What has Slerf experienced from a phenomenon-level MEME to community skepticism?

Author: Web3Mario

Abstract: Hello everyone, it's been a while. After taking some time off, both my body and mind have relaxed, and I'm back to learning and sharing. Recently, the market focus has mainly been on the Chinese stock market, and the crypto world hasn't met the expectations set before the interest rate cuts, appearing somewhat quiet. However, one event has caught my attention: a classic MEME on Solana, the sloth-themed Slerf, is undergoing a CTO (Community Take Over) struggle initiated by a Chinese opinion leader in the Slerf community. As a result, Slerf's price has quickly doubled within five days. Since I previously lacked sufficient understanding and reflection on MEMEs, I see this event as a good learning opportunity. After researching for a while, I have some insights to share and discuss with you all.

What has Slerf experienced from a phenomenon-level MEME to community skepticism?

First, let's briefly review the Slerf project. This is a MEME Coin featuring a sloth as its main image, launched in March 2024 by grumpy@youlovegrumpy on Solana. At that time, the market was strongly influenced by the wealth effect of the phenomenon-level project BOME, which led to a surge of MEMEs centered around presales and fair launches. Slerf was one of them, promising to use 50% of the total token supply for presale, and after a successful presale, all sales proceeds along with another 50% would be injected into the DEX to provide liquidity for the corresponding trading pair, relinquishing all ownership of that liquidity. During its presale phase, it quickly raised about $10 million in SOL at a price of around $0.02. However, at the TGE, due to a developer's operational error, after providing liquidity and relinquishing ownership, and before completing the minting of the presale portion of Slerf, the minting rights of Slerf tokens were abandoned, resulting in all presale participants being unable to receive the corresponding Slerf, and since the presale proceeds were locked in the liquidity pool, refunds were also impossible.

This incident quickly garnered a lot of attention for Slerf. On one hand, the project essentially created a MEME Coin with a bottom value of $0.02 and no circulation, meaning that as long as you entered early enough, your holding cost would be the lowest, determined by the DEX's Bonding Curve. This led to a massive FOMO among users, and Slerf's price surged from the initial $0.02 to as high as $1.2, an increase of nearly 60 times. On the other hand, the impact of this incident covered a sufficiently broad group of presale participants, greatly enhancing subsequent traffic capture potential, quickly attracting attention and support from various institutions and projects. Many institutions and influencers sought to attract traffic by helping to compensate presale participants, including exchanges and many star projects.

Subsequently, with the support of massive traffic, Slerf began activities to donate compensation to presale participants, which was also organized by the exchange LBank. Therefore, I believe the entire fundraising and repayment process should be fair. In addition, Slerf also raised repayment funds by issuing new NFTs, accumulating a total of 36,180 SOL through this past event.

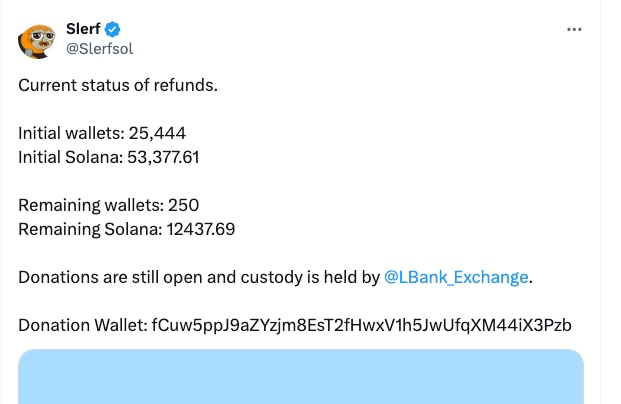

As of September 9, 2024, according to data publicly displayed by the official X account, a total of 25,444 addresses participated in the presale, accumulating 53,377 SOL, with 25,194 addresses repaid, totaling 40,940 SOL. There are still 250 addresses with a total debt of 12,437 SOL that need to be raised, averaging about 60 SOL per address. This means that the entire repayment plan should prioritize small participants. However, this also poses a problem: as most small participants are compensated, the legal risks faced by the founding team will be released as the scope of impact narrows, which means their willingness and effort to repay will significantly decrease. Claims from large participants will become increasingly difficult. Moreover, as attention continues to wane, Slerf holders will have to face losses from a lack of new buying funds leading to a drop in coin price.

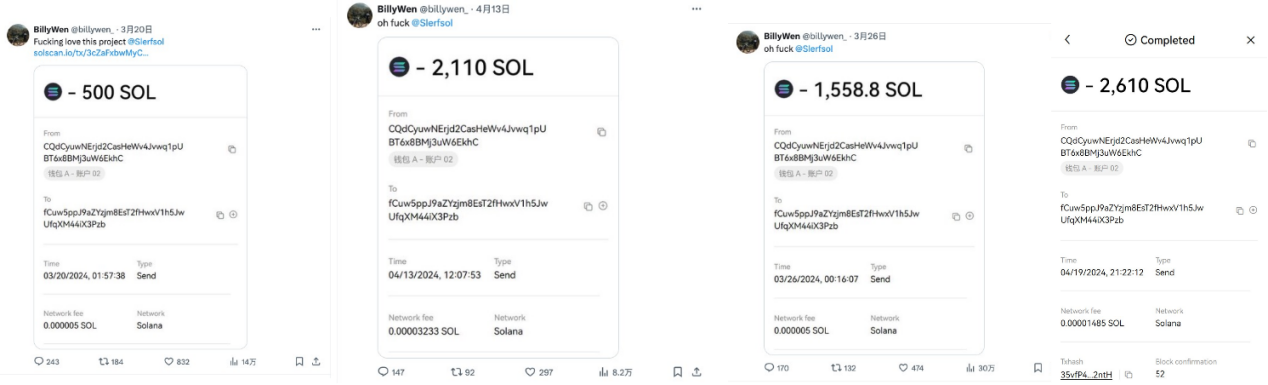

Recently, the CTO initiated by the Chinese opinion leader in the Slerf community, BillyWen@billywen_, is a response to this reality. Billy is affectionately referred to as "Scenery Brother" by his fans, though I'm not entirely clear on the backstory. However, the factors contributing to his significant influence in the Slerf community include: first, he is a whale holding 5 million Slerf (which may also be held by a token fund behind him) and claims not to have sold during the price decline; second, he has donated a total of 6,778 SOL during the Slerf donation activities, valued at about $1 million. This data is indeed verified by on-chain data. Therefore, it can be said that BillyWen is a key opinion leader with high recognition and participation in the Slerf community.

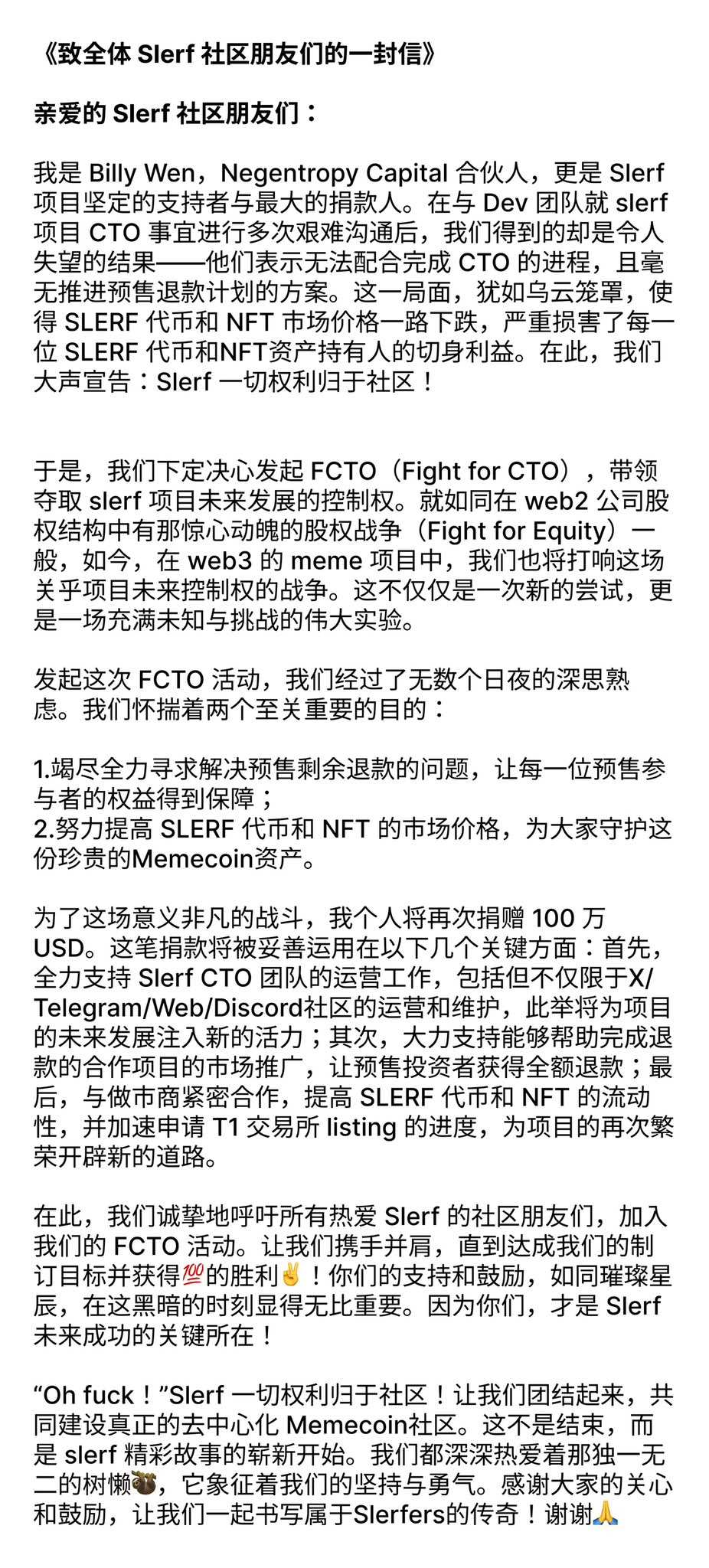

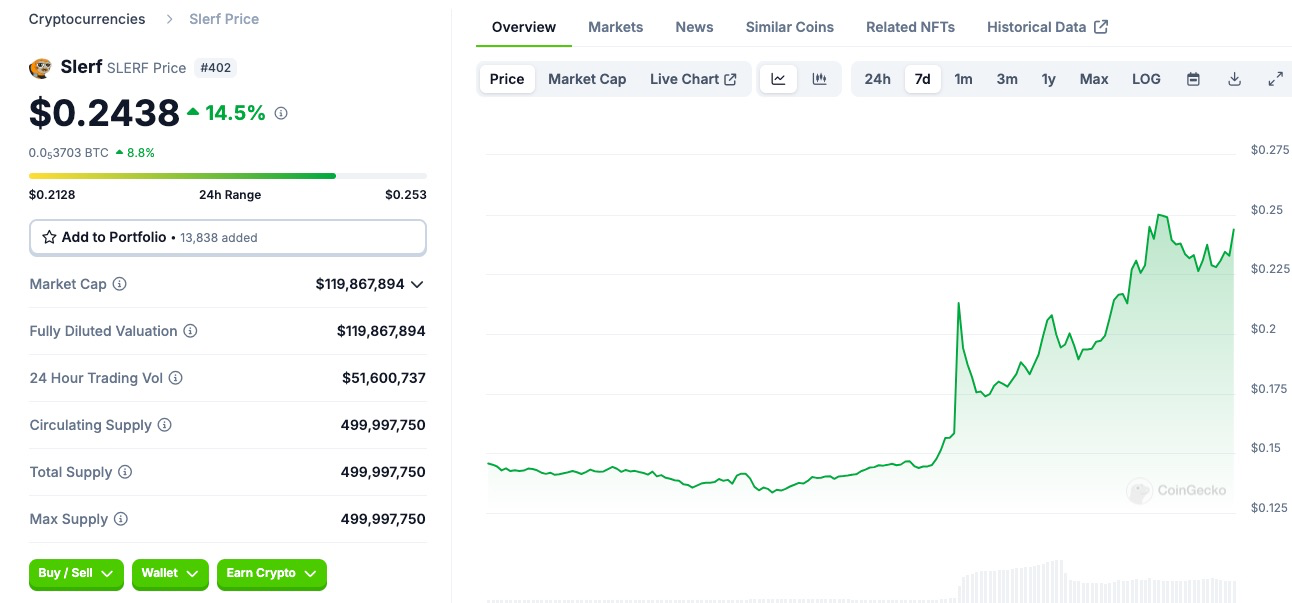

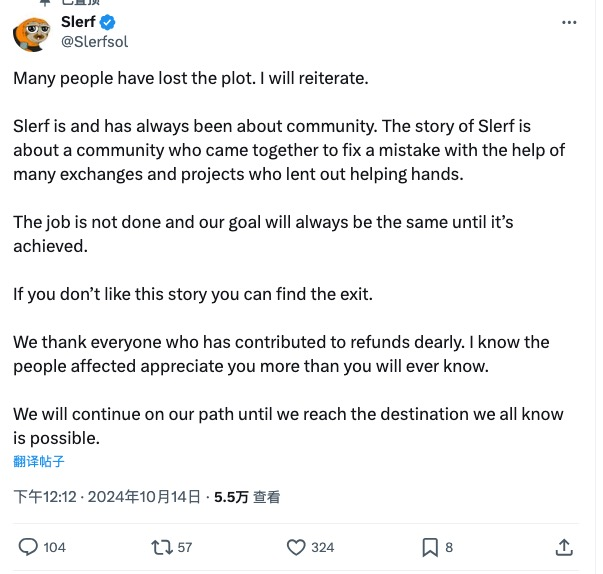

The so-called CTO, short for Community Take Over, is a mechanism primarily aimed at addressing the significant reduction in the cost of issuing MEMEs with the proliferation of some MEME Launchpads, which has led to numerous rug pulls, where the founding team quickly sells off tokens and ceases operations after completing the presale, or even directly rugs. However, there are still some projects that the community holds hope and recognition for, prompting initiators to seek to take over the project and restart it. This process is the CTO. Unlike DeFi projects, most MEMEs do not require on-chain management, so the most critical part of the entire CTO process is taking over the most valuable social media accounts. For Slerf, its official X account has 166,000 followers. In content posted by Billy on October 12, he described that after communication with the Slerf official team regarding the CTO being rejected, he would initiate an FCTO, or CTO struggle, and stated that he would donate another $1 million for the operation of the CTO team. Specific execution details have not been publicly disclosed yet, but this has resonated with the Slerf community and garnered support from related investors, causing Slerf's price to quickly rise from $0.14 to $0.24.

After a long period of silence, the Slerf official account seems to have posted a meaningful message in response to this event, indicating their efforts over the past period. However, the community seems to disapprove of three past actions: the founder Grumpy issued new MEMEs or crypto projects (specifically $CUFF, $MEMECHAN, and $OODLES, all of which have suffered significant price declines) and used Slerf's influence for promotion, ultimately profiting without using the profits for compensation and building Slerf, which the community views as a betrayal.

The above is a brief review of the Slerf incident. Regardless of how this event unfolds, I believe it is a noteworthy attempt that will have a significant impact on the operational paradigm of MEME projects. At the same time, I also tried to abstract some observations on the MEME track, hoping to discuss them with everyone.

Opportunities and Current Challenges in MEME Project Development

The entire observation revolves around two aspects. First, let's explore the deep reasons behind the smooth development of the MEME track today, which I believe mainly has three aspects:

Equal opportunities brought by fair launches, making risk and return comparisons for various secondary market investors more reasonable than VC coins: It has been criticized that many VCs can obtain cheaper chips in the primary market before tokens are listed and circulated, putting many secondary market participants at a disadvantage in terms of holding costs. While this model is relatively normal in the traditional financial world, in the crypto space, the lack of comprehensive regulatory policies for primary market transactions makes it easier for traders to gain advantages. All of this will, in turn, translate into risks for secondary market traders. The benefits of fair launches provide equal opportunities for secondary market investors, balancing risk and return. Whales may have high potential gains, but due to their large capital, the transaction wear and tear when building and liquidating positions, or slippage, can also be significant. In contrast, retail investors may have lower potential returns, but with lighter capital, they can be more flexible in buying and selling, and if they are sensitive to market opportunities, they can achieve quite objective returns by doing well in swing trading.

Low cold start costs for products: Due to the existence of numerous launch platforms, the development costs of products themselves are very low, allowing professional teams to have the capability for industrial-scale production with low risk. Moreover, project operation methods are similar to NFTs, which also helps attract teams and users migrating from the cooling NFT track.

Valuation models in the track have not formed a fixed pattern: Unlike many utility or security projects, MEME products, due to their cultural attributes, find it difficult to establish a definite paradigm for valuation, making them less susceptible to price-to-earnings ratio limitations. Price fluctuations are elastic, holding cost distribution is more uniform, and trading is more active.

Combining the Slerf CTO incident, I believe the current MEME track also faces the following challenges:

How to create sufficient and continuous incentives for MEME founders to ensure their commitment to long-termism: Most MEME projects are actually operated by the founding team. However, for fair launch projects, the long-term profit points for the founding team seem unclear. Aside from potential traffic and brand value, without prior team allocations, even if the token appreciates significantly, the founding team cannot benefit in the short term, as all presale funds are used to provide liquidity. If this requirement is appropriately relaxed, such as allocating a certain team proportion, it may significantly affect traders' participation enthusiasm, as the startup costs for MEMEs are indeed very low.

Is there a better governance paradigm for MEME projects to help them better cope with the increasingly diluted liquidity trend: The rapid emergence of numerous similar projects will dilute the liquidity of a particular popular MEME, meaning that MEME projects have higher maintenance costs compared to other tracks. Additionally, due to the low barriers to entry, the founding teams may not possess strong marketing or commercialization capabilities, which is insufficient to support the long-term development of the project. This places higher demands on the actual operators of the project. Currently, the MEME market has not seen a good governance paradigm to address this issue, and the CTO seems to have been proposed for this purpose. However, since the core asset of MEMEs is traffic value, and the on-chain portion is relatively small, traditional DAO governance tools also seem unable to solve the credible migration process of related resources.

Assuming that the control of MEME projects can be switched, who should ultimately take the lead is also an interesting question: should it be the founding team, whales, or DAO distributed governance? We have already discussed the founding team, but there may also be issues with whale leadership. Considering that for whales, the core benefits are still focused on speculative gains, this zero-sum game can create an adversarial relationship between operators and other users. At that time, with favorable news and chip advantages, operators will face significant temptations to sell for profit, which seems to pose risks for other participants. On the other hand, DAO distributed governance clearly faces issues of execution efficiency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。