Author: Ponyo Source: 4pillars Translation: Shan Oppa, Golden Finance

Earlier this year, $EIGEN traded above $13 in the over-the-counter market. Since its public listing on October 1, its price has hovered between $3 and $4, with a fully diluted valuation (FDV) of approximately $5 to $7 billion. This means that in just six months, EigenLayer's market capitalization has significantly decreased by 70%. Such a sharp decline has left investors puzzled and raised questions about whether the highly anticipated "Restaking" innovation truly lives up to its expectations. In this report, we will analyze the reasons behind $EIGEN's poor performance and discuss its future prospects.

1. Background - Reasons for $EIGEN's Poor Performance Post-Listing

The weak performance of $EIGEN post-listing can be attributed to two key factors frequently discussed within the community.

1.1 Ambiguity of Token Utility

In the white paper released on April 29, 2024, EigenLayer introduced $EIGEN as a "Universal Intersubjective Work Token." This complex and unfamiliar term makes it difficult for investors to grasp the core value of the token.

In simple terms, the primary role of $EIGEN is to mediate and resolve issues that arise in Active Validation Services (AVS). However, the challenge lies in effectively communicating this.

For instance, while the concept is clear to industry insiders, the lack of a direct explanation of the token's actual use, especially for retail investors, has led to confusion. Explaining how $EIGEN addresses failures in decentralized systems adds complexity to its adoption and understanding, particularly in an ecosystem filled with competitive narratives. We delve into the components of this explanation.

Universality

The term "universal" indicates that $EIGEN is not limited to a single blockchain network. Instead, it can be used across a wide range of blockchain infrastructures and applications, such as zk-rollups, cross-chain bridges, MEV solutions, Trusted Execution Environments (TEEs), and even AGI (Artificial General Intelligence) solutions. This flexibility is due to EigenLayer's roots in Ethereum, allowing it to handle asset staking and validation tasks across various networks. In contrast to traditional L1 tokens that are typically tied to specific blockchain ecosystems, $EIGEN's broad applicability is a significant differentiator.

Work Token

A "work token" refers to staking tokens within the network to perform specific tasks. In blockchain terminology, these tasks include validating transactions, generating proofs, and ensuring the integrity of the network—all fundamental processes in Proof of Stake (PoS) systems. In EigenLayer, $EIGEN and its staked version $bEIGEN support the execution of these tasks across various AVS. Validators who violate protocol rules face economic penalties, losing $bEIGEN through a slashing mechanism. This mechanism is similar to traditional PoS systems but extends to more tasks, going beyond typical L1 validation and broadening its application in decentralized services.

Intersubjectivity

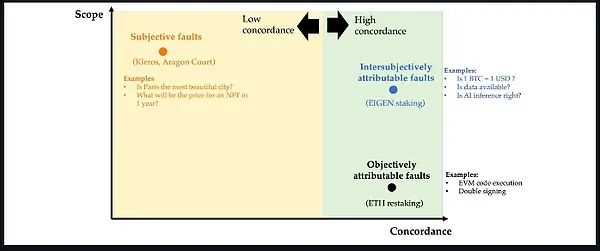

In the blockchain environment, failures can be broadly categorized into three types: objective attribution failures, intersubjective attribution failures, and subjective failures. Intersubjective failures are particularly interesting because they cannot be verified solely through technical means but are widely recognized by participants. Such failures often occur in situations involving off-chain data or requiring human judgment, such as price oracle errors or censorship events. Resolving these failures relies on the collective consensus of network participants, making it a core focus of $EIGEN's functionality. Addressing these consensus-driven errors, especially those involving subjective data inputs, distinguishes $EIGEN from tokens that focus solely on technical validation.

As mentioned, $EIGEN can serve as a mediating tool for resolving intersubjective errors—issues that cannot be technically proven true or false but are generally recognized as errors by participants. For example, if a validator intentionally submits incorrect data or violates protocol rules, the malicious party's staked $EIGEN will be excluded from the network through a forking process. Here, the fork is not merely a separation from the network; it is a powerful punitive measure that renders the value of the tokens held by the violating validator null.

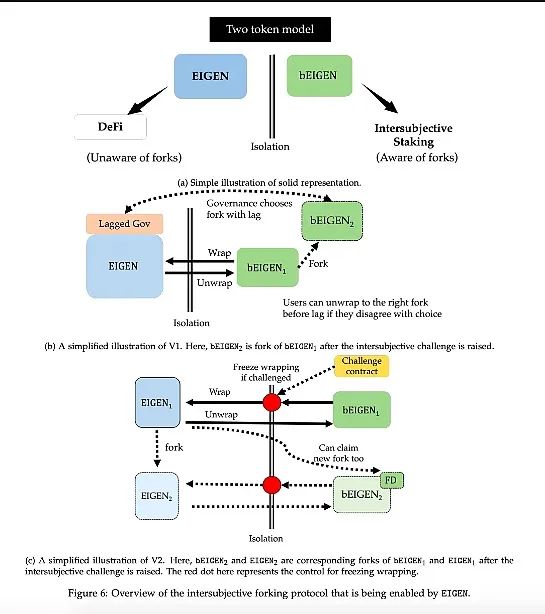

Forking Process

When a failure is detected in a specific Active Validation Service (AVS), challengers can raise a dispute. To resolve this issue, the network will destroy the original $EIGEN and issue new forked tokens, $EIGEN2. In this process, the Fork Distributor (FD) contract allows legitimate $EIGEN holders and stakers to exchange their tokens for the new forked version, $EIGEN2. However, the staked $bEIGEN of malicious actors cannot be converted to $bEIGEN2, effectively rendering their assets worthless.

This forking mechanism serves both as a deterrent and a safeguard, ensuring that participants who contribute to network health are protected while those who act maliciously see the value of their tokens drop to zero. It is a strong economic penalty designed to maintain the integrity of the network and ensure that only honest participants are rewarded.

At this point, a reasonable question arises: why not use $ETH alone to handle these failures instead of relying on $EIGEN? This is due to the potential risk that Ethereum's consensus mechanism requires tasks involving subjective or intersubjective decision-making, rather than the objectively verifiable tasks that Ethereum typically handles. Ethereum's consensus mechanism is designed for tasks that can be deterministically verified, such as validating transactions and ensuring the correct state of the blockchain.

However, when it comes to tasks involving human judgment, such as determining the fairness of specific outcomes (e.g., in prediction markets or content moderation), reaching consensus becomes more complex. These tasks may overload Ethereum's social consensus, as they require subjective agreement among participants, which is not as straightforward as validating cryptographic proofs. By introducing the $EIGEN token, EigenLayer aims to shift these subjective tasks to a different consensus layer, thereby preserving Ethereum's cryptoeconomic security for objectively verifiable transactions while handling more complex, socially recognized tasks elsewhere.

In summary, while the existence of $EIGEN is justified, its utility remains both clear and ambiguous. Although the role of $EIGEN in enhancing AVS security and resolving intersubjective failures is theoretically clear, its actual utility remains unfamiliar to many investors. The value of the token is only realized when intersubjective errors occur within the network, meaning that in the absence of such issues, its utility may appear less obvious. This positions $EIGEN as a niche token, in stark contrast to meme coins, which thrive on hype driven by a lack of any intrinsic utility.

A recent poll conducted by Pinkbrains CEO DeFiIgnas supports this, with over 60% of respondents (2,314 out of 3,839) indicating they would prefer to invest in $MOG rather than $EIGEN. This result highlights investors' tendency to choose assets with easily understandable narratives, further underscoring the challenges $EIGEN faces in gaining broader appeal.

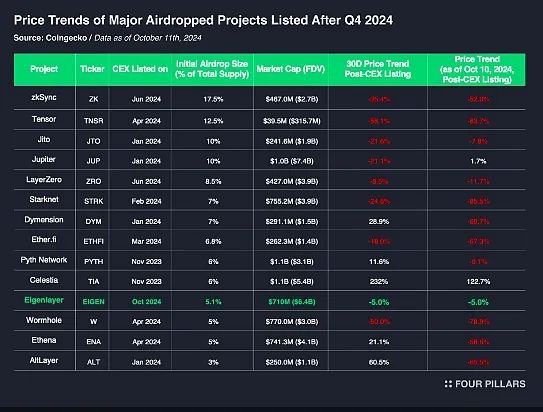

1.2 Impact of Airdrop Selling Pressure

Another key factor contributing to $EIGEN's recent poor performance is the increased selling pressure from airdrop recipients looking to lock in profits. This is a common phenomenon in many projects after token listings. Historically, many airdropped tokens often face downward price pressure shortly after listing, as early recipients are eager to sell their free tokens. For example, looking back at major projects listed in the past year, most tokens experienced significant price declines within the first 30 days post-listing. While macroeconomic conditions, valuations, and token economics all play a role in these price movements, the significant impact of airdrop tokens cannot be overlooked.

In the case of EigenLayer, of the initial circulating supply of 185 million EIGEN, as much as 46% (approximately 86 million EIGEN) came from airdrops. This includes allocations to institutional investors and cryptocurrency giants like Blockchain Capital and Galaxy Digital. Notably, it has been reported that Sun Yuchen and GCR transferred airdropped EIGEN worth approximately $8.75 million and $1.06 million, respectively, to centralized exchanges, exacerbating the selling pressure. Last but not least, a recent statement from the EigenLayer Foundation revealed that approximately 1.67 million EIGEN were stolen in a hacking incident, further worsening the situation.

2. Key Points - Strong Fundamentals with a Focus on AVS Ecosystem Growth

Like any asset, long-term price trends often reflect the underlying growth potential of the project. From this perspective, EigenLayer's fundamentals remain strong, and the main factors to watch for future growth will be the expansion of its Active Validation Services (AVS) ecosystem.

2.1 Market Dominance Through First-Mover Advantage

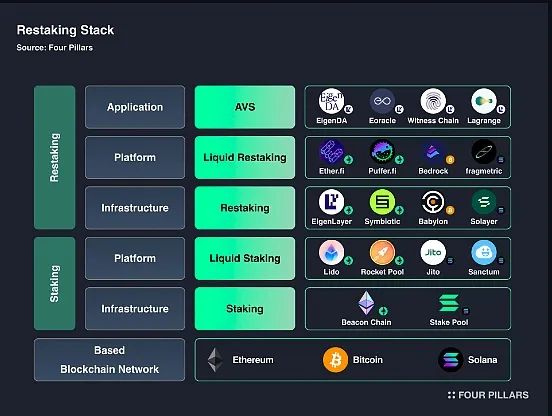

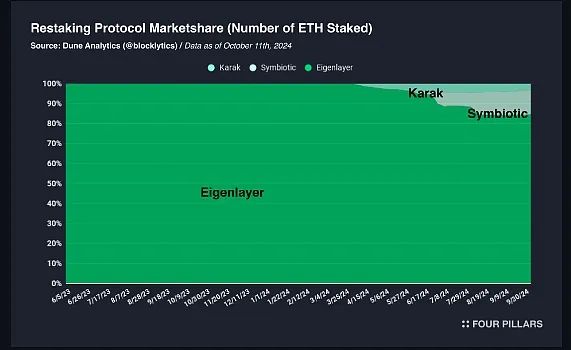

EigenLayer was the first to propose the concept of re-staking and launched its services in June 2023. Since then, several innovative projects have emerged, inspired by re-staking models in different blockchain ecosystems. For example, Symbiotic and Karak have made significant progress in the Ethereum ecosystem, while Solayer and Jito have expanded into the Solana ecosystem. In the Bitcoin space, projects like Babylon are also exploring similar approaches. Additionally, Liquid Re-staking Token (LRT) initiatives such as Ether.fi and Puffer.fi are built on the foundational concepts introduced by EigenLayer. This wave of development highlights EigenLayer's role in shaping a broader re-staking ecosystem while fostering collaboration and an evolving space.

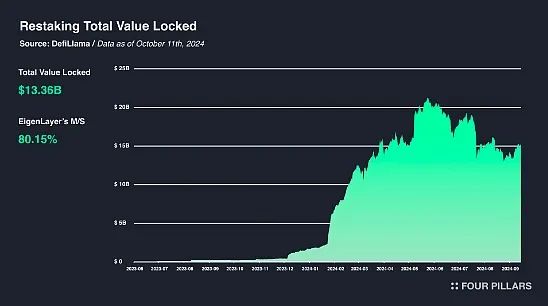

Market data further solidifies this dominance. As of October 11, 2024, the total locked value (TVL) of re-staking protocols reached approximately $13 billion, with EigenLayer alone holding about $10 billion (equivalent to 4.5 million ETH), capturing 80% of the market share. In contrast, Symbiotic and Karak hold 11.7% and 3.7% of the market share, respectively.

2.2 Focus on the Growth of the AVS Ecosystem

While EigenLayer maintains its leading market share, the most critical monitoring factor for the future is the growth rate of the AVS ecosystem. No matter how advanced EigenLayer's technology is, its value remains limited without widespread user adoption and practical applications. If ecosystem growth stagnates, EigenLayer may cede market share to emerging competitors. More importantly, the revenue generated by AVS is directly distributed to $EIGEN stakers, meaning the success and expansion of AVS are closely tied to the value of $EIGEN.

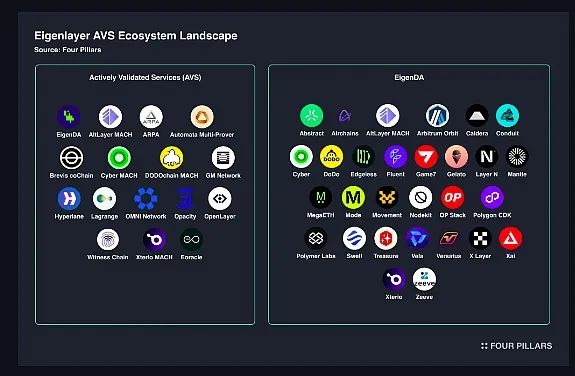

Finally, while there is no clear market narrative driving demand for $EIGEN, a potential catalyst could arise if the market begins to anticipate "AVS airdrop" tokens, similar to the excitement surrounding $TIA earlier this year. If this narrative materializes, the growth of the AVS ecosystem could significantly increase demand for $EIGEN. Currently, there are 17 AVS projects under development on EigenLayer, including EigenDA, with more projects potentially in the pipeline. Additionally, 44 major networks (including Abstract, MegaETH, Mantle, and Movement) support or utilize EigenDA, highlighting its expanding footprint.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。