Operating nodes, earning veCARV, and actively participating in CARV governance will also enhance your eligibility for the second season airdrop, which will release 3% of the tokens.

$CARV is the core token driving the CARV ecosystem, granting users true data ownership and monetization capabilities, focusing on the gaming and AI sectors. With $CARV, users can not only complete multi-chain gas payments but also enjoy exclusive ecosystem benefits. Additionally, $CARV provides access to secure, unified player data profiles for games and projects. As a governance tool, $CARV enables holders to collectively participate in the future development of CARV and promotes the construction of a modular data layer through staking rewards and incentive mechanisms. With the completion of the TGE, CARV plans to accelerate ecosystem integration, promote community-led governance, and further enhance staking rewards, laying the foundation for the long-term development of the ecosystem.

The design of the $CARV token economic model is intricate, but it may seem complex at first glance, involving too many calculations that might discourage you as an ordinary user from knowing how to quickly increase your assets. In this article, we will attempt to help you quickly understand how to play with $CARV, providing clear, actionable guidance to easily enhance your assets.

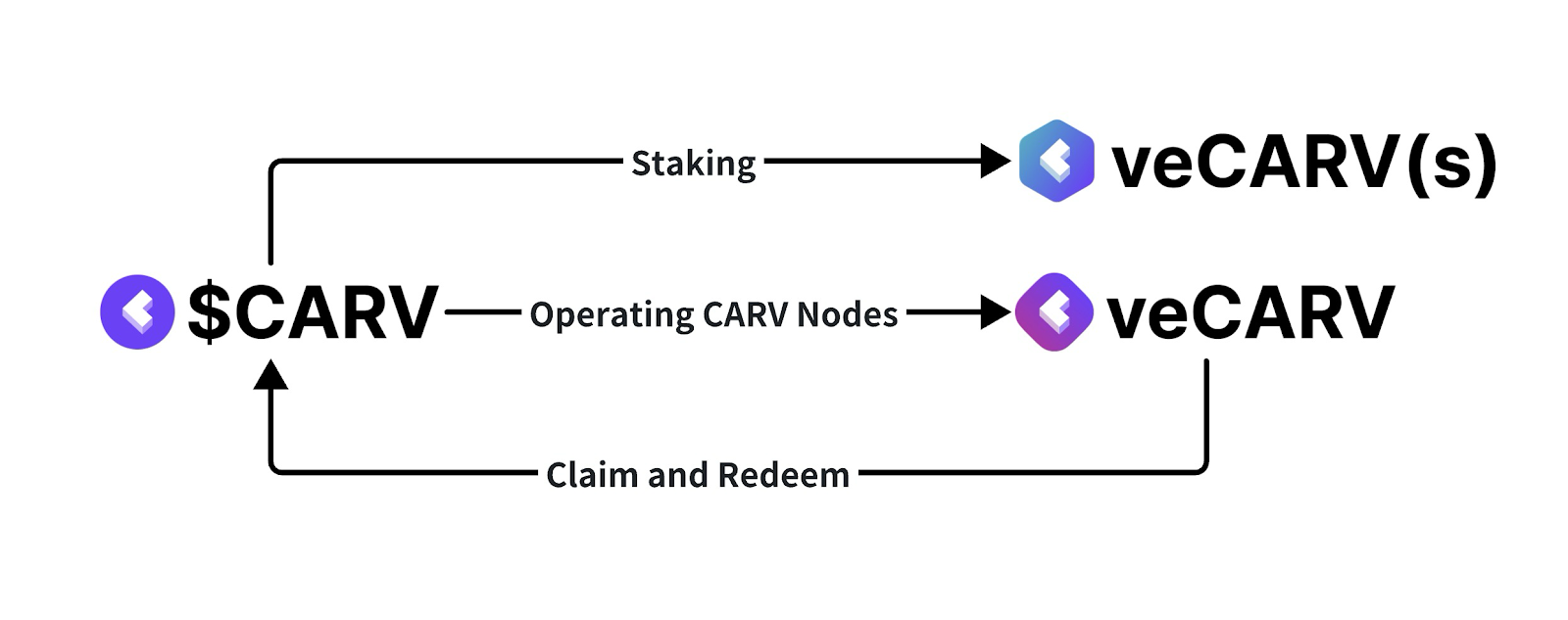

Distinguishing $CARV, veCARV, and veCARV(s)

- ### $CARV – Core Asset

$CARV is the main token of the CARV ecosystem, which is traded on multiple exchanges (you can check the trading information of $CARV on CoinMarketCap and CoinGecko). It can be seen as the core asset of the CARV ecosystem, possessing intrinsic value. We will also provide more detailed strategies for $CARV later and explain why purchasing and staking $CARV can yield good returns.

- ### veCARV – Intermediate Medium

veCARV (voting-escrow CARV) is the key to earning rewards and influence within the CARV ecosystem. veCARV is a non-transferable token that symbolizes your contribution to the CARV ecosystem. Whether through participating in CARV airdrops or running CARV validator nodes to enhance network stability, you can earn veCARV as a reward. [Learn more about CARV nodes and how to obtain them].

By holding veCARV, you will be able to fully participate in the future development of CARV and have voting rights on governance decisions. After receiving veCARV, you can also choose to exchange it for $CARV tokens.

Additionally, there is veCARV(s), a special token obtained by staking $CARV, which grants holders powerful governance rights. Although veCARV(s) cannot be exchanged for $CARV, it has full voting rights in the governance of the ecosystem, allowing you to directly influence the direction of CARV's development.

veCARV allows you to fully participate in the future development of CARV, granting you governance voting power, and can be exchanged for $CARV after receipt.

Furthermore, veCARV(s) is an exclusive token obtained solely through staking $CARV, endowed with strong governance rights. While veCARV(s) cannot be exchanged for $CARV, it possesses full voting rights in ecosystem governance, enabling you to directly participate in the direction of CARV's development.

Concise Overview:

$CARV: Your foundational asset.

veCARV: Opens the door to CARV governance, convertible to $CARV.

veCARV(s): Generated through staking, enjoys full governance rights but not convertible to $CARV.

By clarifying the roles of these tokens, you can better maximize your returns within the CARV ecosystem!

Step-by-Step Guide to Earning More $CARV

Now that you have a clear understanding of $CARV, veCARV, and veCARV(s), the strategies for earning more $CARV become much simpler. Here are two reliable methods to increase your $CARV holdings:

- ### Staking Strategy

Currently, staking $CARV can enjoy an annual percentage rate (APR) of up to 550%. Visit the CARV staking page, select your staking amount and duration—the more $CARV you stake and the longer the commitment, the greater your voting power and daily $CARV rewards. Additionally, actively participating in CARV governance through staking $CARV will also affect your eligibility for the second season airdrop, during which 3% of the tokens will be released.

Tip: Acquire more $CARV through exchanges (you can check the exchange information provided by CoinMarketCap or CoinGecko), then return to the CARV staking page to increase your staking principal. This way, you can enjoy high annual percentage rates and daily inflows of $CARV. Note that staking occurs entirely on-chain, meaning your $CARV will be locked until the staking period ends—so please stake wisely and ensure it is within your capacity!

- ### Long-term Strategy: Operating CARV Nodes

By purchasing and operating CARV validator nodes, you can earn daily veCARV rewards. If you want to further enhance your earnings, you can enable the delegation commission feature, allowing other node holders to delegate to you, thus earning commissions to increase your veCARV rewards.

As the CARV ecosystem expands, CARV validator nodes will play an increasingly critical role, such as verifying CARV DB (self-sovereign virtual storage supported by Eigenlayer) and ensuring the security of CARV Link (on-chain Oracle/Attestation services). These enhancements make validator nodes the cornerstone of a powerful and scalable CARV network. Purchase nodes

Operating nodes, earning veCARV, and actively participating in CARV governance will also enhance your eligibility for the second season airdrop, which will release 3% of the tokens.

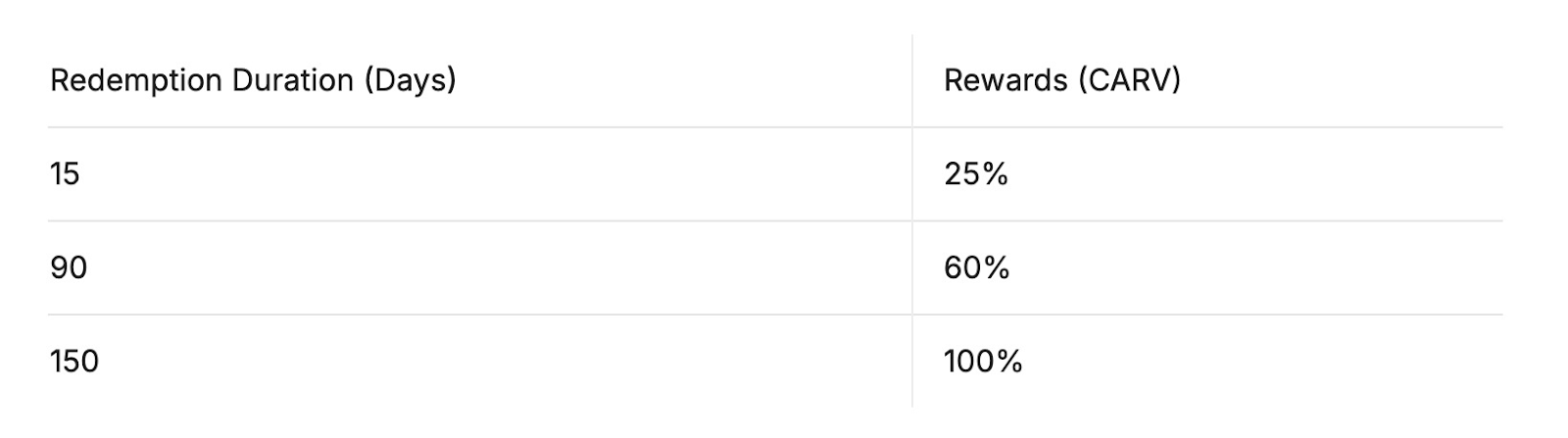

Tip: After receiving veCARV, remember that converting it to $CARV requires configuring a redeem period. The longer the redeem period, the higher the redemption rate—up to 100% full return. Note that once veCARV enters the redemption period, it will no longer be eligible for governance voting.

We can see that the CARV token economics integrates many excellent precedents, such as CURVE. Overall, CARV's token design encourages long-termism, and the token model also considers many selling pressure issues, providing a foundation for stable token prices.

To delve deeper into the principles of CARV's token economics, feel free to refer to the token economics chapter in our white paper. Here you will find detailed algorithms and rule explanations: CARV White Paper - Token Economics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。