Author: Mensh, ChainCatcher

Editor: Nianqing, ChainCatcher

SCR, as Binance's first pre-market trading project, officially launched and experienced a sharp rise and fall after opening, currently consolidating around $1.1. As of the time of writing, the pre-market trading price of SCR is $1.186.

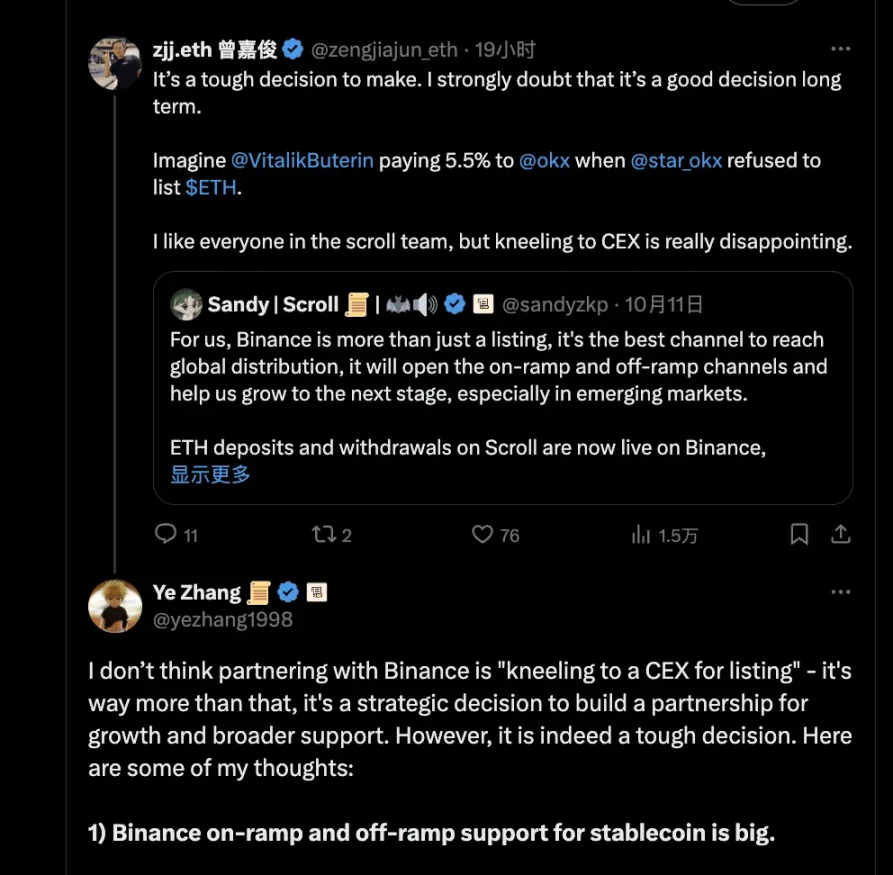

On October 8, Binance and Scroll officially announced that the token SCR would become Binance's first pre-market trading project and released its token economics. Once the news broke, voices in the community questioned whether Scroll's airdrop allocation was too low and the Launchpool allocation too high as a gesture to Binance. In response, Scroll's core contributor Sandy tweeted that Binance is the best channel for achieving global distribution, as it will connect upstream and downstream channels to help Scroll develop to the next stage, especially in emerging markets. Scroll's ETH deposits and withdrawals are now live on Binance, and soon, stablecoin support on Scroll will also be directly available on Binance. This listing on Binance will help Scroll achieve global expansion.

Subsequently, Scroll co-founder Zhang Ye also tweeted to refute the viewpoint of "kneeling to CEX." He stated that this is a strategic decision to establish partnerships to promote growth and gain broader support, and that Binance provides significant support for the entry and exit of stablecoins. Furthermore, the timing of the token issuance is completely different from the situations faced by ETH, Arbitrum, and Optimism at launch, as CEX does not have the same leverage in allocation. He also explained that the Launchpool budget comes from growth, not community airdrops, and will not affect community rights. Token distribution is not a one-time event; it is a growth lever, and project development requires long-term growth. The Scroll technology roadmap and the next phase of ecological growth planning will be released in a few weeks.

However, this response seems to have failed to quell the divisions within the community. In response, three co-founders of Scroll will go online in the community at 3 PM Beijing time tomorrow to address recent questions regarding the SCR release.

So, how is the Scroll token specifically allocated?

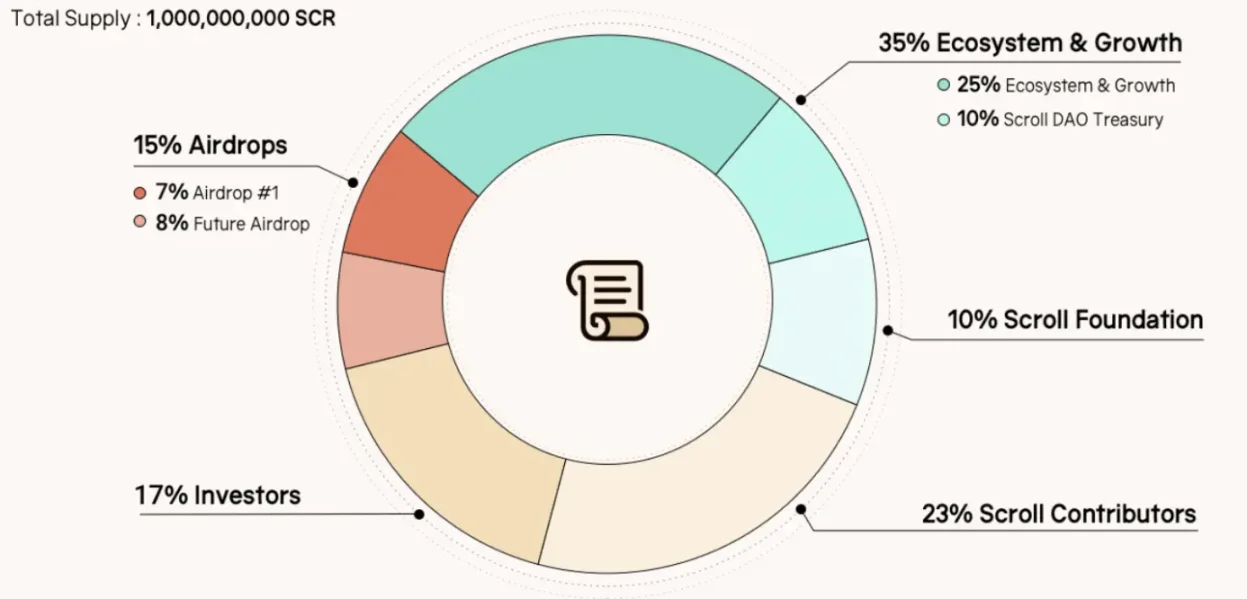

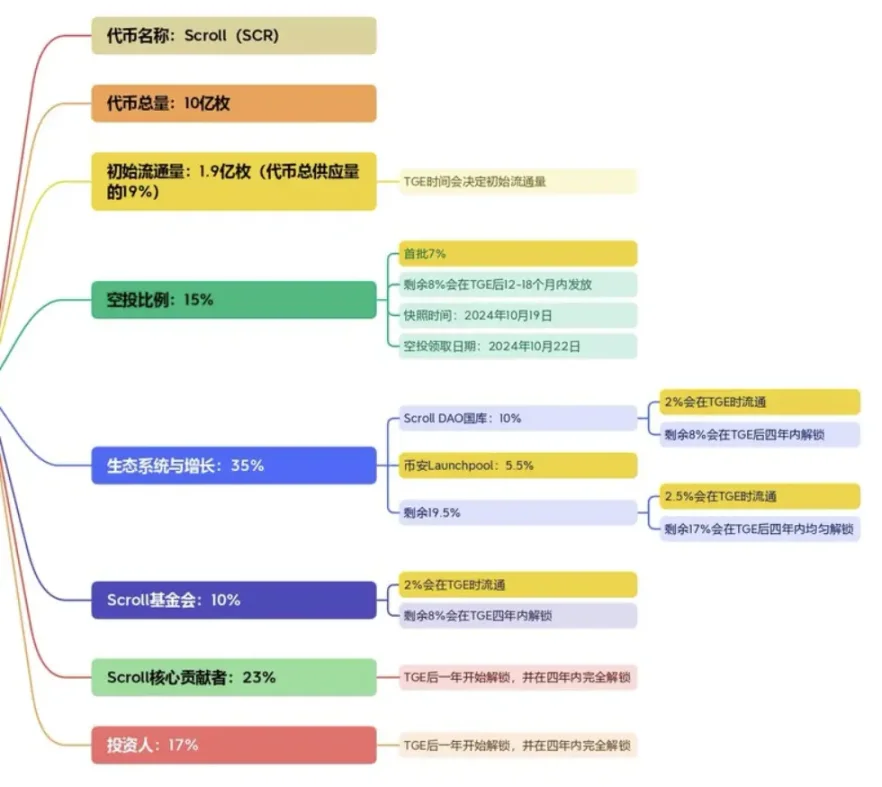

Quick Overview of Scroll Token Economics

The total supply of SCR is 1 billion tokens, with an initial circulation of 190 million tokens (19.00% of the total). In the Scroll token distribution, airdrops account for 15%, ecosystem and growth account for 35%, and the Scroll DAO treasury accounts for 10%. Of this, 2% will be in circulation at TGE, while the remaining 8% will be evenly unlocked over four years after TGE. Binance's Launchpool accounts for 5.5%, and of the remaining 19.5%, 2.5% will be in circulation at TGE, with the remaining 17% evenly unlocked over four years after TGE. The Scroll Foundation accounts for 10%, with 2% in circulation at TGE and the remaining 8% evenly unlocked over four years. Core contributors account for 23%, starting to unlock one year after TGE and fully unlocking over four years, while investors account for 17%, starting to unlock one year after TGE and fully unlocking over four years.

The initial circulation consists of 7% from the first airdrop, 2% from Scroll DAO, 5.5% from Binance mining, 2.5% from the ecosystem, and 2% from the Scroll Foundation. The specific token distribution ratios are shown in the figure:

https://scroll.io/blog/scr-token

https://x.com/CryptoKris666/status/1843937850229952817

In terms of mining distribution, the daily mining quota for BNB is 23.375 million tokens, accounting for 85%. The daily mining quota for FDUSD is 4.125 million tokens, accounting for 15%. The farming period runs from 2024-10-09 00:00 (UTC) to 2024-10-10 23:59 (UTC), with pre-market trading starting on 2024-10-11 10:00 (UTC).

Airdrop Situation

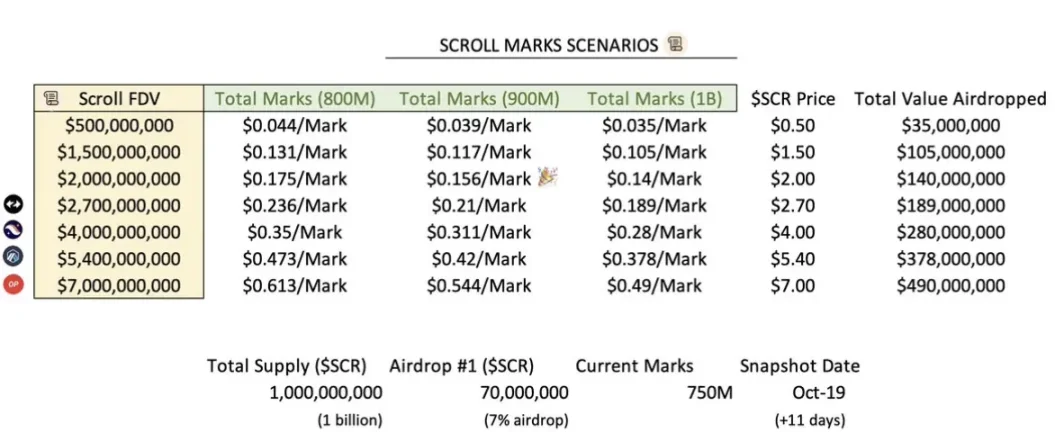

7% of the total Scroll token supply is allocated for the first airdrop, and 8% of the total token supply will be reserved for future airdrops, which are planned to occur within the next 12-18 months. The snapshot time for the airdrop is October 19, 2024, and the airdrop claim date is October 22, 2024.

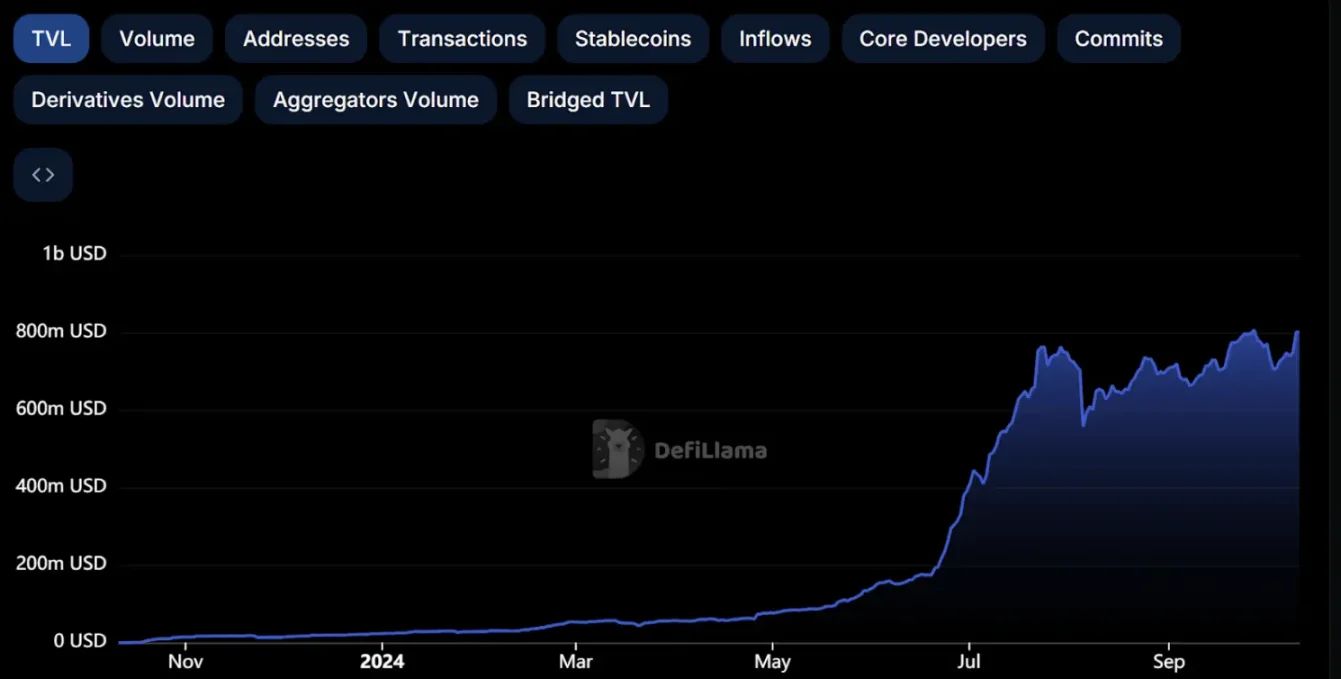

The Scroll airdrop, along with ZKSync, StarkNet, and Linea, has become one of the most active airdrop activities, with airdrop ratios significantly higher than similar projects that launched earlier (ZKSync airdrop 15.6%, StarkNet 18%, Arbitrum 11.6%, Optimism 5.97%). Since the launch of its testnet, Scroll has undergone a long airdrop farming period, starting airdrop interactions in May, with TVL skyrocketing since June, requiring tasks such as using Aave, liquidity inflow, and bridging. According to preliminary data, over 78,000 users may qualify for the airdrop.

https://defillama.com/chain/Scroll

However, some are concerned that a significant portion of the TVL is from users seeking airdrops, which may shrink after TGE, and the end of the airdrop era could harm on-chain value and activity before transitioning to organic traffic.

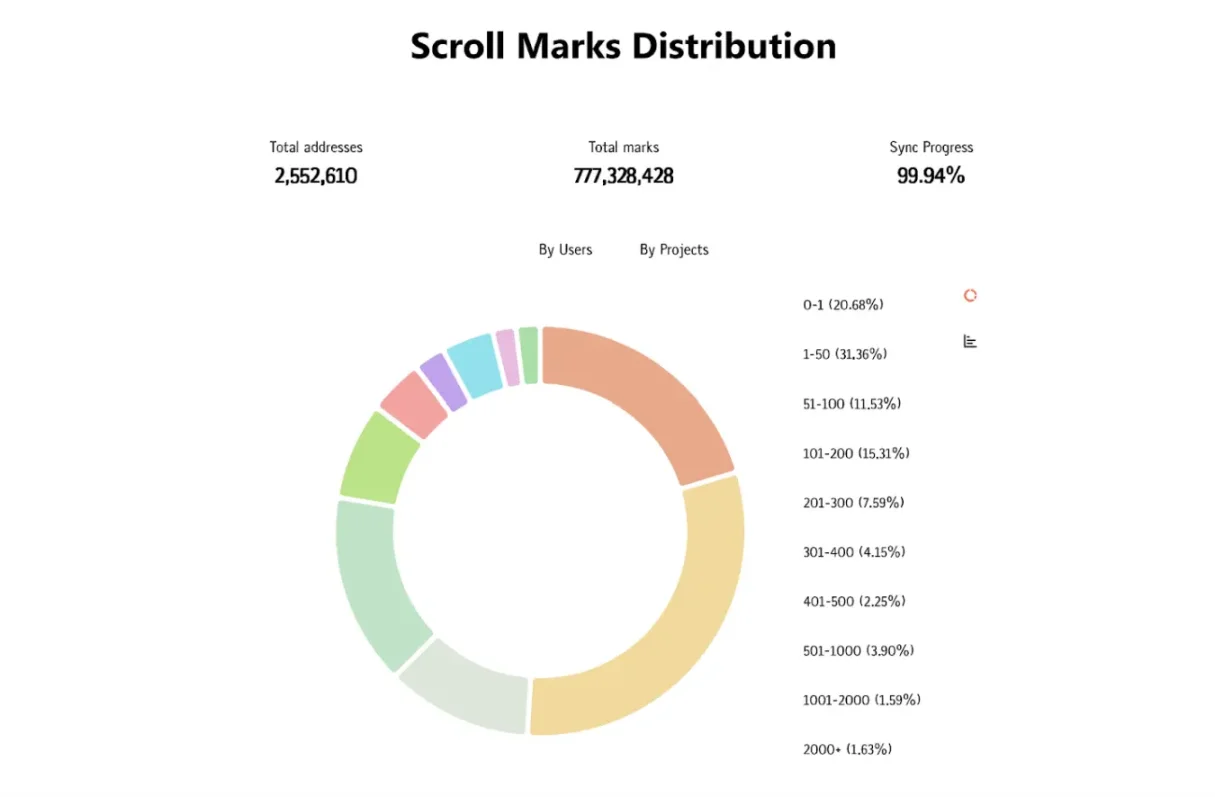

As of October 12, 18:00, the points situation for Scroll users is shown in the figure below. It can be seen that more than half of the users have points less than 50, and more than three-quarters have points less than 200, indicating that a considerable number of users are rushing to "farm" on Scroll in the short term.

https://scrollstat.xyz/

How Does SCR Pre-Market Trading Affect Post-Listing Prices?

Currently, Binance has not announced the specific time for TGE. If TGE occurs before Scroll distributes the airdrop, the circulation ratio at launch will exclude the 7% for airdrops, meaning the initial circulation will drop from 19% to 12%. Alternatively, TGE may coincide with the timing of the Scroll airdrop distribution, which would mean that the pre-market trading period for Scroll could be quite long, while in this case, the initial circulation would remain at 19%. In either scenario, Binance Launchpool will occupy a significant proportion, accounting for at least 28.94% of the initial circulation. As the first project to launch pre-market trading on Binance, will having a price anchor from pre-market trading help make the official opening price more reasonable?

On the positive side, since the circulating tokens in the pre-market trading market only come from the mining output of Binance Launchpool, if this pre-market trading shows a good profit effect, it will stimulate future projects listed on Binance Launchpool. It will also encourage more users to participate in mining on Binance Launchpool.

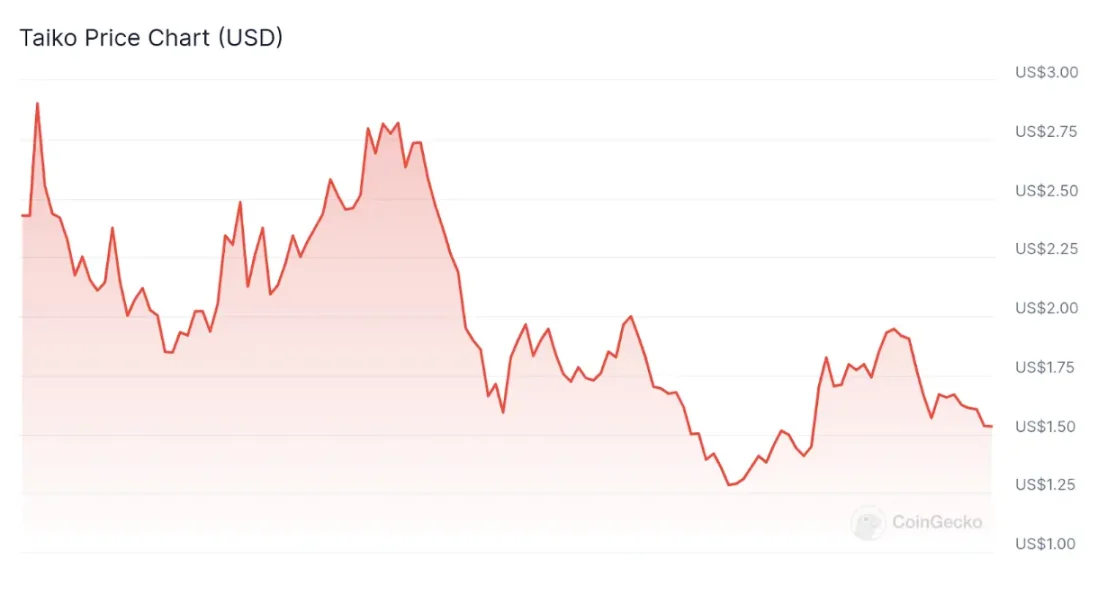

However, at the same time, the characteristics of SCR being "high FDV, low circulation" have led the market to classify it as an institutional coin. Several researchers have compared it to ZKsync and Taiko, believing that SCR is likely to continue facing institutional selling pressure and decline. The pre-market trading on Binance and the significant proportion of airdrops attracting speculators will only lead to them becoming sellers after SCR's TGE. Based on the current pre-market trading situation, there is no obvious selling pressure.

Market Capitalization Prediction

For estimating SCR's market capitalization, three perspectives can be referenced: comparable projects, pre-market trading, and KOL valuations.

As another Ethereum L2, Scroll has many comparables with Taiko, and using Taiko's valuation as a reference for Scroll's valuation is reasonable. In the two rounds of funding already announced, Scroll has raised a total of $80 million. In the latest round of financing, Scroll's valuation is $1.8 billion. Although Taiko's total funding amount before TGE was only $37 million, its current FDV is approximately $1.7 billion, which is close to Scroll's latest round of financing valuation and can serve as a reference for Scroll's circulating market capitalization after listing.

Additionally, based on the pre-market trading markets of Bitget and AEVO, the current pre-market price of SCR is around $1.6, with an FDV valuation of $1.6 billion, which has certain reference value.

According to crypto KOL @OlimpioCrypto's prediction, Scroll's market capitalization increased by $70 million last month and may grow to $1.5 billion before the airdrop snapshot on October 19. Compared to the FDV of Zksync, Starknet, Arbitrum, and Optimism, based on the recent listings of Starknet and zkSync, Scroll's valuation is unlikely to approach that of ARB and OP. However, it is worth noting that Scroll's TVL is $740 million, Arbitrum's is $2.4 billion, Optimism's is $650 million, Starknet's is $240 million, and zkSync's is $860 million.

According to predictions, in a neutral scenario, SCR's FDV is $1.5 billion, in a pessimistic scenario it is $500 million, and in an optimistic scenario it is $2 billion. The following chart shows the relative valuation data, with market data sourced from Munris and Scrollstat.

https://x.com/OlimpioCrypto/status/1843659441897402725

Overall, the volume of the Scroll airdrop is very high. According to Rootdata, as of October 12, Scroll ranks first among the Top 100 popular Web3 projects. As the first project for pre-market trading on Binance, SCR may provide insights into the subsequent development of Binance Launchpool and the market's attitude towards institutional coins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。