_Organized by: Fairy, _ChainCatcher

Last Week's Cryptocurrency Spot ETF Performance

U.S. Bitcoin Spot ETF Net Inflow of $348 Million

Last week, the U.S. Bitcoin spot ETF recorded a net inflow of $348 million. On October 7 and October 11, there were large inflows exceeding $200 million, while there were small outflows from October 8 to 10. Among Bitcoin spot ETFs, only Grayscale's GBTC showed a net outflow, amounting to $31.5 million.

BlackRock's IBIT had the highest inflow, reaching $140 million, followed by Fidelity's FBTC with a net inflow of $138 million. Additionally, BITB, ARKB, and GBTC also saw small inflows.

Source: Farside Investors

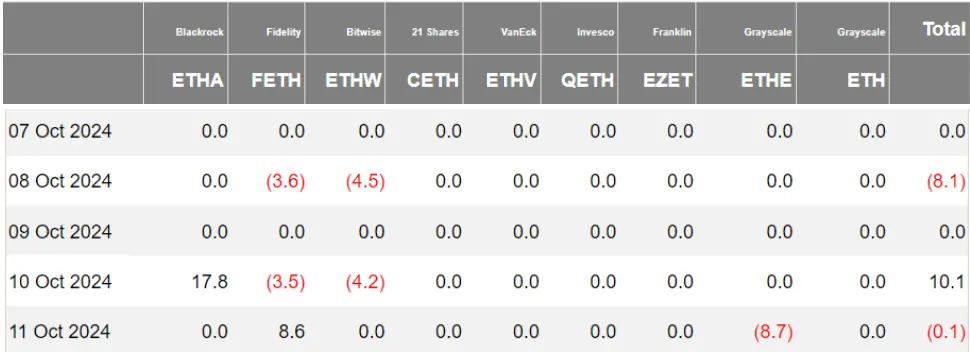

U.S. Ethereum Spot ETF Net Inflow of $19 Million

Last week, the U.S. Ethereum spot ETF had a net inflow of $19 million, showing overall lackluster performance. Out of the 9 ETFs, 5 did not experience any fund movement, with BlackRock's ETHA recording an inflow of $17.8 million only on October 10, remaining quiet for the rest of the time. Furthermore, BlackRock ETHA's ETH holdings have surpassed 400,000 coins.

Bitwise's ETHW and Grayscale's ETHE experienced slight outflows of $9.7 million and $8.7 million, respectively.

Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Outflow of 12.82 Bitcoins

Last week, the Hong Kong Bitcoin spot ETF had a net outflow of 12.82 Bitcoins, with a total net asset value of $26.2 million. The ETF issuer Huaxia holds a total of 2,180 Bitcoins, while Harvest holds only a quarter of that, with 495 Bitcoins.

The Ethereum spot ETF did not experience any fund movement, with a total net asset value of $3.507 million. Huaxia and Bosera's ETH holdings are similar, both close to 6,000 coins, while Harvest holds about half of that, around 3,000 coins.

Data: SoSoValue

Overview of Last Week's Cryptocurrency ETF Dynamics

U.S. SEC Again Delays Decision on Ethereum Spot ETF Options: The U.S. Securities and Exchange Commission (SEC) has once again delayed its decision on the listing of Cboe's Ethereum spot ETF options, with the new expected date pushed from October 19 to December 3.

Korea's Financial Services Commission to Reassess Spot Cryptocurrency ETFs: The Korea Financial Services Commission (FSC) announced plans to re-examine the lifting of the ban on spot cryptocurrency ETFs and institutional account warehouses. Previously, South Korean lawmakers have been calling for a change, with both the ruling Democratic Party and the opposition promising to approve local spot Bitcoin ETFs during earlier elections this year. Since 2018, South Korean institutional investors have effectively been prohibited from opening trading accounts on cryptocurrency exchanges. This policy adjustment may open new avenues for institutional investors to participate in the cryptocurrency market.

Canary Capital Submits Application for Spot XRP ETF The cryptocurrency investment firm Canary Capital has submitted a registration application for a spot XRP ETF to the U.S. SEC, becoming the second company to apply for such a product this month. Founder Steven McClurg stated that the custodian for the ETF has not yet been determined.

Views and Analysis on Cryptocurrency ETFs

Mechanism Capital Co-Founder: ETH Leverage Rises to Levels During ETF Hype, May Pressure ETH

Mechanism Capital co-founder Andrew Kang posted on X platform, stating: “ETH leverage has risen to levels seen during the ETF hype; is there a good reason to explain that this phenomenon is driven by directionless long positions? If not, this will put pressure on ETH.”

Bloomberg Analyst Expects Bitcoin ETF Options to Launch in Q1 2025

Bloomberg analyst James Seyffart stated that exchange-traded funds (ETFs) are likely to launch in the U.S. in the first quarter of 2025.

Seyffart mentioned during a panel discussion at the Permissionless conference on October 9: “I think it’s possible to launch options before the end of this year, but it’s more likely to be in the first quarter of 2025.”

In September, the SEC authorized Nasdaq to list options linked to BlackRock's Bitcoin ETF, iShares Bitcoin Trust (IBIT). They are awaiting final approval from the Commodity Futures Trading Commission (CFTC) and the Options Clearing Corporation (OCC).

Seyffart stated: “Unlike the SEC's regulations, the CFTC and OCC do not have strict deadlines, so they can delay further if they wish.”

The ETF Store President: U.S. SEC Still Believes XRP is a Security, Approval for XRP ETF May Take Time

The ETF Store President Nate Geraci posted on social media, stating: “According to Fox Business News, the U.S. SEC still maintains that the cryptocurrency XRP is a security. Under the current administration, it may take some time for the XRP ETF to be approved.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。