Key Indicators: (Hong Kong Time October 7, 4 PM -> Hong Kong Time October 14, 4 PM):

BTC/USD +1.2% ($63,500 -> $64,250), ETH/USD +1.8% ($2,480 -> $2,525)

BTC/USD December (Year-End) ATM Volatility +1.4v (56.1 -> 57.5), December 25d Risk Reversal Volatility +0.6v (2.3 -> 2.9)

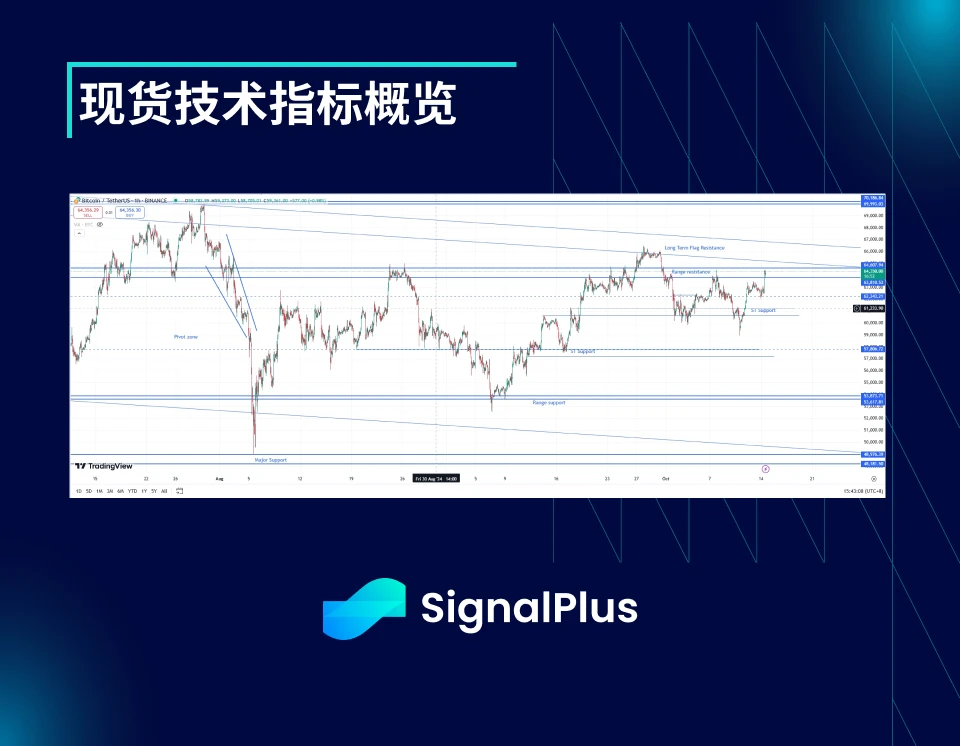

Last week, price volatility was intense, but overall remained within the $60-65k range.

If the price breaks above $66-66.5K, it would indicate a breakout from the top of a long-term flag pattern, with the price expected to rise to $70K, further providing significant upside potential.

If the price falls below $59k, the expected support level is $57k, followed by a further drop to $53.5k.

Major Market Events

This week, cryptocurrency news was mixed, leading to significant price volatility. On Thursday, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against a large crypto company, accusing it of engaging in unregistered crypto securities trading, which triggered a brief liquidation of BTCUSD long positions, causing the price to drop below $60k, reaching a low of $58.8k. However, with Mt. Gox announcing on Friday that it would extend the Bitcoin repayment deadline to 2025 to resolve creditor issues, the Bitcoin price quickly rebounded, briefly surpassing $63k. Ultimately, ahead of the U.S. elections, BTC price is expected to continue fluctuating within the $60k - $65k range.

This week, expectations for China's stimulus policies fell short. A press conference on Saturday announced some medium- to long-term policy measures, but lacked specific details on short-term stimulus or cash distribution. Although overall market sentiment is moving in a positive direction, there is insufficient momentum for a rapid rise in the short term.

U.S. CPI data slightly exceeded expectations, coupled with strong employment data from last week, leading to doubts about the rationale for a 50 basis point rate cut in September. As a result, U.S. interest rate pricing quickly rebounded from the significant rate cut expectations seen two weeks ago, strengthening the dollar against fiat currencies. Nevertheless, cryptocurrency and gold prices generally maintained support.

Despite several polls indicating the election remains a 50/50 race, Trump currently holds a slight lead. The Democratic Party's handling of the increasingly tense Israel-Iran situation may influence the election dynamics in the coming weeks, but overall, this election is expected to remain uncertain until the last moment.

ATM Implied Volatility

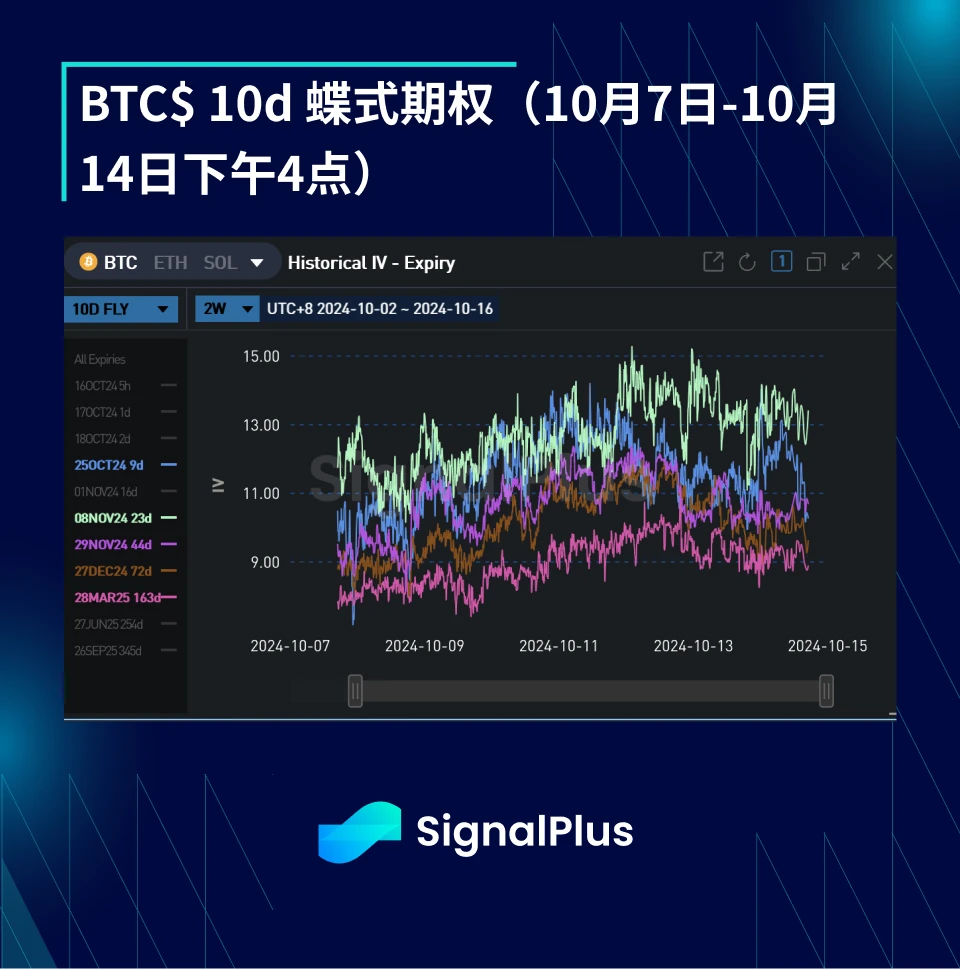

This week, actual volatility remained at very low levels (around 35% - 45%), with spot prices hovering mostly between $60k and $63k, only experiencing brief fluctuations over the weekend. Market participation was insufficient, and perpetual contracts and futures liquidity were generally sluggish, with investors broadly waiting for the U.S. elections (or other catalysts) to drive prices up.

Due to the lackluster performance of actual volatility and insufficient market participation, implied volatility continued to decline this week. However, as spot prices briefly surpassed $63k on Friday, implied volatility rebounded over the weekend; on Monday, spot prices continued to rise, breaking through $63k and challenging the $64k level.

With optimism about China's stimulus policies gradually fading and U.S. data remaining relatively calm, we expect Gamma performance to be subdued this week (with pressure on the front end of options implied volatility contracts). The only short-term risk is the escalation of the Middle East situation, but it currently seems unlikely to have a significant impact.

Last week, as options expiring on November 1 began trading, the pricing of election volatility decreased. The market primarily engaged in arbitrage by selling forward volatility agreements (FVA) for October 25 and November 1, that is, selling November 1 expiring options and hedging with options expiring at the end of October. This, in turn, exerted pressure on the November 8 expiring options and somewhat reduced their weight for that day. As the election approaches, we expect demand for options expiring on that event to rise, as the theta to be paid during this period is relatively low.

Skew/Convexity:

Influenced by the news from Mt. Gox and BTC's strong rebound after briefly falling below $60k, the market regained confidence in rising prices, and volatility skew increased again over the weekend. However, overall, the market's reaction to volatility skew was muted, indicating that the market holds Gamma positions at high spot price levels.

From a convexity perspective, the market remains in a sideways trend, with price breakthroughs still under control, and a significant proportion of bullish spread strategies are being supplied as the year-end approaches.

Wishing you successful trading this week!

You can use the SignalPlus trading indicator feature at t.signalplus.com for more real-time crypto information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。