The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui talking about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to all coin friends' attention and likes, and refuse any market smoke bombs.

Finally, we meet again. I apologize at the beginning of the article. Every time the market starts, Lao Cui is busy guiding users, and I have indeed been absent from sharing with everyone. I also remind everyone that when the market starts, do not wait for Lao Cui's voice. I am basically on the way to guide users. If you have any questions, just communicate with me in time, and remember not to wait for the article. For the new round of trends, let's analyze it again. As for the bullish analysis from the previous article, it has already ended. Congratulations to those who followed along and made a profit. Regarding the future trend, I will give everyone a conclusion first. Those who are impatient can end here. The bullish trend will continue, and the intention to decline is not strong enough. Users holding long positions can continue to hold, just like those in spot trading. Currently, Lao Cui's positions are still retained.

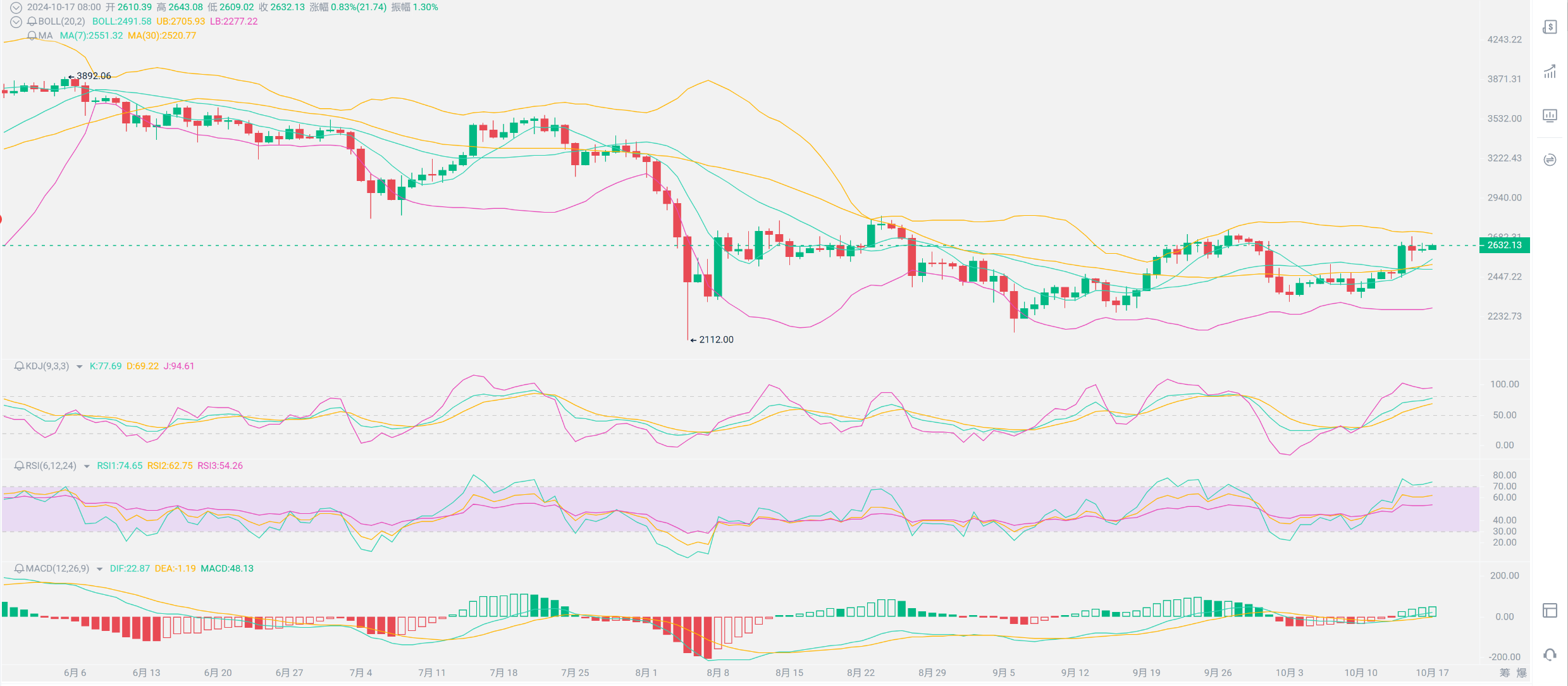

Let's directly enter the technical analysis. From a technical perspective, on the daily chart, the seven-day moving average has once again crossed the thirty-day moving average, and the short-term growth trend remains strong. In conjunction with the Bollinger Bands, the current market is running between the upper and middle bands. However, the upper and lower bands have shown signs of convergence since 08:00 this morning, indicating a narrowing. The narrowing of the Bollinger Bands means that the upper and lower band lines are continuously converging. When the stock price has been declining for a long time and narrows, it indicates that the forces of bulls and bears are gradually balancing, and the stock price will be in a long-term sideways consolidation. Investors should mainly observe. This means that there may be a wave of sideways consolidation in the short term, which means that the recent market is unlikely to show a deep correction trend. This also means that after the bullish consolidation, the next impact will not be the high point of 2688 on the 15th, but very likely to directly impact the high point of 2727 on September 27. The correction will not be deep, symbolizing that the profits above are extremely rich. Currently, it is very easy to see an upward growth of a hundred points, and the downward correction will not be too deep. For those who want to enter the market, focus on long positions.

Next, let's take a look at the RSI indicator. The 6-day indicator has already shown values exceeding 70, and the 12-day value of 63 is also close to 70, with only the 24-day value being slightly safe. In the short term, there are signs of bearishness. The KDJ three-line values are also similar: K line 77, D line 60, J line 93, all three lines are very close to the overbought area, indicating a very obvious short-term correction trend. The last value is the familiar MACD, which formed a golden cross on October 13, and the trend of DIF breaking upward is very strong. The bullish trend has not ended, and the overall trend is still in a bullish space. After looking at all the indicators, I believe everyone is very confused. There are bullish indicators and bearish trends. When viewed together, it is actually very easy to see that this is a typical issue of capital connection after a surge. Not only do you feel confused, but even the market makers are unsure whether to correct or rise. Especially in terms of the Bollinger Bands, it has led everyone to temporarily observe. The overall technical indicators only indicate one problem: it is very likely to form a sideways situation, with a slow correction, but the depth below is not large. Lao Cui's suggestion is that after the correction, it is still possible to look for bullish opportunities, meaning that the strategy of ambushing long positions can continue.

Now, from the news perspective, first, on the military front, the struggle between Iran and Israel seems to have calmed down again, giving the crypto world a chance to survive. As long as the war does not break out again, the continuation of the bullish trend will not be interrupted. On the political front, Trump's chances of winning can be said to be significantly increasing. Once in power, it will be beneficial for the crypto world, and favorable news will only increase in the future. With November 5 approaching, everyone must control their positions around the election. It is best to prepare all entry points before the election, as ambushing in advance may yield better results. Finally, regarding the capital aspect that everyone is concerned about, a wealth management platform in Hong Kong has conducted a survey showing that 76% of private wealth in Asia has already entered the digital currency market, and 18% plan to invest in the future. This perfectly fills the gap before the interest rate cut in November for the crypto world. Although the volatility in the crypto market has not been as severe since the interest rate cut, the anticipated big market has not fully emerged, influenced by political and military factors. Ultimately, the fundamental issue remains that there is no significant capital involvement. Since the last investment of over 200 million dollars, the influx of capital has been increasing. Currently, the market value of the crypto world is quite considerable, and after this round of financing, it is expected to directly break through 3000 this year. Everyone must hold onto their spot positions.

Lao Cui's summary: Whether from the news perspective or the technical perspective, the short-term trend is very clear, still in the stage of surging and correcting, which means that there probably won't be too high points in the short term. The only benefit is that the bearish force is not strong, and everyone is afraid that once it drops, they won't be able to exit in time, allowing the bulls to gain an advantage. Therefore, short positions should definitely not be arranged in the short term. Let's enter our observation period. As long as the recent correction does not break the key support level of 2600, our strategy remains bullish, even blindly bullish. Lao Cui's strategy is that I have not exited the previous long position at 2400, which gives everyone confidence. I will at least let the contract reach above 2800 before considering exiting. For those who want to ambush long positions, the stop-loss space below must be large. You can consider fighting alongside Lao Cui. Of course, don't worry too much. Even if it temporarily breaks below 2600, the depth below will not be too large, so be ready to buy the dip at any time. As long as it dares to drop, everyone can directly take over. For those who find the entry points unclear, just ask Lao Cui. That's all for today.

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess. A master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one territory, aiming for the final victory. The novice, on the other hand, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。