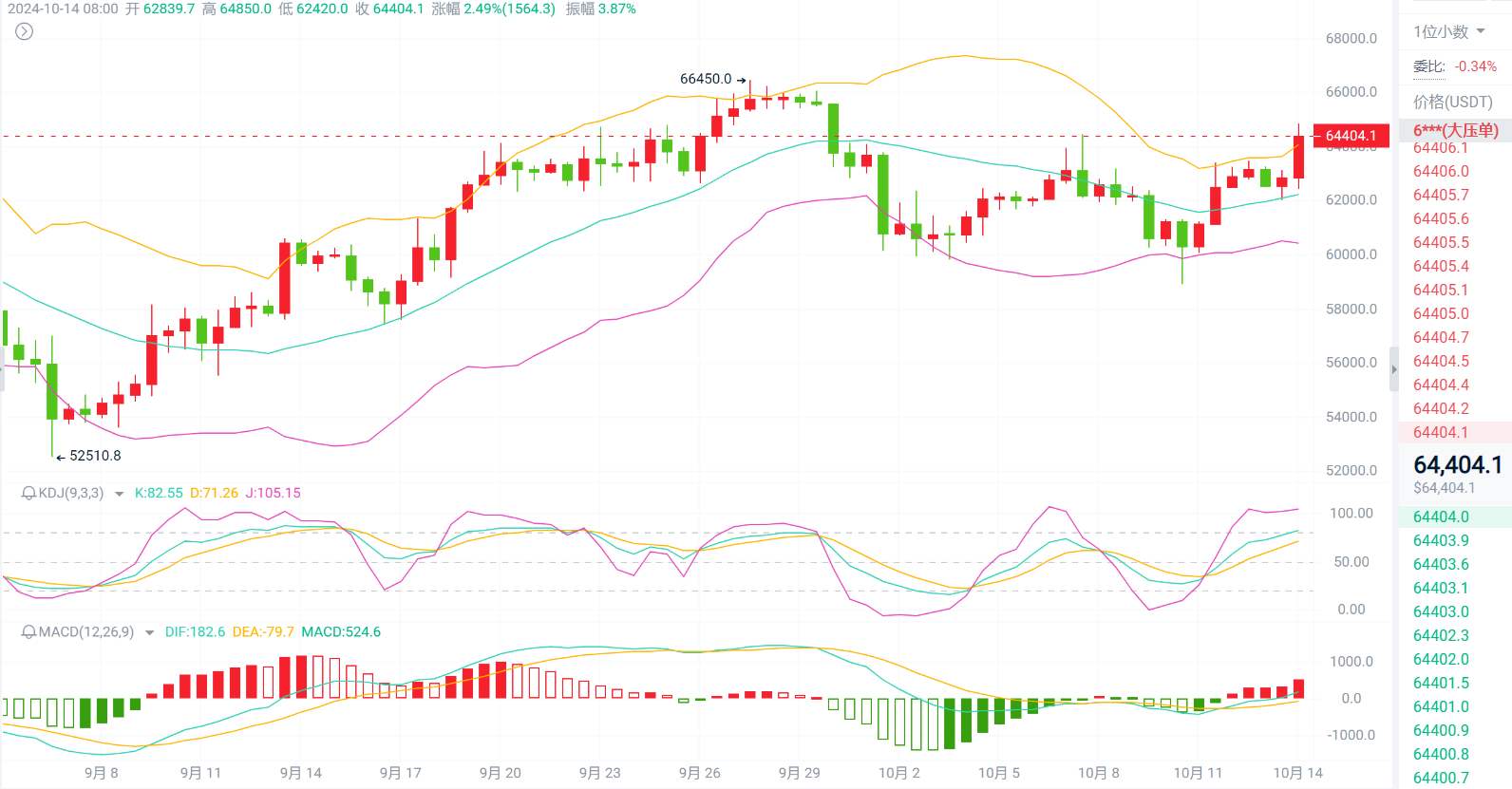

From a weekly perspective, the current MACD bearish momentum is continuously shrinking, and BOLL is generally in a sideways downward trend. The volume shows that this week's trading volume is strong. The current situation indicates that the bulls are in a slow stretching phase, with bullish sentiment for Bitcoin greater than that for Ethereum, which also strengthens the sentiment for Ethereum's upward movement.

From a daily perspective, today's MACD indicator has shown a golden cross signal at a low level, and the price has made a breakthrough upward against the middle line of BOLL. The volume has also released strong trading volume energy. On the 12-hour level, the current MACD and BOLL are in bullish resonance, with the trading volume increasing in proportion to the rise in the main chart. Additionally, the MA5 and MA10 on the main chart have shown a resonant upward sentiment, and the current price has risen above the three-day moving averages. Therefore, the short-term trend direction is mainly bullish with a low buy strategy. Specific entry points can be referenced as follows:

BTC: Buy at 64000-63500, target 65500

ETH: Buy in batches at 2500-2470, target 2580

The above is my personal intraday market analysis, first published on "Public Account: Mu Feng Looks at Trends." Welcome to exchange and learn together!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。