Do not worry about having no friends on the road ahead; there are like-minded individuals on the investment journey. Good afternoon, everyone! I am the King of Coins from the Coin Victory Group. Thank you all for coming here to watch the King’s articles and videos, and I hope the brothers who have been following the King will return.

Click the link to watch the video: https://www.bilibili.com/video/BV1wgmPYzE4M/

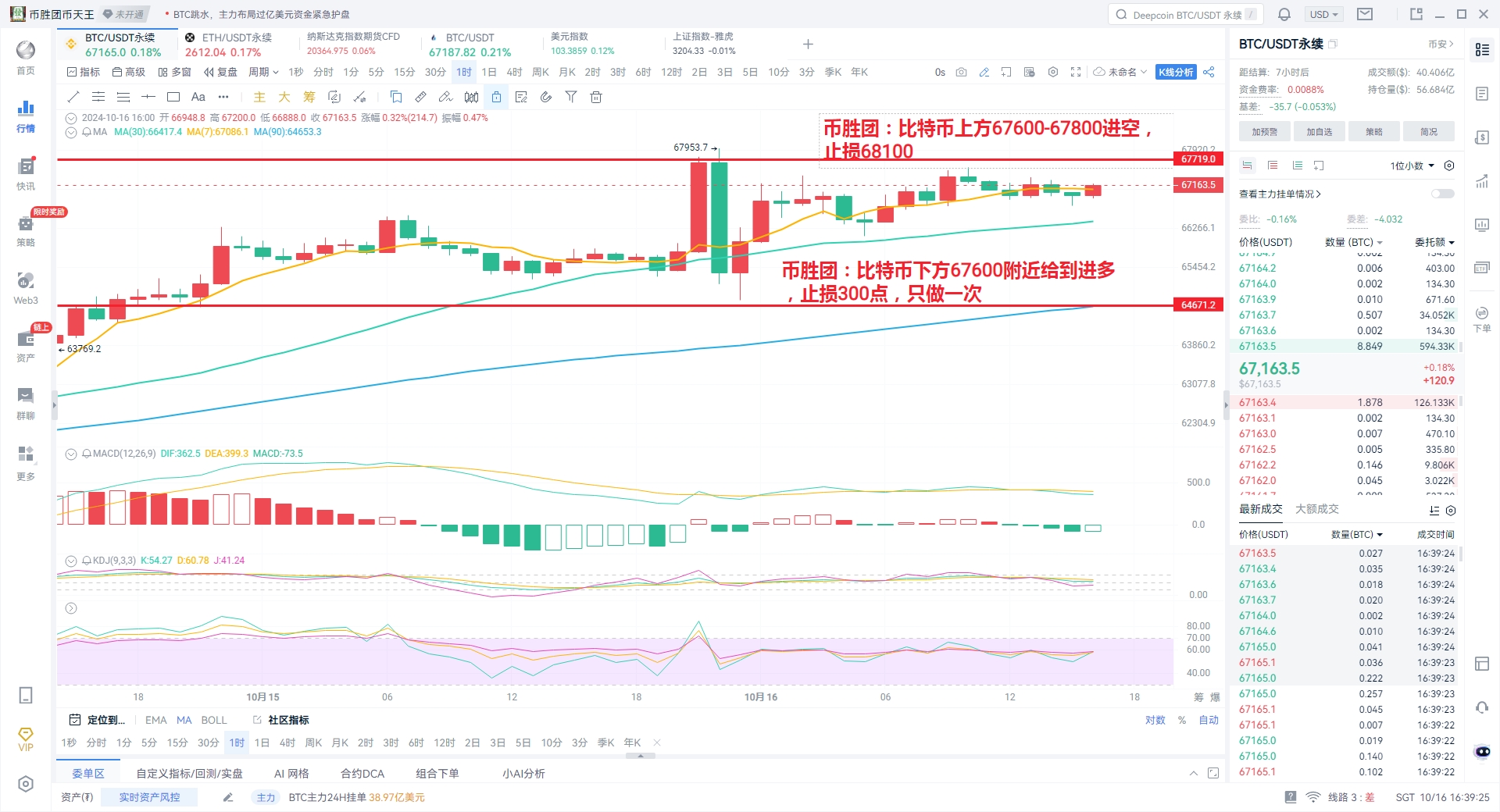

First, let’s review the King’s views on the market from the article and video released yesterday. For Bitcoin, the King suggested entering a short position at 66500 with a stop loss of 300 points, and a long position in the range of 64600-64800 with a stop loss of 300 points. Looking at the market, the short position at 66500 hit the stop loss, but the long position at 64800 provided an entry opportunity, rebounding to around 67500 at its peak, resulting in a decent overall profit of over 2000 points. For Ethereum, the King suggested entering a short position at 2650 with a stop loss of 20 points, and a long position at 2550 with a stop loss of 25 points. Unfortunately, the short position hit the stop loss by a few points, but the long position soared, providing a perfect entry opportunity, with the market rebounding to a high of 2630, resulting in an overall profit of over 80 points. In summary, Bitcoin yielded a profit of 2000 points, and Ethereum 80 points, which is quite good. Congratulations to those who followed along.

From the perspective of influencing factors, Bitcoin's recent market performance has been affected by multiple factors:

Macroeconomic Policy: The Federal Reserve's interest rate cut is one of the key factors for Bitcoin's price recovery. On September 18, the Federal Reserve announced a rate cut, lowering the federal funds rate by 50 basis points to 4.75%-5.00%. This move significantly boosted confidence in the global financial markets, and the cryptocurrency market also warmed up as a result. The rate cut brings more liquidity, prompting investors to seek high-return assets in this context. Bitcoin, as a high-risk, high-return asset, has become a popular choice for capital inflow. Additionally, the rate cut may exacerbate the depreciation risk of fiat currencies like the US dollar, prompting investors to seek hedging tools against inflation. Bitcoin, as a scarce asset, is seen as a means to resist inflation and currency depreciation, thereby increasing demand.

Political Factors: The attitudes of candidates towards cryptocurrencies in the US elections also impact Bitcoin's price. On October 14, US presidential candidate and current Vice President Harris proposed supporting a regulatory framework for cryptocurrencies, promising more investment certainty for 20% of Black Americans who own or have owned digital assets. This news has boosted the trend of digital currencies.

Now, let’s take a look at Bitcoin's specific trend. From the daily chart, there have been two consecutive long bullish candles. After a short-term bearish close yesterday, the market quickly rebounded, resulting in a long lower shadow on the daily candle. This candle now provides infinite possibilities for the market. When this signal appears, there are only two possible outcomes: either it breaks above 70000 to set a new historical high, or it returns to around 60000. From the current macro environment, the King is more inclined to believe in the latter. Personally, I think we will revisit yesterday's low today, and this week may break below yesterday's low. In the short term, I suggest entering a short position around 67800 with a stop loss of 300 points. The lower level around 64600 is still a good point to consider entering long, with a stop loss of 300 points. This long position can only be executed once today. If any friends are stuck in positions, feel free to reach out to the Coin Victory Group, and I will help you resolve the issues.

Next, let’s look at Ethereum's market. First, examining the daily chart, it is clearly different from Bitcoin. After significant volatility, the market formed a doji candle, which is a typical evening star signal, further strengthening the King’s confidence in shorting. Today, Ethereum suggests entering a short position around 2685 with a stop loss of 25 points, and a long position around 2550 can be considered with a small amount, with a stop loss of 25 points. If there is an unexpected stop loss, directly pursue a short position looking at 2430, but note that this long position can only be executed once. Given the overall volatility at the beginning of this month, we will conduct live broadcasts of the market from Monday to Friday at 8:30 PM. Friends in need can find the Coin Victory Group online, and I will send you the link to the live broadcast room.

This article is independently written by the Coin Victory Group. Friends in need of current price strategies and solutions can find the Coin Victory Group online. Recently, the market has been primarily characterized by fluctuations, accompanied by intermittent spikes. Therefore, when making trades, please remember to manage your take profit and stop loss effectively. In the future, when facing significant market data, the Coin Victory Group will also organize live broadcasts across the internet. Friends who wish to watch can find the Coin Victory Group online.

Mainly focused on spot and contract trading for BTC/ETH/ETC/LTC/EOS/BSV/ATOM/XRP/BCH/LINK/TRX/DOT, specializing in strategies such as mobile locking and trading around high and low support and resistance levels, short-term swing trading, medium to long-term trend trading, daily extreme pullbacks, weekly K-line top predictions, and monthly head predictions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。