A maximum of $49.3 million in BONK can be locked, accounting for 3% of the total supply. "Transitioning from virtual to real" may become a necessary path.

Written by: Nan Zhi, Odaily Planet Daily

In 2023, the most outstanding meme token on Solana, besides WIF, is BONK. The main upward trend of the token began in early November 2023, rising from a market value of $20 million to $1.5 billion by mid-December, a 75-fold increase over a month and a half.

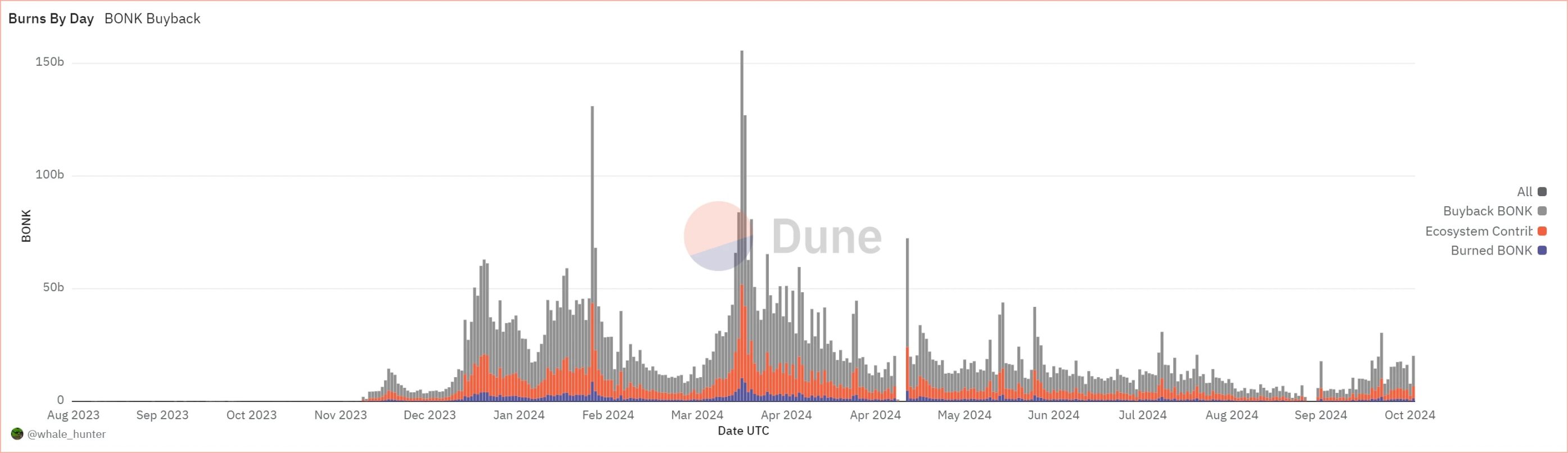

Unlike other tokens, BONK does not solely rely on "community building" for its rise; it has begun to "transition from virtual to real." In August 2023, Bonk launched a Telegram trading bot on the Solana network, which burns BONK tokens by charging bot service fees, accumulating over $10 million worth of BONK burned.

Today, Bonk announced the launch of the BONK ETP "Osprey BONK Trust," which will accept its first batch of qualified investors, aiming to provide a simple and cost-effective way for qualified investors (wealthy individuals) to acquire BONK. Odaily will analyze it in this article.

Osprey BONK Trust Interpretation

Bonk stated on the product introduction page that the Osprey BONK Trust aims to provide a simple and secure investment in BONK, allowing "qualified investors" to invest in BONK without needing a wallet or private keys.

How many tokens are locked?

The Osprey BONK Trust has a relatively strict definition of qualified investors, including:

- Individual annual income must exceed $200,000 (or a combined annual income with a spouse exceeding $300,000), and net assets must exceed $1 million;

- Investment professionals, such as licensed associates of brokerage firms or investment advisors;

- Entities must have $5 million in liquid assets, or all beneficial owners must be qualified investors.

Another key element in the Osprey BONK Trust terms is that the trust will temporarily not offer BONK redemptions, and investors can only sell shares on the secondary market in the near term. Therefore, from the token's perspective, the purpose of launching this trust is to attract high-quality external funds to purchase BONK and "lock" the tokens within the trust.

So, according to the current terms, how many BONK tokens can the Osprey BONK Trust lock at most?

The terms state that each trust share represents 216,999.02 BONK, and the initial outstanding shares are 9,792,000. Therefore, a maximum of 216,999.02 × 9,792,000 = 2.12 trillion BONK can be deposited into the trust, with the current token price at $0.00002273 USDT, equivalent to locking $49.3 million, accounting for 3% of the total token supply, which is quite substantial.

Additionally, the trust will have a 2.5% management fee each year, but it has not been disclosed whether this will be used to burn BONK or other methods to increase the token price.

Why is it attractive to external funds?

Some discussions in the comments section of the trust announcement and official replies reveal that the launch of the Osprey BONK Trust has other implications.

User A commented below the announcement asking what advantages there are in purchasing BONK through the trust compared to buying it directly on-chain.

@R89 Capital replied, "Memecoins gain scale from tax-advantaged accounts." The BONK official agreed with this response, and another BONK official, @oskyment, stated, "For example, being able to invest using your 401 K."

(Odaily Planet Daily note: A 401 K is a retirement savings plan offered by U.S. employers that allows employees to deduct a portion of their wages and invest it in an account.)

How to understand this? Simply put, purchasing the BONK Trust through accounts like a 401 K allows investors to enjoy the benefits of tax deferral and pre-tax investment deductions, potentially gaining certain tax advantages.

To elaborate, when investing through a 401 K account, investment income such as interest, dividends, and capital gains is not immediately taxed within the account until the user withdraws these funds upon retirement. Additionally, any pre-tax income invested in accounts like a 401 K will be exempt from taxation.

However, the author believes that in the face of a 2.5% management fee, even with short-term tax benefits, establishing real attractiveness will still require stable and reliable token price performance to support it, which corresponds to Bonk's other core revenue business, BonkBot.

Risk Warning

It is worth noting that the Osprey BONK Trust states in its terms, "All funds have not been registered under the Securities Act, the Investment Company Act of 1940, or any state securities laws. Shares purchased directly from the fund are offered in a private placement under the Securities Act… and similar important exemptions under the laws of the state and region in which they are located, issued and sold only to qualified investors."

Therefore, shares purchased from the fund are restricted and subject to significant limitations on transfer and resale. Potential investors purchasing directly from the fund should carefully consider these liquidity restrictions before making any investment decisions, including the fact that currently, all funds do not offer redemption plans.

Transitioning from Virtual to Real

For most memes, stripping away the shells of community, culture, and consensus, their essence remains a "money game" and "attention economy," with all profits coming from later entrants. Especially newly born memes focus more on creating events and attracting attention rather than considering practical development.

However, established memes find it difficult to attract more incremental users, leading some tokens to begin "transitioning from virtual to real." Floki launched the RWA product TokenFi (TOKEN), and Bonk launched BonkBot, which burns about $20,000 to $30,000 worth of BONK daily. Since its launch, it has burned $10.53 million worth of BONK, becoming an anchor to stabilize its price.

2024 is set to be a big year for memes, with meme tokens reaching market values of hundreds of millions or even billions of dollars emerging in succession. However, many once-popular memes disappear from public view after losing funding attention. Therefore, the "transitioning from virtual to real" direction that BONK and FLOKI are pioneering may become one of the core choices for the new generation of memes seeking long-term "survival" in the coming years.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。