Has the true value of Banana Gun yet to be discovered?

Written by: Felipe Montealegre, Theia Research

Translated by: Shaofaye123, Foresight News

Good projects often emerge in the most overlooked places. When discussing successful investment cases, people often think of Tesla, Apple, and Amazon, but looking back, you may be surprised to find that most investors made their first pot of gold in niche industries like insurance brokerage, auto parts, and pharmaceutical services, where returns from early potential companies that are not widely discussed may actually be easier to obtain.

We believe the token market offers such opportunities, especially with the Telegram bot, Banana Gun. Banana Gun is one of the best projects in terms of on-chain economic benefits. It benefits from price-insensitive users, valuable order flow, and meaningful economies of scale. The front-end market is one of the largest markets in the on-chain economy. Its fundamentals are often misunderstood, making Banana Gun's valuation relatively cheap compared to other projects.

This article will introduce the five most important but lesser-known features of Banana Gun. Banana Gun has: (i) a high-quality user base; (ii) a moat built on economies of scale; (iii) potential pricing power from order flow quality; (iv) a larger market opportunity than commonly understood; (v) strong fundamentals.

Banana Gun has the most valuable users in the on-chain economy

Banana Gun is a Telegram bot that allows users to trade tokens on EVM and SVM. Users who frequently engage in on-chain trading can perceive the inconveniences even when trading on DEXs like Uniswap and Raydium. This is akin to trading directly through the New York Stock Exchange without using front-end tools like Robinhood or Interactive Brokers. Banana Gun provides convenient trading directly from Telegram while offering features like sniping, copy trading, and anti-RUG. These features are crucial for Banana Gun's core trading community.

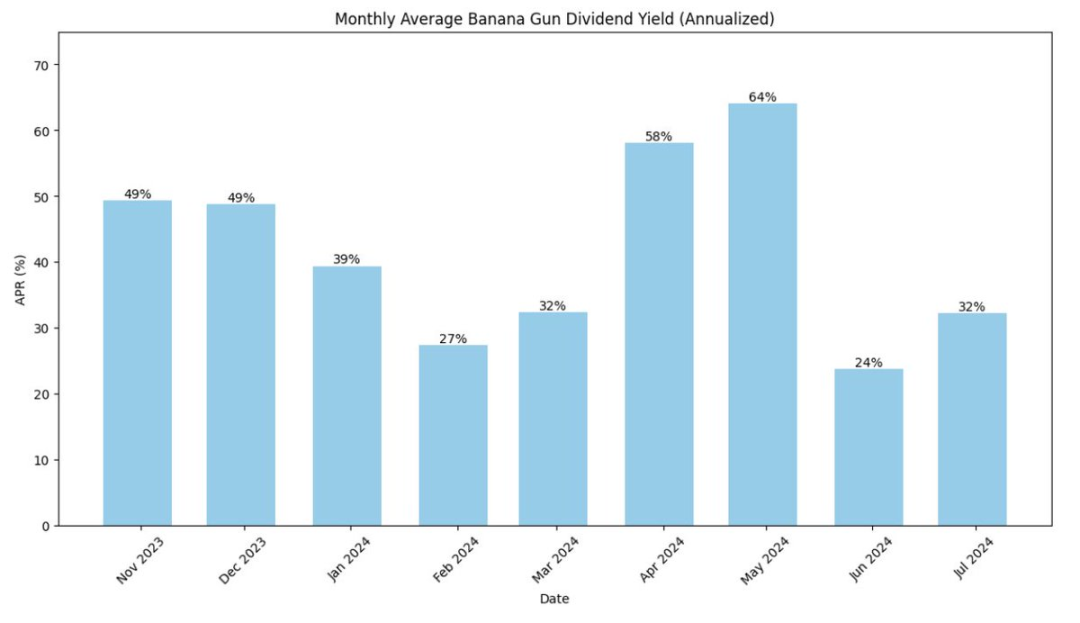

The core users of Banana Gun are speculative traders who can take on high risks in hopes of achieving outsized returns. They are the most valuable users in the on-chain economy because they are active (i.e., high trading volume) and lack price elasticity (i.e., high income). They buy highly volatile Memecoins, hoping for 100x returns. These users can make a fortune in just a few weeks and do not care about paying around 75bps due to their lack of price sensitivity.

To illustrate the importance of user value, we can compare a Memecoin trader with a liquid token fund. Suppose a Memecoin trader manages $100,000, occasionally engages in sniping, and rotates to new positions weekly. Typically, they would generate $2 million in trading volume and about $20,000 in fees over three months. In contrast, a liquid token fund can only trade after approval from its investment committee and seeks optimal fees. The liquid fund generated $5 million in trading volume and about $10,000 in fees over the same three months, despite managing $30 million in assets.

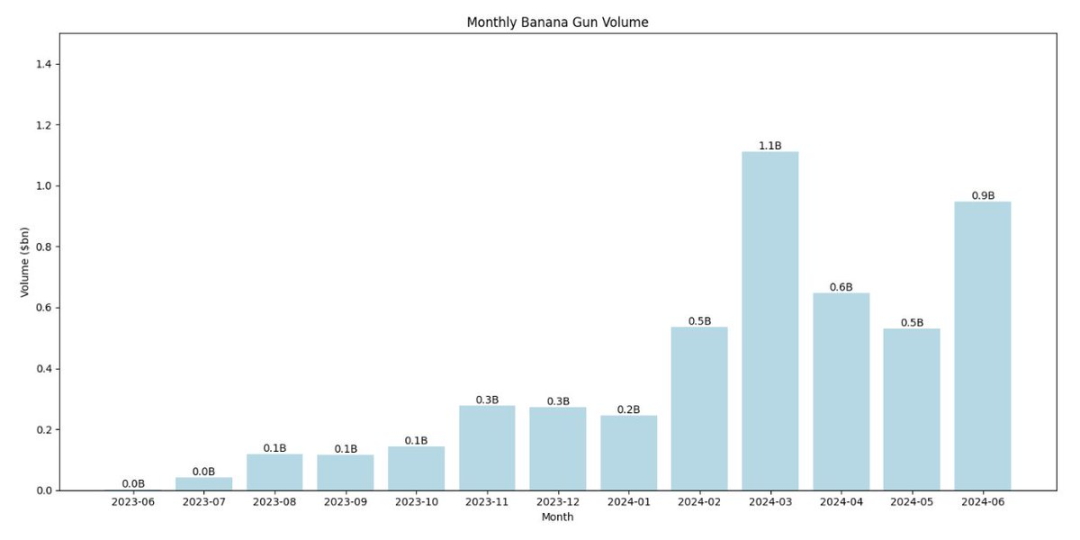

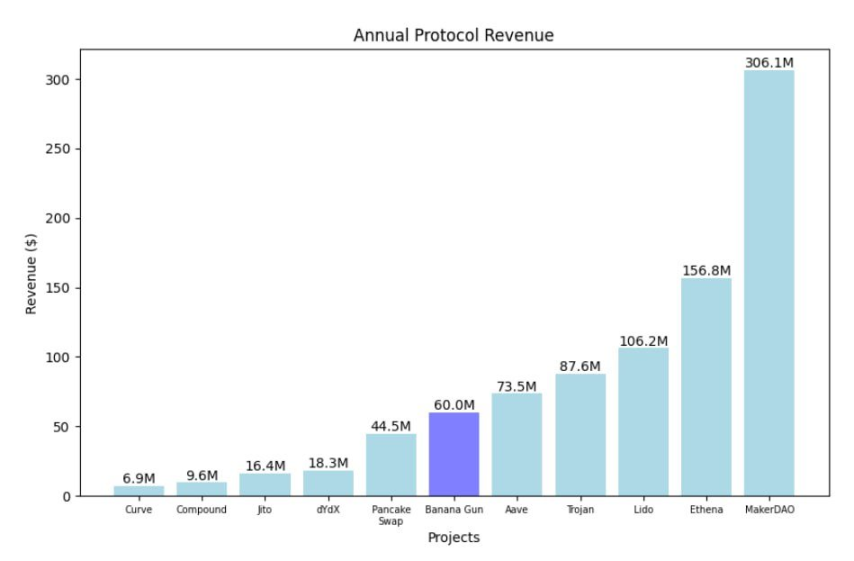

Banana Gun is expected to generate $7.8 billion in trading volume and $60 million in cash flow annually, with a cumulative user base of 151,000 and an average daily user count of about 5,000. These figures reflect its high-quality user accumulation.

Banana Gun has a strong moat based on economies of scale

Banana Gun's users prioritize functionality, user experience, and trade execution.

Active traders do not switch between Telegram Bots; they value convenience more. Therefore, it is particularly important to engage in multi-chain operations and have all the necessary features. This is why becoming the largest Telegram Bot on EVM is easier than becoming the largest on Solana.

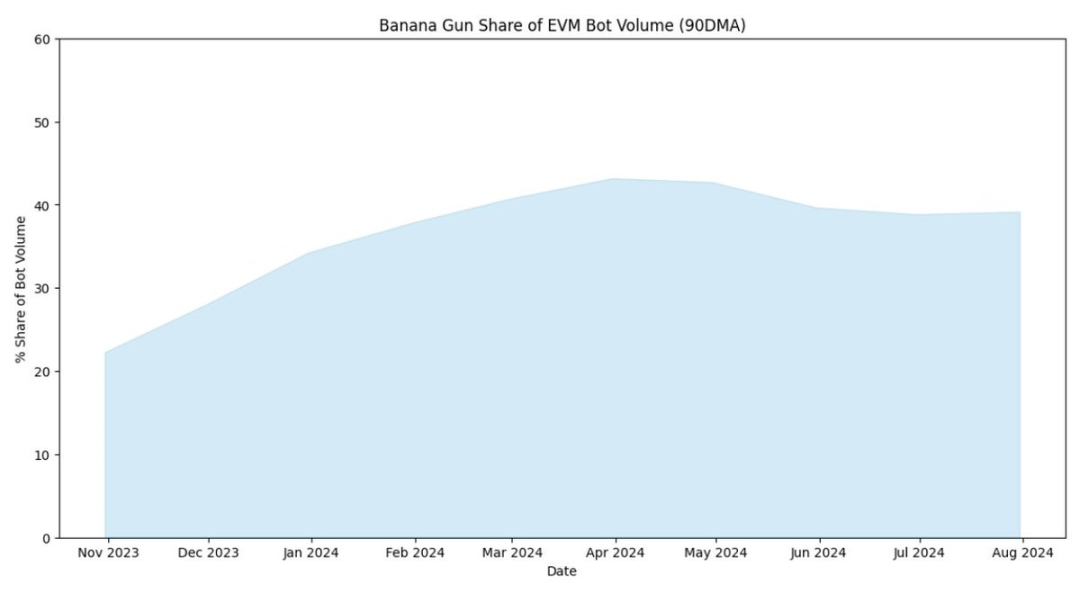

Active traders also focus on a considerable number of advanced features, such as sniping. The interesting aspect of these features is that many lead to natural monopolies. Consider the sniping process. Only one Telegram Bot can successfully snipe for its users, and that is always the one that pays the highest fees. This means that the largest bot or the one with the most snipers is most likely to succeed. This is evidenced by market testing, where Banana Gun has won 88% of the snipes. Other users have little chance of winning the snipes against Banana Gun users.

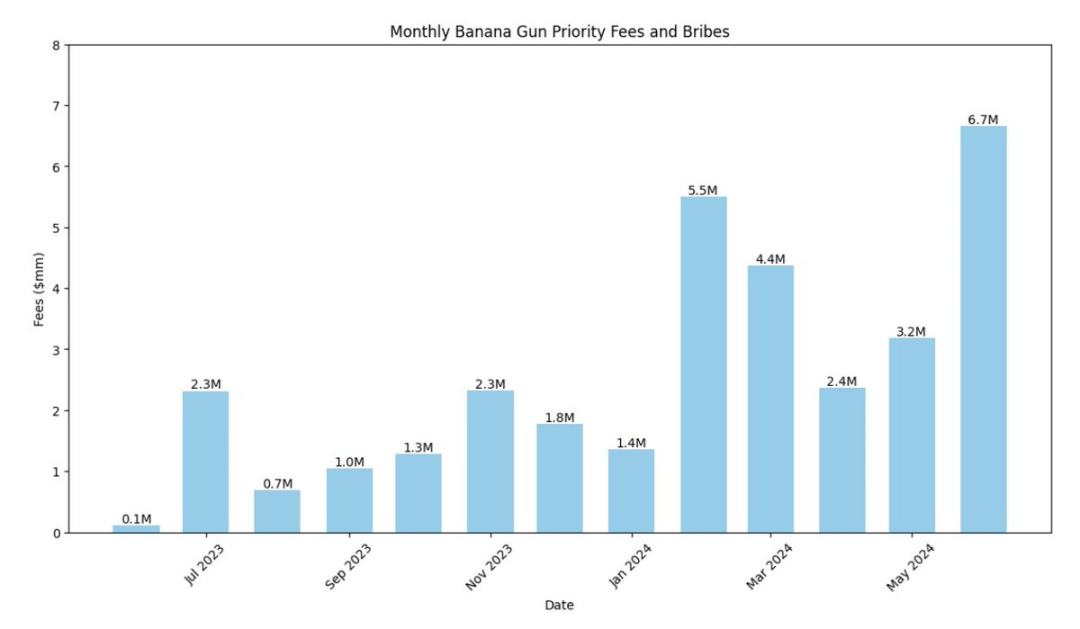

These features require significant infrastructure investment. Good infrastructure is needed to ensure optimal execution, as users expect low latency and high-speed operation. Additionally, other facilities are required to implement anti-RUG features, which necessitate Banana Gun scanning the memory pool to determine if token issuers are withdrawing liquidity and placing user sell transactions in the next block. It is estimated that Banana Gun spends about $3.6 million annually on infrastructure. For projects with lower market shares, even if they can develop similar products, spending $3.6 million on infrastructure is difficult to sustain.

All of this provides Banana Gun with a strong moat. As early investors in the Telegram Bot space, we have witnessed dozens of projects enter with strong capital and excellent founders, but none have been able to take market share from Banana Gun.

Banana Gun's valuable order flow gives it potential pricing power

Banana Gun is one of the most important participants in the order flow space. It is expected to send $50 million in priority fees and bribes to miners in 2024. According to "Decentralization of Ethereum’s Builder Market" (Yang 2024), Banana Gun plays a key role in about 40% of MEV Boost auctions. According to "Decentralizing Monopolistic Power in DeFi" (Markovich 2024), Banana Gun's order flow is the largest driver of profits for Titan, the second-largest miner on Ethereum.

Banana Gun does not charge for order flow, but we believe this will change over time. This could be through order flow auctions directly built into the Ethereum protocol or through direct transactions with miners. It is too early to speculate, but we believe that a significant portion of this $50 million will eventually be returned to Banana Gun's users. Banana Gun is both a profitable project and a protocol of systemic importance within the Ethereum ecosystem.

Solana + Web Application = Huge Market Opportunity

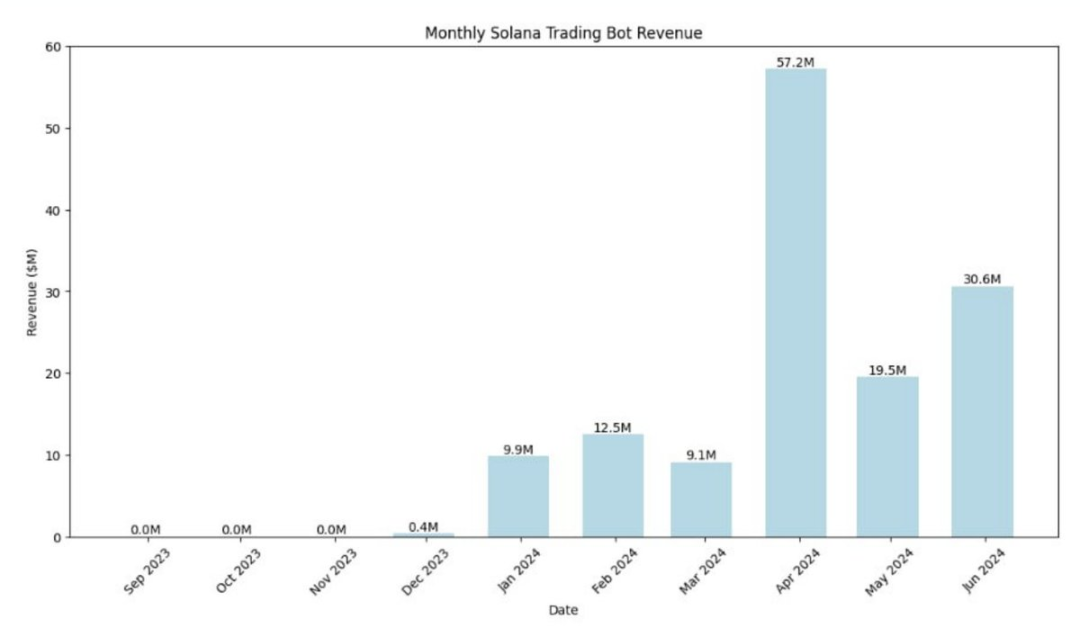

Banana Gun is launching its Solana features. For Telegram Bots, Solana is a more profitable market with less mature competition. It is estimated that Solana's YTD annualized revenue could reach $280 million. Trojan, a mature operator similar to Banana Gun, entered the Solana market earlier this year and is expected to generate over $100 million in revenue in 2024. While it is challenging to fully replicate Trojan's experience, Banana Gun can still carve out a niche on Solana.

Banana Gun is building its own web application. The idea is to create a web application that looks like Binance to users but operates entirely on-chain. Fully developing this product will take several years (as on-chain financial primitives need further improvement), but Banana Gun's team has already begun launching token trading through a feature-enhanced web application.

This is a massive market that should benefit from all the users and order flow we have discussed so far. In traditional markets, 40% of trading volume is completed through front-end tools, and we expect similar results on-chain. Ultimately, the Banana Gun team is focused on the same mission: to control as much high-value order flow as possible, whether on EVM or SVM, on Telegram or WebApp.

Fundamentals

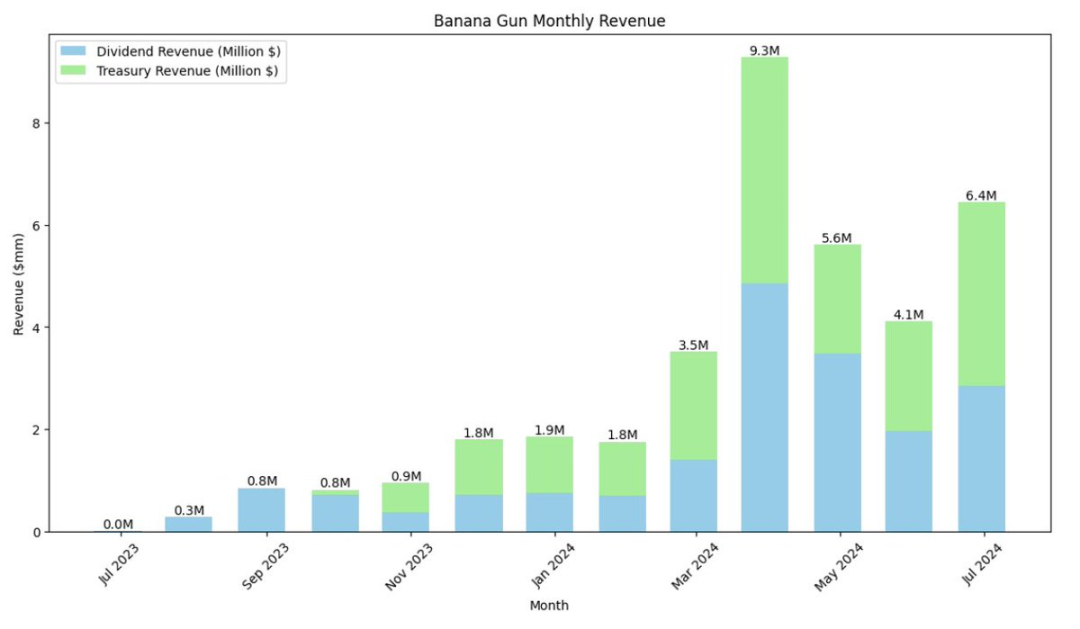

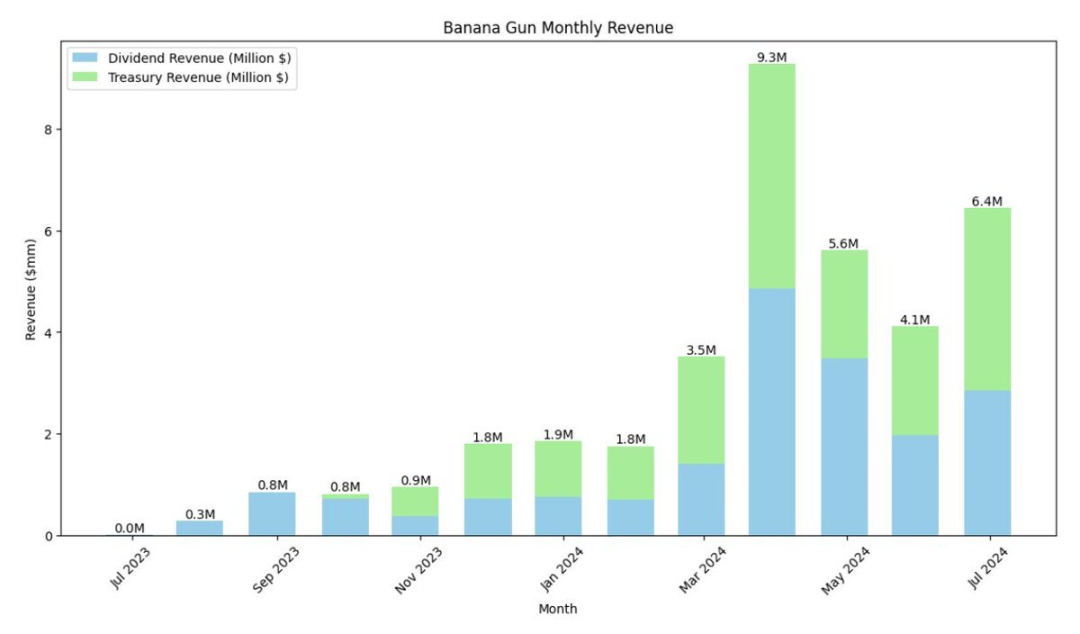

The Banana Gun team is thoughtful in its capital allocation. The company's operating income is $60 million, with 40% of the income returned as dividends to token holders, while the remaining 60% is reinvested into Banana Gun for growth plans and fee payments. However, it is believed that as the team accumulates more funds, they will return more rewards to users.

The team's design at TGE also explains, to some extent, the reasons for its success. When the team launched in 2023, they held 10% of the Banana Gun token supply, with half unlocking over five years and the other half unlocking over eleven years. This is precisely the distribution model the team hopes to use for long-term project development. The tokens unlocking over eleven years can also earn income, providing the Banana Gun team with more motivation to continuously increase revenue and distribute it to token holders. The TGE design is an important basis for Banana Gun's market capitalization.

Our perspective on market capitalization is that analysts should relate circulating market capitalization to time periods. If a project has a circulating market capitalization of $100 million, with an additional $900 million in fully diluted market capitalization that cannot be accessed for ten years, then there is no need to consider that additional $900 million. If a project has a circulating market capitalization of $100 million and $900 million in venture capital set to unlock in the next 18 months, then that additional $900 million must be taken into account. Most situations fall somewhere in between.

Banana Gun's fully diluted market capitalization is $690 million, but this figure includes about 64% of tokens issued to the treasury. This funding was issued during the early development of Banana Gun and is considered a strategic reserve. The team has consistently stated that they will burn these tokens upon unlocking, and approximately 26% of the tokens have already been permanently destroyed before the company generates substantial revenue.

We can adjust Banana Gun's market capitalization from approximately $690 million to $250 million, as only 35% of the tokens can be issued. This is a preliminary estimate. Then, we can add a margin of safety to the estimate and assume that Banana Gun will find effective uses for about 30% of the remaining funds. This leads to an adjusted market capitalization of $345 million. Based on this adjusted market capitalization, Banana Gun's trading price is approximately 5.75 times the earnings ratio (= $345 million / $60 million). This represents a significant price increase for the project after listing on Binance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。