Introduction

The market is ever-changing, and so are people's sentiments. The same price point can evoke different opinions depending on the trading atmosphere. While it is impossible to be right every time, my analysis is publicly available across the internet. Those who have been following my market analysis for a long time are well aware that in this market, survival of the fittest prevails. In the investment field (especially in the cryptocurrency space), the importance of knowledge determines the height of personal wealth. Only by mastering sufficient knowledge can one qualify as a winner and deserve high returns.

In recent days, market sentiment has been increasingly high. Besides mainstream currencies like Bitcoin and Ethereum driving market sentiment and retail operations, there are also other "concept" coins that stimulate market participation to varying degrees. Some people become overnight millionaires, while others lose everything overnight. The risks and profits often accompany significant capital involvement, causing the market's heat to soar once again.

The Story Behind the Price Increase

Today is Monday, and as everyone can see, after the market opened this morning, the entire financial market, including but not limited to A-shares, gold, and digital currencies, is leading an upward trend in their respective fields. Ultimately, this is due to the current tense international situation, which has led to various policies stimulating the stock market both domestically and internationally, and the escalating tensions between North Korea and South Korea have intensified market fluctuations.

As we all know, South Korea is the leading country in digital currency trading in Asia, with about 80% of people participating in this market. Therefore, their international situation will also have a certain degree of influence on the digital currency landscape.

From a long-term perspective, the fundamental data supports the development of Bitcoin and the entire cryptocurrency market. The fluctuations in the second half of the year are merely short-term manifestations. The current situation is quite intuitive; after Bitcoin experienced a significant correction, there hasn't been anything particularly eye-catching in the market. Although various institutions are offloading, the overall market remains optimistic.

Even some speculative funds focus on return rates. In the short term, Bitcoin's return rate is not high, and mainstream coins are suppressed by Bitcoin. Even if funds flow into mainstream coins, the upward potential is limited as long as Bitcoin continues to exert pressure, making it challenging to rally. Therefore, some other coins have become more appealing to investors.

In the end, regardless of any popular coin, it will not disappear but will continue to develop, although it may not always be in the public eye. Thus, it is worth keeping an eye on, as it may suddenly explode at some point, stunning the entire cryptocurrency asset market. This includes Bitcoin and Ethereum, which will play increasingly important roles in the cryptocurrency market.

Bitcoin Market Analysis on 10.14

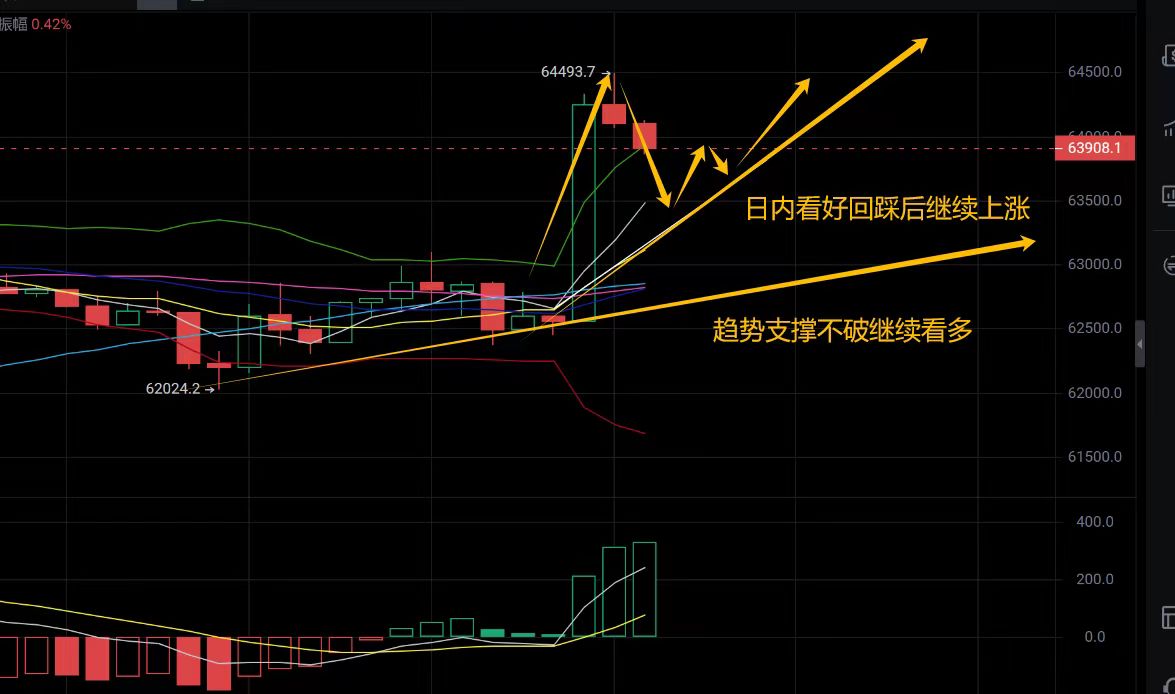

During the midday session today, Bitcoin suddenly accelerated upward without any technical breakthroughs, directly breaking through the previous resistance level of 63,500 and reaching around 64,500 before stopping. The strength of the entire upward movement has driven various levels of the market, forming different degrees of breakout signals. At this stage, we are just waiting for a stabilization period. If it maintains stability above 63,500 today, it is highly likely that it will continue to rise and challenge the resistance level of 65,000. However, in the short term, it is necessary to pay attention to slight pullbacks, so the intraday trading strategy suggests shorting first and then going long.

Bitcoin Trading Strategy Reference on 10.14

Short Position: You can open a light short position in the range of 64,300-64,500, with a stop loss at 64,800, and aim to exit in batches at 63,700-63,100.

High Short Position: You can continue to set up near 65,400.

Long Position: Enter a light long position on a pullback to 63,300-63,000, with a stop loss at 62,700, targeting 64,100-64,900 for batch exits.

Conclusion

I have always believed in a saying by Siddhartha Gautama. He said that no matter who you meet, they are the people you are destined to encounter, not by chance; their presence will teach you something.

I hope that you, who are reading this article at this moment, are lucky. Even if you have experienced some hardships, setbacks, or losses, that is already in the past. One cannot live in the past, can they? People must look forward; the road ahead may still be thorny, but as long as we work together, we can surely overcome obstacles and reach the shores of success!

In fact, the market can sometimes be quite simple, but to most people, it always seems unpredictable. There are two reasons for this: one is insufficient capital, and the other is inaccurate predictions! Capital determines your psychological tolerance levels and directly impacts your profits, not to mention the predictions about the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。