This Space invited HighFreedom, a former macroeconomic analyst at a brokerage, to share his trading strategies, insights on the macro economy, and predictions for the future trends of the cryptocurrency market. With years of trading experience, HighFreedom has a deep understanding of Bitcoin, altcoins, and their relationship with traditional financial markets. The conversation also covered the growth path of novice traders and how to build a systematic trading logic.

*All text is for sharing purposes only and does not constitute any investment advice.

TL;DR

1. About Trader HighFreedom

1) What is the trading strategy?

- Make money from direction, that is, during a bull market, by holding Bitcoin and not selling, earn from the overall market rise.

- Make money from volatility, by controlling leverage, after the BTC price falls into a suitable price range, establish a coin-based (Bitcoin-based) long position, and when the price is right, stake Bitcoin to lend out part of the funds, and then close the coin-based long position when the price rises to increase Bitcoin holdings.

2) Why form such a trading strategy?

- After experiencing several cycles, HighFreedom believes this strategy aligns better with his risk preference and capital management strategy, effectively avoiding the risk of missing out and reducing holding costs.

- In the high-risk, high-drawdown environment of the crypto market, it essentially achieves similar results to high buy-low-sell-high in spot trading. The advantage of the coin-based long strategy is that it can avoid missing the main upward wave in a bull market, while the downside is that it is leveraged long, which has a liquidation price, so it is essential to control leverage risk to a certain extent.

3) Logic of the trading strategy

- Core logic: Combine directional returns with volatility returns, avoiding missing the overall market rise while further increasing Bitcoin holdings through volatility operations. Especially during a bull market, timely use of volatility tools to optimize holdings.

- Risk avoidance: By going long on a coin-based strategy, HighFreedom reduces the risk of selling too early and missing the market, especially in cases of sudden rapid market rises.

4) Expected returns

- Long-term returns: During a bull market cycle, this strategy can achieve overall returns of 3 to 5 times.

- Drawdown management: HighFreedom expects drawdowns to be controlled at around 20%-30%, with extreme cases possibly seeing a 40% drawdown.

5) Considerations for implementing the trading strategy

- Control leverage: Strictly control leverage levels when trading, especially when coin prices are high or market volatility is large. It is generally recommended to keep leverage within 50% to ensure a significant safety margin.

- Timing: Coin-based long positions require choosing the right market timing; this strategy is most suitable for oscillating markets during a bull run. In a rapid main upward wave, this strategy is not applicable because when the market is very hot, the cost of leveraged long positions is very high (for example, in March this year, the funding rate for going long on BTC even exceeded an annualized 70%), making the strategy's profit and loss relatively poor, especially in cases of low spot liquidity, to avoid excessive funding costs.

2. Macroeconomics, US Stocks, and the Crypto Market

1) Why should "crypto people" understand the macroeconomic situation in the US, and what should be the core focus?

- HighFreedom believes there are two types of trading entities in the market: on-market participants and off-market participants. On-market participants are usually veterans in the crypto space, generally holding more coins and less cash, focusing on the cycles of the crypto market, popular sectors, on-chain data, and other indicators. In contrast, off-market participants typically enter the market through channels like spot ETFs, characterized by having more cash and fewer coins, viewing Bitcoin as a risk asset, and flexibly entering and exiting based on market liquidity. In the early stages of the market, participants were mainly on-market crypto individuals, and the market size was small, so they only needed to focus on technical indicators and candlestick patterns. However, as the market developed, off-market traders' funds began to flow in, significantly increasing their impact on the market, thus necessitating attention to US stocks and the overall macroeconomic situation. Similarly, BTC has finally been recognized and married into the wealthy family of US stocks after years of effort.

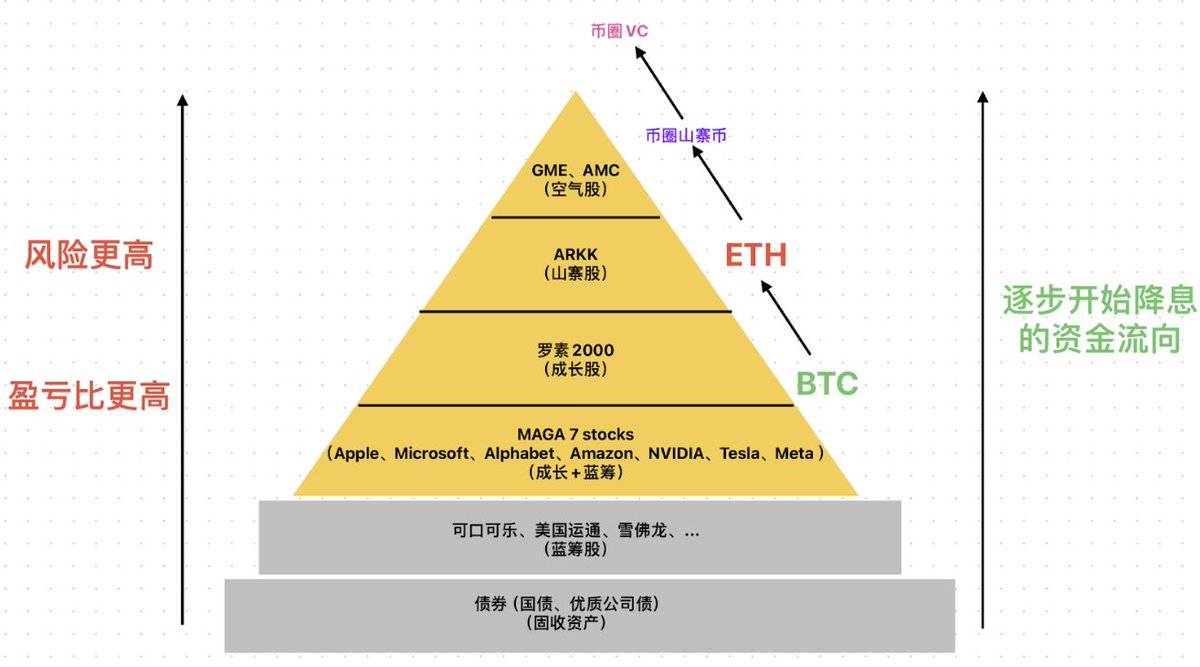

- The US stock market has a pyramid-like structure, from the bottom layer of money market funds and government bonds to the top layer of high-risk, high-return dream companies, with risk and return increasing step by step. HighFreedom believes that Bitcoin's risk and return positioning can roughly be aligned with the Russell 2000 and ARKK, possessing certain fundamentals and growth potential, making it a form of digital gold. Altcoins, on the other hand, carry higher risks, similar to high-risk stocks in the US market (like GME and AMC).

2) How to judge the direction of the current altcoin market through US stock logic?

- HighFreedom believes that when the price of Bitcoin rises to a certain extent, some funds in the market may shift towards higher-risk altcoins, triggering an altcoin rally.

- The performance of altcoins fundamentally depends on the overall market liquidity. If high-risk stocks in the US market, such as ARKK, GME, and AMC, perform well, it indicates ample liquidity, and the altcoin market may also see an upward trend. However, current liquidity is relatively tight, which may suppress the performance of the altcoin market.

- He believes that the recent market has experienced a leverage cleanup both on-market and off-market. The cleanup on July 4 was mainly a deleveraging process within the crypto market, while the cleanup on August 5 was related to off-market (mainly US stocks) funds, which has little to do with the crypto market itself. However, a macro reversal is expected, potentially leading to a new bull market cycle in the fourth quarter. Nevertheless, there are still differing opinions and controversies in the market regarding the future extent of the rise.

3) What should be the steps for beginners to learn trading?

- Basic learning: HighFreedom suggests that novice traders obtain CFA Level 1 certification to systematically learn the fundamentals of financial markets and master key skills such as macroeconomic analysis and industry analysis.

- Deliberate practice: Pay attention to market dynamics daily, analyze the reasons behind token price increases, and cultivate market sensitivity and trading intuition. At the same time, learn risk management, especially how to control leverage in a volatile market.

- Multi-dimensional analysis: In addition to fundamental analysis of financial markets, attention should also be paid to on-chain data and the fundamentals of different cryptocurrencies, building one's own trading logic and system.

4) What is the Stop Doing List?

- Overusing leverage: When trading on-chain, leverage levels must be strictly controlled. The cyclical effects of on-chain trading are significant, especially regarding the behavior of large holders.

- Over-relying on indicators: With the emergence of spot ETFs, the effectiveness of on-chain indicators may be weakened, and investors need to continuously adapt to new market logic and changes. In the long run, if the macroeconomic logic changes, the indicators that investors focus on should also change accordingly.

3. Recommended Traders

1) Fu Peng: From Northeast Securities, has a deep understanding of US dollar assets, excels in systematic analysis, and enjoys sharing insights.

2) Arthur@CryptoHayes: Has an in-depth understanding of the US macro economy; although the wording in his articles can be difficult, his viewpoints are valuable for reference.

3) Victor@VictorL1024: A fund manager, veteran in the crypto space, early miner, with unique views on the market.

4) Bperson sunong@BensonTWN: A veteran from the last bull market, providing some key cyclical indicators that are helpful for trading.

Dialogue Record

FC

Today we have HighFreedom with us. Initially, we wanted to build an investment research system within our fund. We have been looking to talk to people who have previously worked in brokerages or traditional financial institutions and have done research to ask how to build this system. That's how we got to know each other. We have chatted a couple of times, and since we come from different perspectives, it has been quite rewarding. So today, we would like to ask you to share your views on the entire market and some thoughts on the future. We believe this is the main purpose of this conversation. How about you start by briefly introducing yourself, and then we can move on to the next part?

HighFreedom

Okay, sure. Host, good evening everyone. Thank you for the invitation today. I have been listening to your weekly conversations with some friends, and I feel the quality is quite high. My situation is like this: I used to work as a macroeconomic analyst at a brokerage. In 2016, while studying in Singapore, I was introduced to cryptocurrency. So, I have been in this market for about seven to eight years. You can say I am a notorious crypto trader or a cryptocurrency investor. Today, I was brought here, and I have also chatted with the host a few times. I feel the core issue is that everyone thinks this market seems very different from when I first joined in 2016 and 2017, as well as from 2021. So, I would like to discuss this with everyone today, is that okay?

FC

Why don't you start by talking about your trading logic? What does your trading strategy look like?

HighFreedom

Sure. I believe everyone has different risk preferences, acceptable profit-loss ratios, and capital positions. Let me first share my situation. After several bull markets, the most suitable operating logic for me is to make money in two ways during a bull market. The first is to make directional money. Directional money means you clearly know you are in a bull market. Making directional money is simple: don’t touch Bitcoin, whether it goes up or down, just hold it. The second is to make money from volatility. A simple way to make money from volatility is to clear some spot when I think it has risen enough and wait for it to drop back before adding more, continuously doing this to lower my holding costs. This coin-based logic suits me better, which is to make money from volatility.

In summary, I think if during a bull market it drops to a good position, I will go long on a coin-based strategy. When the price goes back up, I will close that part of the position. This way, during the bull market, I am doing one thing: making my Bitcoin holdings increase, aiming to sell at a good price near the market peak. That’s basically the thought process. So, it’s more of a coin-based logic.

Another question is why make it so complicated, with both coin-based longs and contracts. The thing is, everything has its pros and cons. What’s good about it? There is no so-called risk of missing out. Because after experiencing several market changes, you will find that this market is like this. You clearly know the bull market hasn’t ended and is still running, but if you unload some spot, the risk of missing out is quite significant. The market's rise, based on historical data, can complete a 20% to 30% increase in just one to two weeks. This is especially true for Bitcoin, so sometimes if you unload leverage and that part of the spot, it can be quite awkward, and you might miss out suddenly. After holding for a long time and experiencing a lot of fluctuations, it suddenly rises. So, in short, the most suitable operating logic for me is to go long on a coin-based strategy, earn as much directional money as possible, and if I can make money from volatility, I will, and if not, that’s fine; I can just hold. That’s the situation.

FC

You mean going long on a coin-based strategy, finding a relatively low point, and just holding the long position, right?

HighFreedom

For example, a while ago, when it dropped to around 50,000, the lowest was about 48,888. In the crypto market, after the spot price drops, it might slowly stabilize. If I have, say, one Bitcoin when the price is at 52,000, 53,000, or 54,000, I can use that Bitcoin as collateral to borrow, say, 0.5 Bitcoin, which gives me a leverage ratio of around 50%. The liquidation price would be around 20,000. Once the price rises, I can gradually close the position, and one Bitcoin could turn into, say, 1.05 Bitcoin, allowing me to earn some money from volatility. This is the operational logic of going long on a coin-based strategy. Most people use USDT for long positions, but I prefer to use Bitcoin as collateral.

FC

I understand. If that's the case, what do you think is the appropriate capital size for this kind of operation?

HighFreedom

I think if you want to reach a million level, it might be easier, but it also depends on everyone's expected returns in this market. If you hope to achieve a hundredfold return, then I think this operation is completely unsuitable. This operation is more like when you hold Bitcoin during a bull market and feel bored, you should definitely go long when there are good opportunities to increase your Bitcoin holdings. So, if you look at it this way, for example, if you go long at 50,000 with 50% leverage and it rises to 60,000, that’s a 20% increase, and the money we earn is 20% of that 50%.

After a series of operations, your entire position could change from one Bitcoin to 1.1 Bitcoin, which is a ten percent increase. So, I think it really depends on everyone's expectations. Even if I have 100 dollars, I can do this kind of operation. However, those with 100 dollars might not just think that a two to three times return after a bull market is enough; it might not be enough at all. That’s the situation.

FC

Got it. What do you roughly expect the returns to be?

HighFreedom

I think after one cycle, the worst-case scenario might be three to four times, while the best-case scenario could be four to five times. High returns are certainly what everyone desires, but in my case, it’s hard to say. To supplement alpha, you can only use small positions, while you need to maintain a large position to secure beta. Speaking of drawdowns, since my operation involves leverage, if the leverage is set at a mid-level and there’s a rapid decline, my net worth will drop quickly. The maximum drawdown I hope to control is around 40%, which is the least desirable situation. However, after several cycles, experienced traders generally manage to open positions at reasonable levels, so it’s not that extreme. I’m used to drawdowns of 20 to 30 percent; it’s not a big deal. That’s how it is.

FC

Understood. If someone wants to adopt your trading strategy, what key skills do you think are necessary, aside from timing?

HighFreedom

I think the primary skill is controlling leverage. After eight years of experience, I believe this is the most important point. Because later we might also discuss this, looking at various assets around the world, the crypto market consists of high-risk or ultra-high-risk assets that can yield several times or even dozens of times returns. But at the same time, the drawdowns are also very significant. Friends who experienced the last cycle might remember situations like March 12; if you were long on Bitcoin with 2x leverage and your position was wrong, you could get liquidated with a full position. Logically, going long on Bitcoin with 2x leverage should be something that crypto people would consider conservative, but in extreme situations, you could still get liquidated. So, I feel that the main focus should be on controlling risk, which is why my lesson learned is that if I have 100 Bitcoins, I will only open a position of about 40% at most. In extreme situations, if I feel the position is very good, I might go up to around 50%, ensuring a very low liquidation price; I think that’s the most important thing.

Secondly, this strategy has its limitations. As you’ve heard, essentially, going long on a coin-based strategy means borrowing coins from the market. For example, in the current market, the annualized return for coin-based strategies on Binance might be around seven, eight, or nine percent, which I think is completely acceptable. However, when it comes to the market peak, like in March this year, going long on Bitcoin with a coin-based strategy and leverage is not very suitable. Because at that time, the funding rate for going long on Bitcoin on Binance had already exceeded an annualized 60% to 70%, which is extremely high. When the market is sideways, the cost is too high to bear. So, I think one needs to control the position size and liquidation price, and also consider when to enter the market. Doing this kind of operation when the market is very hot is basically not feasible; that’s about it.

FC

I understand. Because I’ve had many offline discussions about your understanding of traditional markets, or the emergence of ETFs. You’ve also mentioned a lot about the changes in our industry, so I think we can talk about the specific logic of your trading strategy. I believe the first factor affecting prices in this cycle is the on-market and off-market factors, right? I think we can start discussing this.

HighFreedom

Sure, no problem. Speaking of this, let me share my growth experience, which also helped me build my own analytical system. In 2016 and 2017, I was still studying in Singapore, and during a dinner gathering, everyone was discussing ESO and the 49 super genesis nodes. What I’m saying might be unfamiliar to new friends, but everyone was very excited back then.

At that time, when I started participating, I felt that the market was relatively small. Basically, only pure crypto people were playing with this, and there were very few funds or people from other markets participating. So, I felt that it was a very primitive market. It was enough to simply look at various technical indicators, candlestick patterns, such as momentum, volume, trading volume, MACD, and so on, including daily charts, EMA, and the Vegas channel. That was basically the situation back then.

Fast forward to the last bull market in 2021, I felt that just looking at these things was not enough. While it was useful, it gradually became insufficient. Because last time, we had limited time, but I have a strong impression of the last bull market. If you participated, you should remember that it was a double top; in April 2021, there was a top around 64,000 to 65,000, which I remember was on April 14. In the second half of the year, there was another top around November, with a spike reaching 69,000. In fact, there was a clear situation: if you looked at the most commonly used data websites, like Glassnode, you would see what actually happened.

In the first half of 2021, I defined that as the spot top, which was a point where long-term holders in the crypto space were continuously selling. However, the top in the second half of 2021 was basically unrelated to the crypto space; from an on-chain perspective, it didn’t have much relevance. The top in the second half of the year was driven by off-market factors, with a large influx of liquidity at a very high point. The Nasdaq index was also soaring, and dollar liquidity was increasing, which caused Bitcoin to rise as well. So, I simply defined the top in April as the spot top and the one in November as the contract top, which was basically driven by off-market contracts without much spot involvement.

So, my feeling is that towards the end of the last cycle, off-market participants began to try to dominate and participate in this market. This time, it’s even more evident. A landmark event that everyone might know is that on January 11, after the approval of the US stock market’s spot ETF, the Bitcoin market finally built a bridge to the vast river of US stocks.

In fact, after all this discussion, I think the current situation is as follows: there are two types of participants in this market. The first type is called on-market participants, which I think includes many of you listening now, our veteran traders and long-time crypto enthusiasts. What are the typical characteristics of these people? First, they hold a lot of coins. If you look at the current situation with the US spot ETF, it has been around for more than half a year, and it has bought less than 5% of Bitcoin, around 4.7% to 4.8%, which is less than 1 million Bitcoins. 94% of Bitcoins have already been mined, and if you consider that 20% of Bitcoins have been lost, it’s estimated that at least around 60% of Bitcoins are still in the hands of crypto people. So, the first type of participant in this market is the on-market participant. Another typical characteristic of these people is that they hold a lot of coins but have relatively less money compared to the second type of participants, which are off-market participants who come in through spot ETFs. Their money is compliant and they are not allowed to buy USDT on Binance to purchase coins; they mainly deal in currencies like USD, HKD, AUD, JPY, etc. This wave of big money has a typical characteristic: they have a lot of money. These actively managed equity funds can easily be in the range of billions or even hundreds of billions of dollars, but they hold relatively few coins. So, I think the current market is composed of these two types of participants.

In this case, both types of participants are forced to pay attention to what the other is looking at. On-market participants may focus more on the original cycles, on-chain conditions, long-term holders, and short-term holders, etc. Meanwhile, off-market participants are more likely to define Bitcoin as a risk asset. When liquidity is abundant, they rush in. When liquidity is poor, they retreat, and risk assets tend to decline. So, I think this is also why when we talked the other day, I felt it’s important to look at both on-market and off-market perspectives to gain a more objective and comprehensive view of the overall situation; I hope everyone can understand this.

FC

OK. So, have you looked into the on-market and off-market situations? Especially regarding the new off-market participants, how much are they allocating, or what is their overall allocation logic?

HighFreedom

I understand, and I think this point is quite clear. After the launch of the US spot ETF, the definition of Bitcoin now and in the future has become quite clear. Bitcoin can now be defined as a growth-oriented digital gold. If you talk to those off-market participants about layer two, minting inscriptions, or meme coins, they won’t understand or care about those things. When you mention the Lightning Network, they don’t care and won’t understand. The only thing they can understand and agree with is that Bitcoin is digital gold, and it’s a growth-oriented digital gold. This also explains why, in their eyes, Bitcoin is now seen as a high-risk asset. After all, it has high volatility, and its market cap is still far less than gold, currently accounting for about 7% to 8%, so it is a growth-oriented asset. So sometimes people discuss what Bitcoin really is; my understanding is simple: Bitcoin is a growth-oriented digital gold, and at present, it is a risk asset with high growth attributes, but it also carries high risks. In the US stock market, I happened to draw a pyramid the other day.

Speaking of this, let's look at how the funds in the US stock market perceive the world. First, we can visualize this as a pyramid. I can't project it, so I'll describe it verbally. The pyramid looks like this: at the bottom layer, there are large-cap assets that have relatively low returns and low risks, such as various money market funds and the American equivalent of Yu'ebao. They invest in overnight repurchase agreements and short-term government bonds, currently yielding around 5.1%, 5.2%, 5.3%, or 5.4%. This category of money market funds is definitely at the base of the pyramid.

Moving up a layer, we have US Treasury bonds, including short-term, medium-term, and long-term bonds.

Next, we have stocks, which also vary. The lowest tier here includes the companies that Warren Buffett loves, such as Coca-Cola, Unilever, Goldman Sachs, and JPMorgan. Do these companies have any grand dreams? Not really; they are industry leaders with strong profit-making abilities, often referred to as cash cows.

One layer above that includes companies with dreams, typically large American tech companies, the so-called "Mega 7" or the "Seven Brothers" or "Seven Fairies." What characterizes these seven stocks? They have very strong cash flow and solid fundamentals. Companies like Google and Apple are incredibly profitable. However, they also have a certain vision; they can point towards the future of humanity.

Moving up another layer, we discussed before, like the Russell 2000, which consists of 2,000 small companies in the US. Some of these companies are profitable, while others are not, spanning various industries without strong stable cash flows. However, these companies might have bigger dreams, which is why they are categorized as weak cash flow but strong dreams.

Going up another layer, if you remember, in 2021, if you hadn't invested in US stocks, you might recall that the hottest topic wasn't Nvidia or Apple; it was Cathie Wood, "Wood Sister." Her fund, particularly the ARKK fund, became very famous.

What is ARKK? It represents very typical human dream-type enterprises. Its underlying assets include telemedicine, implantable chips, and super nuclear fusion, among others. These are things we might think will take 50 to 100 years to realize, but they are difficult to achieve in the next 10 to 20 years.

One layer above that, you might recall a character who recently re-emerged, known as "the Rolling Kitty." This character rallied people around stocks like GME and later AMC, which are mini stocks in the US market. This is not much different from what our crypto friends are doing with PEPE, Dogecoin, and similar assets; they lack fundamental backing.

What I just described illustrates that the lower you go in this pyramid, the larger the capital capacity, but the lower the risk and returns. Conversely, the higher you go, the smaller the capital capacity, but the higher the returns, albeit with potentially larger drawdowns. So, what does this mean? This is the overall structure of the US market. As Bitcoin integrates into this market, we need to consider where Bitcoin fits within this pyramid. I believe there isn't a completely clear consensus on its position yet. People are still exploring and figuring it out, but placing it alongside Apple or Google seems difficult. On the other hand, putting it in the realm of AMC or GME, which are purely speculative, also seems challenging. I think its position is likely somewhere between the Russell 2000 and ARKK; it has fundamentals, is considered digital gold, and is a good growth asset.

Digital gold has dreams. But can we say it’s purely speculative or worthless? Not at all; it’s a valuable asset with certain risks and fundamentals. This is how I perceive the perspective of US market participants regarding Bitcoin. In the last cycle, our feelings were different. Market participants viewed Bitcoin as a speculative asset with extremely high risk and volatility, similar to AMC or GME during times of excess liquidity. However, in this cycle, their understanding has gradually changed, recognizing that Bitcoin is a good asset with fundamentals and is a valuable digital asset.

Digital gold has not yet fully matured, so I wanted to share this overall market structure, which represents the off-market pyramid. With this understanding, we can move on to the next topic, which is quite simple: the less money people have, the fewer dreams they can afford, leading them to invest in money market funds and short-term US Treasury bonds. If they have a bit more money, they might pursue dreams by investing in large tech stocks. The more money and dreams they have, the higher they can aim.

We might also discuss the issue of interest rate hikes and cuts. I remember a metaphor from a friend that resonated with me. He said it’s like the ebb and flow of rivers and streams. What does that mean? When the tide recedes, the small streams dry up first, and as it continues to recede, it reaches the larger rivers. Conversely, when the tide rises, the larger rivers rise first, similar to how in our crypto market, we first see a surge in Bitcoin, then Ethereum, and when that slows down, we start seeing altcoins, eventually leading to various meme coins and tokens. So, I think this is a broad positioning. I want everyone to understand that off-market participants view things in this way.

Secondly, regarding Ethereum, if Bitcoin can be defined within the range of Russell 2000 to ARKK, which represents relatively dream-driven assets with some fundamentals, then I believe Ethereum's definition should be even higher.

Moving up another layer, for example, altcoins in the crypto space, their risk level or liquidity overflow would need to reach the heights of stocks like GME or AMC to take off. For those listening who have stock trading software, you can check the performance of ARKK and GME.

Look at these two stocks during the last cycle in 2021 and see when they surged. You might be surprised to find that their movements closely align with the crypto market's bull run. It seems that these stocks correlate well with altcoins in the crypto space.

You will see that ARKK, which is a fund, peaked at around 150 to 160, which is quite exaggerated. It surged several times in a short period, and GME also saw massive increases, comparable to the surges in many altcoins.

So, I want to convey that as off-market participants gradually enter this market, they bring significant capital, and you have to engage with them. You need to observe what their situation is. Therefore, I want to provide you with a potentially effective reference point. Look at the situation of ARKK and GME. If one day you suddenly notice that these two stocks are soaring, there’s no reason why altcoins in the crypto space wouldn’t also take off. This essentially represents a massive overflow of dollar liquidity. I’ve said quite a bit, but this is the overall logic and framework.

FC

Understood. We’ve had two offline discussions before, and recently there has been quite a bit of volatility. However, if you look at the prices, it’s basically a wide range of fluctuations. Many analyses have been made, including those regarding the yen and expectations. So, what do you think is behind this volatility, and do you believe the upcoming quarter's elections will have an impact? What is your logic from a traditional finance perspective?

HighFreedom

I understand. Here’s the situation: let me recap for you. Today is August 22, and I want to review the significant drops in July and August. These correspond to what we’ve been discussing regarding on-market and off-market dynamics.

What happened on July 4? There were reports that the German government was selling coins, and there were discussions about the Mt. Gox compensation starting, etc. That day was July 4, which I remember clearly was a Thursday.

What was happening in the US on that day? It was Independence Day, and the markets were closed. The liquidity was very weak; there were no buyers or sellers. If someone wanted to forcefully sell, they could indeed push the market down. This led to a hard sell-off, and the US stock market, gold, and US Treasury bonds showed little volatility.

So, the July 4 drop was a very typical case of an on-market decline, a cleansing of leverage within the crypto space. This was a very effective leverage cleanup, and I observed that the liquidation volume was quite high. After clearing a lot of leverage, we could see that the major players in the market were either buying spot or increasing their positions after fully leveraging their spot holdings.

Now, regarding August 5, I believe it had little to do with the crypto market. On that day, which was a Monday, the market dropped. First, it was unrelated to the crypto space. Second, this drop was primarily due to the decline of all valuable assets off-market. For example, Nvidia saw a maximum drop of around 13% to 14%, while Bitcoin itself dropped by 17% to 18%. I think a 17% to 18% drop for Bitcoin was quite significant. Apple dropped by seven or eight percent, Google by eight or nine percent, and the entire Nasdaq fell by nearly ten percent. So, I think Bitcoin's drop of 17% to 18% was quite reasonable. Therefore, July was a cleansing of leverage on-market, while August was a cleansing of leverage off-market.

Now, let’s discuss what happened in August. This ties back to the pyramid structure I mentioned earlier. Remember that the higher you go in the pyramid, the more speculative those stocks are, and when liquidity increases, their prices rise significantly. Conversely, when liquidity recedes, those stocks tend to drop sharply or languish at a bottom for a long time. Look at GME, AMC, and ARKK; they all exhibit this kind of trend.

So, regarding the drop on August 5, I want to recap. Some might mention the carry trade related to the yen, which is one of the reasons. I want to systematically review this. The carry trade, if I had to pinpoint a reason, I think my understanding accounts for about 20% to a maximum of 30%, but definitely not more than that. There are fundamental underlying reasons for historical events, as well as surface-level direct triggers. The direct trigger on that day was quite simple: August 5 was a Monday, and the economic data released on August 10 and August 2 was very poor, with unemployment rates far exceeding expectations. This led to a significant increase in expectations for interest rate cuts, causing the yen to appreciate unexpectedly.

The brothers who borrowed yen to speculate on US stocks were just lying there doing nothing, and suddenly their profits were largely swallowed up by the appreciation of the yen. In this situation, they were forced to start closing their positions painfully, selling off one after another. This is the direct surface reason, a sudden deleveraging. But in reality, I believe the deeper reason for this story needs to be understood from the beginning, which I will define as the starting point.

In March 2020, what happened? Friends in the crypto space will remember that on March 12, there was a significant drop, with Bitcoin falling from $10,000 to around $8,000, then dropping again to the $7,000 range, bouncing back to $8,000, and finally plummeting to a low of around $3,600 or $3,700. But if you look further out, you will find that on March 10, the US stock market began to circuit-break, with the S&P 500 and Nasdaq indices both experiencing this. Warren Buffett even said, "In my lifetime of investing, I've never seen such a large drop."

So what was the situation? It was quite simple; this person was sick. In March of that year, this individual fell ill. People talked about liquidity issues; the entire pandemic led to a lack of liquidity, causing all valuable assets to drop and resulting in a massive deleveraging across the market. So, this person was sick. Now, when someone is sick, it’s simple: they need treatment. I want everyone to understand two things: the doctor treating this illness is the central bank, specifically the Federal Reserve of the United States.

Historically, no central bank in any country has escaped these two characteristics. The first is called decision lag. It’s not that I predict you will get sick and take preventive measures. I think you might catch a cold, so I give you something to boost your immune system. No, it’s not like that; it’s that this person gets sick, and only then do they start to think about what to do. So, all central banks have this characteristic: decision lag.

The second characteristic is the excess dosage. What does this mean? When you are sick, the medicine prescribed should be just the right amount; if ten milligrams is enough, they don’t give you that; they prescribe 200 milligrams instead. So, what happened back then? After this crisis occurred and this person fell ill, the Federal Reserve began to treat the illness, but their decisions were lagging, and the dosage was excessive.

So, when you look back, you will see what kinds of assets began to take off in 2020. We mentioned earlier the top of the pyramid, whether it was Bitcoin, Ethereum, altcoins, or the speculative stocks in the US market like GME and AMC, or fundamentally dream-driven stocks like ARKK, they all took off.

Let’s look at ARKK, which is the most typical example. ARKK reached its peak in the first half of 2021, and throughout 2021, it was in a high-level fluctuation, basically just going down continuously. This is a very obvious feeling, isn’t it? It’s called the diminishing effect of the medicine; after taking an excessive amount of medicine, the first thing to reflect is that there is too much money. If you tell me to buy Nvidia and double my money, I think that’s boring. If you tell me to buy Apple and we make 60%, I find that unexciting. I want to play with things that can multiply by five, ten, or a hundred times.

The situation in the US stock market was similar in 2021. As interest rates gradually increased and the balance sheet was further reduced, quantitative tightening began to actively shrink the previously excessive liquidity. You will find that the overall market's risk appetite gradually decreased. Eventually, what happened? The phenomenon shifted from AMC and GME rising to ARKK rising, and ARKK basically stopped moving up.

Once it started to decline, the market style switched to stocks like the S&P 500, which includes the top 500 stocks in the US market. You will notice that the S&P 500 stopped rising, and only the S&P 100 was rising. Later, when the S&P 100 stopped rising, it became that only the Mega Seven were rising. The so-called Mega Seven includes Microsoft, Nvidia, Google, and Apple. Eventually, it was found that only Nvidia was rising. This is a very clear indication that the excessive dosage was gradually being withdrawn. The quantitative tightening process is slowly pulling back the excess liquidity, and there will always be a turning point.

At this time, I understand that the fundamental reason for the significant drop on August 5 lies in the continuous retreat of liquidity. These risk assets, which have some dreams but also fundamentals, can no longer rise. Eventually, the market style must switch, and this switch is often accompanied by a severe deleveraging.

What did people discover later? Those who speculated on US stocks, especially those playing with Nvidia, were mostly using high leverage by July. They were buying calls and bullish options. Later, when Nvidia's volatility decreased, these guys found it uninteresting and began to leverage more, so as it got closer to this point, it was basically nearing a deleveraging phase.

So, I want to recommend another thing to everyone. This is something I think you might not trade stocks, but you can keep it on your list: the VIX, known as the fear index or volatility index. You will see that with the market's sharp declines, adjustments, or severe style switches, the VIX will rise rapidly from a very low point to a high point, indicating that market volatility has increased. After a style switch, what does it mean for the market to stabilize? You just look at the VIX; it first falls from a very high level and continues to decrease. Secondly, its trading volume is also very low, indicating that no one is playing with this anymore.

During the recent months of July and August, what were the fund managers in the US stock market doing? The more stubborn ones were holding onto their Nvidia, Google, and Apple stocks in the S&P 500 without reducing their positions. However, they took some of their positions out to leverage and go long on the VIX. These people felt that their positions were stagnant and that a turning point might be approaching, so they took protective measures by allocating some of their positions to bet on volatility.

In that sharp decline, it was like all the stocks in their hands were losing money and retracing. However, their positions in volatility made them money. So, their overall position at least ensured a break-even situation, effectively buying insurance.

Buying calls on the VIX, engaging in bullish options on the VIX, and so on. I’ve said a lot, but to summarize, I think this story is quite simple: this person fell ill, and the story began in March 2020 when this person was basically cured. The significant drop in August 2024 essentially represents that the effect of liquidity has retreated to the point of no return. If it retreats further, where will it go? It will retreat to the next layer down, like Coca-Cola or those stocks that Buffett loves to buy, which are pure cash flow stocks. So, I think this is also a market reversal point, gradually retreating, and soon it will start to rise again, leading to discussions about interest rate cuts.

So, I want to review with everyone that if you want to understand how the drop on August 5 occurred, you need to trace back to what happened three to four years ago, in March 2020. Then, from March 2020 to August 2024, review what has happened in the entire US financial market, especially in the strategic financial market, and you will have a clear understanding.

In simple terms, for us in the crypto space, I think it’s quite straightforward. The significant drop on August 5 was a deleveraging off-market, which has little to do with the crypto space. Now, both on-market and off-market have been thoroughly cleaned out; that’s basically the situation.

FC

Understood. So, what I want to say is, for the upcoming market trends, what should we reference? What should we think about for the future? What dimensions should we consider? To be honest, I feel like we’ve reached a very boring time, right? I seriously ask myself; I think now everyone is not pessimistic but rather bored and tired of discussing these matters. Because it seems like there are only a few questions being discussed, right? Ethereum, for example, Ethereum versus Solana, meme coins, there’s no direction; it’s all just this kind of sentiment.

HighFreedom

Understood.

FC

If we look at past experiences, this kind of sentiment usually occurs when we are at a bottom range, right? Generally, it is often accompanied by either a continuing bull market, where a bullish candle goes up, and everyone doubts it, thinking it’s still fluctuating, and then it continues to rise, and they just accept it. That’s basically how it goes. So, for example, what indicators should we look at below? What should we focus on? From your perspective, what do you think?

HighFreedom

Understood. I think it goes back to the fact that there are two groups of participants in this market: the first group is off-market, and the second group is on-market. Let’s first talk about the on-market. I think the most important indicator I always watch is the long-term and short-term holders. The situation of long-term holder supply and short-term holder supply. My estimate is that in this bull market, the long-term holders should have sold at least around 2.2 to 2.5 million Bitcoins. Currently, I calculate that they have sold about 700,000 to 800,000, which is roughly one-third of their holdings. The real decision-makers still have about two-thirds of their holdings left; they are still waiting. This is an on-market factor.

As for off-market factors, as mentioned earlier, if the US continues to reduce its balance sheet and further tighten liquidity, it will basically push down to the next layer. The US tech stocks are also struggling a bit, unable to hold up. But now you will notice a slight turn in the market; after a large-scale deleveraging, the Nasdaq has made a slight reversal and is back to around 20,000 points. The overall market in the US stock market will recognize that interest rate cuts are coming. As interest rates are cut, the overall market's risk appetite will gradually increase.

However, I want to emphasize a small point of knowledge to discuss this matter with everyone. In earlier years, measuring the amount of money in the capital market and the level of risk appetite was very simple and straightforward; you just looked at interest rate hikes and cuts.

When interest rates are raised, there’s no money; when interest rates are cut, there’s money, and people start to invest in riskier assets. When interest rates rise, I become more conservative, and risk assets decline. However, since the financial crisis in 2008, the US has learned from Japan. Japan was the first to start this in 2001. In modern society, Japan began implementing quantitative tightening and quantitative easing in 2001.

The US started this at the end of 2008 and the beginning of 2009. At that time, the Federal Reserve Chairman was Ben Bernanke, and they were learning from Japan’s quantitative tightening and quantitative easing. What does quantitative tightening mean? In fact, the current financial market is much more complex; it’s no longer as simple as just raising or lowering interest rates to explain things. What is the process? First, they lower interest rates, similar to a doctor treating an illness. I first give you some conservative treatment; you take it and see if it helps. If it doesn’t work and the situation is serious, then we’ll move on to injections or IVs. Eventually, it may even lead to surgery.

The US quantitative tightening and quantitative easing processes are similar. First, they lower interest rates; if that solves the problem, then there’s no need to expand the balance sheet afterward. Expanding the balance sheet is quite simple: the central bank prints money to purchase various assets, including everyone’s mortgages, various US Treasury bonds, and so on. So, it’s important to emphasize that it’s not a straightforward sequence of lowering rates, then expanding the balance sheet, then raising rates, and then contracting the balance sheet. It’s not necessarily A to B, then B to C. It starts with A, giving some medicine to see if it works. If it doesn’t, then there’s no need to expand the balance sheet.

So, I want to discuss the topic of interest rate cuts, which has been a hot topic lately. My understanding is that this can be likened to a simple math problem: there’s a water tank with an inflow pipe at the top and an outflow pipe at the bottom. The inflow pipe brings in five liters of water per minute, while the outflow pipe lets out three liters per minute. Now, the tank has 800 liters of water. The question is, what will happen to the tank in ten minutes? The purpose of this example is to illustrate that the water in the tank represents the so-called dollar liquidity. How does the increase or decrease of the US's base currency M0 affect liquidity? What role do interest rate cuts play? Lowering interest rates will help maintain the high pressure in the tank, which was previously very high in a high-interest environment, resulting in a lot of water in the tank and significant pressure.

However, after lowering interest rates, it will still be beneficial for risk assets, but the extent of that benefit may be limited. What would be truly beneficial? Expanding the balance sheet. But again, we return to the topic: if this person is really sick and finds that lowering interest rates doesn’t help, and they can’t recover, then they will take such actions. So, going back to the topic, whether there will be a massive bull market in risk assets depends primarily on whether the Americans are seriously ill. However, I believe this is something ordinary people cannot judge, and even the Federal Reserve officials cannot accurately assess; the Fed itself is always lagging behind.

So, what can we do? I want to share this logic with everyone. If the Federal Reserve officials indeed say, "We are sick, and I am about to expand the balance sheet," then what might happen? Risk assets could collectively plummet, and after that, a large-scale expansion of the balance sheet could replay the story of 2020. However, currently, the probability of this scenario seems low. I lean towards a higher probability of interest rate cuts, where they gradually lower rates, inflation remains stable, and the economy doesn’t collapse. If inflation stabilizes and the economy is healthy, they will continue to lower rates. This will definitely be beneficial for risk assets.

Therefore, I think there are several practical indicators to watch. Everyone should keep an eye on the Russell 2000, which you can search for under the code RUT, or the BlackRock fund called RWM. Add ARKK, GME, and AMC to your watchlist. You don’t have to buy these things, but you should observe them. If you start to see these assets rising, it will indicate that the overall risk appetite in the US stock market is gradually increasing, and people are starting to chase these assets. This is the most direct thing to observe off-market.

As for interest rate cuts, balance sheet expansion or contraction, and dollar liquidity, the issuance of ultra-short, medium, and long-term government bonds, and the monthly flow of these, I think these are too complex for most ordinary investors. There’s not much significance in watching these; just focus on the risk appetite in the US stock market.

This brings me to a point that I think is crucial for holders: they are most concerned about two things. First, how is Bitcoin doing? Second, how are altcoins doing? I think Bitcoin is quite simple and clear; it is a growth-oriented digital gold. When did Bitcoin’s market cap surpass that of gold? It was in November 2021 when Bitcoin reached $69,000, and its market cap was 11% of gold’s market cap, which was a historical high. In every bull market, Bitcoin’s market cap tends to climb higher. Each bull market sees Bitcoin’s market cap relative to gold’s market cap increase. Especially in this round, all the new funds coming in from off-market are simply buying into the digital gold narrative.

So, if you are extremely conservative, you should at least wait until Bitcoin’s market cap reaches a certain level. I’ve been discussing this with my friends; recently, everyone has been feeling down after months of sideways movement and constant fluctuations. They feel like the bull market is over and can’t take it anymore. I believe my judgment is that a new wave of upward movement is yet to begin. Don’t fall before dawn; manage your leverage and mindset well. Because first and foremost, Bitcoin is simple; it’s a digital gold asset. Currently, Bitcoin’s market cap compared to gold’s is only around 7% to 8%, and it hasn’t reached the previous peak. Shouldn’t we give it a little chance? At the very least, it should reach the previous peak before you consider leaving. Based on gold’s market cap of $17 trillion, that would put Bitcoin’s price around $100,000. If you have a bit of ambition, shouldn’t we aim a little higher? Perhaps Bitcoin’s market cap relative to gold should be slightly higher this time?

I estimate that this round could see Bitcoin’s market cap reach 15% to 20% of gold’s. This leads to the next topic: how do we evaluate these things? It’s about looking at the counterparties. I believe the biggest counterparties in this market are all traditional financial institutions in the US. For example, state government funds from all 50 states; currently, three states have started to accumulate Bitcoin. The fastest is Wisconsin, the birthplace of the Republican Party. Wisconsin has a fund of about $150 billion to $160 billion, and they plan to allocate 1% to 2% to Bitcoin. What I want to say is that these people are the true friends of the crypto community because they are real holders; they might hold their purchases for five or ten years without selling.

What is our enemy? Currently, you can see that the spot ETF has seen inflows of about $16 to $17 billion since January 11. From the quarterly disclosures, you can see that around 80% of the holdings are retail investors. The real friends, these institutions, are still on their way; they haven’t boarded the train yet. They have many internal processes to go through before buying these products. They need to learn what Bitcoin is, report to their bosses about Bitcoin, and communicate with regulators about whether they can buy Bitcoin. This product also has a 90-day observation period and other factors.

So, I want to say, don’t rush. The counterparties in this round, the sophisticated term is counterparties, but in layman’s terms, the ones picking up the pieces, are still on their way. They haven’t figured it out yet. Some of the early movers have started buying, like Goldman Sachs using its own money to buy, and some banks in the US have begun to use their own funds to buy. These are the counterparties in this round, and they are just getting started. Therefore, I think the off-market situation is quite optimistic; they are early, but for them, buying risk assets might not be feasible during the most challenging final stages of quantitative tightening. For example, in mid-second quarter, this is the final stage of quantitative tightening, and interest rate cuts are about to begin, meaning quantitative tightening is coming to an end.

They will gradually start buying these assets, so I hope for something: of course, I have a simple wish. I hope they can speed up because everyone is starting to feel the pressure. I think the off-market situation is optimistic, and on-market, we just need to look at the blockchain. Those big players, the whales, long-term and short-term holders, still have a lot of assets they haven’t sold; they are also waiting. So, I think we should be patient; I’m not worried about Bitcoin at all.

Now, let me share my views on altcoins. The first question is, are there altcoins? I believe there are definitely some. Why? It’s simple; just look at who holds Bitcoin. At least around 60% of the coins are in the hands of crypto enthusiasts. When Bitcoin reaches $100,000 or $150,000, these long-term holders will inevitably want to speculate on altcoins.

I’ve always believed that the crypto space is never short of stories; it’s just about whether these stories can meet the right historical timing to ignite a positive cycle. What does this mean? Looking back over the past year, or rather the past six months, the hype around inscriptions has generated tens of billions of dollars, but it has become difficult to sustain. The focus on layer two solutions, like Merlin, has left many heavy investors feeling lost and suffering significant losses, constantly trying to create new stories. This is all happening during the final stages of quantitative tightening, and you can see that stocks like AMC, GME, and ARKK have been struggling for a long time; the market lacks the funds to support these assets. Therefore, it’s normal for these stories not to take off.

So, are there altcoins? It’s simple: at that time, 60% of Bitcoin holders will want to speculate on altcoins, and they will come up with some stories to support that. I think the only point we can discuss is how strong the altcoin movement will be. I see two scenarios. If Bitcoin rises to, say, $120,000 to $130,000 or $140,000, and you see that the Russell 2000, GME, and others are all soaring, even surpassing their previous highs, then altcoins in the crypto space could rise significantly. It would be similar to the summer of 2021 compared to the winter of 2021, where summer was all about DeFi and winter was about NFTs and the metaverse.

This is the first optimistic scenario, but I think the probability of this happening is relatively low because, again, if this person doesn’t take a strong action or doesn’t take a strong medicine, it’s hard for this situation to occur. I think this might be why there are no altcoins; perhaps people are considering these factors. This is the first scenario.

The second scenario, which I think has a higher probability, is that Bitcoin can rise to $120,000 to $130,000 or $140,000. I believe that can happen. However, if at that time the Russell 2000, GME, and AMC are still struggling, and the overall market cap of stablecoins is not excessively high, then the rise of altcoins may be quite limited.

But I believe altcoins do exist, and the vast majority of Bitcoin is in the hands of crypto enthusiasts. If we look at it from another angle, the vast majority of Bitcoin is in the hands of traditional institutional investors in the US stock market. They don’t understand layer two solutions, let alone inscriptions, DeFi, or AI; they don’t understand any of it, and they don’t participate. That would be problematic. The height of Bitcoin’s rise has little to do with altcoins; it has no relation to altcoins at all. So, I believe there will still be altcoins; it’s just a matter of magnitude. Of course, expressing this viewpoint might get me criticized or face backlash, but I believe we are currently at the bottom of the bottom. Whether it’s Bitcoin or altcoins, I think we are at the bottom of the bottom. Everyone should look for suitable targets to invest in. I even think that a few months ago, if you said to invest in altcoins, you would have opened your stock trading software and seen that GME and AMC were struggling, making it hard to invest. The likelihood of making a profit was very low.

However, now I believe that better altcoins may have reached the positions they were in at the beginning of 2021 or early 2024, while weaker altcoins have already reached the positions they were in during the bear market of 2022 or 2023, essentially back to the positions before the surge in August and September. I think this is a time when a reversal is gradually approaching. Finally, the tide has retreated to the point of no return, and it’s about to rise again. You are holding a highly risky asset, hoping for the tide to rise and bring water into your small stream or tributary. Therefore, I don’t think it’s that pessimistic.

Some of my friends think we are in a bear market, but I say the bull market is not over. I hope I won't be proven wrong and that we can verify this soon. We are now in the middle of the third quarter, and I believe that around the fourth quarter, we should be at the bottom of the bottom. The entire bottoming process, both on and off the market, has been thoroughly cleaned up. Moreover, the macroeconomic environment is starting to reverse, gradually shifting from a retreating rhythm to a rising rhythm. The only point of contention is how high this rise will be, which I think needs to be discussed clearly.

FC

We can set the title like this: "The Bull Market Returns in Q4." You’ve basically answered my questions already. However, I suddenly want to add a question. Since you have been in the brokerage industry for quite a while, as a trader, what do you think is the proper growth path for entering a brokerage or the financial market? What should one learn first and then what next?

HighFreedom

Let me think. I particularly recommend that everyone take the CFA Level 1 exam; push yourself to do it. If you register for the early bird, I don’t know how much it costs now, but it used to be around $700 to $800. There are ten subjects in total. CFA stands for Chartered Financial Analyst. This is a set of financial courses from abroad, consisting of three levels: CFA Level 1, CFA Level 2, and CFA Level 3. If you work in a traditional financial institution as an analyst, you need to take this exam.

Why do I want to talk about this? It might not matter if you studied math, music, sports, or physics in school. It’s okay if you haven’t studied finance; the CFA is specifically designed for this purpose. You don’t need to take Levels 2 and 3; I think that’s completely unnecessary if you’re not working in that field. However, it’s worth taking Level 1 because it essentially gives you an opportunity to study something akin to a Master of Finance. Studying abroad for a Master’s in Finance costs tens of thousands of dollars, and the courses are not much different from the CFA. Ironically, many students focus on passing the CFA while studying abroad.

What is the CFA? It consists of ten subjects and provides a comprehensive and systematic understanding of the foundational knowledge of the entire financial system. It is a framework of content. Once you have this framework, you can extend your learning to other areas. It’s simple; you will be speaking the same language as others in the field. Sometimes I feel a bit silly recommending that everyone take a certification exam, but I think it’s very useful. That’s why I encourage my friends to spend this money; it’s not too expensive, just a few hundred dollars. Only by doing this can you force yourself to learn; otherwise, the material can be quite dry and, since it’s all in English, it can be challenging to get through. Having an exam will push you to keep studying; otherwise, you might just dabble for a couple of days and then set it aside and never look at it again. So, I think this is quite beneficial.

You see, not everyone working in brokerages has a finance background. Many people, for example, who analyze the Huawei supply chain, originally studied electronic mechanical manufacturing. Others who focus on TMT (Technology, Media, and Telecommunications) might have studied computer science. There are people from various fields, but they all generally take the CFA because this body of financial knowledge has been around for hundreds of years and is quite rigid.

FC

It seems like you are channeling Professor Hong Hao; you sound like his spokesperson.

HighFreedom

Maybe I should get him to pay me for advertising.

FC

What do you think the CFA is? After we enter the industry, what is considered orthodox? This is quite interesting. Many of my friends often ask me, especially earlier this year, what should I do to enter this industry? What should I learn? Some smart friends ask about your industry rankings. This is quite interesting.

I have some friends who do this; they check the top three tokens by price increase every day and analyze why they are rising. I do this every day too; I take a look at who is at the top of the gainers list and look for reasons for the increase. I think this helps develop muscle memory, so when I see a similar situation next time, I might recognize it.

HighFreedom

That makes sense.

FC

What do you think a trader, like yourself, should focus on in terms of deliberate practice?

HighFreedom

I see where you’re going with this. Let me share my thoughts. In financial institutions, there are two groups of people doing research, the so-called analysts. The first group looks at the fundamentals, focusing on macroeconomic factors. They are often referred to as macro analysts or total analysis, or they might look at fixed income and government bonds, focusing on the macro direction. This is one group.

The second group focuses on specific industries. For example, I look at electronics, you look at consumer goods, and someone else looks at manufacturing; these are industry analysts. I feel that the crypto space is similar. In the crypto world, you have macro analysts, and I think tools like Glassnode are important. Regularly checking Glassnode and understanding its key indicators is crucial for grasping the macro aspects of the crypto market.

Going a level deeper, I think it involves the alpha in the crypto space, looking at various new sectors and directions, such as market capitalization, token unlock situations, and so on. There are tools, like Dingyong and a few others, that provide insights into small tokens and on-chain data. I think this corresponds to the brokerage world, where one group looks at macro factors and another group focuses on various industries. In the crypto space, you have those analyzing Bitcoin on-chain data, and then another group looking at small tokens and alpha opportunities. I feel there are these two groups of people with two sets of focuses. One set corresponds to the on-chain data for Bitcoin, while the other set looks at the fundamentals and unlocking situations for small tokens.

FC

Right, I understand. OK, let’s move to the final segment about growth. I want to know which traders you recommend and who you follow closely, and why?

HighFreedom

Does this have to be limited to the crypto space, or can it be across various fields?

FC

As long as it’s helpful to you.

HighFreedom

OK. I’ll recommend a few people. The first is definitely Fu Peng from Northeast Securities. He’s also into self-media and does quite well. I think his views and analyses on US dollar assets are quite systematic and insightful. He also enjoys sharing his knowledge. I won’t start a debate here; I think Fu Peng is quite competent.

The first person I recommend is Fu Peng. The second person I feel is A Sir; I think he has a relatively clear understanding of US macroeconomic factors. However, he tends to write very long articles filled with American slang, which can be a bit challenging to read. But I think his insights are still valid. For example, back in March or April, he mentioned that liquidity might decrease in April and that the market could trend sideways. Recently, he has been optimistic about the market outlook, suggesting that if Bitcoin breaks $75,000 in September, October, or November, it could be significant. So, A Sir is the second person.

Another person is a friend of mine who is a fund manager. He has his own Twitter account but doesn’t post much because he’s a bit lazy. I often consult him on various issues. His name is Victor, and he’s an old-timer in the crypto space. He started as a miner and has been in the industry ever since. I’ve added notifications for all these people; whenever they post something, I make sure to check it out immediately. There’s also a well-known trader from the last cycle named Person Song, who runs a website. I think he provides useful insights into key cyclical indicators and major cycles.

FC

Got it, that’s great. Everyone can follow these recommendations, and we will publish a written version. Hearing you explain it again today has helped me review and learn new things. I think for those who engage in cyclical trading, the most important thing is to find a hobby.

HighFreedom

Yes, it can be quite boring.

FC

Most of the time, there’s no need to take action.

HighFreedom

Exactly.

FC

I think those who engage in on-chain trading also need to find a good psychologist. The dopamine rush comes too quickly, and when it’s time to leave, it can be hard to accept; it’s not easy. Traders are often highly sensitive individuals. So, HighFreedom, do you have any final thoughts on today’s discussion?

HighFreedom

Let me think. Oh, right, you always ask each interviewee about their so-called "stop doing list."

FC

I initially heard you mention stop-loss strategies; you can elaborate on that.

HighFreedom

I think on-chain data is very important, especially for Bitcoin. You can see very clear cyclical effects. However, I want to discuss something that is useful for this round; everyone doesn’t need to worry about it. But in the future, it might have a significant impact. You see, on-chain cyclical traders accumulate coins and sell them when the bull market arrives, which is quite straightforward. But the important thing is that they have pricing power because they hold a lot of coins. As we mentioned earlier, around 60% of holders are these individuals. They don’t trust any exchange; if they have 10,000 Bitcoins, they won’t put them on OKEx or Binance; they keep them in their cold wallets.

So, I want to say that these on-chain individuals have very strong pricing power. The real holders of large amounts of coins are on-chain, not on exchanges. However, their behavior is visible on-chain.

The problem is that as more and more spot ETFs buy Bitcoin, it might reach around 20% to 30%. You will find that it’s like returning to an exchange environment, where it’s all about Coinbase cold wallet custody addresses. At that point, on-chain data may not be as effective. I think this is something everyone should consider, but I believe it’s a long-term issue that we might not see in this cycle. Secondly, I think regarding off-market situations, I have a set of judgment logic, such as US dollar liquidity, interest rate cuts, and balance sheet expansion or contraction. Of course, the US might come up with a new logic, and if they stop quantitative tightening and easing, we might have to learn again and adapt. But I think this is also something we might not see in the short term. So, I believe these are two points; I don’t have anything else to add.

FC

I understand. Here’s a challenge for you: predict the price of Bitcoin on December 31. No pressure; this is not investment advice.

HighFreedom

You’re putting me on the spot here, haha. I think it will be around $100,000; let’s set that as the target.

At least it touched 100,000; whether it can guarantee 100,000 is hard to say, but it has touched 100,000.

FC

How much did you lose? Not too much, let’s bet.

HighFreedom

You want to be the counterparty.

FC

Of course, I think it won’t reach 100,000, so I’ll be the counterparty. Besides just sending a red envelope, we can also do a lottery later.

HighFreedom

Or we can do it this way: if it reaches 100,000, you treat me to a meal; if it doesn’t, I’ll treat you.

FC

That doesn’t involve everyone; I’ll treat you alone, right? If I lose, I think we should bet on something auspicious, right? I’ll think about how much it will be, and I’ll let you know. If I lose, I’ll send it to your fans and help you with a lottery.

HighFreedom

Sure, 666, 888, and those kinds of numbers.

FC

Right, we are using U as the unit.

HighFreedom

No problem, no problem.

FC

That’s fine.

HighFreedom

May I ask a question as the guest? Why do you think it won’t reach 100,000?

FC

I haven’t thought about this much because I don’t really guess prices, to be honest. But I think if you ask me to look at the exit now, from my perspective, I think it might be, how should I put it, at my expected return, I think there might be a 50% to 100% expectation. I’m not talking about BGC; I’m talking about Ethereum and others. I think it’s about there. Because I think if we assume we exit in the middle to late stage of a bull market, at that time, you can do many things. For example, you can use U to invest in new projects, use U for quantitative trading, or arbitrage. I think all of these could yield around 12% annually, right? I think that winning rate might be higher than just holding coins; that’s my thought.

HighFreedom

But as time goes on, there might be other operations, and the risk-reward ratio might be better. It doesn’t necessarily mean that just holding spot is the best choice.

FC

I think that’s my mindset. Because I know that around 70,000, many people around me sold off a wave.

HighFreedom

That’s just practice.

FC

You can think of it as the first distribution of a long weekend.

HighFreedom

Right? Yes, it was very obvious on-chain in March, with a large amount of distribution, even 3/1.

FC

From the on-chain perspective, recently, Galaxy has been consistently investing, and many institutions are also doing dollar-cost averaging.

HighFreedom

Yes.

FC

It’s quite interesting. OK, then we’ll reveal it on December 31.

HighFreedom

OK, sounds good.

FC

By then, everyone can quickly click to follow. I’ll try to make sure to ask this question to everyone who comes on.

HighFreedom

Sure, I’ll be there. Alright.

FC 01:16:07

From the on-chain perspective, recently, Galaxy has been consistently investing, and many institutions are also doing dollar-cost averaging.

HighFreedom

Yes.

FC

It’s quite interesting. OK, then we’ll reveal it on December 31.

HighFreedom

OK, sounds good.

FC

Everyone can quickly click to follow. In the future, I’ll ask this question to everyone.

HighFreedom

Sure.

FC

Thank you, everyone. Our recording is on Xiaoyuzhou, in a program called "Dialogue with Traders," so you can check it out. That’s basically it. If anyone has good trader recommendations, I’m a bit short on them right now. Thank you all, thank you. We’ll end here today.

HighFreedom

Alright, bye-bye.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。