From nLRT to UniFi is not a simple linear expansion, but aims to build a decentralized infrastructure for Ethereum.

Written by: Puffer Finance

In August, Puffer officially announced its elevation from a native liquidity restaking protocol (nLRP) to a provider of decentralized infrastructure for Ethereum. The product architecture includes a "trinity": the Based Rollup solution Puffer UniFi, the pre-confirmation (Preconf) technical solution UniFi AVS, and the restaking product Puffer LRT.

This article will explore the product of Puffer's native liquidity restaking protocol (nLRP), revealing the internal logic of Puffer's expansion towards Based Rollup, as well as its unique mechanisms in resource integration, market demand satisfaction, and technological innovation, showcasing the completeness and coherence of Puffer's development path from Restaking to Based Rollup.

Puffer LRT: Decentralized Architecture Rooted in Ethereum Roadmap

Therefore, before introducing Puffer UniFi, it is necessary to break down the architecture and characteristics of Puffer nLRT, the native liquidity restaking product. Here, native restaking refers to Puffer's support for directly restaking native ETH, providing it to node operators for PoS validation and AVS validation, which is more native and carries lower risk.

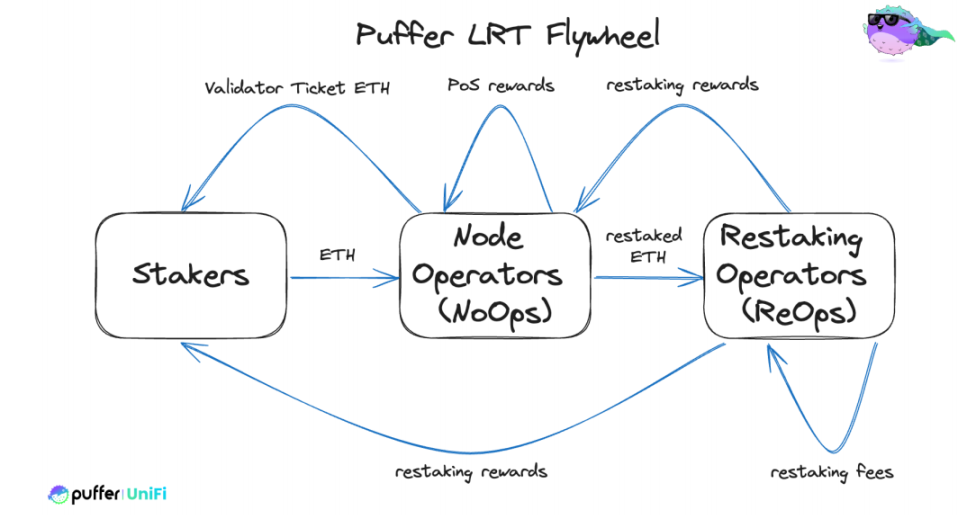

Puffer nLRT services include three main groups: Node Operators (NoOps), Restaking Operators (ReOps), and regular ETH staking users (Stakers):

- Stakers can deposit their ETH, stETH, or wstETH assets into Puffer for staking and receive the native liquidity restaking token pufETH, allowing them to accumulate staking/restaking rewards while using the liquidity of pufETH to participate in other DeFi protocols to further enhance returns;

- NoOps are the core role in the Puffer ecosystem, responsible for running Ethereum PoS validation nodes and participating in Ethereum's consensus process (such as proposing blocks and validating transactions). Interestingly, Puffer ensures that NoOps can earn 100% of PoS rewards as long as they work diligently through the innovative mechanism of "Validator Tickets";

- ReOps are responsible for both PoS validation and AVS operation, maximizing the returns on staked assets by restaking them, and ReOps also serve as NoOps for PoS validation;

It is worth noting that we are currently in a transitional phase where NoOps focus on PoS validation (but can still earn restaking rewards), mainly due to considerations for user asset security—AVS is currently in its early stages, with high uncertainty and risk, so professional node operators temporarily take on this part of the work.

In the future, as technology and mechanisms continue to improve, NoOps will not be limited to their current scope of work but will have more options, including taking on AVS validation responsibilities alongside ReOps.

In this process, Puffer employs various innovative mechanisms to lower the participation threshold for all roles, encouraging more users and node operators to actively participate and further decentralize the Ethereum staking ecosystem.

For example, Puffer's pioneering "Validator Tickets" (VT) model ensures that Stakers and NoOps reach an economic incentive constraint without permission—Stakers can pre-claim PoS rewards for a future period (at a certain discount), while NoOps can earn 100% of PoS rewards as long as they work diligently during the corresponding period.

This allows Stakers and NoOps to enhance node capital efficiency through cooperation based on incentive strategies:

- For Stakers, there is no longer a need to worry about operating nodes "just going through the motions," as they can transfer risk by pre-claiming PoS rewards, avoiding the risk of staking yield loss due to NoOps "slacking off" or even rug pulls;

- For those who want to become NoOps, they can join the Puffer node module without permission by purchasing VT (currently a minimum of 28 VT) and depositing at least 1 ETH (if not using anti-penalty technology, a collateral of 2 ETH is required), achieving higher capital efficiency than traditional liquidity staking protocols;

This significantly lowers the entry barrier for NoOps, allowing more non-institutional small and medium operators to participate in node operation. — This not only enables more ordinary people to run validation nodes with less capital but also allows the same amount of capital to operate more validation nodes, thereby improving capital utilization and strengthening Ethereum's decentralization.

The "One Fish, Multiple Meals" Narrative Expansion of UniFi

This is also the inherent advantage that the Puffer LRT product has over other liquidity staking/restaking products, and here we can see that it precisely aligns with the demand for Based Rollup that Vitalik Buterin has repeatedly highlighted:

In the architecture of Based Rollup, the core idea is to transfer the responsibility of transaction ordering to L1—utilizing the decentralized validation node set of the Ethereum mainnet to propose blocks and package transactions, thereby inheriting L1's security and promoting Ethereum's decentralization.

In simple terms, Based Rollup requires a massive set of validation nodes (decentralized orderers) to promote Ethereum's decentralization, and the Puffer LRT product, by lowering participation thresholds and providing strong decentralized support, can provide the necessary massive set of validation nodes for Based Rollup.

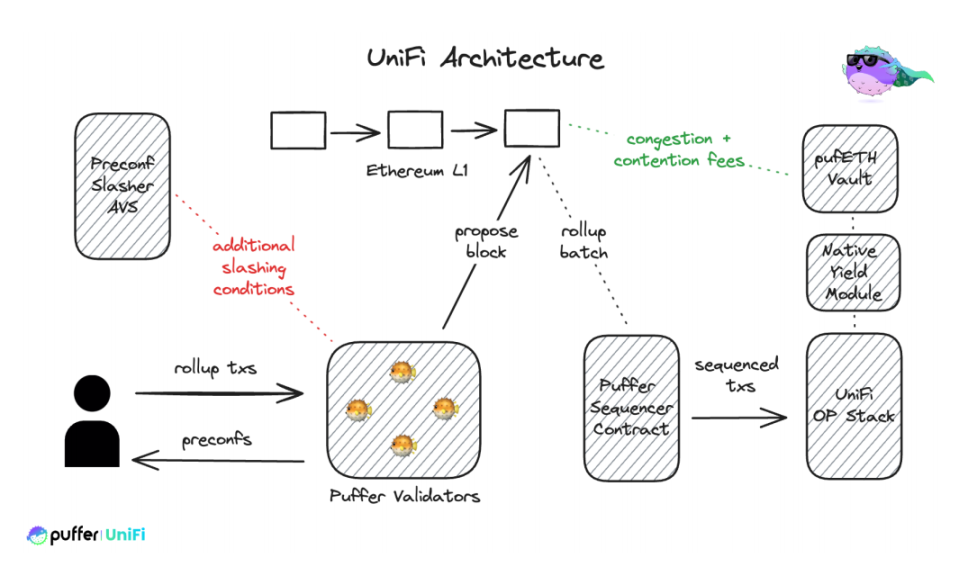

Specifically, from a technical perspective, Puffer UniFi integrates the validation set directly at the Ethereum node level, providing decentralized ordering and pre-confirmation services (UniFi AVS), thus offering fast (millisecond-level) confirmation times while eliminating the risks of single points of failure or censorship from existing centralized orderers, aligning with the direction needed for further decentralization of Ethereum.

From this perspective, it is understandable that the launch of Puffer UniFi is not a spur-of-the-moment exploration of a new direction, but rather a natural narrative expansion based on the mature architecture of the Puffer LRT product:

By leveraging Puffer's restaking validation node set, restaked ETH can be directly used as collateral for pre-confirmation without additional deposits, allowing for a rapid and nearly "zero-cost" expansion to tens of thousands of decentralized orderers. Restaked validation nodes = pre-confirmation service nodes, which not only improves capital efficiency but can quickly establish a pre-confirmation validation node set with a massive number of participants, building the underlying architecture for Based Rollup.

Interestingly, in terms of market demand, the launch of Puffer UniFi can also provide Solo Stakers with more diverse sources of income, helping validation nodes earn additional revenue and achieve "one fish, multiple meals":

Since Ethereum PoS validation nodes directly expand to include L1 ordering services, node operators can earn not only Ethereum PoS validation (Puffer LRT) rewards but also two additional revenue streams from pre-confirmation validation (UniFi AVS) and Rollup transaction ordering fees; additionally, congestion fees and contention fees generated from transactions are used to increase the earnings of PufETH holders.

This further attracts more operators to participate through economic incentives, thereby promoting a higher degree of decentralization for Ethereum.

The Application Chain Universe Vision of Puffer UniFi

From this perspective, the emergence of Puffer UniFi is an attempt to introduce ETH mainnet validation nodes as a decentralized ordering set, combined with the rapid confirmation advantages of its UniFi AVS, to provide a safer and more efficient decentralized solution for Rollups based on the idea of Based Rollup.

In this way, Puffer UniFi can effectively activate the validation node set, allowing validation nodes to earn additional revenue while providing pre-confirmation and transaction ordering services, channeling multiple economic revenue streams of the Ethereum ecosystem towards L1 to enhance Ethereum's economic incentive mechanism, which is also highly aligned with Ethereum's long-term development direction.

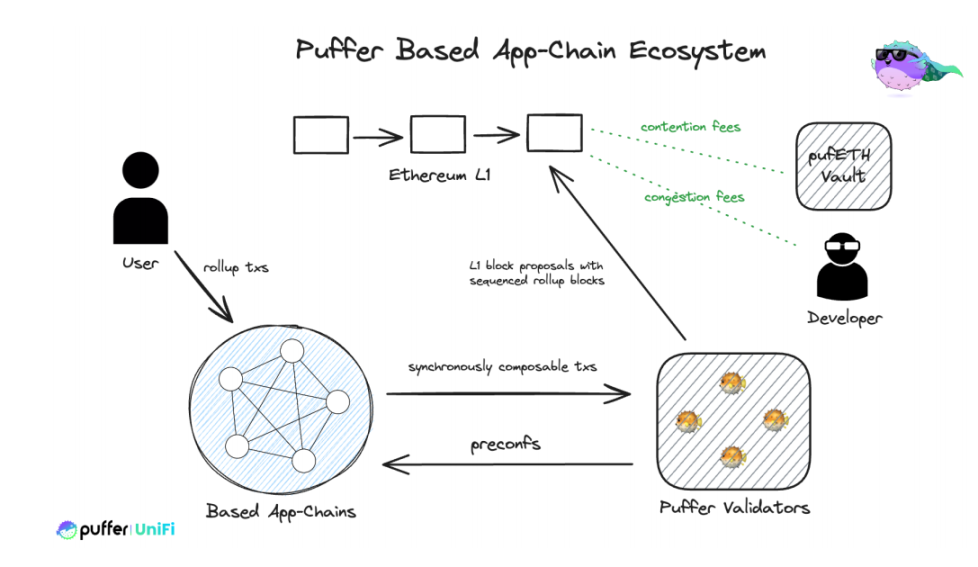

The greater imaginative space lies in the fact that Puffer UniFi allows developers to use the infrastructure it provides to build and deploy their own Based Rollup applications, meaning that in the future, every DApp on UniFi can be seen as an application chain, directly capturing part of the value generated by transaction fees.

This is expected to give rise to a vision of an application chain universe based on Based Rollup:

- On one hand, by eliminating the need for centralized orderers, developers significantly reduce operational burdens and technical overhead, lowering the entry barriers for new developers and simplifying the complexity of subsequent application chain management;

- On the other hand, transactions between multiple application chains can be placed in a single block, as long as they are based on the same decentralized orderer set (Ethereum validation node set), allowing for shared users and liquidity. Users can seamlessly enjoy synchronous composability regardless of which application chain they use, achieving a close connection between Rollup and Ethereum L1. For example, withdrawals from Based Rollup to L1 can be instant, facilitating seamless integration between Rollup and L1, greatly enhancing user experience and the overall efficiency of the ecosystem;

- Additionally, it allows developers/projects to capture the fees generated by application chains, directly linking the success of the ecosystem with the personal success of developers;

In simple terms, UniFi enables project parties developing application chains to gain profit-sharing rights from the orderers, effectively adding an economic lever. Whether used for subsidies, traffic generation, marketing, or retained within their own application chain ecosystem, it can generate entirely new Rollup/application chain incentive mechanisms.

Overall, Puffer UniFi essentially leverages its advantages in staking/restaking validation node sets to enter the new direction of Based Rollup, thereby activating an imaginative space as the foundational infrastructure for the future universe of Based Rollup application chains through the architecture of Based Rollup application chains + the economic mechanisms based on its own orderer set.

Summary

If we clarify the "origin" role that Puffer LRT plays in the entire service matrix, we will find that the transition from LRT services to the launch of Puffer UniFi and even UniFi AVS is not a simple linear expansion of product layout, but rather an inevitable choice based on the resources and technological advantages accumulated through restaking:

Utilizing the staking/restaking validation node set of LRT further meets the demand for decentralized orderer sets for Puffer UniFi as a Based Rollup, while UniFi AVS, as a pre-confirmation technical solution, provides reliable assurance for transactions. This also reflects our judgment and commitment to the future development trends of the Ethereum ecosystem.

In short, Puffer nLRT, Puffer UniFi, and UniFi AVS are a series of products operating in synergy, expanding through a coherent narrative advantage, collectively constructing a comprehensive decentralized infrastructure service system for Ethereum. Among them, Puffer's Validator mechanism is undoubtedly the core infrastructure of the entire system—its permissionless nature brings great openness and scalability to the Ethereum ecosystem, meaning that any Ethereum node has the opportunity to participate.

As time goes on, if more and more new Ethereum nodes emerge and join this node set, it will not only greatly enrich node resources and enhance the degree of decentralization of the network, but also, since Rollups and L1 are based on a common node set, the synergy between Based Rollups built on these nodes and L1 will continue to strengthen. The connections in technical implementation and ecological operation will become increasingly tight, gradually merging into a positive feedback loop for a healthy Ethereum ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。