Original Author: BitMEX

In last week's article, we recommended a bullish options spread strategy to go long on Bitcoin at $62,000. As we approach the expiration date on the 18th, this trade has performed very well so far. Our current trading price is around $67,000—close to the all-time high. We hope you have made a good profit.

In this article, we will assess the probability of Bitcoin breaking through $70,000 and share an options strategy that can be profitable before next Friday, regardless of whether Bitcoin drops, consolidates, or gently rises to $69,000, as long as it does not exceed $71,000.

Let’s dive in.

Factors Driving Recent Gains

Before delving deeper, let’s review the potential factors behind this week’s gains.

Support from Vice President Harris for the cryptocurrency industry: Vice President Harris recently expressed clear support for cryptocurrencies, indicating that Bitcoin may benefit regardless of the outcome of the November elections. However, considering that Trump has expressed intentions to include Bitcoin as part of the U.S. currency reserves, a Trump victory could be even more favorable.

Adjustment in the Chinese stock market and narrowing USDT discount: The strong upward momentum in the Chinese stock market has recently reversed, showing a significant decline of over 13% in the past week. This adjustment in the Chinese stock market may redirect attention and funds back to the cryptocurrency market. Notably, the USDT discount against the Chinese yuan has slightly narrowed to about 1.3% after exceeding 1.5% for two consecutive weeks. This change suggests that selling pressure may have eased and could indicate a renewed interest from Chinese investors in cryptocurrencies.

Does Bitcoin Have Enough Momentum to Break Historical Highs?

It is likely that savvy traders still have ample reason to take profits as Bitcoin approaches historical highs.

Andrew Kang believes that certain bullish factors may be overstated, and while the overall market remains positive, breaking historical highs may require more substantial cryptocurrency ecosystem-specific drivers:

Overemphasis on Federal Reserve rate cuts: The impact of Federal Reserve rate cuts on cryptocurrency prices may be overstated. Bitcoin's 4.5x increase during high-interest periods indicates a weak correlation between interest rates and BTC prices.

Limited impact of Chinese stimulus measures on the crypto market: Optimism surrounding Chinese economic stimulus measures may be more related to stocks than cryptocurrencies. Evidence shows that funds have shifted from cryptocurrencies to Chinese A-shares, with the USDT discount against the yuan reaching 3%.

Realistic market outlook: While not bearish, a more cautious approach suggests that Bitcoin may remain within the $50,000-$72,000 range until significant cryptocurrency-specific catalysts emerge.

Our co-founder Arthur Hayes has also shifted to a more neutral stance on cryptocurrencies, as he sees escalating global geopolitical risks. He advocates for cautious position sizing and preparation for potential "crazy market cap paper losses." In his latest article, Arthur Hayes presents several compelling reasons why Bitcoin may not break its historical high anytime soon, despite the current bullish market sentiment:

Increased geopolitical risks: The escalating conflict between Israel and Iran poses a significant threat to the cryptocurrency market. A major escalation in the conflict could lead to "substantial declines" in cryptocurrency prices.

Unpredictability of war: Hayes emphasizes that "war is uninvestable," highlighting the potential for sudden and severe market turmoil.

Volatility in energy prices: While Bitcoin may benefit from rising energy prices in the long term, short-term volatility could be significant if Middle Eastern oil infrastructure is affected.

Putting Your Market View into Practice: Trading Options

Considering the above factors, we believe that Bitcoin is unlikely to break $71,000 in the short term—1) Bitcoin may rise moderately, but 2) it is unlikely to exceed $71,000 or set a new historical high in the next 1-2 weeks.

Consider a Bullish Options Spread 1x2 Strategy

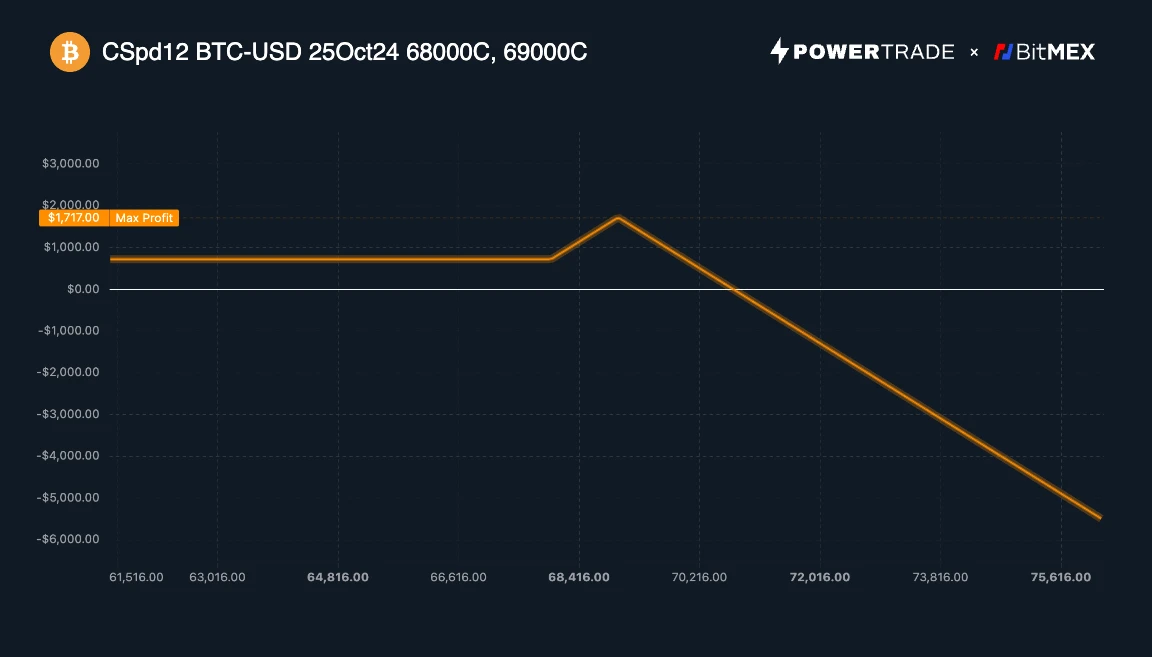

The bullish options spread 1x2 strategy, also known as a 1x2 ratio vertical spread strategy, involves buying one call option at a lower strike price and selling two call options at a higher strike price. The second sold call option is uncovered (naked), carrying unlimited risk. The profit potential is limited, and maximum profit is achieved if the price reaches the strike price of the sold call options at expiration. However, once it exceeds the breakeven point, the risk becomes unlimited due to the potential for the stock price to rise indefinitely.

This strategy allows for potential profits with limited risk while also providing some downside protection.

Trading Strategy

Buy 1 call option for $BTC with a strike price of $68,000, expiring on October 25.

Sell 2 call options for $BTC with a strike price of $69,000, expiring on October 25.

Potential Returns

Breakeven Point: $70,716

Maximum Loss: If $BTC exceeds $70,716, potential losses are unlimited, similar to a short position.

Maximum Profit: If $BTC is priced at $69,000 at expiration on October 25, the maximum profit is $1,683.

Advantages

Higher profit potential: If the asset price rises to the strike price of the sold call options, this strategy may be more profitable than a standard bullish options spread. As long as Bitcoin does not significantly exceed the breakeven point, it also has higher profit opportunities.

Lower initial cost: Selling two higher strike call options can reduce the overall cost of the strategy, potentially resulting in a credit.

Flexibility: The strategy can be adjusted by changing the strike prices and ratios to fit different market outlooks.

Risks

Unlimited risk: If the asset price significantly exceeds the higher strike price, substantial losses may occur due to the naked call selling.

Complex profit structure: This strategy has multiple breakeven points and non-linear risk characteristics, which may be difficult to manage.

Margin requirements: This strategy may require significant margin, especially when the underlying asset is highly volatile.

This strategy is suitable for traders with a moderately bullish to neutral outlook on the market, expecting the asset price to rise moderately or remain relatively stable. Compared to a standard bullish options spread, it offers higher profit potential, but the risks also increase. It is best suited for experienced options traders who can actively manage positions and understand the complexities of ratio spreads.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。