This article aims to delve into Bitcoin scaling protocols, analyzing the future trends of Bitcoin expansion through a horizontal comparison of the advantages and disadvantages of various major solutions.

Author: Shenchao TechFlow

Introduction

State channels (Lightning Network), sidechains (Stacks), Rollups (BitVM), UTXO + client validation (RGB++ Layer)… which will stand out and truly unite the forces of the Bitcoin ecosystem, achieving scalability, interoperability, and programmability, while introducing innovative narratives and significant increments to the Bitcoin ecosystem?

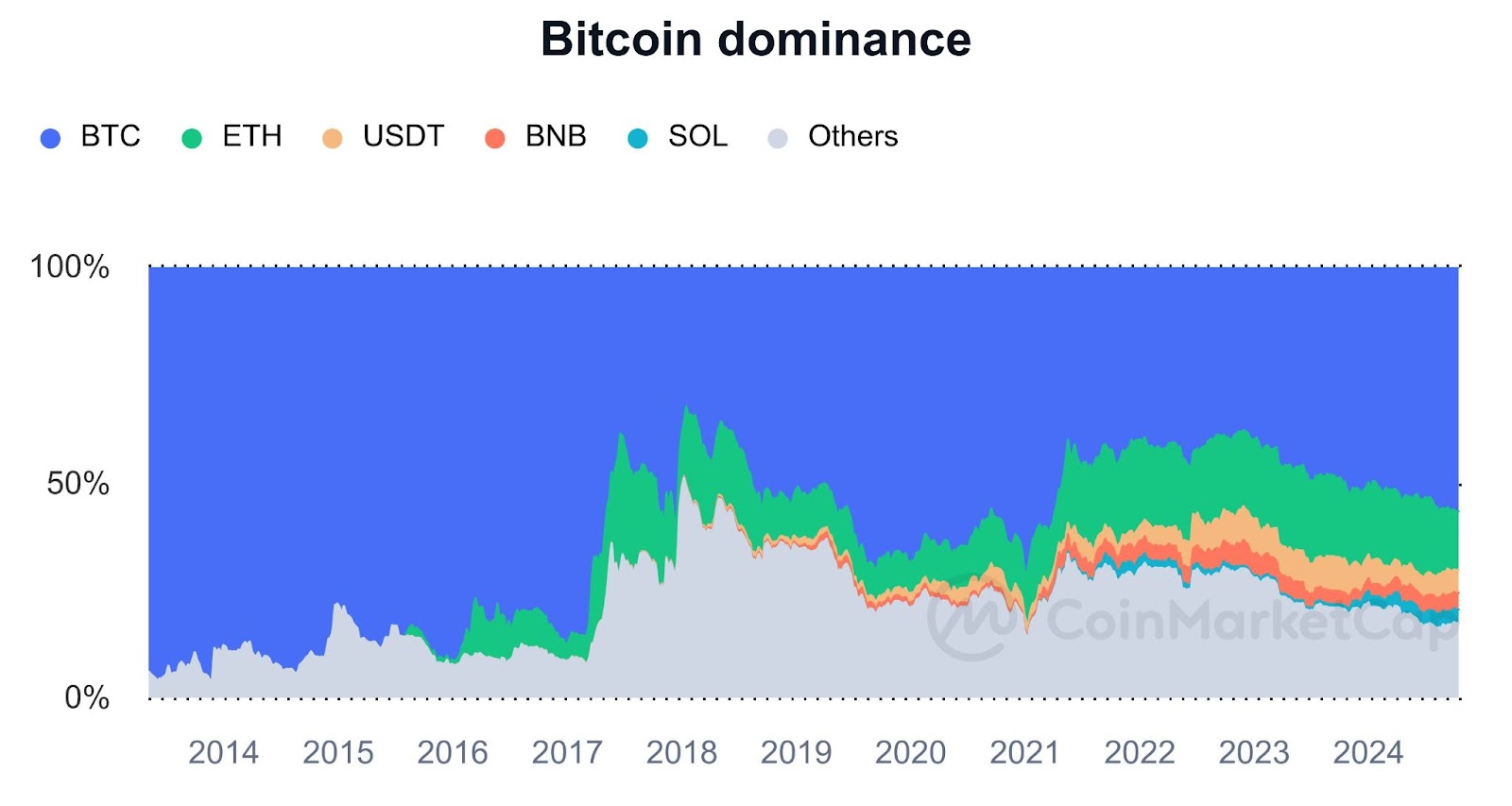

Infrastructure oversupply is an undeniable voice in this cycle of the community. When supply > demand, we can see that both new public chains and L2 solutions are doing everything possible to avoid becoming ghost towns. However, in the Bitcoin ecosystem, we see a completely different picture:

Since the "everyone inscribing" craze, the market has witnessed the community's enthusiasm for participating in the Bitcoin ecosystem. However, due to Bitcoin's scalability limitations, a robust infrastructure is urgently needed before the Bitcoin ecosystem can truly explode. The large investments from institutions, often in the tens of millions, have further propelled the Bitcoin city to roar with machinery, paving roads and building bridges during this cycle.

For a time, it seemed that everyone wanted a piece of the Bitcoin ecosystem's heat, but this piece is not so easily attainable.

The reason is simple:

Due to characteristics such as non-Turing completeness, achieving Bitcoin scalability is not an easy task. Various projects are taking different paths, and Bitcoin's scaling journey is currently experiencing a chaotic exploratory phase.

In this process, we can see established Bitcoin scalability solutions like the Lightning Network, known for their "orthodoxy," revitalizing, while also observing the wild growth of RGB++ proposed by CKB based on RGB, bringing more innovative narratives. Meanwhile, various sidechains and L2 solutions are competing, with some directly borrowing from Ethereum's solutions and others deeply researching improvements based on Bitcoin's own characteristics.

Faced with the trillion-dollar market potential of the Bitcoin ecosystem and the myriad of technical implementation paths, which scaling protocols will stand out, truly unite the forces of the Bitcoin ecosystem, achieve scalability, interoperability, and programmability, and introduce innovative narratives and significant increments to the Bitcoin ecosystem?

This article aims to delve into Bitcoin scaling protocols, analyzing the future trends of Bitcoin expansion through a horizontal comparison of the advantages and disadvantages of various major solutions.

1. Bitcoin Scaling: The Inevitable Path for the Explosion of the Bitcoin Ecosystem

Following the logic of "first determine whether it is necessary, then argue why," we first discuss: Is Bitcoin scaling a pseudo-demand?

The answer is obvious: it is certainly not, in fact, Bitcoin needs scaling solutions more than any other blockchain.

This argument is strongly supported by reality from multiple angles.

From a market perspective, whether it is the craze for inscriptions or the large investments from institutions, we can see the market's enthusiasm for the Bitcoin ecosystem. This enthusiasm is understandable; after all, over the past few years, a significant portion of Bitcoin holders have not just wanted to "hold," but have been frustrated by the lack of more options for ecosystem participation. When interesting narratives emerge in the Bitcoin ecosystem, holders naturally become eager to participate.

Regarding Bitcoin itself, as the pioneer of the cryptocurrency industry, Bitcoin has undergone over a decade of development. The interests of various participants within the ecosystem are not only intertwined but also affect each other. How to achieve balance and maintain long-term attractiveness is a major topic. With the fourth halving expected to be completed in 2024, the reduction in block rewards will lead to decreased profitability for miners, further driving Bitcoin to explore ecological prosperity and achieve richer value flows. Bitcoin also needs to empower network participants and further attract incremental users.

More importantly, in terms of developing the ecosystem, Bitcoin possesses multiple advantages that no other public chain can match: Bitcoin is community-driven and has undergone over a decade of stable operation. Today, its market capitalization has reached $1.2 trillion, holding the highest recognition and awareness among the global public and investors. This endows Bitcoin with an unparalleled degree of decentralization and a strong security foundation. It is also worth mentioning that due to the previous lack of ecosystem, a large amount of Bitcoin funds have remained dormant, lacking deeper value release, which undoubtedly gives more people confidence in the explosion of the Bitcoin ecosystem.

Unfortunately, the performance limitations brought about by Bitcoin's underlying design severely hinder the explosion of the Bitcoin ecosystem: As is well known, Bitcoin can only process about 3-7 transactions per second, and during peak transaction times, the network experiences congestion. To prioritize their transactions, users must pay high fees, resulting in a series of negative experiences such as slow transaction speeds, high costs, and long confirmation times. More importantly, Bitcoin's non-Turing completeness means it lacks the ability to execute complex logic, which significantly dampens the motivation of many developers to build complex smart contract functionalities based on Bitcoin.

Faced with such a powerful yet inherently insufficient Bitcoin, scaling has become the inevitable path for the explosion of the Bitcoin ecosystem. In the current context of discussing needs more than technology, combining Bitcoin's own advantages and disadvantages, and using demand to reverse-engineer solutions, Bitcoin scaling protocols are gradually developing their own principles of "change" and "constancy."

Focusing on Bitcoin's own limitations, Bitcoin scaling protocols aim to bring a series of changes:

One of the core goals of Bitcoin scaling protocols is to enhance the user transaction experience, including improving efficiency and reducing costs.

Additionally, Bitcoin scaling protocols will also strive to help Bitcoin achieve Turing-complete smart contract functionality, allowing developers to build complex logical applications within the Bitcoin ecosystem. The realization of this functionality will enable Bitcoin to support a wider variety of financial products and services, such as decentralized finance (DeFi) applications and automated contract execution, greatly enriching Bitcoin's application scenarios and attracting more developers and users.

Another important change that Bitcoin scaling protocols aim to bring is to enhance interoperability between Bitcoin and other blockchains and ecosystems. By breaking the existing isolation, users can more conveniently transfer assets and data between different platforms. This interoperability will strengthen the connections within the entire blockchain ecosystem, promote resource sharing and collaboration, and drive innovation and development.

Regarding Bitcoin's advantages, Bitcoin protocols will focus on inheriting and promoting:

Bitcoin scaling protocols will pursue a greater degree of inheritance of Bitcoin's decentralization and strong security, which not only ensures greater security but also truly brings innovation to the Bitcoin ecosystem, rather than simply acting as a bridge to introduce Bitcoin assets into other ecosystems and prosper them.

Another noteworthy point is that Bitcoin scaling protocols should aim to expand without significantly altering the mainnet. We know that the Bitcoin ecosystem has previously attempted on-chain scaling solutions and upgraded multiple times, such as expanding block space and implementing Segregated Witness (SegWit), which laid a solid foundation for subsequent Bitcoin scaling. However, since most on-chain scaling solutions alter the mainnet code and sacrifice decentralization and security to some extent, on-chain scaling solutions are approached with caution. The community is increasingly inclined towards building off-chain solutions based on Bitcoin L1, which neither affects Bitcoin's underlying structure nor solves performance issues.

After understanding the "change" and "constancy" of Bitcoin scaling protocols, we have also established some specific evaluation dimensions for measuring Bitcoin scaling protocols. Based on these dimensions, comparing the mainstream Bitcoin scaling protocols currently on the market may help readers develop a clearer understanding of the advantages and disadvantages of various technical implementation paths.

2. Introduction to Mainstream Bitcoin Scaling Solutions and Comparison of Advantages and Disadvantages

Following different technical implementation paths, the mainstream Bitcoin scaling solutions currently on the market can be roughly divided into the following types:

State Channels

Sidechains

Rollups

UTXO + Client Validation

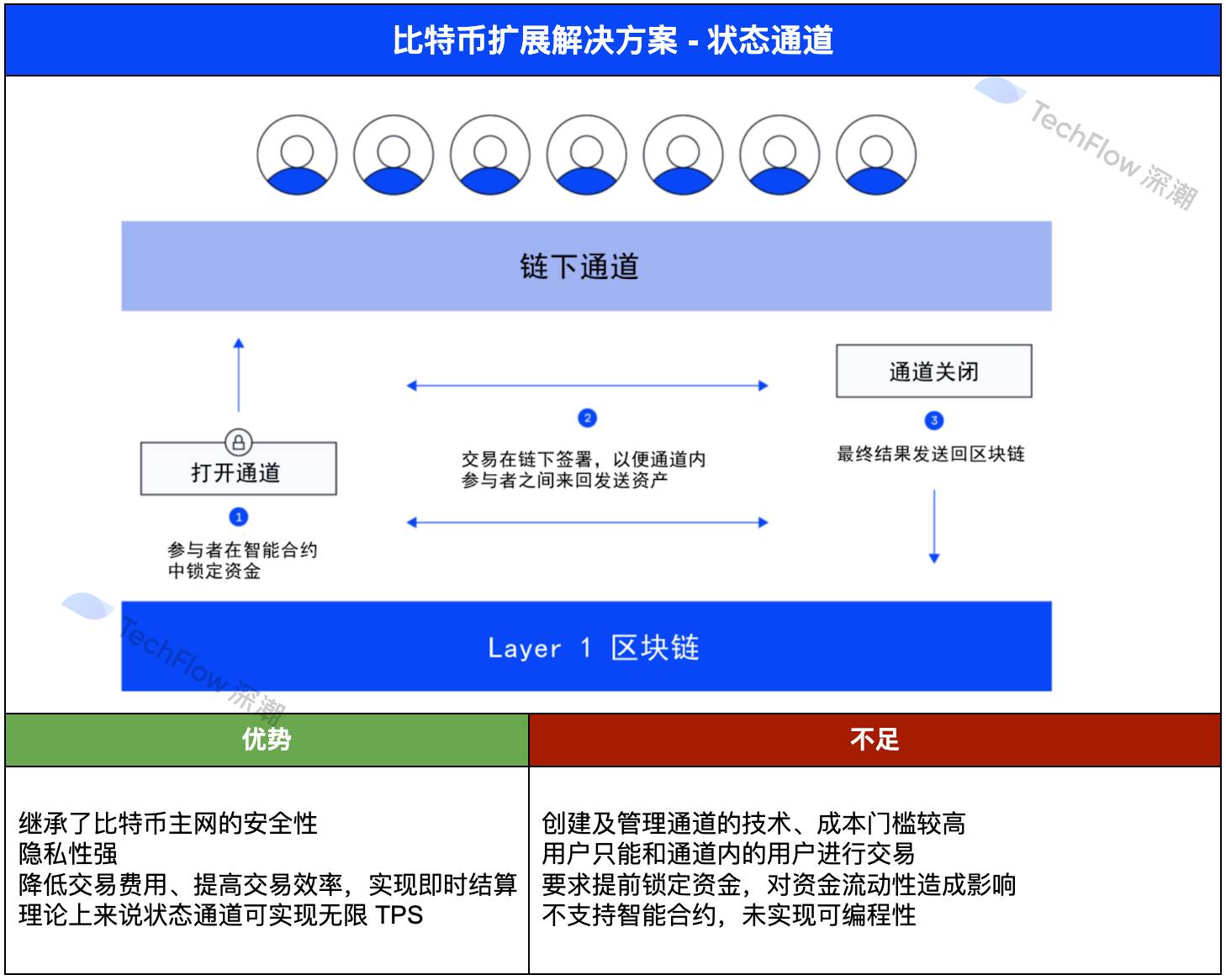

2.1 State Channels

State channels can be considered one of the earliest attempts at Bitcoin scaling and the most orthodox solution, with the most famous representative project being the Lightning Network.

According to its definition: establish a channel between two or more parties, and then conduct multiple transactions within the channel, with only the final state recorded on the Bitcoin main chain, thereby increasing speed and reducing costs.

We can explain the working principle of state channels through a very vivid example:

A group of people submits a deposit to establish a WeChat payment group. In this group, transactions not only incur low fees but also occur quickly. Finally, when the group is dissolved, all payment states that occurred in the group will be updated to the Bitcoin mainnet after confirmation.

Understanding the operational logic of state channels reveals their clear advantages and disadvantages:

The advantages are: on one hand, state channels significantly reduce the computational load on the mainnet, achieving lower transaction fees and higher transaction efficiency; on the other hand, the final state is verified by the Bitcoin mainnet, so state channels inherit the security of the Bitcoin mainnet well; additionally, since multiple transactions can occur within the channel, theoretically, state channels can achieve unlimited TPS.

The disadvantages are: on one hand, the technical and cost barriers for creating a channel are relatively high; on the other hand, users can only transact with other users within the channel, which brings many limitations; furthermore, state channels require funds to be locked in advance, which affects the liquidity of funds; more importantly, state channels do not support smart contracts, which clearly does not meet the needs of the Bitcoin ecosystem.

Image source: Internet

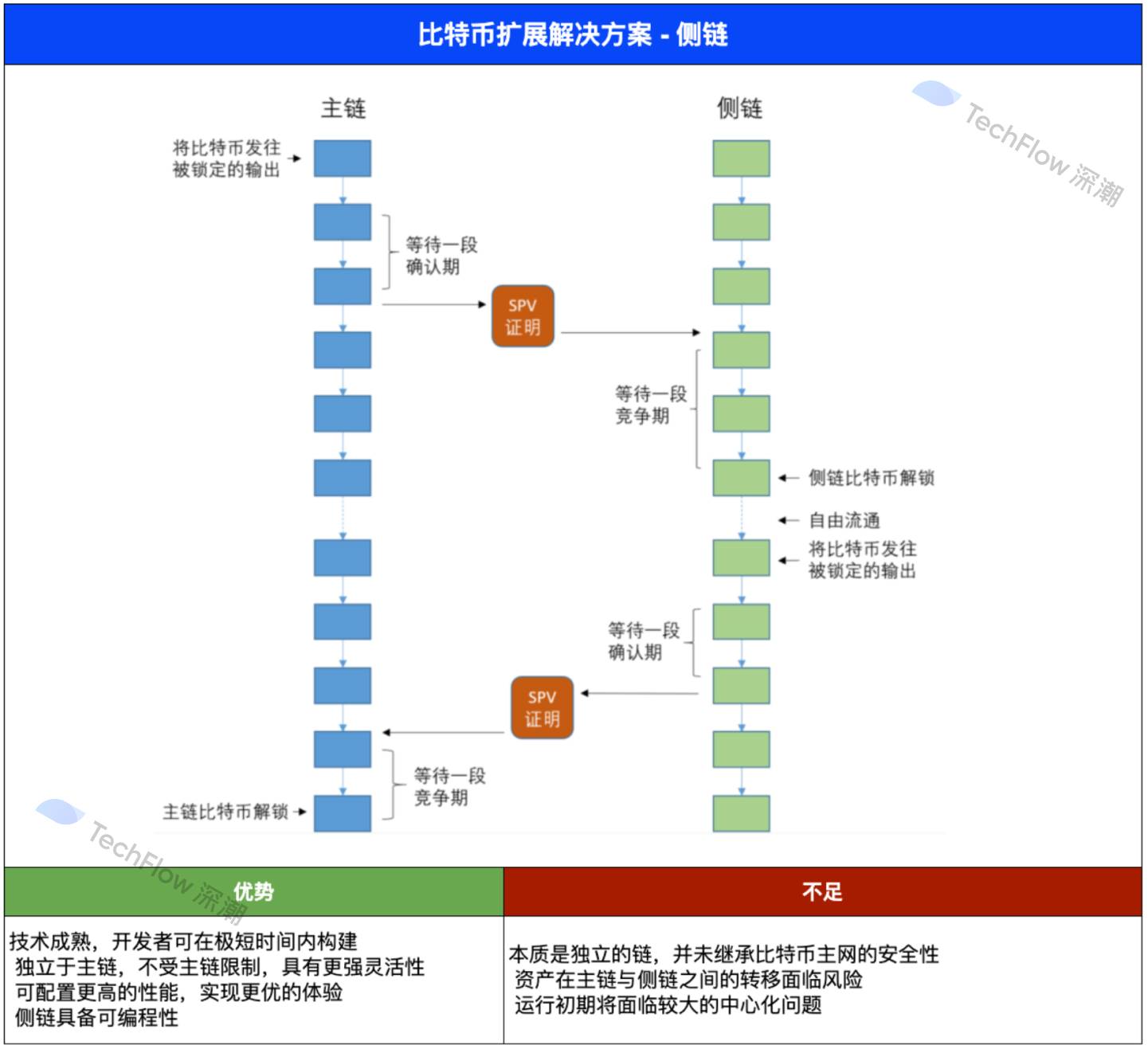

2.2 Sidechains

In fact, the concept of sidechains has been around for a long time. This solution is essentially an independent chain that runs in parallel with the main chain and supports users to transfer assets from the main chain to the sidechain for interaction, connected through a two-way peg mechanism.

There are quite a few projects adopting this technical implementation path, not only the well-known old project Stacks but also the rapidly rising newcomer Fractal Bitcoin, which has attracted community attention.

Since sidechains operate independently from the Bitcoin mainnet, they can theoretically break through Bitcoin's own technical framework limitations, selecting the most advanced designs to achieve higher performance and better experiences.

However, precisely because sidechains operate independently from the Bitcoin mainnet, they cannot inherit Bitcoin's strong security foundation well. Their trust basis is built on their own consensus mechanisms, and there are significant centralization issues in the early stages of operation. Of course, many sidechain projects are currently proposing innovative solutions to address this issue, striving for better binding with Bitcoin's security foundation within their respective consensus mechanisms.

Image source: Internet

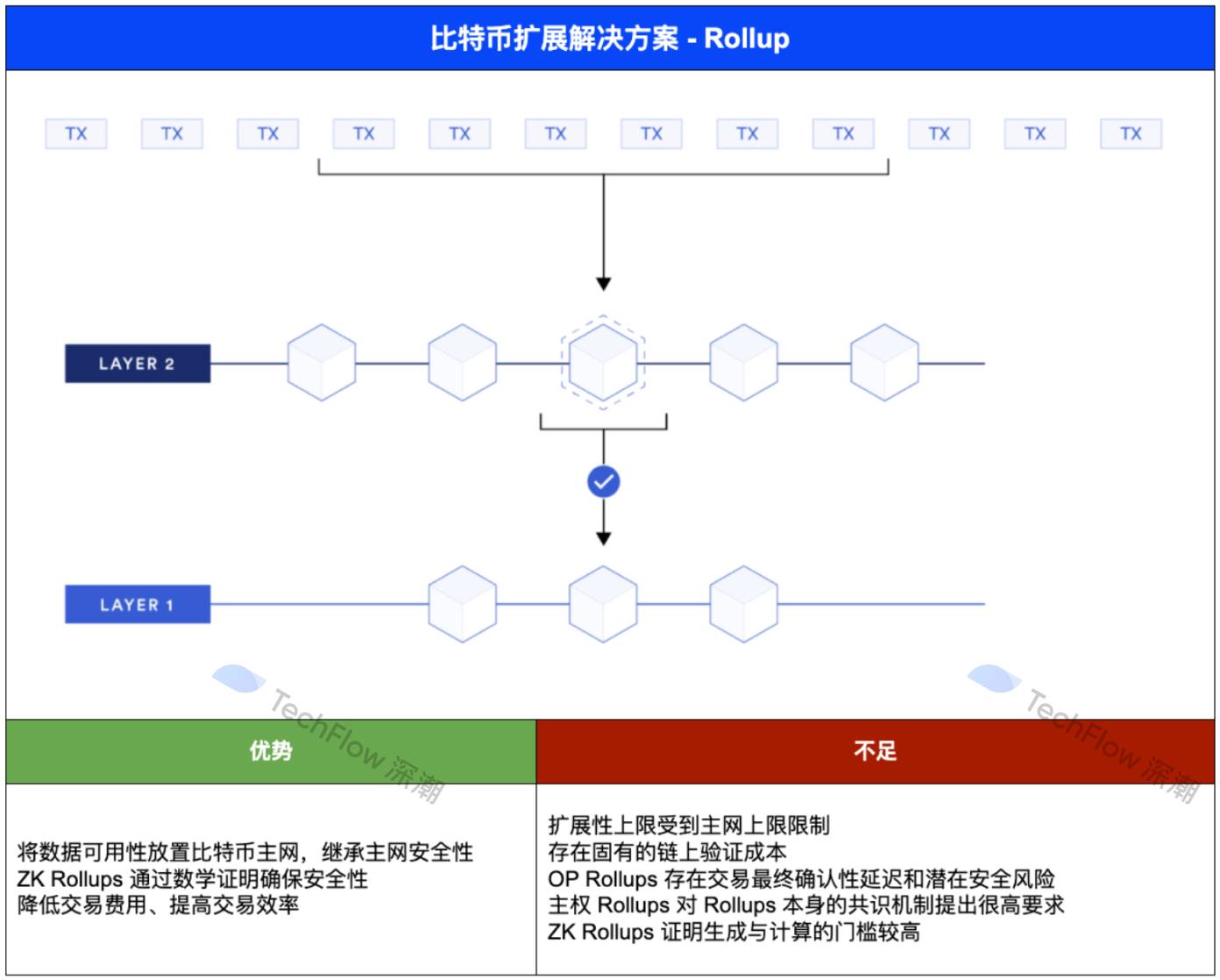

2.3 Rollups

Many people’s understanding of Rollups primarily comes from Ethereum L2. In the competitive landscape of Ethereum L2, projects utilizing Rollup solutions occupy a significant portion of the market. Similarly, in the current Bitcoin infrastructure boom, Rollup technology is also shining in the Bitcoin ecosystem, with projects like B² Network and Bitlayer becoming popular within the Bitcoin ecosystem.

When discussing the specific operational logic, Rollups execute transactions off-chain, aggregating multiple transactions into batches, which are then published to the main chain all at once. This mechanism places data availability on the main chain to inherit its security and decentralization, significantly reducing the amount of data that must be stored on-chain, potentially alleviating congestion on the Bitcoin network and lowering transaction costs.

However, unlike Ethereum Rollups, Ethereum has a virtual machine, which means most Ethereum Rollups use the Ethereum blockchain as a data availability layer and consensus layer. Bitcoin, lacking a virtual machine, raises the question of how Bitcoin L1 can verify the validity of Rollup proofs. This presents additional challenges for Bitcoin scaling projects that choose the Rollup technology solution.

Currently, there are three different types of Rollups in the Bitcoin ecosystem, but none of the three models are perfect:

OP Rollups are based on a trust principle, where transactions are assumed to be valid by default, but there is a challenge period. This model is simpler and easier to integrate, allowing for larger-scale scalability, but the existence of a dispute window can lead to delays in the final confirmation of transactions.

Sovereign Rollups take a more independent approach, placing data availability on the main chain while validating and executing transactions through their own consensus mechanism. This model allows Rollups to share Bitcoin's security foundation while not being constrained by Bitcoin's scripting limitations, but it places high demands on the consensus mechanism of the Rollups themselves.

Validity Rollups (including ZK Rollups) use cryptographic proofs to verify the correctness of off-chain transaction batches without revealing underlying data. This method balances efficiency and security; however, the complexity and computational demands of generating ZK proofs have always been a challenge.

Image source: Internet

2.4 UTXO + Client Validation

If Rollups are seen as "imported goods" from Ethereum, then UTXO + client validation is more like a customized solution designed based on Bitcoin's own characteristics.

To intuitively introduce UTXO + client validation, it requires more elaboration, partly due to its inherent technical complexity and partly due to the multiple optimizations and evolutions this solution has undergone in recent years.

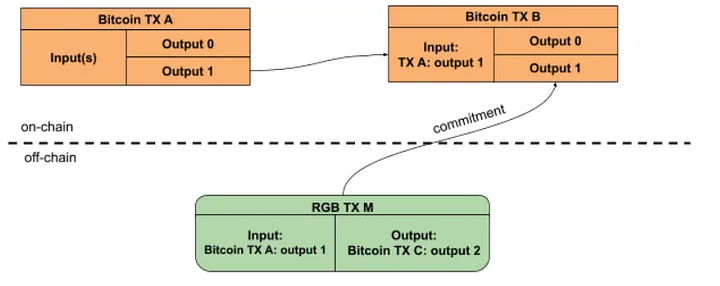

We know that Bitcoin does not have the concept of accounts but uses the UTXO (Unspent Transaction Output) model, which is the core concept of Bitcoin transactions and the design foundation of the UTXO + client validation technology path. Specifically, this solution attempts to perform off-chain ledger calculations based on Bitcoin UTXOs and ensures the authenticity of the ledger through client validation.

This concept originated from Peter Todd's ideas of single-use seals and client-side validation proposed in 2016, ultimately leading to the birth of the RGB protocol.

As the name suggests, a single-use seal acts like an electronic seal, ensuring that a message can only be used once, while client validation aims to move the verification of token transfers from Bitcoin's consensus layer to off-chain, where specific transaction-related clients perform the validation.

The core idea of RGB is that users need to run the client themselves and personally verify asset changes related to them. In simple terms, the asset recipient must first confirm that the asset sender's transfer declaration is correct before this transfer declaration can take effect. This series of processes occurs off the Bitcoin chain, placing complex smart contract calculations off-chain to achieve efficiency and privacy protection.

So how does it inherit Bitcoin's strong security? RGB uses Bitcoin UTXOs as seals, linking RGB state changes to the ownership of Bitcoin UTXOs. As long as the Bitcoin UTXOs are not double-spent, the bound RGB assets will not experience double payments, achieving inheritance of Bitcoin's strong security.

Indeed, the birth of RGB is significant for the Bitcoin ecosystem, but things are always rough in the initial stages of development, and RGB still has many flaws:

For example, ordinary users using simple client products do not have the ability or resources to save all historical transactions, making it difficult to provide transaction proof to counterparties. Additionally, different clients (users) only store data relevant to themselves and cannot see others' asset statuses, which can easily lead to client data island issues. This lack of global visibility and data transparency severely hinders the development of applications like DeFi.

Moreover, RGB transactions, as Bitcoin's extended transactions, rely on a P2P network for propagation. Users need to perform interactive operations when conducting transfer transactions, all of which depend on a P2P network independent of the Bitcoin network.

More importantly, the virtual machine of the RGB protocol primarily uses AluVM, lacking comprehensive development tools and practical code, and there is currently no complete interaction solution for ownerless contracts (public contracts) within the RGB protocol. This makes multi-party interactions difficult to achieve.

It is precisely because of these issues that the established public chain project Nervos Network, known for its technical prowess, began exploring more optimized solutions, leading to the emergence of RGB++.

Although RGB and RGB++ are closely related in name and both stem from important concepts like single-use seals and client validation, RGB++ is not an extension of RGB. In fact, RGB++ does not use any RGB code; more rigorously, RGB++ is a complete reconstruction based on the RGB concept to achieve a series of optimizations.

The core idea of RGB++ is to delegate the data verification work originally performed by users, giving it global verifiability. Of course, users can also run clients themselves to verify the data and related transactions of RGB++.

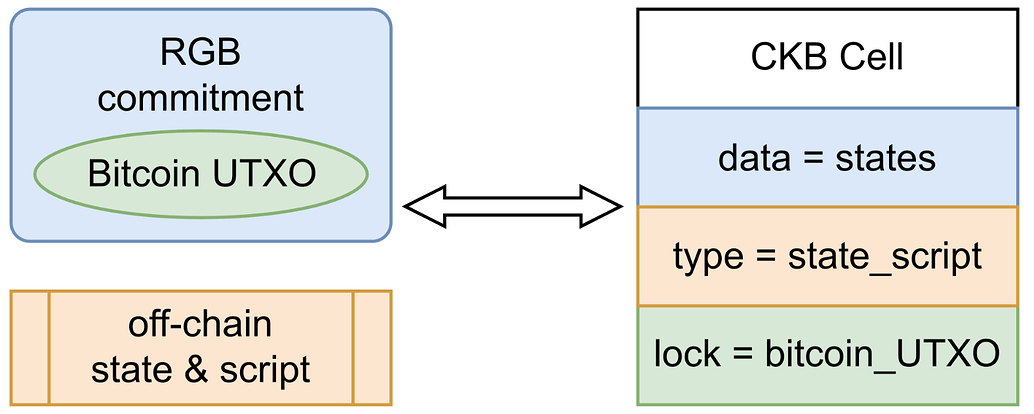

Who is it delegated to? Public chains and platforms that support UTXO and extend UTXO to give it programmability, such as CKB and Cardano.

How is it delegated? This involves the important concept of "isomorphic binding": Bitcoin is the main chain, while CKB and Cardano act as shadow chains of the Bitcoin main chain, using the extended UTXOs on CKB and Cardano as containers for RGB asset data, writing the parameters of RGB assets into these containers, achieving binding between the main chain and shadow chains, and directly displaying the data on the blockchain.

For example, due to the properties of Cell extended UTXOs, Cells can establish a mapping relationship with Bitcoin UTXOs, allowing CKB to serve as a public database for RGB assets and an off-chain pre-settlement layer, replacing the RGB client to achieve more reliable data hosting and RGB contract interaction.

In this way, on one hand, RGB++ inherits the strong security foundation of Bitcoin, and on the other hand, the non-interactive RGB transactions brought by RGB++, the promise of aggregating multiple transactions, and the ability for BTC assets to interact directly with CKB chain assets without cross-chain operations will further unlock more use cases like DeFi.

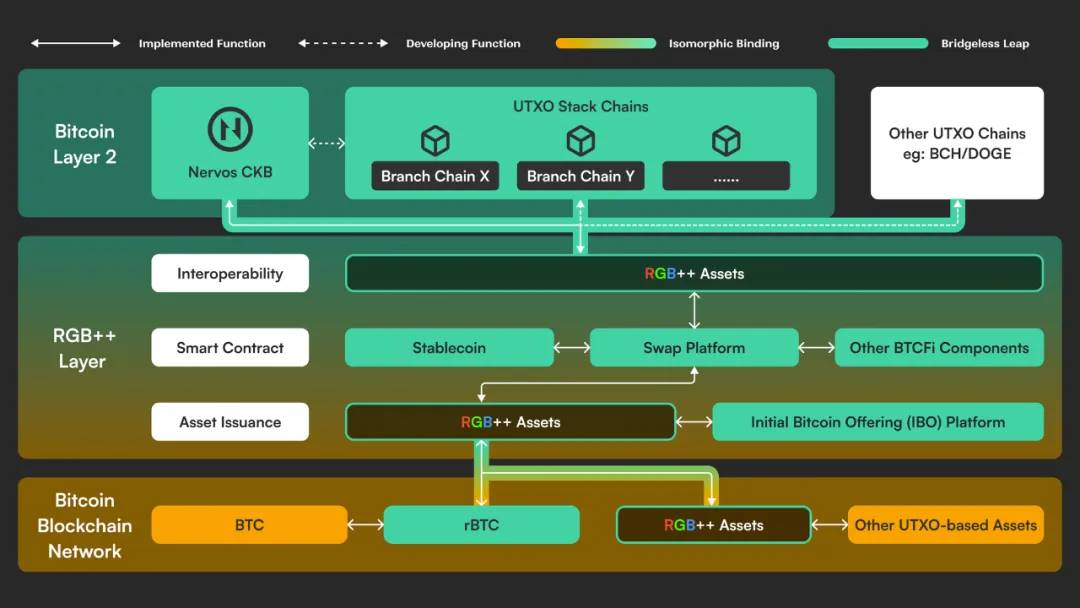

With outstanding advantages in security, efficiency, and programmability, RGB++ has received high praise in the industry since its inception, becoming one of the mainstream Bitcoin scaling protocols despite its high cognitive threshold. As RGB++ completes its upgrade to RGB++ Layer in July 2024, Bitcoin scaling will once again usher in a moment of innovation.

From the name of this upgrade, we can capture a lot of information: from protocol to Layer, RGB++ will undoubtedly develop towards a broader service scope, deeper aggregation, and more seamless interaction.

It’s like each country (blockchain) initially having its own operational rules, while RGB++ Layer aims to find a common point (UTXO) and leverage this common point to connect important elements of ecological development, achieving a higher degree of "common language and shared tracks," building a stronger infrastructure layer for the development of the Bitcoin ecosystem.

First, as an infrastructure, RGB++ Layer must be easy to understand and widely accepted: RGB++ Layer has a complete native AA solution that can well accommodate the account standards of other public chains. This feature not only facilitates support for some key scenarios but also clears obstacles for UX.

RGB++ Layer is also committed to achieving unified asset issuance: RGB++ Layer supports the issuance of various RGB++ assets, including user-defined tokens (UDT) similar to ERC20 and digital objects (DOB) similar to ERC721. Thanks to the advantages of the UTXO model, RGB++ Layer can create a new paradigm for asset issuance, supporting the simultaneous issuance of the same asset on multiple chains, with different proportions issued on each chain. This not only achieves coordination and unification between different chains but also provides high flexibility for asset issuers.

Since asset issuance can be unified, asset interaction will also be more seamless: Through RGB++ Layer's bridge-less cross-chain (Leap), assets on UTXO chains can cross to another UTXO chain without a cross-chain bridge, bringing stronger security and achieving higher interoperability. Various assets based on UTXO chains like Cardano, Dogecoin, BSV, and BCH can be seamlessly integrated into the Bitcoin ecosystem.

After bridging the two major gateways of asset issuance and asset interaction, RGB++ Layer aims to bring a unified smart contract framework and execution environment to the Bitcoin ecosystem through CKB-VM, endowing Bitcoin with stronger programmability: Any programming language that can support the RISC-V virtual machine can be used for contract development on RGB++ Layer, enabling the construction of complex logical applications and making the explosion of BTCFi and the realization of more innovative scenarios possible.

Up to this point, this article has introduced the basic operational logic, representative projects, and pros and cons of four mainstream Bitcoin scaling protocols. Readers can review the content through the chart below and gain a more intuitive and clear understanding of the advantages and disadvantages of various Bitcoin scaling protocols.

Of course, the above content is derived from the analysis and summary of the past performance of various solutions. In the current cycle, as the Bitcoin ecosystem is poised for growth, the representative projects within the various technical implementation paths are not idle; rather, they are continuously seeking innovation and breakthroughs to secure a better ecological position.

Therefore, after comparing the past, we should focus on the future by exploring the "seeking change" principles of leading projects in various solutions, gaining insight into the future competitive landscape of Bitcoin scaling solutions.

3. The Ecological Status and Future Potential of Major Protocols

3.1 Lightning Network: A Symbol of "Orthodoxy," Moving Towards a Multi-Asset Network

The orthodoxy of the Lightning Network can be traced back to 2009, when Bitcoin's creator, Satoshi Nakamoto, included a draft of payment channel code in Bitcoin 1.0, which was the prototype of the Lightning Network.

After more than a decade of development, the Lightning Network has become very mature. According to 1ML statistics, the Lightning Network currently has 12,700 nodes; 48,300 payment channels; and approximately 5,212 Bitcoins in channel funds, establishing partnerships with multiple social and payment projects.

Comparing this to the data from May of this year, which showed 13,600 nodes, 51,700 channels, and 4,856 Bitcoins in funds, it can be observed that the growth rate of funds in the Lightning Network has slowed, and the number of channels has even declined. Additionally, community sentiment has reflected some negative comments in recent years.

On one hand, during the early development phase of the Lightning Network, many developers recognized the numerous limitations and challenges of this technology in terms of scalability, and the complexity of the Lightning Network protocol has made the development process slow, both difficult and time-consuming.

On the other hand, after several years of development, most people's understanding of it has been limited to payment aspects. Anton Kumaigorodski, a core developer of the Lightning Network, once candidly stated on social media that people should look for other directions beyond payments. This has further pushed the Lightning Network to a crossroads of transformation.

What is even more lamentable is that team disagreements have seemingly accompanied the development of the Lightning Network. Over the past year, several developers have left, further complicating an already challenging development process.

Of course, in the face of adversity, the Lightning Network has not remained idle. In addition to continuing to leverage its advantages and deepening its focus on micropayments, the Lightning Network has gradually realized that the narrative of the Bitcoin currency network is more attractive compared to Bitcoin assets, and it has begun to move towards building a multi-asset network.

On July 23, 2024, Lightning Labs released the first mainnet version of the multi-asset Lightning Network, officially introducing Taproot Assets into the Lightning Network.

Before the emergence of the Taproot Assets protocol, the Lightning Network only supported Bitcoin as a payment currency, making its application scenarios very limited.

With the launch of the multi-asset Lightning Network mainnet version, anyone or any institution can use the Taproot Assets protocol to issue their own tokens, which also supports the issuance of fiat-backed stablecoins. The assets of the Taproot Assets protocol are fully compatible with the Lightning Network, making applications such as global instant settlement of foreign exchange transactions and purchasing goods with stablecoins a reality, further promoting the Lightning Network to become the infrastructure for a global payment network.

3.2 Stacks: An Established Sidechain Project, Nakamoto Upgrade Completed

In the Bitcoin ecosystem, Stacks is a unique presence. It is not only an OG project launched in 2017 but also became the first token sale approved by the U.S. Securities and Exchange Commission (SEC) under Regulation A+ in 2019.

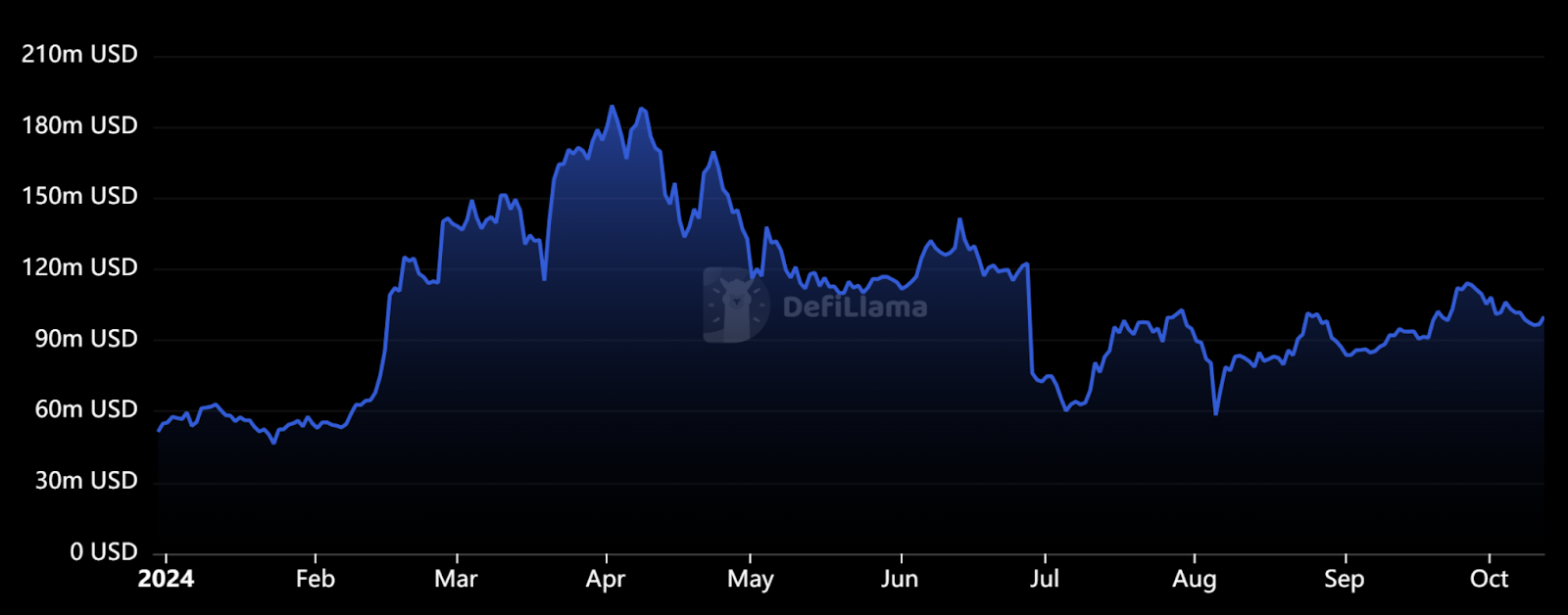

According to DeFi Llama data, with the rise of inscriptions, Stacks' TVL has continued to grow since the beginning of 2024, peaking at $183 million in early April. However, with the decline in the popularity of inscriptions, Stacks' TVL has fallen back to around $100 million. It is worth mentioning that after years of development, the DeFi activity on the Stacks chain is remarkable, with projects like StackingDao, which ranks first in TVL, having over 30,000 real staking users, and the cumulative number of independent wallets on Stacks exceeding 1.21 million.

However, as a sidechain project, Stacks also faces many challenges:

On one hand, the security of the chain heavily relies on the budget of Stacks miners. The connection structure between the Stacks chain and the Bitcoin network (such as the transfer proof mechanism) helps improve decentralization and security but limits on-chain performance and scalability.

On the other hand, while sidechains offer greater flexibility, they essentially build a new chain outside of the Bitcoin chain, with an independent governance structure and transaction model. Therefore, some people believe that Stacks lacks orthodoxy and does not have strong recognition within the Bitcoin community.

Recently, a milestone moment in the Stacks ecosystem is the Stacks Nakamoto upgrade: This upgrade not only brings stronger security to Stacks but also significantly improves block confirmation times, achieving transaction speeds of around 5-10 seconds, which is approximately 100 times faster than the current transaction speed.

At the same time, the core team of Stacks is also developing sBTC, a trustless solution that bridges BTC from the Bitcoin main layer to another chain. sBTC establishes a bridge for BTC assets between the Bitcoin network and the Stacks chain, and its permissionless, open-participation characteristics will further unleash DeFi innovation for Stacks, bringing a $10 billion TVL opportunity.

3.3 BitVM: Bringing Expression Logic Directly into Bitcoin

As mentioned earlier, Bitcoin lacks a virtual machine, making it difficult to verify the validity of Rollup proofs. The birth of BitVM aims to introduce expression logic directly into Bitcoin without requiring any changes to Bitcoin itself, helping to achieve off-chain computation and verify any computation on the Bitcoin blockchain. This development not only emphasizes security and efficiency but also opens the door to Bitcoin programmability (such as Turing-complete smart contracts).

Although BitVM is in its early stages, it has attracted attention from projects and the community. Currently, several projects, including Bitlayer, Citrea, Yona, and Bob, are adopting BitVM.

At present, BitVM is still working on perfecting its mechanism, with the upcoming major upgrade BitVM2 and BitVM Bridge being notable examples:

BitVM2 aims to achieve off-chain execution of complex computations and on-chain fraud proofs. This design cleverly implements Turing-complete computation verification within Bitcoin's limited scripting capabilities.

BitVM Bridge adopts a new 1-of-n security model, where as long as there is one honest participant, theft can be prevented. It is seen as a catalyst for significantly enhancing the cross-chain security and decentralization of Bitcoin and promoting the development of BTCFi.

It is worth noting that while BitVM2 greatly simplifies the verification process, the on-chain verification gas costs remain high. Additionally, BitVM is essentially an unimplemented concept of a virtual computer, and its operational logic does not fundamentally break through the limitations of ZK Rollups and Optimistic Rollups. Therefore, many members remain cautious about BitVM.

3.4 RGB++ Layer: The Layer for Bitcoin Asset Issuance, Smart Contracts, and UTXO Interoperability

After completing the RGB++ Layer upgrade, RGB++ Layer has shifted its focus from brand narrative to more refined implementation paths, choosing BTCFi as the construction focus to carry out a series of technical iterations and ecological development. It subsequently announced a series of important updates and innovative products, aiming to integrate the Bitcoin asset issuance layer, smart contract layer, and interoperability layer into one, rapidly advancing towards a more secure, seamless, and efficient Bitcoin infrastructure layer.

In terms of asset issuance, RGB++ Layer is introducing a new asset issuance model called IBO (Initial Bitcoin Offering), characterized by supporting the creation of liquidity pools directly on UTXOSwap, allowing newly issued assets to be traded with high liquidity, balancing fairness and community engagement, and bringing a new paradigm for asset issuance to RGB++ assets and the Bitcoin ecosystem.

As a decentralized exchange built on RGB++ Layer, UTXOSwap adopts intent-based trading as its core, implementing off-chain matching and on-chain verification processes, utilizing the parallelism of UTXO to improve trading efficiency, aiming to become the central hub of RGB++ Layer, aggregating liquidity from various UTXO chains and laying a solid foundation for DeFi development.

Stablecoins, as one of the three driving forces of DeFi development, have also been strategically positioned by RGB++ Layer: Stable++, as a decentralized over-collateralized stablecoin protocol, can efficiently build over-collateralized vaults and liquidation modules using the powerful Turing-complete programmability of RGB++ Layer, supporting users to use BTC and CKB as collateral to mint the stablecoin RUSD, which is pegged to the U.S. dollar. Thanks to the strong interoperability of RGB++ Layer, RUSD is compatible with all UTXO chains and circulates freely within the Bitcoin ecosystem, becoming an important component of BTCFi liquidity.

Beyond being an innovator, RGB++ Layer is more committed to becoming an enabler of the Bitcoin ecosystem, further integrating liquidity and application scenarios through strong partnerships to promote the further explosion of the Bitcoin ecosystem. UTXO Stack and Fiber Network are prime examples of this.

In September, UTXO Stack announced its transformation into a staking layer for the Lightning Network and launched a corresponding token incentive mechanism to encourage users to stake CKB and BTC to enhance the liquidity of state channels. This series of measures aims to provide better liquidity and a better yield model for the Lightning Network, paving the way for its large-scale adoption.

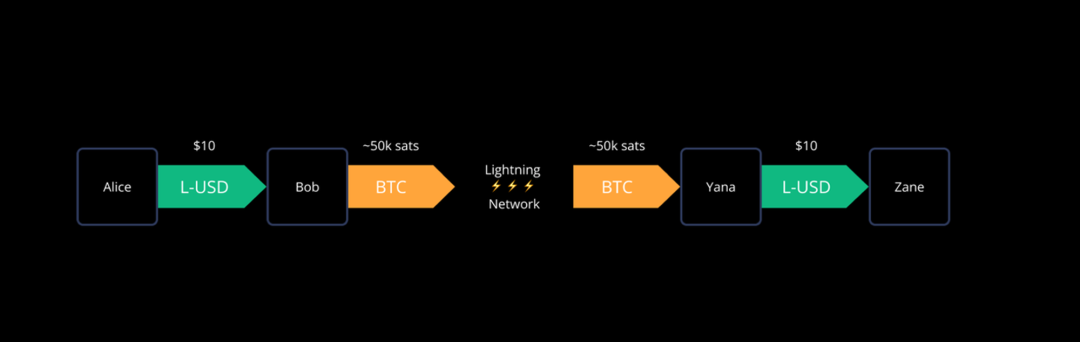

Fiber Network, on the other hand, is an L2 network based on CKB, with initial functions similar to the Lightning Network. It aims to become a high-performance, low-cost payment network for microtransactions. However, compared to the Lightning Network, Fiber Network benefits from the Turing completeness of CKB, offering greater flexibility in liquidity management, higher efficiency, lower costs, and a better user experience. More importantly, while the Lightning Network focuses on a single currency (BTC), Fiber Network's other significant new feature is its support for multiple assets, including BTC, CKB, and Bitcoin-native stablecoins like RUSD, as well as other RGB++ assets. This will pave the way for complex cross-chain financial applications.

However, the birth of Fiber Network is not intended to replace the Lightning Network. The ultimate goal of Fiber Network is to become a scalable solution for programmability in the Bitcoin ecosystem. In this process, Fiber Network will closely collaborate with the Lightning Network. The technical stack of Fiber Network mainly includes CKB's Cell, RGB++ Layer, Bitcoin script's HTLC, and the Lightning Network's state channels. The first test version released by Fiber Network has already validated the feasibility of transferring assets from the BTC Lightning Network to CKB in a decentralized manner, allowing more BTC assets to circulate on CKB.

Due to the technical isomorphism between Fiber Network and the Lightning Network, there is a natural foundation for achieving cross-chain atomic swaps between the two. This combination of "Bitcoin-level security + Ethereum-level functionality + Lightning Network-level speed" will not only shine in the payment field but also promote the realization of native stablecoins, native lending, and native DEXs in the Bitcoin ecosystem, further driving the explosion of BTCFi.

Conclusion

Through this article, we have explored the diverse landscape of Bitcoin scaling solutions:

State channels theoretically can achieve infinite TPS;

Sidechains have outstanding flexibility advantages;

The success of Rollups in the Ethereum ecosystem has led to increased expectations for their development in the Bitcoin ecosystem;

Meanwhile, UTXO + client validation has undergone multiple iterations, and RGB++ Layer appears to be a culmination of various attributes, inheriting the security of the Bitcoin mainnet while possessing multiple advantages in user experience, programmability, and interoperability. From a technical theory perspective, it is a relatively mature and complete Bitcoin scaling solution.

However, it is worth noting that while RGB++ Layer has been iterating and optimizing with a clear development path, its specific performance still needs further validation in the practice of ecological construction. As multiple project roadmaps and products are launched within the ecosystem, will RGB++ Layer become a significant driving force in unleashing the potential of BTCFi?

The competition for Bitcoin scaling solutions is still undefined, with various solutions showcasing their strengths. Ultimately, who will emerge victorious remains to be seen by the community.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。