Original Author: @DefiIgnas

Original Title: "L2s Are the New Old L1s—And Why ETH's Price Is Stuck."

Original Translation: zhouzhou, BlockBeats

Editor's Note: This article explores the current state and challenges in the blockchain space: L1s that fail to adapt to innovation (such as Cosmos) are facing serious difficulties, while emerging L1s (like Sui, Sei, and Aptos) have gained some attention in the short term but still need to innovate continuously to establish themselves in the long run. At the same time, the newly emerging L2s are similar to past L1s, lacking differentiation and innovation, and facing survival pressure. Although some diversification trends are beginning to emerge in the market, overall, Ethereum has not won the L1 war. Instead, alternative L1s and L2s are striving to create their own new futures.

The following is the original content (reorganized for readability):

Did Ethereum Win the L1 War?

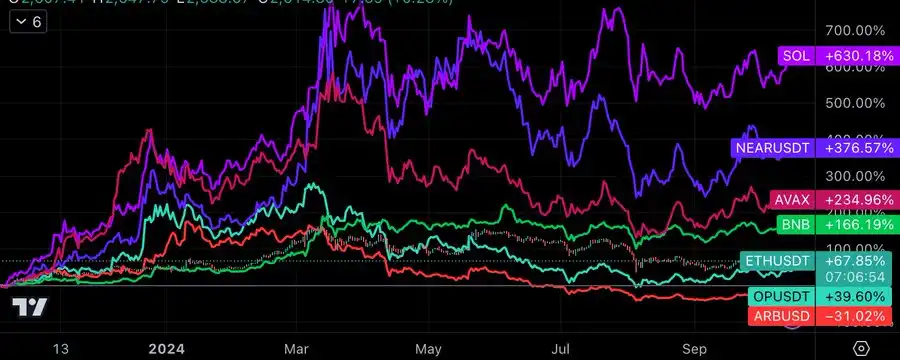

If you ask me this question now, my answer is clearly no, which is also a significant reason why the price of $ETH is stagnant. However, during the bear market, the view of ETH as the "L1 winner" was widely circulated.

We all know that a bull market will eventually come, so many people sold their other L1 assets and increased their holdings in the two assets we believe will not disappear: BTC and ETH.

All other L1 assets are considered likely to disappear for one of two reasons:

First, other L1s compete for yield-hungry investors by offering liquidity mining rewards, using protocols that are fundamentally similar to Aave and Uniswap V2. Aside from Ethereum, there is almost no innovation at the application layer.

Avalanche, BNB Chain, Polygon… are all similar, with their only differences being:

- Lower fees

- Faster speeds

- Brand image

- The amount of liquidity mining rewards they can offer

Second, with the rise of L2s like Optimism and Arbitrum, a new narrative for Ethereum is gradually forming, as these L2s promise scalability without compromising security. During the bear market, they performed quite well, while other L1s continued to lose total value locked (TVL) and users.

Solana is a huge blow to Ethereum extremists.

Despite being severely impacted by the FTX collapse, SOL not only recovered successfully but also shattered the illusion that Ethereum's aggregation method is the only viable scaling solution. As more L2s go live, the fragmentation of liquidity and user experience becomes increasingly severe. With each new L2 launched, Solana's monolithic approach appears more attractive.

The emergence of the debate between modular and monolithic structures has ended the narrative of "Ethereum winning the L1 war." Those investors who increased their ETH holdings during the bear market are now continuing to sell ETH to buy SOL and other L1s.

Other L1s are also innovating, and today they have a clearer and richer vision compared to a few years ago.

Avalanche: Just launched Avax9000, allowing for permissionless L1 (rather than L2) releases based on application needs.

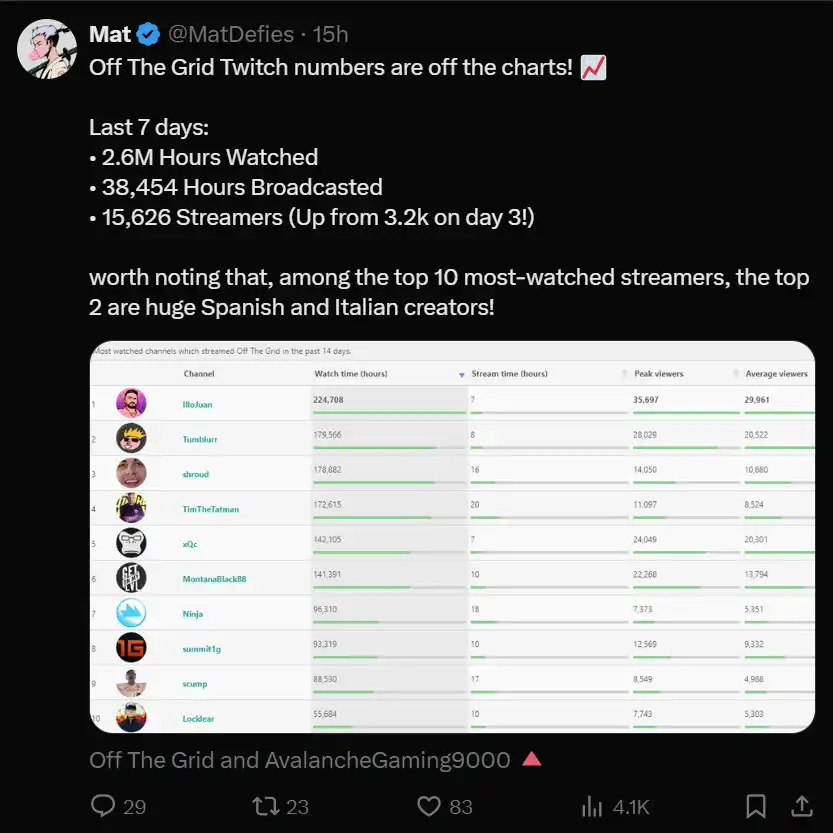

Compared to Ethereum L2s, Avalanche's L1 benefits from unified cross-chain communication. Additionally, the value appreciation of the main chain in Avalanche is also clearer. Avalanche's biggest victory is the "Off the Grid" game, which indicates that its vision is being realized. This could also revitalize the narrative of GameFi.

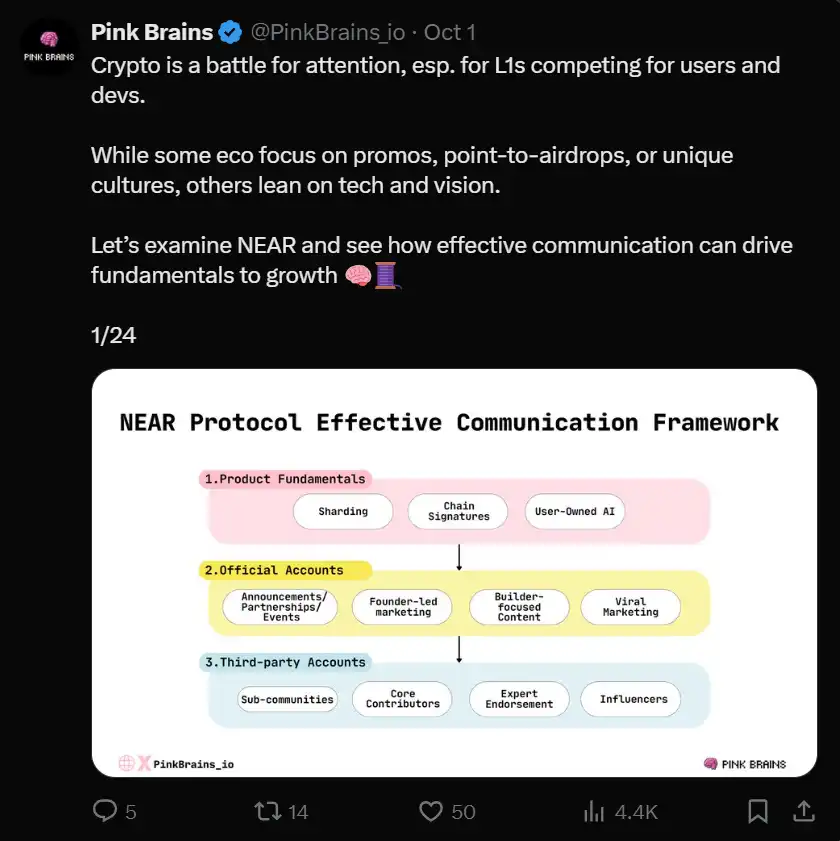

Near: Establishing its position as both a monolithic and modular blockchain, Near also provides chain abstraction for L2s through a unified user interface (BOS), supports L2 account aggregation, and implements the sharding technology that Ethereum abandoned.

BNB Chain: Launched opBNB L2 to reduce fees, but the more important upgrade is BNB Greenfield, focusing on DataFi to monetize data and intellectual property, as well as decentralized AI (training LLMs under privacy protection).

Fantom: Further strengthens its monolithic design through the Sonic upgrade, aiming for 2000 transactions per second (TPS) without sharding or L2, targeting the new generation of decentralized applications (dApps).

Gnosis: Building the financial dApp I use daily.

L1s that fail to innovate and adapt are facing difficulties, with Cosmos being the most obvious example. Once a pioneer of modular blockchains, it is now losing users, liquidity, and market attention, with the trading price of $ATOM having fallen back to levels before the 2020/21 bull market.

Meanwhile, emerging L1s like Sui, Sei, and Aptos still rely on the old "new shiny L1" strategy. Although they have gained some attention in the short term, they must innovate and achieve differentiation to thrive in the long term.

Today's new L2s are similar to past L1s, with almost no transaction fees and little differentiation outside of branding. They attract some fork protocols for airdrops but lack true innovation. As the airdrop craze fades and total value locked (TVL) declines, L2s must diversify and attract unique decentralized applications (dApps) to survive, and their token economic models are relatively poor.

Projects that cannot adapt to market changes may be eliminated, just like some EVM chains that emerged during the DeFi summer of 2020.

Nevertheless, there are still signs of diversification in the market: L2 interoperability alliances (such as OP Superchain, zkSync Elastic chain, etc.) are developing, Base is benefiting from Coinbase, and zkSync has invested millions of dollars to attract unique dApps.

Overall, Ethereum has not won the L1 war, and the value appreciation of all L2s remains unclear. However, this is actually a good thing for the entire industry. Even as Ethereum faces challenges, alternative L1s are still striving to build their future and provide use cases that Ethereum may not be suitable for.

And now, the time has come for L2s to prove their value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。