This month's key event is the Federal Reserve's interest rate cut of 50 basis points, which has brought optimism to the market and sparked a strong rebound in risk assets, including cryptocurrencies.

CoinEx Insight released a comprehensive report on the cryptocurrency market for September 2024. The crypto market is driven by significant policy changes and new technological developments. This month's key event is the Federal Reserve's interest rate cut of 50 basis points, which has brought optimism to the market and sparked a strong rebound in risk assets, including cryptocurrencies. This dovish stance is echoed by similar actions from the European Central Bank (ECB) and the Bank of England (BoE), reversing the previous market downturn, with Bitcoin leading this wave of increase.

Bitcoin's Bull Market Breakthrough

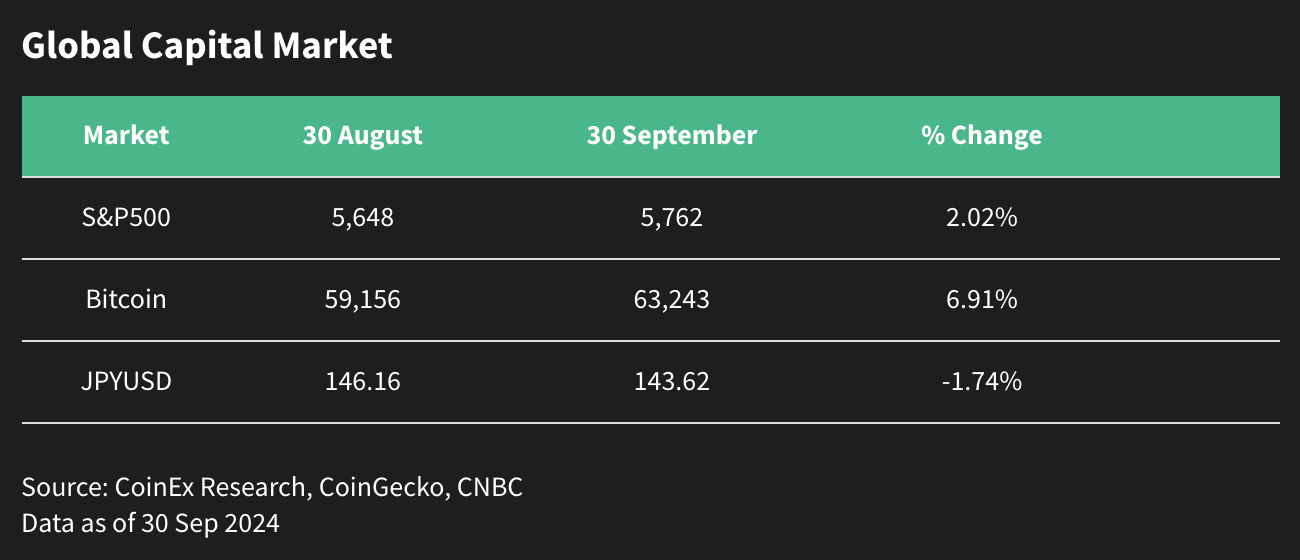

At the beginning of the month, Bitcoin's trading price was unstable, reaching a low of $52,700. However, after the Federal Reserve announced the rate cut, Bitcoin rose from $58,000 to a recent high of $66,000, ultimately closing at $63,300, an increase of over 20%. This rebound is reflected across the entire cryptocurrency market. Bitcoin is now targeting the key resistance level of $70,000, and the macro outlook for the remainder of 2024 appears positive, especially with the continued impact of Federal Reserve policies.

Recession Risks

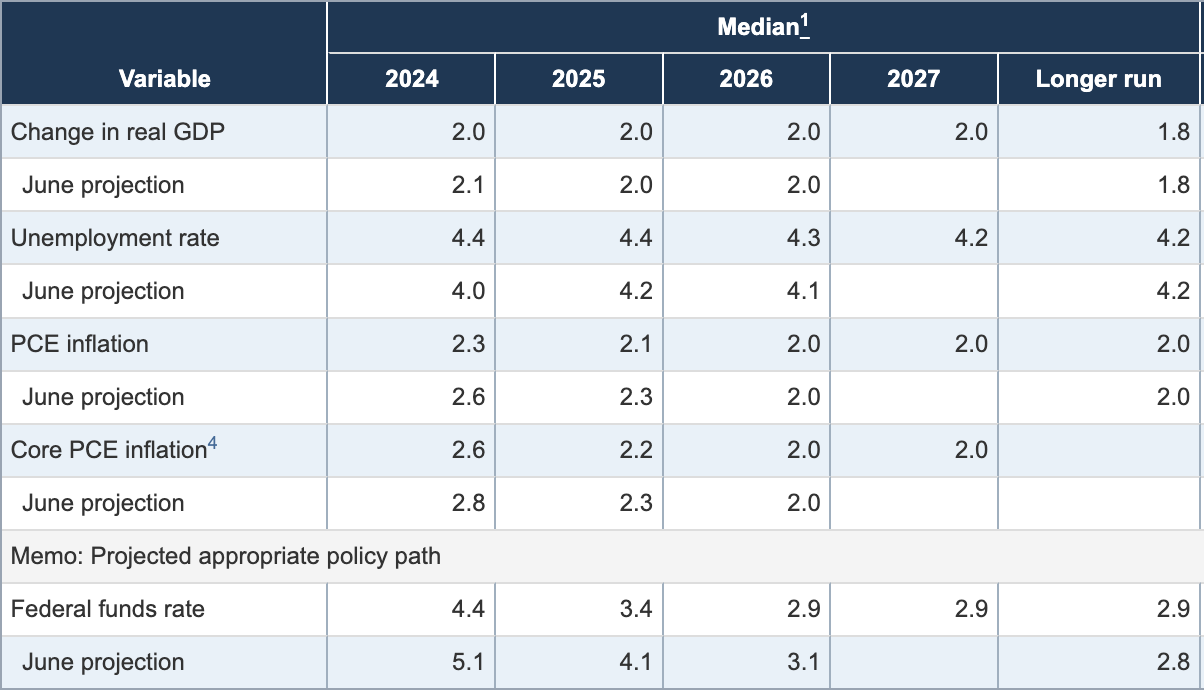

Global markets closely monitored central bank policies in September. Recent forecasts from the Federal Reserve indicate that GDP growth predictions for 2025 and 2026 remain unchanged at 2%, suggesting confidence in the economy's resilience to ongoing policy changes. Meanwhile, the inflation outlook remains manageable. However, with the expected rise in unemployment rates, the Federal Reserve's actions reflect that the labor market may face some pressure.

Source: Federal Reserve Data as of September 18, 2024

USD/JPY - Key Variables to Watch

However, market participants are closely watching variables such as the USD/JPY exchange rate, as continued interest rate hikes by the Bank of Japan could impact global liquidity.

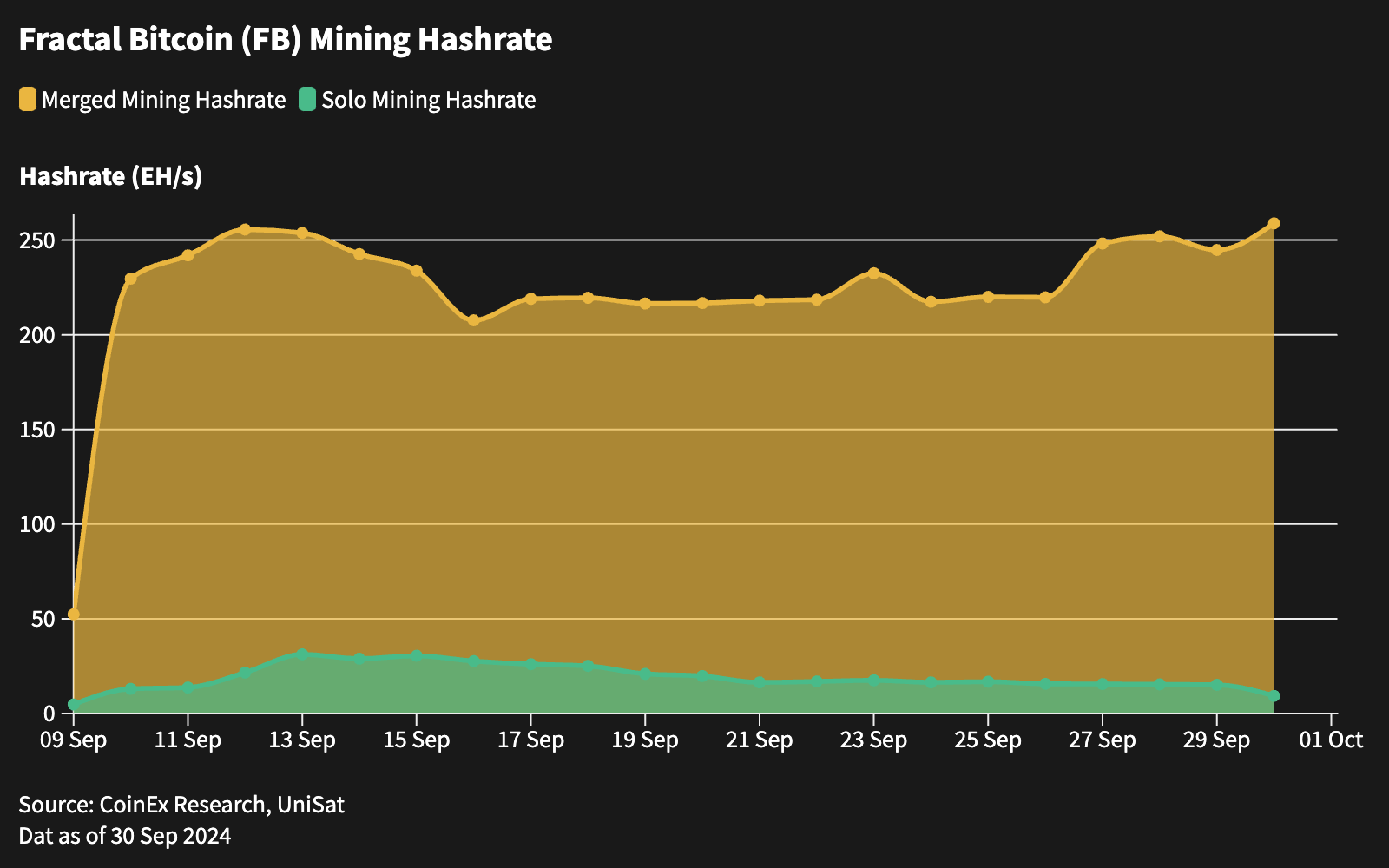

Technological Innovation: Fractal Bitcoin Mainnet

One of the most significant technological developments this month is the launch of the Fractal Bitcoin mainnet on September 9. Fractal Bitcoin is a Layer 2 solution that enhances Bitcoin's transaction efficiency while maintaining compatibility with the main Bitcoin network. It allows for expanded functionalities, such as the OP_CAT opcode, enabling developers to test new features without disrupting the core system. This innovation has made Fractal Bitcoin one of the top three proof-of-work chains by computational power, supported by the ViaBTC mining pool, with CoinEx being the first exchange to list its native FB token.

For CoinEx's analysis of Fractal Bitcoin, see “Fractal Bitcoin: The Pioneering Network of Bitcoin - Analysis of Technical Innovation and Challenges”.

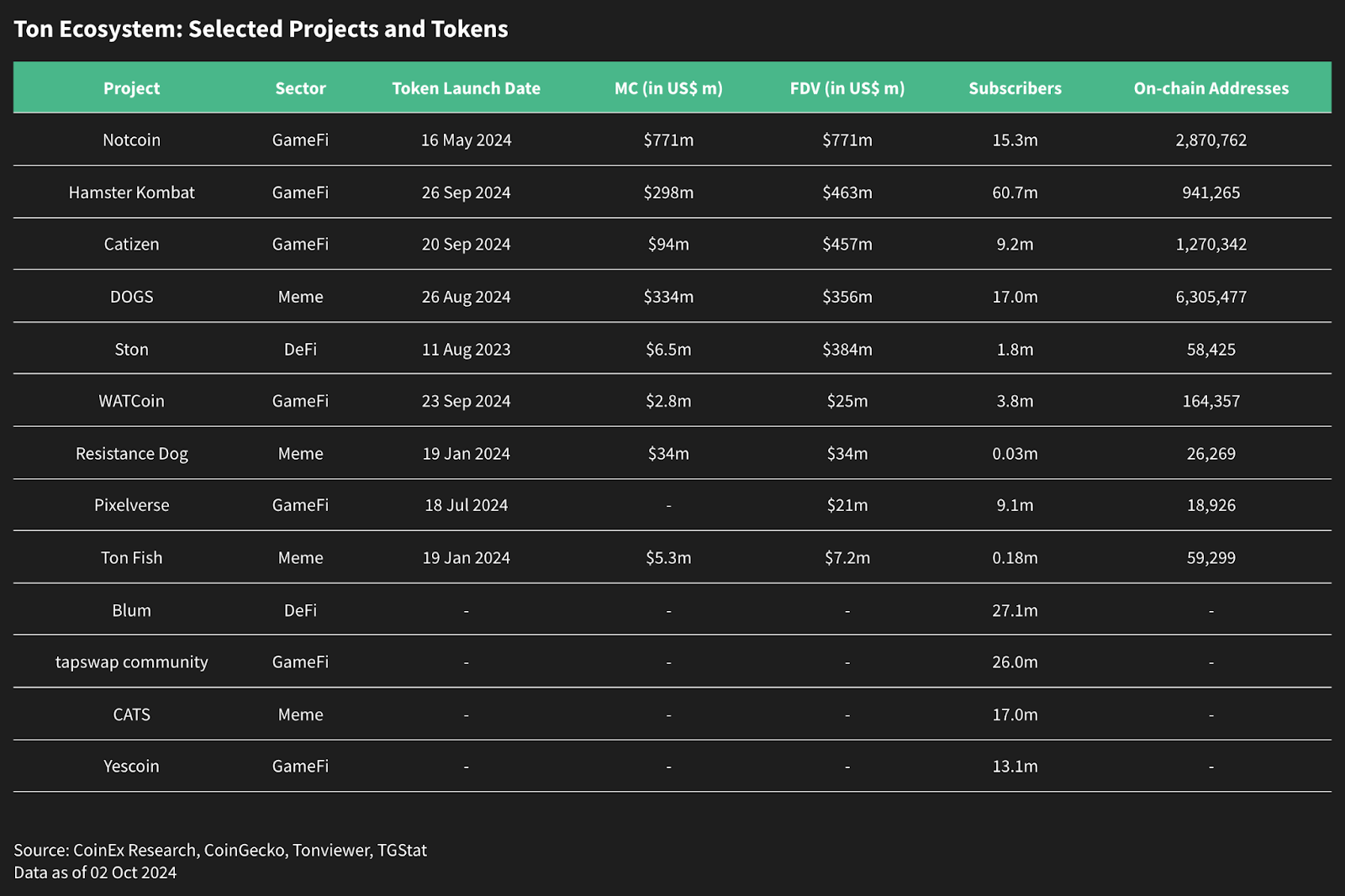

Challenges Facing the Ton Ecosystem

Despite the optimism in the crypto market, the Ton blockchain faces challenges with its new tokens CATI and HMSTR. These two tokens have performed poorly since their launch, declining by 55% and 35%, respectively. Concerns about the sustainability of the "click-to-earn" model may limit the appeal of similar projects due to market saturation. The future of the Ton ecosystem will largely depend on its ability to provide a unique value proposition to sustain long-term growth.

Meme Token Craze Driven by Social Media

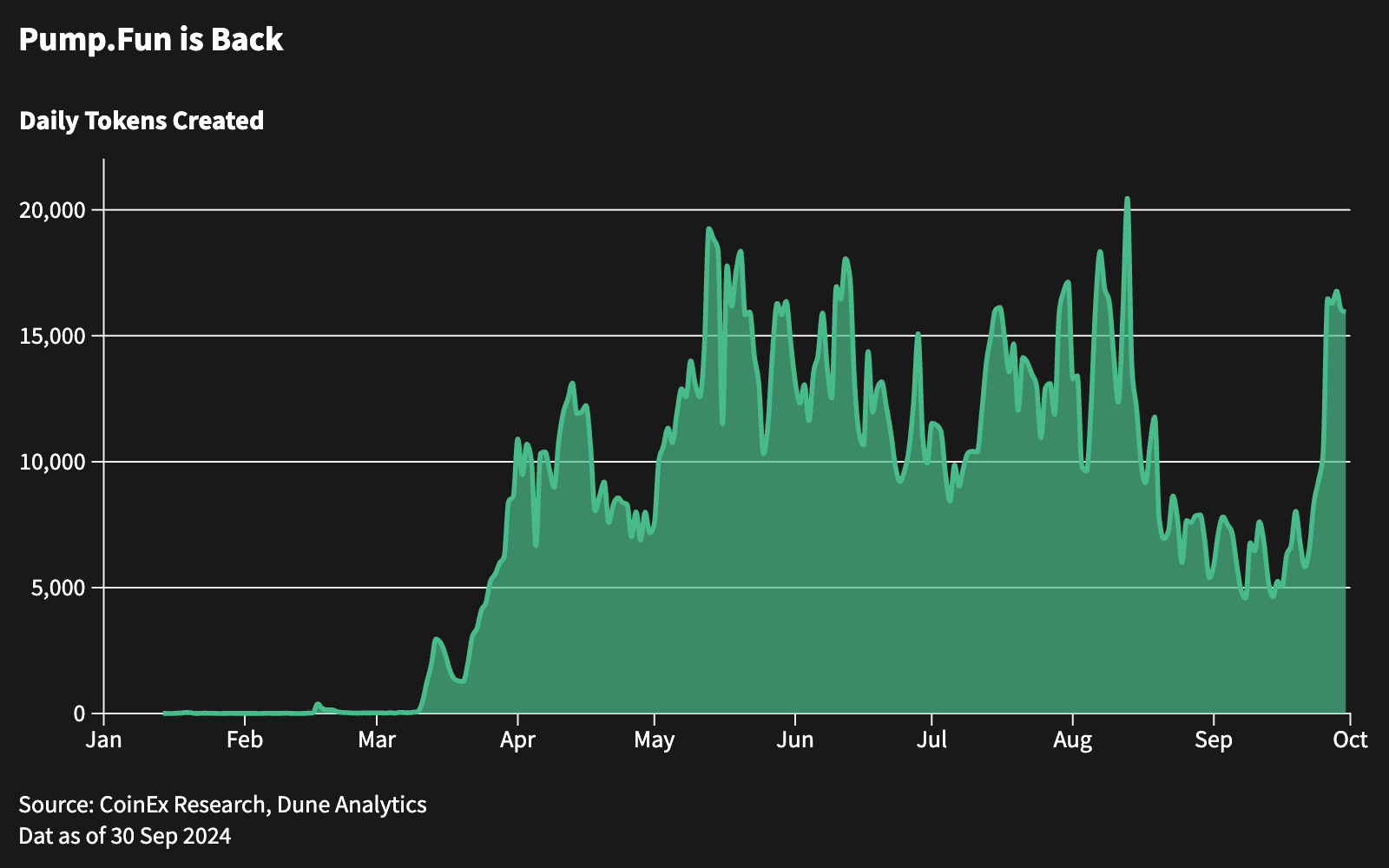

September also witnessed a resurgence of meme tokens, driven by viral trends on social media. Animal-themed tokens, such as the Thai dwarf hippo Moo Deng, penguin (PESTO), and frog (OMOCI), sparked speculative interest, particularly on the Solana blockchain. Daily token creation levels on Pump.Fun have rebounded to highs seen earlier this year. While meme tokens have garnered attention, they are highly volatile, and investors are advised to remain cautious amid the hype.

Looking Ahead: Economic Data and Market Sentiment

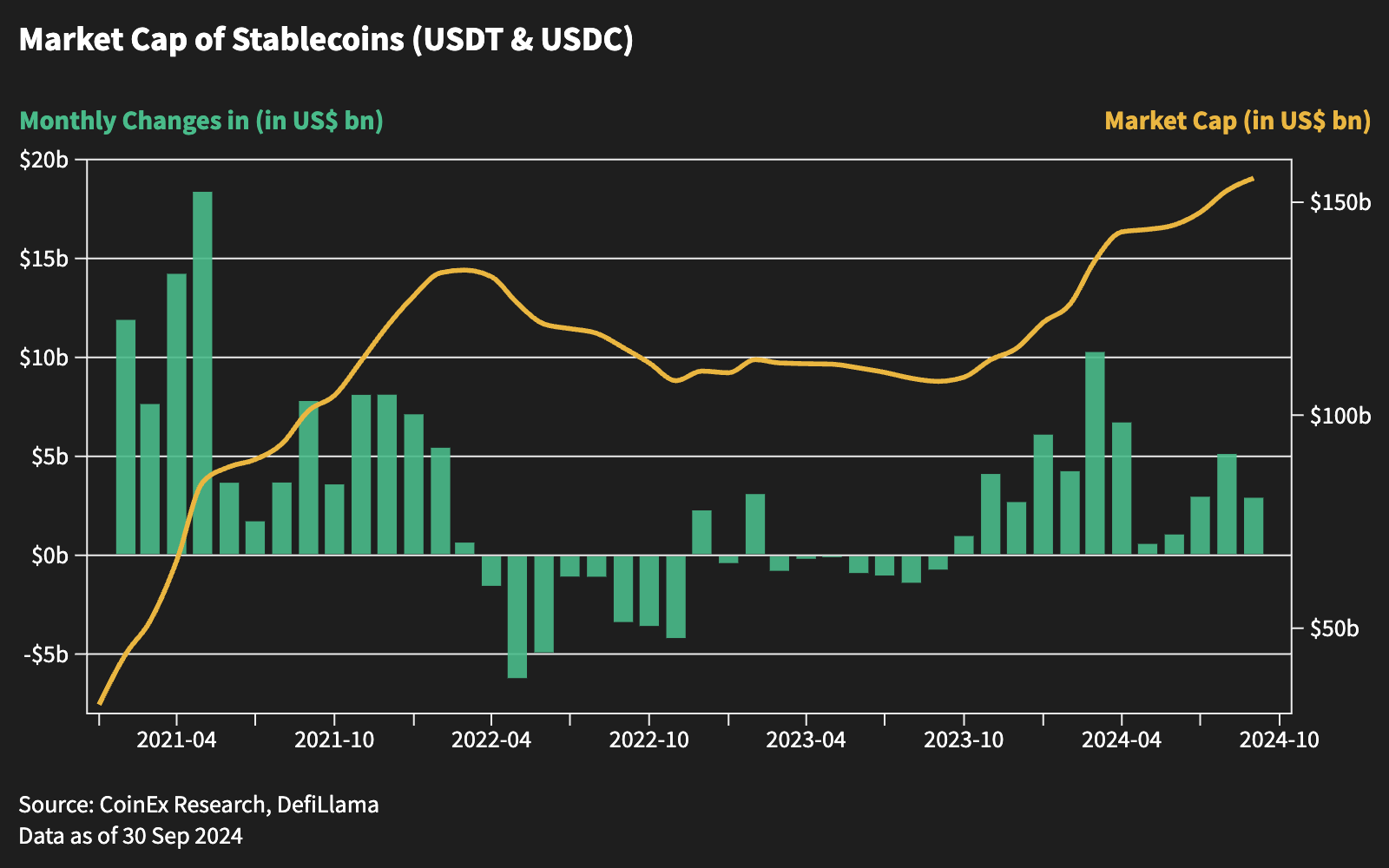

Despite a slowdown in stablecoin inflows, September ended with $2.9 billion, reflecting ongoing investor confidence in the market. As October unfolds, market participants will closely monitor economic data and the U.S. elections, which may bring the next wave of activity to the crypto space.

In summary, September 2024 was a pivotal month for cryptocurrencies, with macroeconomic policies, technological innovations, and speculative trends playing significant roles in shaping market direction. With global monetary policies becoming more accommodative and technological advancements, the outlook remains optimistic as we move toward 2025.

About CoinEx

CoinEx was established in 2017 and is a global cryptocurrency exchange dedicated to simplifying crypto trading. The platform offers a variety of services, including spot and futures trading, margin trading, swaps, automated market makers (AMM), and financial management services, serving over 10 million users across more than 200 countries and regions. Since its inception, CoinEx has adhered to a "user-centered" service principle. With sincere intentions, it cultivates a fair, respectful, and secure crypto trading environment, enabling individuals of all experience levels to easily enter the world of cryptocurrencies with user-friendly products.

CoinEx Research is committed to providing in-depth analysis and insights to help investors navigate the ever-changing cryptocurrency market, uncovering complexities and opportunities for the future.

To learn more about CoinEx, please visit: Website|Twitter|Telegram|LinkedIn|Facebook|Instagram|YouTube

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。