Trader Chen Shu: 10.16 Afternoon Bitcoin and Ethereum Market Strategy *No. 1, Yesterday's Strategy Successfully Validated the Day's Volume Reduction and Price Increase, Focus on the Strength of the Pullback

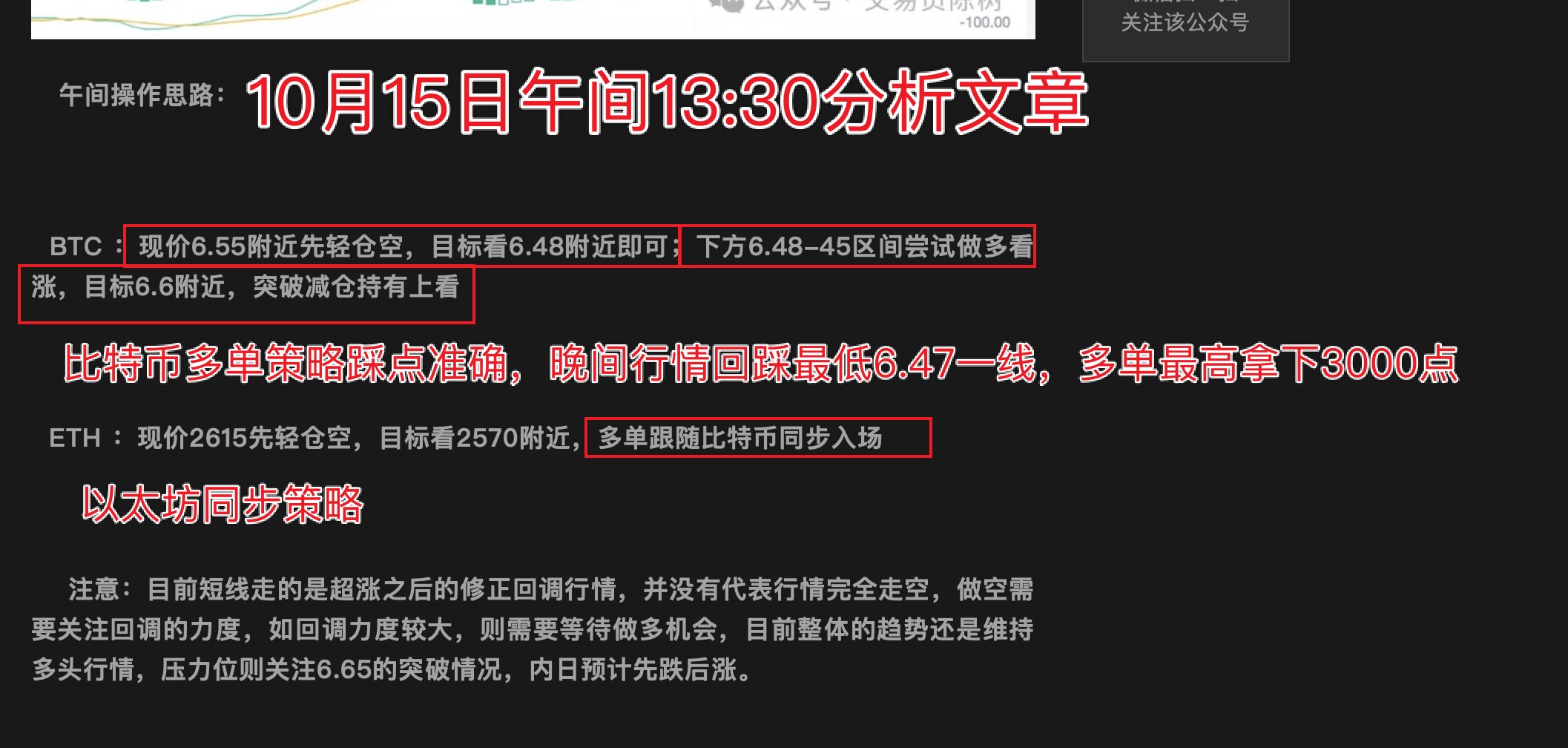

The analysis in the article from October 15 suggested a strategy of first falling and then rising, initially recommending a short at 6.55 targeting 6.48, followed by a long at 6.48-45, which peaked around 68,000, yielding a profit of 3,000 points. The price prediction was accurate, and Ethereum also saw gains. Congratulations to friends who followed the article's strategy. Currently, the market is consolidating at a high of 67,000. Please see the following analysis for operational guidance.

From the daily chart of Bitcoin, although there were spikes up and down yesterday, the daily candle still closed with upper and lower shadows as a red K-line. The daily resistance level remains at around 6.83, and short-term attention should be paid to the selling pressure from trapped positions at this level. On the 4-hour chart, the price is still strongly moving upwards along the MA5/10 moving averages, with limited downward pullback strength. Short-term support can be monitored at the 4-hour MA5/10 moving averages. Caution is advised when chasing high prices during this volume-reduced increase, as there has not yet been a significant pullback correction since this round of price increase. Be wary of a large-scale pullback at the end of the week.

Ethereum reached a high of 2700 yesterday, closing with a green K-bar with upper and lower shadows. The resistance level is consistent with the image in yesterday's article at around 2700. The short-term phase resistance level is at the weekly MA2660. Before breaking and stabilizing above this level, a strong upward movement is difficult to achieve. On the hourly chart, the price is currently showing divergence in the short term, with the coin price oscillating around the MA10/30 moving averages. Pay attention to the hourly MA60 moving average (2580) for support.

Afternoon Operational Strategy:

BTC: Light long positions in the 6.63-6.6 range, targeting the 6.3-6.8 range; if the price touches 6.83-6.88, take light short positions looking for a 1-2000 point pullback.

ETH: Light long positions near 2580, targeting 2630-2660; if the price reaches 2700-2680, take light short positions looking for a 60-100 point pullback.

Note: The short-term trend remains strong, but the market has begun to show divergence. The higher the price goes, the greater the potential for a downward waterfall effect. During the upward movement, try not to chase the price; when going long, always set a stop loss. Next, focus on the breakthrough of the 6.83 resistance level. After being overbought, there has not yet been a corrective pullback, so caution is needed in the short term.

The daily analysis strategy has a very high success rate! Analysis is not easy, so I hope everyone can give a free follow, save, like, and comment. Thank you all, and feel free to leave comments below for discussion; I will reply to each one!

For real-time market strategy exchanges and inquiries about market issues, you can follow my personal account homepage, the original (Coin World) ranked first personal KOL main influencer, providing free guidance and answers to trading questions. Everyone is welcome to communicate and exchange ideas!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。