Human nature is to fear loss and seek advantage. For example, when the price of Bitcoin surges, people are afraid of buying at a high price, worried about poor entry points, and concerned about potential pullbacks. This is a manifestation of the fear of loss. However, the market is not something we can control, especially during a strong one-sided trend, where significant pullbacks are unlikely. As everyone watches the price rise continuously, they miss opportunities slipping through their fingers.

Note, I am not referring to any specific individual, but rather the vast majority; this is human nature. In a volatile market, after a strong bullish candle breaks through, most people will not immediately participate but will wait for the market to stabilize and pull back before entering. True one-sided trends often happen in one go; if there is a pause or excessive adjustment, it indicates that the strong trend has ended, just like yesterday's market. I mentioned a pullback to the 65400-65600 range to go long; how many people were lost in their own thoughts, looking at the so-called "high position" and hesitating to enter? The biggest misconception in trading is making decisions based on price; I have repeatedly emphasized in my live broadcasts that trading must consider the market structure, which is the trading system of each trader!

The root of suffering is the pursuit of certainty. Impermanence is the norm and is how life should be. Speculation is about trading risks, trying to align probabilities in your favor. What you give out will come back to you; sometimes, it's wise to take a small loss, be a bit foolish, and a bit slow. For instance, if the market is bullish, once that is confirmed, don’t be too rigid with your position; reduce your position size a bit, and get in first—if it reverses, so be it.

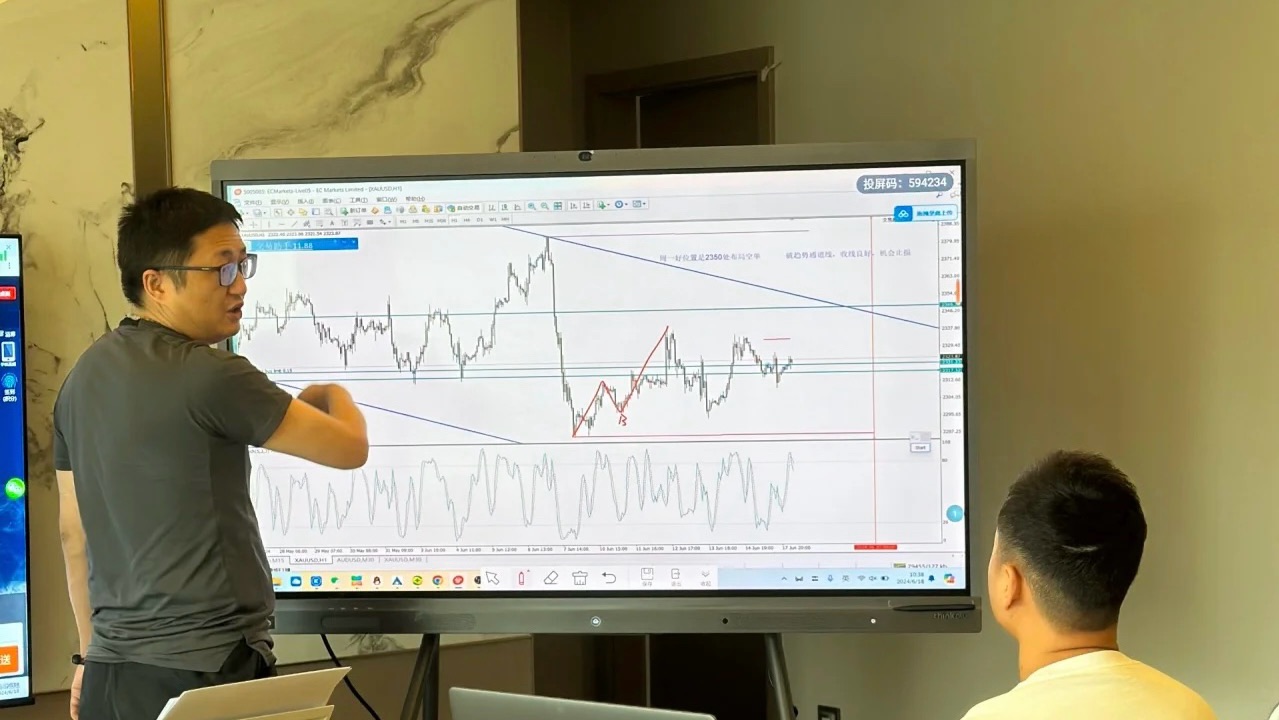

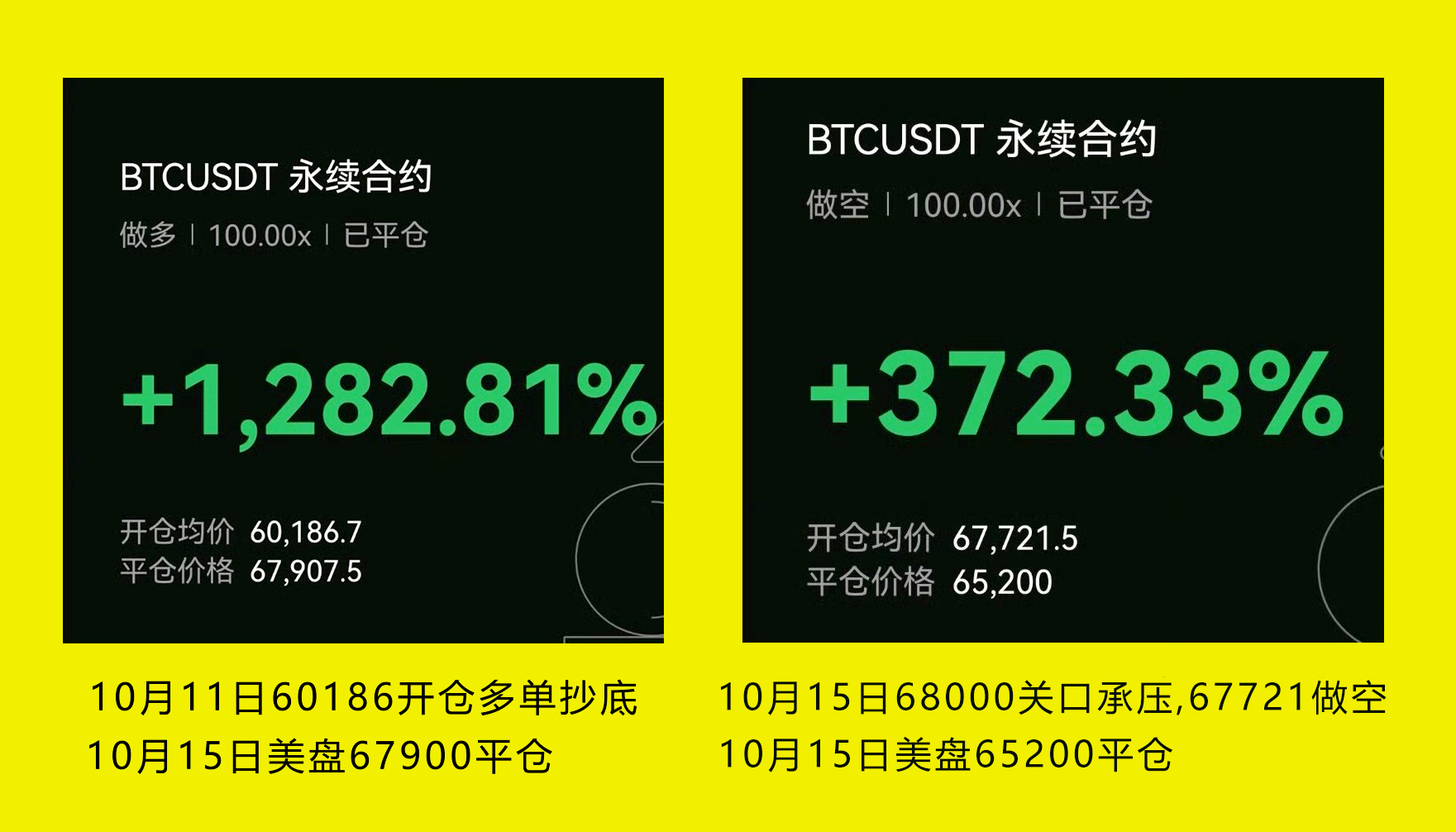

Now, let’s review this wave of upward movement. On October 13, in my public account article "Trader Sean: Bitcoin Adjustment Ends, Last Entry Opportunity for Bulls, Aiming for 68000 This Month," I provided a strategy to go long at 62700, targeting 68000 for profit-taking. On October 15, in the article "Trader Sean: Don’t Be Deceived, Bitcoin Pullback is Still Bullish! 'Fear of Heights' Will Ultimately Miss Out," I suggested going long at 65400, targeting 68000 for profit-taking, all of which can be verified. As for Ethereum, I won’t emphasize too much; I mentioned starting long trades at 2440, which rose by 200 points. Below are the trading records!

Let me share my thoughts moving forward:

Last night, the US market experienced a rollercoaster, quickly retracing to 64800 after first hitting the daily and weekly channel trend line resistance at 68000. However, it’s worth noting the way the market moved; it completed quickly in a short time, which is clearly a washout market, also known as a spike-and-reverse market. This morning at 8 AM, the daily candle closed with a bullish K, forming a star-like pattern, which is a continuation pattern and unlikely to change the market direction. From a fundamental perspective, we are about to enter the US election phase, which will provide some support to the US stock market. Although there is currently pressure at the 68000 level, I believe this wave of upward movement will likely break through the channel trend line resistance! Even if it cannot break through in the short term, if the market turns bearish, it will test or fake break the resistance multiple times, creating a trap for bulls before falling. Therefore, my current suggestion is to continue buying at support levels!

On the six-hour chart, after the US market broke the pressure at the 66800 top-bottom conversion point yesterday, as of this writing, there have been three consecutive candles testing the bottom without forming a downward break. The market will likely rely on the 66800 support to build a new box structure at a high level, with the short-term pressure still at the 68000 level!

October 16 trading suggestion: Go long near 66800, with a target of 1000 points above. There is currently not enough momentum to achieve a substantial break above 68000.

Dear readers, if you have market conditions to discuss or exchange ideas, feel free to follow my public account!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。