Investigation Report: 94% of Asian Private Wealth Has Invested or Is Considering Investing in Cryptocurrency | The Allocation of Digital Assets by the Wealthy Has Become a Trend——

Cointelegraph cites a report recently released by Aspen Digital, showing that interest in cryptocurrency among Asian private wealth is significantly increasing.

The survey indicates that 76% of Asian private wealth has already ventured into digital assets, with another 18% planning to invest in the future, totaling up to 94%.

Personally, I believe that true wealthy individuals primarily allocate their funds to #BTC; as more wealthy funds enter, the price of Bitcoin rises, and then the funds will flow to others;

The report surveyed 80 family offices and high-net-worth individuals in Asia, most of whom manage assets ranging from $10 million to $500 million.

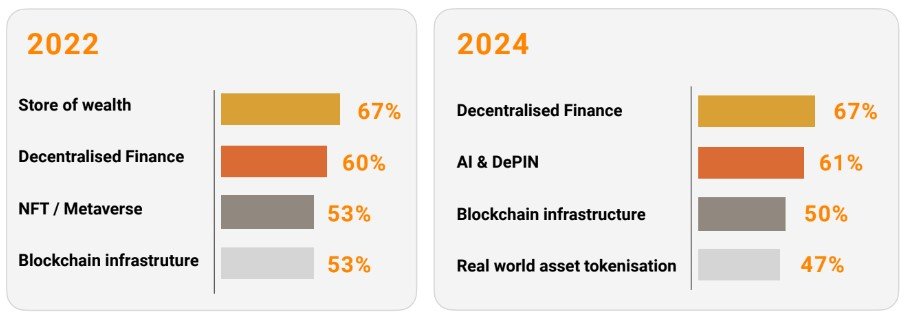

This proportion has significantly increased compared to just 58% of respondents involved in digital assets in 2022.

Two-thirds of respondents expressed interest in decentralized finance (DeFi), and 61% showed concern for AI and DePIN. Additionally, with the approval of spot Bitcoin ETFs in the U.S. and Hong Kong, 53% of respondents gained exposure to cryptocurrency through funds or ETFs.

From: @BlockBeatsAsia

Link: https://www.theblockbeats.info/flash/266971

In the future, more wealthy individuals will allocate digital assets. Compared to other global assets, the growth potential and security of digital assets will continue to improve. Here are several main reasons for allocating digital assets:

1) Diversified Investment Portfolio:

Digital assets, such as cryptocurrencies (Bitcoin, Ethereum, etc.) and some NFTs (non-fungible tokens), provide investment opportunities that differ from traditional financial markets. This helps to diversify risk, as the price fluctuations of digital assets often do not correlate with traditional assets like stocks and bonds.

2) High Potential Returns:

Although the digital asset market is highly volatile, the potential return rates can significantly exceed those of traditional investments. Early investors in Bitcoin or other popular projects have witnessed returns of tens or even hundreds of times, which is an undeniable attraction for the wealthy.

3) Privacy Protection:

Bitcoin and some other cryptocurrencies offer relatively anonymous transaction methods, which is an advantage for wealthy individuals who wish to maintain privacy in certain investment activities, although anonymity is being challenged with increasing compliance.

4) Hedge Against Inflation:

Cryptocurrencies, especially Bitcoin, are often seen as "digital gold." Wealthy individuals may convert a portion of their assets into cryptocurrencies as a strategy to hedge against inflation, as the supply of cryptocurrencies is limited, contrasting with the unlimited printing of fiat currencies.

5) Technological Belief and Futurism:

Many wealthy individuals hold an optimistic view of blockchain technology and its application prospects. Investing in digital assets is not only for economic returns but also to support and promote what they believe are new technologies that will change the world.

6) Social and Cultural Capital:

Owning or investing in digital assets may be seen as fashionable, avant-garde, or a ticket to enter specific social networks, especially within certain social circles. This is not only an economic consideration but also a symbol of social status.

7) Tax Avoidance and International Transfer:

While legality and ethics may vary, digital assets can, in some cases, be used for tax avoidance or cross-border asset transfers, as they are not subject to the same strict international regulations as traditional assets.

8) Innovation and Opportunity:

The digital asset market offers opportunities to participate in startup projects, DeFi (decentralized finance), NFTs, and other rapidly developing fields, providing not just investment opportunities but also the chance to participate in or lead emerging markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。