Profitable trading can sometimes yield returns more quickly, and the internal rate of return (IRR) may also be higher than that of durable trading.

Author: Social Graph Ventures

Translation: Deep Tide TechFlow

This article discusses the criteria we use for venture capital assessment at Social Graph Ventures. I refer to it as the durability and profitability assessment criteria for tokens, which is unique to cryptocurrency venture capital because token generation events can achieve early liquidity.

Currently, 95% of the crypto transactions we are involved in include token warrants, Simple Agreements for Future Tokens (SAFT), or some legal terms that clarify how early investments convert into tradable tokens when the company decides to launch.

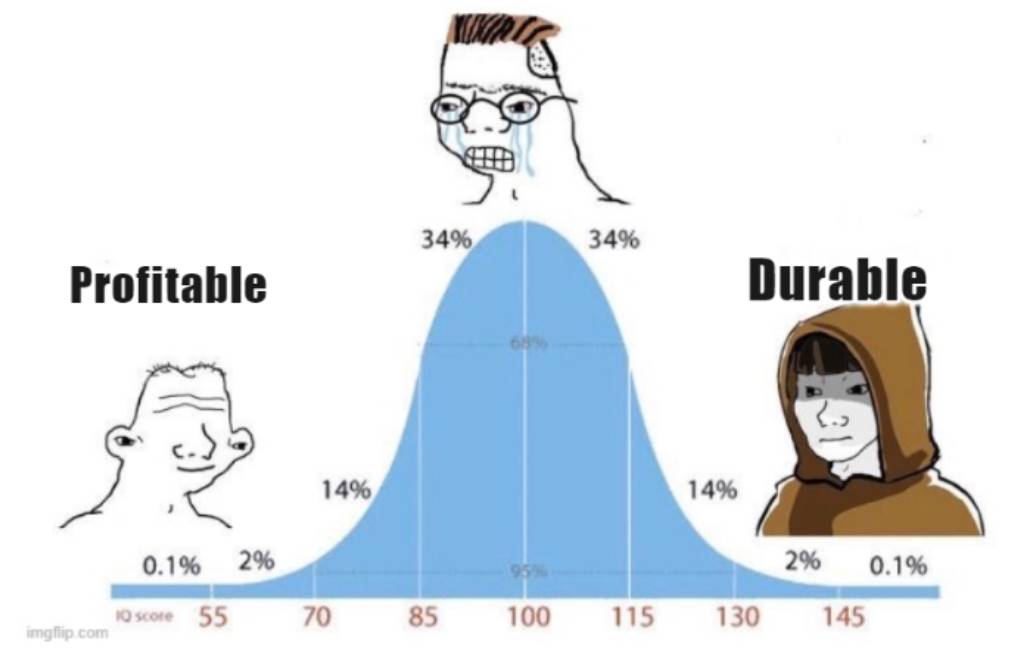

Our method for assessing these token risk trades is: either durable or profitable.

Durability

Durability investment theory refers to the ability of a token's value to remain stable over time. This means the project has a clear path to create a sustainable revenue stream that can value the underlying token. The token possesses a flywheel effect that aligns stakeholders. The token governs the use of this revenue and derives value directly from it while controlling the project's future. This is a very elegant model. Sometimes, a durable theory does not even require the issuance of a token.

When evaluating durability theory, you should ask yourself:

Do I believe these founders are fulfilling their life mission? Will this become their lifelong career? What has happened in their lives that puts them in this position?

Does the current product have a clear appeal that can demonstrate a stable revenue stream now or in the future?

Is there a token model flywheel that can accelerate the project's development path and remain sustainable in 10 years? There are many more, but these are fundamental. If the answers to these questions are affirmative, then you have a durable project.

Profitability

On the other hand, we have profitability theory. In this case, as an investor, you need to assess the potential exit value of the token once it goes live.

The representative of this theory is memecoins. These tokens have no income to support them. Their value relies on attention, community, and speculation. Their value is highly volatile, and aside from a few memecoins (or NFTs) with strong brand value, there is little reason to believe they have durability.

In similar fields, there are some "utility token" projects where these tokens do not have a clear logic to explain how cash flow is tied to them. Companies may generate cash flow, but this cash flow may all or partially flow to equity holders. This dichotomy makes these digital assets very ambiguous and difficult to price.

When evaluating profitability theory, you should ask yourself:

Can the team create a strong brand and community?

What is the token unlock plan for this deal for me and others?

What is the story behind it, and how long will it last after the token unlock?

At what valuation am I investing, and what valuation do I think it will trade at during the TGE and at different points in time?

Comparison of Durability and Profitability

Clearly, assessing durability is more challenging than assessing profitability. Both can bring returns to your portfolio, which is the dilemma. Complicating matters, profitable trades can sometimes yield returns more quickly, and the internal rate of return (IRR) may also be higher than that of durable trades.

This is similar to value investing and trend investing in traditional finance, but at an earlier stage, where market efficiency is lower and legal gray areas are prevalent.

We hope our portfolio can consist entirely of durable projects, but this is difficult to achieve; missing a profitable trade at the time may not be a wise choice. The opportunity cost of profitable trades in the cryptocurrency space is very high. This is why we see many "VC tokens" experience booms and busts. It is also why those who enter the market earlier profit the most, while latecomers often gain nothing.

In summary: We strive to make your portfolio as durable as possible, but we will not give up on those "left-brain" trades that may bring profits to the portfolio. (“Left-brain” trades typically refer to investment decisions based on logic, analysis, and data-driven approaches.)

This article is for informational purposes only and does not constitute advice to buy or sell securities or pursue any specific investment strategy. This article should not be used as a basis for evaluating any investment or any specific investment strategy. You should consult your own advisors regarding the business, financial, tax, legal, and all other relevant matters concerning any investment. The views expressed in this article reflect the author's current opinions and do not necessarily represent the views of Social Graph Ventures LLC.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。