⚡️Xiao Hei @CryptoHayes latest post indicates that frequent geopolitical conflicts will increase the risk points for #Crypto. He has liquidated most of his meme holdings but remains optimistic about #Bitcoin. He also discusses three risk points in the real world from the perspective of war.

The angles are quite novel, worth a look——

1⃣Physical Risk

Currently, geopolitical conflicts are escalating in the Middle East, where Iran is the region with the highest concentration of mining power, accounting for 7% of the global hash rate.

Although #BTC mining equipment is susceptible to physical damage, there is a precedent with China's ban, which allows us to assume that even in extreme situations, there will not be a significant impact on Bitcoin.

2⃣Energy Risk

Assuming the Israel-Iran conflict intensifies, resources such as oil and natural gas may be contested and destroyed. Energy prices will rise in tandem, and Bitcoin's value in fiat currency will increase.

Hard currency has an innate ability to resist energy shocks, and the profitability of Bitcoin mining will continue to be maintained, at least keeping its value relative to energy. This is the brilliance of Satoshi Nakamoto's design.

3⃣Currency Risk

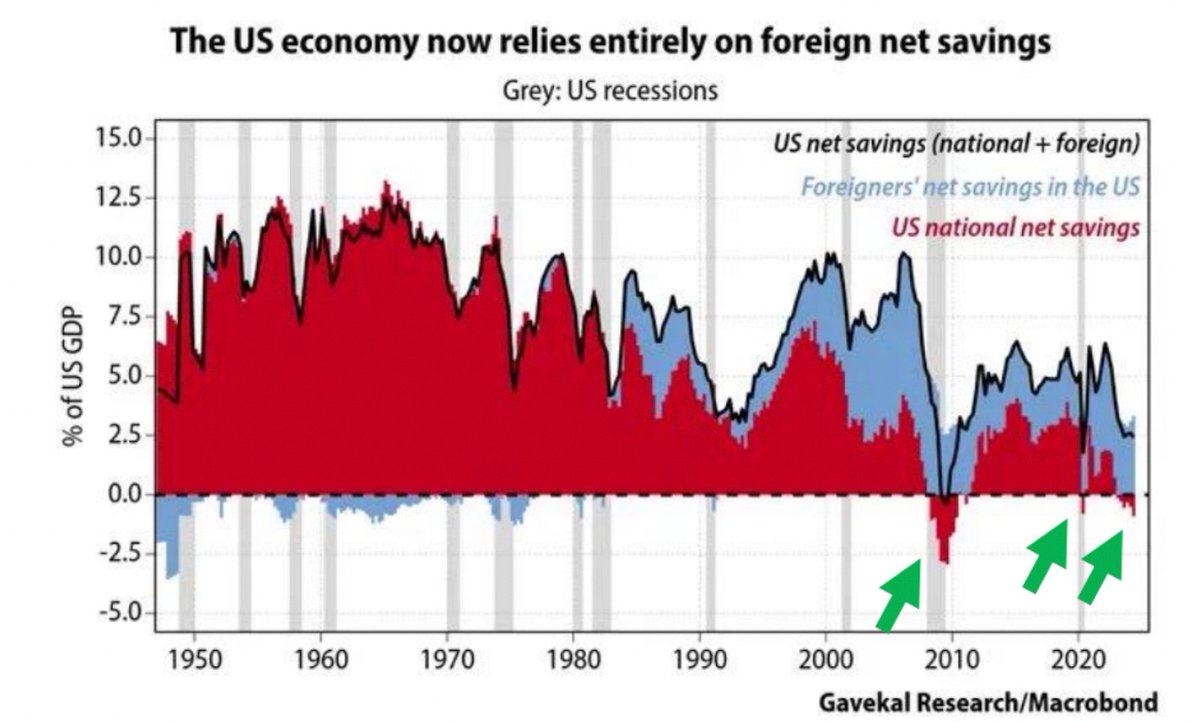

The United States, as the big hand pushing from behind, provides military aid through credit rather than cash savings. Such massive military spending directly implies that the Federal Reserve's balance sheet will increase sharply, and the U.S. government will face continuous money printing.

In contrast to the assistance from China and Russia to Iran, this will not expand the global fiat currency supply. Therefore, the more the U.S. lacks money and prints more, the more it will stimulate a bull market for Bitcoin.

Bitcoin will rise over time, but the process will inevitably involve significant volatility, and there will also be a lot of junk coins being hyped.

The key is to adjust your holdings appropriately at all times. I have significantly reduced my MEME holdings during this war and am keeping idle funds waiting for the next entry point.

War is unpredictable, and the best approach is to invest your funds into a financial asset that can avoid fiat currency depreciation and maintain purchasing power.

👉Original article: https://cryptohayes.substack.com/p/persistent-weak-layer

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。