In the past 24 hours, BTC has surged over 6.6%, reaching a high of $66,500, marking a new high since August. The rise in BTC has led to a recovery in the entire cryptocurrency market, with market sentiment shifting from neutral to greedy, and ETH and other altcoins experiencing significant gains to varying degrees.

This round of BTC's increase is mainly influenced by factors such as a large influx of ETF funds, the upcoming U.S. elections, and reduced market selling pressure. Yesterday, the net inflow amount for the U.S. spot Bitcoin ETF reached as high as $556 million, with all other ETFs, except for BTCW, seeing inflows.

U.S. presidential candidate Kamala Harris announced her support for a "regulatory framework for cryptocurrencies and other digital assets" during her campaign speech. Although she did not disclose more details, this has somewhat stimulated the rise in the cryptocurrency market.

Currently, there are less than three weeks until the U.S. elections, and Harris's change in attitude suggests that regardless of which candidate takes office, there will not be a severe negative impact on the cryptocurrency market.

Chu Yuechen: Bitcoin and ETH Market Analysis and Trading Reference for 10.15

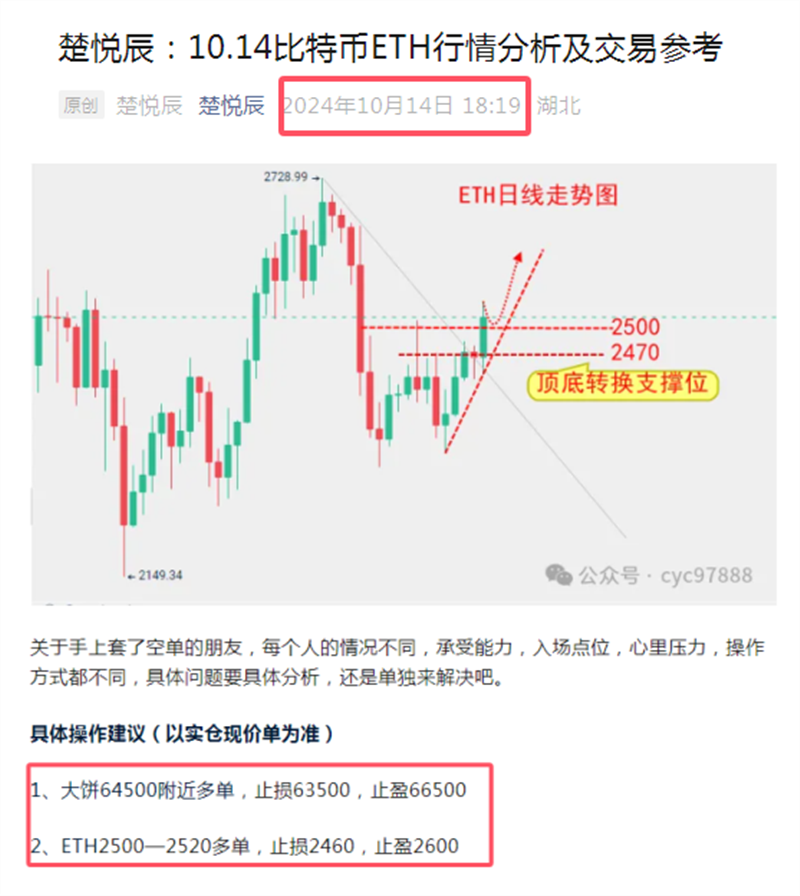

In the previous text, we explained the reasons for the recent rise in Bitcoin. We also provided a bullish strategy yesterday, where those who went long near $64,500 achieved the target of the previous high at $66,500.

Today, we will discuss the significant pressure at the $66,500 level. This indicates that there are clearly profit-taking behaviors from low-position long positions, which is why there is pressure and a pullback at this point. As retail investors, we should not chase after the price at this level. Once the main players take profits, the price will significantly pull back, and we will be left standing at a high position.

Regarding operations, the strategy is quite simple. No single trade can be 100% accurate, so it is advisable to attempt shorting at the pressure level. This morning, I informed clients to try shorting near $66,000, and we are currently holding a small profit of a few hundred points. Of course, we must set a stop-loss, which we can place at $66,800 to prevent being stopped out by a spike at the high, so we should add an extra 300 points above.

If the price strongly breaks through the $66,500 high point, we will exit the short position, and if there is a slight pullback, we can enter a long position again, targeting $70,000 and $72,000.

ETH is similar; yesterday we provided a long position between $2,500 and $2,520, and the target of $2,600 has been achieved. The current price is around $2,620. When I was shorting Bitcoin this morning, I also indicated a short position for ETH, which is currently also showing a small profit. The same logic applies to ETH; we should set the stop-loss at $2,670, while still looking at the support levels of $2,520 to $2,500.

For friends who are stuck in short positions, everyone's situation is different, including their risk tolerance, entry points, psychological pressure, and trading methods. Specific issues need to be analyzed individually, so let's address them separately.

Specific Operation Suggestions (based on actual market prices)

Short position near $66,000 for Bitcoin, stop-loss at $66,800, take profit at $64,500.

Short position near $2,630 for ETH, stop-loss at $2,670, take profit at $2,520.

Before the market moves, any analysis can be correct and has its reasons, but no single trade will be absolutely accurate, and there are risks involved. Therefore, the premise for making money is to manage risk well. The market changes in real-time, and the strategy points are for reference only and should not be used as the basis for entry. Investment carries risks, and profits and losses are borne by the investor.

Many individual investors find it difficult to enter the trading door, often simply due to the lack of a guide. The problems you ponder over may be easily resolved with a single suggestion from an experienced person. Daily real-time market analysis, along with guidance from experience-sharing groups, and evening practical trading guidance groups are available for real-time support. Evening live broadcasts will explain real-time market conditions.

For more real-time market analysis, please follow the public account: Chu Yuechen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。