Popular Spot

SATS is currently operating in a bullish channel, suitable for buying and holding.

WLD can be slightly monitored, as there are quite a few low-point signals.

Pay more attention to CORE; if it breaks the bearish trend, there will be a nice upward wave.

CFX should be closely monitored to see if it can break through and stabilize at 0.19280; if it stabilizes, consider entering.

The above four spots have been around for over ten days. If you just saw this, do not enter blindly; feel free to leave a message or join the community for discussion.

Market Interpretation

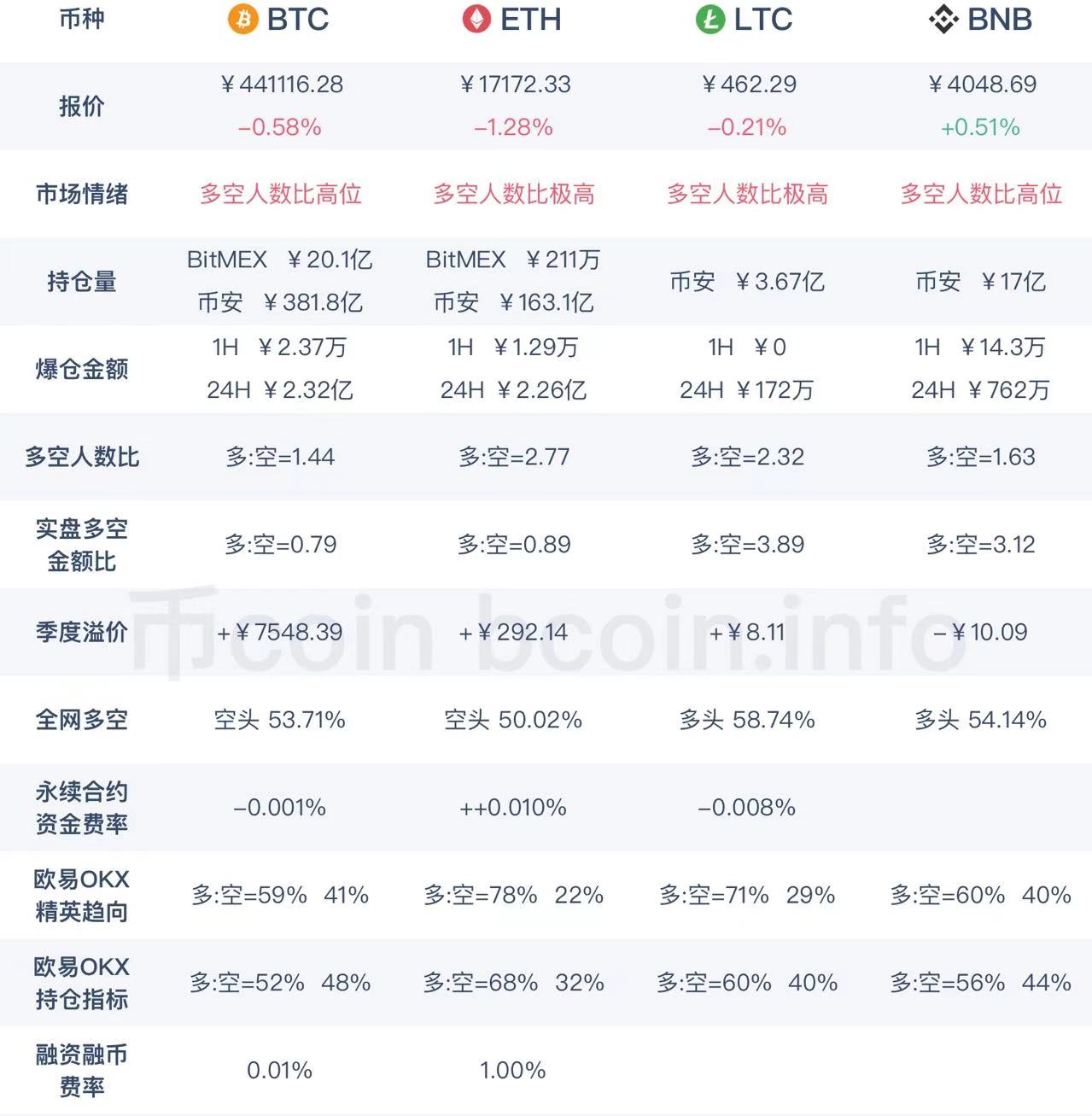

BTC has broken through 68000, brothers! 🎆🎆🎆 Finally here, otherwise, you guys have been waiting too long and can’t hold on anymore. When making big profits, remember to stay calm, brothers, because if this upward movement cannot stabilize, there is still a sense of a significant drop coming. Be sure to pay attention! From a structural perspective, this small bull run is still led by BTC, with the second coin following. Additionally, the second line actually made the first move, so if a bull-to-bear event occurs, be sure to cut losses without hesitation. Manage your contract positions well and remember to focus on the key short-term trend around 【67746-68400】. For the four-hour and daily lines, watch if 69000 can break through; if it stabilizes, we can expect around 71000. If it doesn’t stabilize, the bears will start to gain strength. The first support below is directly around 65500; if it breaks, look at 64-63-62-61, with 59300 as the extreme. Those who understand, understand. 😄 I mainly use naked K and channels for layout, rarely using MA Bollinger Bands due to their strong lagging nature. So if you want to see them, you can leave a message, and I can include them next time. Also, note that this article has lagging characteristics and is mainly for reference. You can check the daily updates on the public account "Coin Towards Money" 🔍.

Resistance Level: 69000-71000

BTC Support Level: 65500

As for ETH, I have always had high hopes, but it’s not performing well. I’ve been watching it to lead this round of the bull market, but it’s not strong. It’s still following the leader, with overall gains not being significant. Therefore, I believe there might be another bottom formation before it has a chance to start. If the second coin charges, it won’t be an ordinary bull market, you know? From a level perspective, the short-term range is between 【2580-2674】, and you can temporarily buy on dips. If it breaks above or below that position, we need to update our strategy. If the bottom breaks, look at the old position of 2423; if it breaks above, look at 2790-2850-3100. Personally, I hope for a breakout upwards because I’ve been watching the long positions rise, right? So, brothers, remember to manage your defense and position regardless of the direction. Thank you all for your recognition; personal suggestions are for reference only. If you want to follow me in and out, feel free to leave a message and join the community! When others are greedy, I am fearful; when others are fearful, I am greedy. Remember, if you don’t understand something, you can leave a message to communicate, or you can search for the same name online 🔍! Be mindful of risks! Please like, watch, and share this article!

ETH Resistance Level: 2590

ETH Support Level: 2423

Macroeconomic Overview: The three major U.S. stock indices closed lower, and U.S. Treasury yields rose.

The three major U.S. stock indices all closed lower, with the S&P 500 index down 0.96% at 5695.94 points; the Dow Jones index down 0.94% at 41954.24 points; and the Nasdaq index down 1.18% at 17923.90 points. The benchmark 10-year U.S. Treasury yield is at 4.03%, while the 2-year U.S. Treasury yield, which is most sensitive to Federal Reserve policy rates, is at 3.99%.

The U.S. 2-year/10-year Treasury yield curve has turned negative for the first time since the Federal Reserve cut rates by 50 basis points on September 18. Traders expect further rate cuts from the Federal Reserve this year to be less than 50 basis points.

Summary

In the coming months, Bitcoin may continue to face challenges from market volatility and macroeconomic policies. As investor interest in DOGE rises, it may drive its price further up. The market's interpretation of Federal Reserve policies will be key, especially the pace and magnitude of rate cuts, which will directly affect the performance of risk assets.

Additionally, as the U.S. presidential election approaches, political meme tokens may see a surge in popularity, attracting more investor attention. Overall, the recovery of the altcoin market and the popularity of meme tokens may provide new opportunities for investors, but the sustainability and stability of the market still need to be observed.

Personal Introduction

Graduated from Nanjing University’s Finance Department, previously worked as a risk management expert and private wealth advisor at Shanghai Yimeng Securities.

Invested in BTC for the first time in 2015, focusing on the cryptocurrency space for nine years. Experienced multiple bull and bear cycles.

Incorporating deep financial expertise and sufficient industry experience into practice.

Helping students quickly master trading skills and improve trading systems.

Trading Style: Good at building structured thinking, creating financial trading courses, and naked K strategies.

For business inquiries, search for the same name on the public account "Coin Towards Money."

Join the group for learning

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

Search for the same name on the public account "Coin Towards Money."

Also, please help me like + watch + share this article! 👌😂 The links and advertisements below do not belong to me; please be cautious in identifying them.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。