A comprehensive understanding of the impact of Telegram games, market growth, and sustainability challenges.

Written by: Stella L

Data Source: Footprint Analytics Games Research Page

In September, the market capitalization of blockchain game tokens grew by 29.2%, reaching $23.2 billion, while daily active users (DAU) increased by 12.3% to 4.7 million. A significant trend is the rapid rise of Telegram games, which has sparked intense competition between blockchain networks and centralized exchanges for user acquisition. However, this booming situation raises questions about the sustainability of on-chain participation.

At the same time, new regulatory challenges are gradually emerging, prompting some established projects to reconsider their blockchain integration strategies. As the industry continues to adapt to these changes, the focus remains on effectively leveraging blockchain technology to create sustainable and engaging gaming experiences.

Macroeconomic Market Review

The crypto market showed strong performance in September. Bitcoin opened at $57,429 and closed at $63,485 by the end of the month, achieving a 10.5% increase. While Ethereum also performed positively, it still lagged behind Bitcoin. Ether started at $2,426 and ended at $2,603, with a growth rate of 7.3%. Notably, in mid-September, the ETH/BTC price ratio hit a new cycle low of 0.0386.

Data Source: Bitcoin and Ethereum Price Trends

Several key factors contributed to this positive market sentiment:

- Monetary Policy Shift: On September 18, the U.S. Federal Open Market Committee (FOMC) unexpectedly implemented a larger-than-expected 50 basis point rate cut. Later in the month, Chinese policymakers enacted macroeconomic stimulus measures, providing support to global stock markets.

- Regulatory Progress: The U.S. regulatory environment showed signs of improvement. The U.S. Securities and Exchange Commission (SEC) approved the listing application for a spot Bitcoin ETP (exchange-traded product), with expectations for more similar applications to be approved.

- Institutional Adoption: The Bank of New York Mellon appears to be preparing to offer crypto asset custody services, a move that could further solidify the legitimacy of cryptocurrencies in the financial sector.

- Political Support: The political landscape also saw positive changes. Former U.S. President Trump announced a new decentralized finance (DeFi) protocol, and Vice President Harris made statements supporting digital assets and blockchain technology.

Overview of the Blockchain Gaming Market

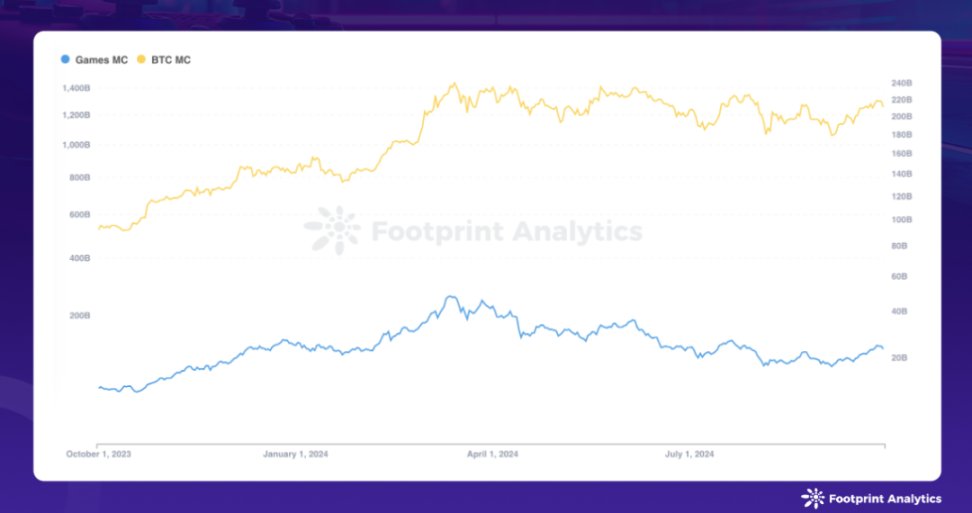

In September, the Web3 gaming sector experienced a rebound, aligning with the overall upward trend in the crypto market. The market capitalization of blockchain game tokens surged from $18 billion to $23.2 billion, marking a significant growth of 29.2%. This recovery follows a substantial decline in the previous month, demonstrating the close correlation between this sector and macro crypto market dynamics.

Data Source: Market Capitalization of Blockchain Game Tokens and Bitcoin Market Capitalization

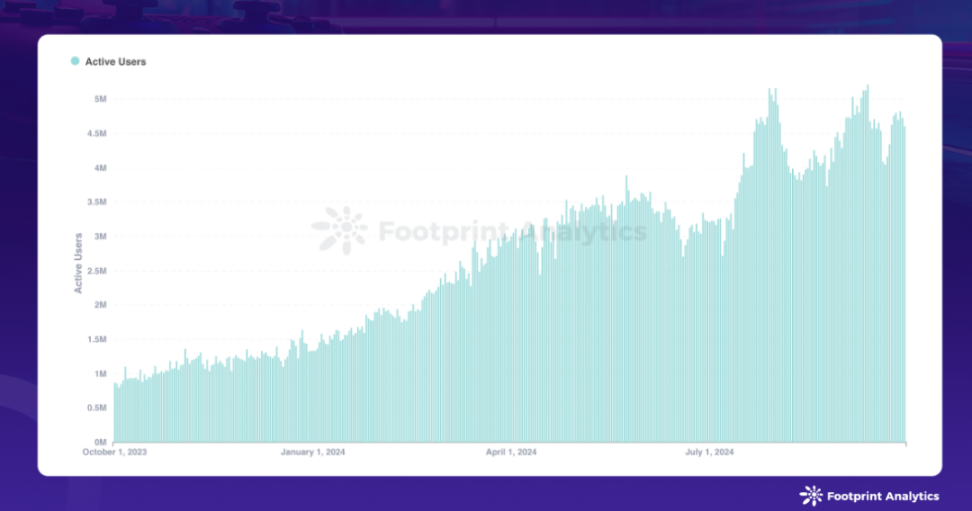

User engagement continued to rise, with daily active users (DAU) calculated by unique wallets reaching 4.7 million in September. This growth rate of 12.3% compared to August was primarily driven by increased activity on the opBNB network.

Data Source: Daily Active Users in Blockchain Games

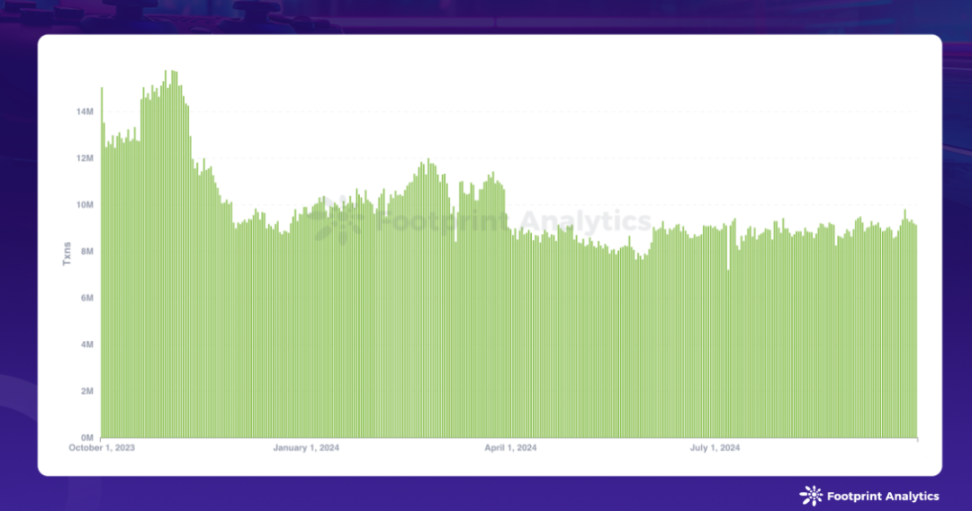

Transaction metrics also showed improvement, with the average daily transaction volume in blockchain games reaching 9.1 million, a slight increase of 2.5% from August.

Data Source: Daily Transaction Counts in Blockchain Games

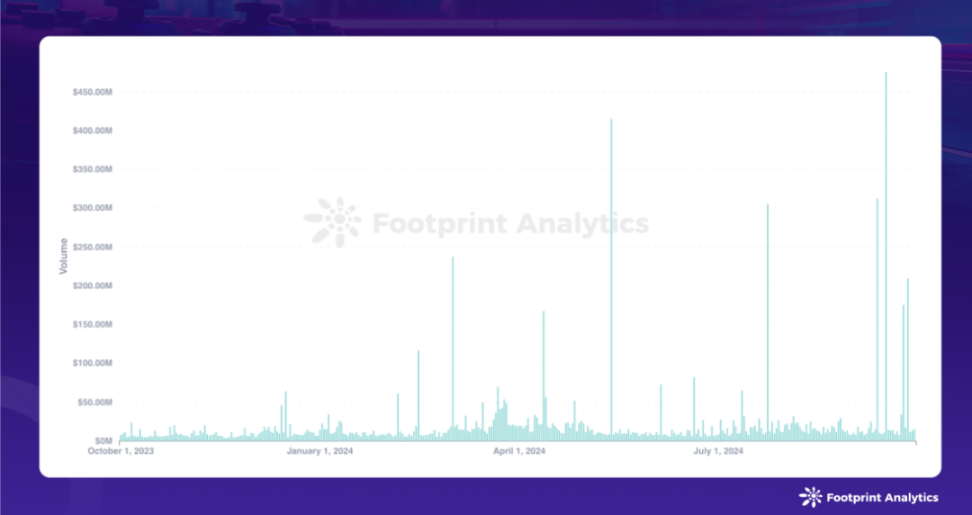

However, the daily transaction value in blockchain games declined by 22.9%, ultimately settling at $13.1 million. It is important to note that this data excludes several anomalous data points resulting from internal wallet transfers within the same game on September 13, 17, 25, and 27.

Data Source: Daily Transaction Amounts in Blockchain Games

In September, the focus significantly shifted towards games based on the Telegram platform. This change is primarily reflected in two aspects:

On one hand, there is the expansion of blockchain networks: in addition to TON, several blockchain networks are competing to attract users from the Telegram ecosystem, a trend that began to emerge last month. For example, the BNB chain has integrated with Telegram, providing users and developers with a seamless access experience.

On the other hand, there is competition among centralized exchanges (CEX): centralized exchanges are actively vying for Telegram's traffic, viewing it as an important user acquisition channel. Binance stands out in particular, quickly launching four tokens based on Telegram and TON. In September, Binance announced its 58th project Hamster Kombat (HMSTR) and its 59th project Catizen (CATI) on Launchpool, continuing the momentum from August's launches of Toncoin (TON) and Dogs (DOGS). Other exchanges, such as Bitget, are also making strategic investments, such as injecting $30 million into the TON blockchain.

Catizen

This trend is not limited to exchanges; various entities and projects are also launching their own Telegram-based initiatives. Binance is set to launch a Telegram mini-game app called Moonbix, while CryptoKitties has announced a Telegram game titled "CryptoKitties: All The Zen."

At the Token2049 conference in Singapore in 2024, Bybit CEO Ben Zhou shared some data: "Some tokens have brought us millions of new registered users, with 400,000 to 500,000 becoming deposit users. (These new users) mainly come from Eastern Europe, Africa, South Asia, Nigeria, India, and some European countries."

TON has established effective user acquisition channels and conversion funnels with exchanges, inspiring similar strategies within the industry. However, there are signs that this acquisition effect may be waning, as the same users may be circulating among various projects.

Despite these games performing well in user acquisition, their contribution to on-chain activity seems limited. Most games merely put tokens on-chain, while gameplay and assets remain off-chain. This structure raises questions about long-term sustainability and economic viability.

Data shows a disconnect between user acquisition and sustainable on-chain participation. Without ongoing on-chain user activity, these games and developments may struggle to maintain economic vitality in the long term. As the industry continues to evolve, bridging the gap between initial attraction and sustained on-chain participation is crucial for the healthy development of the Web3 gaming ecosystem.

Blockchain Game Public Chains

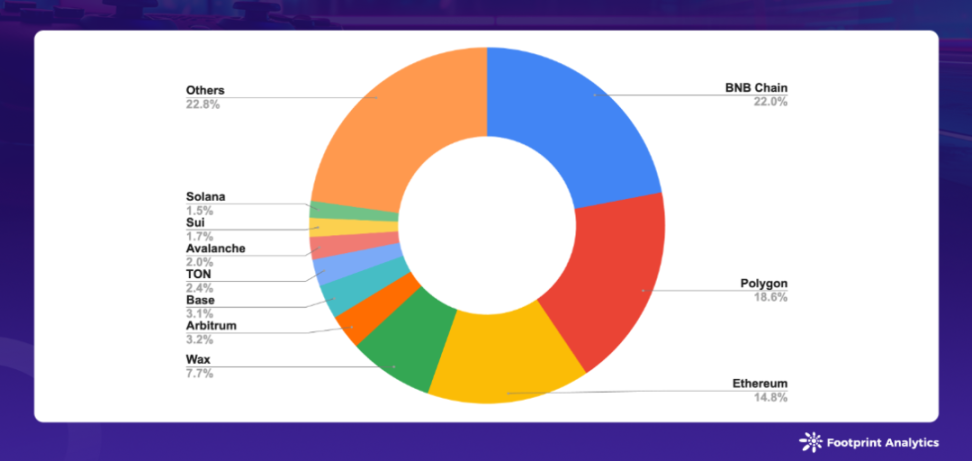

In September, the number of active games across various blockchain networks increased to 1,563, a growth of 4.5% from August. Market dominance remained stable, with the BNB chain, Polygon, and Ethereum accounting for 22.0%, 18.6%, and 14.8% of the total number of games, respectively.

Data Source: Proportion of Active Game Projects on Various Public Chains

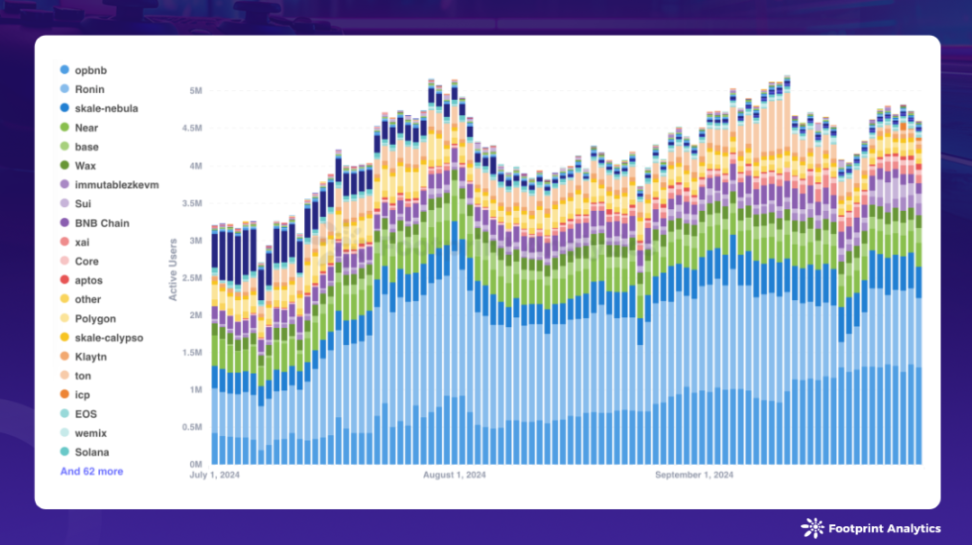

The DAU landscape underwent significant changes, with opBNB, Ronin, and Nebula (SKALE subnet) emerging as the top-performing chains, averaging 1.1 million, 1.1 million, and 458,000 daily active users, respectively. By the end of September, the DAU shares of these chains were 28.2%, 20.1%, and 9.2%.

Data Source: Daily Active Game Users on Various Public Chains

opBNB demonstrated significant growth, with its average DAU in September surging by 62.0% compared to August, increasing its market share from 22.4% to 28.2% during the month. This growth was driven not only by the popular game SERAPH: In The Darkness but also by the launch of the new game Elfin Metaverse in mid-September, which is an esports platform and open-world metaverse.

In contrast, Ronin's DAU share continued to decline, dropping from 29.5% in August to 20.1% in September. This trend is primarily attributed to the underperformance of Pixels, whose DAU fell from over 700,000 to 470,000 during the month. Notably, although Ronin's average DAU in August was nearly double that of opBNB, opBNB surpassed Ronin in September, marking a significant shift in the competitive landscape.

Sui's average DAU grew by 48.4% to 92,000, benefiting from the success of the Telegram game BIRDS, which attracted a large number of users in its first week of launch. This achievement highlights the trend of blockchain leveraging Telegram for user acquisition.

Core's average DAU increased by 66.9% to 62,000, driven by the second season of the Core Ignition Drop, which included Web3 games in addition to BTCFi. Games like World of Dypians and Pixudi played a key role in attracting users to join the Core ecosystem.

Pixudi

The competition between blockchains in terms of games and users is becoming increasingly intense. The Treasure DAO community is discussing a proposal to consider migrating its Web3 gaming ecosystem from Arbitrum to ZKsync. This potential migration is primarily due to the delay of Arbitrum's "Gaming Catalyst Program," which has yet to see any actual implementation. The program proposed to allocate 200 million ARB tokens over two years to incentivize game development on its blockchain.

Overview of Blockchain Games

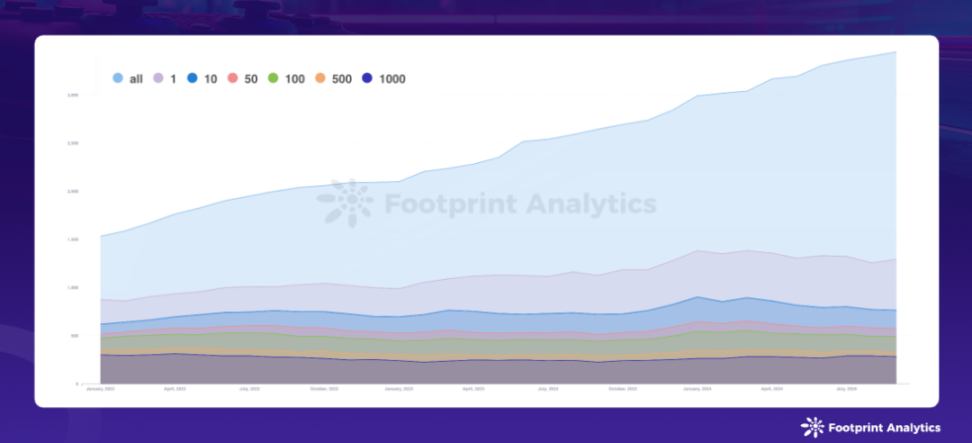

The blockchain gaming sector now includes 3,448 games, of which 1,295 are active. Notably, 285 games attract more than 1,000 monthly active on-chain users (MAU), accounting for 8.3% of all games and 22.0% of active games. This distribution highlights the ongoing challenges faced by the blockchain gaming sector in terms of user retention and engagement.

Data Source: Monthly Active Blockchain Games

In September, the blockchain gaming industry faced new regulatory scrutiny, extending beyond the previous focus on CEX, stablecoins, and DeFi. Particularly noteworthy is the case of Sorare, a fantasy sports company, which was charged in the UK for "offering unauthorized gambling facilities." This case indicates that regulators are increasingly paying attention to blockchain gaming platforms, especially those that blur the lines between gaming, gambling, and digital asset trading.

Also in September, the blockchain gaming sector witnessed the exit of certain projects. Dimensionals, a Roguelike deck-building game developed by Mino Games, officially transitioned to a purely Web2 model, abandoning its initial blockchain and NFT integration. Mino Games has received strong support from venture capital firms such as Andreessen Horowitz (a16z), Y Combinator, and Standard Crypto, with total funding reaching $18.2 million.

The project's Web3 journey began with the launch of the Genesis Stone series in March 2023, but it faced numerous challenges along the way, including bot attacks during whitelist giveaways and DDoS attacks. This well-funded project’s transition from Web3 to Web2 has sparked important discussions about the challenges of integrating blockchain technology into traditional gaming models and the long-term viability of certain Web3 gaming paths.

The tightening of regulatory scrutiny and the difficulties in technical implementation are forcing companies to reassess their strategies. Successful projects need to adeptly navigate compliance issues, ensure robust security, develop engaging gameplay that demonstrates the value of blockchain integration, and find a balance between meeting the expectations of traditional gamers and crypto enthusiasts.

Blockchain Game Investment and Financing

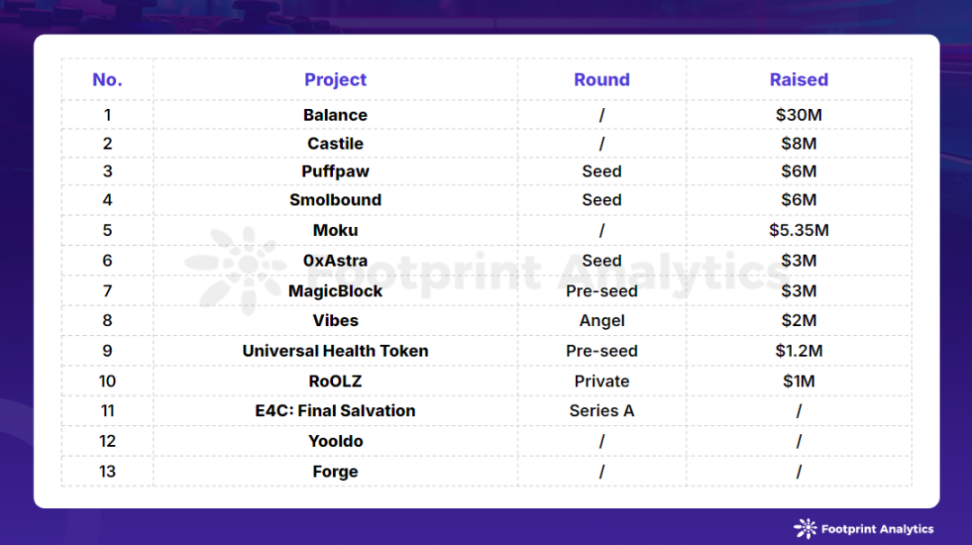

In September, the Web3 gaming sector secured $65.6 million in investments across 13 financing events, a 6.6% increase from August. Three of these financing rounds did not disclose specific amounts.

Investment and Financing Events in the Blockchain Gaming Sector in September 2024 (Source: crypto-fundraising.info)

The gaming and social platform E-PAL launched its AI-based blockchain experience platform, Balance. This initiative follows two successful funding rounds led by a16z and Galaxy Interactive. This significant investment will primarily be used for the development of Balance's infrastructure, which is crucial for E-PAL's ambitious goal of building an open, inclusive, and fair Web3 ecosystem. This move also highlights the trend of integration between AI, blockchain, and social gaming platforms.

Speaking of a16z, its gaming fund, Game Fund One, launched with a scale of $600 million, has achieved significant results over the past two years. The fund announced it will invest $30 million in technology startups related to gaming, focusing on cutting-edge areas such as AI, VR/AR, and Web3 gaming. The application window opened on August 26, 2024, and closed on September 30, with plans to officially launch in San Francisco in January 2025. Selected startups will receive comprehensive support from the fund, including expert talks, personalized mentoring, and an investment of $750,000 for each company. Additionally, these companies will benefit from the expertise and resources of the a16z SPEEDRUN team.

Furthermore, some innovative projects have also secured new funding.

Puffpaw, an innovative platform that combines health initiatives with blockchain technology, raised $6 million in seed funding. Their "Quit Smoking & Earn Money" model, built on Berachain, represents a new approach to incentivizing positive health behaviors through blockchain rewards.

Universal Health Token (UHT) gamifies healthcare through blockchain technology, successfully raising $1.2 million in pre-seed funding, attracting investments from industry leaders including Animoca Brands and Polygon. This project showcases the trend of applying gaming and blockchain principles to traditional non-gaming sectors, with the potential to revolutionize health engagement and management.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。