Evening market trends: How might they unfold? Little A analyzes for you!

Welcome to the group chat to ask Little A for more analysis: jv.mp/JaQ0CE

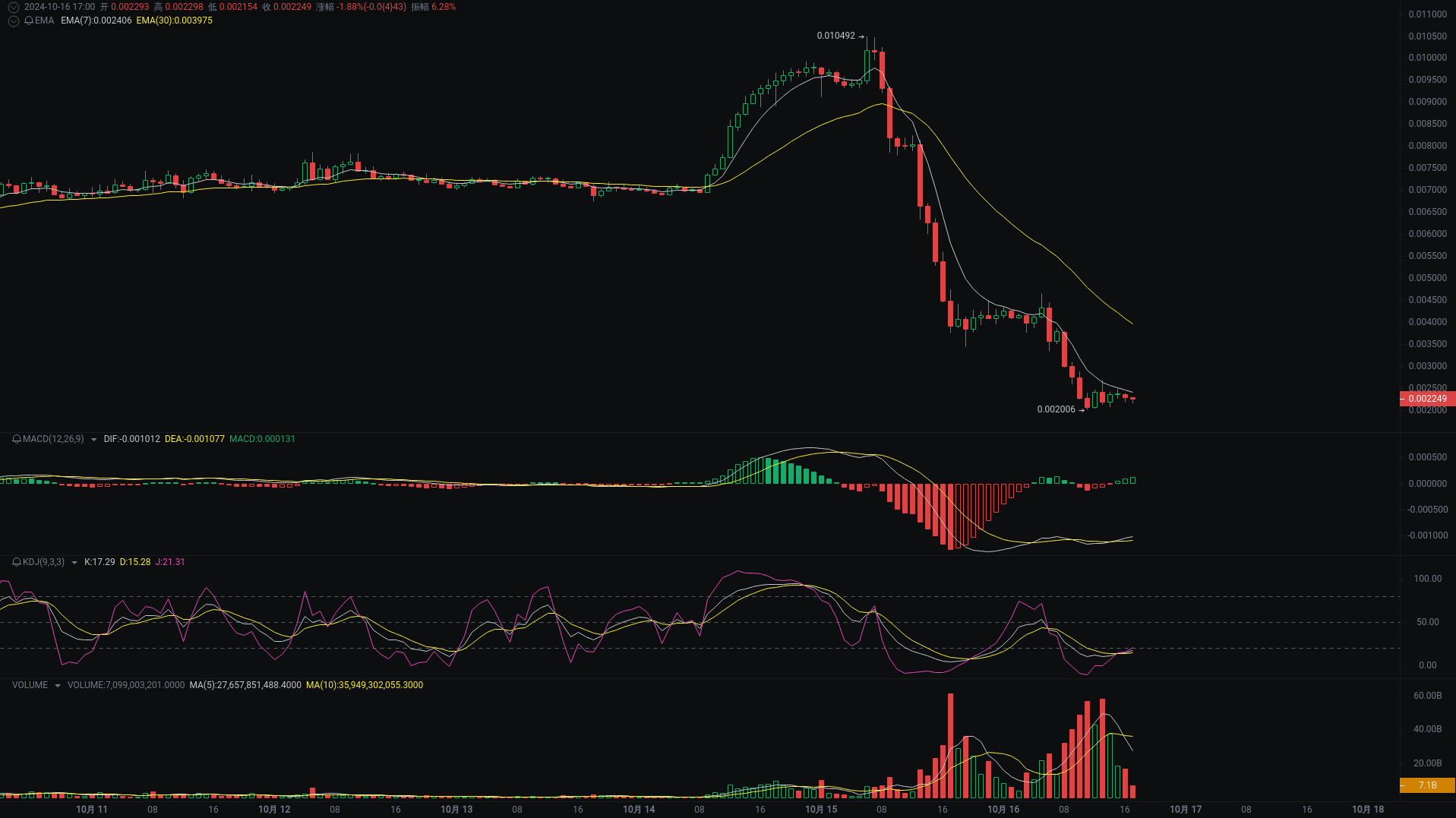

REEF

REEF's 1-hour price trend: Down.

This is a 1-hour Binance REEF/USDT candlestick chart, with the latest price at: 0.002249 USDT, including EMA, MACD, KDJ, and volume indicators.

【Buy and Sell Points】

Buy Point One: 0.002300 USDT (Considering the current price is close to the lowest price, and the KDJ indicator shows possible overselling, a small exploratory buy can be made at this level)

Buy Point Two: 0.002100 USDT (If the market continues to decline, this price will be closer to previous lows, providing further safety margin for extreme overselling)

Long Stop Loss Point: 0.001950 USDT (Set below Buy Point Two, leaving enough space to avoid triggering the stop loss due to minor fluctuations, and also near a psychological support level)

Sell Point One: 0.002500 USDT (If the market rebounds, this price is a recent minor resistance level, suitable for initial reduction of positions or short-term profit-taking)

Sell Point Two: 0.002800 USDT (A higher resistance level, if the market can recover to this point, it may indicate a possible trend reversal, considered a long-term target or profit-taking point for most positions)

Short Stop Loss Point: 0.002900 USDT (Set above Sell Point Two, ensuring enough leeway for short operations, and also a key psychological resistance level)

【Price Trend Analysis】

Candlestick Patterns:

- Recent candlesticks show a significant price drop, especially from 06:00 on October 15 to 17:00 on October 16, falling from a high of 0.010492 to the latest price of 0.002249. This sharp decline may be accompanied by panic selling.

- The candlesticks from 07:00 on October 15 to 17:00 on October 16 show multiple long upper and/or lower shadows, indicating market uncertainty, with both buyers and sellers attempting to control the market but with no clear winner.

Technical Indicators:

- The MACD indicator shows that DIF and DEA remain in negative territory, and the MACD histogram is also negative, indicating a strong downward trend.

- In the KDJ indicator, both K and D values are low and close to 20, with J value fluctuating significantly, reflecting the overselling situation that may lead to a rebound opportunity in the future.

- The EMA indicator shows that the short-term EMA (7) has crossed below the long-term EMA (30), further confirming the downtrend.

Volume:

- During the sharp price decline, volume increased, especially when the price hit the bottom (e.g., at 14:00 on October 16), with volume peaking, which may indicate a temporary extreme panic point.

- Subsequently, volume began to decrease, indicating a decline in market activity, and investors may be waiting to see further market developments.

bome

bome's 1-hour price trend: Up.

This is a 1-hour HTX bome/USDT candlestick chart, with the latest price at: 0.008982 USDT, including EMA, MACD, KDJ, and volume indicators.

【Buy and Sell Points】

Buy Point One: 0.009000 USDT (EMA(7) and EMA(30) are about to form a golden cross, if the price retraces to this level, it may be a good buying opportunity)

Buy Point Two: 0.008700 USDT (Near recent lows, if the price further dips to this level, it may attract buying interest)

Long Stop Loss Point: 0.008500 USDT (Providing enough space to avoid triggering the stop loss due to minor fluctuations, while considering this price is below the recent lows)

Sell Point One: 0.009200 USDT (Above the current price, if there is a short-term rebound to this level, consider taking partial profits)

Sell Point Two: 0.009400 USDT (Close to the high on October 15 at 20:00, as a higher target sell point)

Short Stop Loss Point: 0.009600 USDT (Above recent highs, if the price breaks through, it may indicate further bullishness, suitable for setting a short stop loss)

【Price Trend Analysis】

Candlestick Patterns:

- Recent candlesticks show increased price volatility, especially between 09:00 and 11:00 on October 15, with significant price swings, indicating market uncertainty.

- In the last few hours, the candlestick bodies have gradually shortened, accompanied by upper and lower shadows, which may indicate a relative balance of power between buyers and sellers within the current price range.

Technical Indicators:

- In the MACD indicator, the negative divergence between the DIF and DEA mean lines is narrowing, and the MACD histogram has turned positive, suggesting potential strengthening of upward momentum.

- In the KDJ indicator, the J value is at 29.59, while K and D values are 26.68 and 25.22 respectively, with the KDJ three lines close together and at low levels, possibly indicating an upcoming rebound.

- In the EMA indicator, EMA(7) is below EMA(30), but the gap is narrowing; if EMA(7) crosses above EMA(30), it may confirm an upward trend.

Volume:

- After reaching a peak at 19:00 on October 15, volume began to gradually decrease, showing a certain degree of divergence from price trends, and caution is needed regarding the risk of price pullback due to shrinking volume.

- In the latest period, volume has increased compared to the previous period; if this continues, it may support further price increases.

WLD

WLD's 1-hour price trend: Down.

This is a 1-hour Binance WLD/USDT candlestick chart, with the latest price at: 2.311 USDT, including EMA, MACD, KDJ, and volume indicators.

【Buy and Sell Points】

Buy Point One: 2.330 USDT (This price is near multiple hourly lows from 08:00 to 12:00 on October 16, which may form short-term support)

Buy Point Two: 2.251 USDT (This is the lowest price in the recent period; if the price tests this level again and does not break below, it can be seen as a strong support level)

Long Stop Loss Point: 2.230 USDT (Slightly below Buy Point Two, providing enough space to avoid triggering the stop loss due to minor fluctuations)

Sell Point One: 2.376 USDT (Recent rebound high; if the price rises to this level, it may encounter selling pressure)

Sell Point Two: 2.400 USDT (The top of the trading range between 23:00 on October 15 and 00:00 on October 16; breaking this point may indicate further upward movement)

Short Stop Loss Point: 2.422 USDT (Above Sell Point Two, considering possible false breakout space)

【Price Trend Analysis】

Candlestick Patterns:

- Recent candlesticks show significant price volatility, with a long bullish candlestick from 00:00 to 16:00 on October 15, indicating buyers controlling the market. In the following hours, the price retreated, forming a short bearish candlestick with a long upper shadow, suggesting increased selling pressure.

- From 06:00 to 12:00 on October 16, several small candlesticks with lower shadows may indicate finding a support level, but failed to effectively reverse.

Technical Indicators:

- MACD indicator: The latest MACD value is negative, and DIF is below DEA, showing a death cross state, indicating the current trend is bearish.

- KDJ indicator: The J value is gradually declining from a high point, with K and D lines interlacing, showing no clear golden cross or death cross signals, indicating the market lacks clear direction.

- EMA indicator: EMA(7) is below EMA(30), and both are trending downward, which is typically seen as a bearish market trend in the short term.

Volume:

- In terms of volume, it peaked between 22:00 and 23:00 on October 15, when the price also reached a recent high, after which volume began to gradually decrease, along with the price retreating.

- In the last few hours, volume has remained relatively stable, with no significant increase, lacking sufficient momentum to push prices up or down.

※All content provided by the intelligent analysis assistant Little A, for reference only and does not constitute any investment advice!

Little A's Intelligent Analysis is AICoin's industry-leading intelligent analysis tool, easily helping you interpret cryptocurrency trends, analyze indicator signals, and identify entry and exit points. Experience it on the APP or PC.

PC & APP Download: https://www.aicoin.com/download

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。