Prediction markets may seem interesting and have a gambling nature, but they are actually humanity's "oracles."

Written by: Stacy Muur, Substack

Translated by: Shan Ouba, Golden Finance

Today's focus is on the report "Markets Will Save the World" released by Delphi. After reading this report, my view of prediction markets shifted from "Wow, this is just a new form of binary options" to "Wow, this is indeed a big deal." I can confidently say this is one of the best works from the Delphi team, and I can't wait to share the highlights with you.

To better understand this article, you need to examine prediction markets from a macro perspective, not as an end user, and not even as an investor.

What do AI and prediction markets have in common?

ChatGPT and prediction markets have similar functions: ChatGPT answers questions, while prediction markets predict events.

ChatGPT can access all online knowledge but cannot make unbiased judgments based on that knowledge. It understands the past and comprehends others' views on future outcomes, but remains passive.

Markets can be seen as a form of general intelligence. While there are some key differences, the similarities between markets and AI models like GPT-4 are quite significant. Both rely on vast amounts of human-generated data, compressing enormous knowledge and reflecting our world back to us in implicit ways.

However, we ask very few questions of the market and do not empower it to take action. Instead, we often view the market as an unpredictable slot machine and judge it based on the answers it provides.

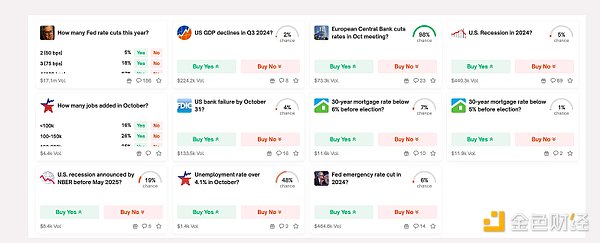

Prediction markets actually offer something different from today's AI tools. They are increasingly seen as reliable sources of information, serving as "truth machines."

Collective Intelligence

Unlike AI models like ChatGPT that rely on developer expertise, Polymarket relies on the collective opinions of users. The key difference lies in the source of trust: ChatGPT requires trust in its developers, while Polymarket is based on consensus among participants, becoming a tool for assessing collective knowledge.

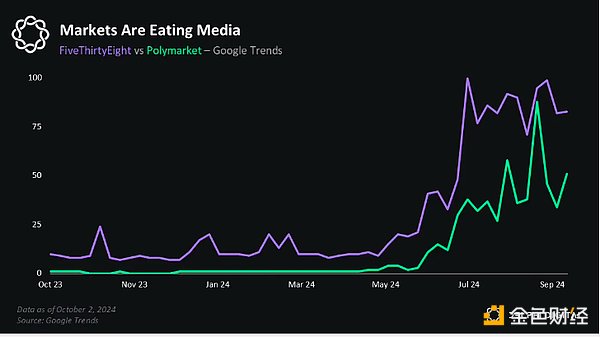

Interest in prediction markets is growing as they reveal truths through user predictions. This is becoming increasingly important, especially as trust in institutions like media and government declines, with prediction markets gradually filling this gap.

A notable example of prediction markets is the 2024 presidential election.

In September 2023, Polymarket predicted a 22% chance of Joe Biden dropping out of the race, far ahead of traditional polls and expert opinions. By the summer of 2024, despite Biden's team repeatedly assuring the public that he would not drop out, prediction markets continued to lower his chances of running. By July 2024, the prediction was validated—Biden officially announced his withdrawal from the race.

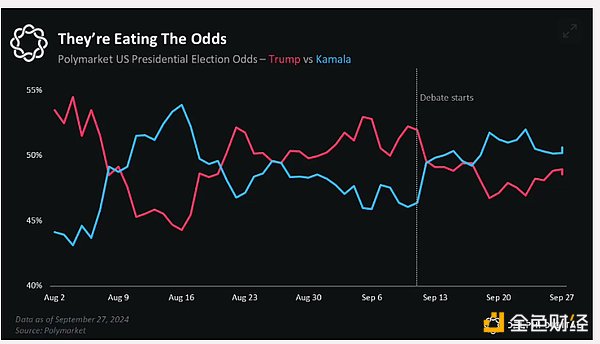

Another example is the shift in prediction markets during the debate between Trump and Kamala Harris. Within 20 minutes of the debate starting, market predictions began to turn against Trump, influencing public opinion and social media discussions. This demonstrates how prediction markets can correct biases and become objective sources of information.

Driving Factors and Challenges

In 2024, 78% of Polymarket's trading volume is related to elections. Trading volume is expected to decrease after November 5, but may surge before the election, reflecting trends from 2020.

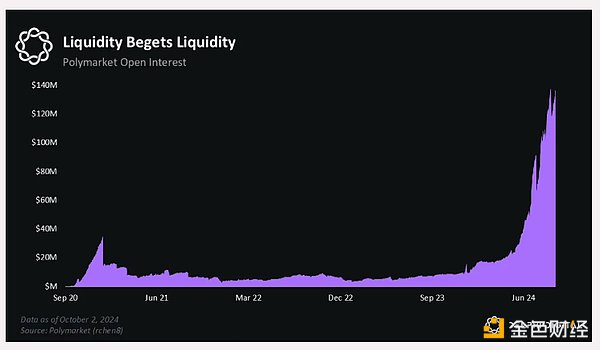

However, a significant challenge facing Polymarket and other prediction markets remains low liquidity.

Low liquidity leads to market inefficiencies, thereby reducing market reliability.

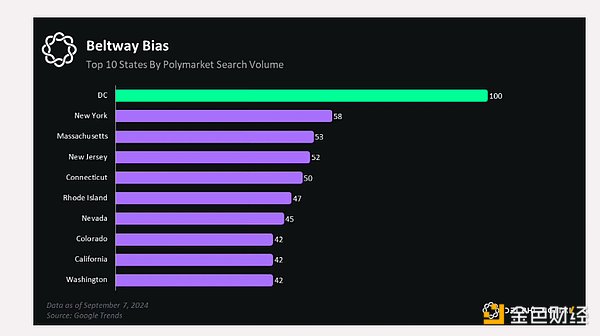

For example, betting large sums of money (like a $1 million bet on Kamala Harris winning) can cause prices to drop significantly. Insufficient liquidity makes it difficult for large traders to enter or exit positions, increasing the likelihood of distortions such as biases. For instance, many Polymarket users share similar political views, which can amplify related biases.

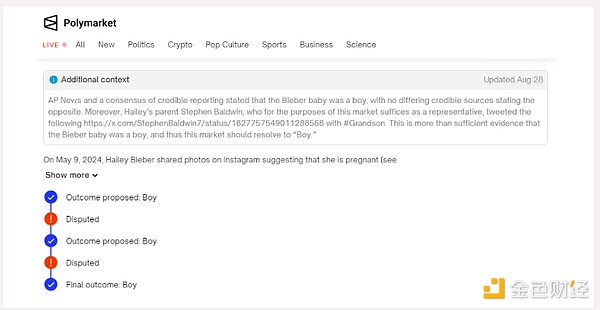

Another key issue is the operation of oracles like UMA, which can delay dispute resolution even when the facts are clear. A notable case involved a dispute over Justin Bieber's child, which became complicated due to the platform's technical rules.

Possible alternatives include turning to centralized dispute resolution systems or implementing AI oracles to enhance user experience.

The zero-sum nature of prediction markets makes them less attractive to traders, as one person's gain means another person's loss. This dynamic complicates profit potential.

User biases and liquidity issues are also prominent. Notably, 95% of Polymarket's trading volume comes from just 20 traders, making the market susceptible to manipulation.

For example, a group of large traders attempted to tilt the presidential election market in favor of Kamala Harris but lost $60,000 due to the rapid response of other participants.

Market Overview

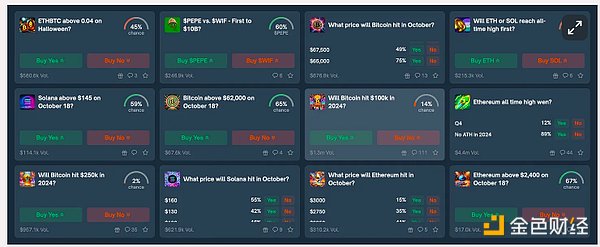

In the next 6-12 months, about 25 new platforms are expected to launch, intensifying competition.

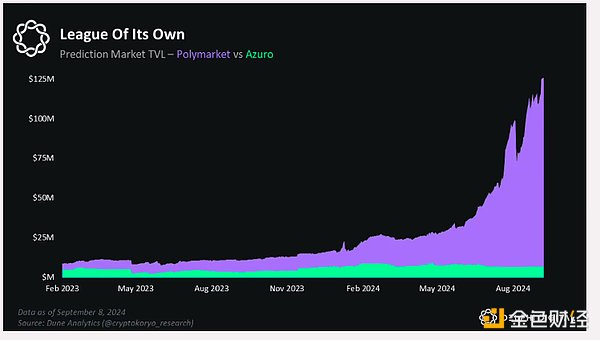

Polymarket remains the market leader, while Azuro is trying to catch up by providing liquidity to other platforms. Interestingly, despite Azuro having its own token, it still struggles to compete with Polymarket, which has no token.

Drift is a Solana-based platform set to launch in August 2024, gaining attention for its integration with perpetual DEX and lending platforms. It offers over 30 types of betting collateral, helping to reduce opportunity costs through built-in yields.

New platforms emphasize innovation, focusing on decentralization, enhancing user experience, and new betting categories like pop culture, gaming, and SocialFi. SocialFi has emerged on Polymarket through social betting discussions. Using AI for dispute resolution also shows promise for improving decision-making accuracy.

Azuro and Drift offer unique approaches centered on decentralization and improving user interaction, which could change the market landscape in the coming years.

Is the Future Futarchy?

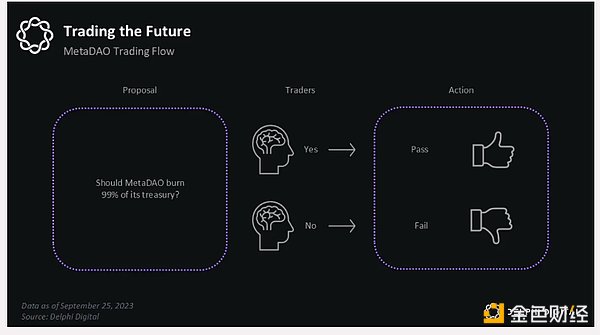

ChatGPT and prediction markets have similar functions: ChatGPT answers questions, while prediction markets predict events. However, both are passive tools that cannot directly bring about real change. To make an impact, active decision-making is required—AI needs AI agents, and prediction markets need Futarchy.

Futarchy is a concept proposed by economist Robin Hanson in 2000, which makes decisions through market mechanisms rather than voting. In 2023, developer Prophet implemented Futarchy in the MetaDAO on the Solana blockchain.

Unlike Polymarket, which allows users to bet on "what should happen," MetaDAO is developing decision markets where users bet on what they believe will happen.

Passive vs. Active Markets

In prediction markets, participants are passive. You sit on the couch, watch the game, and bet on who will win. You have a "stake" in the participation, but you cannot control the outcome of the game.

Decision markets, on the other hand, are active. Through speculation, you can actually influence the outcome. This dynamic allows participants to trade proposals and shape results, improving decision-making efficiency and promoting economic development.

Personal Insights

Markets are not just for speculation or chasing profits in zero-sum games. They also provide valuable data.

Curious about trending topics on the X platform (formerly Twitter) tomorrow? Check out the charts of those rising lists—this pattern has appeared multiple times in projects like memecoins, Solana, and Sui. Price movements often precede discussions, which in turn amplify price changes.

Sometimes, you just need to observe the charts and let them speak.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。