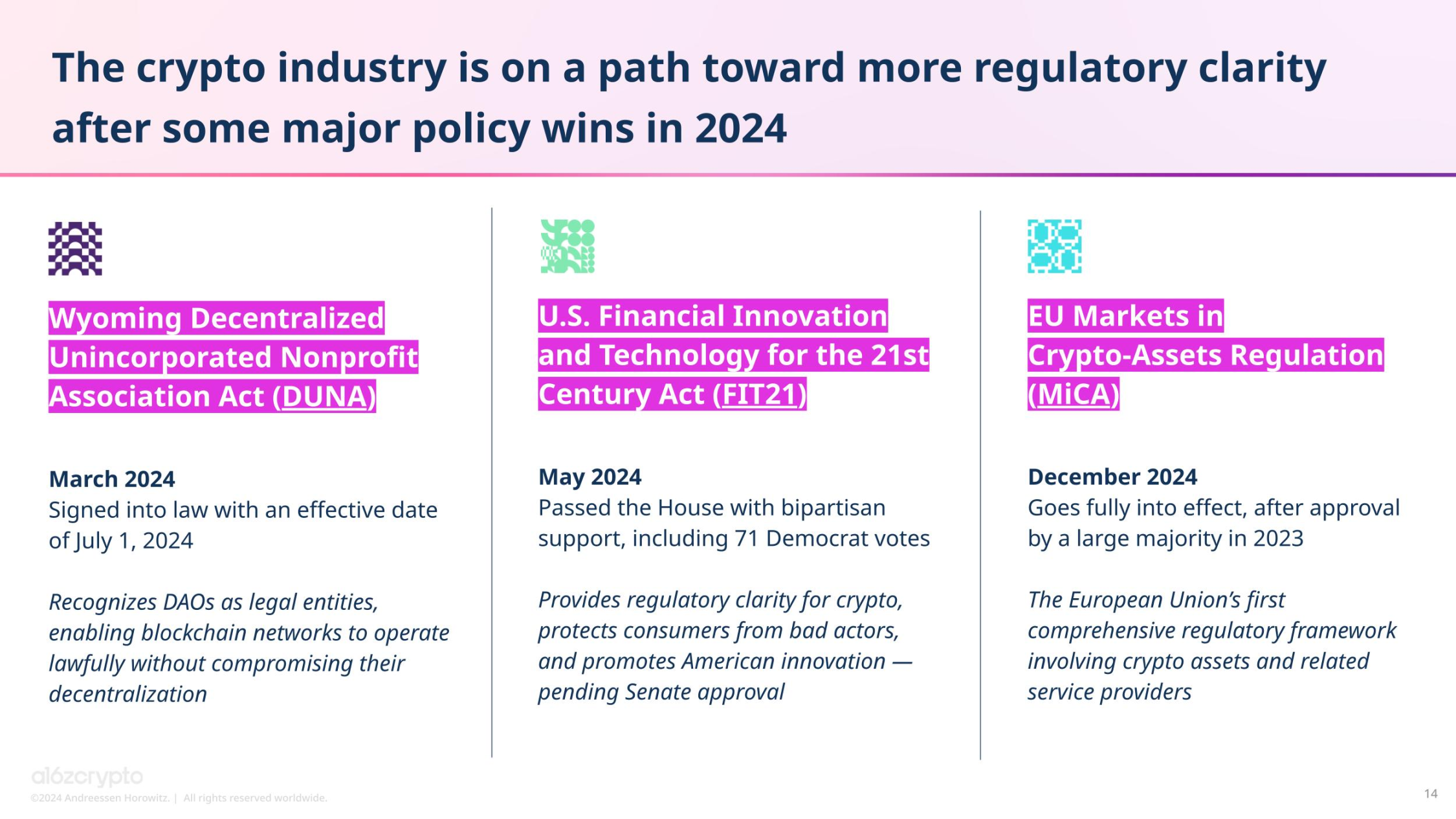

This year, the cryptocurrency industry has also made other significant progress in the policy arena. At the federal level, the House passed the Financial Innovation and Technology Act of the 21st Century (FIT21) with bipartisan support, with 208 Republicans and 71 Democrats voting in favor. If passed and approved by the Senate, this bill will provide much-needed regulatory clarity for cryptocurrency entrepreneurs.

Equally important, at the state level, Wyoming passed the Decentralized Nonprofit Association Act (DUNA), which provides legal recognition for decentralized autonomous organizations (DAOs), allowing blockchain networks to operate legally while remaining decentralized.

The EU and the UK have been the most proactive in cryptocurrency policy and regulation. In contrast, several European institutions have issued more public consultation requests than the U.S. Securities and Exchange Commission. Meanwhile, the EU's Markets in Crypto-Assets Regulation (MiCA) has become the first comprehensive cryptocurrency policy framework and is set to come into full effect by the end of the year.

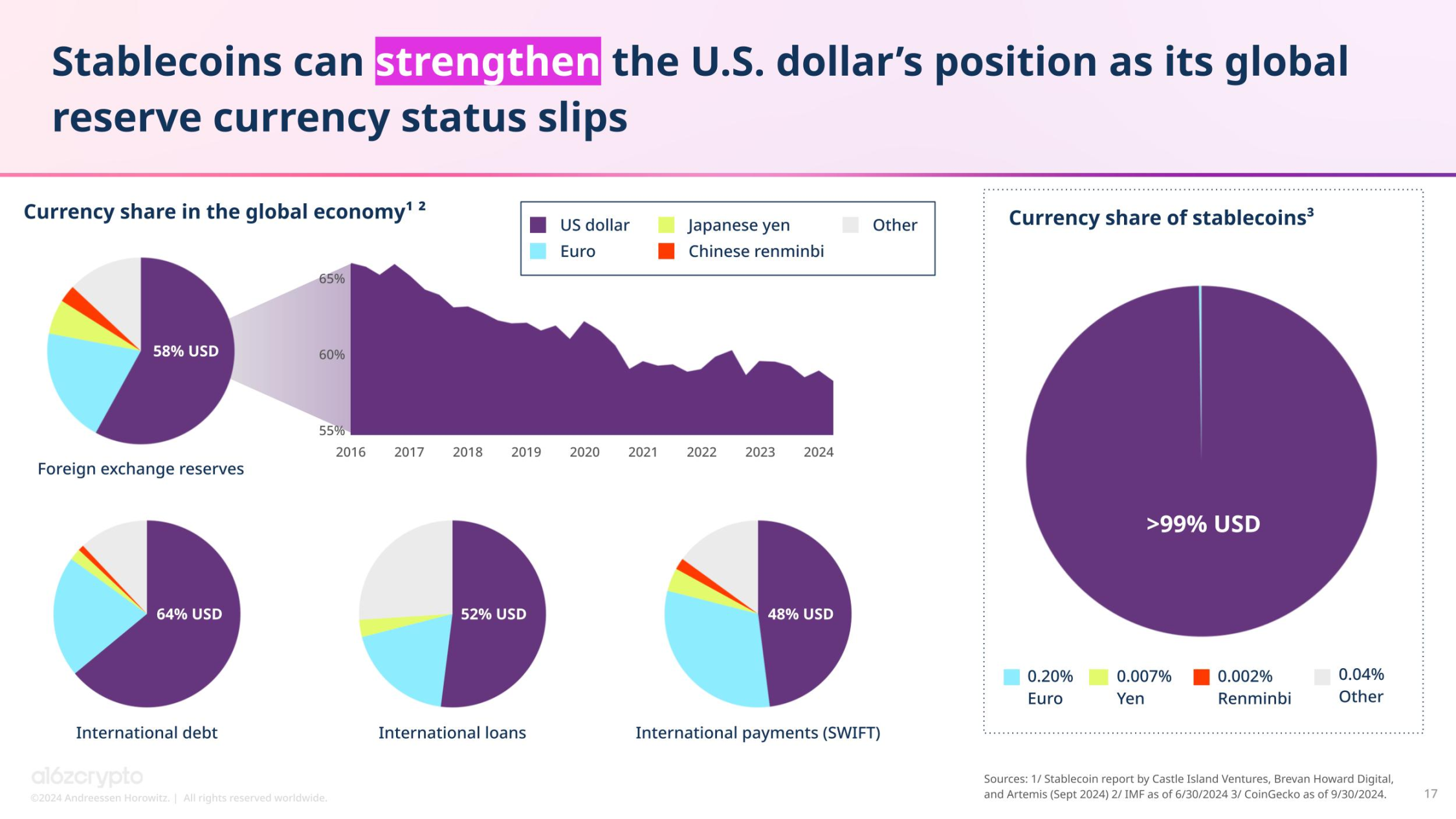

Stablecoins, as one of the most popular cryptocurrency products and a focal point of policy discussions, have seen multiple bills circulated in Congress. At least in the U.S., one of the driving forces behind this issue is the recognition that stablecoins can reinforce the dollar's position globally, even as the dollar's status as the global reserve currency has declined. Currently, over 99% of stablecoins are pegged to the dollar, far exceeding the next largest currency—stablecoins pegged to the euro, which account for only 0.20%.

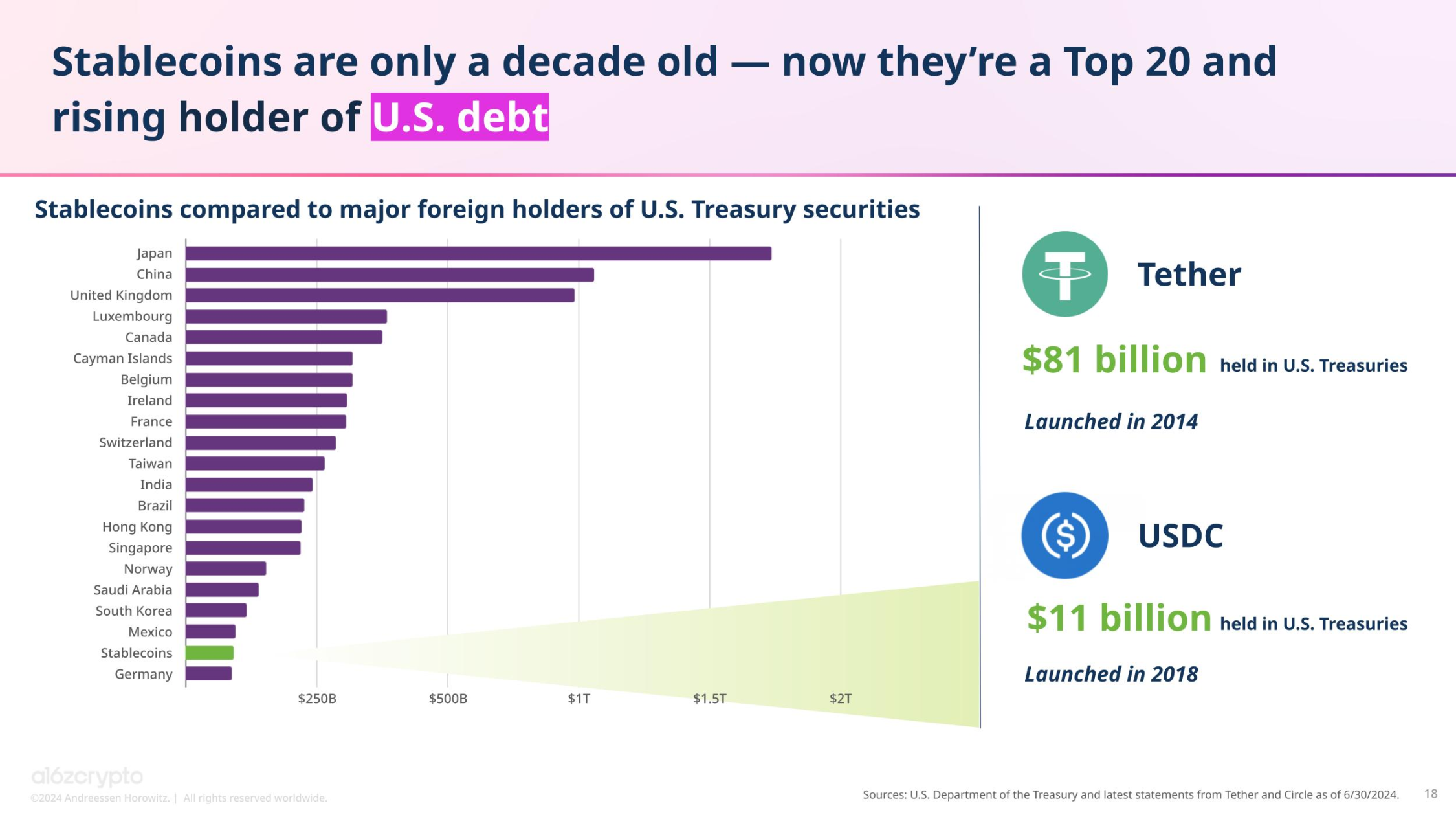

In addition to showcasing the dollar's strength globally, stablecoins may also strengthen the U.S. financial foundation domestically. Despite only a decade of history, stablecoins have already become one of the top 20 holders of U.S. debt, ahead of countries like Germany.

While some countries are exploring central bank digital currencies (CBDCs), the opportunity for stablecoins in the U.S. is evident. Given these discussions and the increasing attention from political figures toward cryptocurrency, we expect more countries to begin seriously formulating their cryptocurrency policies and strategies.

Stablecoins Have Found Product-Market Fit (PMF)

By enabling fast, low-cost, global payments, stablecoins have become one of the most obvious "killer applications" of cryptocurrency. As New York Congressman Ritchie Torres (D-N.Y.) wrote in a September op-ed for the New York Daily News: "The proliferation of dollar stablecoins—made possible by the ubiquity of smartphones and crypto technology—could become the largest financial equity experiment in human history."

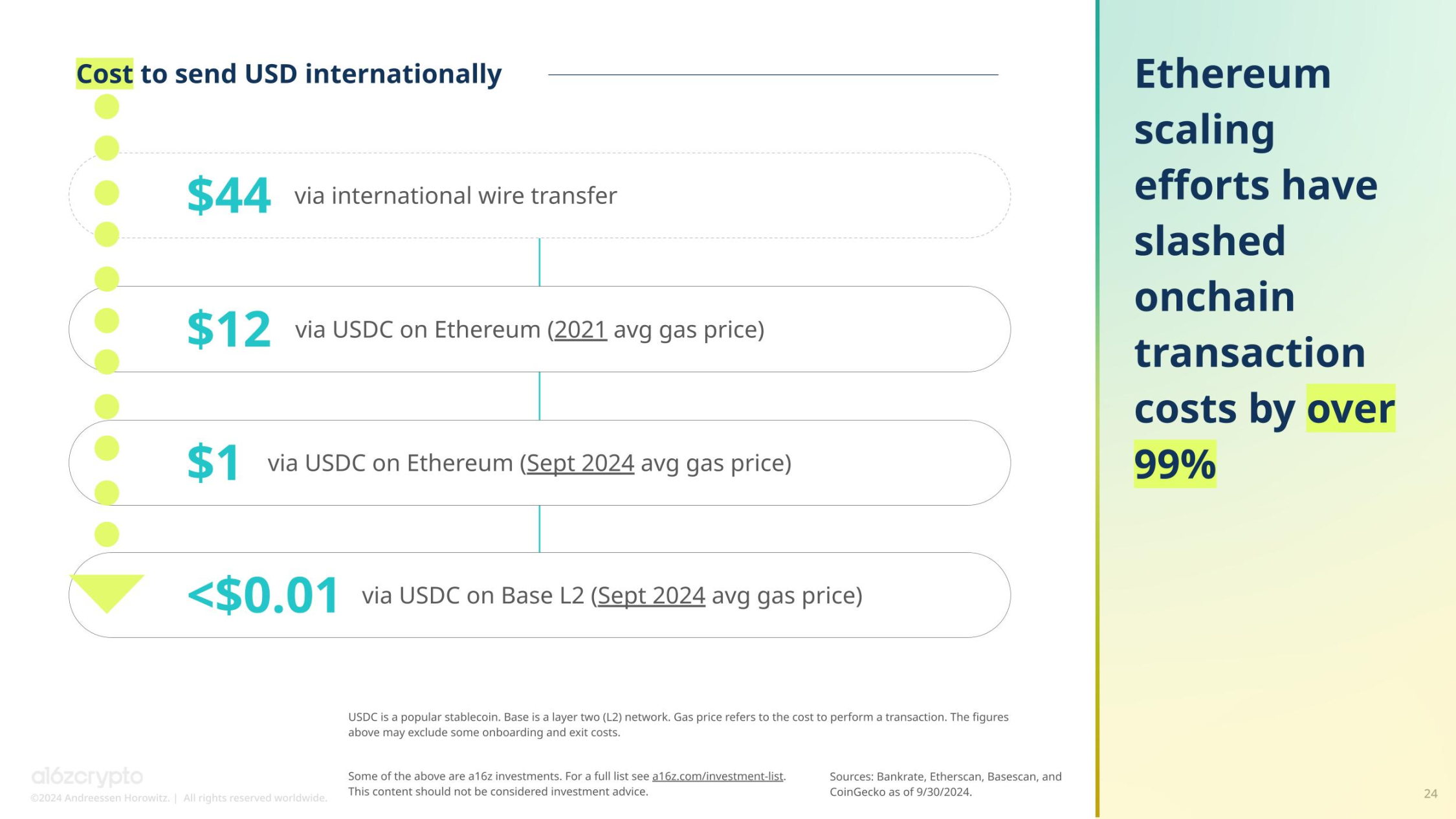

The large-scale scaling has significantly reduced the cost of cryptocurrency transactions, especially those involving stablecoins, with costs in some cases dropping by over 99%. On Ethereum, the average gas fee for transactions involving USDC this month was $1, compared to an average of $12 in 2021. The average fee for sending USDC on Coinbase's popular Layer 2 network Base is less than 1 cent. (Note: These figures may not include certain entry and exit costs.)

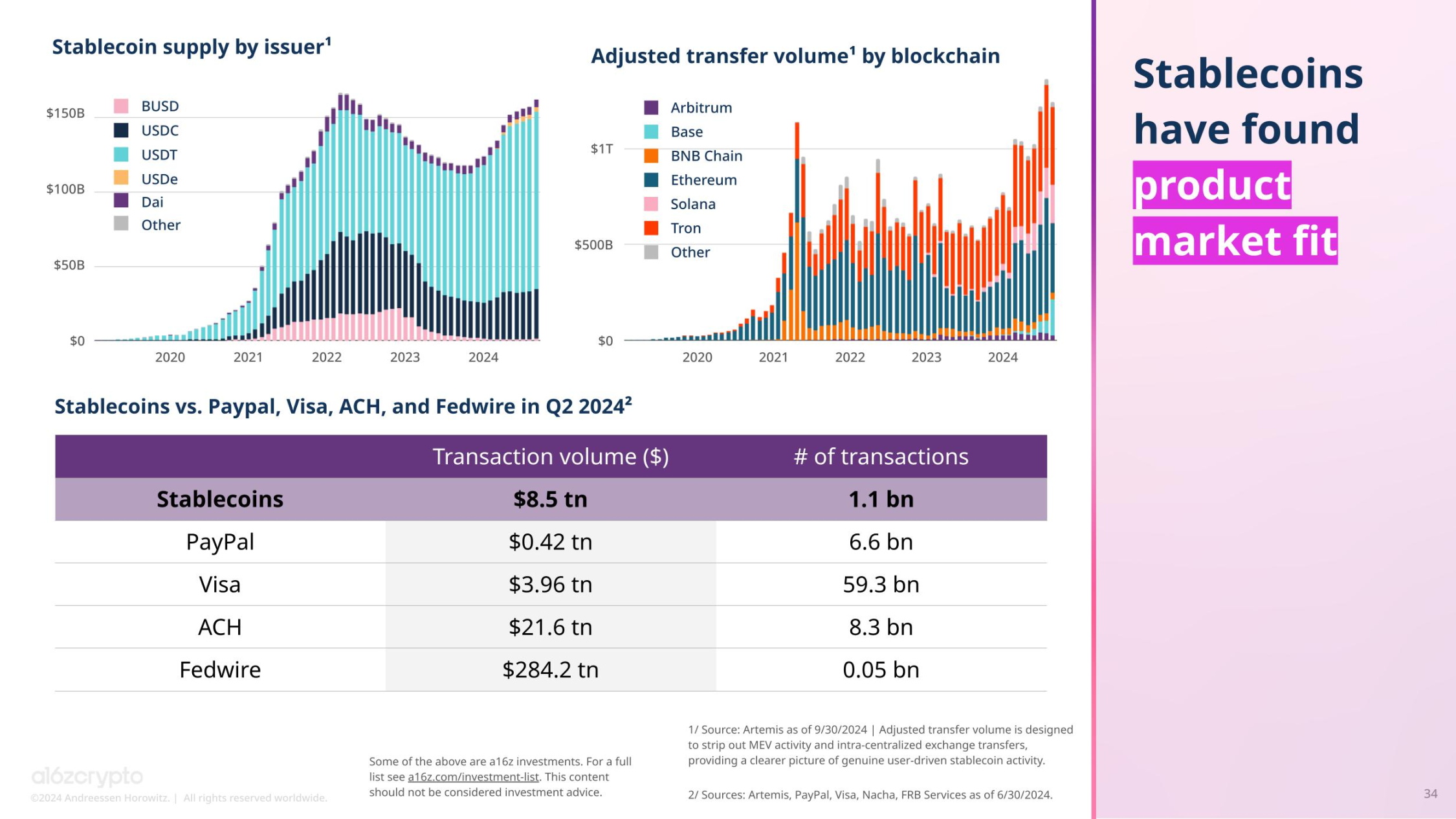

In contrast, the average fee for international wire transfers is $44.

Stablecoins have made value transfer more convenient. In the second quarter of 2024 (as of June 30), the trading volume of stablecoins reached $8.5 trillion, involving 1 billion transactions. During the same period, the trading volume of stablecoins was more than double that of Visa's $3.9 trillion. The ability of stablecoins to compete with well-known payment service providers like Visa, PayPal, ACH, and Fedwire greatly demonstrates their practicality.

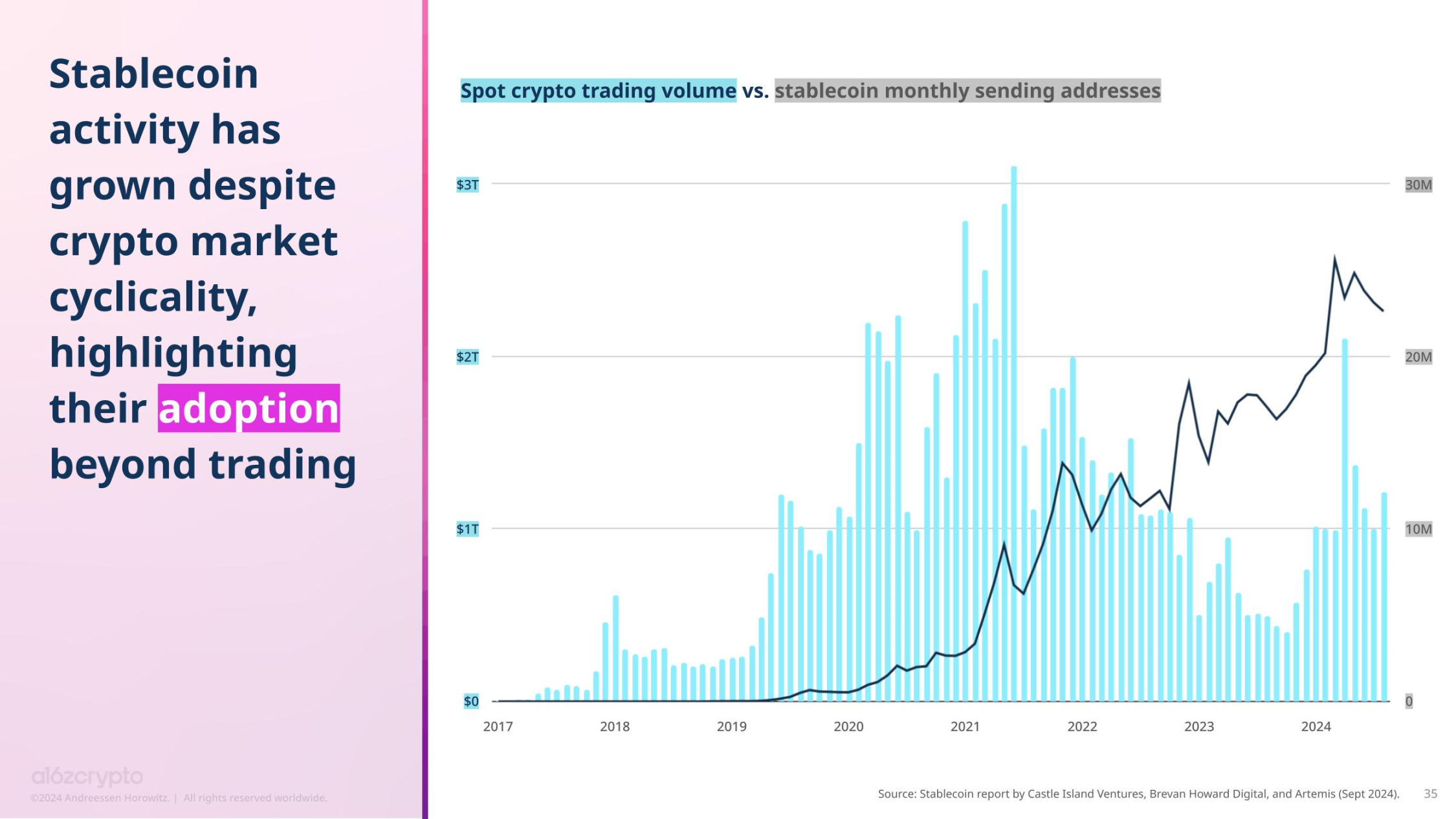

Stablecoins are not a passing trend. When comparing the activity of stablecoins with the market cycles of volatile cryptocurrencies, there seems to be no correlation. In fact, even as spot cryptocurrency trading volumes decline, the number of addresses using stablecoins continues to rise each month. In other words, the use cases for stablecoins have transcended mere trading.

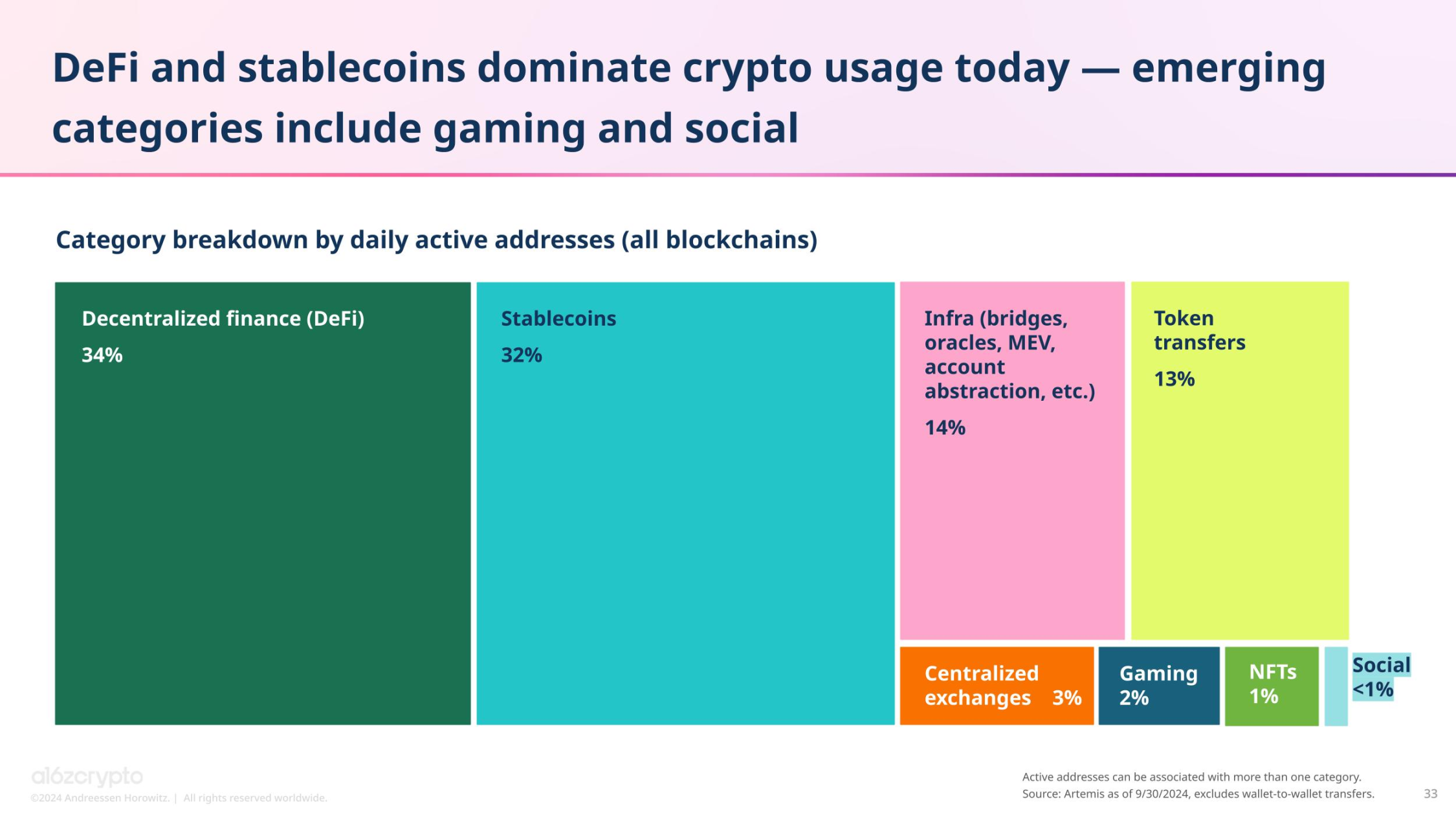

Stablecoins account for nearly one-third of daily cryptocurrency usage, reaching 32%, second only to DeFi's 34%, measured by the share of daily active addresses. The remaining cryptocurrency usage is distributed across infrastructure (cross-chain bridges, oracles, MEV, account abstraction, etc.), token transfers, and some other emerging applications such as gaming, NFTs, and social media.

Infrastructure Improvements Increase Throughput and Significantly Reduce Transaction Costs

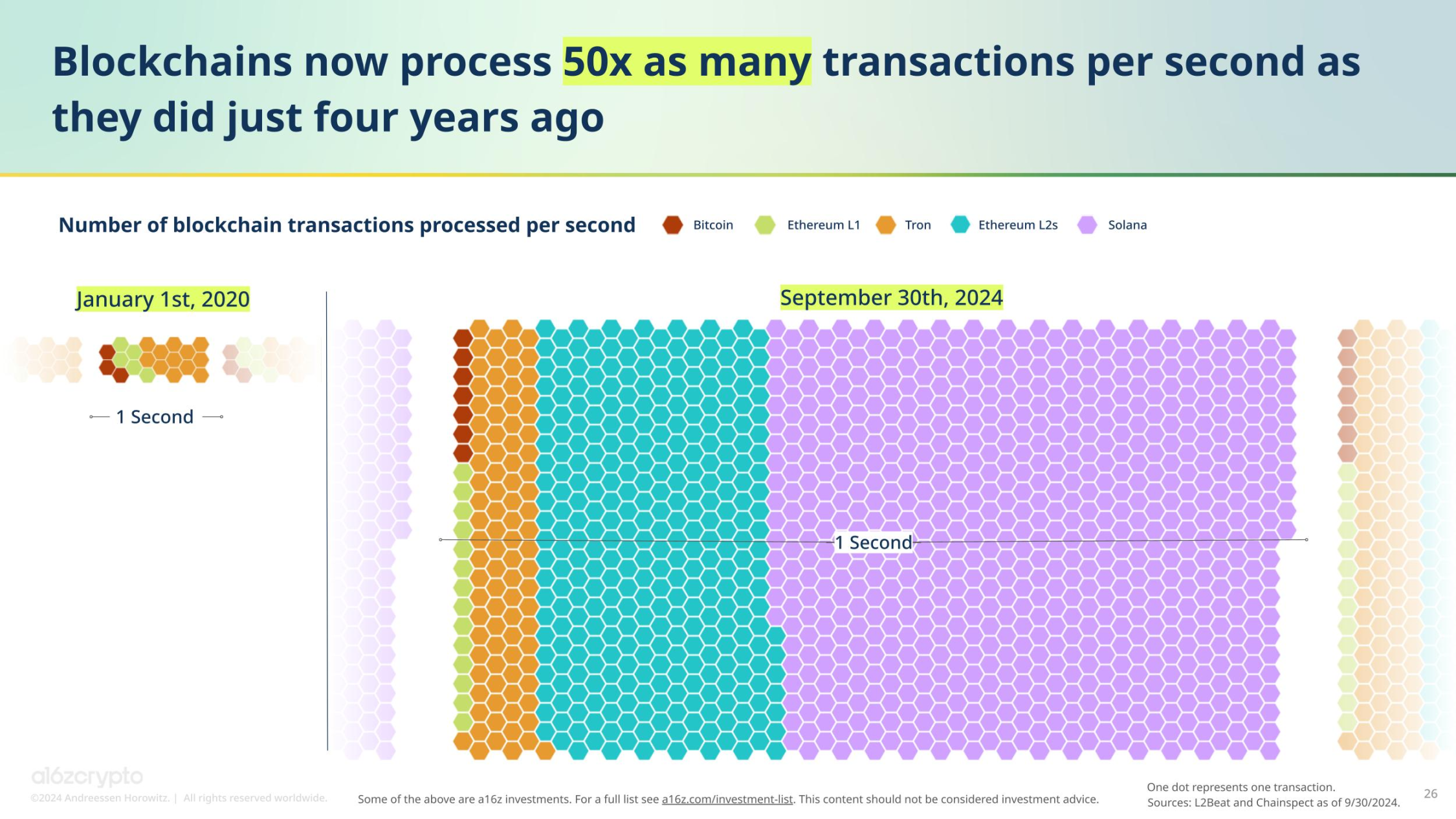

The popularity and ease of use of stablecoins can largely be attributed to advancements in underlying infrastructure. First, the capacity of chains is growing. Due to the rise of Ethereum L2 and other high-throughput chains, the number of transactions processed per second on chains is more than 50 times what it was four years ago.

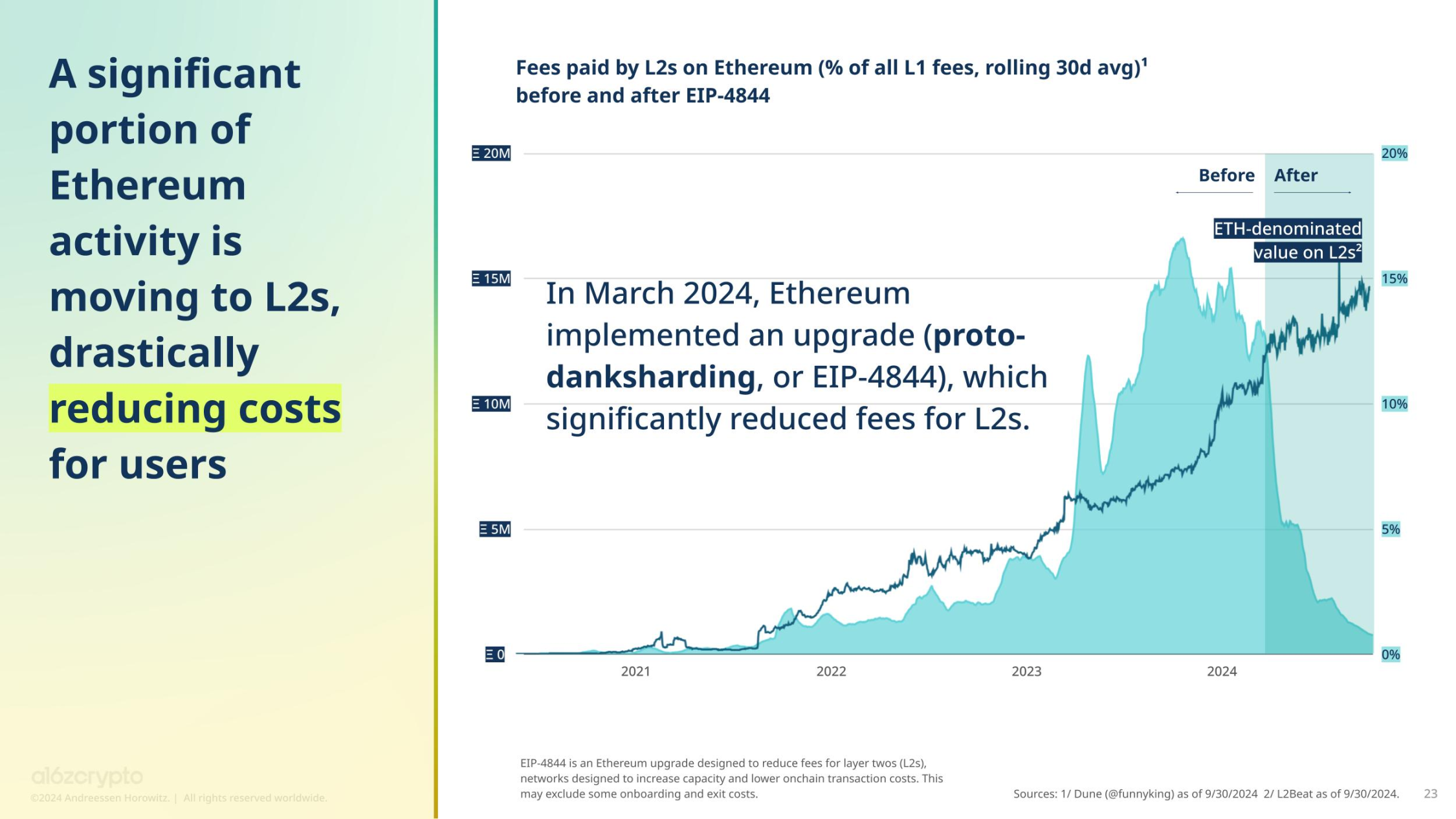

Even more surprisingly, Ethereum's biggest upgrade this year—Dencun or EIP-4844—implemented in March 2024, has significantly reduced L2 fees. Since then, even as the value in ETH on L2 continues to rise, the fees paid on Ethereum for L2 have drastically decreased. In other words, as blockchain networks become more popular, they are also becoming more efficient.

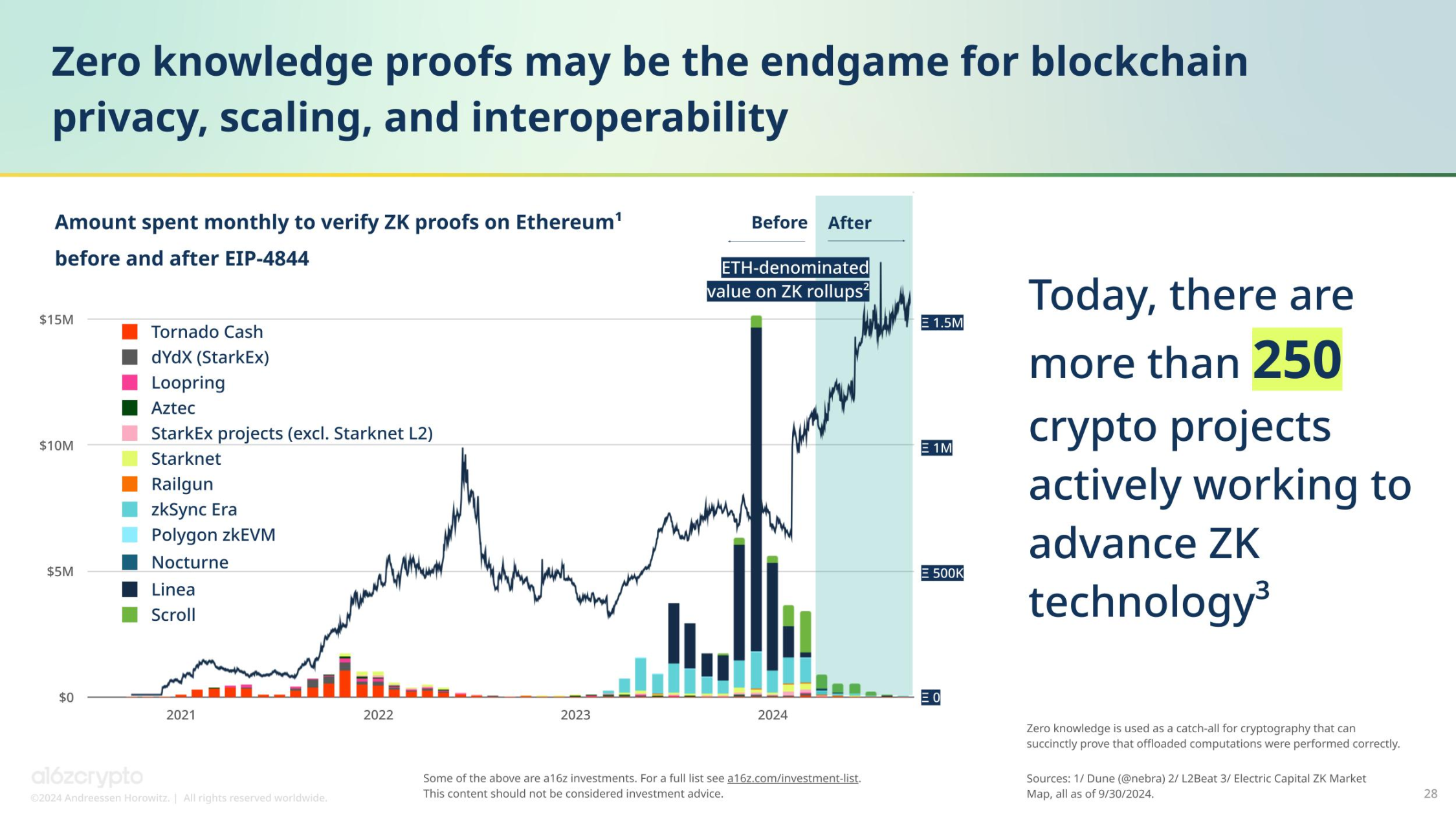

The development of zero-knowledge proof (ZK proofs) technology is a similar case. This technology has significant implications for blockchain scalability, privacy, and interoperability. Even as monthly expenditures for verifying zero-knowledge proofs on Ethereum decline, the value in ETH on ZK Rollups continues to rise. In other words, zero-knowledge proofs are not only becoming more popular, but their costs are also decreasing. (Here, "zero-knowledge" is used as a general term referring to cryptographic techniques that can succinctly prove the correctness of computations outsourced to Rollup networks.)

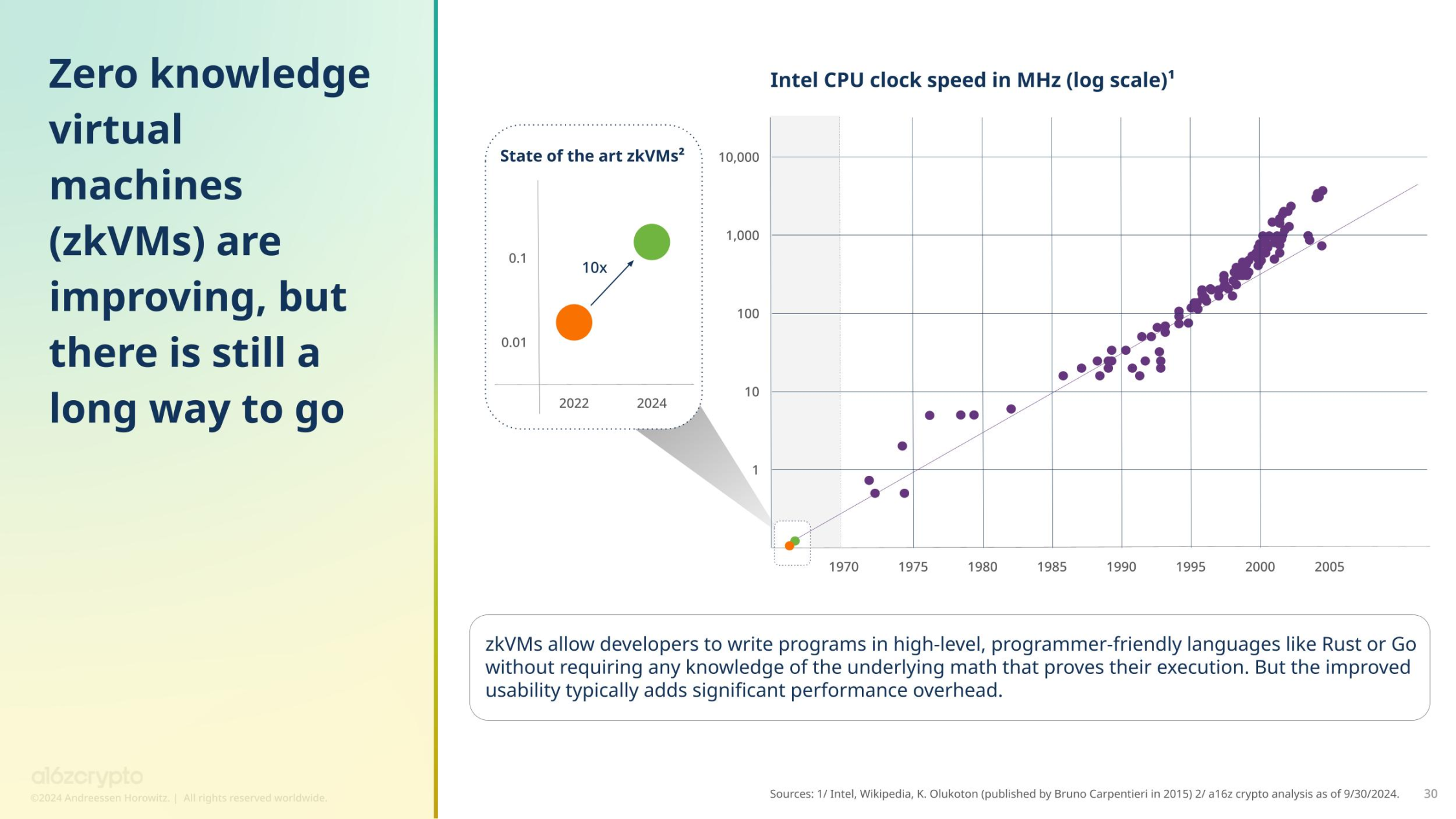

ZK technology is very promising, providing developers with a new pathway to cheap and verifiable blockchain computation. However, zero-knowledge-based virtual machines (zkVMs) still have a long way to go in terms of performance, and there is a significant gap to catch up with traditional computers, which is an observation that requires caution.

With these infrastructure improvements, it is not difficult to understand why blockchain infrastructure remains one of the most popular areas for developers, and L2 has already become one of the top five hot development subcategories we track.

DeFi Remains Popular and Continues to Grow

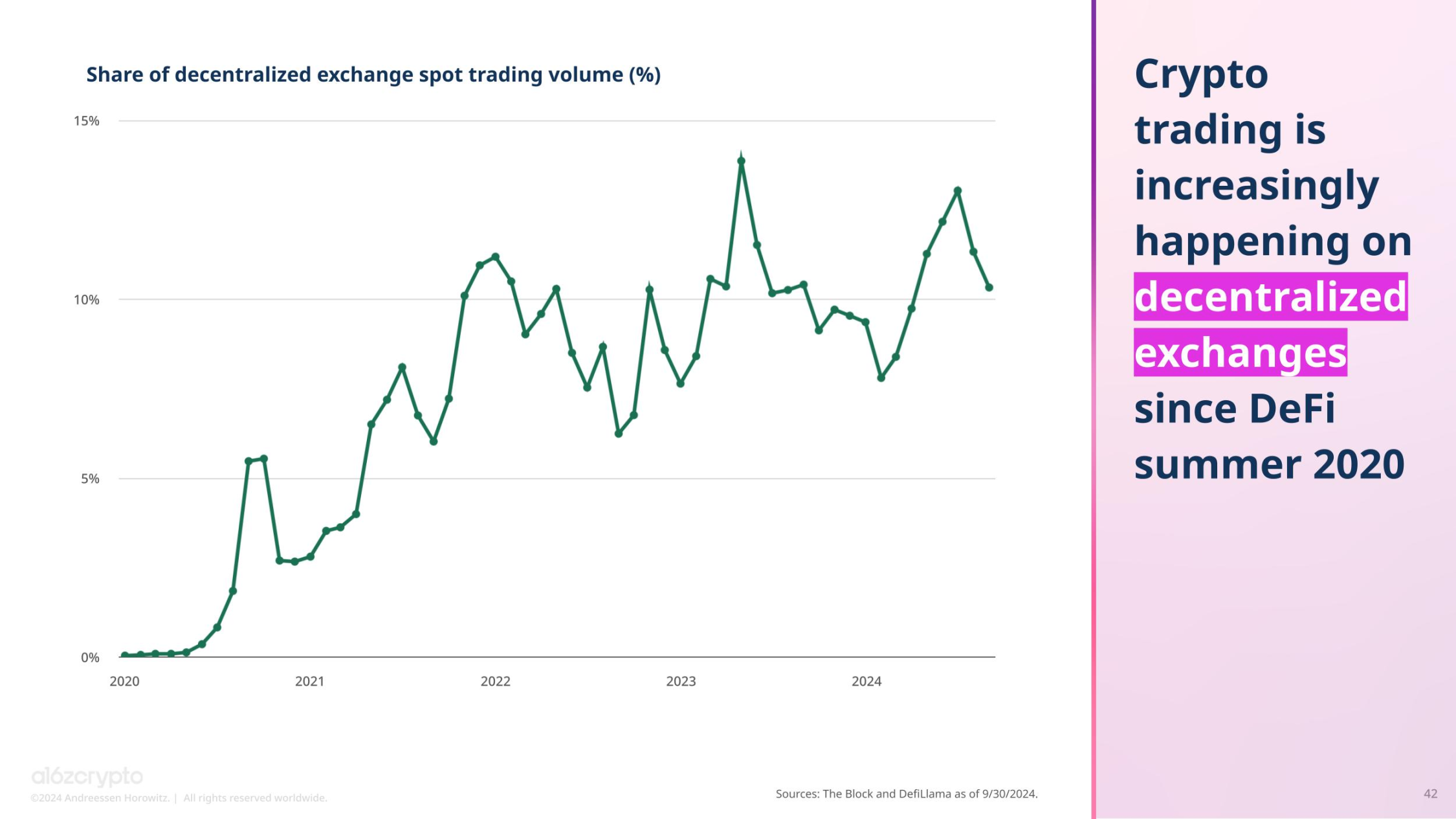

The only area that attracts developers more than infrastructure is DeFi, which also holds the largest share of cryptocurrency usage, with 34% of daily active addresses coming from DeFi. Since the emergence of DeFi in the summer of 2020, decentralized exchanges (DEXs) have grown to account for 10% of spot cryptocurrency trading activity, whereas all trading activity four years ago occurred on centralized exchanges.

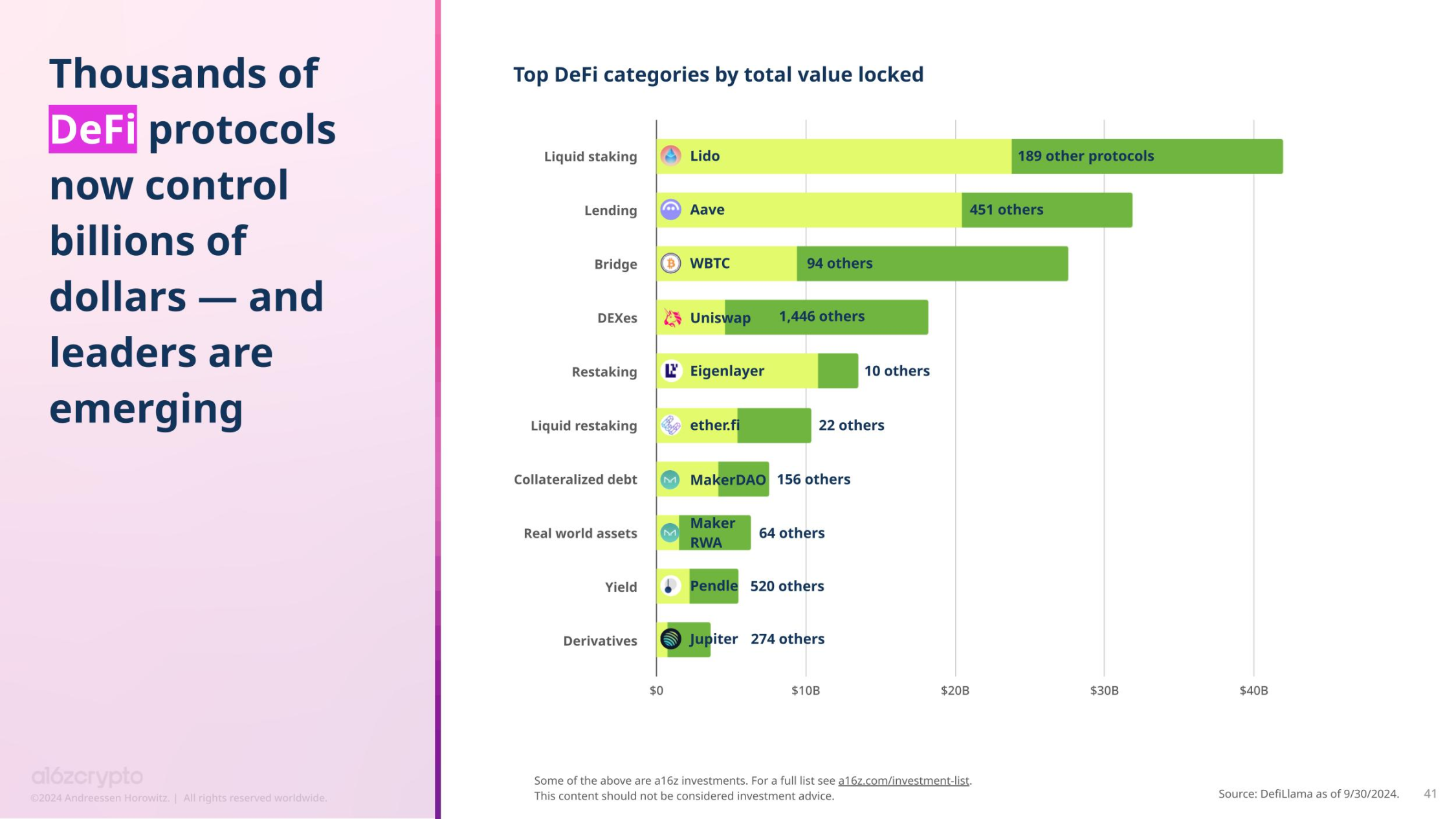

Currently, over $169 billion is locked in thousands of DeFi protocols. Some of the most significant DeFi subcategories involve staking and lending.

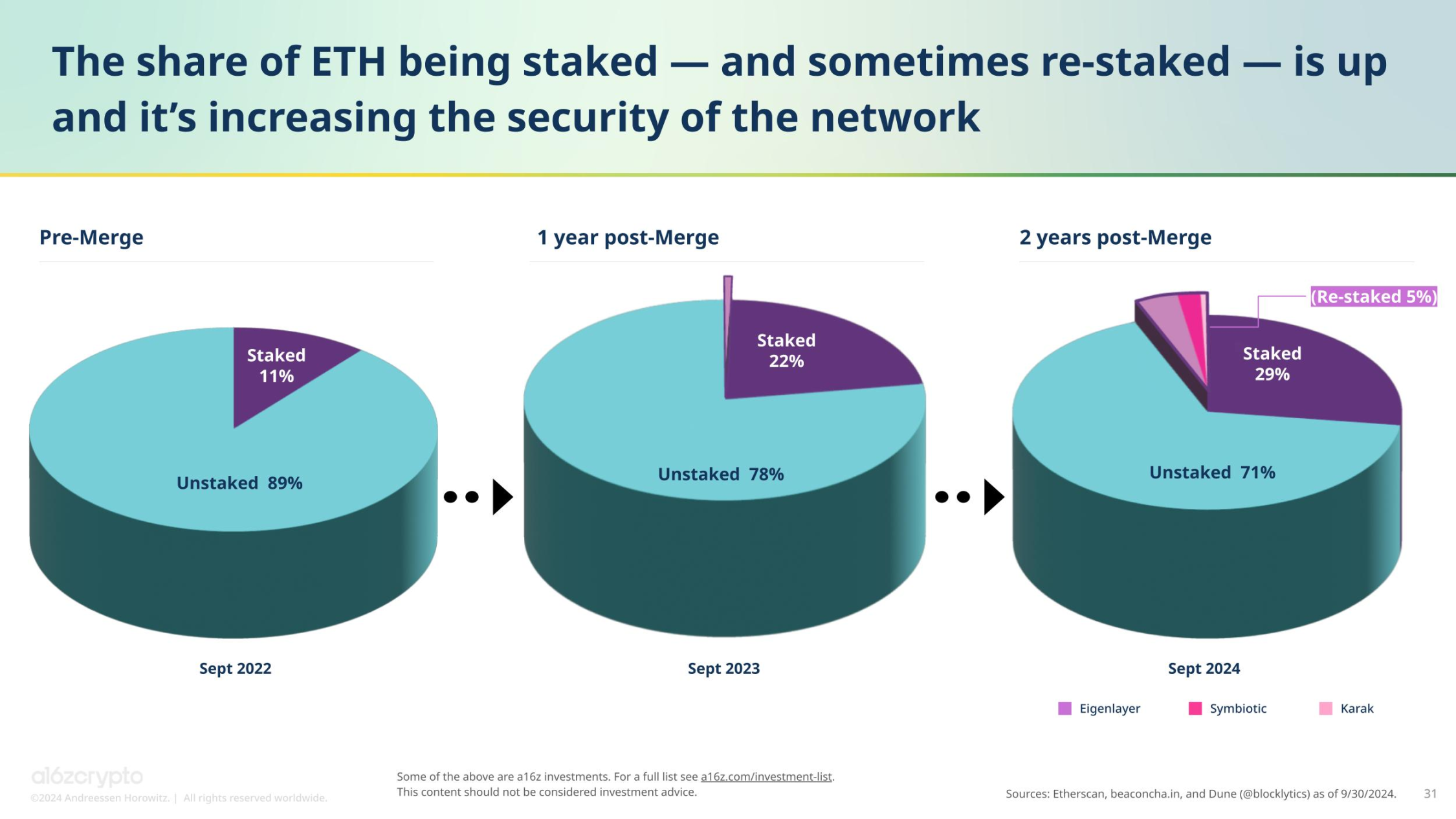

Since Ethereum completed its transition to proof of stake (PoS) just over two years ago, the network's energy consumption and environmental impact have significantly decreased. Since then, the share of staked ETH has risen from 11% two years ago to 29%, greatly enhancing the network's security.

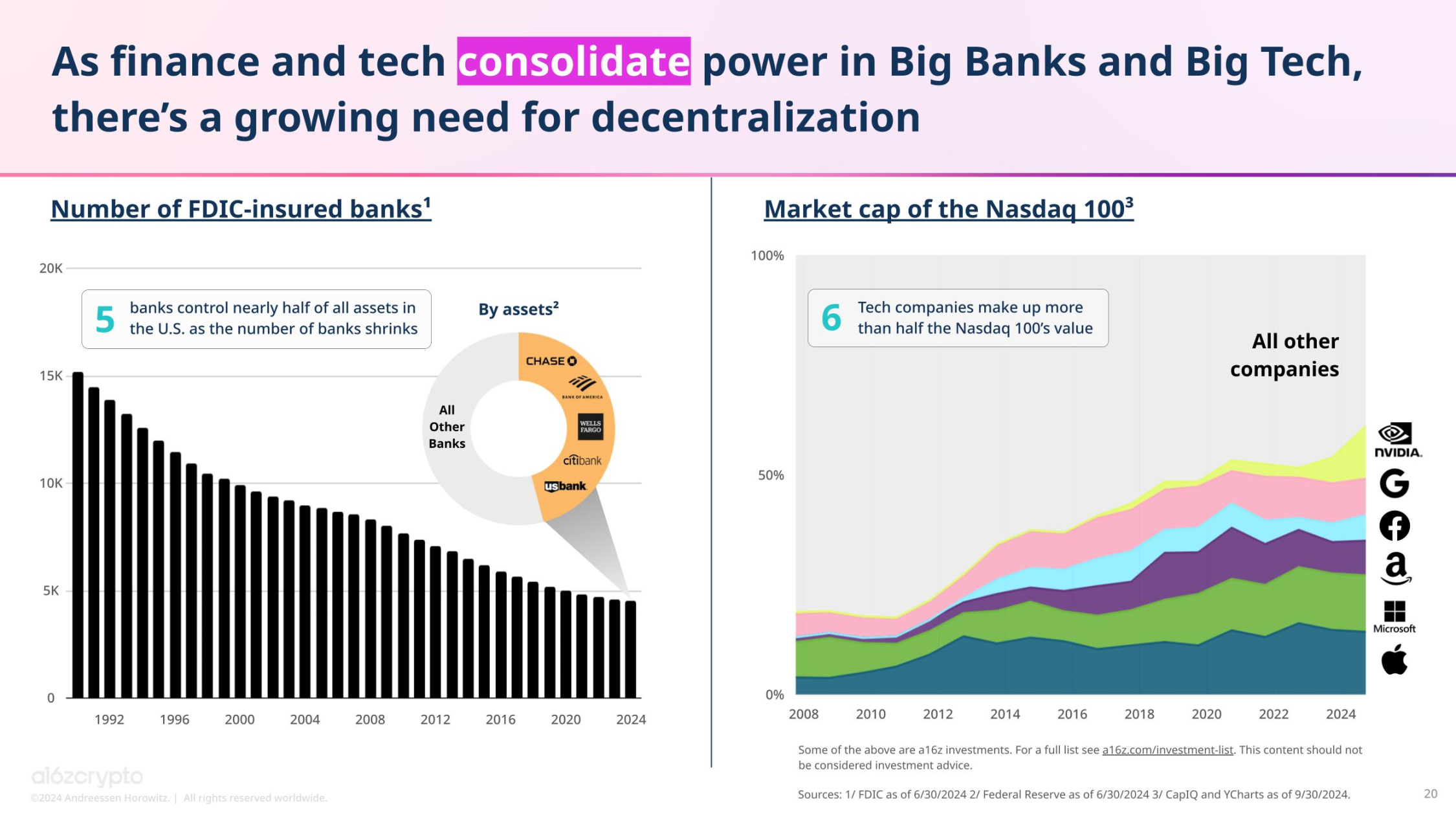

Although still in its early stages, DeFi offers a promising alternative to address the trends of centralization and power concentration in the U.S. financial system. Since 1990, the number of banks in the U.S. has decreased by two-thirds, with large banks dominating asset distribution.

Cryptocurrency is Expected to Address Some of AI's Most Pressing Challenges

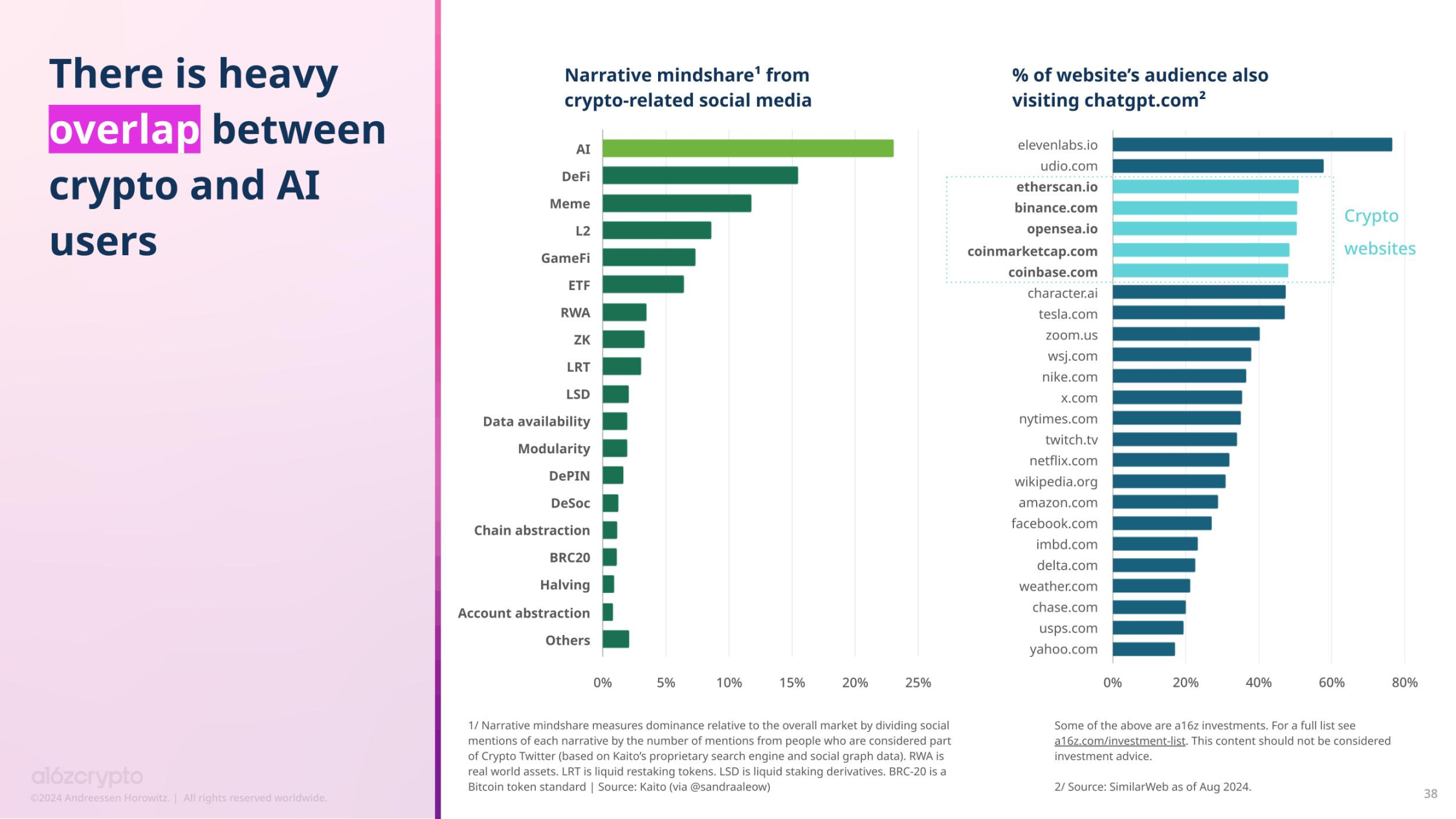

AI is not only leading trends across the tech industry but has also become one of the hottest trends in the cryptocurrency space this year.

AI is one of the trends most frequently discussed by cryptocurrency KOLs on social media. Surprisingly, there is a significant overlap between users visiting chatgpt.com and those visiting top cryptocurrency websites, indicating a close connection between cryptocurrency and AI users.

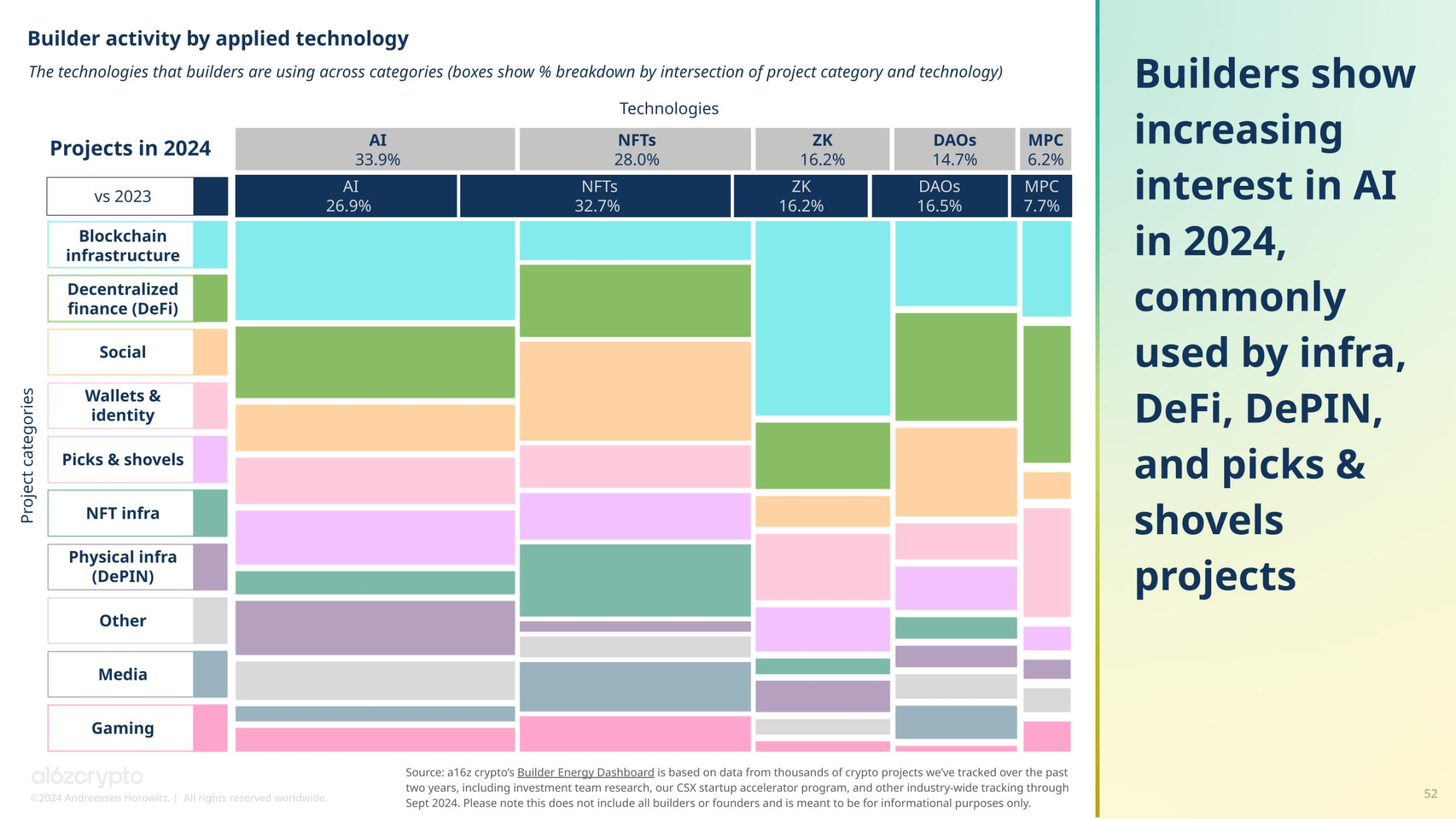

Cryptocurrency developers also have strong ties to AI. According to our "Builder Energy" dashboard, about one-third of cryptocurrency projects (34%) report that they are using AI, regardless of the field in which they are building, up from 27% a year ago. The most popular category for applying AI technology is blockchain infrastructure projects.

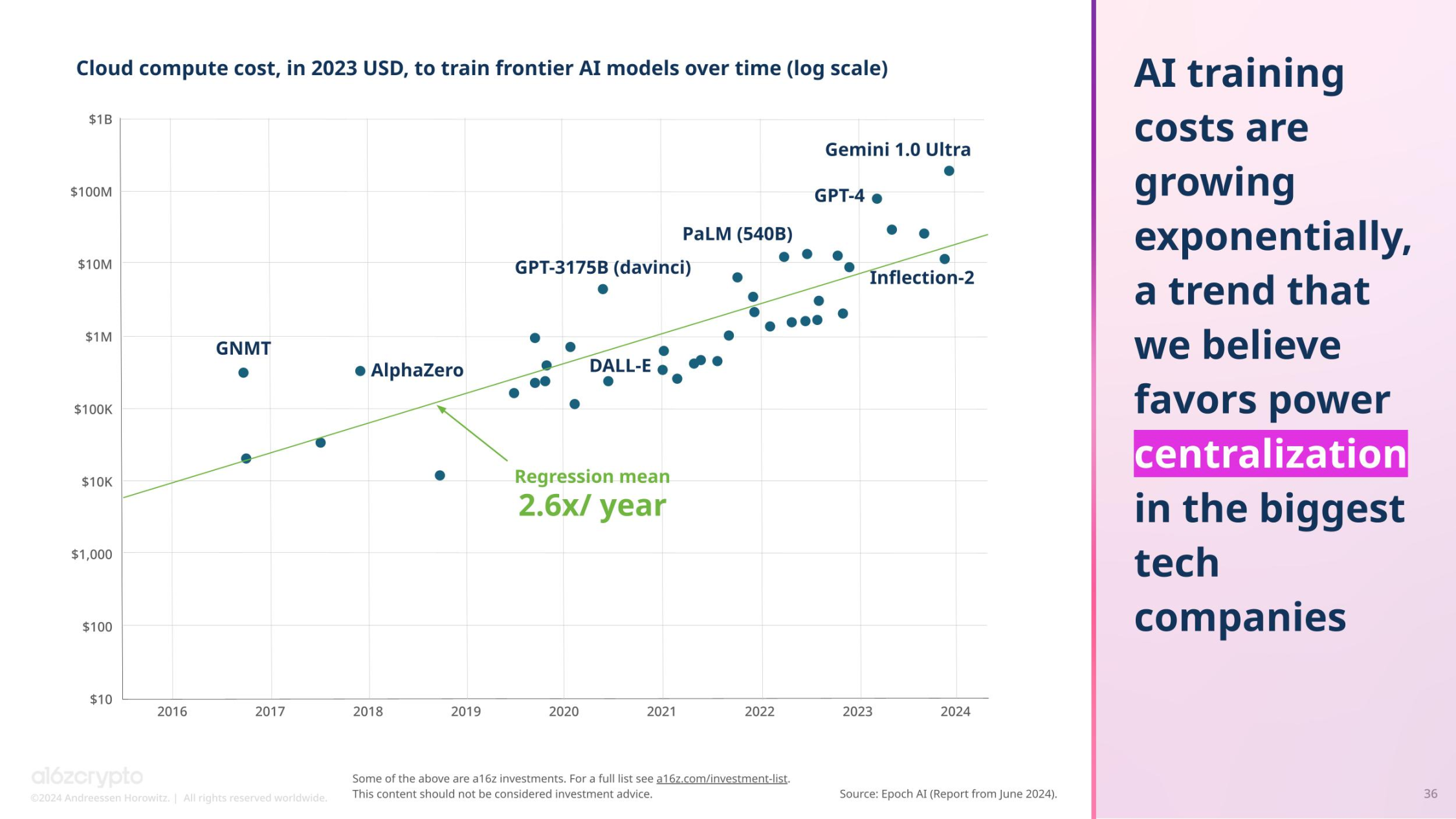

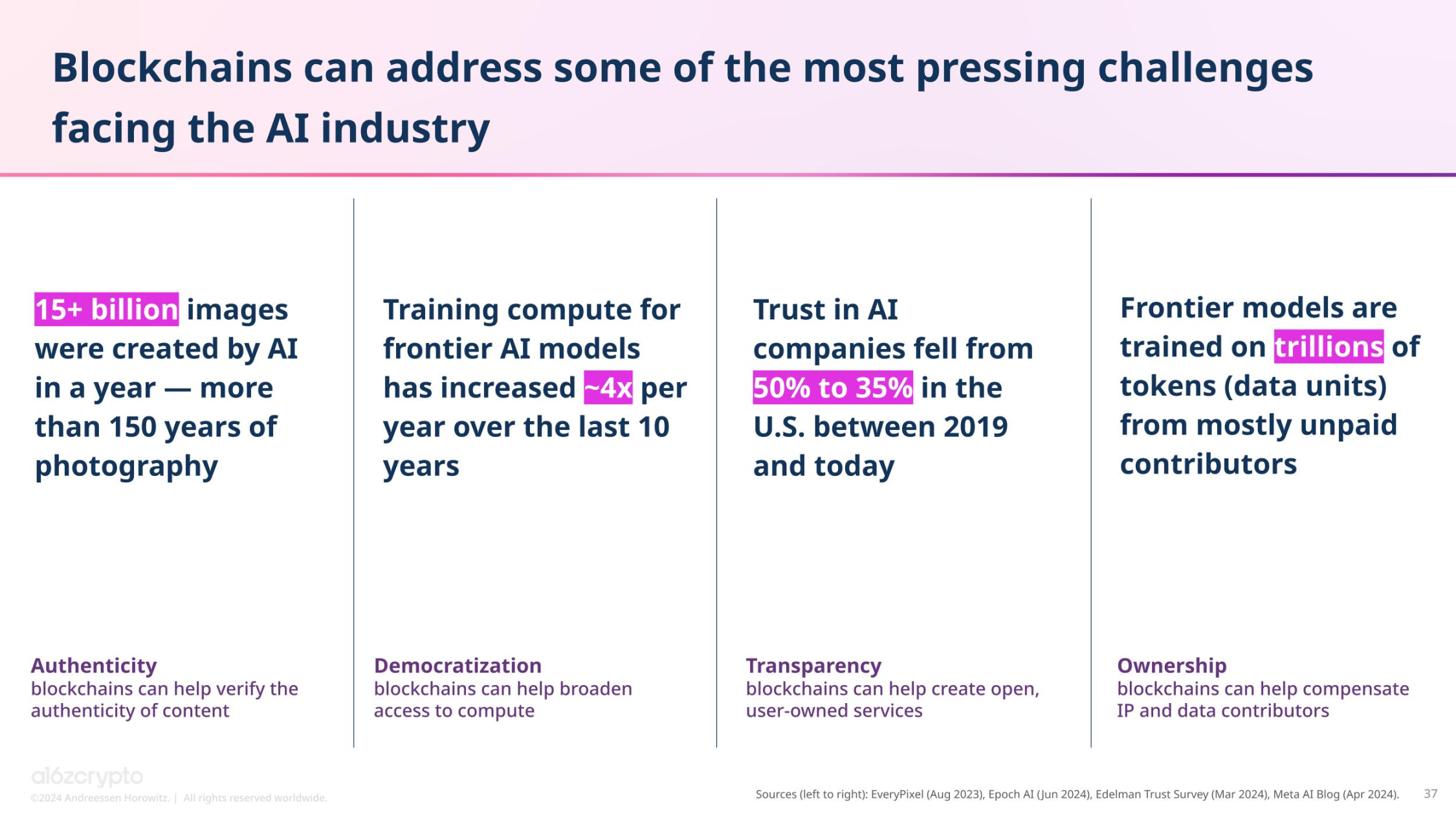

Given that the training costs for cutting-edge AI models have increased at a rate of four times per year over the past decade, we believe that AI may lead to further concentration of power on the internet. Without intervention, only the largest tech companies may have the resources to train the latest AI models.

The centralization-related challenges of AI are almost the opposite of the opportunities provided by the decentralization of blockchain networks. Many cryptocurrency projects have begun to attempt to address these challenges, including Gensyn (democratizing access to AI computing resources), Story (helping creators get compensated by tracking intellectual property), Near (running AI on open-source, user-owned protocols), and Starling Labs (helping verify the authenticity and provenance of digital media).

In the coming years, the intersection of cryptocurrency and AI may further strengthen.

More Scalable Infrastructure Unlocks New On-Chain Applications

As transaction costs decrease and chain capacity increases, potential consumer applications for cryptocurrency become more feasible.

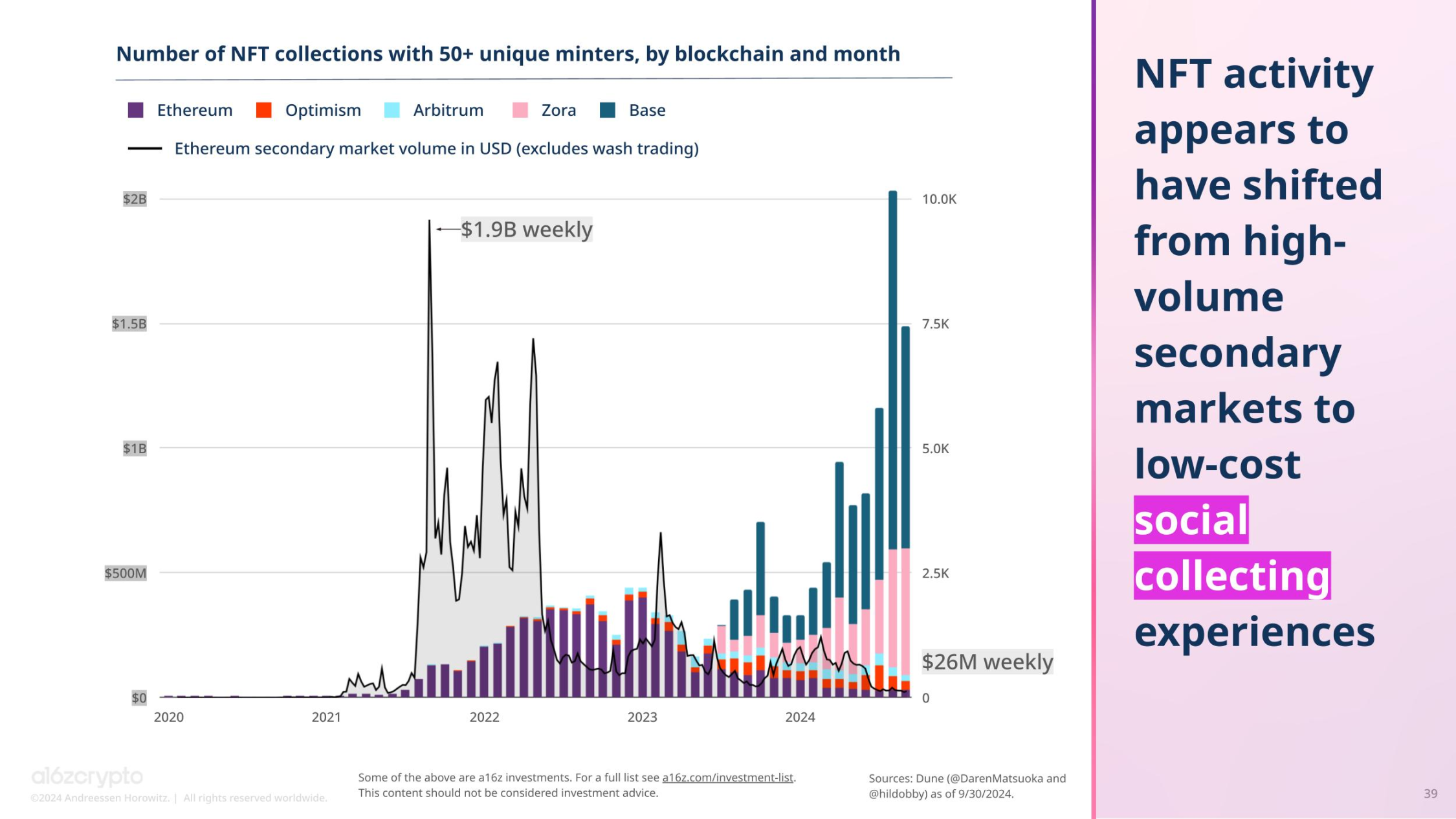

Take NFTs as an example. A few years ago, when transaction fees were relatively high, people traded NFTs through secondary markets, totaling billions of dollars. Today, this activity has decreased, replaced by a new consumer behavior: minting low-cost NFT collections on social applications like Zora and Rodeo. This represents a significant shift in the NFT market that was hard to imagine before the drastic reduction in transaction fees.

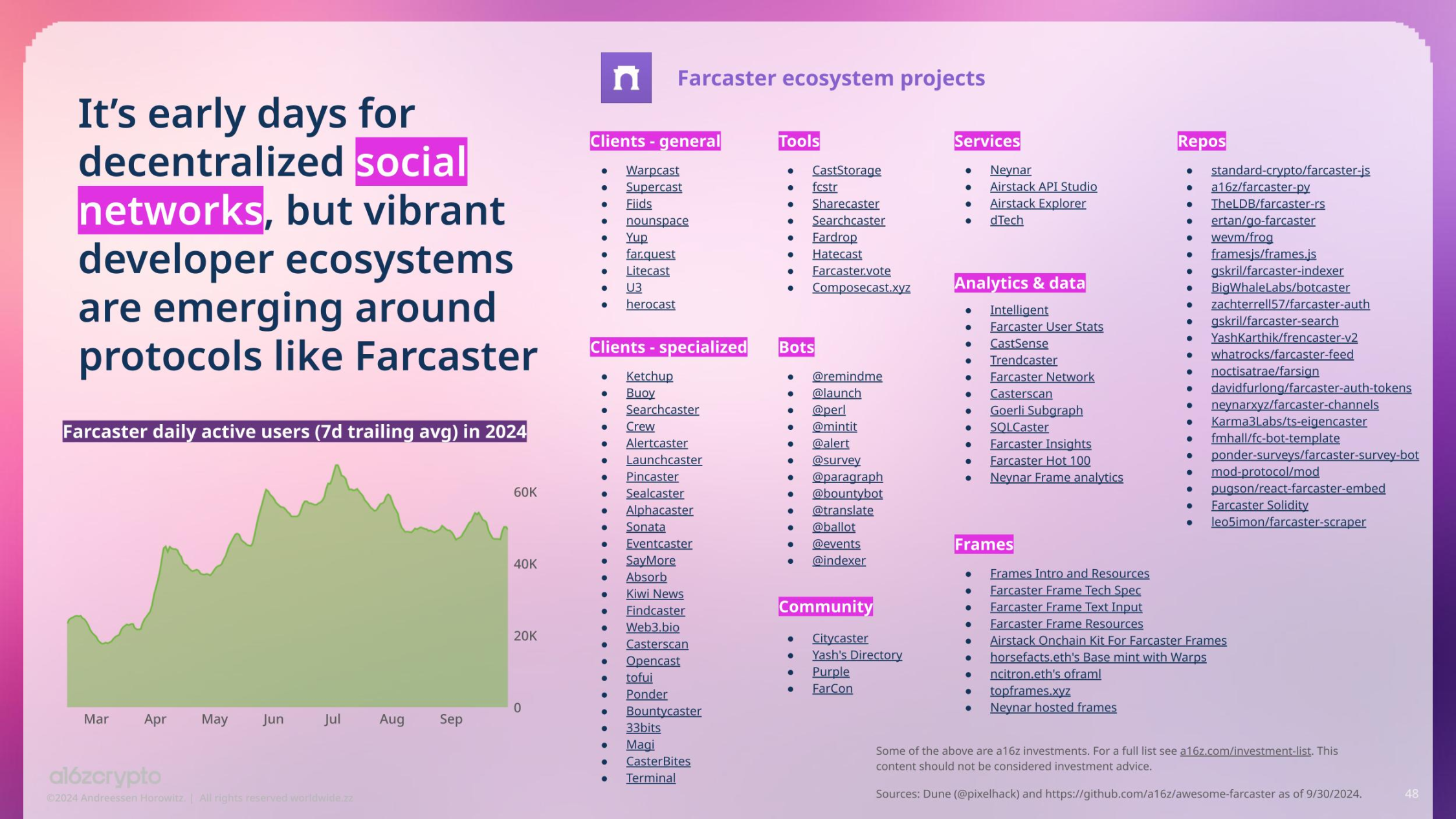

Social networks are another example. Although they currently account for only a small portion of daily on-chain activity, they attract a significant amount of developer interest: according to our dashboard, social-related cryptocurrency projects accounted for 10.3% in 2024. In fact, social network-related projects, such as Farcaster, have become one of the top five hottest development subcategories this year.

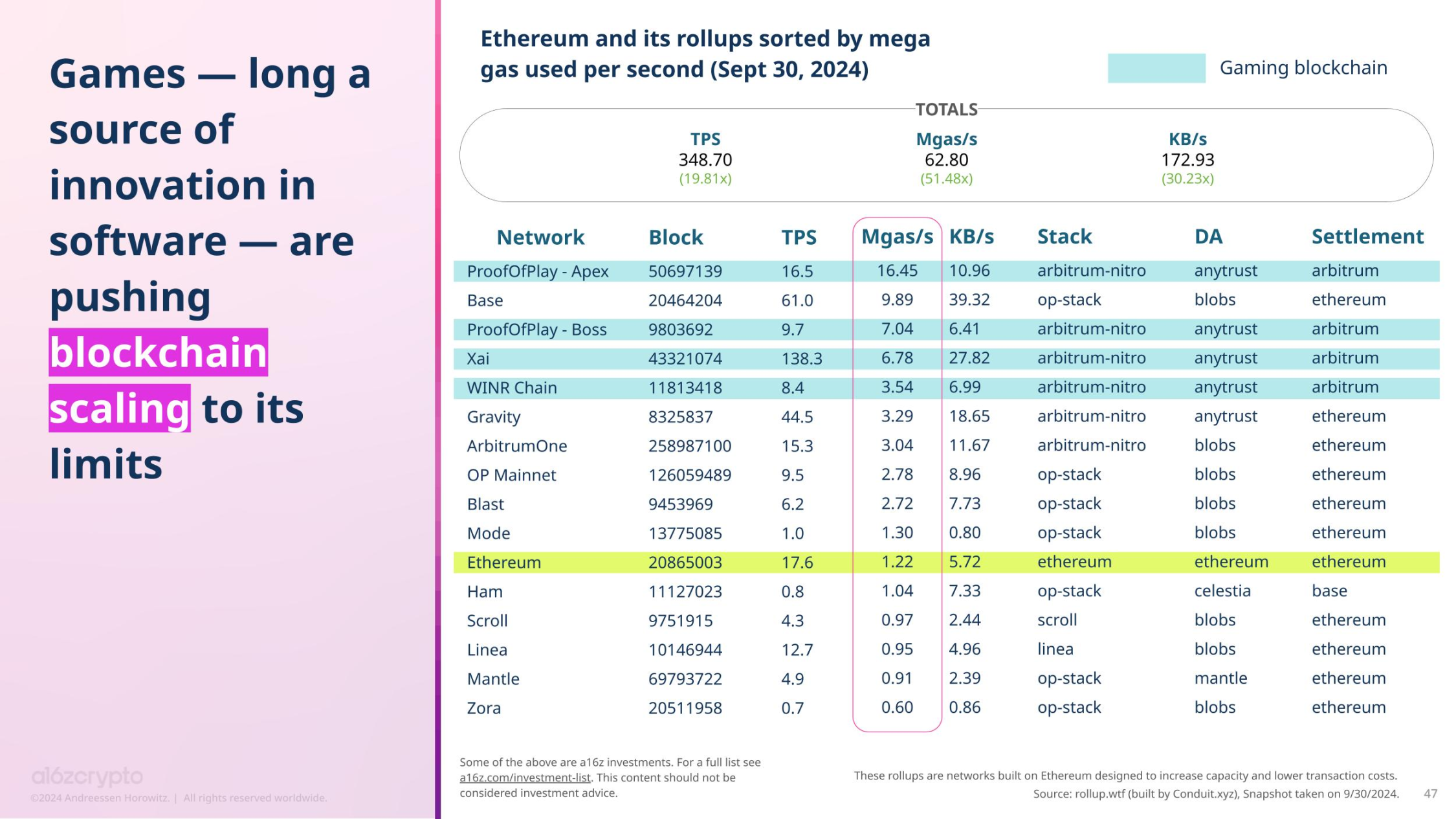

At the same time, on-chain games are pushing chain scalability to its limits. For example, the Rollup system used in the maritime adventure role-playing game "Pirate Nation" by Proof Of Play has consistently consumed the most Gas per second in Ethereum Rollups.

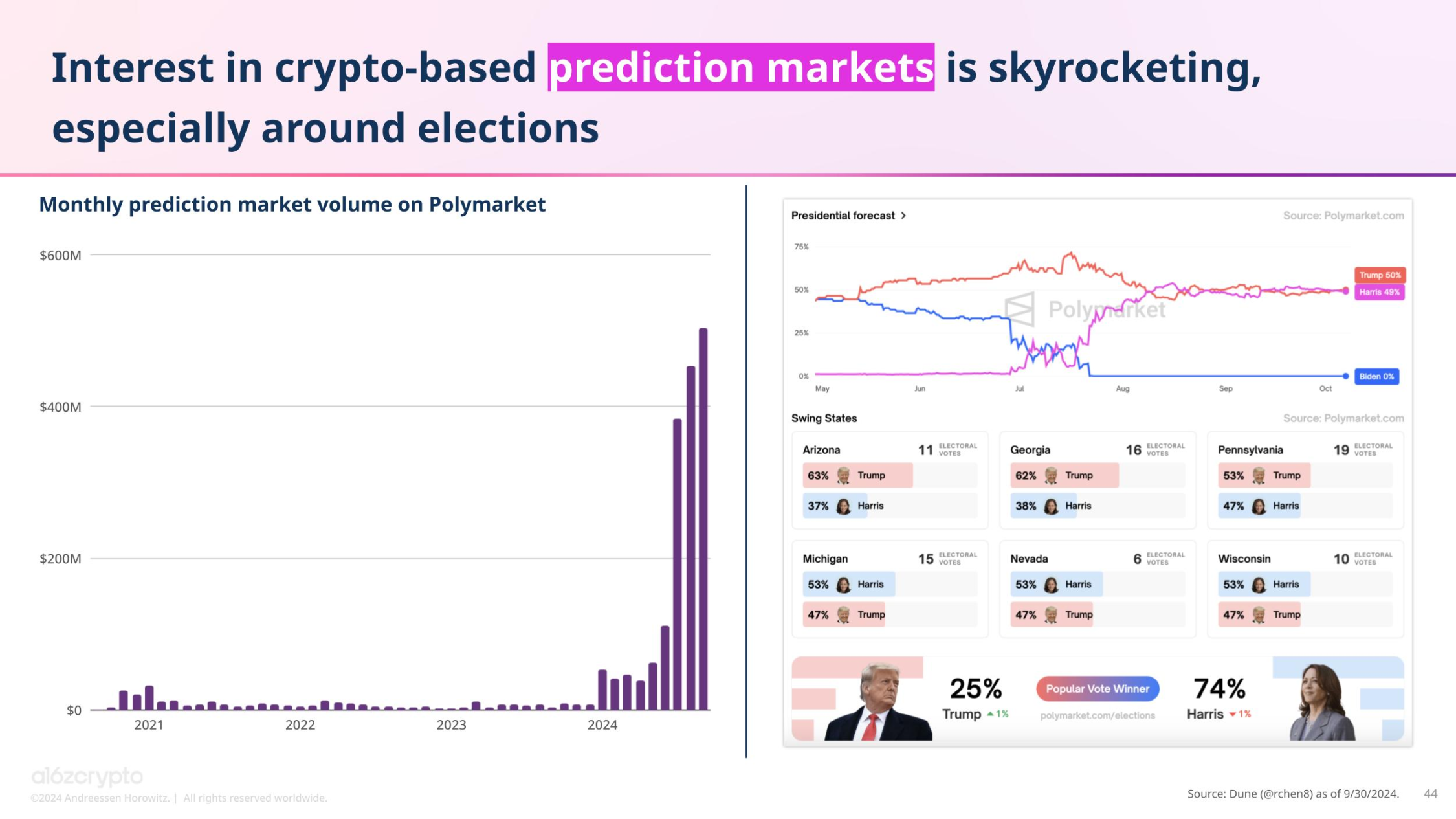

As the November elections approach, despite prediction markets being illegal in the U.S., crypto prediction markets are experiencing a spotlight moment and driving the overall development of prediction markets. Kalshi, a non-crypto prediction market, won a victory in a lower court last month while pursuing federal litigation around election contracts. (As of now, registered exchanges can offer traditional futures contracts based on elections.)

New consumer behaviors are beginning to emerge. These new experiences were previously unattainable due to the complexity of blockchain infrastructure and high transaction costs. As blockchain technology improves along the classic technology price-performance curve, more such applications are expected to thrive.

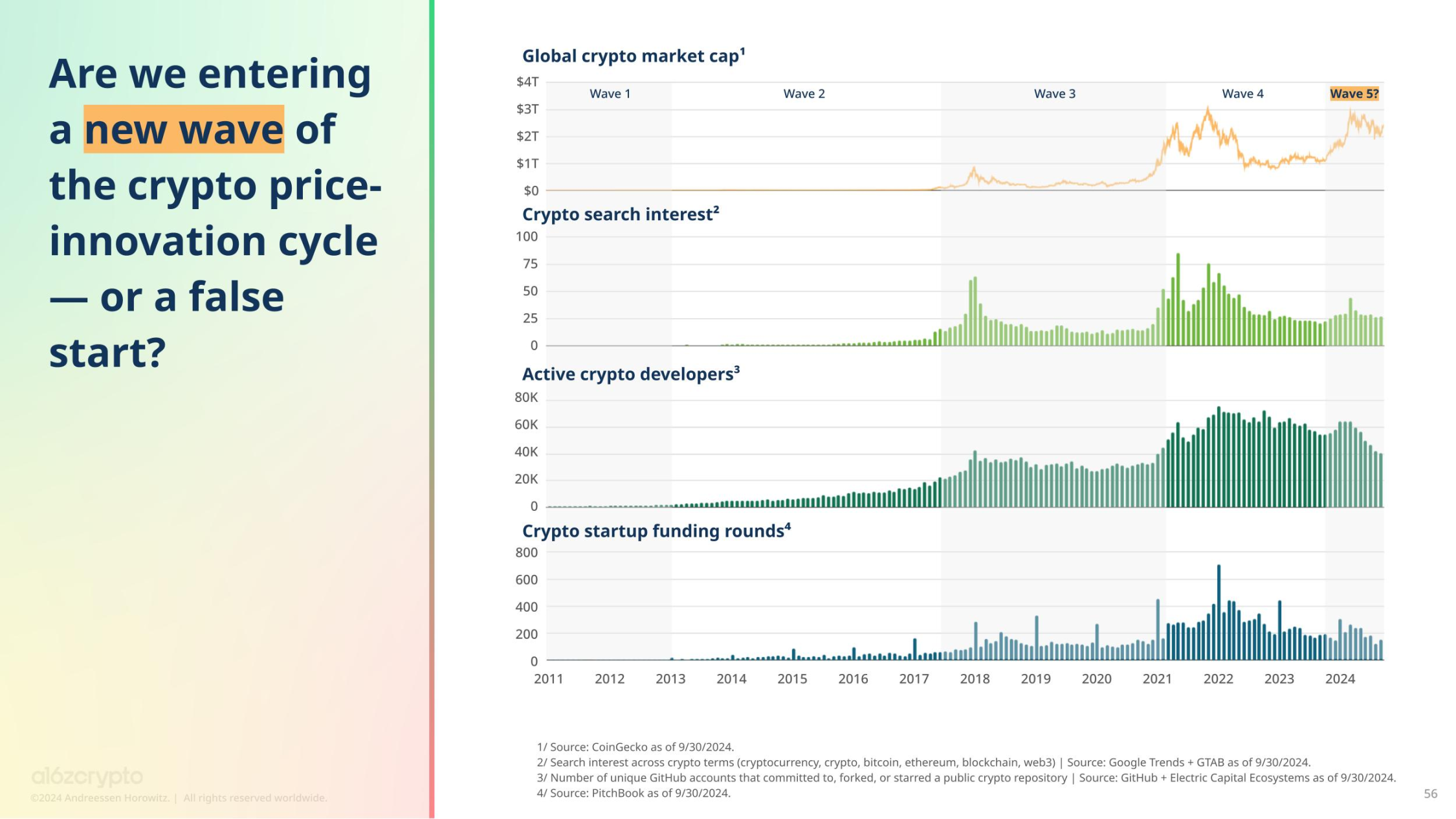

Overall, the state of cryptocurrency has made significant progress in policy, technology, and consumer adoption over the past year. There have been major milestones in policy, including the sudden approval and listing of Bitcoin and Ethereum ETPs, as well as the passage of important bipartisan crypto legislation. Infrastructure has seen significant improvements, from scaling upgrades to the rise of Ethereum L2 and other high-throughput chains. New applications are being built and used, ranging from pillars like stablecoins to explorations of emerging categories such as AI, social networks, and gaming.

Whether we have entered the fifth wave of the price-innovation cycle remains to be seen. However, as an industry, cryptocurrency has made undeniable progress over the past year. As demonstrated by ChatGPT, a single breakthrough product can change an entire industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。