Match NFT Phase 5 is set to officially launch on October 15.

The retail (speculative) mindset is a significant reason why crypto players struggle to capture excess returns and continue to incur investment losses. The so-called retail mindset rejects and refuses new things outside of one's own understanding, harboring significant biases.

On October 15, the Match NFT Phase 5 auction is about to go live, and it is worth every user taking a look.

1. Outperforming the Market: The Wealth Effect of the Match Gold Mine

Since the beginning of the year, the wave of Meme coins has come one after another. Especially in the past month, as institutional narratives have weakened, the Meme market has erupted again, with various zoo coins emerging from cats and dogs to monkeys and hippos. Even Binance has frequently launched various projects, allowing a group of crypto players to achieve considerable wealth gains.

Against this backdrop, the Meme token RFG launched by Match perfectly meets this market expectation. As an innovative project that integrates SocialFi, AI, and Meme elements, Match provides investors with highly attractive profit opportunities through its unique value network design.

(1) RFG: Caring for Crypto Investment Refugees

The token RFG, short for Refugee, translates to "难民" in Chinese. This name is a double entendre, reflecting care for crypto investment refugees and attention to the global refugee situation. The emergence of RFG represents hope for crypto investment refugees.

In terms of token distribution, RFG has achieved a 100% fair and just launch, with a total issuance of 100 billion. The project team has no reserved tokens and no private placements, avoiding unfair phenomena such as project teams profiting from reserved tokens and large holders dumping. This makes the token distribution more transparent and fair, aligning with the fair launch attributes of Meme coins.

Among them, 10% of the total RFG tokens are directly airdropped, giving every user the opportunity to obtain RFG by participating in community activities, not just through purchases; 30% is allocated for liquidity provision; and 60% is used for user community mining and other business outputs. All RFG tokens are locked in smart contracts and will only be released according to corresponding rules or logic in business scenarios. This distribution method ensures the fairness of the tokens and avoids market manipulation.

From a market potential perspective, the project is currently in its initial launch phase, with RFG's circulating market value at only $1.04 million, of which liquidity is as high as $320,000. To obtain RFG, apart from airdrops, users can only earn it through RFG staking mining, RFG LP liquidity staking mining, and Match NFT staking mining.

(2) Multiple Mining Methods: Amplifying Returns

How do the returns and break-even situations of the three RFG mining methods perform?

First, let's look at the RFG token staking situation. According to official platform data, RFG staking is divided into flexible and fixed terms: flexible annualized return is 16.2%; fixed returns are 20% (60 days), 30% (90 days), 45% (180 days), and 65% (360 days).

From the perspective of annualized returns alone, RFG's level exceeds that of the vast majority of projects currently on the market, where other mainstream coins generally have annualized returns below 10%. Meme projects like Bome have not launched any deposit interest services—thus, from this angle, RFG stands out in the Meme ecosystem.

Furthermore, the RFG LP liquidity mining returns are also impressive; official data shows that the current annualized return reaches 122%. More importantly, RFG's price has remained stable over the past month, with no impermanent loss in LP, and in addition to staking mining, users receive a 0.3% trading fee dividend, achieving multiple returns.

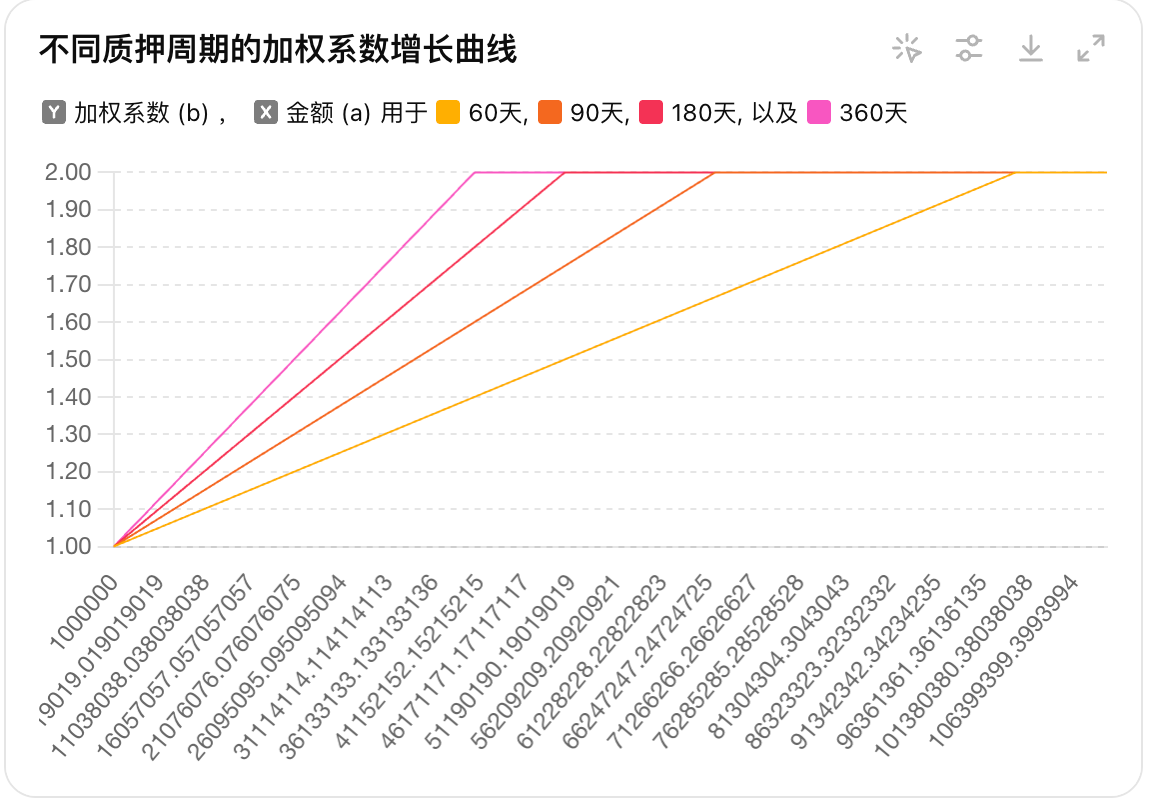

Finally, let's look at Match NFT staking mining, which is also a focal point for investors. Currently, the annualized return for the single pool of α NFTs is the lowest at about 89.8%, while the highest three NFT staking pools have an annualized return of 485%, meaning the daily return rate for the Match NFT mining pool is between 0.25% and 1.32%. Additionally, if users stake RFG, they can receive a Boost multiplier, up to two times, resulting in a daily return of 0.5% to 2.65%. As shown below:

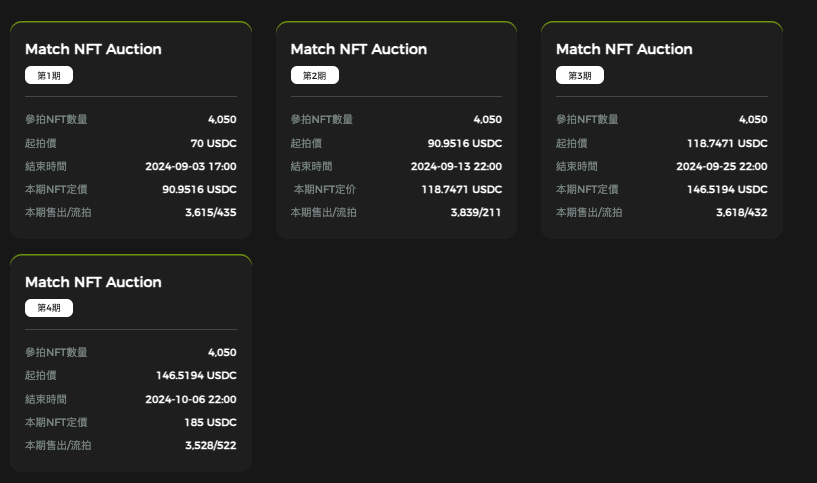

However, this is only the RFG mining yield generated from NFT staking. In fact, the floor price of the NFTs held by users is also continuously rising, with the auction data from the past four phases as follows:

- The starting price of the first phase was $70, and the final transaction price was $90.95, an increase of about 30%;

- The starting price of the second phase was $90.95, and the final transaction price was $118.74, an increase of about 30.5%;

- The starting price of the third phase was $118.74, and the final transaction price was $146.51, an increase of about 23.3%;

- The starting price of the fourth phase was $146.51, and the final transaction price was $185, an increase of about 26.2%;

In summary, over the past four auction phases, the average increase in the auction floor price was 26%, with an interval of 10 days between each auction, meaning the average daily profit from the NFT floor price is about 2.6%. If this trend continues, subsequent NFT auctions have the potential to yield even more profits.

With the combination of the above three parts of returns, Match NFT players can achieve daily returns of 3.85% to 7%. If the RFG price maintains its current level, the break-even period will be between 13 to 26 days; if the price increases, the break-even period will be further shortened.

2. How Does Match Break the "Mining Withdrawal Sale" Death Spiral?

"Mining withdrawal sale" was a nightmare for early DeFi mining players, especially as large holders rushed into various mining pools, directly leading to "mining collapses," raising concerns about Match. However, Match has broken the traditional mining project's death spiral, largely thanks to its carefully designed economic model and innovative gameplay, with the core goal of reducing selling pressure and increasing buying pressure.

(1) Empowering RFG Application Scenarios to Reduce Selling Pressure

The RFG token has various application scenarios that greatly enhance its practicality and value stability. It is precisely because of these diversified applications that the price of RFG has not collapsed but has shown a continuous upward trend.

As mentioned earlier, users can stake RFG for single-token mining or provide liquidity LP for mining to earn returns. Additionally, RFG can also be used in the SMS (Social Matching Staking) NFT pool for Boost APY bonuses—when RFG reaches a certain quantity, users can obtain a Boost coefficient. The more they stake and the longer the time, the greater the Boost, with a maximum of 2. The Boost coefficient can be used to enhance the efficiency of NFT staking mining. When RFG is staked in flexible or different fixed terms, each can obtain its own Boost coefficient, and the maximum Boost coefficient is used to calculate the final yield of NFT staking mining. As shown below:

When the amount of staked RFG reaches a certain level, it can provide a Boost multiplier for Match NFT staking, up to two times. The higher the level of the NFT, the more returns generated, which in turn further stimulates more users to stake more to obtain higher-level NFTs.

More importantly, staking RFG can increase the probability of obtaining rare NFTs (mainly γ), and the mining efficiency for rare NFTs is also higher. If users do not stake RFG, the probabilities of obtaining α, β, and γ are 50%, 30%, and 20%, respectively; after staking a certain amount, the total probability of obtaining γ can reach up to 50%.

With multiple strategies in place, the amount of RFG staked has significantly increased. Data shows that the current TVL of token staking on the Match platform has reached $897,000. In other words, about 90% of circulating RFG tokens are staked and locked, which greatly reduces selling pressure.

(2) LP Liquidity Increases Buying Pressure

The aforementioned multiple measures have also stimulated market enthusiasm for purchasing RFG from another dimension.

Observing data from the past two months, it can be seen that since the first NFT auction and mining began over a month ago, the price of RFG has not experienced a large-scale decline, and has even increased by 5% compared to before, with the liquidity pool growing from the initial $100,000 to the current $340,000.

Additionally, Match has also designed a liquidity pool to support the market. Early users who received airdrops need to add LP liquidity for RFG to obtain a certain proportion of the airdrop. The benefit of this approach is that it not only prevents early opportunists from dumping endlessly but also allows airdrop users to convert into buying pressure, increasing the liquidity pool.

For LPs, it can achieve "one fish, five eats." First, airdrop users can obtain tokens at a lower price after the project starts adding liquidity, allowing them to fully capture the value of RFG's rise; second, LP users can earn a 0.3% trading fee dividend, primarily in ETH and RFG tokens, further gaining price advantages; third, adding liquidity allows them to share an additional 60% airdrop, resulting in zero-cost tokens; fourth, single-token staking of RFG can increase the probability of obtaining higher-level NFTs during auctions, thus generating more returns; fifth, LPs can mine on Match, with an annualized return of 16%, further acquiring more cheap tokens. Platform data shows that the annualized return for the Match platform's USDC-RFG LP staking pool currently reaches 122%, with a locked value of $319,000.

(3) Reducing Large Holder Hoarding and Arbitrary Dumping

Match has also introduced a random algorithm. After the NFT auction is completed, it can only be determined whether a user has won, but the specific type of NFT can only be known when the user actually claims and opens it. The probabilities of different types of NFTs vary, with higher-level NFTs having lower probabilities. The random algorithm ensures the randomness and scarcity of NFTs, preventing large holders from hoarding them by bidding high prices.

To prevent whale monopolization, Match also limits the number of times users can participate. Each user can successfully participate in a maximum of two NFT auctions, meaning they can obtain up to 4 NFTs, ensuring that tokens are sufficiently decentralized; failing to obtain an NFT in the current auction does not affect the qualification to continue participating in subsequent auctions until they successfully acquire NFTs from 2 auction phases. Additionally, Match employs three core factors to verify user identities, avoiding account farming.

Therefore, theoretically, the probability of a user wanting to obtain a complete set of three different types of NFTs is relatively low, with the vast majority only owning one or two types of NFTs, leaving a demand window for subsequent SMS social matching joint mining.

Through the above measures, Match does everything possible to ensure that NFT tokens are sufficiently decentralized, avoiding large holders from arbitrarily hoarding NFTs for mining and dumping, thus opening up a pathway for future price increases.

3. New Opportunities: The Fifth Auction is Coming

Currently, in the crypto market, the boost to token prices mainly comes from increasing burn scenarios. For example, major exchanges regularly use a fixed percentage of their revenue/profit to repurchase tokens from the market for burning. ETH also implemented EIP-1559 in 2022 to increase ETH consumption.

However, the final results have not been ideal; more often than not, it merely paints a big picture for users, increasing their imagination for the future, as the percentage of tokens burned is actually not high. What truly drives token price increases are broader factors, including traffic, consensus, product quality, and the completeness of the ecosystem. The Match project achieves a steady increase in the value of the RFG token by building a complete ecosystem and providing diversified application scenarios.

The Match NFT Phase 5 auction is set to officially launch on October 15. Here are some practical suggestions regarding this auction for reference.

First, a total of 4,050 NFTs will participate in the auction, adopting an "English auction" format, meaning the starting price of the second phase will be determined by the final price of the first phase, with the highest bidder winning. Therefore, the starting price for this auction is $185, and based on the increases from previous phases, the final transaction price for Phase 5 is expected to be $233. Users wanting to obtain 2 NFTs will need to deposit at least $466, and it is best to deposit $500, which can be refunded if they do not win; setting a reasonable bid can directly set at $233 to increase the chances of winning.

Second, to obtain high-level NFTs, it is best to stake a certain amount of RFG tokens in advance to gain Boost bonuses. It is recommended to stake over 5 million tokens (approximately $1,500) to effectively increase the probability of obtaining rare NFTs.

Third, as the number of auction phases increases, the NFT floor price is expected to continue rising, and the RFG token will also appreciate accordingly. Therefore, participating in Match NFT is not only a short-term investment opportunity but also a good chance to lay out long-term value.

The Match NFT Phase 5 auction undoubtedly brings new opportunities for investors. Through its innovative economic model, fair auction mechanism, and diversified sources of income, Match has successfully created an investment platform that provides stable returns while having long-term appreciation potential.

In this uncertain crypto market, Match NFT, with its unique design and robust performance, has become a focal point worth paying attention to in 2024.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。