🧐 Looking at Future Price Trends from the Puffer Technological Revolution —

Since last year, the Restaking track, which has been part of the entire upward trend, is nearing the end of its countdown to the TGE of Puffer @puffer_finance;

However, what everyone envisions for the Restaking track is actually a grand narrative of Puffer as a decentralized infrastructure provider for Ethereum —

Puffer is no longer just a single liquidity restaking platform but has elevated itself to become a decentralized infrastructure provider for ETH. The launch of Puffer UniFi is not merely about creating an L2 but is a native Rollup liquidity aggregation solution for L1.

1️⃣ What are the main technical cores and performance of Puffer upon launch?

1) First, let’s discuss what Puffer aims to achieve:

Many people have not taken the time to understand Puffer; they believe it is merely a restaking protocol. In reality, this is just part of its functionality. The significant transformation of Puffer lies in the comprehensive construction of the Based Rollup solution —

Its flagship Puffer UniFi (the Based Rollup solution) and UniFi AVS (the pioneering Rollup pre-confirmation configuration service) are becoming the core infrastructure that will reshape ETH's greatness once again.

Puffer's three main components, Puffer LRT, Puffer UniFi, and UniFi Preconf AVS, are not independent narratives but are interconnected engineering designs, with the ultimate service endpoint being Puffer UniFi.

Moreover, Puffer UniFi is not a simple L2 solution but a comprehensive construction aimed at the Based Rollup solution, which is expected to lead ETH to glory once again. Its value and significance are undoubtedly extraordinary!

Advantages from a technical perspective:

UniFi AVS (Actively Validated Services):

Puffer introduces an unprecedented transaction processing method through UniFi AVS, achieving extremely low latency transaction confirmation times (reaching 100 milliseconds) via pre-confirmed Layer 2 transactions. This innovation not only enhances the real-time nature of transactions but also significantly boosts the scalability of the Ethereum network.

Based Rollup Technology:

Puffer's UniFi rollup solution represents the next generation of Layer 2 technology based on Ethereum, providing not only fast L1 withdrawals but also allowing sub-second transactions. This is particularly important for DeFi applications as it improves user experience while reducing transaction costs.

Restaking 2.0:

The upcoming Puffer Restaking V2 introduces features such as Fast Path Rewards and Globally Enforced Anti-Slashers, which not only optimize the interests of validators and node operators but also lower the entry barrier by reducing collateral requirements, enhancing the security and scalability of the ecosystem.

By innovating technology to address the scalability and security issues of the Ethereum network, Puffer not only creates market competitiveness for itself but also contributes to the healthy development of the entire Ethereum ecosystem. This means that with the growth of DeFi and more decentralized applications, Puffer is expected to gain a larger market share, further reflecting its economic advantages.

In summary, Puffer's greatest advantage lies in its technological innovation, which can address the main challenges currently faced by Ethereum and other blockchain networks, such as scalability, transaction speed, and decentralized governance, while its economic model promotes long-term ecosystem health and user participation. The combination of these two advantages gives Puffer unique competitiveness and development potential in the market.

So, in reality, Puffer has carved out a path in the crowded Restaking track based on the interests of Ethereum, integrating and coordinating the interests of various parties as a leader in ETH development;

2) Now let’s discuss Puffer's performance after launch and its future.

The launch was actually quite disappointing, with the market mostly filled with critical voices; we can view this criticism from two sides:

First, the page crash indeed prevented many from claiming their airdrops in a timely manner. Secondly, the quantity of airdrops claimed was heavily criticized, which was naturally expected, including my own feelings of anxiety when claiming the airdrop;

This is undoubtedly a misstep;

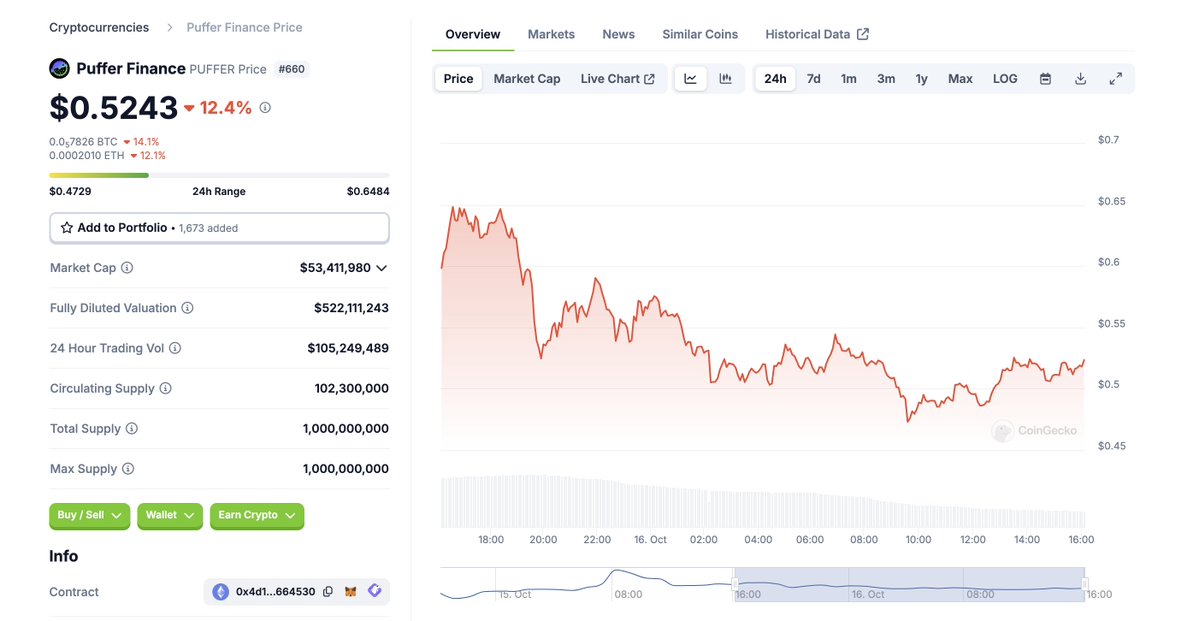

Secondly, looking at the price objectively, the rapid drop to 0.3 after launch and the subsequent rebound to a high of 0.95 yesterday, now back to 0.5 in a sideways trend;

I personally think this indicates two things:

First, the rapid rebound proves that many still value Puffer's financing background and its Based Rollup solution along with the pre-confirmation technology UniFi AVS; thus, the bottom-fishing army remains very determined. Indeed, when it dropped to 0.3, the circulating market cap was only 30 million dollars, which was definitely worth buying;

Second, the current wide fluctuations around 0.5 may continue for a while, aligning with the expectations of most people. The airdrop participants and those holding reward tokens will need to exchange them here before it can rise again; based on the circulating market cap, Puffer's technological prospects, and its popularity overseas, I still see potential for growth;

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。