Author: Jake @ Antalpha Ventures, Blake @ Akedo Games, Jawker @ Cipherwave Capital

Introduction

Games cannot be made well by simply following a "this then that" approach; games that are created in one go are unlikely to withstand the long-term tests of the market. This series of analytical articles on Web3 games will examine the long-term stable development of the Web3 gaming field from the perspectives of tokens and economic systems, core mechanisms and gameplay systems, industrial production and creation (art and programming), testing and operations, analyzing the segmented parts of Web3 games in different chapters. Among these, the content on core mechanisms and gameplay systems will be treated as internal documents and will not be publicly published for the time being. Authors welcome individual communication regarding this part.

This series of articles aims to logically organize Web3 games rather than simply listing and piling up information. Web3 gaming is a sector with strong content and consumption attributes. The author adheres to the principle of "it doesn't matter if it's a black cat or a white cat; a cat that catches mice is a good cat," analyzing Web3 games calmly and objectively from multiple angles, refusing to be swayed by superstition, authority, prohibitions, slogans, ideologies, biases, and emotions. Based on the assumptions of a free market and Hayek's thoughts, the views and reflections in this article are for research and analysis purposes only, for readers' reference, and do not constitute investment advice. Investment carries risks, and caution is advised when entering the market. For any other questions related to Web3 games, feel free to contact Jake, Blake, or Jawker via Twitter for discussion.

This article is the first in the Web3 Gaming analysis series: Tokens and Economic Systems. Although numerical aspects will be covered in the next article on core mechanisms and gameplay systems, the token and economic system is increasingly important due to the deposit and withdrawal attributes of Web3 gaming, thus it is analyzed separately in the first article. An excellent token and economic system can enhance a game, but it cannot provide essential support in times of need. Some thoughts and theories in this article can extend beyond gaming and can also be applied to other types of crypto applications.

Token Categories and Attributes

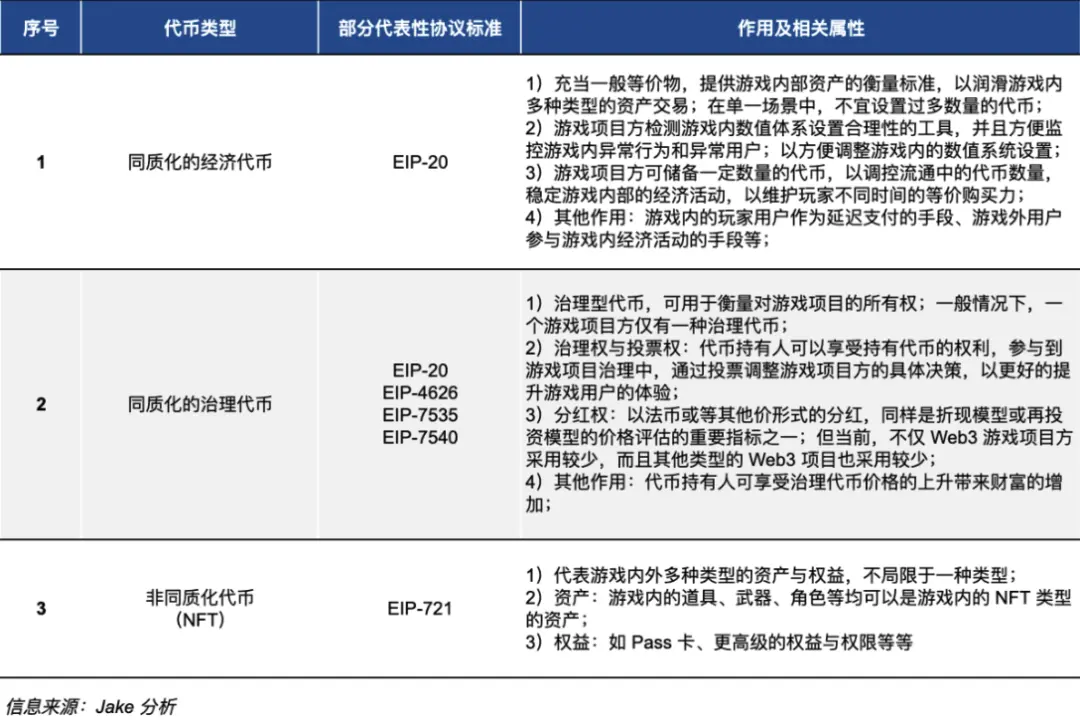

It is generally believed that there are two main types of on-chain token asset issuance: one is fungible tokens (such as those supported by the ERC-20 standard), and the other is non-fungible tokens (such as those supported by the ERC-721 standard). In practical applications, Web3 games have different demands for different types of tokens, and various types of fungible and non-fungible tokens may be used in games. Tokens, as symbols of credit on the chain, do not directly create wealth; they can only facilitate the transfer of wealth, with the direction and duration of transfer depending on the attributes of money and patience. Chips and assets will have unique attributes and positioning, ultimately relying on asset narratives or assumptions. The attributes of funds determine what kind of narratives and assumptions they will pay for. The table below lists some potential types of tokens needed in Web3 games, including fungible economic tokens, fungible governance tokens, and non-fungible tokens.

Game developers can adopt various types of fungible and non-fungible tokens, but it is important to note that when it comes to tokens in Web3 games, the number of tokens issued is not a standard for measuring a game developer's economic model. High-quality developers can effectively manage the in-game economic system using a single token, and there is no need to adopt a dual-token or even multi-token economic model. At the same time, it is worth noting that the right to issue assets is sufficiently tempting and can lead Web3 game developers to become addicted; unlike stablecoin issuance (where stablecoin developers have diverse collateral reserves and are subject to strict collateral limitations), Web3 game developers issue assets without anchors, relying on the development expectations, cash flow, and credit of the Web3 game. If developers abuse the right to issue assets, it can lead to a relative decline in the prices of assets both inside and outside the game, harming players' purchasing power and asset rights, and affecting the experience of consumer-level users. Game developers should use the right to issue assets cautiously.

Based on the above analysis, different types of tokens require different analytical methods. Below is a brief analysis of three types of assets:

Fungible Economic Tokens

Similar to the systems of points, gems, coins, and silver coins in traditional games, fungible economic tokens in Web3 games serve similar roles in different subsystems: providing a standard for measuring asset prices within the game and facilitating transactions among users within and between different subsystems. In practice, a single economic token is often used within the same subsystem rather than a dual-token or multiple types of tokens; otherwise, developers must constantly maintain the equivalent purchasing power of multiple tokens for the same game asset. Therefore, for developers, there is no need to add extra work to maintain exchange rate stability among multiple tokens within a single subsystem, so a single token should be issued for that subsystem. Additionally, if developers can use a single token to maintain and facilitate transactions across multiple subsystems, issuing extra tokens would be entirely unnecessary. For the same type of NFT assets, if multiple fungible economic tokens are issued to match and trade with them, it can confuse players; since the purpose of economic tokens is to facilitate transactions, if issuing economic tokens contradicts this purpose, it is completely unnecessary.

In the application of this type of token, game developers should strive to avoid significant fluctuations in the prices of economic tokens within the game. If there are sharp changes in asset prices measured by token price standards, consumers' purchasing power will experience drastic changes, affecting their gaming experience and driving consumer-level users out of the market; if the market experiences sharp fluctuations and the trading pool is deep enough, it will attract arbitrage institutions, hedge funds, quantitative trading institutions, and other types of entities into the market. The ultimate outcome of this situation would be that Web3 games become mere shells, with the real "players" being institutional users rather than consumers. Of course, Web3 game developers can choose to settle and trade with stablecoins pegged to the US dollar, but in this case, it can be seen as transferring part of the "minting power" to the outside, and it can also be viewed as an expansion of US dollar credit on-chain. If the general equivalent of settlement and trading fluctuates or even collapses, it will lead to the collapse of the internal economy of Web3 games. In an ideal situation, the purchasing power of the economic tokens issued by Web3 developers and fiat currency for in-game assets should remain within a controllable range, and the average annual depreciation rate can be maintained between 2% - 4%.

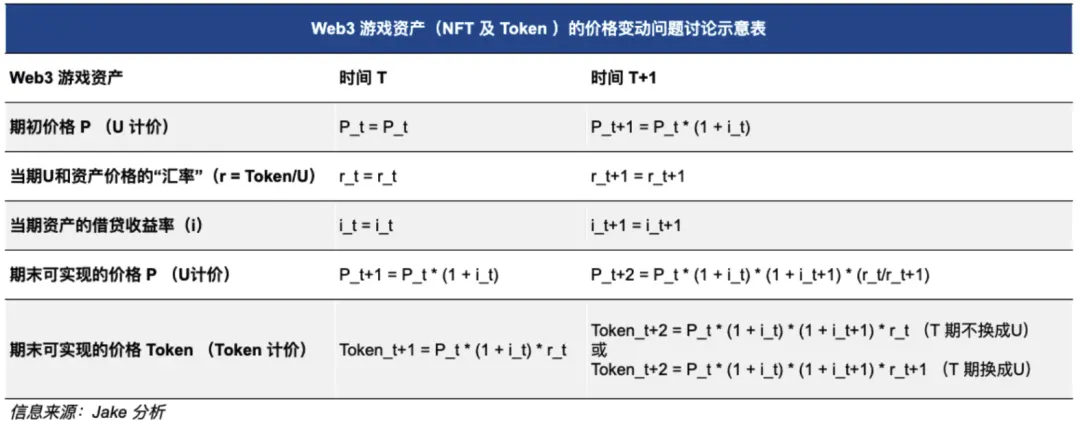

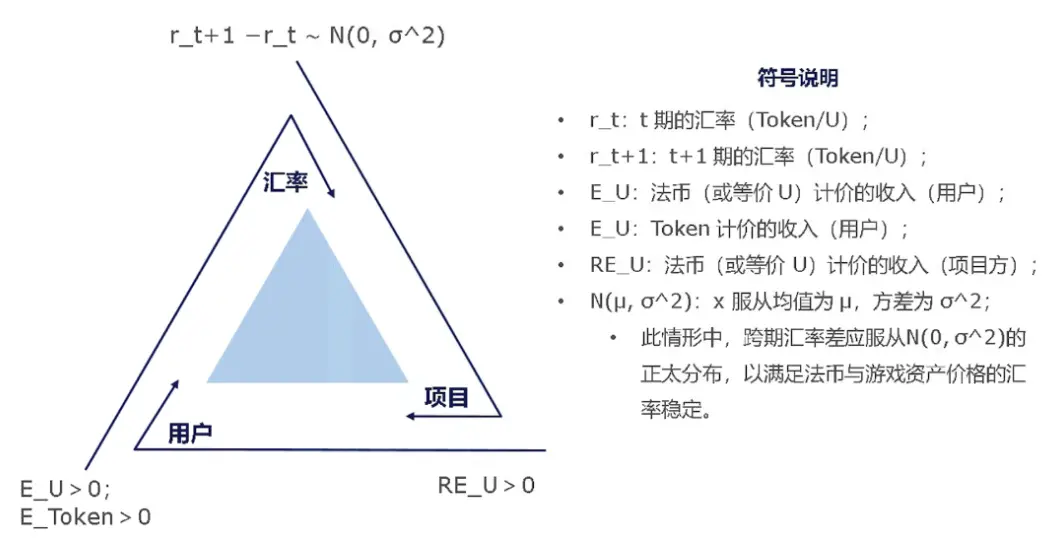

As shown in the figure above, based on current asset issuance and lending agreements, Web3 game assets are influenced by various factors such as lending rates and the "exchange rate" of deposits and withdrawals. To stabilize consumer confidence in their game and assets, the initial price of Web3 game assets, the price at time T, and the price at time T+1 should not fluctuate too much; otherwise, it will severely impact consumers' gaming experience and confidence, attracting arbitrage groups to "buy low and sell high" on game assets. From the perspective of USD (or equivalent U) valuation, the price fluctuations of Web3 game assets are related to the forward lending rate (), the spot "exchange rate" level (), and the forward "exchange rate" level (). Therefore, to maintain the equivalent purchasing power of game assets against USD assets (or equivalent U), Web3 game developers should strive to keep the equation of the spot and forward exchange rates () and the forward lending rate () in a relatively stable state, with fluctuations representing the "asset minting tax" imposed by Web3 game developers on game assets, i.e., the rate of inflation. When the product of the forward lending rate and the spot exchange rate ( → ) approaches zero, inflation can be expressed as the ratio of the difference between the spot and forward "exchange rates" () to the forward "exchange rate" (). This can be represented by the equation:

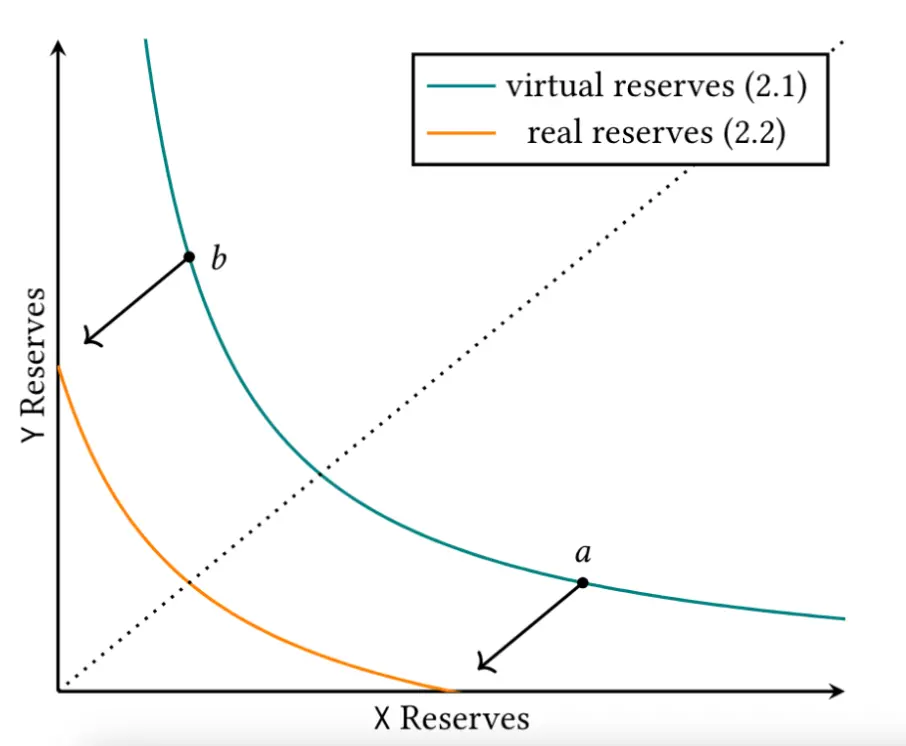

π

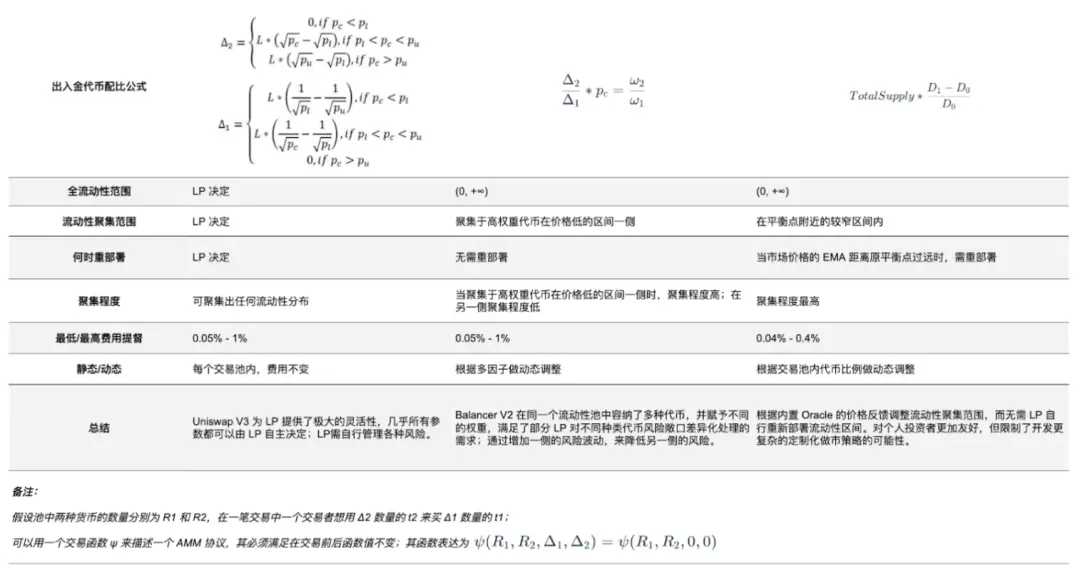

For the issuance and regulation of fungible economic tokens, Web3 game developers can adjust their economic token models based on traditional monetary issuance theories. Reference books include Monetary Economics by Peter Howells and Keith Bain, Monetary Economics: Theory and Policy by Carl E. Walsh, Monetary Economics by Ben Bernanke, Michael Woodford, and Jordi Gali, and Monetary Policy Frameworks: A Synthesis by Frederic S. Mishkin. Additionally, by referencing Uniswap's AMM constant product mechanism, game developers can adjust the circulation quantity and price of economic tokens through the mechanism shown in the following diagram.

Source: Uniswap V3 White Paper

When using Uniswap, developers need to create trading pairs and inject sufficient liquidity into those pairs. In the new version V3, due to different liquidity densities in different price ranges, it is necessary to calculate each small interval of the same liquidity density separately. When crossing the boundary of an interval, similar calculations are needed for the next interval. Game developers can adjust the price to the target price range based on these calculations. However, when using Uniswap, developers need to pay attention to effective versus actual liquidity. When the price moves away from the position interval, the liquidity of that position will no longer be active, and no fees can be earned. At that price point, liquidity will consist entirely of one type of token, as the other token will be exhausted. If the price re-enters the interval, liquidity will become active again. At the same time, Web3 game developers can choose products from other AMM mechanism products; below is a horizontal comparison of AMM mechanism products. (This can also be applied to other types of fungible tokens)

Source: Altonomy Ventures Research; Jake's整理分析

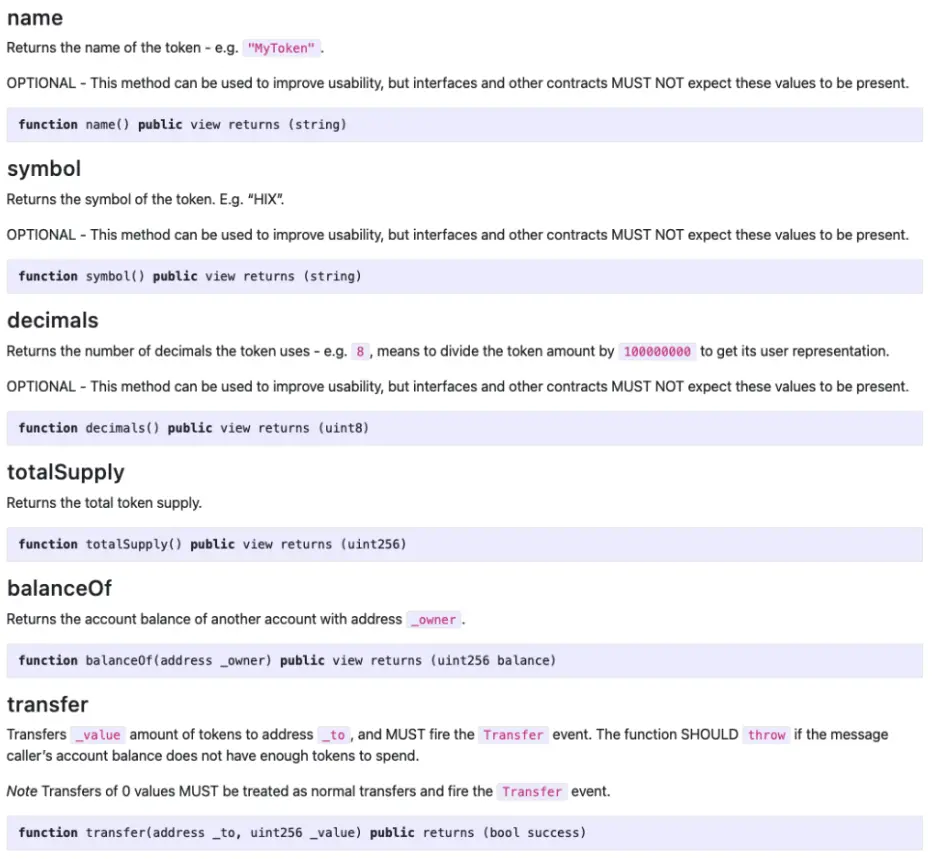

However, it is important to note that if the game developers put internally circulating tokens on-chain, their ability to regulate the internal economic system will be limited. As shown in the figure below, due to the parameter settings required by the ERC-20 protocol standard, there is a maximum limit on the number of tokens that can be issued. Therefore, when reaching this limit, the game developers will not have enough tokens to regulate the quantity of circulating tokens, ultimately losing control over the price of the economic tokens.

Source: Ethereum Improvement Proposals (ERC-20)

Although the holder structure of economic tokens may experience significant price fluctuations during bull and bear market cycles, if the game developers have sufficient token reserves, they can stabilize the price fluctuations of economic tokens to some extent.

Fungible Governance Tokens

Generally, holders of fungible governance tokens enjoy rights such as proposal rights, voting rights, and dividend rights. At the same time, Web3 game developers can divide the rights of governance tokens, allocating proposal rights, voting rights, and dividend rights into different sub-tokens; or use assets like NFTs to grant different permissions. The following will analyze several aspects of governance tokens.

Regarding proposal rights and voting rights, addresses holding a certain proportion of governance tokens have the right to exercise proposal rights, participate in company governance, and influence the company's development direction, while other token-holding addresses can amend, vote on, and reject the proposal. This creates a positive feedback loop, guiding the game project in a direction preferred by the market. However, for game developers, it is necessary to treat proposal rights and voting rights with caution to prevent the proliferation of democratic politics and the abuse of rules, avoiding situations where a minority's democracy leads to the tyranny of the majority. Since it cannot be guaranteed that everyone has a sufficiently deep and correct understanding of the project and its future development, developers should strive to avoid excessive dispersion of governance tokens in the holder structure; in the design of the token structure, developers should allocate governance tokens to addresses that have a profound understanding and are beneficial to the project's development. If a tyranny of decision-making by a minority occurs, and the majority of addresses blindly follow, it will amplify the rights of the minority, echoing He Shen's saying: "Today the emperor killed Wang Danwang, and the people of Hangzhou cheered; if tomorrow he kills Lord Ji, the people of Hangzhou will cheer just the same."

Regarding dividend rights, in traditional financial systems, project valuation can be conducted using dividend discount models and dividend reinvestment models related to dividend rights. However, in the Web3 world, there is a lack of sufficient practices from developers based on fiat currency dividends; in the current market, if Web3 game developers offer dividends, most will be in the form of governance tokens. However, this can lead to selling pressure on governance tokens, and the declining price of governance tokens can trigger pessimistic market sentiment, leaving a negative impression of the developers. Therefore, in the current market, project valuation can only be conducted through relative valuation methods; however, in practice, since developers have not disclosed all their financial and operational information, and even if disclosed, it is not audited, the relative valuation method, while usable, remains of low credibility. Thus, in the current situation, there is a lack of strong and credible valuation models for the price of governance tokens and comprehensive assessments of projects; from this perspective, governance tokens are to some extent a type of memecoin linked to the developers.

To avoid a complete memecoin situation, there are protocol proposals similar to dividend rights in the current Ethereum protocol proposals that developers can refer to, such as ERC-1726 (closed), ERC-4626, ERC-7535, and ERC-7540. Ideally, developers can adopt one of these standards to distribute fiat currency (equivalent to U) dividends proportionally to addresses holding governance tokens. Other on-chain asset categories, such as on-chain bonds and assets, staking rewards, treasury bills, and other similar on-chain assets, can also adopt similar standards. It is undeniable that in the evaluation systems of off-chain and on-chain assets, cash flow-based valuation systems remain one of the most effective valuation methods.

Similar to economic tokens, during bull and bear market transitions, the holder structure of governance tokens will also affect the price level of governance tokens; if the holder profile of governance tokens is value-oriented, long-term oriented, or insensitive to price fluctuations, the price drop during bull and bear transitions will be relatively low; the specific fluctuations and timing still need to be determined based on the token holding structure.

Non-Fungible Tokens (NFTs)

Non-fungible tokens generally refer to the assets issued by Web3 game developers, including but not limited to avatars, pets, equipment, items, and other types of assets. These types of assets are generally supported by protocols such as ERC-721 and ERC-1155. Regarding non-fungible tokens, my previous work NFT Revolution: Exploring Protocols, Valuation, and Business Models provided a detailed analysis of NFT protocols, valuation methods, and business models. For Web3 game developers, the token economics of NFTs still need to pay attention to the following points.

First, similar to economic tokens, NFTs in Web3 games need to have consumption and usage scenarios. Without consumption and usage scenarios, NFT assets will become "meme NFTs" related to the game developers. Similarly, the structure of NFT holders will affect the price fluctuation range of NFTs. Especially during bull and bear transitions, arbitrage users are more willing to abandon their "chips" than consumer users. Different consumer preferences will drive different types of user groups to behave differently.

Additionally, in the current situation, the pricing method for buying and selling NFTs differs from the AMM trading system for fungible tokens. Pricing can be relatively subjective, and for developers, it is impossible to directly build a trading pool for users to trade. Therefore, in the current situation, an Orderbook trading format is adopted. Limited by trading efficiency and the psychological expectations of both parties, Orderbook trading needs to balance liquidity and price slippage. For Web3 game developers, if all parameters of NFTs can be utilized in the game, then the price of the same type of NFT asset should theoretically be linked to the parameter settings, meaning the price should be a function of the various parameters of the NFT. However, due to the current lack of relevant protocols and middleware, the following will propose some conceptual optimization solutions for NFT trading in Web3 games.

Profitability and Consumption of Web3 Games

Regarding the profitability of Web3 games, many Web3 users believe that playing Web3 games is a way to make money, even simulating yield curves, but they have not clearly identified significant sources of profit. Without a source of profit, users rushing in are likely to become a source of profit, turning into counterparties of profit sources. Earning in Web3 games is possible, but one should not rely on the Play-to-earn economic model for profit (in the form of fiat currency or U). As mentioned earlier, tokens, as symbols of credit on the chain, do not directly create wealth; they can only facilitate the transfer of wealth, with the direction and duration of transfer depending on the attributes of money and patience. Chips and assets will have unique attributes and positioning, ultimately relying on asset narratives or assumptions. The attributes of funds determine what kind of narratives and assumptions they will pay for. Developers, as counterparties to player users, are both the rule-makers and the "players" holding a large amount of "chips," making it difficult for ordinary players to compete directly with them. The following is a brief analysis of the types of profit sources.

Demand for Tokens

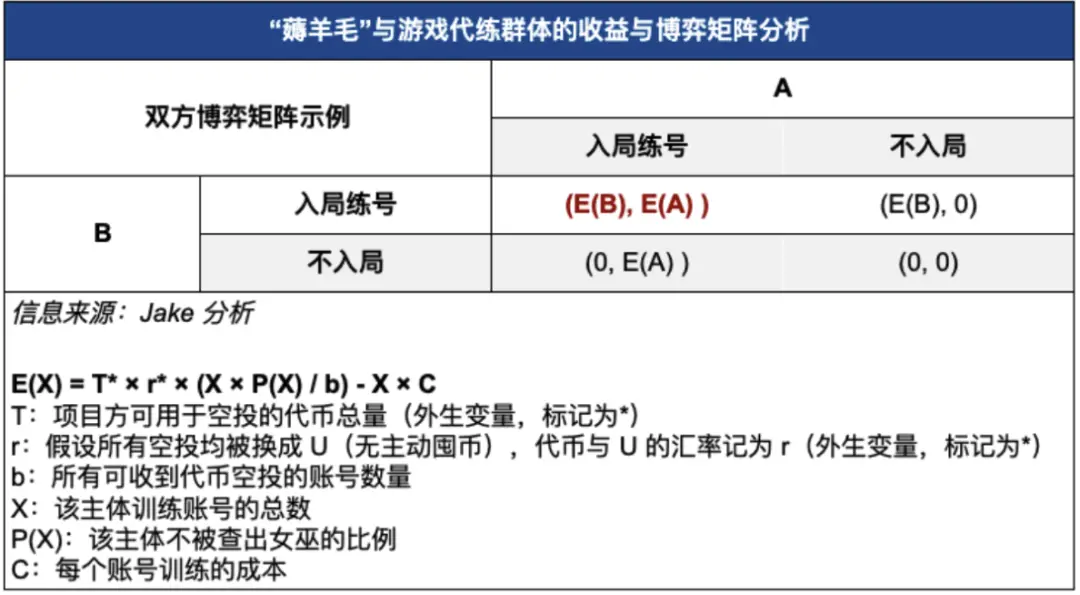

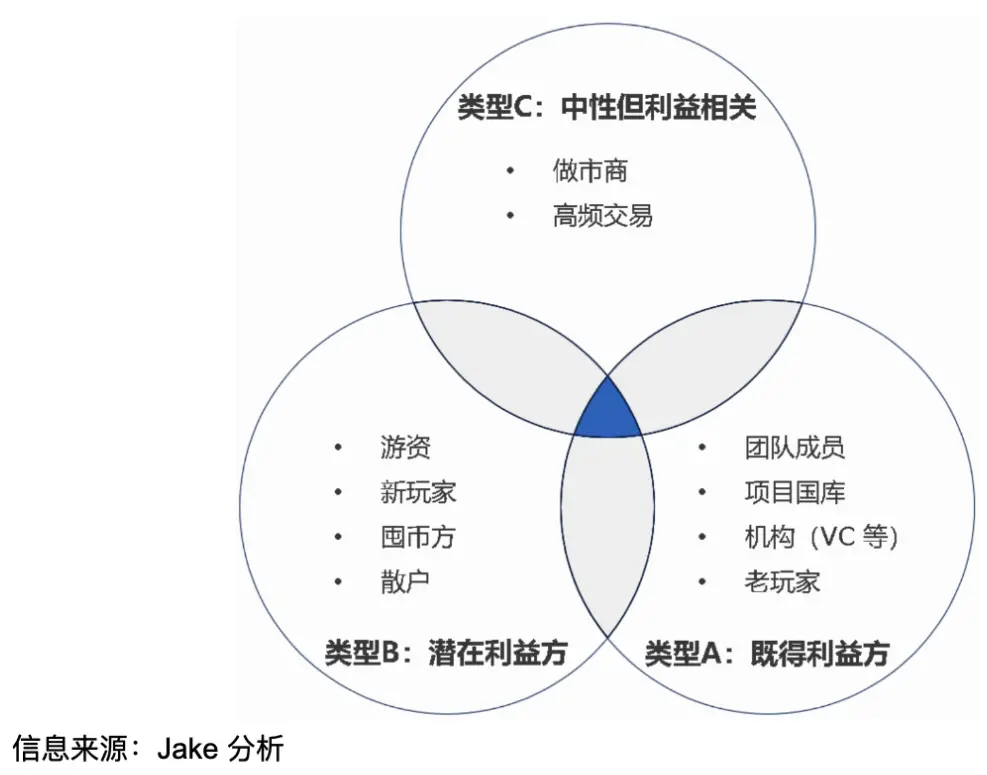

In the market, developers generally issue tokens using the ERC-20 protocol, which limits the number of tokens that can be issued and fixes the supply. Users, influenced by emotions such as greed and fear, will drive the demand for tokens, pushing the price of tokens up, which further stimulates the demand for purchase by profit-seeking users. The paper gains of existing token holders will increase. Therefore, in this case, the demand side is the main driving force behind the rise in token prices. Thus, from the perspective of token demand, the dynamic game between new token holders and vested interests (existing users, developers, team members, investment institutions, hoarders, etc.) affects the price of tokens. First, the analysis will prioritize the two-party game, followed by an analysis from the perspective of a multi-party game. The following table is a simplified two-party "sheep shearing" matrix (a multi-party game analysis framework will be provided later). Considering the complexity of real projects and studios, several assumptions are made:

The project's airdrop rules are public and transparent, the total amount of airdropped tokens is fixed, and will be fairly airdropped to addresses that meet the rules;

The developers will check for "witches," but there is a probability that they will not find them;

The cost of each account for "sheep shearing" and game boosting studios is the same;

Studios will immediately convert the tokens they receive into U, meaning they will not actively hoard tokens to affect the "exchange rate";

Studios do not know the total number of addresses eligible for airdrops;

The account operations of the studios are consistent.

Based on the above assumptions, studios do not know the total number of addresses eligible for airdrops and cannot directly calculate the total number of tokens received (to account for profits and costs). Therefore, to maximize profits, studios will not choose to stop leveling up accounts, and the game between studios lies in increasing the proportion of airdrop addresses, i.e., (). In this case, under the background of both parties' games, both will choose to enter the game, so it will ultimately reach the Nash equilibrium point of this matrix: (E(B), E(A)). This Nash equilibrium point is similar to the Nash equilibrium point in the prisoner's dilemma. In real life, due to factors such as costs, inconsistent account operations, witch checks, and the airdrop ratio set by developers, the final airdrop ratio received by studios may not meet expectations, leading to potential losses. Moreover, in real life, there is not only a game between studios but also a multi-party game between new token holders and vested interests (existing users, developers, team members, investment institutions, and hoarders, etc.).

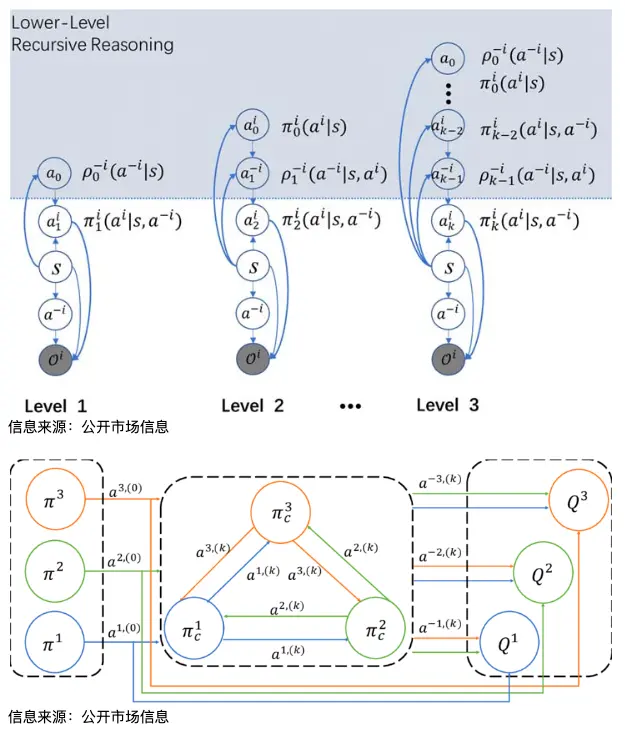

But as mentioned earlier, tokens, as symbols of credit on the chain, do not directly create wealth; they can only facilitate the transfer of wealth, with the direction and duration of transfer depending on the attributes of money and patience. Chips and assets have unique attributes and positioning, ultimately relying on asset narratives or assumptions. The attributes of funds determine what kind of narratives and assumptions they will pay for. Similarly, 100 BTC are indistinguishable; the attributes, preferences, and risks behind the assets determine that their addresses will make different behavioral decisions. Understanding the distribution structure of tokens and counterparties is crucial for the token and economic system. The AMM trading mechanism can also illustrate this point. The multiple logic analysis (K-level Reasoning) in economics provides a good interpretation and analysis of the reasoning and behavior of both parties in this form of game. The following figure describes the K-level recursive reasoning model. In this model, the symbol a represents the depth of thought. The modeling of the counterparty is approximated through the function ρ-i. The 0-level model refers to the situation where the counterparty is viewed as completely random. In the model diagram, the light blue area represents the recursive reasoning process of agent i. Each stage of calculation includes the results of the previous stage, and deeper-level agents will backtrack to derive the optimal result for the current round. For example, the 2-level model includes the calculation results of the 1-level model. In real life, the actual situation is far more complex than the model analysis; this model is for reference only and does not constitute investment advice.

Dividends and Staking of Governance Tokens

Regarding dividends, this method is currently used less frequently by Web3 game developers, while most Web3 game developers adopt a model that allows users to stake assets: users can earn rewards by staking assets, but this staking does not directly destroy the assets staked by users, so this form of staking becomes one of the ways for users to earn income. Many developers use the method of "staking tokens, rewarding tokens, points, sub-tokens, Pass NFTs" to incentivize users to lock in token liquidity, but several issues arise during actual operation. When rewarding staking, the rewarded tokens, points, sub-tokens, or other types of game assets exhibit high inflationary growth. If there are not enough consumption scenarios to absorb the selling pressure of token assets, then at some point in the future, the selling pressure from the rewarded assets will lead to a rapid decline in the relative price of the assets: that is, if there is no change on the demand side, staking may reduce the circulating supply in the short term and limit price declines, but the increase in rewards leads to an increase in supply, which in turn drives selling pressure and price declines. In the long run, if Web3 game developers use divergent user reward functions to maintain user numbers and stable user demand, it will deplete the developers' long-term credit, akin to drinking poison to quench thirst. The solution is to increase user demand, whether through attracting new users or expanding new demand points for existing users, which can effectively slow down the trend of declining prices for tokens and other assets.

Most Ponzi-like dividend and staking income economic models primarily exhibit the following issues: First, Web3 game developers cannot maintain a stable high annualized return over a long period. The source of income is unclear. Second, there is a failure to accurately analyze the demand side, and the demand side's profile, such as distinguishing between consumers and investors, is not accurately analyzed. There is no clear understanding or beneficial measures for the preferences of consumer-level users. Developers have failed to introduce clear measures to cater to consumer-level users, making it impossible to retain economic benefits. Moreover, on a fragile economic model, developers are unable to maintain a stable economic system (asset prices, token prices, etc.) for a long time; once faced with whales holding a large amount of "chips" dumping, it will amplify panic. Web3 game developers can monitor the following indicators to assess Ponzi-like income models, facilitating corrections for longer-term stable development: 1) Whether the income function is a divergent function. 2) The source of income. 3) The impact of new user inflows and outflows on the income rate of existing users. Game developers can address Ponzi-like economic model issues through various means: such as auxiliary financial facilities, convergent income functions, Slashing mechanisms, etc.

Other Types: Airdrops, Incentive Tasks, and Other Potential Gameplay

Airdrops, incentive tasks, and other potential gameplay can increase user participation and enthusiasm, as well as promote community activity and interaction. Through airdrops, users can receive some rewards for free, increasing their goodwill and trust in the platform. Incentive tasks can guide users to complete specific activities to earn additional rewards.

Based on the above analysis, the sources of income for Web3 games include various sources. However, it is still important to note that for game developers, if they want to meet the requirements for long-term development, they must meet the following standards:

From the developer's perspective: Achieve surplus retention in fiat currency valuation (or equivalent U valuation), meaning that retained earnings are positive on the balance sheet; and that net cash flow from operating activities is positive on the cash flow statement; (in this case, external economic compensation can be provided to developers through fiat currency valuation or convertible equivalent fiat currency valuation, such as fiat currency or equivalent U-valued advertising, etc.)

From the user's perspective: The total amount of funds invested by all participating users in the game must be greater than the total amount of funds withdrawn, i.e., ∑(Input) ≥ ∑(Output), (in the same currency); at the same time, the utility of users must at least fill the gap between funds withdrawn and funds invested, i.e., ∑(Input) ≤ ∑(Output) + ∑(Utility), (in the same currency)

From the user's perspective, the entertainment and consumption attributes of the game are its most basic attributes and the foundation for users' continued investment; if the two conditions are combined, it will be found that the utility of users is the cornerstone for Web3 game developers to achieve surplus retention under sustainable development conditions. As for the financial attributes, they can play a complementary role for Web3 game developers rather than being a lifeline. The ability to break the limitations of time and space in capital circulation and scheduling cannot fundamentally solve the utility problem for users unless it is a "casino-like" Web3 game developer. (Users have a probability of winning and a probability of losing, but the form is not limited to traditional casino games; the developer's source of income is from the rake.) Moreover, according to supply and demand theory, the growth in demand for game assets will drive up game prices, but if the growth in asset demand is viewed solely as the financial return brought to users by the game itself, it is akin to a narrow-minded approach that not only ignores economic laws but also disregards the development of Web3 games and the expansion and maintenance of new player users.

Gamification of On-Chain Finance vs. Financialization of Games

Regarding the direction of Web3 games, there have always been two viewpoints: the financialization of games and the gamification of on-chain finance. The direction of the gamification of on-chain finance is more challenging than the financialization of games for several reasons: First, the issue of counterparties. Wealth does not appear out of nowhere, nor does it disappear into thin air. It only transfers from one place to another through the medium of tokens. Therefore, the counterparty will become other users (in a game) or the developers themselves (subsidies). Developers can subsidize in the short term for the purpose of incentivizing users and marketing, but long-term excessive subsidies are unsustainable. (Examples outside of Web3 games: subsidies to group-buying users in the group-buying war, subsidies to diners by Ele.me and Meituan in the food delivery war, subsidies to passengers by Uber and Didi, subsidies to cyclists by Mobike and Ofo; some fast-track apps subsidizing users.) Although token valuation is adopted, due to the volatility of token prices under the credit system (Token/U exchange rate analysis model) and various factors in real-life consumption, game developers still need to maintain retained earnings valued in fiat currency; the game between counterparties will push game developers into a quasi-casino business model, where users have a probability of winning and a probability of losing, but the form is not limited to traditional casino games; the developer's source of income is from the rake. Second, the issue of long-term yield. As mentioned earlier, it is difficult to maintain a high yield over a long period. Influenced by factors such as trading pools, the larger the capital volume, the harder it is to achieve high yields.

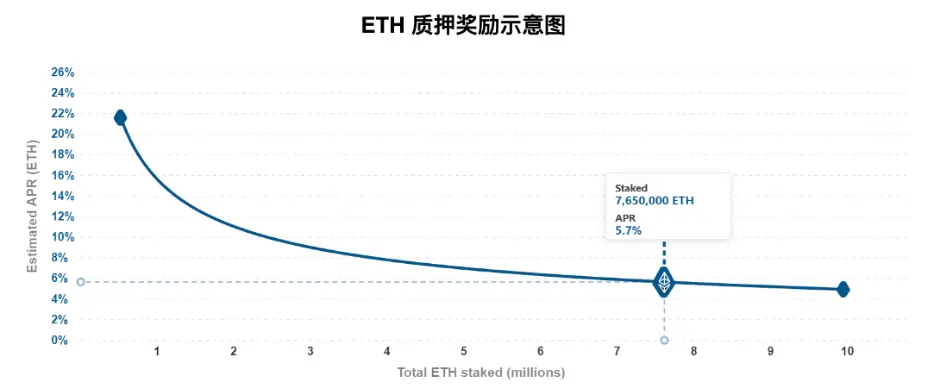

Moreover, the setup of the income and penalty mechanisms is inadequate. For example, the Staking mechanism. Many game developers blindly imitate the economic models of infrastructure and set up staking mechanisms, but taking Ethereum's staking mechanism as an example, by staking Ethereum, one can earn block rewards and transaction fees. As the amount of funds staked in Ethereum increases, the staking yield will decrease. The two exhibit a negative correlation. At the same time, if the staking nodes act maliciously, Ethereum's penalty mechanism will lead to a decrease in yield, even resulting in negative yields. Therefore, Ethereum's staking mechanism, through the staking mechanism, can maintain the stability of network operation, rewarding nodes that maintain the network and punishing nodes that harm the network. However, in Web3 games, staking tokens do not provide any rewards to incentivize network stakers, nor do they impose any penalties on stakers who harm the network. Simply locking the liquidity of game assets through staking does not fundamentally solve the problem of the divergent income function of game assets. In the absence of certain parameters, the mismatch between the asset staking mechanism and the model required by the game is not conducive to the long-term development of the game.

Source: Public Market Information

The supply and demand relationship determines the current price of tokens, with the outflow and inflow "exchange rate" (Token/U) being its manifestation. An open economic system is more complex than a closed economic system, and it also brings more potential expansion scenarios and application spaces. Since the credit system associated with Web3 games supports the long-term development of Web3 projects and potential token demand, guiding users and institutions to trust the game system is one of the key measures to drive up token demand. The attributes and patience of users and institutions determine how long they can hold tokens; ultimately, Web3 game tokens and assets will rely on asset narratives or assumptions. The attributes of funds determine what kind of narratives and assumptions they will pay for. In the subfield of Web3 Gambling, users are not fools; they simply want a fair game, or at least one that appears fair on the surface, rather than being arbitrarily harvested and robbed by institutions or "dealers." When the token holding structure is unhealthy, or when the return-to-odds ratio is inappropriate, users will naturally exit. This conclusion is not limited to Web3 Gambling; it also applies to some other Web3 fields, such as the issuance quantity and price changes of Memecoins, which can reflect this phenomenon well. Due to past trading histories where some institutions arbitrarily harvested users, users' trust in certain institutions has diminished; the memories of past "one-wave" projects and "guillotine" harvesting targeting retail investors are still vivid. Therefore, tokens with high FDV and backed by institutions are increasingly unpopular among retail investors, leading them to shift from high FDV, low liquidity projects to trading Memecoins in search of a fairer PvP game.

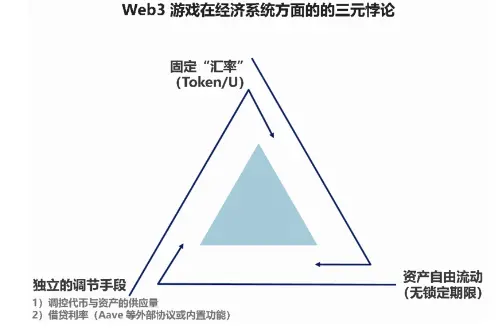

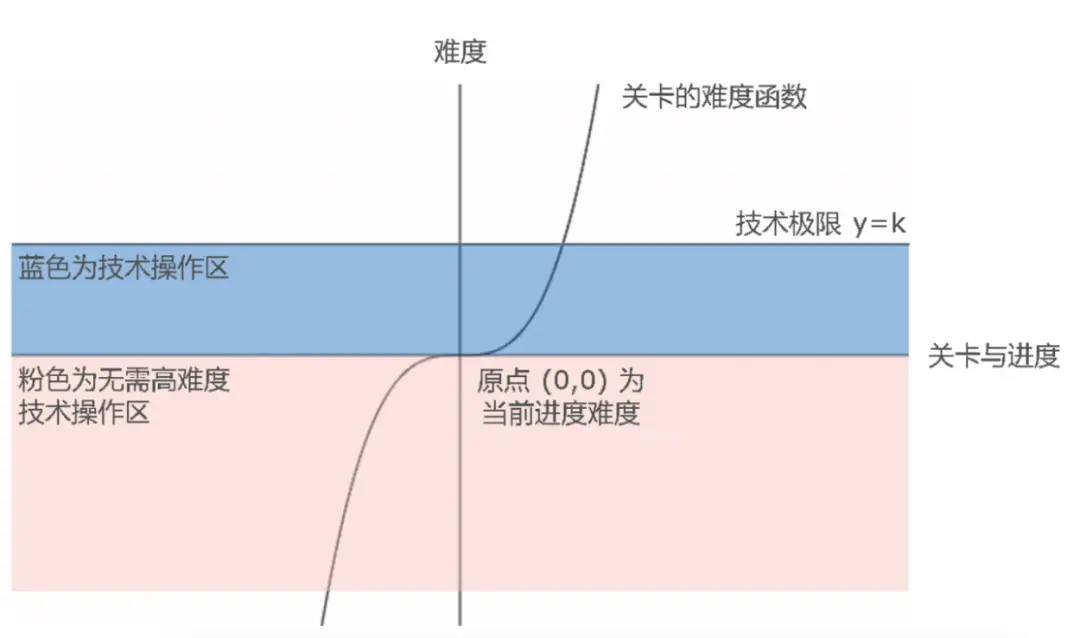

At the same time, due to the lack of channels for deposits and withdrawals in traditional Web2 games, the financial attributes and necessity have not been fully realized in traditional games. Additionally, traditional technology has not fully demonstrated other rights such as ownership, usage rights, and lending rights of assets, making Web3 games more powerful in terms of potential. In an open economic system, the mobilizable resources and personnel far exceed those in a closed economic system. The financial attributes grant more flexibility to in-game assets, significantly enhancing users' ability to allocate their assets over time and space, and allowing for the separation of ownership and usage rights of assets. Since Web3 tokens and assets have greater liquidity, assets and tokens with deposit and withdrawal attributes still need to meet the conditions of the "impossible triangle" of the Web3 game economic system, which states that among the three conditions of fixed exchange rates (Token/U), free flow of assets and tokens, and independent regulatory means (such as adjusting the supply of assets and tokens, and interest rates under internal and external conditions), at most two can be satisfied. Therefore, in the process of designing game economic mechanisms, Web3 game designers need to break through the limitations of Web2 games, transcend the assumptions of closed economies, and seek balance within the impossible triangle to achieve stability in the game's numerical system and financial equilibrium.

Source: Jake Analysis

Game Numerical System and Economic Design

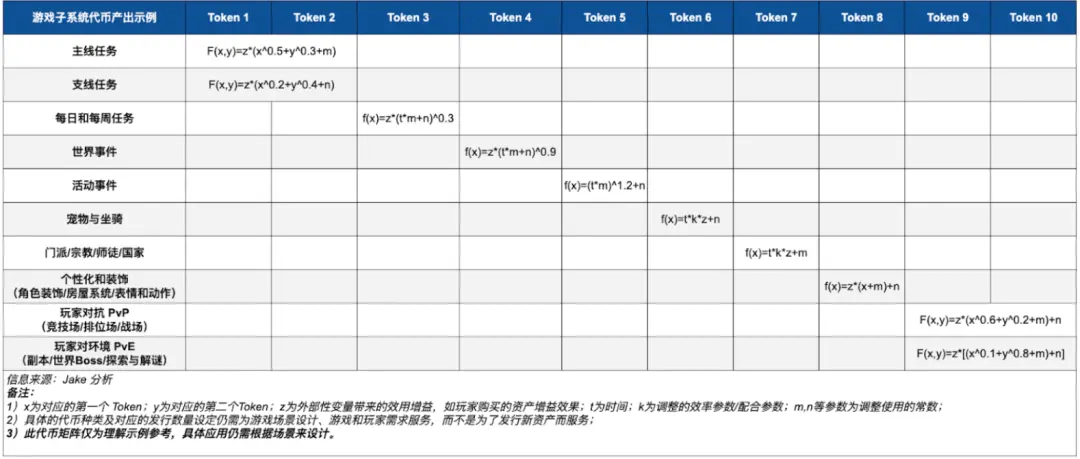

Due to the attributes of deposits and withdrawals, dynamic multi-party games, and price fluctuations, the status of the numerical system and economic design in games becomes even more important. Factors that game designers will focus on include, but are not limited to, type, time, function, experience, etc. This article will provide a brief analysis, while the next chapter in this series will analyze the game's numerical system and economic design in detail from the perspective of numerical planning. Game numerical planning, or game balance design, is responsible for the design of rules and systems related to game balance, including AI, levels, and other content outside of the storyline, such as weapon damage values, HP values, and combat formulas, all designed by numerical planners. The numerical system needs to maintain the balance of the game (cost-benefit ratio, combat balance, numerical balance, etc.), formulate strategic numerical designs (directly adjusting numerical values and cost-effectiveness, numerical upper and lower limits and probability distributions, fairness and system balance, combat mechanism support and algorithmic posteriori, etc.), and consider players' frustration (the difference between actual costs and expected benefits should not lead to excessive or insufficient frustration, thereby affecting players' gaming experience). From the perspective of game design and planning, the numerical part can be divided into the following sections:

Combat Values: Various attribute values and their distribution relationships, growth rates, and game balance in combat, including numerical planning in competitive games;

Economic/System Values: Involves the economic structure between various systems, the rhythm of returns for players based on the time invested in the game, and the planning of currency value;

Activity/Operation Values: In various activities and operations within the game, how to meet the needs of players with different payment capabilities to enhance the comfortable experience for all players;

Others: A combat-themed game typically establishes a dedicated combat planning team to coordinate the combat values within the game.

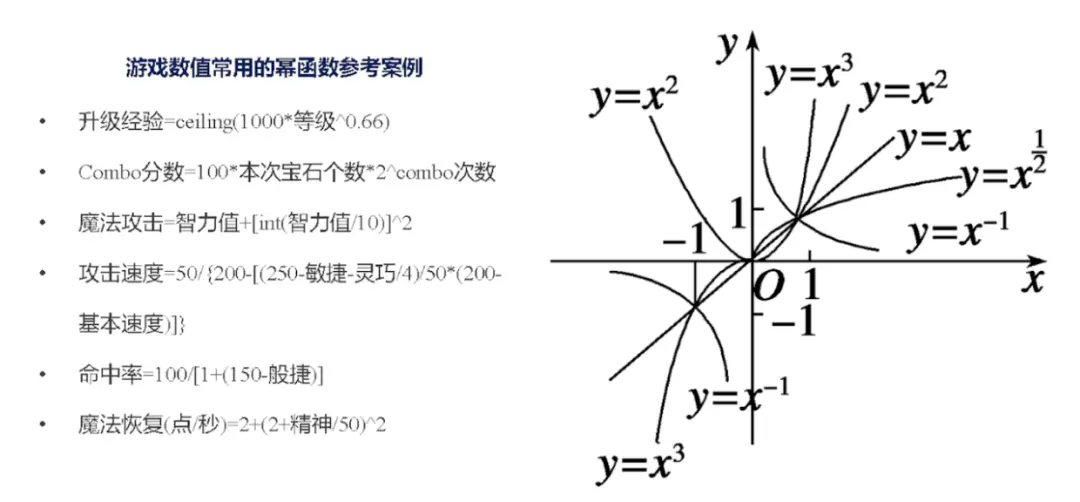

Case reference for Web3 game numerical formulas

Game numerical planning is a dynamic process that requires continuous adjustments based on player positioning and preferences, actual operational conditions, and player feedback data. In MOBA games, this may involve research on aspects such as map size, character movement speed, various attributes, career growth trends, skill burst damage ratios, equipment effects, and the impact of advanced attributes on combat. Game developers need to deeply understand player interests to ensure that the game can attract and retain players. The second article in this analysis series will provide a detailed analysis of game numerical planning, and this article will not elaborate further. Meanwhile, relevant books on game numerical design, such as "Balance Master: Game Numerical Combat Design," can be referenced. The following image is an example of a game numerical system.

Source: Public Market Information

Source: Public Market Information

Moreover, the deposit and withdrawal attributes of Web3 allow tokens and in-game assets to be traded with certain fiat currencies (or fiat-pegged tokens). Building trading pairs between the assets of Web3 projects and various fiat currencies (or fiat-pegged tokens) is, to some extent, a form of credit expansion corresponding to fiat currencies (the fiat currency corresponding to the trading pair), meaning that the quantity and variety of assets priced and supported by that fiat currency increase. Currently, the mainstream remains the expansion of US dollar credit; at the same time, due to the involvement of various types of fiat currencies (or various tokens pegged to fiat currencies), traditional international financial theories such as triangular arbitrage and foreign exchange derivative trading can be applied to the assets and tokens of Web3 games.

Need for Comprehensive Economic Theories and Protocols/Middleware Support

If Web3 game developers target their audience as game users or consumers, they can avoid a rapid demise to some extent. However, in practical applications, due to the lack of more comprehensive theoretical and protocol support, Web3 game developers cannot issue assets related to depreciation or amortization. Therefore, in actual operations, the real profit point does not come from consumer-type game users but from an increase in demand, leading to a rise in the prices of sold assets. Without practical consumption scenarios and evaluation methods related to cash flow, the prices of assets (both fungible and non-fungible tokens) are prone to decline. Even increasing liquidity cannot reverse the downward trend. In this case, during a rapid decline in demand, it is easy to lead to a death spiral for game developers. The following are several theories and protocols/middleware directions that Web3 game projects need to consider when designing games.

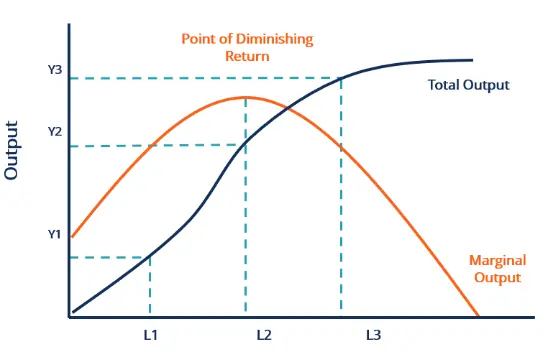

Marginal Theory and Analysis

Marginal refers to a slight adjustment to a decision or change, with the results caused by the slight adjustment being the marginal effect. In economics, marginal theory focuses on studying and discussing the additional effects or changes produced by increasing or decreasing a unit quantity in specific situations. Marginal theory is applied in various fields of economics. Mathematically, it can be expressed as dy/dx, indicating the rate of change of the function f(x) at the point x.

Source: Public Market Information

From a marginal perspective, when analyzing Web3 game users, the profit function equation and cost function equation of players can be used to measure the actions of rational profit-seeking users at each step. For example, assuming that all users in a Web3 game are profit-seeking rather than consumers, then for users, they will only take the next action, such as entering the next level, raising the next pet, or constructing the next building, when the marginal benefit exceeds the marginal cost; in this case, game developers can monitor the flow of tokens within the game, identify the most profitable methods for players, and adjust internal game parameters to reduce user profits or increase user costs, thereby slowing the outflow of capital within the game.

Source: Public Market Information

The following table is a case of distortion between NFT utility and price. In all levels from Level 1 to Level 8, the return ratios of Type A NFT assets are higher than those of Type B NFT assets, so rational users will purchase Type A NFT assets rather than Type B NFT assets. For the project team, issuing Type B NFT assets results in low purchase volume and low returns, making it completely unnecessary to issue Type B NFT assets, as the resulting purchase increment will fall short of expectations.

Source: Jake Analysis

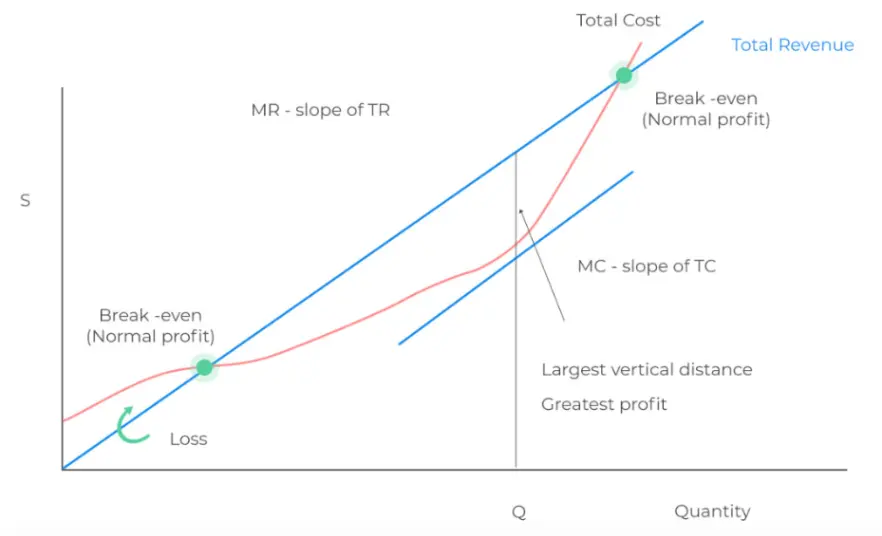

From the perspective of marginal theory, Web3 game developers can examine the cost-benefit ratio of each new user, i.e., profit/cost expenses. If the cost of acquiring and subsidizing users exceeds the benefits brought by the users, then Web3 game developers need to adjust their numerical systems to avoid greater losses; furthermore, assuming that Web3 game developers are committed to long-term operations, they should avoid using short-term Ponzi economic models that quickly attract profit-seekers. Ponzi economic models can only be established in the short term and cannot achieve stable economic conditions in the long term, as they require sacrificing some users' funds to pay interest and returns to other users. In the long run, returns priced in fiat currency do not hold. If developers persist in a Ponzi economic model for the long term, two outcomes may occur: due to high returns and high selling pressure, long-term asset prices may trend downward, or due to the inability to maintain high returns priced in fiat currency, Web3 game developers will need to subsidize profit-seekers, ultimately leading to the "treasury" of the game project being depleted. That is, if there is a lack of sustained growth in external demand for game assets, then in a Ponzi economic model, the stable exchange rate between fiat currency and game asset prices, the high returns provided by game assets to players, and the positive cash inflow (retained earnings) of the project team's treasury cannot remain stable in the long term. Developers can examine the returns and costs of individual users, i.e., check whether high returns for that user are subsidized by sacrificing the investment funds of other users, and can timely adjust relevant numerical values to avoid falling into the long-term growth dilemma and trap of Ponzi economic models.

Source: Jake Analysis

As mentioned earlier, regardless of whether a cat is black or white, a good cat is one that catches mice. From the experience of Web2 games, under the same monetary measurement, some accounting rules and monetization methods still apply to Web3 games. Wrapped in so-called ideologies, authorities, prohibitions, slogans, biases, and emotions, Web3 games face significant limitations and constraints in monetization and profitability. In pursuit of what is deemed correct and ideological, the analysis and production framework of games are overlooked, and the profitability under the same token or currency is abandoned. It is challenging for Web3 games to achieve self-sustainability in profitability throughout their lifecycle, relying instead on "minting rights" or "the rights to mint and issue new assets" to facilitate the transfer of assets and wealth in alternative forms. Therefore, Web3 games still need to consider the revenue and cost issues of individual users. Some monetization methods from Web2 games can serve as references for Web3 game development: subscriptions (weekly cards/monthly cards/point cards/Pass cards/paywalls), in-game purchases of game assets, ad monetization, paid downloads, transaction fees and taxes, and various paid peripherals. Especially regarding in-game purchases of assets, player behavior and aspects such as the game's storyline, levels, scenes, and tasks need to consider the cost and revenue situation of new users in a single scene and single consumption activity. From a mathematical and economic perspective, the revenue of new users and retained users must exceed their corresponding costs to achieve self-sustainability in the game's internal economic system. This aspect of game operation will be detailed in the section on Web3 game operation and distribution.

Asset Issuance: Minting and Issuing Rights of Tokens and Other Assets

For Web3 game developers, the minting and issuing rights of tokens or other NFT assets are backed by the credibility of the project team, granting them the power to earn revenue during the issuance of currency and other assets. For the project team, there is no need to rely on other methods (such as transaction fees); simply "minting new assets" can bring convenient income. New assets can serve various roles in Web3 games, such as utility within certain sections of the game, facilitating the operation of various sections, and aiding in monitoring and regulating user behavior within the game.

However, the allure of minting and issuing rights can lead project teams to become obsessed and indulgent. Since issuing new assets can directly generate income, the motivation for the project team to maintain old assets and empower their utility diminishes. From a long-term perspective, excessive use of minting and issuing rights is akin to drinking poison to quench thirst; it not only leads to a depreciation trend for both new and old assets but also causes the collapse of the project's credit system. Without restrictions, the minting rights and asset creation rights from a century ago would be abused, and the same will happen a century later. Therefore, for game developers, if they wish to maintain and survive in the long term, they must manage the power of asset minting and issuance with caution.

Generally speaking, from the perspectives of token systems and economics, issuing new assets without utilizing existing assets—including governance tokens, economic tokens, and various types of NFT assets—will be regarded as a tax and exploitation of existing asset holders. Theoretically, as the purchasing power of fiat currency declines for new and old assets, the "inflation" brought by newly supplied assets will lead to a decrease in the prices of both new and old assets, accompanied by a tightening of the project's credit. If the project team heavily relies on asset issuance, such behavior will severely impact the stable operation of both the internal and external economic systems of the game, leading to a shortage and downward trend in asset liquidity, and the expectation of falling asset prices will further drive depreciation. Moreover, it will be challenging for game developers to adjust the internal economic system of Web3 games through external compensation. Therefore, without considering external parameters, project teams pursuing long-term growth will not regard minting taxes as a primary source of income but will focus on transaction fees and taxes as their main revenue sources.

Based on the above analysis, the quantity of newly released and issued assets should be a function equation concerning new users and their purchasing power. Theoretically, new users and their purchasing power should push up the prices of issued assets; similarly, a decline in the number of active users or users leaving the Web3 game will lead to a drop in the prices of issued assets. This situation will severely affect consumer experience. Therefore, to maintain equivalent purchasing power for assets or tokens, the retained users and their purchasing power are irrelevant variables in the new asset issuance function. If factors such as user acquisition remain unchanged in game operations, then in the differential equation of the new asset issuance function concerning the number of new users, the purchasing power parameter of new users can be roughly equated to the purchasing power parameter of retained users. In the differential equation, the specific parameters of purchasing power depend on the purchasing power parameters of real consumer users across different regions. As one of the important parameters for the quantity of new asset issuance, the number of new users depends on various factors such as game marketing, community operations, and channel endpoints. Additionally, some external factors are also independent variables in the function equation for the quantity of newly released and issued assets, such as factors affecting the macroeconomic environment and external liquidity.

Measurement and Evaluation: ROI Model for Web3 Game Investment Recovery

The cash flow of Web3 game products is entirely opposite to that of insurance products. Traditional insurance products provide stable and continuous cash flow, leading to accounting losses at the time of payout, while the nature of game products is completely opposite, involving higher risks, high initial investment costs, and cash flow that only materializes later, with instability. Analyzing from the perspective of financial products, Web3 games need to use models to measure investment returns.

The commonly used recovery model calculation formula is ROI = LTV / Cost. When ROI = 1, it indicates complete recovery, and LTV = Cost. However, simply reducing costs without considering payment quality does not shorten the recovery cycle, so it is preferable to lower costs while keeping LTV unchanged, or to accept a slight increase in costs if LTV increases, with ROI as the guiding principle to obtain economic benefits. A successful Web3 game will see continuous growth in subsequent LTV, accompanied by high retention data, so when measuring and testing, it is essential to focus on retention and related metrics. When LTV grows slowly, retention data can decline rapidly, making it difficult to achieve long-term stable development.

Combining this series' third part (Testing and Operations), different types of products and data will exhibit different recovery cycle characteristics. Light mobile games primarily consist of casual games, with most user acquisition for light mobile games and mini-games relying on ad monetization, while a small portion involves in-game purchases plus ad monetization. Generally, the recovery cycle for in-app purchase-based light games is usually within a week, as the games lack depth and gameplay cannot support long-term player retention, necessitating quick recovery. Ad-free casual games typically have slightly weaker monetization capabilities but longer player retention, with a payback period of about six months. Medium mobile games fall between light and heavy, balancing gameplay and monetization, including card games, strategy games, idle games, and nurturing games, with recovery cycles similar to heavy games, generally around three to four months. Heavy mobile games feature deeper gameplay, ongoing operational activities, and high player engagement, but their audience coverage is not as extensive as that of medium and light games, with recovery cycles of about two to three months. The growth characteristics of LTV show that the second day's LTV is twice that of the first day, and the seventh day's LTV is 2-2.5 times that of the second day (representing only some games).

Source: Public Market Information

In reality, the situation is far more complex than the ideal model. Different types of games have different payment models. Achieving a first-day ROI of 40%-50% does not necessarily indicate excellent financial data; it still requires consideration of subsequent growth and retention to assess recovery. Moreover, since Web3 games are still considered high-risk "input-output" products, estimates of payment models require at least 7-14 days of test data as samples, and future growth in user acquisition and marketing should be calculated based on the growth of test data. For optimizing data models, game developers can adjust the core gameplay and mechanism systems based on game testing data, while operations can adjust activity arrangements, community interactions, and marketing channels. Specific reference testing data includes retention rates, churn times, ARPU, and churn events (detailed information can be found in the third part of this series: Testing and Operations).

Protocol Layer: Lack of Parameter Settings for Corresponding Consumer Goods or Consumable Attributes

To prevent game players from becoming overly reliant on specific in-game assets, such as weapons and defensive gear, Web3 games need to establish durability for game assets, i.e., the depreciation and amortization attributes of game assets. Players need to continuously invest resources to maintain game assets; otherwise, the utility of game assets will gradually approach zero. At the same time, the setting of asset durability encourages players to acquire new assets or repair existing ones, promoting the circulation and balance of the internal economic system of the game. Players must continuously engage in acquiring, trading, and using resources to maintain the economic activity, balance, and dynamism of the game.

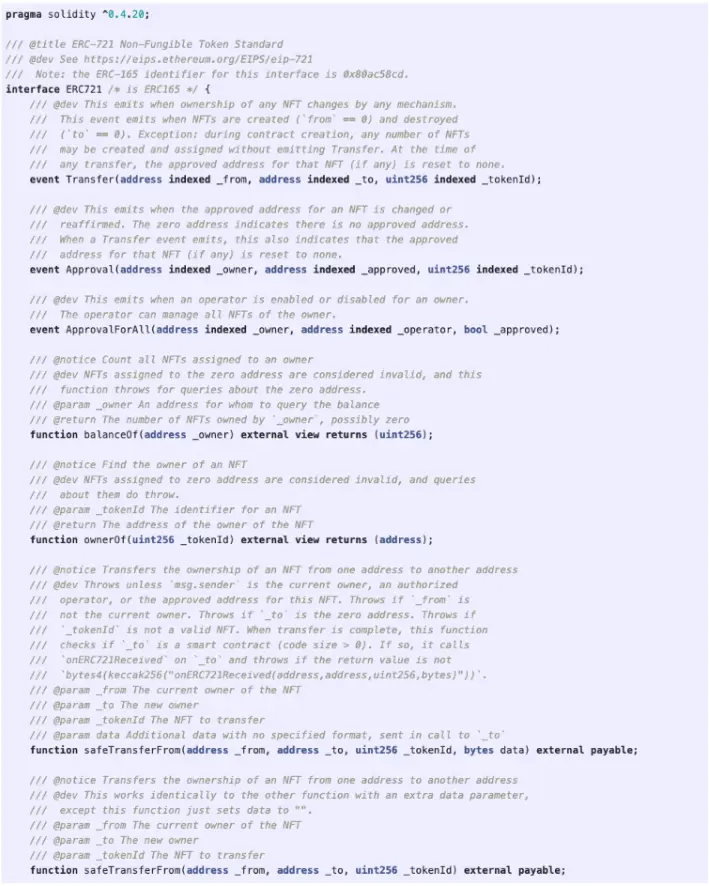

Web3 game developers can adopt commonly used NFT or Semi-NFT asset protocols (such as EIP-721, EIP-1155, EIP-3525) as the protocol standards for asset issuance in games. However, an overview of NFT or Semi-NFT asset protocol standards reveals that there are strict constraints and descriptions regarding core indicators such as quantity, address, and byte data, but from the perspective of game assets, the protocol standards lack settings for time limits on assets, methods of depreciation and amortization (such as accelerated depreciation, straight-line depreciation, and decelerated depreciation), depreciation and amortization coefficients, initial utility parameters of assets, interest rates, and other indicators. Among these, interest rates and other indicators could be potential important metrics in Web3 RPG games. Current NFT and Semi-NFT asset protocol standards have not fully explored the consumable or expendable attributes of assets, making it difficult for Web3 games and other Web3 applications to continuously incentivize players to purchase and maintain assets and to fully utilize the assets' utility. The following is a display of the EIP-721 protocol standard.

Source: Public Market Information

Middleware: Middleware Based on Supplementary Parameter Settings in Protocol Standards

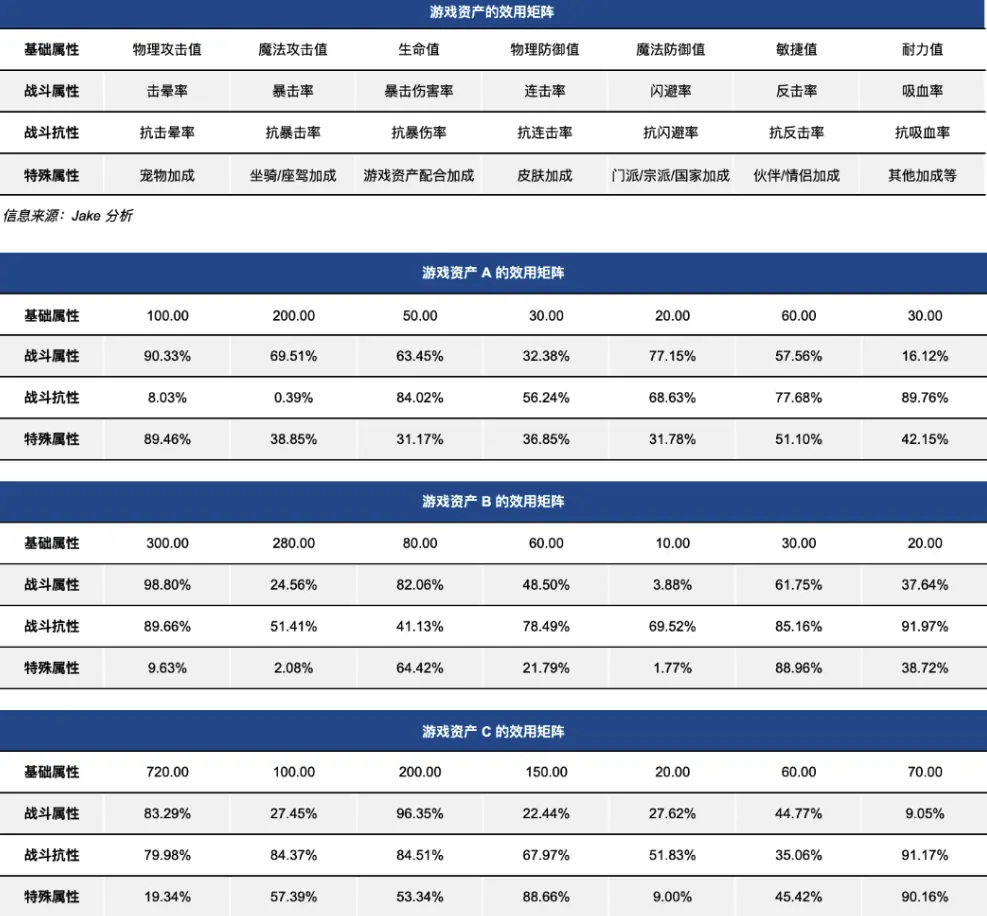

As mentioned above, due to the current asset protocol standards lacking several core parameter settings for various asset types, corresponding middleware remains in a state of vacancy based on the new asset protocol standards. Furthermore, a secondary trading system based on this middleware cannot be established, and the liquidity of secondary assets cannot be guaranteed. From the perspective of project demand in Web3 games, some in-game assets cannot be put on-chain due to the absence of new asset protocols. Even if they are put on-chain, the utility of in-game assets cannot be fully realized. Additionally, due to limitations from middleware and trading systems, the pricing mechanisms related to assets are incomplete, and the liquidity of the secondary market will also be significantly affected. The following matrix data structure represents an example analysis of the equipment system in Web3 games:

Source: Jake Analysis

The above are three game asset cases A, B, and C, where the corresponding basic attributes, combat attributes, combat resistances, and special attributes in the matrix data structure are different. Therefore, theoretically, different asset utilities in the same Web3 game (with the same pricing mechanism) will have different pricing. However, based on the current middleware on asset protocols, there is a lack of a pricing mechanism for asset utilities. In addition to the internal factors affecting asset utility within Web3 games, external factors will also influence the pricing mechanism of Web3 game assets, such as the asset lifecycle, methods of depreciation and amortization, depreciation and amortization coefficients, interest rates, and the external economic environment mentioned above. Artistic factors will also be one of the subjective factors affecting player purchases, but there is currently a lack of quantitative indicators to clarify the external compensation of artistic factors on game asset utility.

In summary, whether it is fungible or non-fungible tokens, tokens related to Web3 games do not create wealth out of thin air; they serve as a vehicle for wealth transfer. Tokens and assets will have unique attributes and positioning, ultimately finding addresses that pay for the narrative or assumptions of the assets. After the project team establishes a trading pool, users on the demand side can obtain various consumption and financial utilities, while potential rent-seeking addresses will also participate in the competition and struggle among addresses. Web3 games have adopted blockchain innovations but still need to meet conditions and restrictions in areas such as "accounting," "exchange rates," and "finance." Since Web3 games possess the attributes of deposits and withdrawals, the status of the numerical system and economic design in traditional games becomes even more important. However, due to the absence of certain parameters in the underlying protocols of current fungible and non-fungible tokens, such as the lack of time, depreciation coefficients, and methods in asset-related protocols, the attributes of current on-chain assets have not been fully realized. In the future, more middleware and applications based on new protocols will thrive. It is worth noting that granting Web3 game project teams the minting rights of tokens and assets may lead to abuse. The minting rights and asset creation rights from a century ago were abused, and the same will happen a century later. This article is the first in a series analyzing Web3 games, and we look forward to the next article in the Web3 game analysis series (Part II) on industrial production and creation (technology and art). The content regarding core mechanisms and gameplay systems will be treated as internal documents and will not be publicly published for the time being. Authors are welcome to communicate and discuss this part separately.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。